Global Diverter Valves Market By Type (Hydraulic Diverter Valves, Electric Diverter Valves, Manual Diverter Valves), By Operation (Blow-Through Diverter Valves, Fall-Through Diverter Valves), By Material (Cast Iron, Stainless Steel, Brass/Bronze, Acetal, Ductile Iron), By End-User Industry (Oil & Gas, Chemical & Petrochemical, Pharmaceuticals, Food & Beverage, Other End-User Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: October 2024

- Report ID: 27534

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Operation Analysis

- By Material Analysis

- By End-User Industry Analysis

- Key Market Segments

- Drivers

- Restraint

- Challenges Facing Diverter Valves Market

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

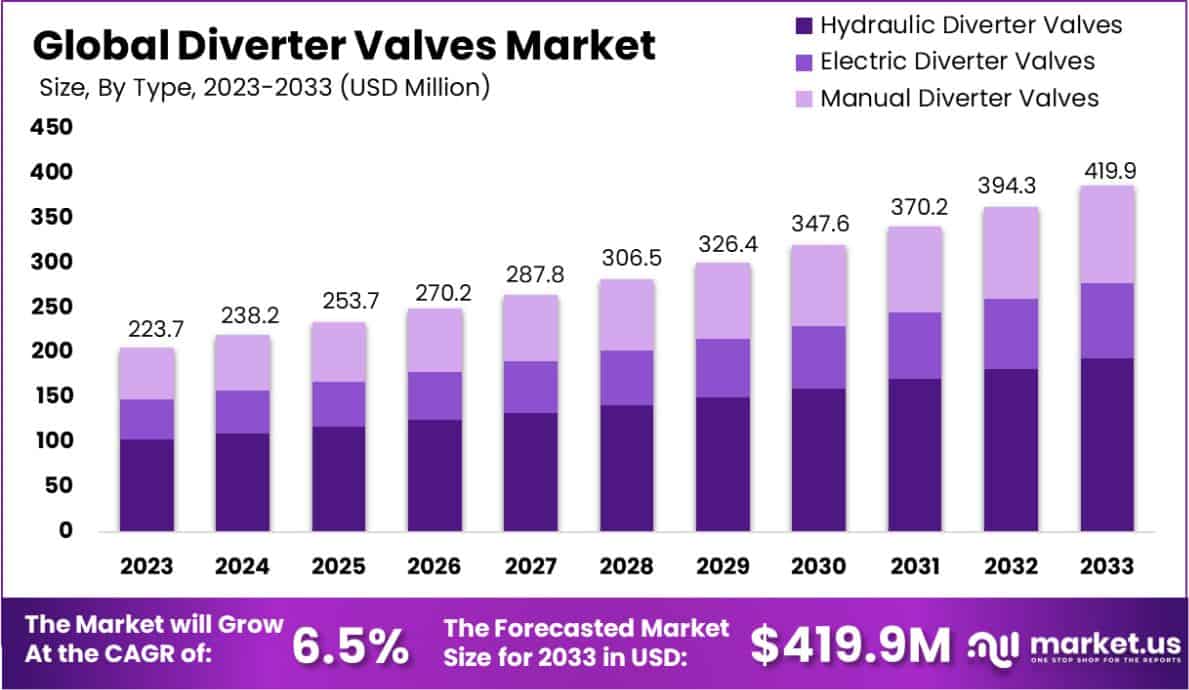

The Global Diverter Valves Market size is expected to be worth around USD 419.9 Million by 2033, From USD 223.7 Million by 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

Diverter valves are specialized mechanical devices designed to direct the flow of material or fluid between multiple destinations within a handling or processing system. They are essential components in industries such as manufacturing, mining, pharmaceuticals, and food processing, where precise control of material flow is critical for operational efficiency and safety.

The Diverter Valves Market encompasses the production, distribution, and technological development of diverter valves used across various industries. This market is driven by the expanding industrial automation, which demands more efficient fluid handling systems to ensure precision and reduce waste.

The market’s growth is primarily fueled by increasing industrialization and advancements in automation technologies. Industries are adopting automated systems to enhance precision in processes like fluid dynamics and material handling, directly boosting the demand for diverter valves.

The demand for diverter valves is high in sectors that require rigorous process control, such as water treatment, pharmaceuticals, and food and beverage production. The need for reliable, efficient, and contamination-free processes in these industries propels the demand for advanced diverter valves.

