Global Marijuana Cigarette Market Size, Share, And Business Benefits By Type (Standard, Pre-rolled), By Application (Recreational, Medical Use), By Distribution Channel (Convenience Store, Supermarket, Online Sale, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153731

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

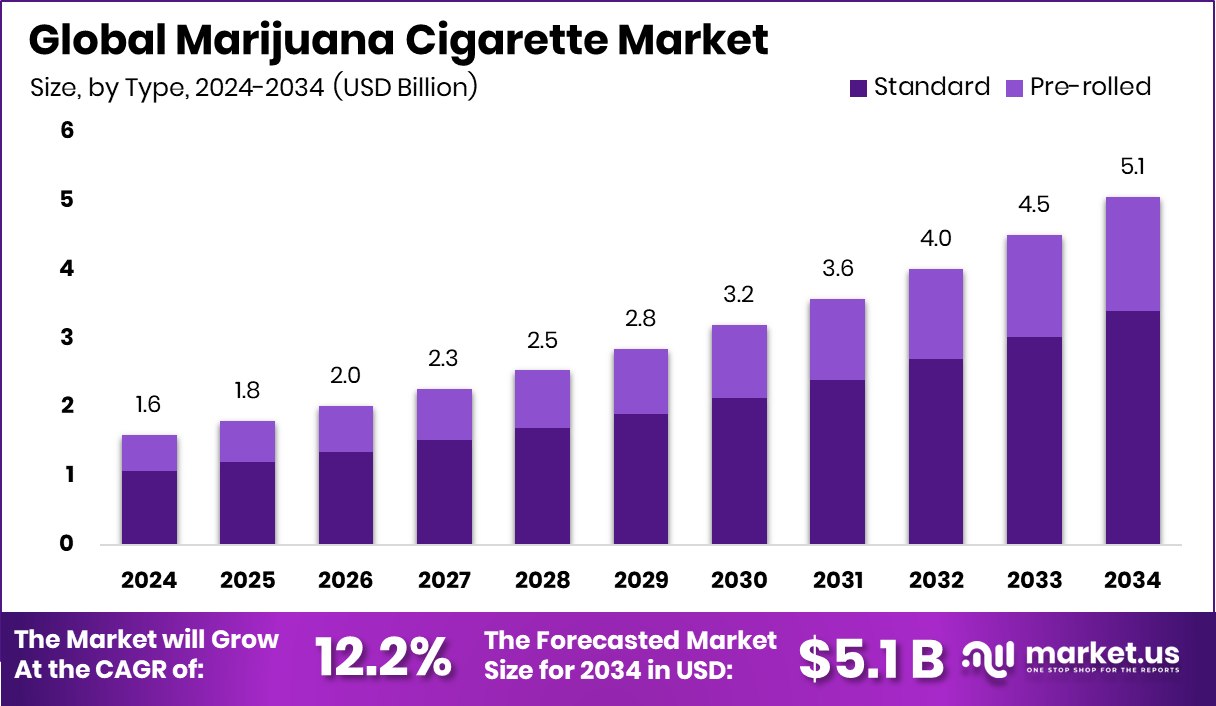

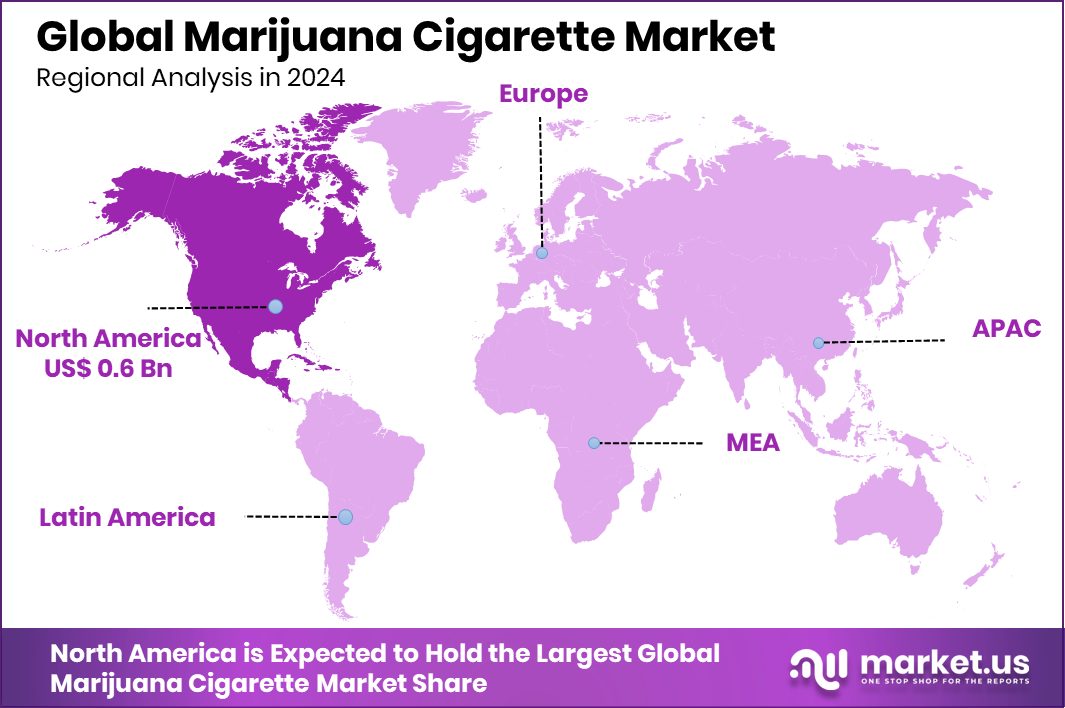

The Global Marijuana Cigarette Market is expected to be worth around USD 5.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 12.2% from 2025 to 2034. North America’s marijuana cigarette market reached USD 0.6 Bn, capturing 41.7% share.

A marijuana cigarette, commonly referred to as a “joint,” is a rolled cigarette containing dried flowers and leaves of the cannabis plant. It is typically hand-rolled using rolling paper, though pre-rolled versions are also available. Marijuana cigarettes are smoked for recreational or medicinal purposes, as cannabis contains compounds like THC and CBD that produce psychoactive and therapeutic effects.

The marijuana cigarette market refers to the legal industry involved in the production, distribution, and sale of pre-rolled cannabis products. This market includes both medical and recreational segments, depending on regional regulations. It encompasses a range of formats such as traditional hand-rolled joints, filtered pre-rolls, and infused variants.

The growth of this market is largely driven by the increasing legalization of cannabis for both medical and recreational use. As more countries and states permit its sale, consumer access has broadened significantly. Additionally, growing social acceptance and government regulation are helping transform cannabis from an illicit product into a formal consumer good.

Demand for marijuana cigarettes is also rising due to their convenience and familiarity. Compared to other cannabis formats, joints offer a ready-to-use experience without the need for additional equipment. This appeals especially to first-time users or casual consumers seeking an easy entry point into cannabis consumption.

Key Takeaways

- The Global Marijuana Cigarette Market is expected to be worth around USD 5.1 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 12.2% from 2025 to 2034.

- Standard marijuana cigarettes dominate with 67.1% due to their widespread availability and user preference.

- Recreational use leads the marijuana cigarette market with 76.2% due to expanding legalization trends.

