Global Laboratory Informatics Market By Solution (Laboratory Information Management Systems, Electronic Lab Notebooks, Chromatography Data Systems, Laboratory Execution Systems, Enterprise Content Management, Scientific Data Management Systems, Other Solutions), By Component (Software, Service), By the Delivery Mode (On-Premise, Web-Hosted, Cloud-Based), By End-User (Pharmaceutical Companies, Biotech Companies, Chemical Industries, Life Sciences Industries, Food & Beverage Industries, Agricultural Industries, Other End Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 104539

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

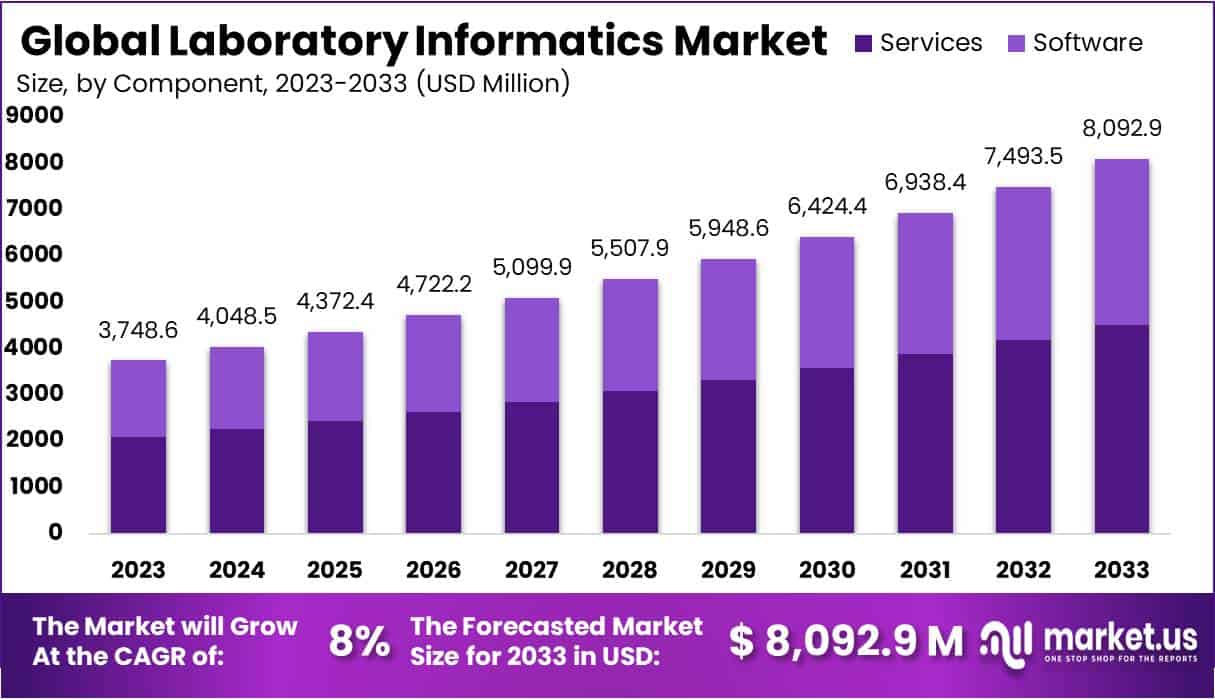

The Global Laboratory Informatics Market Size is expected to be worth around USD 8092.9 Million by 2033, from USD 3748.6 Million in 2023, growing at a CAGR of 8% during the forecast period from 2024 to 2033.

Laboratory informatics is a field that focuses on the application of information technology and data management systems in the laboratory environment. It involves the use of computer systems, software applications, and other technologies to streamline and enhance the processes and operations within a laboratory setting. In the next few years, automation will be more popular due to increased demand.

The rise in technological advances in molecular genomes, genetic testing practices, and data generation by laboratories has led to a dramatic increase in data generated by them over the past decades. Additionally, increasing patient engagement and preference for personalized medicine will increase the demand for laboratory automation systems.

Key Takeaways

- Market Size & Growth: Global Laboratory Informatics Market to reach USD 8,092.9 Million by 2033, growing at 8% CAGR from USD 3,748.6 Million in 2023.

- Solution Dominance: In 2023, Laboratory Information Management Systems (LIMS) captured 48.6% market share, emphasizing integrated life sciences and research services.

- Component Dominance: In 2023, Services held a strong 55.9% market share, driven by outsourced LIMS solutions and increasing awareness of associated benefits.

