Global Insect Repellent Market By Product Type (Spray, Vaporizers, Cream and Other Product Types) By Insect Type (Bugs Repellent, Mosquito Repellent, Fly Repellent and Other Insect Types) By Distribution Channel (Offline Retail Stores and Online Retail Stores) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 15649

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

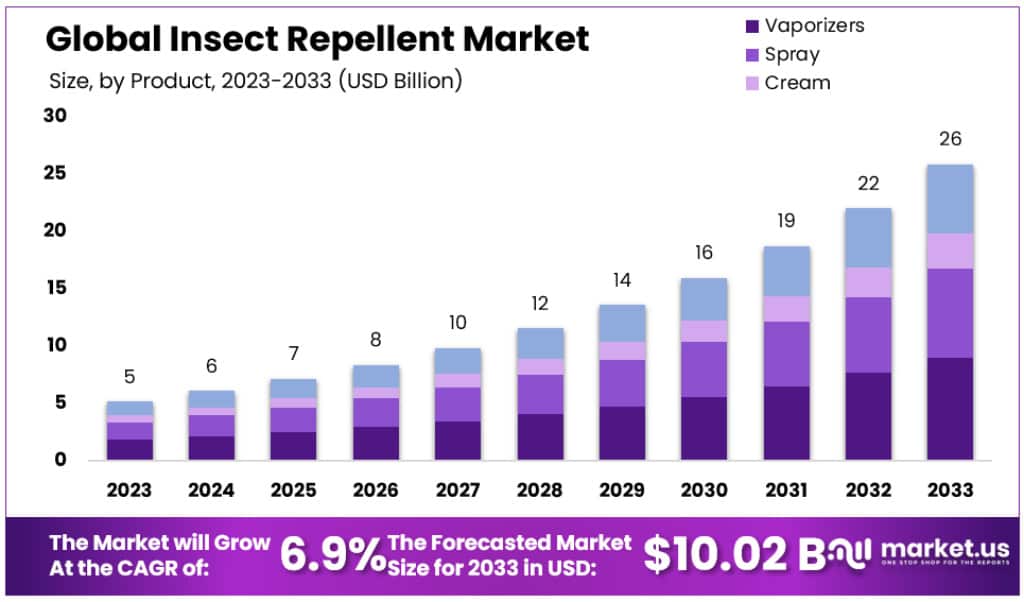

The Global Insect Repellent Market size is expected to be worth around USD 26 Billion by 2033, from USD 5 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2023 to 2033.

Insect repellents are substances applied to the skin, clothing, or other surfaces to discourage insects from landing or crawling on that surface. They are used to prevent, repel, or mitigate pests, such as mosquitoes, ticks, flies, and other biting insects. Insect repellents are not meant to kill insects but to keep them away to prevent bites and the spread of diseases.

Due to rising consumer awareness of insect-borne illnesses and growth in household and commercial garbage, the market is anticipated to expand.

Key Takeaways

- The Global Insect Repellent Market is expected to reach approximately USD 26 billion by 2033.

- In 2023, the market size was approximately USD 5 billion.

- The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% from 2023 to 2033.

- Vaporizers held the largest market share in 2023, accounting for about 35% of the market.

- The insect repellent spray segment is expected to have a CAGR of 8.2% over the forecast period.