There is a significant opportunity in the development and integration of smart diverter valves equipped with sensors and real-time data analytics. These innovations can offer enhanced monitoring and control capabilities, aligning with the growing trend of IoT and smart factories in the industrial sector.

The Diverter Valves Market is experiencing a notable surge in demand, influenced significantly by advancements in industrial automation and stringent process control requirements across various sectors. These devices are crucial in optimizing operational efficiencies and ensuring precise control in fluid management systems used in smart manufacturing, pharmaceuticals, and food processing industries.

Government initiatives and funding are pivotal in fostering these advancements. For instance, the Indian government’s Department of Science & Technology is investing up to 60 lakhs INR in technologies including diverter valves, underlining the sector’s potential for significant technological advancements and industry growth.

This strategic funding underscores the government’s commitment to enhancing industrial automation capabilities within the country.

Moreover, in Canada, initiatives such as NorthRiver Midstream Inc.’s installation of 15 waste heat recovery units and five diverter valves, supported by $6.43 million of provincial funding, demonstrate regional investment in energy efficiency and process optimization.

Similarly, Ovintiv Canada ULC’s recent $2.43 million project to upgrade 78 compressors with more efficient valves showcases how targeted investments can spur technological enhancements and market growth.

These developments reflect a broader trend toward improved efficiency and sustainability within industry operations, presenting substantial growth opportunities for the Diverter Valves Market.

The integration of such technologies signifies a move towards more sustainable industrial practices and enhanced system performances, establishing a robust foundation for continuous growth and innovation within this market segment.

Key Takeaways

- The Global Diverter Valves Market size is expected to be worth around USD 419.9 Million by 2033, From USD 223.7 Million by 2023, growing at a CAGR of 6.5% during the forecast period from 2024 to 2033.

- In 2023, Hydraulic Diverter Valves held a dominant market position in the by-type segment of the Diverter Valves Market, with a 46.2% share.

- In 2023, Blow-Through Diverter Valves held a dominant market position in the operation segment of the Diverter Valves Market, with a 65.3% share.

- In 2023, Cast Iron held a dominant market position in the By Material segment of the Diverter Valves Market, with a 36.1% share.

