Global Kettlebells Market By Type (Traditional Cast Iron Kettlebells, Adjustable Kettlebells, Competition Kettlebells, Rubber Coated Kettlebells), By Weight Range (Medium Weight (10-25 lbs), Light Weight (Under 10 lbs), Heavy Weight (25 lbs and above)), By End-User (Individual Consumers, Gyms and Fitness Centers, Sports Training Facilities, Rehabilitation Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135725

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

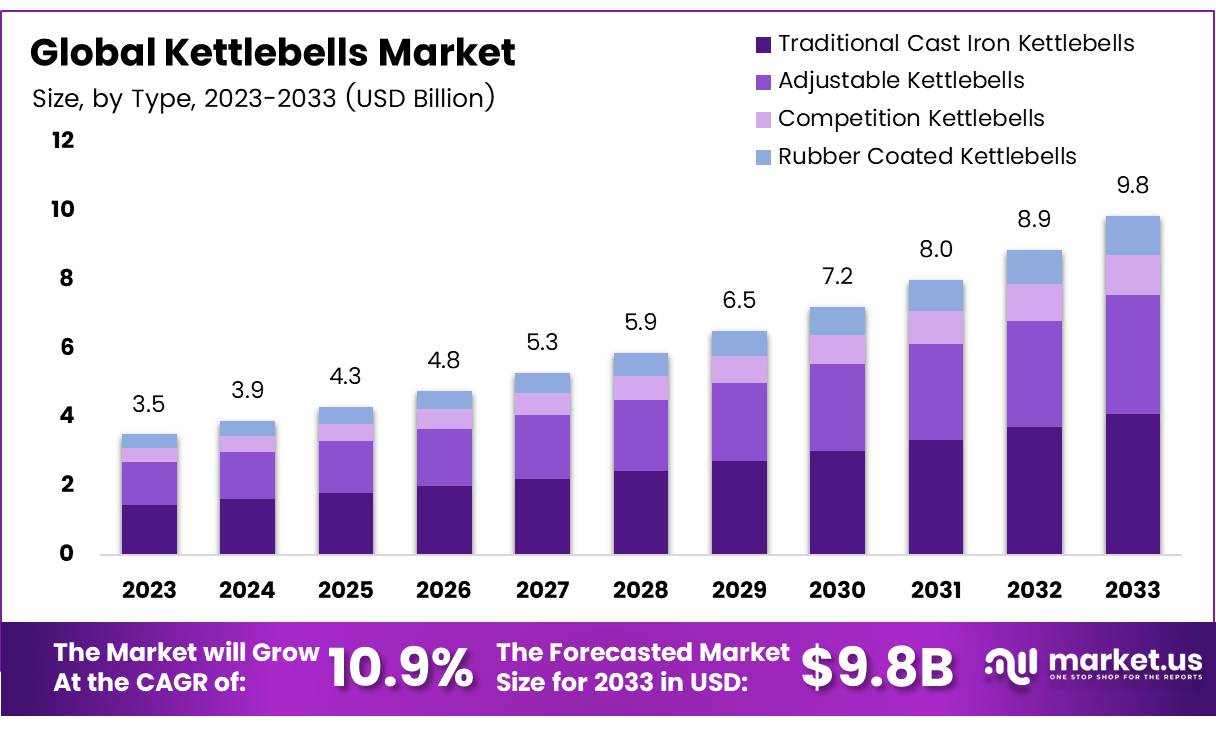

The Global Kettlebells Market size is expected to be worth around USD 9.8 Billion by 2033, from USD 3.5 Billion in 2023, growing at a CAGR of 10.9% during the forecast period from 2024 to 2033.

Kettlebells are versatile pieces of strength training equipment, originating from Russia as a farming weight tool and evolving into a staple in fitness regimes. Typically made from cast iron or steel, kettlebells feature a ball-like shape with a flat base and a handle on top, allowing for a wide range of motion exercises.

The kettlebell market refers to the commercial landscape surrounding the production, distribution, and sale of kettlebells. This market includes manufacturers, distributors, fitness studios, and direct-to-consumer sales channels. The adoption of kettlebells in various training programs, driven by their effectiveness and versatility, has fostered growth in this sector.

