Global Locomotive Market Size, Share, Growth Analysis By Type (Electric, Diesel, Other), By Technology (IGBT Module, GTO Thyristor, SiC Power Module), By End-use (Passengers, Switcher, Freight), By Component (Rectifier, Auxiliary Power Unit (APU), Inverter, Alternator, Traction Motor, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147188

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

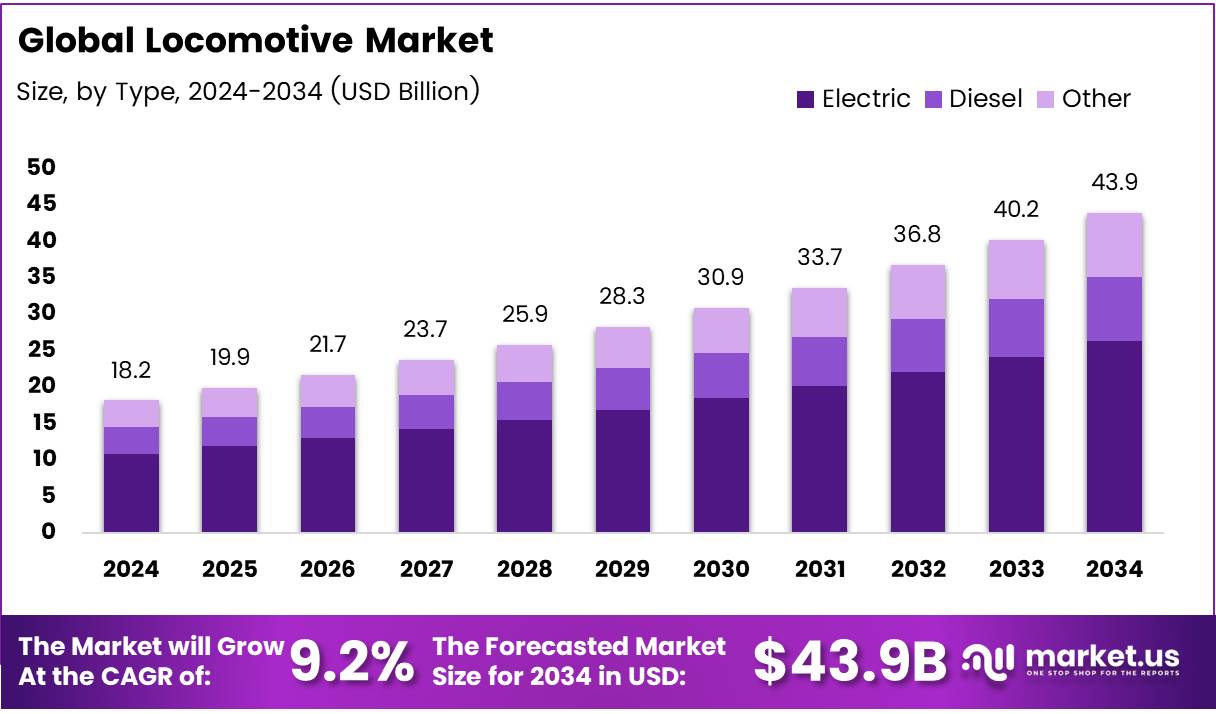

The Global Locomotive Market size is expected to be worth around USD 43.9 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

The locomotive market refers to the global trade and production of locomotives used in rail transport, including electric, diesel, and hybrid engines. Locomotives play a critical role in global trade and transportation networks, helping to facilitate goods movement across long distances. The market includes manufacturers, suppliers, and maintenance providers, serving industries such as freight and passenger transport.

In 2023, according to OEC, global trade of electric locomotives reached $1.14B, reflecting the growing demand for environmentally sustainable transport options. Electric locomotives are becoming increasingly popular due to their energy efficiency and lower environmental impact compared to diesel alternatives. This is a key factor in the locomotive market’s transition towards greener solutions.

The U.S. rail industry also plays a significant role in the global locomotive market. According to the Association of American Railroads (AAR), approximately 38% of U.S. rail carloads and intermodal units, as well as 37% of rail revenue, are directly tied to global trade. This highlights the importance of locomotive transport in the supply chain and global commerce, positioning the market for consistent growth as international trade continues to expand.

In emerging markets, such as India, locomotive production is growing rapidly. According to PIB, between 2004 and 2014, India produced 4,695 locomotives, with a national annual average of 470. This production capacity underlines India’s growing infrastructure investments and its rising role as a key player in the global locomotive market. India’s commitment to increasing its rail network is expected to drive further demand for both new locomotives and maintenance services.

