Global Luxury Boxes Market Size, Share, Growth Analysis By Type (Paper, Plastic, Metal, Wood, Glass, Others), By Application (Food and Beverages, Apparel, Jewelry, Electronics, Personal Care and Cosmetics, Tobacco, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151055

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

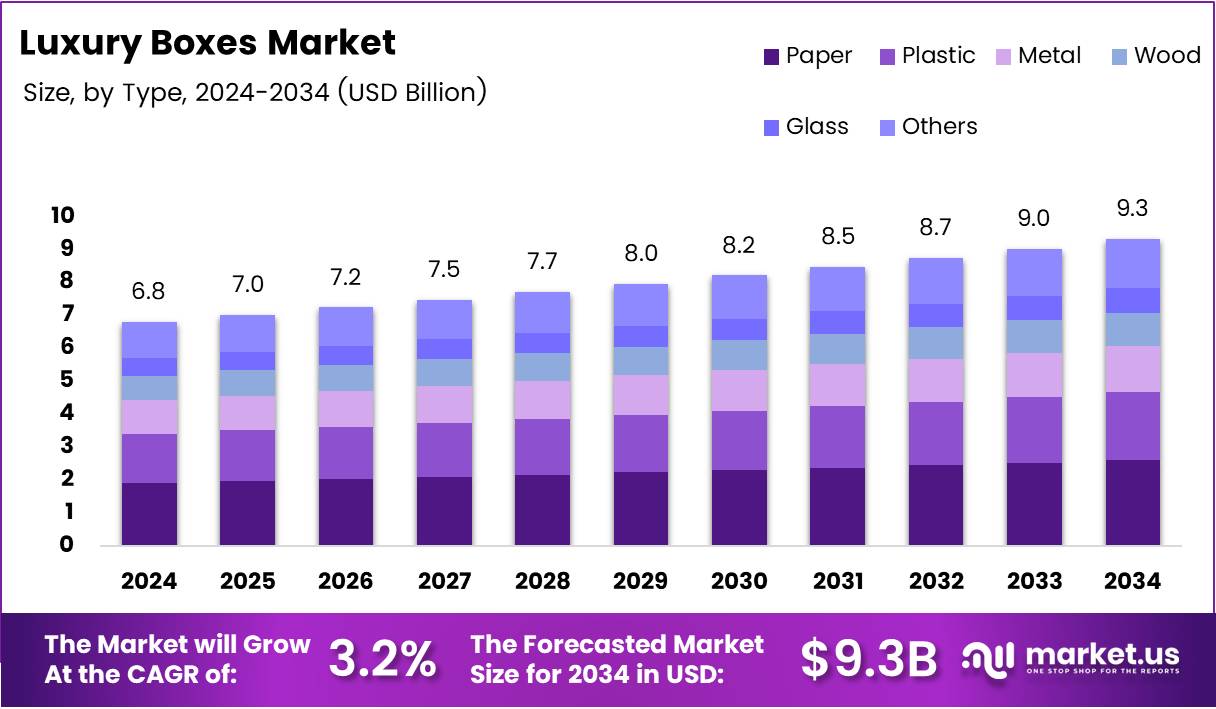

The Global Luxury Boxes Market size is expected to be worth around USD 9.3 Billion by 2034, from USD 6.8 Billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

The luxury boxes market has been gaining significant traction in recent years, driven by the growing demand for premium packaging that enhances the unboxing experience for consumers. These high-end packaging solutions are used across various sectors, including luxury fashion, cosmetics, and jewelry. The primary goal of luxury boxes is to offer an elevated presentation that aligns with the exclusivity of the product inside.

Growth in the luxury boxes market can largely be attributed to the increasing consumer preference for aesthetic packaging. According to Lussopack, 72% of American consumers are influenced by packaging design when making a purchase decision. This statistic highlights how crucial packaging has become in shaping consumer behavior. As brands look to differentiate themselves in a crowded market, the demand for luxury packaging continues to rise.

Furthermore, premium packaging plays a significant role in fostering customer loyalty. A study by Brprinters reveals that 61% of consumers are more likely to repurchase a luxury product if it comes in premium packaging. This data suggests that investing in high-quality packaging not only attracts initial customers but also encourages repeat business, which is vital for long-term brand success.