The market’s expansion is further supported by a growing awareness of health and wellness and the increasing popularity of functional training. Kettlebells are not only prevalent in individual fitness regimens but are also increasingly incorporated into group fitness classes and rehabilitation programs, highlighting their broad appeal.

The growth of the kettlebell market can also be attributed to the rising popularity of home gyms and personalized fitness, trends accelerated by recent global events that have highlighted the need for versatile, space-efficient workout solutions.

Furthermore, the burgeoning senior demographic presents a unique opportunity for kettlebell manufacturers and distributors. Programs designed to enhance muscle strength and reduce inflammation in older adults can drive kettlebell adoption in this growing user segment.

Recent studies underscore the effectiveness and potential of kettlebell training, further validating market growth prospects. According to a 2023 study published by PMC, an 8-week kettlebell circuit training program notably enhanced explosive power and strength endurance by 11% among handball players aged 21-25 years.

Similarly, a 2022 randomized controlled trial (RCT) indicated that kettlebell training could significantly improve physical attributes essential for athletic performance, including a 17% increase in bone mineral density and a 15% improvement in push-pull leg strength among under-12 soccer players (PMC).

Moreover, a 2024 study highlighted the health benefits for seniors, demonstrating that kettlebell training twice a week could decrease inflammation and boost muscle strength in previously inactive individuals aged 60-80 years (Physiology).

Market interest is also evident from consumer behavior; for instance, in the UK, Google Ads keywords data from Xplorgym showed a 49% year-on-year increase in searches for ‘strength training’ as of September 2024, illustrating a heightened consumer interest in fitness regimes that include strength components. In the United States, the user base for kettlebells saw a notable rise, reaching approximately 14.5 million in 2023, up nearly 6% from the previous year as per recent Statistics.

Key Takeaways

- Global Kettlebells Market projected to reach USD 9.8 billion by 2033, growing at a CAGR of 10.9% from 2024 to 2033.

- Traditional Cast Iron Kettlebells dominate the market, preferred for their durability and affordability.

- Medium Weight (10-25 lbs) kettlebells lead the market due to their versatility in both aerobic and anaerobic workouts.

