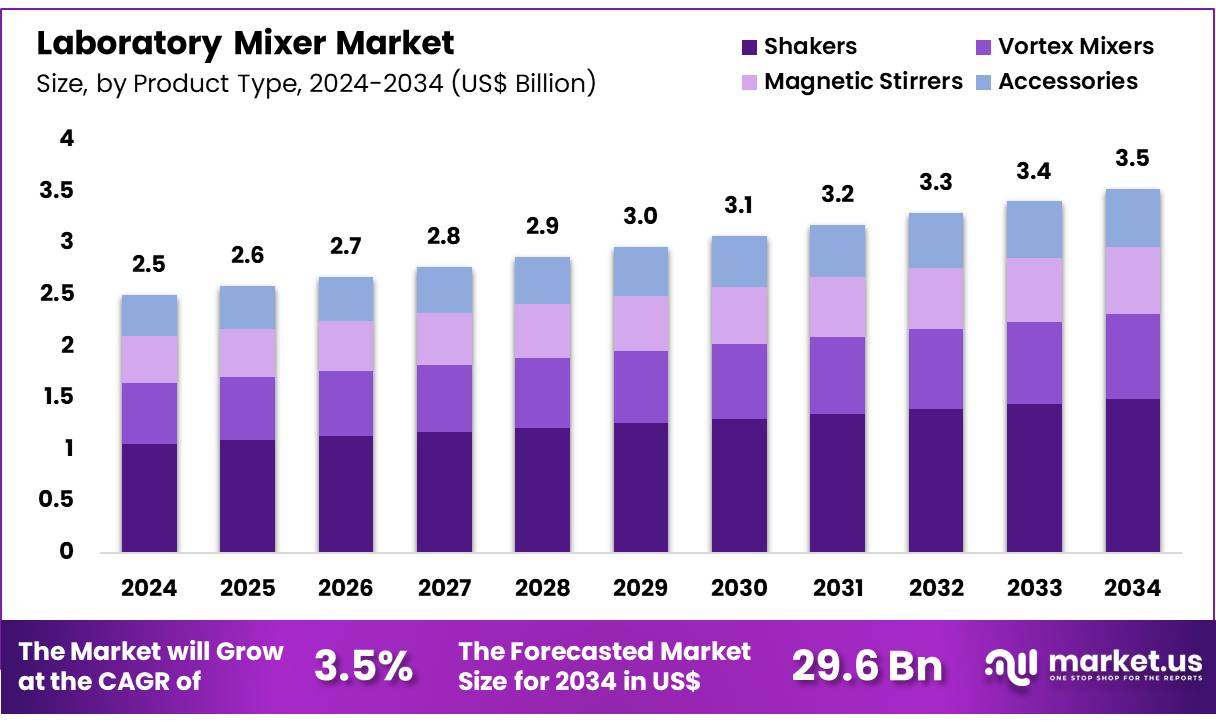

Global Laboratory Mixer Market By Product Type (Shakers (Orbital Shakers, Rollers/Rotators, and Others), Vortex Mixers, Magnetic Stirrers, and Accessories) By Application (Pharmaceutical & Biotechnology Companies, Research Laboratories & Institutes, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155522