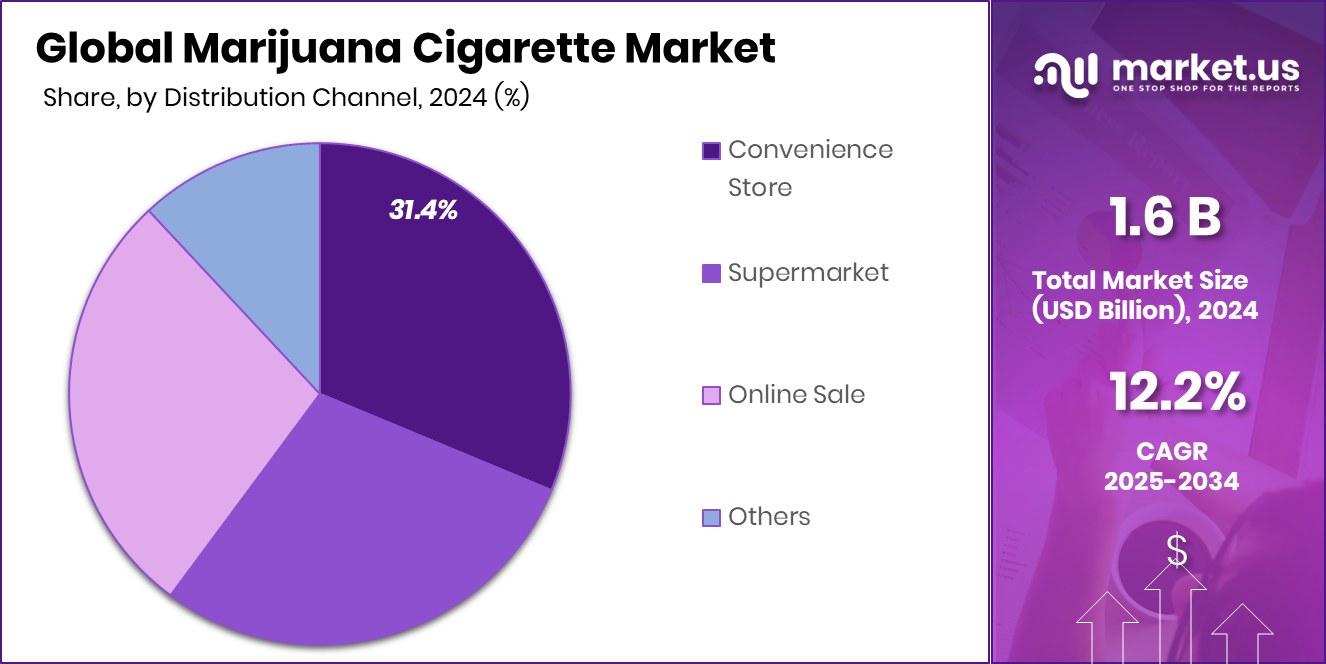

- Convenience stores account for 31.4% of sales due to accessibility and high consumer foot traffic.

- With a 41.7% share, North America leads in marijuana cigarette demand and consumption.

By Type Analysis

Standard type dominates the Marijuana Cigarette Market with a 67.1% share.

In 2024, Standard held a dominant market position in the By Type segment of the Marijuana Cigarette Market, with a 67.1% share. This strong positioning can be attributed to the widespread consumer preference for traditional, ready-to-use cannabis formats that resemble conventional tobacco cigarettes. The standard type is typically favored due to its simplicity, familiarity, and ease of use, particularly among recreational users and those new to cannabis consumption.

The 67.1% market share reflects the dominance of this format across both established and emerging markets, where the demand for pre-rolled, uncomplicated cannabis products continues to rise. Standard marijuana cigarettes are often perceived as a more accessible and less intimidating option compared to alternative cannabis delivery methods, contributing to their broad appeal.

With consumer trends leaning toward convenient and discrete usage, the standard type continues to lead sales channels and retain shelf space in dispensaries and licensed outlets. Its dominance in 2024 highlights the ongoing relevance of simple, easy-to-use cannabis products in a growing and diversifying market landscape.

By Application Analysis

Recreational use leads market applications, accounting for 76.2% share.

In 2024, Recreational held a dominant market position in the By Application segment of the Marijuana Cigarette Market, with a 76.2% share. This significant share reflects the widespread adoption of marijuana cigarettes for personal and social enjoyment, especially in regions where cannabis use has been legalized for non-medical purposes. The recreational segment benefits from increasing societal acceptance, relaxation of legal restrictions, and growing interest among adult consumers seeking alternatives to alcohol and tobacco.

The 76.2% market dominance underscores the role of recreational consumption in driving overall sales volume. Marijuana cigarettes are popular in this segment due to their convenience, familiarity, and ease of use, which appeal to casual users and social smokers. Events, festivals, and private gatherings often create high-consumption scenarios where recreational marijuana products are in demand.