The importance of sustainable practices in the luxury boxes market cannot be overlooked. According to a survey by Sustainability Online, 30% of luxury packaging sales are expected to use sustainable solutions over the next three years. This shift is being driven by increasing consumer awareness of environmental issues and growing pressure on companies to adopt greener packaging solutions. This trend aligns with the broader push for sustainability in the packaging industry.

Additionally, consumers are becoming more discerning about packaging that reflects a brand’s commitment to sustainability. A study shows that 46% of U.S. consumers are bothered by ‘empty space’ in packaging, while 75% view such packaging as a sign that the brand does not prioritize sustainability. These insights underscore the growing importance of efficient and eco-friendly packaging solutions in the luxury sector.

Governments and regulatory bodies across the globe are also playing a pivotal role in shaping the market by introducing regulations aimed at reducing packaging waste. In response, many luxury box manufacturers are investing in innovative solutions to meet these standards while maintaining the appeal and luxury associated with their products. As consumer and regulatory pressures continue to mount, the luxury boxes market will likely experience further evolution toward sustainable and eco-conscious packaging solutions.

Key Takeaways

- The Global Luxury Boxes Market is expected to reach USD 9.3 Billion by 2034, growing at a CAGR of 3.2% from USD 6.8 Billion in 2024.

- Paper dominates the By Type Analysis segment in 2024, preferred for its sustainable nature, customization options, and premium feel.

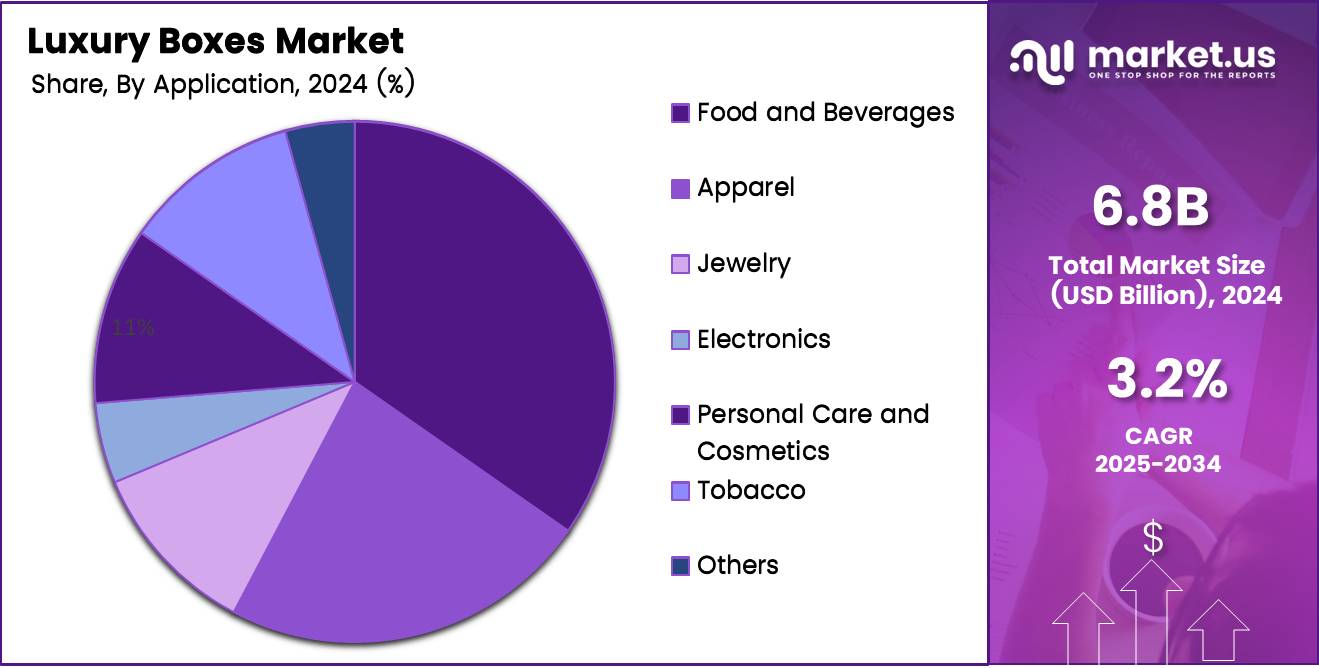

- Food and Beverages holds a dominant market position in the By Application Analysis segment, driven by the growing demand for gourmet foods, wine, and confectionery.