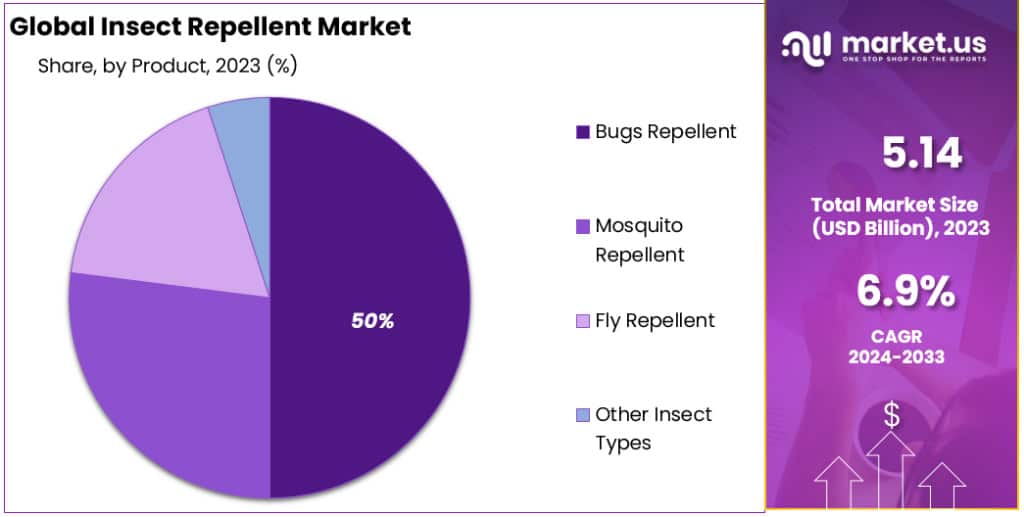

- Mosquito repellents held a dominant market position in 2023, with a share of approximately 50%.

- The bugs-repellent segment is expected to have an anticipated CAGR of 7.0%.

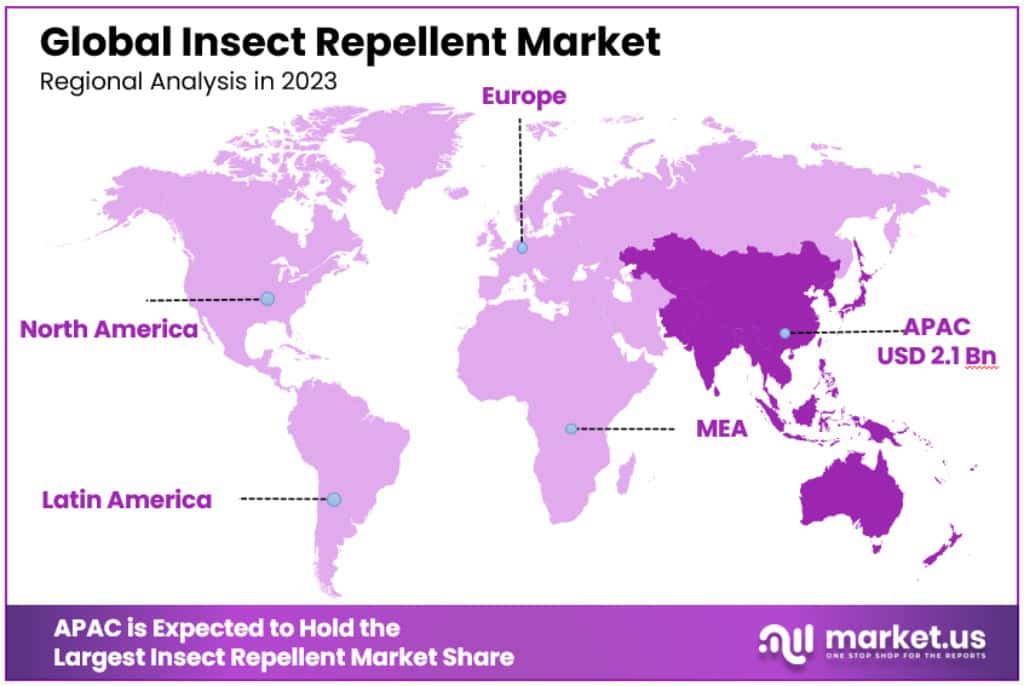

- The Asia Pacific region accounted for 41% of the market share in 2023, equivalent to USD 2.1 billion.

- China is the largest market for insect repellents in Asia Pacific.

- The Middle East and Africa are expected to grow at a rate of 7.2% in the coming years.

- S.C. Johnson & Son company is a significant player in the market, offering a variety of products.

Product Type Analysis

In the insect repellent market, distinct product segments like vaporizers, sprays, creams, and other forms have emerged, each catering to specific consumer needs and preferences. In 2023, the market dynamics reveal a notable trend towards the adoption of various product types, reflecting diverse consumer behaviors and demands.