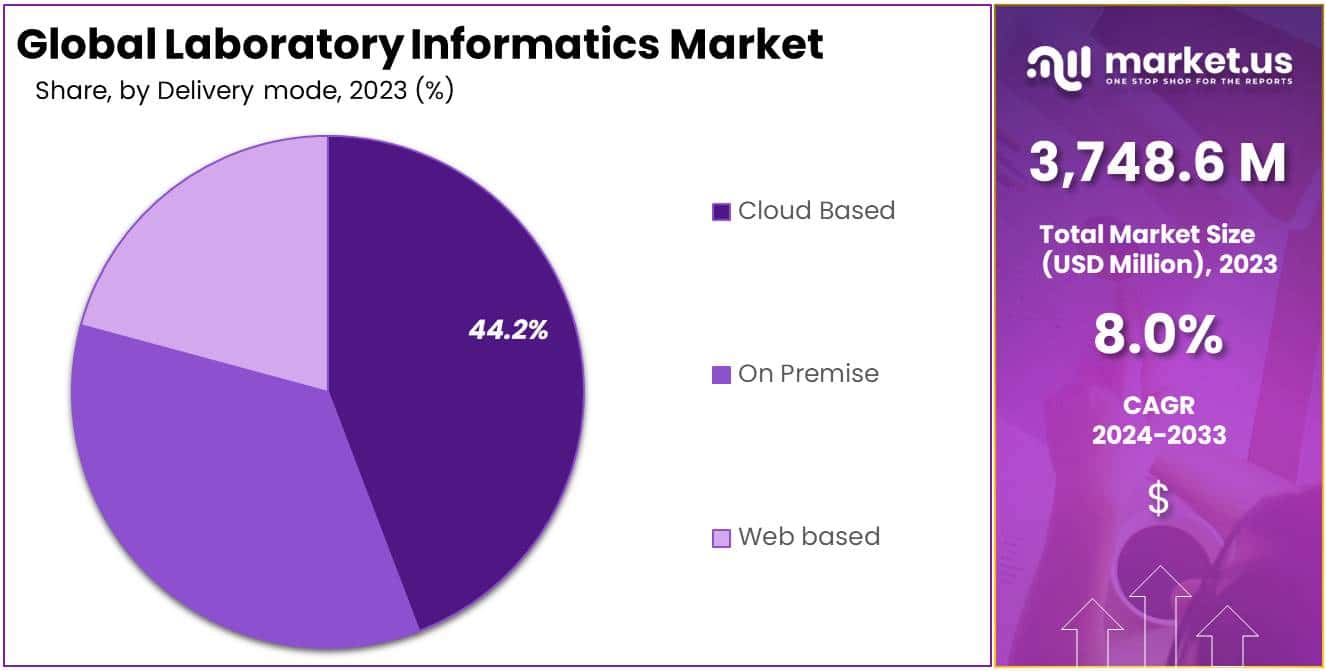

- Delivery Dominance: Cloud-based systems dominated in 2023 with a 44.2% share, providing remote data storage and real-time tracking, particularly favored by CROs.

- End-User Focus: Life Science Companies held 29.6% market share in 2023, reflecting increased demand for electronic and virtual laboratories in improving operational efficiency.

