Global Smart Transformer Market Size, Share, Statistics Analysis Report By Type (Power Transformers, Distribution Transformers, Specialty Transformers, Instrument Transformers), By Component (Converters, Switches, Transformers, Hardware for Trasformer Monitoring, Others), By Application (Traction Locomotive, Smart Grid, Electric Vehicle Charging, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141352

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

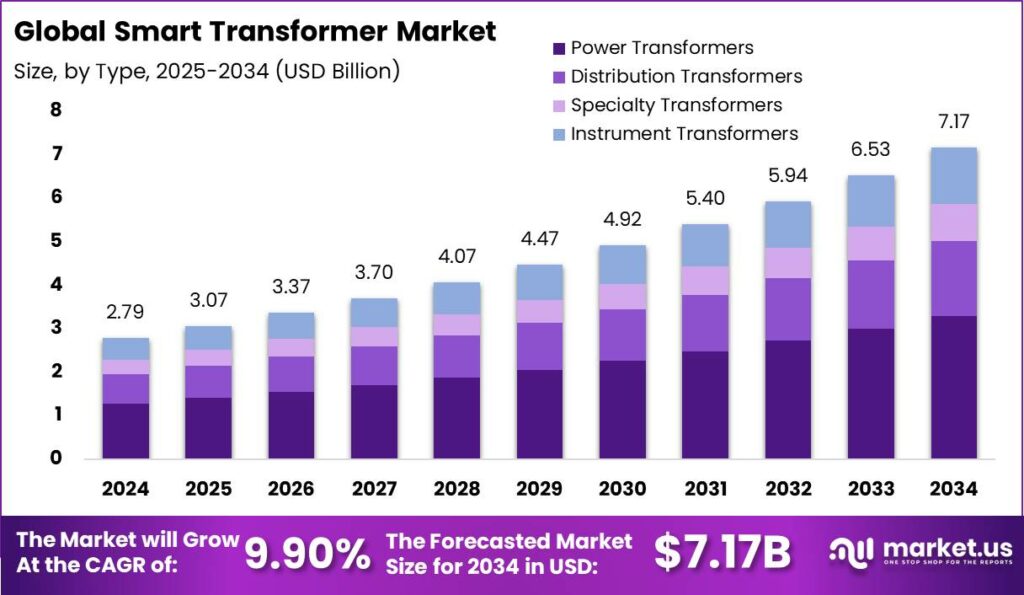

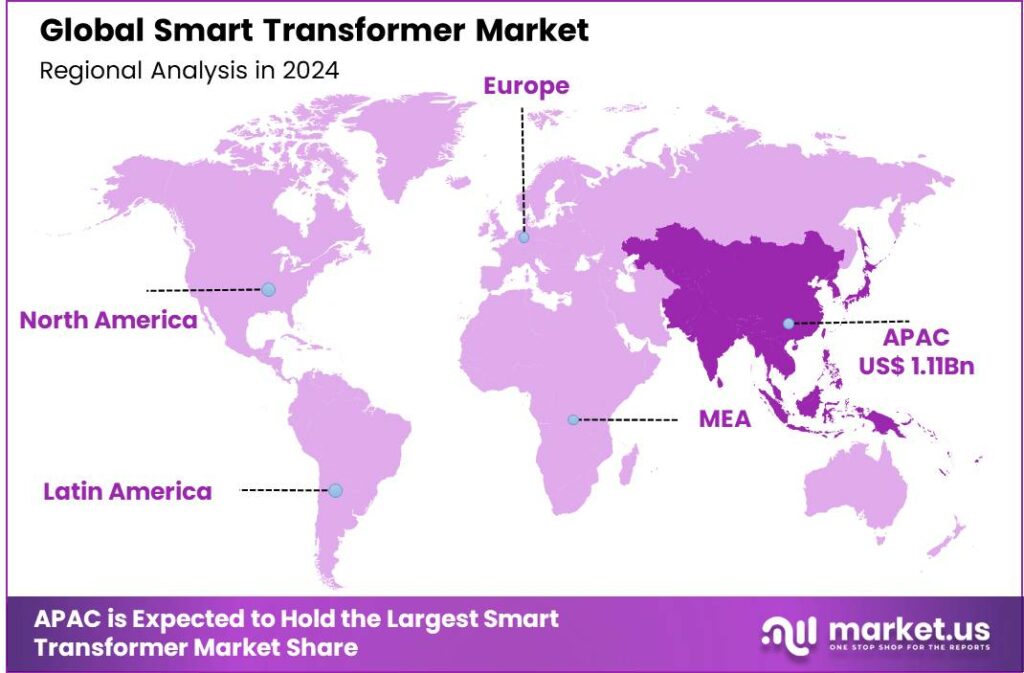

The Global Smart Transformer Market size is expected to be worth around USD 7.17 Billion By 2034, from USD 2.79 Billion in 2024, growing at a CAGR of 9.90% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific dominated the smart transformer sector, holding over 40% of the global market share, with an estimated revenue of USD 1.11 billion.

A smart transformer is an advanced form of transformer technology that integrates electronics and software to manage power distribution and enhance the operational efficiency of electrical systems. These transformers are a key element of the smart grid trend, providing features like voltage regulation, remote monitoring, and real-time feedback.

The smart transformer market is driven by the need for greater grid stability and renewable energy integration, catering to utilities, industrial sectors, and commercial establishments. As the grid evolves with diverse energy sources and fluctuating demands, smart transformers are key to ensuring efficient energy distribution and reliability.

Several major factors are driving the growth of the smart transformer market such as the rise of renewable energy sources like solar and wind demands advanced grid technologies to manage intermittent power and ensure stability. Aging power infrastructure in developed countries needs upgrades, with smart transformers offering a more efficient solution.