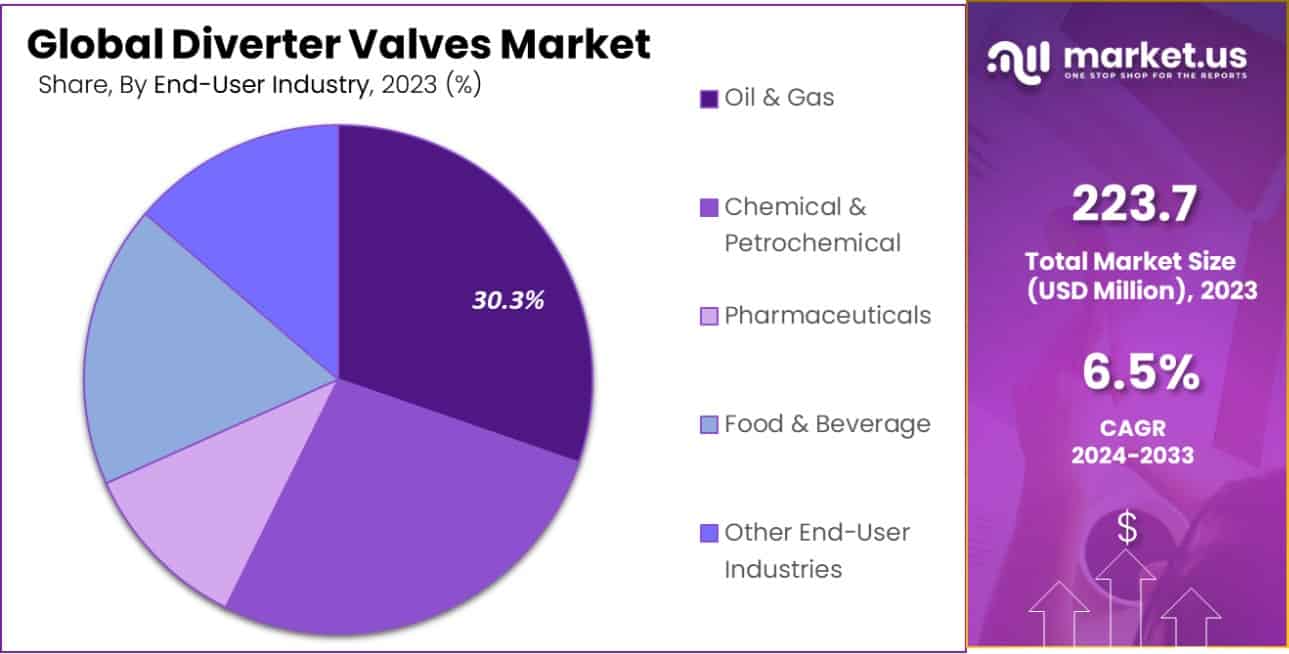

- In 2023, Oil & Gas held a dominant market position in the end-user Industry segment of the Diverter Valves Market, with a 30.3% share.

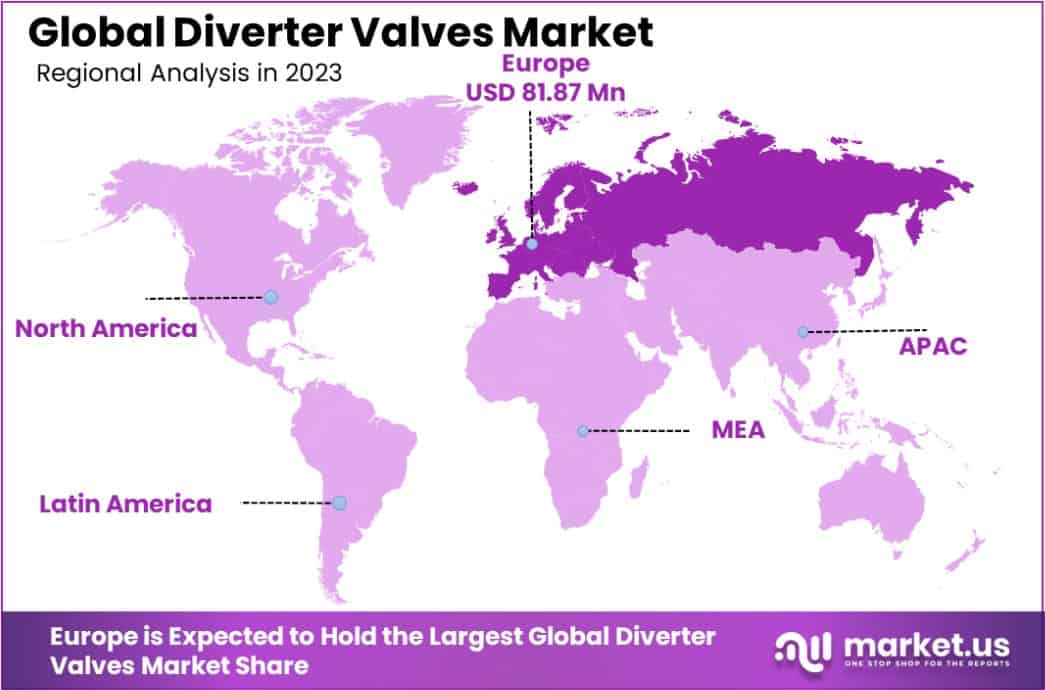

- Europe dominated a 36.6% market share in 2023 and held USD 81.87 Million in revenue from the Diverter Valves Market.

By Type Analysis

In 2023, the Diverter Valves Market was notably dominated by Hydraulic Diverter Valves, which accounted for a significant 46.2% share within the By Type segment. This prominent position is attributed to their extensive adoption across various industries, where precision in fluid handling and durability are paramount.

Hydraulic Diverter Valves are preferred for their robust performance in challenging environments, where they ensure efficient and reliable directional control of media flow. This type of valve is especially crucial in sectors such as manufacturing, oil and gas, and water treatment, where precise hydraulic control is necessary to maintain system integrity and operational safety.

Electric Diverter Valves also held a considerable portion of the market, appreciated for their ease of integration with automated systems, offering remote operability and reduced manual intervention. These valves are particularly advantageous in applications requiring precise, programmable flow paths and are increasingly integrated into modern industrial setups.