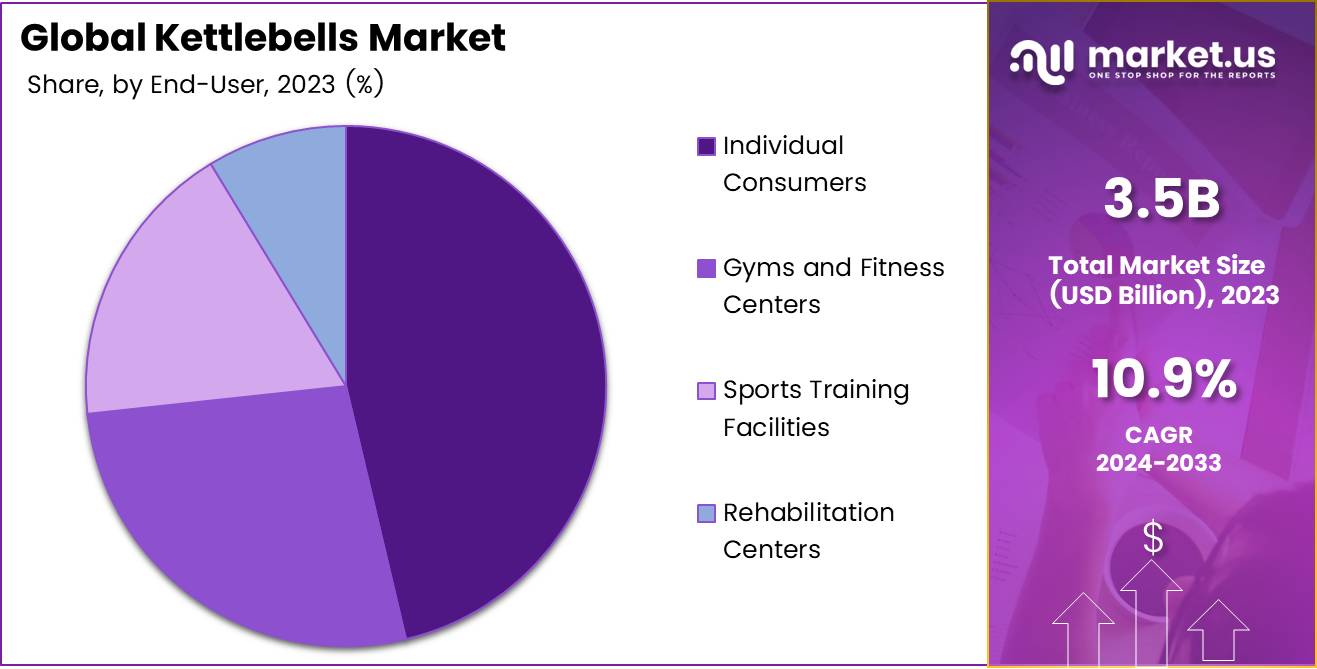

- Individual Consumers are the primary end-users, driven by increased health awareness and the adoption of home fitness equipment.

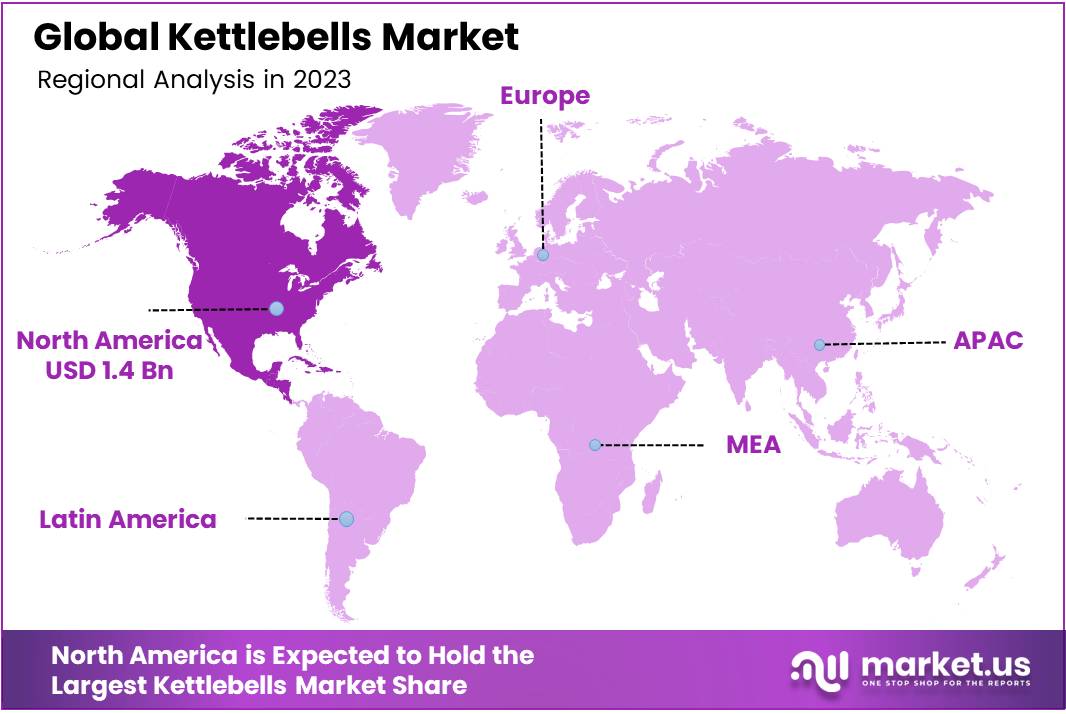

- North America holds the largest market share at 40.5%, valued at USD 1.4 billion, influenced by a strong fitness culture and high consumer spending on fitness equipment.