Vaporizers

In 2023, vaporizers held a commanding position in the market, securing a significant ~35% share. This dominance is primarily attributed to the convenience and efficacy they offer. Unlike sprays or creams requiring direct application, vaporizers provide continuous, passive protection. These devices, once activated, emit repelling vapors, creating an invisible barrier against insects in indoor environments.

This feature spares users the need for frequent reapplications, a major factor driving consumer preference. The segment, originally leading in 2018, has maintained its market leadership, underscoring its sustained appeal. The widespread use of vaporizers, often incorporating herbal components, underscores their growing popularity.

Sprays

The insect repellent spray segment, with an expected CAGR of 8.2% over the forecast period, reflects a growing consumer inclination. Sprays are favored for their effectiveness, ease of portability, and precise application, making them ideal for both outdoor activities and everyday use.

In June 2023, the launch of Shubug Insect Repellent’s Shubug Active and Shubug Natural marked a significant development in this segment. These products, tailored for an active lifestyle, boast a natural formula providing up to 10 hours of mosquito and pest defense in a single application. Shubug Active extends this protection to 12 hours, emphasizing quality ingredients and safety for outdoor enthusiasts. This trend highlights a consumer shift towards health-conscious and convenient solutions for insect repellence.

Creams and Other Products

While not as dominant as vaporizers or sprays, creams, and other insect-repellent products occupy a niche but important segment of the market. These products often appeal to consumers seeking direct, skin-based protection or those with specific preferences or sensitivities. Although their market share is smaller compared to vaporizers and sprays, they offer diversity and choice in a market increasingly characterized by personalized consumer needs.

Insect Type Analysis

In 2023, the insect repellent market is segmented by insect type, encompassing products specifically targeting bugs, mosquitoes, flies, and other insect types. Each segment addresses distinct consumer concerns and market needs.

Mosquito Repellent

In 2023, mosquito repellents held a dominant market position, capturing an impressive share of approximately 50%. This segment’s growth is largely fueled by the rising incidence of mosquito-borne diseases such as malaria, dengue, Zika virus, and chikungunya. Heightened awareness of these diseases has significantly driven the demand for effective mosquito repellents.

Innovations in this space are also notable, as evidenced by the U.S. Environmental Protection Agency’s (EPA) registration of the AM 601 Pod with transfluthrin in July 2023. This product launch represents the ongoing growth and innovation within the segment. Despite this dominance, concerns over toxic ingredients like DEET present challenges, although the increasing demand for plant-based alternatives offers new opportunities, especially in untapped rural markets.

Bugs Repellent

The bugs-repellent segment, with an anticipated CAGR of 7.0%, is another vital area of the market. The demand in this sector is driven by consumer preferences for odorless and non-sticky products. In March 2023, Zevo’s launch of its On-Body Mosquito + Tick Repellents, available in various forms including aerosol, pump spray, and lotion, catered to these preferences. These products, offering up to 8 hours of protection, highlight the evolving consumer demand for repellents that are both effective and comfortable to use.

Fly Repellent and Other Insects

While not as prominent as mosquito and bugs repellents, fly repellents and products targeting other insects hold a smaller yet significant portion of the market. These products cater to specific needs, providing solutions for consumers dealing with particular insect problems. Their market share, though smaller compared to mosquito and bugs repellents, is crucial in offering a comprehensive range of options to consumers.

Key Market Segments

By Product Type

- Spray

- Vaporizers

- Cream

- Other Product Types

By Insect Type

- Bugs Repellent

- Mosquito Repellent

- Fly Repellent

- Other Insect Types

By Distribution Channel

- Offline Retail Stores

- Online Retail Stores

Drivers

- Growing Cases of Disease Outbreaks: According to the World Health Organization, Vector-borne diseases contribute to over 17% of all infectious diseases, causing more than 700,000 deaths annually. Diseases like malaria, dengue, chikungunya, Zika virus, and West Nile virus, primarily spread by mosquitoes, have heightened the need for effective insect repellents. For instance, malaria, transmitted by Anopheles mosquitoes, results in over 400,000 deaths each year globally, with a significant impact on children under five. Dengue, spread by Aedes mosquitoes, affects over 3.9 billion people in 129 countries annually, with about 40,000 fatalities.