Manual Diverter Valves, while less technologically advanced, remain essential in applications where direct, hands-on control is preferred or in environments where simplicity and cost-effectiveness are prioritized. Their straightforward design and operation make them a viable choice for small-scale operations and emerging markets where sophisticated infrastructure is lacking.

By Operation Analysis

In 2023, Blow-Through Diverter Valves held a dominant market position in the By Operation segment of the Diverter Valves Market, commanding a substantial 65.3% share. This dominance is largely due to their critical role in systems requiring continuous, high-volume material flow, such as in pneumatic conveying systems utilized within the bulk material handling industries.

These valves are designed to provide a seamless, efficient directional change of materials like powders, pellets, and granules with minimal disruption, making them indispensable in sectors like food processing, pharmaceuticals, and chemical manufacturing.

Blow-Through Diverter Valves are favored for their ability to minimize wear and degradation of conveyed materials, thus ensuring integrity and quality in the production process. Their robust construction and ability to withstand high throughput demands align with the operational needs of large-scale industrial applications, thereby reinforcing their market superiority.

On the other hand, Fall-Through Diverter Valves, which allow materials to drop through the valve from one chute to another, accounted for the remainder of the market. While they are simpler in design and cost-effective, they are generally more suitable for applications involving less abrasive or lower-volume material handling.

Their usage tends to be more prevalent in industries where gravity assists in the material transfer process, complementing the high-performance attributes of blow-through types in diverse operational settings.

By Material Analysis

In 2023, Cast Iron held a dominant market position in the By Material segment of the Diverter Valves Market, with a 36.1% share. This predominance is attributed to cast iron’s exceptional durability, cost-effectiveness, and resistance to wear, which are critical attributes in heavy-duty industrial applications.

Cast iron diverter valves are extensively used in industries such as water treatment, mining, and manufacturing, where robust material is essential to handle abrasive or corrosive fluids effectively.

Stainless Steel followed closely, valued for its corrosion resistance and hygienic properties, making it indispensable in the food processing, pharmaceutical, and chemical sectors. This material’s ability to maintain purity and withstand extreme environments supports its substantial market share.

Brass/Bronze, known for their good corrosion resistance and machinability, are preferred in applications requiring more precise control and where corrosion potential is moderate, such as in residential and commercial plumbing systems.

Acetal and Ductile Iron also hold significant positions in the market. Acetal is chosen for its low friction and high wear resistance in lighter applications, whereas ductile iron, with enhanced strength compared to cast iron, is suitable for more demanding applications where additional toughness is required. Each material caters to specific industry needs, shaping the diverse landscape of the Diverter Valves Market.

By End-User Industry Analysis

In 2023, the Oil & Gas sector held a dominant market position in the By End-User Industry segment of the Diverter Valves Market, with a 30.3% share. This leading stance is primarily driven by the rigorous demands for robust fluid management solutions in exploration, production, and refining processes.

Diverter valves are crucial in these operations for directing flow safely and efficiently, managing everything from crude oil to natural gas, which necessitates high-performance materials and reliable mechanisms to withstand harsh conditions and high pressures.

Following closely, the Chemical & Petrochemical industry leverages diverter valves for their ability to control and direct chemical flows during the manufacturing process, emphasizing the need for valves that offer chemical resistance and operational reliability.

The pharmaceutical industry also integrates these valves to ensure contamination-free handling and precise control of ingredients, crucial for maintaining stringent health and safety standards.

Similarly, the Food & Beverage industry relies on diverter valves for sanitary processing applications to handle liquids and solids without compromising food safety, where stainless steel valves are particularly prevalent.

Other End-User Industries, including water treatment and construction, utilize diverter valves for various applications, requiring custom solutions tailored to diverse operational requirements, thereby supporting the overall market growth and innovation within this sector.

Key Market Segments

By Type

- Hydraulic Diverter Valves

- Electric Diverter Valves

- Manual Diverter Valves

By Operation

- Blow-Through Diverter Valves

- Fall-Through Diverter Valves

By Material

- Cast Iron

- Stainless Steel

- Brass/Bronze

- Acetal

- Ductile Iron

By End-User Industry

- Oil & Gas

- Chemical & Petrochemical

- Pharmaceuticals

- Food & Beverage

- Other End-User Industries

Drivers

Key Drivers in Diverter Valves Market

The Diverter Valves Market is primarily driven by the increasing need for efficient material handling across various industries, including pharmaceuticals, food and beverages, and construction.