Type Analysis

Traditional Cast Iron Kettlebells Lead in Market Share, Favored for Their Durability and Cost-Effectiveness

In 2023, Traditional Cast Iron Kettlebells held a dominant market position in the By Type Analysis segment of the Kettlebells Market. Traditional cast iron kettlebells have maintained their popularity due to their durability and affordability, making them a preferred choice for both home gyms and commercial fitness centers.

Adjustable kettlebells followed in market share, offering versatility and space efficiency. Their adjustable weight features appeal to users who seek customizable options for progressive strength training, thereby driving their adoption among fitness enthusiasts with limited storage space.

Competition kettlebells, designed for professional use, feature uniform sizes with varying weights and are made to meet specific standards for official kettlebell competitions. Although they represent a smaller portion of the market, the rise in kettlebell sports globally has bolstered their sales.

Lastly, rubber-coated kettlebells are increasingly favored for their reduced noise and floor damage properties. These kettlebells cater to users prioritizing equipment longevity and aesthetic appeal in both home and institutional settings, slowly expanding their market presence.

Weight Range Analysis

Medium weight kettlebells lead the pack, favored by both gym rookies and workout warriors alike!

In 2023, Medium Weight (10-25 lbs) held a dominant market position in the By Weight Range Analysis segment of the Kettlebells Market. This category’s prevalence can be attributed to its versatility, catering to a wide array of fitness enthusiasts from beginners to seasoned athletes. The medium weight kettlebells are particularly favored for their utility in both aerobic and anaerobic exercises, enhancing their appeal across diverse consumer segments.

Conversely, the Light Weight (Under 10 lbs) segment targets beginners and those engaged in light workout routines. This segment is essential for individuals focusing on high-repetition endurance training or those in the initial stages of physical fitness, emphasizing technique over resistance.

The Heavy Weight (25 lbs and above) segment appeals to advanced fitness enthusiasts and professional athletes. This category is crucial for progressive strength training and building muscle mass. The demand in this segment is driven by a growing interest in high-intensity interval training (HIIT) and strength conditioning programs among more experienced users.

Collectively, these segments illustrate a comprehensive market landscape driven by consumer fitness levels and training preferences, each playing a pivotal role in shaping the overall dynamics of the kettlebells market.

End-User Analysis

Kettlebells Appeal Broadly, Led by Individual Consumers’ Embrace for Home Fitness

In 2023, Individual Consumers held a dominant market position in the By End-User Analysis segment of the Kettlebells Market. This segment’s strength is primarily driven by the increasing awareness among the general public regarding health and fitness, which has significantly boosted the adoption of home workout equipment, including kettlebells.

Gyms and Fitness Centers also form a substantial market share, leveraging the versatility of kettlebells for both individual workouts and group fitness classes. These facilities frequently update their equipment to attract and retain membership, thus consistently driving volume purchases.

Sports Training Facilities incorporate kettlebells into athletic training programs to enhance strength, balance, and conditioning, reflecting a steady uptake in this segment. The integration of kettlebells into sports-specific conditioning routines highlights their efficacy in improving athletic performance.

Rehabilitation Centers have recognized the benefits of kettlebells in physical therapy and rehabilitation settings. The use of kettlebells helps in the recovery and strengthening of muscles, making them essential tools in therapeutic protocols, thus expanding their market presence.

Key Market Segments

By Type

- Traditional Cast Iron Kettlebells

- Adjustable Kettlebells

- Competition Kettlebells

- Rubber Coated Kettlebells

By Weight Range

- Medium Weight (10-25 lbs)

- Light Weight (Under 10 lbs)

- Heavy Weight (25 lbs and above)

By End-User

- Individual Consumers

- Gyms and Fitness Centers

- Sports Training Facilities

- Rehabilitation Centers

Drivers

Kettlebells Market Growth Driven by Rising Health Consciousness

The expansion of the kettlebells market is primarily fueled by increasing health awareness among the public. This surge in consciousness is often supported by various government health initiatives aimed at promoting physical wellness.

Additionally, the trend towards home fitness routines, which gained significant momentum during recent global health crises, has further propelled the demand for kettlebells. These versatile weights are not only popular in home gyms but are also extensively integrated into functional training programs at fitness centers and personal training sessions.