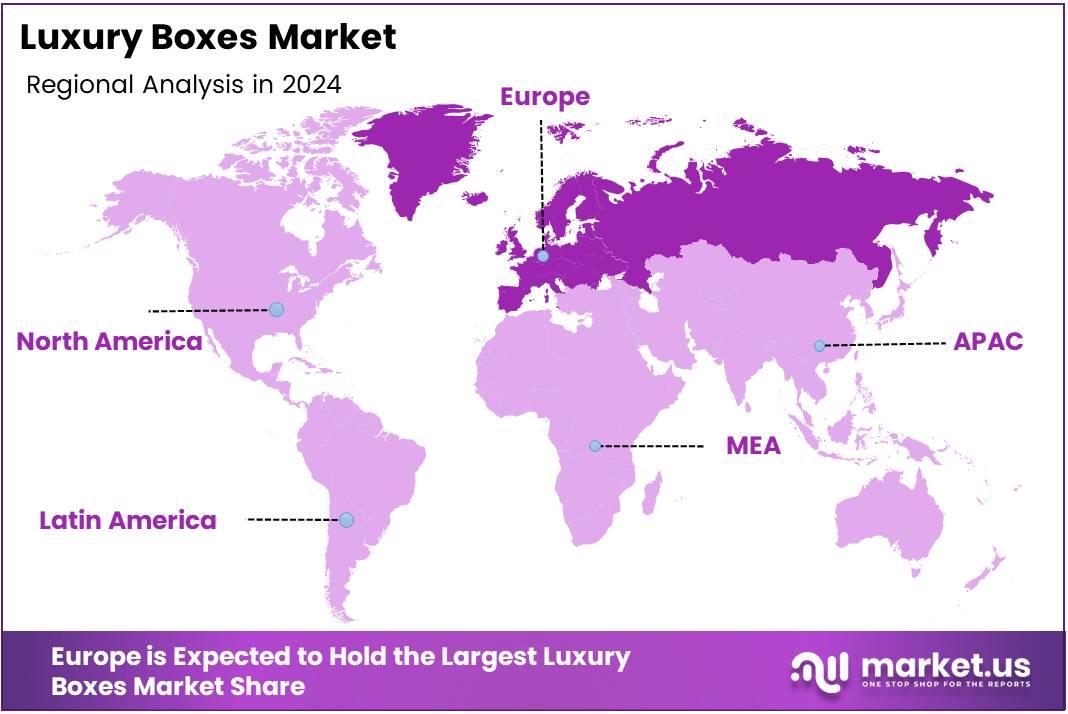

- Europe leads the global market, with strong demand across the fashion, cosmetics, and gourmet food industries, driven by a focus on sustainability and design aesthetics.

Type Analysis

Paper leads the market in 2024 with a dominant share due to its eco-friendliness and versatility.

In 2024, Paper held a dominant market position in the By Type Analysis segment of the Luxury Boxes Market. Paper remains a preferred material for luxury packaging due to its sustainable nature, customization options, and premium feel. Brands aiming for eco-conscious branding often choose paper-based luxury boxes to align with consumer preferences for greener alternatives.

Plastic follows as a versatile option, favored for its durability and lightweight properties. Despite growing environmental concerns, plastic is still used in high-end packaging for electronics and cosmetics where protection and aesthetics are priorities.

Metal packaging continues to appeal to niche markets, especially where long-term durability and a premium tactile experience are key. It’s often used in limited-edition luxury products and collector’s items.

Wood packaging conveys a rustic, premium feel, making it ideal for high-end wine, spirits, and gourmet products. Its use, while limited by cost and weight, reflects exclusivity and craftsmanship.

Glass packaging, though rare in luxury boxes, finds use in fragrance and cosmetics, lending elegance and transparency. Others include innovative and hybrid materials tailored to luxury branding needs, often blending design and sustainability.

Application Analysis

Food and Beverages lead with a commanding share in 2024, driven by premium gifting trends and demand for artisanal packaging.

In 2024, Food and Beverages held a dominant market position in the By Application Analysis segment of the Luxury Boxes Market. The segment thrives on the rising popularity of gourmet foods, wine, and confectionery in premium gifting. Luxury boxes for food enhance brand value and customer experience, particularly during festive and corporate seasons.

