Japan Glued Laminated Timber Market Size, Share, Growth Analysis By Type (Modified Melamine Resin, Phenol Resorcinol Resin, Polyurethane, Others), By Form (Straight Glulam Beams, Curved Glulam Beams, Laminated Veneer Lumber, Others), By Grade (Premium Grade, Framing Grade, Industrial Grade, Architectural Grade), By Lamination Configuration (Horizontal Lamination, Vertical Lamination, Diagonal Lamination), By Application (Commercial, Residential, Bridges and Infrastructure, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 29984

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

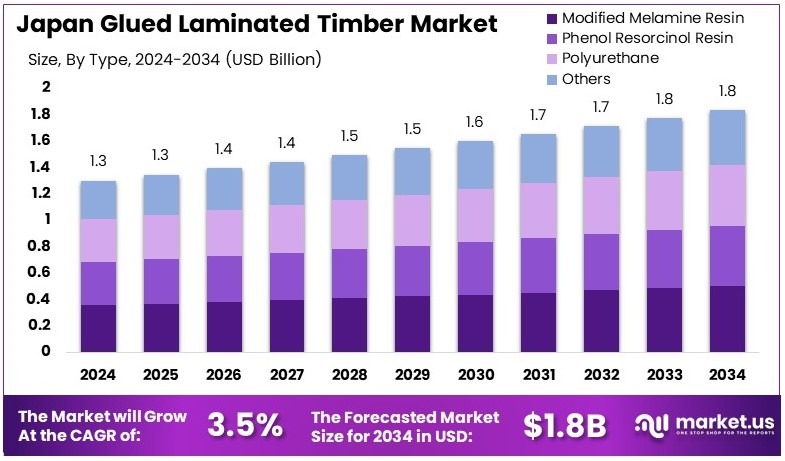

The Japan Glued Laminated Timber Market size is expected to be worth around USD 1.8 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

Japan glued laminated timber, often called “glulam,” is engineered wood made by bonding layers of timber with strong adhesives. It is designed for structural strength and stability. Glulam is commonly used in Japan for beams, columns, and building structures. It offers advantages like durability, design flexibility, and earthquake resistance.

The Japan glued laminated timber market refers to businesses involved in producing, distributing, and selling glulam products within Japan. This market includes manufacturers and construction companies that use laminated timber for residential, commercial, and industrial buildings. Demand mainly comes from the construction sector for housing and infrastructure projects.

Japan’s glued laminated timber (glulam) market is steadily growing. The country produced 1.98 million cubic meters of glulam in 2021. Structural applications made up 1.90 million cubic meters, showing strong demand from construction companies. Therefore, glulam remains an essential material for building projects across Japan.

Furthermore, the Japanese glulam market continues to expand, driven by consistent construction needs. In 2021, Japan also imported 1.97 million cubic meters of glulam products. These imports indicate that local production alone cannot meet the country’s demand. Consequently, the market offers opportunities for both local manufacturers and global exporters.

In addition, several factors support market growth, including Japan’s frequent need for earthquake-resistant buildings. Glulam provides strength, safety, and flexibility, ideal for areas prone to natural disasters. As such, builders prefer using glulam, boosting the market’s prospects, especially in earthquake-prone regions.

However, market competition remains intense, as many local manufacturers compete on price and quality. This has led to moderate market saturation, with limited room for new players. Nonetheless, companies that can offer high-quality and innovative products still have opportunities, particularly in specialty or eco-friendly glulam segments.

Key Takeaways

- The Japan Glued Laminated Timber Market was valued at USD 1.3 Billion in 2024 and is expected to reach USD 1.8 Billion by 2034, with a CAGR of 3.5%.

- In 2024, Modified Melamine Resin led the type segment with 27.3%, owing to its durability and strong adhesive properties.

- In 2024, Straight Glulam Beams dominated the form segment with 38.2%, preferred for structural applications in construction.

- In 2024, Framing Grade accounted for 34.3%, due to its strength and suitability for residential buildings.

- In 2024, Horizontal Lamination was the leading lamination configuration with 43.2%, ensuring structural stability and flexibility.