Furthermore, the recreational market is supported by growing retail infrastructure, such as dispensaries and licensed outlets, offering a variety of standard marijuana cigarette options. The dominance of the recreational segment also points to broader cultural shifts, where cannabis use is increasingly seen as a lifestyle choice rather than a stigma.

By Distribution Channel Analysis

Convenience stores contribute 31.4% of the marijuana cigarette market distribution.

In 2024, Convenience Store held a dominant market position in the By Distribution Channel segment of the Marijuana Cigarette Market, with a 31.4% share. This leadership position can be attributed to the accessibility, wide geographic presence, and extended operating hours of convenience stores, making them a preferred retail point for consumers seeking immediate or impulse purchases.

The 31.4% share reflects the strong consumer reliance on convenience stores as a go-to channel for standard marijuana cigarette products, particularly in urban and semi-urban areas. These stores often benefit from high foot traffic and visibility, which further supports impulse buying behavior and strengthens product turnover. The inclusion of marijuana cigarette products in such mainstream retail formats also reflects the growing normalization of cannabis use in day-to-day life.

Moreover, convenience stores play a key role in meeting the demand for discreet, on-the-go cannabis options. Their presence in residential areas and near transportation hubs ensures continued consumer reach and market coverage. In 2024, the dominant position of convenience stores highlights their strategic importance in the marijuana cigarette retail ecosystem.

Key Market Segments

By Type

- Standard

- Pre-rolled

By Application

- Recreational

- Medical Use

By Distribution Channel

- Convenience Store

- Supermarket

- Online Sale

- Others

Driving Factors

Widening Legalization Boosts Market Demand Rapidly

One of the primary driving factors for the marijuana cigarette market is the increasing legalization of cannabis across various countries and states. Governments around the world are easing restrictions on both medical and recreational cannabis use, which has significantly expanded the consumer base. As laws change, more adults have legal access to marijuana products, leading to higher retail sales and the formalization of the supply chain.

This legal shift has also reduced stigma, making cannabis use more socially acceptable. The structured legal framework ensures better product safety and quality, attracting new users. As legalization continues to spread, the demand for marijuana cigarettes is expected to grow steadily, especially through regulated and licensed retail channels.

Restraining Factors

Strict Government Rules Limit Market Expansion Globally

A major restraining factor for the marijuana cigarette market is the strict and varying regulations across different countries and regions. While some areas have legalized cannabis, many others still maintain strict laws that ban its production, sale, or use. Even in regions where it is legal, complex licensing processes, high compliance costs, and advertising restrictions can limit market growth.

These regulatory barriers create uncertainty for businesses and discourage new investments. Additionally, international trade of marijuana products remains heavily restricted, which affects global expansion efforts. Until more consistent and relaxed regulatory frameworks are adopted worldwide, the marijuana cigarette market will continue to face limitations in reaching its full growth potential.

Growth Opportunity

Rising Demand for Organic Cannabis Product Variants

A key growth opportunity in the marijuana cigarette market lies in the increasing consumer preference for organic and chemical-free cannabis products. Health-conscious users are showing growing interest in cigarettes made from naturally grown cannabis without pesticides, additives, or artificial ingredients. This shift in demand is opening new avenues for premium, eco-friendly product lines.

Producers that focus on sustainability, clean cultivation practices, and transparent labeling can attract a loyal customer base. As awareness about the health effects of inhaling harmful substances rises, organic marijuana cigarettes are gaining popularity among both new and experienced users. This trend offers brands a chance to differentiate themselves and meet consumer demand for safer, cleaner, and more natural cannabis smoking options.

Latest Trends

Micro‑Doses and Low‑Strength Pre‑Rolled Joints Rising

A notable latest trend in the marijuana cigarette market is the surge in micro-dose and low-strength pre-rolled joints. These products deliver smaller amounts of THC per cigarette, catering to consumers who prefer a mild psychoactive experience. Instead of standard potency joints, users can choose products labeled with specific low THC content, such as 1–2 mg or balanced THC: CBD ratios.