- Rising Health Consciousness: The COVID-19 pandemic has significantly raised awareness about personal hygiene and health. Insect repellents are increasingly viewed as essential for health and hygiene, particularly in outdoor settings.

Restraints

- Side Effects on Babies: Concerns about the safety of insect repellent chemicals, especially on infants, pose a significant restraint. Parents are cautious of potential health risks, leading to reduced demand for chemical-based repellents.

Opportunities

- Demand in Outdoor Activities: The growing popularity of outdoor activities such as hiking, camping, and fishing has spiked the demand for insect repellents. With approximately 30,000 cases of Lyme disease reported annually in the U.S. (CDC, 2021), there’s a heightened awareness of the need for effective protection against insect bites.

Challenges

- Resistance Development in Insects: Insects developing resistance to active ingredients like DEET and picaridin is a major challenge. This resistance diminishes the efficacy of insect repellents, necessitating new formulations and strategies.

Trends

- Technological Advancements: Innovations in product development, such as the introduction of organic and eco-friendly repellents, are reshaping the market. These advancements cater to consumer preferences for safer alternatives to synthetic repellents.

- Increased Awareness: The spread of vector-borne diseases and the resultant rise in health awareness are driving the insect repellent market. For instance, the prevalence of diseases like malaria and dengue has fueled demand for repellents, especially in regions with high mosquito populations.

- Growing Urbanization and Industrialization: Urban development and industrial activities have indirectly contributed to the spread of mosquito-borne diseases, amplifying the need for effective repellents.

- Government Initiatives: Programs like the National Framework for Malaria Elimination in India highlight the role of government actions in promoting insect repellent use.

Regional Analysis

Asia Pacific

In 2023, the Asia Pacific region is at the forefront of the insect repellent market, holding a major 41% share, which translates to USD 2.1 billion. This strong position is mainly because of the region’s climate – it’s warm and humid, perfect for mosquitoes and other insects to thrive. Most countries here, except North Korea, face a high rate of dengue fever, contributing a large part to the worldwide spread of this disease. India, Indonesia, Myanmar, Sri Lanka, and Thailand are particularly hard hit.

China, with its large population and increasing income levels, is the biggest market for insect repellents in Asia Pacific. More people can afford these products now, and they’re using them more because living standards have improved. Insect repellents of various kinds, like sprays, machines that emit vapor, and coils, are popular due to common household pests.

In India, there’s a growing demand for these products as people become more aware of health issues. Government programs aimed at reducing malaria and promoting cleanliness, like the National Framework for Malaria Elimination and Swachh Bharat Abhiyan, are helping this rise in demand. The World Health Organization (WHO) even expects a huge decrease in global malaria cases by 2030, showing the success of these health measures.

The problem of diseases spread by insects, like dengue fever, malaria, and Japanese encephalitis, is big in the Asia-Pacific area. In 2021, India alone saw about 67,377 cases of dengue, and Japan regularly deals with many cases of Japanese encephalitis each year. These health issues are key reasons why the insect repellent market is growing in the region.

Middle East and Africa

The Middle East and Africa are also seeing growth in this market, expected to grow at a rate of 7.2% in the coming years. This is because more people are becoming aware of how important it is to protect themselves from diseases carried by insects. Africa, in particular, is heavily affected by malaria, accounting for around 90% of all cases globally. In the Middle East, there are many campaigns to educate people about these diseases and the role of insect repellents in preventing them.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The insect repellent market is characterized by a blend of international and domestic players, contributing to a competitive and somewhat stagnant market environment. Major companies in this market are focusing on strategies like mergers, acquisitions, and establishing new operations across different regions to enhance their product portfolios.

S.C. Johnson & Son company holds a significant share in the market, standing as a leader due to its extensive product range. They offer a variety of products, including DEET-based repellents, natural and organic options, and other specialized products. To maintain and strengthen its market position, S.C. Johnson & Son has been investing heavily in scaling up the production of its core products.