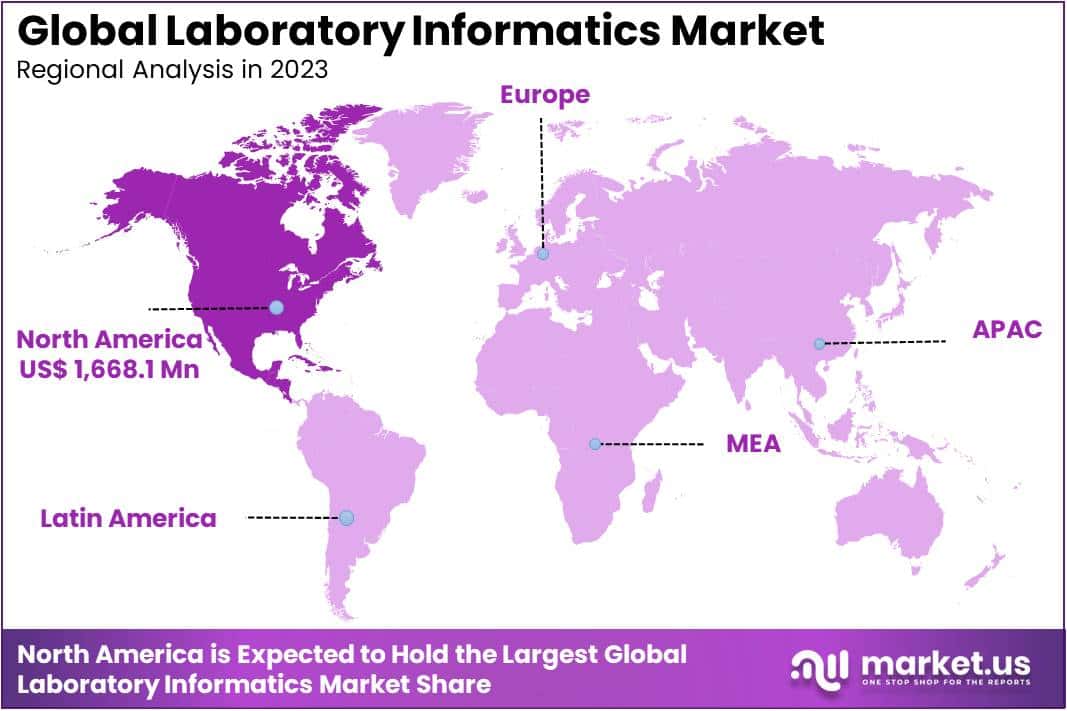

- Regional Dynamics: North America dominated with over 40% revenue, driven by policies supporting laboratory information systems. Asia Pacific poised for growth due to CROs and outsourcing hubs.

Solution Analysis

In 2023, LIMS segment held a dominant market position, capturing more than a 48.6% share.

Based on solution analysis, the laboratory informatics market is segmented into laboratory information management systems, electronic lab notebooks, chromatography data systems, laboratory execution systems, enterprise content management, scientific data management systems, and other products. The laboratory information management systems segment (LIMS), dominated the market with a 48.6% revenue share. These systems include master data management and reporting of the sample lifecycle, stability studies, system administration, schedules, and inventory.

They also have storage capacity, logistics, and logistical workflow. The segment is expected to grow because of the demand for integrated services in life sciences and research to reduce data management errors and enhance the quality analysis of research information. These factors will ensure that the LIMS segment remains at the top of the market for the forecast period.

Due to its increasing adoption by researchers in analytical chemistry laboratories, the Electronic Lab Notebooks (ELN system) segment will see significant growth. CAGR for the Enterprise Content Management segment (ECM) is expected to be 3.5% over the forecast period. ECM is gaining popularity as it provides integrated and comprehensive solutions for the increasing healthcare industry challenges. ECM provides a central approach to capturing, creating, organizing, accessing, and analyzing an entire organization’s media, knowledge assets, and electronic documents. Companies offer ECM services such as consultation, design, implementation, and maintenance.

Component

In 2023, Services segment held a dominant market position, capturing more than a 55.9% share.

Based on components, the laboratory informatics market is segmented into services and software. Services dominated the market, accounting for 55.9% of the total revenue. It is expected to continue its dominance over the forecast period. The segment’s growth is due to an increase in outsourcing LIMS solutions. These services are outsourced because large pharmaceutical research laboratories lack the skills and resources required to deploy analytics. CROs provide laboratory informatics services.

These packages include compliance with promotional spending, social analytics, manufacturing process analysis, manufacturing process maintenance, predictive analytics for medical device failure, benchmarking solutions, and preventative maintenance. In the next few years, users will be more aware of the benefits associated with these solutions and will increase their demand.

The software will see a lot of growth in the future due to the availability and cost-effectiveness of software such as SaaS. Software for laboratory informatics is capable of performing critical functions like data storage, interpretation, analysis, and data capture. This software must be updated regularly to keep up with the most recent analytics methods.

Delivery Mode

In 2023, Cloud Based System segment held a dominant market position, capturing more than a 44.2% share.

Based on delivery mode, the laboratory informatics market is segmented into on-premise, web-hosted, and cloud-based. Cloud-based technology dominated the market, accounting for over 44.2% of the revenue in 2021. It is expected to continue its dominance during the forecast period. Cloud-based technology allows for remote storage of large amounts of data to free up space on clients’ devices and allows data retrieval according to client requirements.

It includes three services: Platform as a Service, Infrastructure as a Service, and Software as a Service. SaaS-based services are available for cloud-based analytics software. IBM offers Watson Analytics Services on the SaaS platform. Core Informatics, LabVantage Solutions, Inc. offers cloud-based services to LIMS. Cloud-based platforms are being adopted more by CROs because of their associated benefits, such as lower labor costs, reduced time and space needed for system implementation, and secure access to clinical data.