Manufacturers are tailoring these micro-dose options with clear labeling and consistent dosage, reinforcing user confidence. The trend works by promoting responsible consumption and offering a softer introduction to cannabis use. By addressing user concerns about tolerance, side effects, or over-intoxication, micro-dose pre-rolls expand the market to include casual and cautious users, boosting overall adoption.

Regional Analysis

North America held a strong market share of 41.7%, valued at USD 0.6 Bn.

In 2024, North America held a dominant position in the global Marijuana Cigarette Market, accounting for 41.7% of the total share and reaching a market value of USD 0.6 billion. This regional leadership can be attributed to the widespread legalization of recreational cannabis across several U.S. states and the growing acceptance of cannabis consumption in both the U.S. and Canada. Regulatory advancements, consumer awareness, and the presence of a well-established retail infrastructure have further supported market expansion in this region.

In Europe, the market is gradually developing due to shifting regulatory frameworks and increasing discussions around cannabis decriminalization. Although full legalization remains limited in most countries, medical use and pilot recreational programs are opening pathways for market entry.

Asia Pacific remains a nascent market with low penetration, primarily due to restrictive legal environments. However, discussions around medical cannabis use are increasing in countries like Thailand and South Korea, signaling potential for future development.

In the Middle East & Africa, the market remains limited due to stringent regulations and cultural barriers, although some nations have begun exploring cannabis cultivation for export purposes.

Latin America is witnessing slow but steady progress, with certain countries legalizing medical cannabis, offering a foundation for future recreational markets. North America continues to lead globally in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aphria maintained its strategic focus on product innovation and international expansion, contributing to its solid presence in the marijuana cigarette market. The company has leveraged its strong cultivation capabilities and proprietary strains to cater to the rising demand for premium pre-rolled products. Its vertical integration across cultivation, processing, and distribution continues to offer competitive cost advantages.

Aurora Cannabis remained a significant player due to its diversified product offerings and large-scale production infrastructure. In 2024, Aurora expanded its footprint through partnerships and licensing deals in select international markets. Its emphasis on high-THC pre-rolls and value-tier segments helped it to appeal to both new and seasoned consumers. Aurora’s continuous improvements in production cost per gram and its ability to scale operations efficiently remain crucial for sustaining profitability in a competitive landscape.

Canopy Growth, backed by global partnerships and a strong retail network, sustained its leadership through targeted innovation in the pre-rolled segment. The company capitalized on consumer preferences for ready-to-use formats by launching new variants and blends. With investments in brand marketing and quality control, Canopy retained consumer loyalty, especially in North America.

Top Key Players in the Market

- Aphria

- Aurora Cannabis

- Canopy Growth

- Cresco Labs

- Cronos Group

- Curaleaf

- Green Thumb Industries

- Harvest Health

- MedMen

- Sundial Growers

- Tilray Inc.

- Trulieve

Recent Developments

- In May 2025, Canopy Growth announced broader product innovation targeting high-demand adult-use formats, including expanded pre‑roll offerings. This included new Claybourne Frosted Flyers flavours (Watermelon Z, Super Sour Apple) and a new 5×0.5 g pack, Tweed Quickies in 10×0.35 g format, and 7ACRES live resin infused pre‑rolls in Blue Dream and Jack Haze.

- In August 2024, Cresco Labs began testing new pre-roll production processes to boost volume and efficiency. The company implemented advanced manufacturing technology in selected states, achieving a roughly 10× increase in throughput. Executives indicated that these efforts are intended to improve margins and quality before rolling out the improvements across multiple markets.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 5.1 Billion CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standard, Pre-rolled), By Application (Recreational, Medical Use), By Distribution Channel (Convenience Store, Supermarket, Online Sale, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aphria, Aurora Cannabis, Canopy Growth, Cresco Labs, Cronos Group, Curaleaf, Green Thumb Industries, Harvest Health, MedMen, Sundial Growers, Tilray Inc., Trulieve Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Marijuana Cigarette MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Marijuana Cigarette MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aphria

- Aurora Cannabis

- Canopy Growth

- Cresco Labs

- Cronos Group

- Curaleaf

- Green Thumb Industries

- Harvest Health

- MedMen

- Sundial Growers

- Tilray Inc.

- Trulieve