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

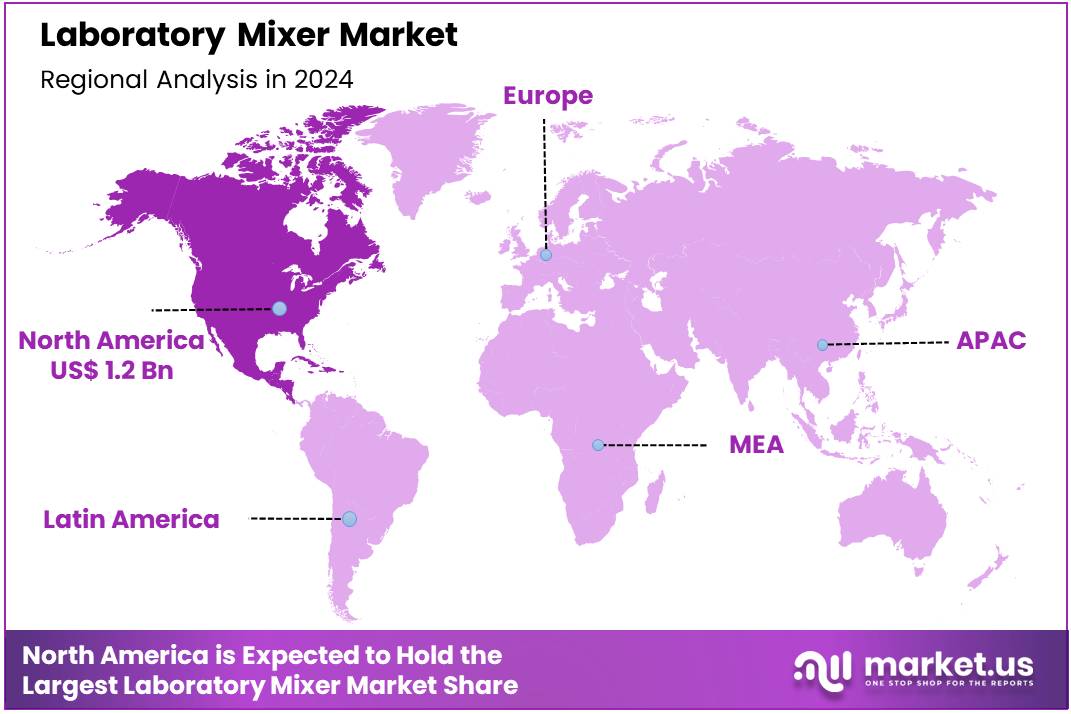

Global Laboratory Mixer Market size is expected to be worth around US$ 29.6 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 3.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 47.5% share with a revenue of US$ 1.2 Billion.

The laboratory mixer market is experiencing substantial growth, driven by the increasing demand for precision and efficiency in pharmaceutical, biotechnology, and chemical research. This expansion is largely fueled by the development of advanced automated systems that enhance mixing accuracy, speed, and scalability.

Manufacturers are now offering mixers equipped with advanced features such as programmable controls, data logging, and seamless integration with Laboratory Information Management Systems (LIMS). This trend towards automation and high-throughput screening is a direct response to the evolving needs of modern research, where the ability to handle multiple samples simultaneously has become a standard requirement. For example, the Benchmix 10, a compact high-shear lab mixer designed for efficient powder dispersion, exemplifies this trend.

Emerging technologies are also playing a pivotal role in transforming the market. The integration of Internet of Things (IoT) technology and artificial intelligence into laboratory equipment facilitates remote monitoring, predictive maintenance, and more efficient resource utilization, further enhancing the appeal of modern laboratory mixers.

While smaller laboratories may face financial challenges, with advanced mixers priced above US$ 7,000 compared to basic models under US$ 500, the long-term durability and efficiency gains provided by high-performance mixers make them a valuable investment. This push for technological advancement is supported by significant investments in scientific research. For example, the National Institutes of Health (NIH) had a total budget of US$ 47.35 billion in 2024, with a substantial portion allocated to research grants that support both academic and private sector laboratories, directly fueling the demand for advanced laboratory equipment.

Additionally, the rise in research activities, especially within the pharmaceutical and biotechnology sectors, is creating a sustained demand for laboratory mixers. These devices are critical for a wide range of applications, from drug discovery to vaccine development. The strong focus on research and development (R&D) at the national level further strengthens this trend.

The National Science Foundation (NSF) reports that US R&D spending totaled US$ 892 billion in 2022, with an estimated increase to US$ 940 billion in 2023. This robust funding environment ensures that laboratories across various sectors will continue to require advanced mixing solutions. Moreover, the Centers for Disease Control and Prevention (CDC) contributes to this demand through its programs, with its FY 2024 budget including funding for laboratory capacity building to support public health initiatives that require state-of-the-art equipment for critical analyses and surveillance.

Key Takeaways

- In 2024, the market for laboratory mixer generated a revenue of US$ 2.5 billion, with a CAGR of 3.5%, and is expected to reach US$ 29.6 billion by the year 2034.

- The product type segment is divided into shakers, vortex mixers, magnetic stirrers, and accessories, with shakers taking the lead in 2023 with a market share of 42.3%.