Apparel is another major segment where luxury boxes elevate brand presentation, especially in high-end fashion and seasonal collections. Sophisticated packaging supports the overall perception of exclusivity and elegance.

Jewelry consistently demands exquisite packaging, with boxes that ensure security while enhancing the aesthetic appeal of the item inside. This sector relies heavily on customization and quality finishes.

Electronics benefit from luxury boxes that offer both protection and unboxing appeal. Premium headphones, watches, and tech gadgets often come in such packaging to create a high-end feel.

Personal Care and Cosmetics use luxury packaging to reinforce brand prestige and consumer indulgence. Boxes are designed to enhance unboxing rituals for skincare, perfumes, and beauty kits. Tobacco uses luxury boxes primarily in cigars and limited-edition products to maintain exclusivity.

Key Market Segments

By Type

- Paper

- Plastic

- Metal

- Wood

- Glass

- Others

By Application

- Food and Beverages

- Apparel

- Jewelry

- Electronics

- Personal Care and Cosmetics

- Tobacco

- Others

Drivers

Rising Disposable Income and Consumer Spending Drive Luxury Boxes Market Growth

Rising disposable income and increasing consumer spending have positively impacted the demand for luxury goods. As more consumers have greater purchasing power, their preference for high-end products and packaging has grown. This, in turn, boosts the demand for premium luxury packaging, particularly luxury boxes. Consumers are now more willing to invest in well-designed, high-quality packaging that adds to the overall appeal of luxury products.

The growing trend of e-commerce also contributes to this market shift. Online retailers cater to the demand for packaging that not only protects the product but also provides a premium unboxing experience, which enhances customer satisfaction. Furthermore, the growing awareness of eco-friendly and sustainable packaging solutions aligns with consumer preferences, driving the demand for innovative packaging solutions in the luxury goods market.

Restraints

High Production Costs and Limited Raw Materials Restrain Luxury Boxes Market Growth

The luxury boxes market faces several challenges, including high production costs. The use of premium materials and intricate designs contributes to expensive manufacturing processes. These high costs may deter smaller brands or limit the production of such packaging for certain products.

Additionally, the limited availability of raw materials such as high-quality paper, metals, or specialized packaging components further complicates the production process. Economic downturns also affect the demand for luxury goods, reducing the willingness to invest in premium packaging.

The increased scrutiny of packaging waste disposal regulations adds another layer of complexity, as brands are pressured to adopt more sustainable practices, which can increase operational costs.

Growth Factors

Growth Opportunities in the Luxury Boxes Market

The expansion of luxury goods markets in emerging economies presents significant growth opportunities for the luxury boxes market. As middle-class populations grow in these regions, there is an increased demand for high-end products and the packaging that accompanies them. This creates a fertile ground for luxury packaging providers to expand their presence and cater to new markets.

Custom-designed and personalized luxury packaging is also gaining traction. Consumers are increasingly looking for unique and tailored experiences, and luxury packaging plays a key role in that demand.

Integration of digital technology, including smart packaging, is becoming a game-changer, offering interactive experiences that enhance product appeal. Moreover, the beauty and cosmetics sector’s rising demand for luxury packaging offers further growth potential for the industry.

Emerging Trends

Trending Factors in the Luxury Boxes Market

Sustainability has become a critical focus in the luxury boxes market. More brands are prioritizing eco-friendly practices, opting for biodegradable and recyclable materials for their packaging. Consumers are more conscious of their environmental impact, prompting brands to adopt greener alternatives in packaging.

Minimalist and modern packaging designs are also trending, with an emphasis on elegance and simplicity. Interactive and experiential packaging elements, which engage consumers and create memorable unboxing experiences, are gaining popularity.

Additionally, luxury brands are incorporating technology into packaging to make it more functional and appealing. This includes features like QR codes for product information and personalized messages, enhancing the overall consumer experience.

Regional Analysis

Europe Dominates the Luxury Boxes Market

Europe leads the global luxury boxes market, driven by a well-established luxury goods sector and high consumer expectations for premium packaging. The region shows strong demand across fashion, cosmetics, and gourmet food industries. A growing emphasis on sustainable materials and sophisticated design aesthetics further supports market growth.

