Global IT Security Outsourcing Market Size, Share Analysis Report By Location (On-shore, Off-shore), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Industry Vertical (Aerospace & Defense, BFSI, Healthcare, Retail & e-commerce, Telecom & Media, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151823

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

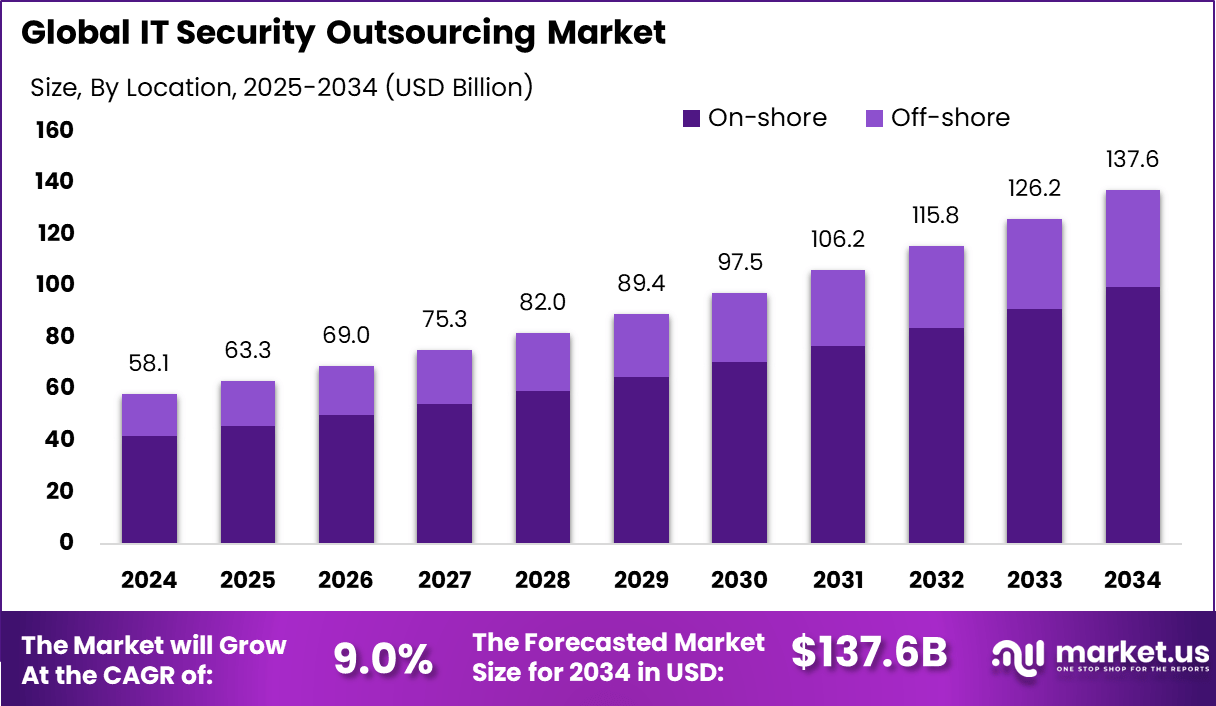

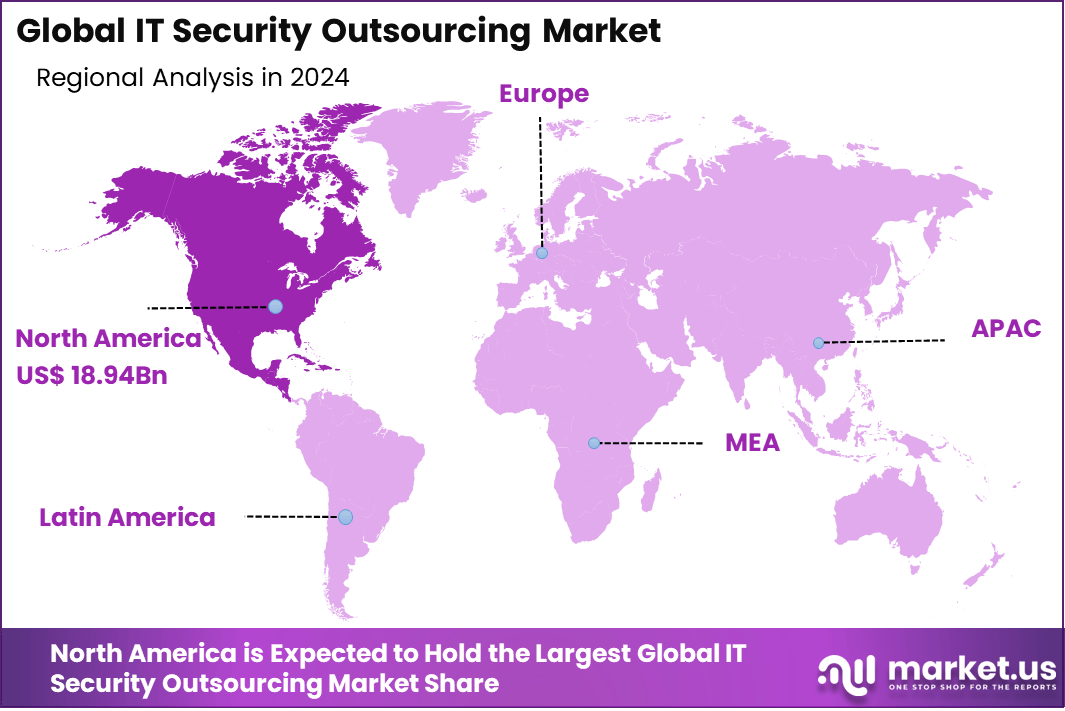

The Global IT Security Outsourcing Market size is expected to be worth around USD 137.6 Billion By 2034, from USD 58.1 billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 32.6% share, holding USD 18.94 Billion revenue.

The IT Security Outsourcing Market represents the strategic delegation of cybersecurity functions to specialized external providers, including managed security services, threat intelligence, and incident response. This market has evolved as organizations confront growing cyber threats and seek holistic, scalable protection by leveraging expert vendors.

A primary driving factor for this market is the sharp rise in both frequency and sophistication of cyber attacks. Businesses increasingly recognize that internal teams alone cannot fully mitigate advanced threats, leading to outsourcing of security monitoring, threat hunting, and rapid response functions. Furthermore, tightening data privacy regulations have made third-party compliance expertise essential, reinforcing market demand .

The increasing adoption of technologies such as Managed Detection and Response (MDR), Zero‑Trust frameworks, AI‑powered analytics, and Security‑as‑a‑Service (SECaaS) is reshaping delivery models. MDR provides proactive endpoint monitoring and expert-led investigations, while Zero‑Trust enables continuous verification of access. AI-enhanced threat detection and cloud-native security platforms are becoming standard elements in outsourced offerings .

Organizations pursue these technologies to benefit from expert human-machine collaboration, rapid detection, and mitigation capabilities. The ability to scale infrastructure on demand, coupled with reduced capital expenditure and access to 24/7 expert teams, further supports outsourcing adoption. Subscription-based services offer predictable costs and allow for rapid deployment of cutting-edge security measures.

Key Insight Summary

- The global IT security outsourcing market is expected to grow from USD 58.1 billion in 2024 to USD 137.6 billion by 2034, reflecting a solid CAGR of 9.0%. Rising cyber threats and the shortage of skilled professionals are major growth drivers.

- In 2024, North America led the market with a 32.6% share, generating approximately USD 18.94 billion in revenue. Enterprises in the region are prioritizing external security expertise due to increasing digital risks.