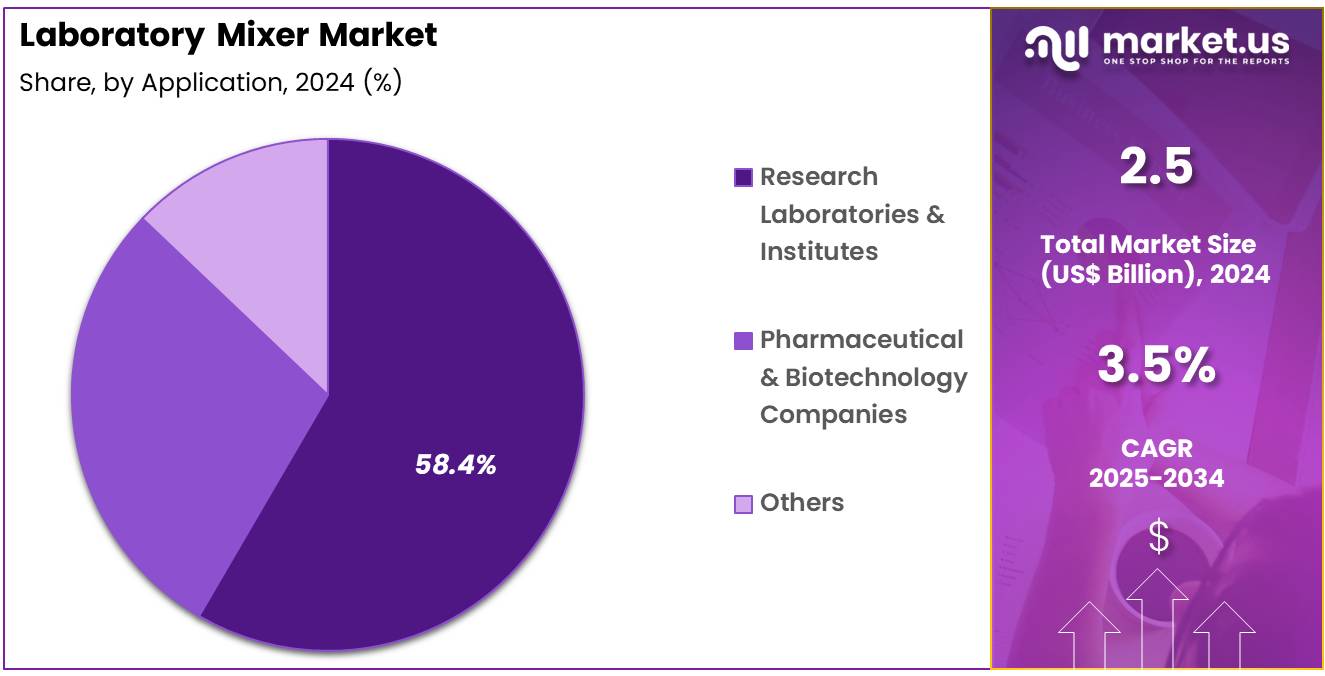

- Considering application, the market is divided into pharmaceutical & biotechnology companies, research laboratories & institutes, and other. Among these, research laboratories & institutes held a significant share of 58.4%.

- North America led the market by securing a market share of 47.5% in 2023.

Product Type Analysis

Shakers account for 42.3% of the product type segment in the laboratory mixer market. This growth is expected to continue as shakers are essential laboratory tools used to agitate liquids and powders, facilitating processes like cell culture, mixing, and biochemical reactions. Shakers are especially useful in applications within pharmaceuticals, biotechnology, and life sciences research, where precise and uniform mixing is required for experiments and formulations. The growing demand for research in drug discovery, diagnostics, and biotechnology applications is driving the increased adoption of laboratory shakers.

Additionally, advancements in shaker technology, such as programmable shakers with variable speed and temperature control, are expected to further increase their usage. As research laboratories and pharmaceutical companies continue to prioritize efficiency and reproducibility in their work, the demand for advanced shaker systems will likely increase. The market is also supported by the rise of biotechnology research and clinical studies requiring accurate mixing for consistent results, driving the growth of this segment.

Application Analysis

Research laboratories & institutes represent 58.4% of the application segment in the laboratory mixer market. This growth is expected to continue as these institutions are the primary consumers of laboratory mixers, especially in the fields of basic research, chemical engineering, life sciences, and biotechnology. The increasing number of research projects focused on disease understanding, drug discovery, and clinical trials contributes to the demand for high-quality laboratory mixers.