North America Luxury Boxes Market Trends

North America follows closely, with market expansion driven by trends in personalized packaging and unboxing experiences. Increased online retail activity and consumer preference for upscale presentation contribute to steady demand. Innovation in packaging design and materials plays a key role in regional growth.

Asia Pacific Luxury Boxes Market Trends

Asia Pacific is witnessing significant growth, driven by rising disposable incomes, luxury brand expansion, and cultural practices that emphasize gifting. Countries like China, India, and South Korea are key markets contributing to rising demand. Evolving consumer tastes and a growing e-commerce ecosystem are reshaping the packaging landscape.

Middle East and Africa Luxury Boxes Market Trends

The Middle East and Africa region shows promising potential in the luxury boxes market, supported by high-end retail development and a strong culture of luxury consumption. The demand for exclusive, custom-designed packaging is increasing, especially in the GCC countries. Hospitality and gifting traditions also drive market interest.

Latin America Luxury Boxes Market Trends

Latin America is gradually emerging in the luxury boxes market, with Brazil and Mexico leading regional adoption. Rising awareness of premium branding and packaging aesthetics supports market interest. Despite economic challenges, the growing luxury retail sector is creating opportunities for upscale packaging solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Luxury Boxes Company Insights

In 2024, Sealed Air Corporation continues to lead the luxury packaging space, focusing on innovative and sustainable packaging solutions. The company is committed to enhancing the aesthetics and functionality of luxury boxes, leveraging eco-friendly materials to meet rising consumer demand for sustainability.

Stora Enso Oyj is another key player shaping the market with its diverse range of premium paperboard packaging. The company’s strong emphasis on renewable materials and sustainable production processes positions it as a significant player in the eco-conscious luxury packaging sector.

Graphic Packaging Holding Company has made substantial advancements in the luxury boxes market, offering high-quality packaging solutions that emphasize consumer experience. Known for its innovative designs and focus on efficiency, the company caters to various industries, including luxury goods and cosmetics.

WestRock Company is at the forefront of the luxury boxes market with its expertise in paperboard packaging. The company’s commitment to sustainability and advanced design capabilities has made it a preferred choice for luxury product packaging, particularly in the food and beverage sector.

These four companies demonstrate strong growth and strategic positioning within the luxury boxes market, driven by innovation, sustainability, and design excellence.

Top Key Players in the Market

- Sealed Air Corporation

- Stora Enso Oyj

- Graphic Packaging Holding Company

- WestRock Company

- Mayr-Melnhof Karton AG

- Sonoco Products Company

- International Paper

- Rengo Co., Ltd.

- DS Smith plc

- Smurfit Kappa Plc

- Oji Holdings Corporation

- Mondi Group

Recent Developments

- In January 2025, Indulge Global secured $1 million in funding to expand its luxury concierge services, marking a significant step towards enhancing its premium offerings and catering to the growing demand for exclusive services.

- In June 2024, Arca Space Capital made a strategic investment in five luxury packaging companies, strengthening its position in the luxury packaging sector and fostering innovation in packaging solutions for high-end products.

- In August 2024, Mainetti acquired Morresi Cartotecnica to bolster its presence in the luxury packaging market in Southern Europe, enhancing its capabilities to offer tailored packaging solutions for luxury brands in the region.

- In March 2025, ISEM Packaging Group acquired Egisa, a move aimed at expanding its portfolio and improving its competitive positioning in the luxury packaging sector by adding new technologies and capabilities.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Billion Forecast Revenue (2034) USD 9.3 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Paper, Plastic, Metal, Wood, Glass, Others), By Application (Food and Beverages, Apparel, Jewelry, Electronics, Personal Care and Cosmetics, Tobacco, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Sealed Air Corporation, Stora Enso Oyj, Graphic Packaging Holding Company, WestRock Company, Mayr-Melnhof Karton AG, Sonoco Products Company, International Paper, Rengo Co., Ltd., DS Smith plc, Smurfit Kappa Plc, Oji Holdings Corporation, Mondi Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sealed Air Corporation

- Stora Enso Oyj

- Graphic Packaging Holding Company

- WestRock Company

- Mayr-Melnhof Karton AG

- Sonoco Products Company

- International Paper

- Rengo Co., Ltd.

- DS Smith plc

- Smurfit Kappa Plc

- Oji Holdings Corporation

- Mondi Group