Cloud-based systems offer many other benefits, including real-time data tracking and remote access to data. These factors will provide this sector with lucrative opportunities. The installation of services and solutions within an organization is called on-premise delivery. Users receive web-based LIMS solutions via web servers that use the internet protocol. The web-based solution includes four components: internet connection, web server, and data administrator. The Internet and web-based services offer the advantage of being able to access remote areas with only one computer or monitoring device in labs. Over the forecast period, cloud computing solutions will be more popular than web-based segments.

End-User Analysis

In 2023, Life Science Companies segment held a dominant market position, capturing more than a 29.6% share.

This includes biobanks, clinical and molecular diagnostic laboratories, contract service organizations, pharmaceutical and biotechnology firms, academic research institutes, and contract service organizations. In order to improve product quality and operational efficiency, the life sciences industry is seeing a rise in demand for laboratory informatics. These requirements are increasing, and so is the demand for electronic and virtual laboratories. Laboratory informatics systems can be used to manage large amounts of data and disaggregate research and discovery silos.

The demand for LIMS is expected to rise due to technological advances in healthcare. The segment’s growth is expected to be boosted by the increasing adoption of LIMS in hospitals, research labs, and other settings. This is due to its expanding application scope for patient engagement and workflow management, billing, tracking patient information, quality assurance, and patient health information tracking.

Due to the increasing trend toward outsourcing, the CROs sector is expected to experience profitable growth over the forecast period. The lucrative growth of CROs is due to outsourcing companies’ increasing adoption to lower healthcare costs. LIMS can also be used in forensic science and the metal and mining industries, as well as other pharma labs. This segment is expected to grow because of the rising need to reduce operational costs and the benefits associated with LIMS use.

Key Market Segments

Based On Solution

- Laboratory Information Management Systems

- Electronic Lab Notebooks, Chromatography Data Systems

- Laboratory Execution Systems

- Enterprise Content Management

- Scientific Data Management Systems

- Other Solutions

Based On Component

- Software

- Service

Based On the Delivery Mode

- On-Premise

- Web-Hosted

- Cloud-Based

Based on End-User

- Pharmaceutical Companies

- Biotech Companies

- Chemical Industries

- Life Sciences Industries

- Food & Beverage Industries

- Agricultural Industries

- Other End Users

Drivers

Increasing Need for Laboratory Automation

Automation is emerging as a viable solution to the shortage of lab professionals. It also helps reduce manual intervention in laboratory processes. With the help of dedicated workstations, software to program instruments, and software to automate routine lab procedures, lab productivity is improved, and individual researchers can focus on more important tasks. Automating lab procedures can provide high-quality data and better documentation.

Standardized systems that produce reproducible results can be developed by the use of strict regulatory requirements and supervisory standards. Due to the exponential growth in data generated by lab systems, efficient data storage, analysis, and sharing is essential. This is where laboratory informatics solutions can help. They significantly improve, accelerate, and increase the efficiency and productivity of laboratory processes.

Restraints

High Maintenance and Service Cost

This market is being held back by high maintenance and service fees for laboratory informatics solutions. Industry experts claim that IT solutions’ maintenance costs are higher than their actual costs. Maintenance and service (which include modification of the software to meet changing user needs) are recurring expenses that amount to between 20-30% of total ownership cost.

Training and implementation costs are also around 15% of the total price. These factors make it difficult for small and medium-sized labs to invest in these systems, which limits their adoption. This restraint will likely decrease with the advent of cloud-based services in the future.

Opportunity

Significant Growth Potential in Emerging Countries

Major markets for LIMS are China, India, Brazil, Singapore, Brazil, and the Middle East. These markets lack the proper standards and regulations that are required in developed countries like the US. This opens up huge opportunities for vendors who cannot meet these standards. Many biopharmaceutical companies are moving their manufacturing plants to Asia in order to lower costs.

This is driving a large demand for information technology solutions in Asian countries. The COVID-19 pandemic, however, has forced stakeholders from developed markets like the US and Europe to reduce their dependence on Asian countries to make the transition to in-house operations.

Trends

Laboratory Information Management System is Expected to Hold its Highest Market Share in the Product

The market for laboratory informatics is expected to grow due to technological advances in the field of laboratory information management systems. LabVantage Solutions has released LabVantage 8.4, the latest version of its laboratory management software. The new version includes many updated features that improve lab efficiency and effectiveness, as well as make it easier for staff and managers to work.