The promotion of kettlebell workouts by fitness influencers through social media platforms has also significantly contributed to their popularity, influencing both beginners and seasoned fitness enthusiasts to incorporate these tools into their workout regimes. This comprehensive adoption underscores the kettlebells’ effectiveness in a wide array of physical fitness routines, thus driving market growth.

Restraints

Kettlebells Market Growth Driven by Rising Health Consciousness

The growth of the kettlebells market faces notable restraints, primarily due to the high cost of quality equipment. Premium kettlebells, known for their durability and ergonomic designs, come with a price tag that might be prohibitive for budget-conscious consumers. This factor could limit market expansion as potential users may opt for lower-priced alternatives, which, however, might not offer the same quality or benefits.

Moreover, the market for kettlebells also contends with the widespread availability of alternative fitness equipment. These alternatives, ranging from resistance bands to advanced cardio machines, are often perceived as safer or more effective, attracting a significant portion of consumers seeking comprehensive workout solutions.

The presence of these alternatives can divert potential sales from the kettlebells segment, further impacting its growth potential in a competitive fitness equipment market.

Growth Factors

Smart Kettlebells Revolutionize Fitness with Digital Tracking and Interactive Guidance

The kettlebell market is poised for significant growth, driven primarily by technological advancements. The development of smart kettlebells, which incorporate digital features for tracking performance and providing user guidance, represents a key opportunity. These innovative products cater to the increasing consumer demand for fitness equipment that supports interactive and data-driven workout experiences.

Moreover, there is substantial potential for market expansion into emerging markets. As the middle-class populations in these regions continue to grow, introducing kettlebells can meet the rising interest in affordable and effective fitness solutions. Additionally, forging partnerships with fitness centers can amplify market penetration.

By integrating kettlebells into gym memberships and fitness programs, companies can enhance product visibility and appeal, encouraging more widespread use in both personal and commercial fitness settings. These strategic moves, when combined, offer a robust pathway for revenue growth and market expansion in the kettlebell industry.

Emerging Trends

Hybrid Workouts Drive Kettlebell Market Popularity

The kettlebell market is witnessing significant growth driven by the trend of hybrid workouts, which integrate kettlebell exercises with other fitness modalities like yoga or Pilates. This approach caters to a growing consumer preference for versatile and comprehensive fitness routines that can be tailored to individual needs and preferences.

Moreover, manufacturers are tapping into digital transformations by integrating their offerings with smart fitness apps, enhancing user engagement through trackable progress and personalized workout plans. There is also a notable shift towards aesthetically pleasing designs, with kettlebells now available in various colors and styles to complement modern home decor.

Additionally, the market is adapting to the subscription economy by offering premium content subscriptions, providing users with a constant stream of innovative and challenging workout routines. These factors collectively contribute to the dynamic expansion of the kettlebell market, appealing to fitness enthusiasts who seek functionality, connectivity, and style in their workout equipment.

Regional Analysis

North America Leads with 40.5% Share and USD 1.4 Billion in Revenue

The kettlebells market exhibits significant regional diversity, with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America each presenting unique dynamics and opportunities.

North America dominates the market, holding a 40.5% share with a valuation of USD 1.4 billion. This robust performance can be attributed to a growing trend towards fitness and wellness, coupled with high consumer spending on gym equipment and personal fitness products.

Regional Mentions:

In Europe, the market is driven by increasing awareness about health and fitness, supported by government initiatives to promote physical activities. The rise of boutique gyms and specialized fitness centers further fuels the demand for kettlebells. Europe’s focus on sustainable and locally sourced fitness equipment also aligns with consumer preferences for environmentally friendly products.

The Asia Pacific region is witnessing rapid growth due to rising urbanization and increasing disposable incomes. Countries like China and India are major contributors, with the proliferation of fitness centers and home gyms. The region’s young demographic and burgeoning middle class provide a fertile ground for the expansion of the kettlebells market.