The push for electric vehicle (EV) adoption and charging infrastructure drives demand for smart grid solutions. Regulatory and environmental pressures also encourage utilities to invest in smart technologies that offer energy savings, reduce carbon footprints, and improve system resilience. Together, these factors highlight the strategic value of smart transformers in modern electrical networks.

According to a report by PTR, the global addition of renewable energy capacity, including solar and wind, reached approximately 181 GW in 2022. Looking forward, from 2022 to 2030, the capacity of renewable energy is forecasted to expand robustly at a CAGR of 9.5%. This growth signifies a shift towards non-traditional energy sources, particularly wind and solar power.

Such a transition is expected to drive the adoption of smart transformers, replacing conventional transformers to better accommodate the variable nature of renewable energy production. Smart transformers are gaining popularity in both developed and emerging markets for their efficiency, flexibility, and sustainability.

In developed regions, they enhance system reliability within smart grid initiatives, while emerging markets use them to improve power distribution and address grid instability. Growing environmental concerns and the focus on energy efficiency are also driving their adoption.

Key Takeaways

- The Global Smart Transformer Market size is projected to reach USD 7.17 Billion by 2034, growing from USD 2.79 Billion in 2024. The market is expected to expand at a CAGR of 9.90% from 2025 to 2034.

- In 2024, the Power Transformers segment captured more than 46% of the total market share, holding a dominant position.

- The Transformers segment dominated the market in 2024, accounting for over 35% of the total smart transformer market share.