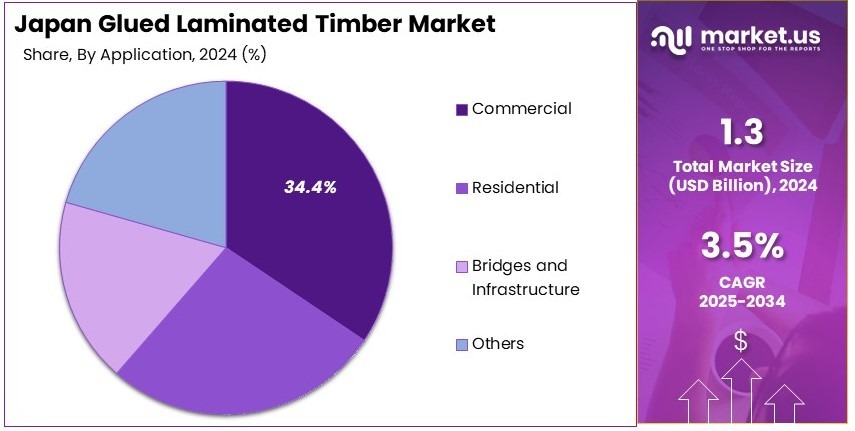

- In 2024, Commercial Construction held 34.4% of the application segment, driven by increasing demand for sustainable building materials.

Type Analysis

Modified Melamine Resin dominates with 27.3% due to its superior adhesive properties and moisture resistance.

In the Japan Glued Laminated Timber Market, the Type segment is led by Modified Melamine Resin, capturing a 27.3% market share. This dominance is attributed to its enhanced properties that make it highly suitable for environments requiring moisture resistance and strong adhesive qualities. Modified Melamine Resin is preferred in construction projects where durability and longevity are critical, such as in humid or wet conditions frequently encountered in Japan.

Other types, including Phenol Resorcinol Resin and Polyurethane, also contribute to the market. Phenol Resorcinol Resin is valued for its robust performance under high temperatures and its load-bearing capacity, making it ideal for structural applications.

Polyurethane is favored for its flexibility and is used in both interior and exterior applications, enhancing the versatility of glued laminated timber products. The category labeled ‘Others’ includes a variety of adhesives that cater to niche applications, offering solutions where traditional resins may not perform as well, thus supporting the market’s growth through innovation.

Form Analysis

Straight Glulam Beams lead with 38.2% owing to their structural efficiency and ease of use in construction projects.

The Form segment of the market sees Straight Glulam Beams at the forefront, holding a 38.2% share. This preference is primarily due to their structural efficiency and compatibility with various architectural designs. Straight Glulam Beams are essential in construction for their ability to bear significant loads and span large distances, making them a staple in both residential and commercial building projects.

Curved Glulam Beams and Laminated Veneer Lumber are other critical forms within this market. Curved beams provide aesthetic value and architectural flexibility, allowing for innovative building designs.

Laminated Veneer Lumber is recognized for its uniformity and strength, playing a pivotal role in precision-demanding environments. The ‘Others’ category encompasses additional forms that fulfill specialized needs, adapting to unique construction requirements and supporting the diversification of the glued laminated timber market.

Grade Analysis

Framing Grade leads with 34.3% due to its widespread use in load-bearing applications across various construction projects.

In the Grade segment, Framing Grade timber holds the majority market share of 34.3%, reflecting its extensive use in load-bearing structures due to its strength and reliability. This grade of timber is preferred in both residential and commercial construction, where structural integrity is paramount.

Premium Grade and Architectural Grade timber also play significant roles, the former for high-quality finish applications and the latter for visually exposed structures requiring aesthetic appeal. Industrial Grade timber, though less common, is crucial for applications demanding robustness and durability, particularly in industrial settings where environmental stressors are prevalent.

Lamination Configuration Analysis

Horizontal Lamination dominates with 43.2% as it provides optimal strength and flexibility for a wide range of construction needs.

Horizontal Lamination holds the largest share in this segment, with a 43.2% market penetration. This configuration is preferred for its ability to provide optimal strength and flexibility, which is essential for the majority of construction applications. Horizontal Lamination allows for longer spans and greater load-bearing capacities, making it a fundamental choice in the building industry.

Vertical and Diagonal Lamination configurations, while smaller in share, are essential for specific structural and aesthetic requirements. Vertical Lamination is chosen for its ability to offer greater heights and structural depth, whereas Diagonal Lamination is used in projects requiring enhanced shear resistance and a distinctive architectural look.

Application Analysis

Commercial applications lead with 34.4% due to the increasing demand for eco-friendly and aesthetically pleasing construction materials.

In the Application segment, Commercial uses of glued laminated timber dominate, capturing a 34.4% market share. This trend is driven by the growing preference for green building materials and the aesthetic flexibility that glued laminated timber provides. Commercial buildings benefit from the material’s natural appearance and its ability to create warm, inviting spaces.