The Middle East & Africa region, although smaller in comparison, is experiencing growth driven by luxury fitness facilities and increasing health awareness among the affluent population. The trend towards adopting Western fitness regimes among the younger population also contributes to market growth.

Latin America, while still emerging in the kettlebells market, shows potential due to an increasing number of health clubs and a growing awareness of lifestyle diseases. Countries like Brazil and Argentina are seeing a shift towards more health-conscious behaviors, which is expected to propel the demand for fitness equipment, including kettlebells.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global kettlebells market of 2023, several key players stand out due to their brand recognition, product innovation, and market penetration strategies.

Companies such as Iron Edge, Kettlebell Kings, and Rogue Fitness lead the pack with their high-quality, durable products that cater to both fitness enthusiasts and professional athletes. These brands have established a strong online presence, leveraging digital marketing and direct-to-consumer sales channels to enhance customer engagement and retention.

Iron Edge and Kettlebell Kings, in particular, have differentiated themselves through their focus on premium materials and ergonomic designs, appealing to a clientele that prioritizes performance and comfort. Rogue Fitness continues to dominate by offering a wide range of fitness equipment, including kettlebells that are often used in CrossFit, a niche but rapidly growing segment.

Mid-tier players like Perform Better and Yes4All offer competitively priced options that attract budget-conscious consumers. These brands have successfully expanded their market share by focusing on cost efficiency and accessibility, making them popular choices in both residential and commercial markets.

Emerging brands such as Onnit and Rep Fitness have carved out unique positions by integrating innovative features, such as adjustable weights and eco-friendly materials, into their kettlebell designs, resonating with a younger, environmentally conscious demographic.

Moreover, specialized companies like Kettlebell Foundry and Titan Fitness focus on niche markets, offering customized solutions that cater to specific customer needs, such as custom logos or enhanced grip features, further enhancing their market presence.

Overall, the competitive landscape in 2023’s kettlebell market reflects a blend of quality, innovation, and brand strategy, with each key player leveraging their strengths to capture and expand their customer base in a growing fitness industry.

Top Key Players in the Market

- Iron Edge

- Kettlebell Kings

- Rogue Fitness

- Perform Better

- Yes4All

- Onnit

- Rep Fitness

- Titan Fitness

- Kettlebell Foundry

- PowerBlock

- TRX Training

- CAP Barbell

- Power Systems

- Lifeline Fitness

- York Barbell

Recent Developments

- In December 2023, Ladder successfully secured $12 million in Series A funding to simplify strength training concepts and stimulate its growth trajectory.

- In May 2024, the fitness startup Portl garnered $3 million from investors including Bharat Innovation Fund, Kalaari Capital, and T-Hub Foundation to expand its technological and market reach.

- In December 2024, QUELL announced a $10 million Series A investment led by Tencent, aiming to enhance its market presence and develop its interactive fitness technology.

- In September 2024, EGYM attracted approximately $200 million in growth capital at a valuation exceeding $1 billion, with L Catterton, a prominent global consumer-focused investment firm, as the lead investor.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Billion Forecast Revenue (2033) USD 9.8 Billion CAGR (2024-2033) 10.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Traditional Cast Iron Kettlebells, Adjustable Kettlebells, Competition Kettlebells, Rubber Coated Kettlebells), By Weight Range (Medium Weight (10-25 lbs), Light Weight (Under 10 lbs), Heavy Weight (25 lbs and above)), By End-User (Individual Consumers, Gyms and Fitness Centers, Sports Training Facilities, Rehabilitation Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Iron Edge, Kettlebell Kings, Rogue Fitness, Perform Better, Yes4All, Onnit, Rep Fitness, Titan Fitness, Kettlebell Foundry, PowerBlock, TRX Training, CAP Barbell, Power Systems, Lifeline Fitness, York Barbell Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Iron Edge

- Kettlebell Kings

- Rogue Fitness

- Perform Better

- Yes4All

- Onnit

- Rep Fitness

- Titan Fitness

- Kettlebell Foundry

- PowerBlock

- TRX Training

- CAP Barbell

- Power Systems

- Lifeline Fitness

- York Barbell