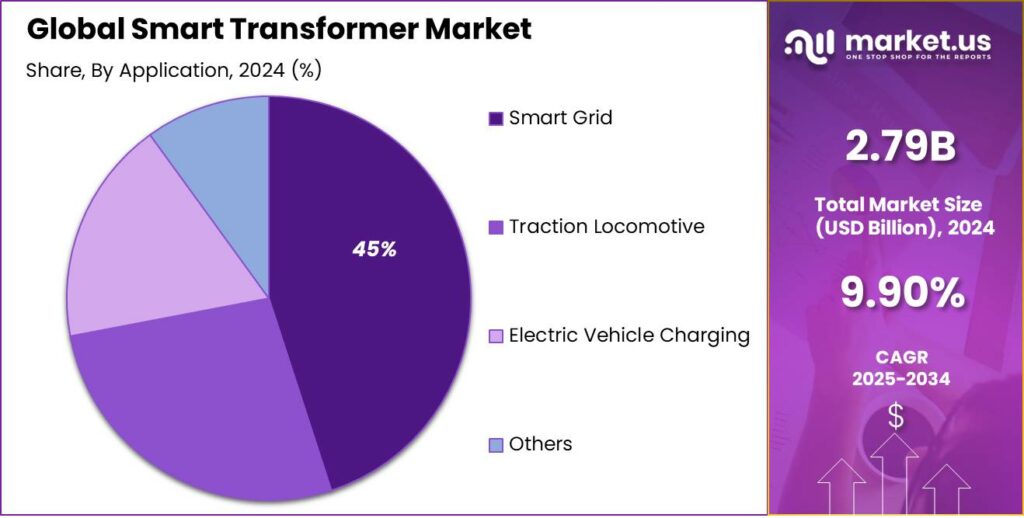

- The Smart Grid segment led the global smart transformer market in 2024, securing more than 45% of the total market share.

- In 2024, Asia-Pacific emerged as the dominant region in the smart transformer sector, capturing more than 40% of the global market share, with an estimated revenue of USD 1.11 billion.

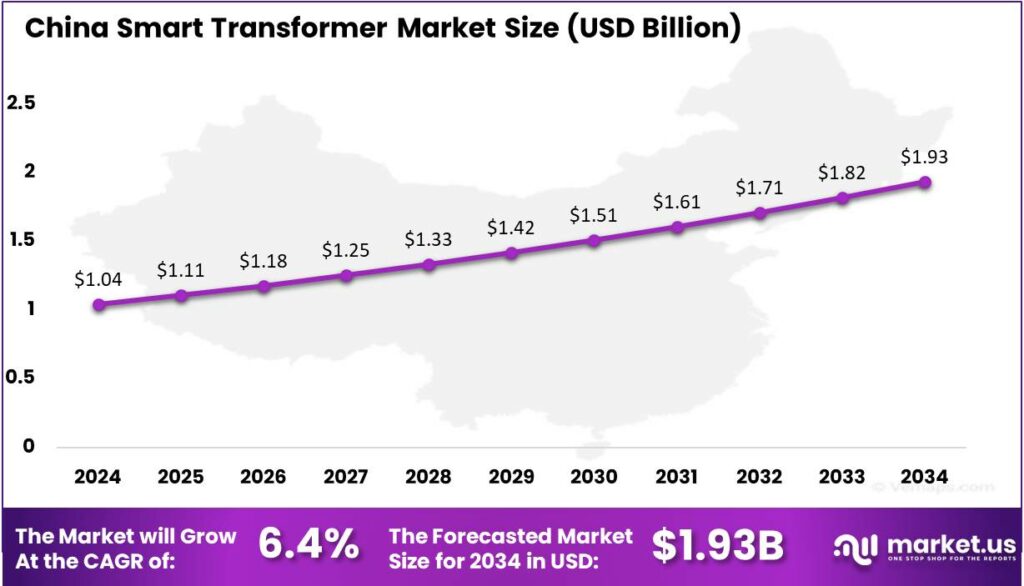

- The China smart transformer market is expected to reach approximately USD 1.04 billion by 2024, with a CAGR of 6.4%.

China Smart Transformer Market

The China smart transformer market is projected to reach a value of approximately USD 1.04 billion by 2024, with a compound annual growth rate (CAGR) of 6.4%. This market is expected to witness steady growth over the forecast period, driven by an increasing demand for energy-efficient solutions and the modernization of the power infrastructure.

The market expansion can be attributed to various factors, including government initiatives to enhance grid infrastructure and the rising need for sustainable and reliable power distribution systems. China’s ongoing investments in renewable energy integration and the move towards smart grid development further contribute to the adoption of smart transformers.

Additionally, advancements in transformer design, such as the integration of IoT and AI, are expected to create further opportunities for growth, providing better operational efficiency and cost savings. As a result, the China smart transformer market is poised for significant advancements in the coming years, with sustained growth driven by technological innovation and policy support.

In 2024, Asia-Pacific held a dominant market position in the smart transformer sector, capturing more than 40% of the global market share, equivalent to an estimated revenue of USD 1.11 billion. This dominance stems from the rapid expansion of power infrastructure in countries like China and India, with significant investments in smart grid technologies and renewable energy integration.