Market players are expected to introduce new products and solutions that will help in the expansion of the laboratory informatics industry. Millipore Sigma, for example, announced that it launched the Lanexo Lab Safety, Compliance, and Inventory Management System at Pittcon. This new digital laboratory informatics system will drastically reduce lab time and increase data quality and traceability.

Regional Analysis

North America Region Dominates the Market

North America was the dominant market, accounting for over 40% of all revenue. Policies supporting the deployment of laboratory information systems and infrastructure with high digital literacy are key factors in this market’s growth. The region’s rising healthcare costs and the increasing pressure to lower the cost curve have led to an increase in the adoption of LIMS. The key factors driving regional market growth are well-established pharmaceutical companies as well as the need to limit operational costs associated with information management and analysis.

The Asia Pacific market for laboratory informatics will experience significant growth due to the growing number of CROs that offer LIMS solutions. Major players seek out LIMS outsourcing from companies in the region in order to lower the cost of LIMS support systems and increase operational efficiency. Outsourcing hubs emerge in developing economies like India and China. The rise in the incidence of infectious and cardiovascular diseases in India has led to an increase in eClinical services. This will lead to an increase in laboratory informatics services over the forecast period.

India is able to provide the infrastructure necessary to conduct clinical trials that will allow for affordable patient care and evidence-based administration. These initiatives are expected to increase market growth by allowing China’s lab informatics to be accessed.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

With the presence of many local and regional players, the market for companion diagnostics is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

Listed below are some of the most prominent Laboratory Informatics industry players:

Market Key Players

- Thermo Fisher Scientific, Inc.

- Core Informatics

- LabWare, Inc.

- PerkinElmer, Inc.

- LabVantage Solutions, Inc.

- LabLynx, Inc.

- Agilent Technologies

- ID Business Solutions Ltd.

- McKesson Corporation

- Waters Corporation

- Abbott Informatics

- Other Key Players

Recent Developments

- In October 2023, PerkinElmer expanded its range of laboratory informatics tools by acquiring Sciara Technologies, a company known for its cloud-based solutions for data capture and management. This move strengthens PerkinElmer’s capabilities in Laboratory Information Management Systems (LIMS) and Chromatography Data Systems (CDS), allowing them to offer more comprehensive data management solutions to laboratories.

- In September 2023, LabVantage joined forces with BenchSci to integrate artificial intelligence (AI) into its informatics suite. This collaboration allows researchers to utilize AI-powered data analysis directly within the Laboratory Information Management System (LIMS) environment, boosting efficiency and potential discoveries in scientific research.

- In June 2023, Waters Corporation introduced a significant update to its Oasis LIMS platform. This update focuses on providing users with an improved experience, enhanced data visualization tools, and increased integration capabilities with laboratory instruments. Waters Corporation aims to keep its LIMS offerings modern and competitive in the market.

- In May 2023, Thermo Fisher Scientific announced a strategic partnership with Microsoft to develop and implement cloud-based laboratory informatics solutions. This collaboration harnesses the power of Microsoft’s Azure cloud platform to create secure and scalable informatics solutions, catering to the increasing demand for cloud-based data management in laboratory settings.

Report Scope

Report Features Description Market Value (2023) USD 3,748.6 Mn Forecast Revenue (2033) USD 8,092.9 Mn CAGR (2024-2033) 8.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution- Laboratory Information Management Systems, Electronic Lab Notebooks, Chromatography Data Systems, Laboratory Execution Systems, Enterprise Content Management, Scientific Data Management Systems, and Other Products; By Component- Software, Service; By Delivery Mode- On-Premise, Web-Hosted, Cloud-Based; By End-Users- Pharmaceutical Companies, Biotech Companies, Chemical Industries, Life Sciences Industries, Food & Beverage Industries, Agricultural Industries, and Other End Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Core Informatics, LabWare, Inc., PerkinElmer, Inc., LabVantage Solutions, Inc., LabLynx, Inc., Agilent Technologies, ID Business Solutions Ltd., McKesson Corporation, Waters Corporation, Abbott Informatics, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Laboratory Informatics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Laboratory Informatics MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Core Informatics

- LabWare, Inc.

- PerkinElmer, Inc.

- LabVantage Solutions, Inc.

- LabLynx, Inc.

- Agilent Technologies

- ID Business Solutions Ltd.

- McKesson Corporation

- Waters Corporation

- Abbott Informatics

- Other Key Players