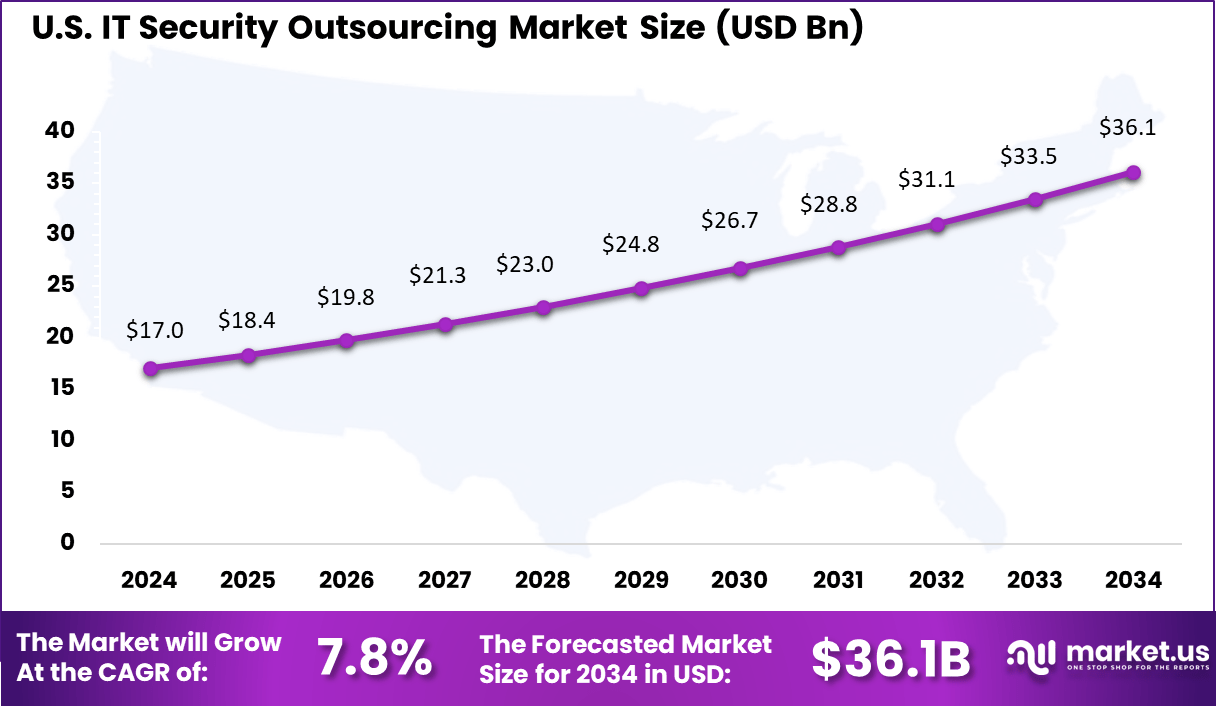

- The U.S. market reached USD 17.04 billion in 2024 and is expected to grow at a CAGR of 7.8%. Strong compliance mandates and advanced threat landscapes are accelerating outsourcing in critical sectors.

- By location, On-shore outsourcing dominated with a 72.4% share in 2024. This shows a preference for domestic partners who align with local regulatory frameworks and data privacy laws.

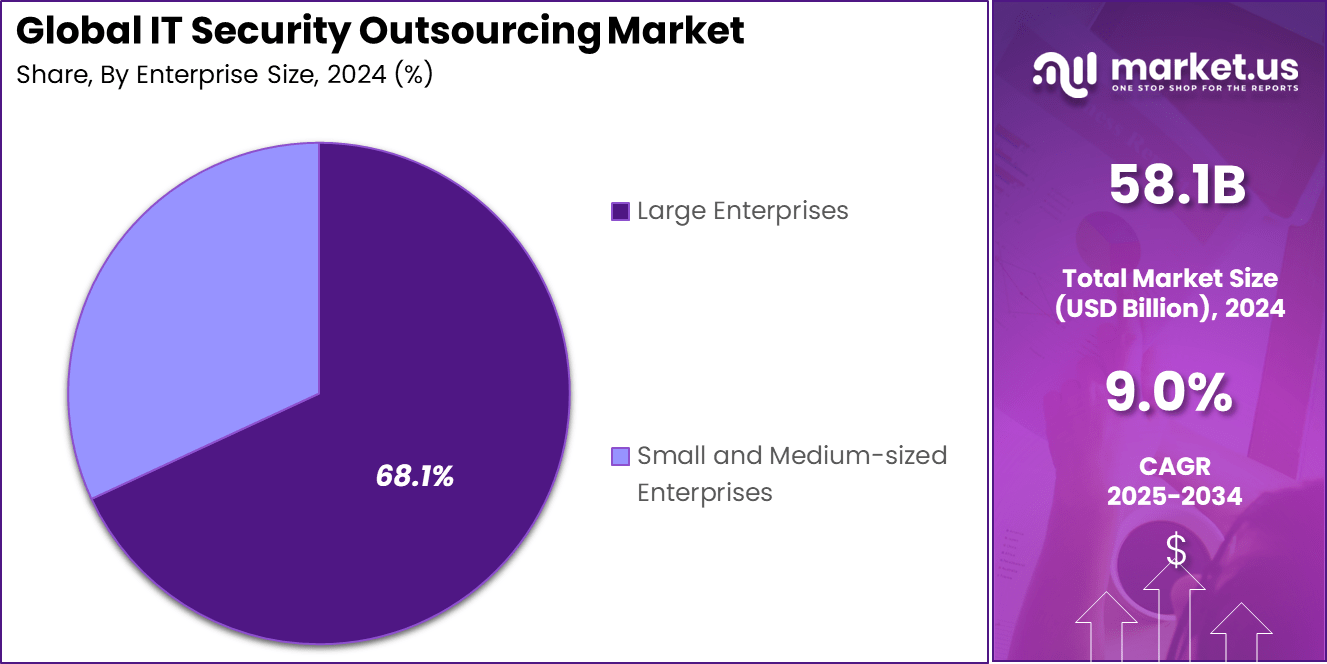

- Large enterprises held 68.1% of the market, driven by complex infrastructure and the need for 24/7 threat monitoring, incident response, and compliance management.