The growing demand for energy-efficient solutions, along with government initiatives to modernize electricity grids, has fueled the region’s growth. The adoption of digital technologies in power management and the push for urbanization in Asia-Pacific further enhance the market outlook.

China, as the largest contributor to the region’s market share, is leading the way in smart transformer adoption due to its substantial energy consumption and ongoing infrastructure overhaul. With a focus on reducing grid losses and improving efficiency, China’s robust support for smart grid projects and renewable energy initiatives positions it as a key player.

Asia-Pacific is set to maintain leadership in the smart transformer market due to technological advancements, significant investments in smart grid infrastructure, and favorable government policies. The region’s focus on energy efficiency and large-scale infrastructure projects creates a strong environment for market growth.

Type Analysis

In 2024, the Power Transformers segment held a dominant market position, capturing more than 46% of the total market share. This can be attributed to the essential role power transformers play in the transmission of electricity over long distances.

Power transformers are critical in stepping up or stepping down voltage levels, which is fundamental for efficient energy transfer from power plants to distribution networks. Their importance in large-scale grid infrastructure projects, especially in regions with rapidly expanding energy demands, positions them as a cornerstone of the smart transformer market.

The preference for power transformers is driven by their capacity to handle high voltages, a requirement for maintaining grid stability in both developed and emerging economies. As urbanization and industrialization accelerate, power transformers are indispensable for managing the increased energy consumption, ensuring that power transmission remains efficient, reliable, and cost-effective.

The integration of renewable energy into national grids has increased the demand for power transformers. Wind and solar plants require transformers to manage fluctuating voltage levels and ensure grid stability. As renewables grow, power transformers are essential for connecting these sources to existing networks, enabling a greener, more reliable energy grid.

Component Analysis

In 2024, the Transformers segment held a dominant market position, capturing more than a 35% share of the smart transformer market. The significant share of the Transformers segment can be attributed to the core role that transformers play in power distribution systems.

Transformers are crucial components in power grids, responsible for voltage regulation and power flow management, making them key to smart grid infrastructure. As renewable energy adoption rises and efficient energy distribution becomes more vital, smart transformers with advanced monitoring and control features are in higher demand.

The Transformers segment remains dominant due to their critical role in power systems. Beyond voltage regulation, smart transformers offer real-time monitoring, fault detection, and grid stabilization, becoming essential as utilities shift to more resilient, automated, and sustainable energy networks.

The demand for smart transformers is growing due to the need for grid modernization in both developed and emerging markets. These transformers offer improved efficiency, lower operational costs, and better control over energy flows, which are crucial for optimizing energy usage amid rising electricity demand and environmental concerns.

Application Analysis

In 2024, the Smart Grid segment held a dominant market position in the global smart transformer market, capturing more than 45% of the total market share. This leadership can be attributed to the increasing demand for efficient, reliable, and scalable power distribution systems across the world.

Smart grids combine advanced digital technologies with traditional power grids to enhance performance through real-time monitoring, fault detection, and remote control. These features are vital for maintaining grid stability, reducing transmission losses, and improving efficiency, helping to meet the increasing energy demands in urban and industrial areas.

The shift towards renewable energy is driving the growth of the smart grid segment. As countries invest in solar, wind, and other renewables, sophisticated grid systems are needed to manage their variability. Smart transformers are crucial for optimizing energy distribution and ensuring reliable integration of renewable power into the grid.

Government initiatives to modernize and digitize grid infrastructure are boosting the smart grid sector, with countries in North America, Europe, and Asia-Pacific prioritizing smart grid development. These investments are key to achieving sustainability goals, enhancing grid resilience, and making power delivery more flexible and responsive to demand changes.