As these research facilities require advanced and reliable equipment to ensure accurate mixing for a wide range of experiments, laboratory mixers, particularly shakers and vortex mixers, are critical tools. The global increase in research funding, particularly in healthcare and life sciences, is projected to drive further growth in the demand for laboratory mixers. Additionally, as technological advancements in laboratory equipment, such as automated mixing systems and data-driven controls, gain traction, research laboratories are likely to continue investing in state-of-the-art mixers to support their evolving research needs.

Key Market Segments

By Product Type

- Shakers

- Orbital Shakers

- Rollers/Rotators

- Others

- Vortex Mixers

- Magnetic Stirrers

- Accessories

By Application

- Pharmaceutical & Biotechnology Companies

- Research Laboratories & Institutes

- Other

Drivers

The increasing investment in pharmaceutical and biotechnology R&D is driving the market.

The laboratory mixer market is experiencing significant growth driven by increasing R&D spending across the pharmaceutical and biotechnology sectors. As companies globally strive to develop new drugs, vaccines, and advanced therapies, the demand for precise and efficient laboratory equipment, including mixers, has surged. R&D spending by the top 2,500 R&D spenders worldwide, which account for 90% of global business R&D investment, surpassed €1.3 trillion in 2022, marking a 13% increase over the previous year. This substantial financial commitment directly translates into a greater need for high-performance laboratory equipment.

Furthermore, a 2023 study on global pharmaceutical R&D spending found that the 20 leading companies with the highest R&D budgets invested an estimated $145 billion in their research and development, representing an increase of 4.5% from the previous year. This continuous allocation of capital to scientific discovery and drug development creates a sustained demand for laboratory mixers, which are essential for everything from cell culture preparation and reagent mixing to the development of complex formulations. This trend demonstrates the industry’s commitment to innovation and fuels the market for the core tools required to achieve it.

Restraints

The high cost of advanced equipment and long product lifecycle are restraining the market.

A significant restraint on the laboratory mixer market is the high cost associated with advanced equipment, combined with the long operational lifespan of these durable machines. While basic mixers may be relatively inexpensive, high-performance, automated, and multi-functional mixers can be a substantial capital investment, often ranging from $2,000 to over $7,000 for a single unit. This high price point creates a barrier to entry, especially for small and medium-sized research laboratories, academic institutions, and startups with limited budgets.

Furthermore, the inherent durability and long lifespan of these instruments can reduce the frequency of replacement purchases, which negatively impacts the revenue streams of manufacturers. Many mixers, when properly maintained, can function effectively for a decade or more. A 2024 report on laboratory equipment investment noted that due to inflation and rising costs, laboratories are increasingly prioritizing equipment with a longer depreciation cycle. This longevity, while a benefit for the end-user, acts as a brake on market expansion by slowing the replacement cycle and dampening new sales.

Opportunities

The growing demand for automation and high-throughput screening is creating growth opportunities.

The laboratory mixer market is presented with significant opportunities due to the increasing demand for laboratory automation and high-throughput screening across various scientific disciplines. As research and development activities become more complex and require the processing of a larger number of samples in a shorter time, manual mixing methods are proving insufficient. This has created a strong market for automated and robotic laboratory mixers that can integrate seamlessly into existing workflows.

A 2024 report on the life sciences sector highlighted a strong focus on laboratory automation to enhance efficiency and reduce human error, with major biopharma companies investing in systems that can handle thousands of samples daily.

For example, a 2023 study published in Automation in Life Sciences noted that high-throughput screening campaigns, which are now standard in drug discovery, have increased the number of samples processed by over 50% in the past three years. This trend requires advanced mixers capable of automated and parallel processing to ensure consistency and precision at a scale that manual processes simply cannot achieve. This shift toward automation is not only a matter of convenience but a fundamental requirement for the future of scientific research, creating a clear pathway for market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a critical role in shaping the operational environment for manufacturers and suppliers in the laboratory mixer market. Inflationary pressures globally have driven up the costs of essential raw materials, specialized electronic components, and high-purity metals, which are vital to the production of these advanced instruments. According to data from the US Bureau of Labor Statistics (BLS), the Producer Price Index for “Machinery, Equipment, and Supplies Wholesaling” rose by 0.7% from February to May 2024, reflecting the growing costs encountered by distributors and manufacturers.