Residential applications and others like Bridges and Infrastructure also significantly contribute to the market. Residential use is bolstered by the material’s energy efficiency and comfort, while infrastructure projects leverage its durability and resistance to environmental elements. The ‘Others’ category includes innovative applications in areas like temporary structures and exhibition spaces, showcasing the material’s versatility and adaptability to diverse construction needs.

Key Market Segments

By Type

- Modified Melamine Resin

- Phenol Resorcinol Resin

- Polyurethane

- Others

By Form

- Straight Glulam Beams

- Curved Glulam Beams

- Laminated Veneer Lumber

- Others

By Grade

- Premium Grade

- Framing Grade

- Industrial Grade

- Architectural Grade

By Lamination Configuration

- Horizontal Lamination

- Vertical Lamination

- Diagonal Lamination

By Application

- Commercial

- Residential

- Bridges and Infrastructure

- Others

Driving Factors

Government Policies and Urban Development Drive Market Growth

Japan’s government is actively promoting sustainable construction materials to reduce carbon emissions. Incentives and subsidies encourage developers to use timber-based solutions, such as glued laminated timber (glulam), in residential and commercial projects.

This aligns with Japan’s goal of achieving carbon neutrality while reducing reliance on high-emission materials like concrete and steel. Public policies also support timber construction in urban planning, fueling demand for prefabricated and modular wooden structures. These structures offer faster construction times and lower environmental impact, making them an attractive choice for urban expansion.

Another key driver is the increasing use of earthquake-resistant glulam structures. Given Japan’s high seismic activity, architects and engineers are leveraging the flexibility and strength of laminated timber to enhance structural stability. Glulam’s ability to withstand seismic forces makes it a preferred material for both residential and commercial buildings in earthquake-prone areas.

Additionally, the environmental benefits of timber construction are gaining recognition. Timber absorbs carbon dioxide, contributing to a lower carbon footprint compared to conventional materials. As a result, the rising preference for sustainable and resilient construction materials is driving the growth of Japan’s glued laminated timber market.

Restraining Factors

High Costs and Regulatory Barriers Restrain Market Growth

Despite its benefits, the production of glued laminated timber faces significant cost challenges. The sourcing and processing of high-quality raw materials require advanced techniques, increasing production expenses. Unlike conventional materials, glulam manufacturing involves strict quality control measures, adding to overall costs. This makes it less accessible for cost-sensitive projects, limiting its adoption in certain construction segments.

Additionally, a shortage of skilled labor is slowing market growth. Advanced timber construction techniques, including precise glulam assembly and on-site installation, require specialized training. However, Japan faces a declining workforce in the construction sector, making it difficult to meet rising demand.

Moreover, regulatory challenges related to fire safety compliance pose another obstacle. While technological advancements are improving fire-resistant treatments, strict building codes still restrict the use of timber in large-scale urban projects.

Competition from alternative engineered wood products and steel-framed construction also affects market penetration. Cross-laminated timber (CLT), another popular engineered wood product, sometimes competes with glulam, leading developers to explore hybrid solutions. Steel remains a dominant choice for high-rise buildings due to its long-standing industry acceptance and fire resistance. Overcoming these challenges is essential for the widespread adoption of glulam in Japan’s construction market.

Growth Opportunities

Hybrid Timber Structures and Sustainable Forestry Provide Opportunities

The integration of cross-laminated timber (CLT) with glulam presents new opportunities for hybrid construction. CLT enhances glulam’s strength, allowing for the development of taller and more complex wooden structures. This combination is being used in commercial and mixed-use buildings, offering an alternative to traditional steel and concrete construction. Developers and architects are increasingly exploring these hybrid solutions to create energy-efficient and environmentally friendly structures.

Advancements in adhesive technologies are also expanding the potential of glulam. New adhesives improve strength and durability while ensuring environmental compliance. This makes glulam more suitable for long-term applications, increasing its adoption in infrastructure projects.

Similarly, the rise of mass timber in high-rise construction is a promising trend. With advancements in structural engineering, mass timber buildings are gaining approval in urban centers, further driving demand for glulam.

Sustainable forestry initiatives are another key growth driver. Ensuring a stable supply of raw materials is crucial for long-term market expansion. Japanese forestry programs emphasize responsible logging and reforestation, providing a consistent source of timber while maintaining environmental balance. These initiatives support the increasing demand for sustainable construction, positioning glulam as a critical material for future building projects.

Emerging Trends

Biophilic Design and Digital Prefabrication Are Latest Trending Factors

Biophilic architecture is gaining popularity, influencing construction trends in Japan. This design approach emphasizes the integration of natural wood elements in buildings to enhance well-being and productivity. As a result, developers are incorporating more exposed glulam beams and wooden interiors to create aesthetically pleasing and environmentally friendly spaces. The demand for natural and organic building materials is driving further interest in glulam-based structures.