As companies focus on optimizing production workflows and minimizing downtime, diverter valves play a crucial role by directing flow paths in pneumatic conveying systems, ensuring the quick and safe transfer of materials.

Additionally, advancements in automation and control technologies are enhancing the performance of these valves, leading to higher adoption rates. The market also benefits from stringent safety regulations that necessitate reliable equipment to handle potentially hazardous materials, further propelling the demand for advanced diverter valves.

Restraint

Challenges Facing Diverter Valves Market

One significant restraint in the Diverter Valves Market is the high cost of advanced diverter valves, which can be a barrier for smaller companies and emerging markets.

These advanced systems often require substantial initial investments in both the valves and the necessary control systems, making it challenging for smaller entities to adopt them.

Additionally, the market faces technical challenges in maintaining the valves, especially in harsh working environments where wear and tear can reduce efficiency and increase maintenance costs.

The presence of cheaper, lower-quality alternatives also poses competition, potentially limiting market growth as some companies opt for less expensive solutions despite their lower efficiency and shorter lifespans.

Opportunities

Expanding Opportunities in the Diverter Valves Market

The Diverter Valves Market is seeing growing opportunities due to rising industrial automation. As industries like pharmaceuticals, food processing, and construction increasingly automate their operations, the demand for diverter valves, which are essential for directing materials through automated systems, is also growing.

Moreover, the push towards smarter manufacturing facilities, equipped with Internet of Things (IoT) technologies, presents a significant opportunity for integrating advanced diverter valves that can be remotely monitored and controlled, enhancing efficiency and reducing downtime.

Additionally, expanding markets in developing countries, where industrial growth is accelerating, offer new avenues for sales and expansion for manufacturers of diverter valves, as these regions invest in modernizing their production capabilities.

Challenges

Operational Challenges in the Diverter Valves Market

The Diverter Valves Market faces notable challenges, primarily from the technical difficulties in valve operation under varied and extreme conditions. These valves often operate under high temperatures and pressures, which can lead to frequent mechanical failures and a need for regular maintenance, increasing operational costs.

Furthermore, the compatibility of diverter valves with various materials being handled is crucial, as incorrect applications can result in clogs or damage, impacting overall system efficiency. Another challenge is the rapid pace of technological change, which requires continuous updates and adaptations in valve design to meet evolving industry standards and customer expectations.

Additionally, stringent environmental regulations demand that companies ensure their systems limit emissions and leaks, complicating the design and application of diverter valves in sensitive or highly regulated industries.

Growth Factors

Growth Factors in the Diverter Valves Market

The Diverter Valves Market is experiencing growth driven by several key factors. First, the global expansion of industries such as mining, food, and beverage, and pharmaceuticals demands more sophisticated material handling solutions, including diverter valves, to enhance production efficiency and safety.

The trend towards automation in manufacturing processes also fuels the need for reliable diverter valves that can integrate seamlessly into automated systems for better flow control and reduced manual intervention.

Additionally, environmental concerns and regulatory compliance regarding emissions and material spillage are pushing companies to adopt high-quality diverter valves that ensure precise material routing and minimize waste.

The growth in emerging economies, which are investing heavily in infrastructure and industrialization, provides further opportunities for the expansion of the diverter valves market.

Emerging Trends

Emerging Trends in the Diverter Valves Market

Emerging trends in the Diverter Valves Market are shaping its future growth and development. A significant trend is the increasing integration of smart technologies, where diverter valves are equipped with sensors and digital controls that allow for remote monitoring and automated operations.

This technological advancement enhances precision in material handling and flow direction, significantly reducing human error and increasing operational efficiency. Additionally, there’s a growing emphasis on sustainability, driving the adoption of energy-efficient and low-emission diverter valves.

These valves are designed to operate with minimal energy consumption and reduced environmental impact. The trend towards customized solutions is also prevalent, as industries with specific needs, like pharmaceuticals and chemicals, require diverter valves that can handle unique materials safely and efficiently, boosting demand for specialized products.

Regional Analysis

The Diverter Valves Market exhibits dynamic regional variations, with Europe leading with a dominant share of 36.6% and a market value of USD 81.87 million. This dominance is fueled by robust industrial activities in countries like Germany, the UK, and France, which are heavily investing in automation and efficient material handling technologies across industries such as pharmaceuticals, food & beverage, and manufacturing.