- The BFSI sector led with 29.7% share, reflecting its priority on securing sensitive financial data, preventing fraud, and ensuring regulatory compliance through specialized security partnerships.

US Market Size

The U.S. IT Security Outsourcing Market was valued at USD 17 Billion in 2024 and is anticipated to reach approximately USD 36.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 7.8% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 32.6% share, with reported revenues of approximately USD 18.94 billion in the IT security outsourcing market. This leadership can be largely attributed to the region’s advanced digital infrastructure and growing cybersecurity threats targeting critical industries such as finance, healthcare, and government.

Enterprises in the United States and Canada have demonstrated a high reliance on outsourced security expertise to counter increasingly sophisticated attacks, especially in cloud environments and hybrid IT systems. The strong regulatory framework governing data protection in the region, including compliance mandates like HIPAA, CCPA, and NIST standards, further accelerated the adoption of outsourced services to maintain security posture.

The dominance of North America is also supported by its mature IT service ecosystem, with a concentration of global service providers, SOC-as-a-Service vendors, and managed security firms headquartered in the region. Moreover, the demand from large enterprises to outsource threat detection, endpoint protection, and vulnerability management has surged due to rising operational costs and the widening cybersecurity skills gap.

By Location Analysis

In 2024, the On‑shore segment held a dominant market position, capturing more than a 72.4% share. This preeminence can be largely attributed to enterprises’ preference for deep regulatory alignment and heightened data protection when outsourcing IT security within their own country.

On‑shore partnerships allow organizations to operate under familiar legal frameworks, ensuring compliance with domestic cybersecurity laws while avoiding cross-border data transfer complications. In addition, reduced time‑zone differences and language congruence facilitate real‑time collaboration and swift incident response – critical factors in the high‑stakes arena of cyber defense.

The elevated cost of on‑shore security services is balanced by gains in operational clarity and control. With vendor proximity, it becomes feasible to conduct in‑person training, audits, and secure data exchanges, reinforcing trust and accountability in outsourced arrangements. Moreover, cultural alignment enhances communication quality, reducing misinterpretation that can compromise threat detection and mitigation efforts.

By Enterprise Size

In 2024, the Large Enterprises segment held a dominant market position, capturing more than 68.1% share. This commanding lead reflects larger organizations’ inclination to outsource critical IT security functions due to their extensive and complex digital landscapes. With sophisticated infrastructure spanning data centers, cloud environments, and global operations, large enterprises face greater exposure to cyber threats, making outsourcing to specialist providers a strategic imperative.

Their scale permits investments in comprehensive security solutions – such as managed detection and response (MDR), threat intelligence, and compliance management – that are more economically and operationally viable when sourced externally. The prioritization of advanced security capabilities has further reinforced large enterprises’ market dominance.

These organizations often integrate emerging technologies – such as AI-driven monitoring, XDR platforms, and zero-trust frameworks – into their outsourced models, enabling proactive risk mitigation. Additionally, the ability to negotiate enterprise-grade service-level agreements (SLAs) and demand tailored security protocols reinforces operational resilience.

By Industry Vertical

In 2024, the BFSI segment held a dominant market position, capturing more than a 29.7% share within the IT security outsourcing domain. This leadership stems from the sector’s acute sensitivity to data protection and the reputational risks associated with security breaches. Financial institutions manage vast volumes of sensitive customer and transactional data, making robust cybersecurity measures not a luxury but a necessity.

This urgency has led to extensive outsourcing of threat intelligence, encryption services, and compliance monitoring to specialized providers who can deliver advanced protections aligned with evolving regulatory frameworks. The result has been a noticeable consolidation of the BFSI segment’s influence in the IT security outsourcing landscape.

The dominance is further reinforced by the integration of digital banking platforms, mobile payments, and online customer portals – all of which amplify attack surface exposure. Outsourcing allows BFSI firms to gain access to cutting‑edge security technologies such as AI-driven detection, identity and access management, and managed SOC operations without the overhead of in‑house deployment.

Key Market Segments

By Location

- On-shore

- Off-shore

By Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SME’s)

By Industry Vertical

- Aerospace & Defense

- BFSI

- Healthcare

- Retail & e-commerce

- Telecom & Media

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend

AI‑Driven Outsourced Security

The rise of AI-powered cybersecurity solutions is reshaping outsourcing. According to a recent survey, 36% of security leaders report that AI-driven attacks are outpacing their defenses, and 90% lack adequate safeguards against such threats.