In addition to inflation, geopolitical tensions in key manufacturing regions have disrupted global supply chains, resulting in volatility and potential shortages of critical components. A 2024 report on the global supply chain for scientific equipment revealed that ongoing conflicts and trade disputes have caused a 2.9% increase in the supply chain rate for the year, driven largely by rising raw material and freight costs. Despite these challenges, the industry has adapted by focusing on operational efficiency and expanding its supplier network, which helps maintain a more stable and resilient manufacturing environment.

The current tariff structure in the United States is adding complexity to the supply chain dynamics. New tariffs on imported laboratory equipment and electronic components from major trading partners have significantly increased the landed cost of these products. A 2025 review of US tariffs indicated that some laboratory instruments and supplies face duties of up to 25% or higher, depending on their classification and country of origin. This tariff burden impacts manufacturers’ profitability, driving up prices for laboratories and research institutions, which may slow the acquisition of new equipment.

According to a 2024 report by the Biotechnology Innovation Organization (BIO), its members spent around US$1.2 billion on imported lab supplies and equipment that were subject to tariffs, highlighting the vulnerability of the sector to trade disruptions. However, these tariffs are providing a competitive edge to US-based manufacturers who are not subject to such duties.

As a result, some research institutions are increasingly turning to domestically produced goods, seeking a more stable supply chain and predictable pricing. This shift is supporting the growth of domestic manufacturing, prompting companies to invest in local production capabilities to bypass the tariff burden and solidify their market positions, offering a positive long-term outlook for the sector.

Latest Trends

The adoption of advanced controls and data logging capabilities is a recent trend.

A significant trend observed in 2024 is the widespread adoption of advanced controls and data logging capabilities in laboratory mixers, driven by the increasing need for precision, reproducibility, and regulatory compliance. Modern mixers now routinely feature digital controls, programmable settings, and the ability to record and log mixing parameters such as speed, time, and temperature. This technological advancement allows researchers to eliminate human variability, ensuring that every experiment is performed under identical conditions.

A 2024 product announcement from a major life sciences tool provider highlighted its new line of magnetic stirrers with integrated data logging and wireless connectivity. These devices can transfer run data directly to a laboratory information management system (LIMS), streamlining data management and improving the integrity of research records. The growing emphasis on quality control and regulatory requirements, particularly in pharmaceutical manufacturing and clinical diagnostics, is a primary catalyst for this trend. This capability allows researchers to easily replicate experiments and provides a clear audit trail, which is essential for regulatory submissions and quality assurance.

Regional Analysis

North America is leading the Laboratory Mixer Market

The North American laboratory mixer market held a dominant position in the global industry, capturing a 47.5% market share in 2023. This leadership is largely driven by the region’s highly developed pharmaceutical and biotechnology sectors, which consistently invest in cutting-edge research and development tools. A significant driver of this trend is the National Institutes of Health (NIH), which allocated approximately US$ 47.68 billion in its fiscal year 2023 budget to fund numerous biomedical research projects requiring advanced laboratory equipment.

Additionally, the US is home to a large number of pharmaceutical manufacturing facilities that prioritize innovation and operational efficiency. According to the National Science Foundation (NSF), federal research and experimental development obligations in the US totaled US$ 186.4 billion in 2023, reflecting a strong and ongoing commitment to scientific progress.

The laboratory mixer market in the US is projected to experience significant growth as regional leaders focus on developing more efficient and automated systems to enhance productivity while adhering to stringent regulatory standards. The Food and Drug Administration (FDA) plays a key role in this growth, with its rigorous approval process encouraging the development of high-quality and reliable equipment.

Technological innovations are further accelerated by collaborations between academia, government agencies, and industry leaders, all working together to enhance precision, reliability, and sustainability in mixing processes. North America’s focus on personalized medicine and advanced therapies will continue to fuel the demand for laboratory mixers capable of handling small, precise volumes and complex protocols.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific region is expected to become the fastest-growing market for laboratory mixers in the coming years. This growth is driven by increasing collaborations between industry and academia, rising healthcare spending, and substantial government investments in research and development across the region. China’s expenditure on research and development (R&D) surpassed 3.6 trillion yuan in 2024, underscoring its commitment to establishing itself as a global leader in scientific innovation. This significant investment is directly supporting the growing demand for laboratory equipment, including mixers. Similarly, Japan allocated 22.05 trillion yen for R&D in fiscal year 2023, with the pharmaceutical sector being a major contributor to this expenditure.