Key Market Segments

By Type

- Power Transformers

- Distribution Transformers

- Specialty Transformers

- Instrument Transformers

By Component

- Converters

- Switches

- Transformers

- Hardware for Trasformer Monitoring

- Others

By Application

- Traction Locomotive

- Smart Grid

- Electric Vehicle Charging

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increasing Demand for Smart Grid Technologies

The growing adoption of smart grid technologies is a significant driver for the expansion of the smart transformer market. Smart transformers, being an essential component of smart grids, enable the real-time monitoring, control, and optimization of electricity distribution. They enhance the grid’s reliability, efficiency, and sustainability by enabling bidirectional communication between utilities and consumers.

As power grids are evolving to accommodate renewable energy sources, such as solar and wind, the need for more flexible and adaptable infrastructure has increased. Smart transformers help in seamlessly integrating these renewable sources, reducing energy loss, and improving the overall grid stability. The ongoing urbanization and industrialization globally are creating higher demands for more efficient power distribution systems.

Restraint

High Initial Investment Costs

One of the primary challenges inhibiting the widespread adoption of smart transformers is the high initial investment required for their deployment. Although these transformers offer significant long-term benefits, including reduced maintenance costs, increased energy efficiency, and improved grid reliability, the upfront costs can be a significant barrier for many utilities, particularly in developing regions.

Additionally, the retrofitting of existing infrastructure with smart transformers often requires additional investments, making it financially challenging for utility companies to fully modernize their grids. In many cases, utilities must weigh the long-term benefits against the short-term capital expenditures, which can delay or hinder adoption. In developing economies, where budget constraints and infrastructural challenges are more pronounced, the affordability of these transformers remains a critical issue.

Opportunity

Integration with Renewable Energy Sources

The integration of renewable energy sources into national grids presents a significant opportunity for the smart transformer market. As the world increasingly turns toward cleaner energy solutions, such as wind and solar power, the need for advanced grid infrastructure to manage these intermittent energy sources becomes critical.

Smart transformers enable smoother renewable integration by handling supply fluctuations, balancing load demands, and ensuring stable energy distribution. As renewable energy projects continue to proliferate worldwide, the demand for smart transformers that can manage these variable energy sources will grow.

In addition, the potential for smart transformers to improve grid efficiency and reliability while lowering energy loss positions them as a key enabler for the global shift toward sustainable energy systems. Government policies and incentives promoting renewable energy and reducing carbon emissions are driving growth in the smart transformer market.

Challenge

Cybersecurity Threats

As smart transformers are integrated into digital grids, they become more vulnerable to cybersecurity threats. These transformers rely on advanced communication systems to transmit real-time data, control power flow, and adjust operations dynamically. Digital systems in smart transformers expose grids to cyberattacks, risking outages, data breaches, and equipment damage, threatening grid reliability and safety amid growing cyber threats.

Utility companies and grid operators must invest in robust cybersecurity protocols to safeguard smart transformers and protect sensitive data from unauthorized access. The need for ongoing monitoring, encryption, and threat detection systems adds additional operational complexity and cost. Despite the advantages offered by smart transformers, addressing cybersecurity vulnerabilities is a key challenge that must be overcome for their widespread adoption in smart grids.

Emerging Trends

Smart transformers are transforming the electrical power industry by enhancing control, monitoring, and efficiency. By integrating digital technologies like sensors, communication systems, and IoT devices, they enable real-time data transmission and health monitoring. This helps detect potential faults early, ensuring more reliable energy delivery.

Another emerging trend is the shift towards power transformers with advanced insulation materials. These materials not only improve the durability of transformers but also contribute to reducing energy losses, making the entire system more efficient. Smart transformers support renewable energy by adjusting voltage and optimizing power flow, ensuring smooth integration of variable sources like wind and solar into the grid.

The development of digital control systems and AI-based predictive analytics is also playing a critical role. By using machine learning algorithms, these systems can predict when a transformer is likely to fail or need maintenance, reducing downtime and repair costs.

Business Benefits

A key advantage is improved operational efficiency. Smart transformers enable continuous monitoring and real-time data collection, optimizing performance and minimizing unscheduled outages. Predictive maintenance helps prevent costly emergency repairs by identifying issues early, improving asset management, reducing downtime, and enhancing system reliability.

Furthermore, smart transformers contribute to significant energy savings by minimizing energy losses during transmission. As these transformers are designed to adjust voltage levels automatically and respond to grid fluctuations, they help in maintaining a stable and efficient power supply.