Following closely is Spectrum Brands. In May 2023, their subsidiary, Hot Shot, launched a new line of Ant, Roach & Spider Killer aerosols. These products, available in scents like Crisp Linen, Fresh Floral, and Lemon, were developed in response to consumer feedback about the unpleasant chemical smell of traditional insecticides.

Another key player, Reckitt Benckiser, introduced an innovative product in May 2023 through its subsidiary, Mortein. The Mortein Smart+ liquid vaporizer, tested and developed at the Mortein Advanced Research Lab in Gurugram, India, promises accelerated effectiveness and improved protection against disease-causing mosquitoes.

Known for its diverse portfolio and global presence, Godrej Consumer Products has established itself as a leader in the market. Their focus on product innovation has led to the development of four innovative products, aimed at expanding both their product range and global reach.

Other notable players in the market include Dabur India Limited, Coghlan’s Ltd., Johnson & Johnson, Sawyer Products, Henkel AG & Co. KGaA, and Jyothy Laboratories Ltd., each contributing to the market through a mix of product innovations and strategic initiatives.

Market Key Players

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Dabur India Limited

- Coghlan’s Ltd.

- S.C. Johnson & Sons Inc

- Johnson & Johnson

- Spectrum Brands, Inc.

- Sawyer Products

- Henkel AG & Co. KGaA

- Jyothy Laboratories Ltd.

- Other Key Players

Recent Developments

Acquisition

December 2023: Terminix, a leading pest control company, acquires SC Johnson, a major player in household insect repellents like OFF! This consolidation is expected to strengthen Terminix’s presence in the consumer market and potentially lead to new product offerings and distribution channels.

New Trends and Company News

- October 2023: Smart Repellents: Repellents integrated with AI and wearable technology are gaining traction. Skeeter Shield, a U.S. company, launched a smart patch that uses sensors and AI to adjust repellent release based on user activity and mosquito activity levels.

- November 2023: Plant-Powered Protection: Research by the University of California, Berkeley, highlights the effectiveness of a new plant-derived compound, limonene oxide, in repelling mosquitoes. This could pave the way for next-generation, naturally-derived insect repellents.

- December 2023: Subscription Model: Repellent subscription services like Bite Squad and Buzzkill are gaining popularity, especially among environmentally conscious consumers. These services offer regular deliveries of eco-friendly repellents and refills, reducing waste and promoting convenience.

Report Scope

Report Features Description Market Value (2023) USD 5 Billion Forecast Revenue (2033) USD 26 Billion CAGR (2023-2032) 6.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spray, Vaporizers, Cream and Other Product Types) By Insect Type (Bugs Repellent, Mosquito Repellent, Fly Repellent and Other Insect Types) By Distribution Channel (Offline Retail Stores and Online Retail Stores) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Reckitt Benckiser Group PLC, Godrej Consumer Products Ltd, Dabur India Limited, Coghlan’s Ltd., S.C. Johnson & Sons Inc, Johnson & Johnson, Spectrum Brands, Inc., Sawyer Products, Henkel AG & Co. KGaA, Jyothy Laboratories Ltd. Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Insect Repellent market in 2023?The Insect Repellent market size is USD 5 Billion in 2023.

What is the projected CAGR at which the Insect Repellent market is expected to grow at?The Insect Repellent market is expected to grow at a CAGR of 6.9% (2023-2033).

List the segments encompassed in this report on the Insect Repellent market?Market.US has segmented the Insect Repellent market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type (Spray, Vaporizers, Cream and Other Product Types) By Insect Type (Bugs Repellent, Mosquito Repellent, Fly Repellent and Other Insect Types) By Distribution Channel (Offline Retail Stores and Online Retail Stores)

-

-

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Dabur India Limited

- Coghlan's Ltd.

- S.C. Johnson & Sons Inc

- Johnson & Johnson

- Spectrum Brands, Inc.

- Sawyer Products

- Henkel AG & Co. KGaA

- Jyothy Laboratories Ltd.

- Other Key Players