The laboratory mixer market in Asia Pacific is also being fueled by the rapid expansion of the biotechnology and pharmaceutical industries in countries like India and South Korea. India’s biotechnology sector is experiencing rapid growth, with a projected valuation of US$ 150 billion by 2025. This expansion is largely driven by government initiatives such as Aatmanirbhar Bharat and Make in India, which are stimulating domestic demand and boosting the global recognition of Indian biopharmaceuticals.

South Korea is another key player, with the Ministry of Science and ICT approving an R&D budget of US$ 18.6 trillion in 2024 to strengthen core technologies and foster scientific talent. These strategic investments and the growing research capabilities across the Asia Pacific region are creating a dynamic and rapidly expanding market for laboratory mixers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the lab equipment sector are driving growth by implementing a comprehensive strategy centered on technological innovation, expanding their global presence, and forming strategic alliances. These companies are significantly investing in research and development to produce next-generation mixing devices featuring advanced automation, integrated sensors, and sophisticated data management capabilities, which improves consistency and dependability in vital research and manufacturing processes.

They are also actively entering new markets in developing regions where a surge in pharmaceutical and biotechnology R&D is increasing the demand for new laboratory instruments. Moreover, manufacturers are forging strategic collaborations with research institutions and industry partners to create specialized, application-specific solutions for fields like cell and gene therapy, positioning themselves as critical contributors to the scientific community.

DLAB Scientific Co., Ltd., a prominent manufacturer of lab equipment, is a China-based company with a strong international footprint, including subsidiaries in the US, Europe, and India. Established in 2002, the company specializes in producing a broad selection of general laboratory instruments, including a variety of mixing apparatus. DLAB’s business model emphasizes delivering dependable, high-quality, and cost-effective equipment that complies with global standards, establishing the company as a key supplier for a wide range of chemical, biological, and clinical diagnostic laboratories around the world.

Top Key Players

- Thermo Fisher Scientific

- Silverson

- Shuanglong Group Co. Ltd

- SARSTEDT AG & Co. KG

- REMI GROUP

- Labstac Ltd

- IKA-Werke

- Eppendorf

- Corning Incorporated

- Bio-Rad Laboratories Inc

- Benchmark Scientific Inc

- Antylia Scientific

Recent Developments

- In April 2023, Thermo Fisher Scientific launched the Solaris Benchtop Temperature Controlled Orbital Shakers, designed to improve both performance and energy efficiency in laboratory settings. Available in both incubated and refrigerated versions, these shakers are 58% more energy-efficient than older models with traditional compressors, marking a significant step towards sustainability in lab equipment.

- In June 2022, IKA-Werke introduced the TWISTER, a groundbreaking convertible mixing device. It offers the flexibility to operate as either a single-position or multi-position magnetic stirrer, making it highly adaptable for a wide range of laboratory tasks and improving overall mixing efficiency.

- In January 2022, LINXIS Group, in partnership with IK Partners, successfully acquired Shaffer, a company specializing in industrial mixers and process equipment, from Bundy Baking Solutions. As part of the deal, the Bundy family retained a minority stake, ensuring ongoing collaboration as the business continues to expand in the process equipment industry.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 29.6 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Shakers (Orbital Shakers, Rollers/Rotators, and Others), Vortex Mixers, Magnetic Stirrers, and Accessories) By Application (Pharmaceutical & Biotechnology Companies, Research Laboratories & Institutes, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Silverson, Shuanglong Group Co. Ltd, SARSTEDT AG & Co. KG, REMI GROUP, Labstac Ltd, IKA-Werke, Eppendorf, Corning Incorporated, Bio-Rad Laboratories Inc, Benchmark Scientific Inc, Antylia Scientific. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific

- Silverson

- Shuanglong Group Co. Ltd

- SARSTEDT AG & Co. KG

- REMI GROUP

- Labstac Ltd

- IKA-Werke

- Eppendorf

- Corning Incorporated

- Bio-Rad Laboratories Inc

- Benchmark Scientific Inc

- Antylia Scientific