North America follows closely, driven by advancements in industrial automation and the presence of stringent regulatory standards that mandate the use of high-quality diverter valves to ensure safety and environmental compliance.

In Asia Pacific, the market is rapidly expanding due to the industrial growth in China, India, and Southeast Asia, where there is increasing demand for diverter valves in sectors such as construction and agriculture. This region is expected to witness the highest growth rate in the coming years, attributed to ongoing industrialization and urbanization.

Meanwhile, the Middle East & Africa, and Latin America regions are experiencing moderate growth. These areas are gradually adopting more automated solutions in material handling, albeit at a slower pace compared to other regions.

The focus in these regions is on improving infrastructure and expanding manufacturing capabilities, which are anticipated to gradually boost the demand for diverter valves.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Diverter Valves Market, three key players—Emerson Electric Co., Flowserve Corporation, and Weir Group PLC—continue to significantly shape the industry landscape in 2023.

Emerson Electric Co. has solidified its position as a leader by leveraging its extensive technological expertise and innovation capabilities. The company focuses on integrating smart technologies into its diverter valves, enhancing their efficiency and reliability.

Emerson’s strategy of offering customized solutions tailored to specific industry needs, particularly in oil and gas and water treatment, allows it to maintain a strong market presence and cater to a broad customer base.

Flowserve Corporation stands out for its commitment to sustainability and efficiency. Its diverter valves are renowned for their durability and precision, which are critical in high-stakes environments such as chemical processing and power generation.

Flowserve’s investment in research and development has led to advancements in valve technology that minimize leakage and reduce operational downtime, thereby supporting stringent environmental and safety standards.

Weir Group PLC focuses on sectors where the handling of abrasive or corrosive materials is common, such as mining and minerals processing. Weir has enhanced its market competitiveness through strategic acquisitions that expand its product offerings and geographic footprint.

By continuously improving the wear resistance and operational life of its diverter valves, Weir effectively meets the demanding requirements of its industrial customers.

These companies, through strategic innovation, robust customer engagement, and continuous improvement of product offerings, are well-positioned to capitalize on the growing demands of the diverter valves market, despite facing intense competition and fast-evolving industry standards.

Top Key Players in the Market

- Emerson Electric Co.

- Flowserve Corporation

- Weir Group PLC

- Cameron International Corporation

- Rotork plc

- GEA Group AG

- Pentair plc

- Mueller Water Products, Inc.

- IMI plc

- ITT Inc.

- Alfa Laval AB

- Spirax-Sarco Engineering plc

- Other Key Players

Recent Developments

- In October 2024, Flowserve acquired MOGAS Industries, enhancing its severe service valve offerings and aftermarket services in mining and process industries, and supporting its growth strategy with a $305 million investment.

- In September 2024, GEA introduced the CONTA dual block valve technology for spray dryers, enhancing safety and efficiency in food and dairy processing by reducing microbiological risks and simplifying maintenance.

- In December 2022, Emerson introduced the ASCO™ Series 209 proportional flow control valves, designed for precise fluid regulation in medical, HVAC, and food and beverage industries, offering high precision, energy efficiency, and global approvals.

Report Scope

Report Features Description Market Value (2023) USD 223.7 Million Forecast Revenue (2033) USD 419.9 Million CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydraulic Diverter Valves, Electric Diverter Valves, Manual Diverter Valves), By Operation (Blow-Through Diverter Valves, Fall-Through Diverter Valves), By Material (Cast Iron, Stainless Steel, Brass/Bronze, Acetal, Ductile Iron), By End-User Industry (Oil & Gas, Chemical & Petrochemical, Pharmaceuticals, Food & Beverage, Other End-User Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Emerson Electric Co., Flowserve Corporation, Weir Group PLC, Cameron International Corporation, Rotork plc, GEA Group AG, Pentair plc, Mueller Water Products, Inc., IMI plc, ITT Inc., Alfa Laval AB, Spirax-Sarco Engineering plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Emerson Electric Co.

- Flowserve Corporation

- Weir Group PLC

- Cameron International Corporation

- Rotork plc

- GEA Group AG

- Pentair plc

- Mueller Water Products, Inc.

- IMI plc

- ITT Inc.

- Alfa Laval AB

- Spirax-Sarco Engineering plc

- Other Key Players