Government investment and regulatory factors are crucial in shaping the locomotive market’s future. Many countries are prioritizing sustainable transport infrastructure, allocating funds for electrification and modernization of rail networks. For instance, the European Union and the U.S. are investing heavily in rail upgrades to improve efficiency and reduce carbon emissions. These investments, coupled with regulations pushing for more sustainable technologies, will drive growth in the locomotive market over the coming years.

Moreover, stricter regulations on emissions and energy consumption are encouraging innovation in locomotive technology. With governments worldwide pushing for more eco-friendly solutions, manufacturers are under pressure to deliver more energy-efficient and low-emission products. This trend presents significant opportunities for companies specializing in electric and hybrid locomotives, which are expected to capture a larger share of the market.

Key Takeaways

- The global locomotive market is projected to reach USD 43.9 billion by 2034, growing at a CAGR of 9.2% from 2025 to 2034.

- Electric locomotives dominated the market in 2024, holding a 48.9% share, driven by energy efficiency and lower environmental impact.

- IGBT Modules led the technology segment in 2024, due to their high efficiency and reliability, resulting in reduced operational costs.

- The Passengers segment held a dominant position in 2024, fueled by demand for urban transportation, high-speed trains, and sustainable travel.

- Rectifiers were the leading component in 2024, essential for converting AC to DC for efficient power distribution in locomotives.

- The Asia-Pacific region is the largest market, driven by significant investments in rail infrastructure, particularly in China and India.

Type Analysis

Electric Locomotives hold 48.9% share in By Type Analysis segment of Locomotive Market in 2024

In 2024, Electric locomotives dominated the By Type Analysis segment of the locomotive market, holding a substantial share of 48.9%. The widespread adoption of electric-powered locomotives can be attributed to their superior energy efficiency and reduced environmental impact compared to their diesel counterparts. Electric locomotives are increasingly favored for both passenger and freight services, especially in regions with robust electric grid infrastructure.

Diesel locomotives, while still significant, accounted for a smaller portion of the market. They are preferred in areas where electrification is not feasible due to geographical challenges or infrastructure limitations. However, with the push for cleaner alternatives, the diesel segment is expected to face gradual decline in the long term.

Other types of locomotives, which include hybrid and steam-powered models, hold a minimal share in comparison. These are typically used for specialized applications where electric and diesel options are not suitable.

Technology Analysis

IGBT Module leads with a dominant market share in By Technology Analysis segment of Locomotive Market in 2024

In 2024, IGBT Modules led the By Technology Analysis segment of the locomotive market, securing a prominent share. Their ability to offer high efficiency and improved reliability at reduced operational costs has made them a preferred choice in locomotive technology. These modules are particularly valued for their superior thermal performance and faster switching capabilities, making them crucial in modern electric and hybrid locomotives.

GTO Thyristors, while still in use, have been slowly replaced by IGBT modules due to the latter’s greater efficiency and ease of integration into modern systems. GTO Thyristors are mainly found in legacy systems, and as such, their market share is on the decline.

SiC Power Modules, though emerging, have not yet captured a significant portion of the market. While these modules offer enhanced performance under high-voltage and high-temperature conditions, their adoption is still in the early stages, which limits their immediate impact in comparison to the IGBT segment.