Outsourcing providers are integrating artificial intelligence and machine learning into vulnerability scanning, threat detection, and incident response, offering clients advanced, adaptive protection. This trend reflects a shift toward proactive, intelligent security models managed by external experts.

Driver

Skills Shortage and Upskilling Needs

The persistent cybersecurity skills gap continues to drive outsourcing demand. A study of U.S. tech leaders found that 64% viewed cyberattacks as the top business threat over the next decade, prompting 53% to prioritize cybersecurity talent – especially at entry level.

Outsourcing bridges this gap by providing access to skilled professionals without the burden of direct recruitment, training, or retention. This resource-efficient model meets urgent security needs amid tightening labor markets.

Restraint

Lagging Internal Compliance

Many firms struggle to integrate outsourced, AI‑enabled defenses into existing compliance frameworks. Accenture reports that organizations are falling behind in adapting their cybersecurity policies to address AI‑driven risks. This slow pace of internal adjustment limits the advantages of outsourced services, as legacy systems and manual processes hamper seamless integration with modern, outsourced security tools.

Opportunity

Scalable MSSP for SMEs

Outsourced Managed Security Service Providers (MSSPs) present a strong opportunity by delivering cloud-based, cost-effective security – especially valuable to SMEs. The Security-as‑a‑Service market has been expanding rapidly, propelled by SMEs seeking robust cyber defenses without infrastructure-heavy on-premises investments. MSSPs can leverage scalable delivery models to serve smaller firms affordably while retaining enterprise-grade capabilities, opening a wide market segment.

Challenge

Managing Third‑Party and AI‑Driven Risks

The integration of third-party and AI components into supply chains introduces new vendor-related and AI-centric security risks. Industry guidance emphasizes that security leaders must develop processes to manage vendor cyber hygiene and ensure that AI tools are configured securely.

Failing to establish continuous real-time assessments and accountability introduces blind spots in security postures. Managed providers and clients must collaboratively institute governance, oversight, and adaptive assessments.

Key Player Analysis

Accenture PLC and IBM Corporation remain at the forefront of the IT security outsourcing landscape. Their long-standing global presence and continuous investment in intelligent security platforms have enabled these firms to deliver highly scalable and integrated cybersecurity solutions. Accenture’s focus on AI-driven threat detection and IBM’s hybrid cloud security strategy provide clients with real-time incident response capabilities.

Fujitsu Limited, Hewlett Packard Enterprise Development LP, and SAP SE have deepened their cybersecurity offerings through digital transformation services. Fujitsu’s emphasis on secure cloud migration and HPE’s edge-to-cloud security frameworks are aligned with the growing demand for distributed security models. SAP continues to embed secure-by-design principles into its enterprise application ecosystem.

Capgemini Services SAS, Cognizant Technology Solutions Corporation, Infosys Limited, and NTT DATA GROUP Corporation contribute to the competitive momentum through cost-efficient, globally distributed security outsourcing. These firms offer managed security services backed by security operations centers (SOCs), threat intelligence, and compliance management.

Top Key Players Covered

- Accenture PLC

- IBM Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- SAP SE

- Capgemini Services SAS

- Cognizant Technology Solutions Corporation

- Infosys Limited

- NTT DATA GROUP Corporation

- Oracle Corporation

- Others

Recent Developments

- Accenture PLC pursued expansion of its financial services security competencies. In January 2025, the firm acquired a digital‑twin technology platform from Singapore‑based Percipient, aimed at enhancing core banking modernization with improved security simulation and controls.

- IBM Corporation deepened its Oracle‑application offerings through the January 2025 acquisition of Applications Software Technology LLC. The move is expected to enhance IBM’s managed security services by integrating secure Oracle‑stack consultancy into its portfolio.

Report Scope

Report Features Description Market Value (2024) USD 58.1Bn Forecast Revenue (2034) USD 137.6 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Location (On-shore, Off-shore), By Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), By Industry Vertical (Aerospace & Defense, BFSI, Healthcare, Retail & e-commerce, Telecom & Media, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture PLC, IBM Corporation, Fujitsu Limited, Hewlett Packard Enterprise Development LP, SAP SE, Capgemini Services SAS, Cognizant Technology Solutions Corporation, Infosys Limited, NTT DATA GROUP Corporation, Oracle Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Security Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

IT Security Outsourcing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Accenture PLC

- IBM Corporation

- Fujitsu Limited

- Hewlett Packard Enterprise Development LP

- SAP SE

- Capgemini Services SAS

- Cognizant Technology Solutions Corporation

- Infosys Limited

- NTT DATA GROUP Corporation

- Oracle Corporation

- Others