Digital prefabrication techniques are also revolutionizing the glulam market. Advanced CNC machinery and robotic fabrication allow for custom-designed timber components, increasing efficiency and reducing construction waste. Prefabricated glulam structures enable faster on-site assembly, making them an attractive solution for both residential and commercial developments. This trend is accelerating adoption, particularly in Japan’s urban housing sector.

Fire-resistant treatments and smart coatings are enhancing the safety of timber structures. Innovations in fire-retardant materials ensure compliance with stringent building regulations, making glulam a viable choice for large-scale construction.

Additionally, carbon credit programs linked to sustainable timber usage are encouraging more developers to adopt eco-friendly building materials. These programs provide financial incentives for reducing carbon footprints, reinforcing glulam’s position as a key material in sustainable architecture. As these trends continue to evolve, the glued laminated timber market in Japan is expected to see steady growth.

Competitive Landscape

The Japan Glued Laminated Timber Market features prominent players like JK Holdings Co. Ltd., Meiken Lamwood Corp., HASSLACHER Holding GmbH, and Holzindustrie Schweighofer GmbH. JK Holdings leads with a strong domestic presence, offering a variety of glued laminated timber products tailored to Japanese architectural needs, focusing on earthquake resistance and aesthetic value.

Meiken Lamwood Corp. is known for its innovation in laminated timber technology, providing high-quality products that support sustainable building practices in Japan. Their commitment to environmental standards and quality has made them a trusted brand in construction and building materials.

HASSLACHER Holding GmbH and Holzindustrie Schweighofer GmbH, both European-based companies, have made significant inroads into the Japanese market with their high-grade glued laminated timber products. These companies bring advanced European woodworking techniques and a strong focus on sustainability and durability, appealing to Japanese builders looking for eco-friendly and high-performance building solutions.

Together, these companies significantly influence the Japanese glued laminated timber market by offering products that meet stringent safety standards and by pushing the boundaries of architectural design with innovative timber solutions.

Major Companies in the Market

- JK Holdings Co. Ltd.

- HASSLACHER Holding GmbH

- Holzindustrie Schweighofer GmbH

- Forssell Timber

- FM Timber

- Sanno Housing Co. Ltd.

- Stora Enso Oyj

- Keitele Forest Oy

- Mayr-Melnhof Holz Holding AG

- Boise Cascade Company

- D.R. Johnson Wood Innovations

- Meiken Lamwood Corp.

Recent Developments

- ITOCHU and Mukai Kogyo Co., Ltd.: On January 2025, ITOCHU Corporation, in collaboration with Mukai Kogyo Co., Ltd., announced the establishment of FORJ Co., Ltd. The venture is intended to bolster the production and export of Japanese cedar lumber to North America.

- Timberlab Holdings, Inc. and American Laminators: On May 2024, Timberlab Holdings, Inc. acquired American Laminators, an Oregon-based glulam manufacturer. This acquisition enhances Timberlab’s capabilities in mass timber construction, reflecting a growing global interest in sustainable building materials.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 1.8 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Modified Melamine Resin, Phenol Resorcinol Resin, Polyurethane, Others), By Form (Straight Glulam Beams, Curved Glulam Beams, Laminated Veneer Lumber, Others), By Grade (Premium Grade, Framing Grade, Industrial Grade, Architectural Grade), By Lamination Configuration (Horizontal Lamination, Vertical Lamination, Diagonal Lamination), By Application (Commercial, Residential, Bridges and Infrastructure, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape JK Holdings Co. Ltd., HASSLACHER Holding GmbH, Holzindustrie Schweighofer GmbH, Forssell Timber, FM Timber, Sanno Housing Co. Ltd., Stora Enso Oyj, Keitele Forest Oy, Mayr-Melnhof Holz Holding AG, Boise Cascade Company, D.R. Johnson Wood Innovations, Meiken Lamwood Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Japan Glued Laminated Timber MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Japan Glued Laminated Timber MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- JK Holdings Co. Ltd.

- HASSLACHER Holding GmbH

- Holzindustrie Schweighofer GmbH

- Forssell Timber

- FM Timber

- Sanno Housing Co. Ltd.

- Stora Enso Oyj

- Keitele Forest Oy

- Mayr-Melnhof Holz Holding AG

- Boise Cascade Company

- D.R. Johnson Wood Innovations

- Meiken Lamwood Corp.