End-use Analysis

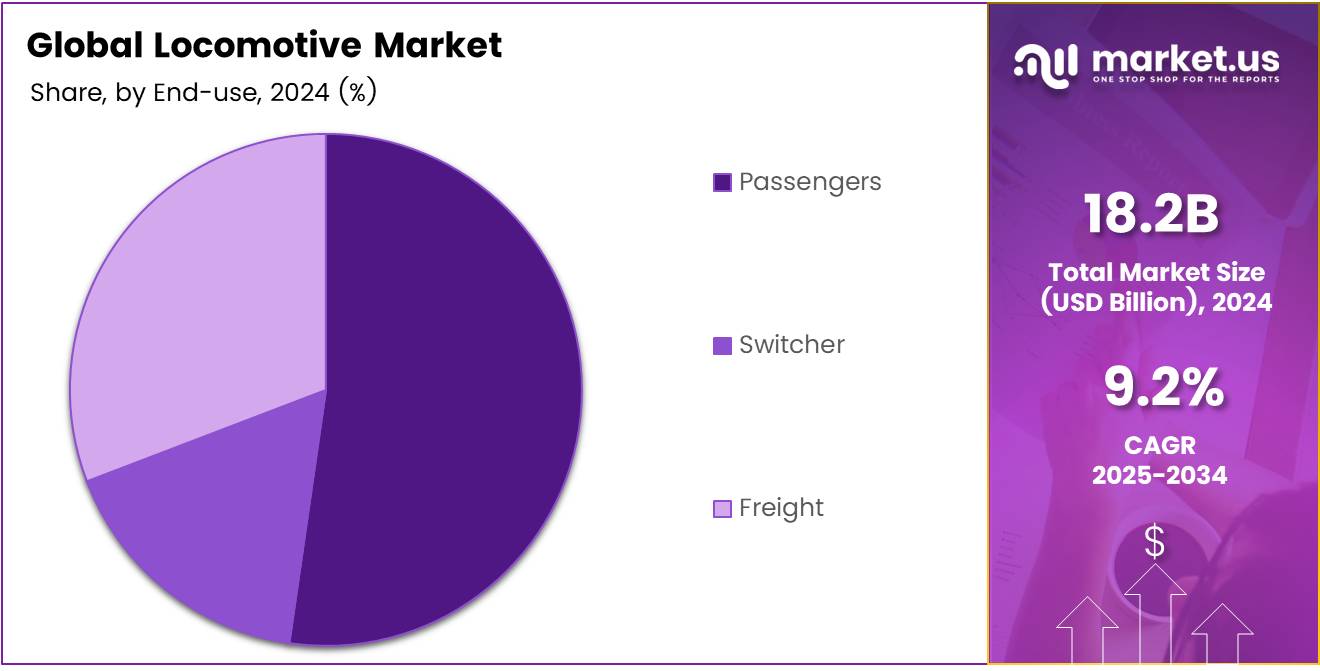

Passengers dominate the By End-use Analysis segment of Locomotive Market with strong demand in 2024

In 2024, the Passengers segment held a dominant market position in the By End-use Analysis segment of the locomotive market. This segment is experiencing significant growth, driven by increased demand for urban transportation solutions, high-speed trains, and sustainable travel options. Passenger trains, particularly in regions with well-established rail networks like Europe and Asia, are key drivers of this growth.

The Switcher segment, which primarily deals with locomotives used for switching operations in rail yards and terminals, holds a smaller share in comparison. While still an important part of the market, it does not experience the same level of expansion as passenger-focused applications.

Freight locomotives also continue to hold a stable position within the market. The demand for freight transportation remains strong, especially with the growing emphasis on rail over road for long-distance cargo. However, passenger trains take precedence in terms of growth and innovation, with governments and private sectors prioritizing investments in high-speed and electrified passenger rail systems.

Component Analysis

Rectifiers maintain leadership in By Component Analysis segment of Locomotive Market in 2024

In 2024, Rectifiers held a dominant market position in the By Component Analysis segment of the locomotive market, due to their critical role in converting alternating current (AC) to direct current (DC) for efficient power distribution across locomotive systems. Rectifiers are integral to both electric and hybrid locomotives, and their widespread use across various locomotive types ensures their market dominance.

The Auxiliary Power Unit (APU) segment also plays a vital role in providing power to systems when the main engine is not running. However, its share is relatively smaller compared to rectifiers, as APUs are typically used in specific applications for auxiliary power rather than the primary propulsion of locomotives.

The Inverter and Alternator segments are similarly important but more specialized in their roles. Inverters convert DC to AC, while Alternators provide electrical power to the locomotive systems. These components are indispensable, but their market share is lower in comparison to rectifiers due to the latter’s broad application in both electric and hybrid locomotive systems.

Key Market Segments

By Type

- Electric

- Diesel

- Other

By Technology

- IGBT Module

- GTO Thyristor

- SiC Power Module

By End-use

- Passengers

- Switcher

- Freight

By Component

- Rectifier

- Auxiliary Power Unit (APU)

- Inverter

- Alternator

- Traction Motor

- Others

Drivers

Urbanization and Expansion of Rail Networks Drive Growth in Locomotive Market

As cities continue to grow and expand, the need for efficient transport systems becomes more critical, driving the demand for locomotives. Urbanization results in an increased population and freight movement, prompting a need for more trains and better infrastructure.

Rail networks are being expanded to meet this growing need, especially in densely populated areas where traffic congestion is high. More cities are recognizing that trains offer a practical solution for reducing road traffic and enhancing mobility. This demand for efficient and large-scale transportation systems has significantly boosted the locomotive market, especially in urban centers.