Another key benefit is enhanced grid resilience. Smart transformers can automatically adapt to changing grid conditions, ensuring a stable, uninterrupted energy supply. This is crucial for sectors like manufacturing and data centers, where even brief power disruptions can result in significant financial losses.

Key Player Analysis

ABB is one of the leading players in the smart transformer market, known for its cutting-edge technology and strong global presence. The company offers a wide range of smart transformer solutions designed for renewable energy integration, grid modernization, and reducing energy losses.

Siemens is another major player in the smart transformer market, with a strong focus on digitalization and sustainable energy solutions. Siemens has developed smart transformers that enhance grid reliability, efficiency, and flexibility, allowing utilities to better manage and distribute power.

Schneider Electric stands out for its smart transformer solutions that focus on energy management and industrial automation. The company’s products are designed to optimize the use of energy, reduce operational costs, and improve overall grid efficiency. Schneider Electric has been at the forefront of developing solutions that integrate renewable energy sources and enable a more resilient power infrastructure.

Top Key Players in the Market

- ABB

- Siemens

- Schneider Electric

- Eaton

- GE

- Wilson Tranformer

- Mitsubishi Electric

- Bhel

- CG Power

- Gridco

- Howard Industries

- SPX Transformer

- Other Key Players

Top Opportunities Awaiting for Players

The Smart Transformer market presents numerous growth opportunities for industry players.

- Rising Demand for Smart Grids: As the global demand for more efficient, reliable, and sustainable energy systems grows, smart transformers are essential for optimizing smart grids. These transformers enable better monitoring, control, and fault detection, ensuring seamless energy distribution.

- Integration with Renewable Energy: The increasing shift towards renewable energy sources like solar and wind presents an opportunity for smart transformers to handle fluctuating power inputs. Their ability to adjust to varying loads helps stabilize the grid and integrate intermittent energy sources more effectively.

- Government Initiatives & Investments: Governments around the world are investing heavily in modernizing energy infrastructure, creating strong demand for smart transformers. Policies promoting energy efficiency and carbon reduction are also driving growth in this sector.

- Advancements in IoT and AI Technologies: The convergence of smart transformers with IoT (Internet of Things) and AI technology opens up new opportunities for predictive maintenance, real-time monitoring, and improved grid management, enhancing operational efficiency and reducing downtime.

- Expansion in Emerging Markets: Developing regions like Asia-Pacific and Africa are rapidly expanding their power infrastructure, creating a high demand for smart transformers. These areas are focusing on improving their energy networks, and smart transformers can offer cost-effective, reliable solutions.

Recent Developments

- November 2024: Siemens approved an additional investment of Rs.100 crore in its Kalwa transformer plant to expand product lines and meet growing demand for grid technology products, driven by energy transition trends.

- November 2024: ABB and Oktogrid introduced a digitally integrated transformer sensor to enhance grid performance and reliability. This innovation includes real-time monitoring and rapid data transmission to the cloud, making it more accessible and cost-effective for manufacturers.

- February 2025: Schneider Electric Infrastructure announced plans to expand its transformer manufacturing capacity by investing Rs.13.6 crore, aiming to increase production from 5,500 MVA to 7,000 MVA by the end of FY26.

Report Scope

Report Features Description Market Value (2024) USD 2.79 Bn Forecast Revenue (2034) USD 7.17 Bn CAGR (2025-2034) 9.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Power Transformers, Distribution Transformers, Specialty Transformers, Instrument Transformers), By Component (Converters, Switches, Transformers, Hardware for Trasformer Monitoring, Others), By Application (Traction Locomotive, Smart Grid, Electric Vehicle Charging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Siemens, Schneider Electric, Eaton, GE, Wilson Tranformer, Mitsubishi Electric, Bhel, CG Power, Gridco, Howard Industries, SPX Transformer, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart Transformer MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Smart Transformer MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Siemens

- Schneider Electric

- Eaton

- GE

- Wilson Tranformer

- Mitsubishi Electric

- Bhel

- CG Power

- Gridco

- Howard Industries

- SPX Transformer

- Other Key Players