Restraints

High Initial Investment and Stringent Emission Regulations Restrain Locomotive Market Growth

One of the key challenges faced by the locomotive market is the high initial investment required for both locomotives and rail infrastructure. The capital-intensive nature of these projects can deter governments and private companies from investing in new systems.

Additionally, older diesel locomotives face stricter emission regulations. Governments around the world are imposing more stringent environmental standards, which often force operators to either retrofit older engines with cleaner technologies or face potential bans. These costs, coupled with the complexity of upgrading infrastructure, pose significant barriers to market growth.

Growth Factors

Electrification of Rail Networks Presents Lucrative Growth Opportunities in Locomotive Market

One of the most promising growth opportunities in the locomotive market is the electrification of rail networks. This shift to electric and hybrid locomotives offers significant environmental benefits and increased operational efficiency. As many countries seek to reduce carbon emissions, electric trains are becoming a preferred choice.

In addition, emerging markets in regions such as Africa and Southeast Asia are looking to invest in new rail networks, providing fresh opportunities for locomotive manufacturers. Additionally, the demand for high-speed rail in regions like Europe, Asia, and North America is expanding, fueling the need for advanced locomotives. These factors present a substantial growth potential for the locomotive market.

Emerging Trends

Battery-Electric Locomotives and PPPs Shape Future of Locomotive Market

The locomotive market is witnessing significant trends that could reshape its future. One such trend is the shift toward battery-electric locomotives. Battery-powered trains are becoming increasingly commercially viable, offering a cleaner alternative to traditional diesel-powered locomotives.

Public-private partnerships (PPPs) are also gaining traction, enabling the joint funding and management of rail systems. These collaborations make it easier to finance and improve rail infrastructure, making it more accessible for governments and companies. Lastly, many companies are opting to modernize and upgrade older locomotive fleets rather than replace them entirely. Retrofitting these older engines with new technologies helps reduce costs while maintaining operational efficiency, marking another important trend in the market.

Regional Analysis

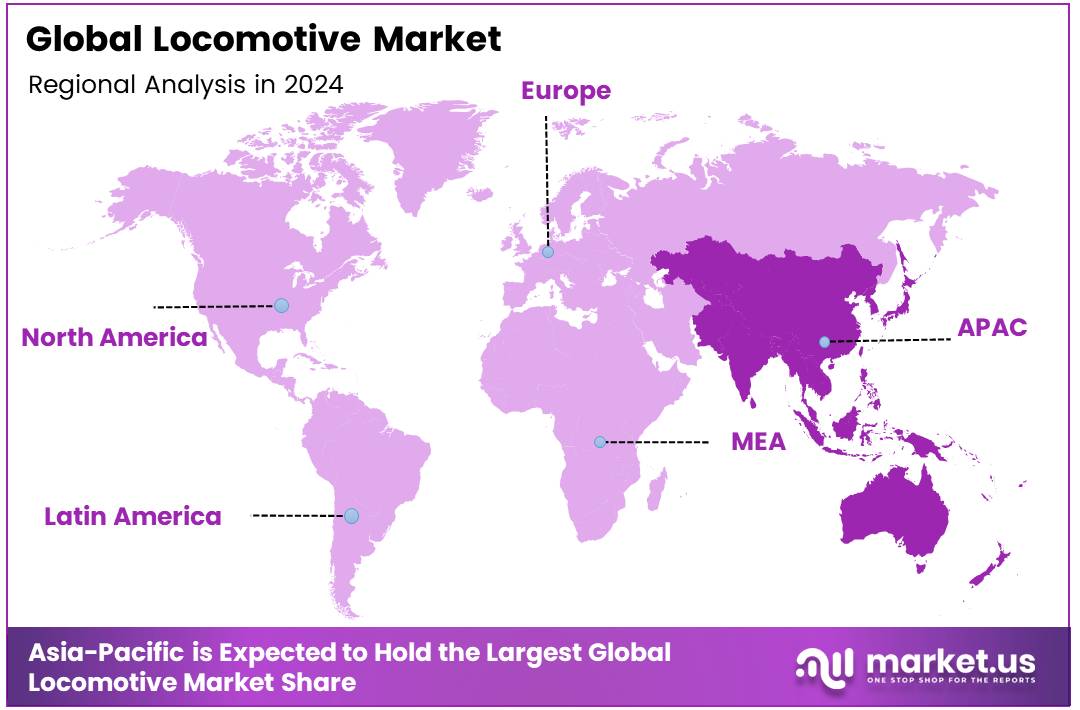

Asia-Pacific Dominating the Global Locomotive Market

The Asia-Pacific region is the largest player in the global locomotive market, accounting for a dominant share. This growth is fueled by substantial investments in railway infrastructure, especially in countries like China and India, which are continuously expanding and modernizing their rail systems. The rapid adoption of high-speed trains and electric locomotives, along with government initiatives supporting sustainable transport, further strengthens the market’s growth in this region.

Regional Mentions:

North America holds a significant share of the global locomotive market, driven by the U.S. and Canada’s efforts to enhance the efficiency and sustainability of their rail systems. The increasing demand for electric locomotives, alongside the modernization of aging rail infrastructure, is a major factor supporting growth in this region. Additionally, the rise of autonomous locomotives in freight transportation is expected to drive further market expansion.

Europe continues to maintain a substantial share of the locomotive market, largely due to its focus on modernizing rail networks and enhancing sustainability. Countries like Germany, France, and the UK are leading the way in adopting electric locomotives and integrating advanced technology into their rail systems. Furthermore, European governments are investing heavily in railway electrification and sustainable solutions to reduce carbon emissions.

Latin America’s locomotive market is experiencing steady growth, particularly in countries like Brazil and Argentina, where rail networks are being expanded to support industrial and agricultural needs. Brazil’s significant investments in rail infrastructure and its growing mining sector are key drivers. As the region’s economies continue to develop, the demand for efficient and reliable rail transport is expected to increase.

The Middle East & Africa region is witnessing gradual growth in the locomotive market as countries focus on modernizing their aging rail systems. The adoption of electric and hybrid locomotives is gaining traction, especially in the Middle East, where large-scale infrastructure projects are underway. While the market is still in a developmental stage, the region is poised for growth with increasing investments in rail transport.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

BHEL has established itself as a key player in the locomotive market, particularly in India. The company focuses on manufacturing electric locomotives, offering a strong presence in the domestic market while expanding its footprint internationally. Leveraging its technological expertise and strategic collaborations, BHEL is poised to meet the growing demand for energy-efficient and eco-friendly locomotives, particularly in the emerging markets where electrification of rail networks is a priority.

Strukton, headquartered in the Netherlands, is a prominent player in the railway infrastructure sector, offering advanced solutions for railway systems, including locomotives. The company is well-known for its high-quality engineering and integration services, contributing to the modernization of rail networks across Europe and globally.

AEG Power Solutions B.V. is recognized for its role in providing energy solutions for locomotive systems, including power supplies and electrical components. With a focus on the optimization of locomotive energy consumption, AEG is a critical enabler of electrification and sustainable transport solutions. Their products enhance the performance and efficiency of locomotives, making them an integral partner for locomotive manufacturers and rail operators globally, particularly in the European market.

Top Key Players in the Market

- Bharat Heavy Electricals Limited

- Strukton

- AEG Power Solutions B.V.

- Hitachi, Ltd.

- Toshiba Corporation

- Mitsubishi Heavy Industries, Ltd.

- Wabtec Corporation

- Alstom

- CRRC Corporation Limited

- Siemens AG

Recent Developments

- In February 2025, Rail First announced a significant investment in new locomotives aimed at enhancing the sustainability of freight transportation in Australia, supporting the transition to greener logistics. This move is part of the company’s broader strategy to modernize its fleet and reduce carbon emissions in the sector.

- In March 2025, Alstom proudly delivered its 500th electric locomotive for Indian Railways, a milestone that highlights the success of the “Make in India” initiative. The new locomotives are expected to reduce operational costs, increase energy efficiency, and alleviate congestion in India’s busy rail network.

- In January 2025, RIVE raised an additional 270 million euros to fund further investments in advanced locomotive technology. This funding aims to accelerate the development and deployment of innovative, sustainable rail solutions across European markets.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Billion Forecast Revenue (2034) USD 43.9 Billion CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Electric, Diesel, Other), By Technology (IGBT Module, GTO Thyristor, SiC Power Module), By End-use (Passengers, Switcher, Freight), By Component (Rectifier, Auxiliary Power Unit (APU), Inverter, Alternator, Traction Motor, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bharat Heavy Electricals Limited, Strukton, AEG Power Solutions B.V., Hitachi, Ltd., Toshiba Corporation, Mitsubishi Heavy Industries, Ltd., Wabtec Corporation, Alstom, CRRC Corporation Limited, Siemens AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bharat Heavy Electricals Limited

- Strukton

- AEG Power Solutions B.V.

- Hitachi, Ltd.

- Toshiba Corporation

- Mitsubishi Heavy Industries, Ltd.

- Wabtec Corporation

- Alstom

- CRRC Corporation Limited

- Siemens AG