Global Inoculants Market Size, Share, And Business Benefits By Type (Silage Inoculants, Agricultural Inoculants), By Microbe (Fungal, Bacterial), By Form (Dry, Liquid), By Crop Type (Cereals, Oilseeds and Pulses, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157443

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

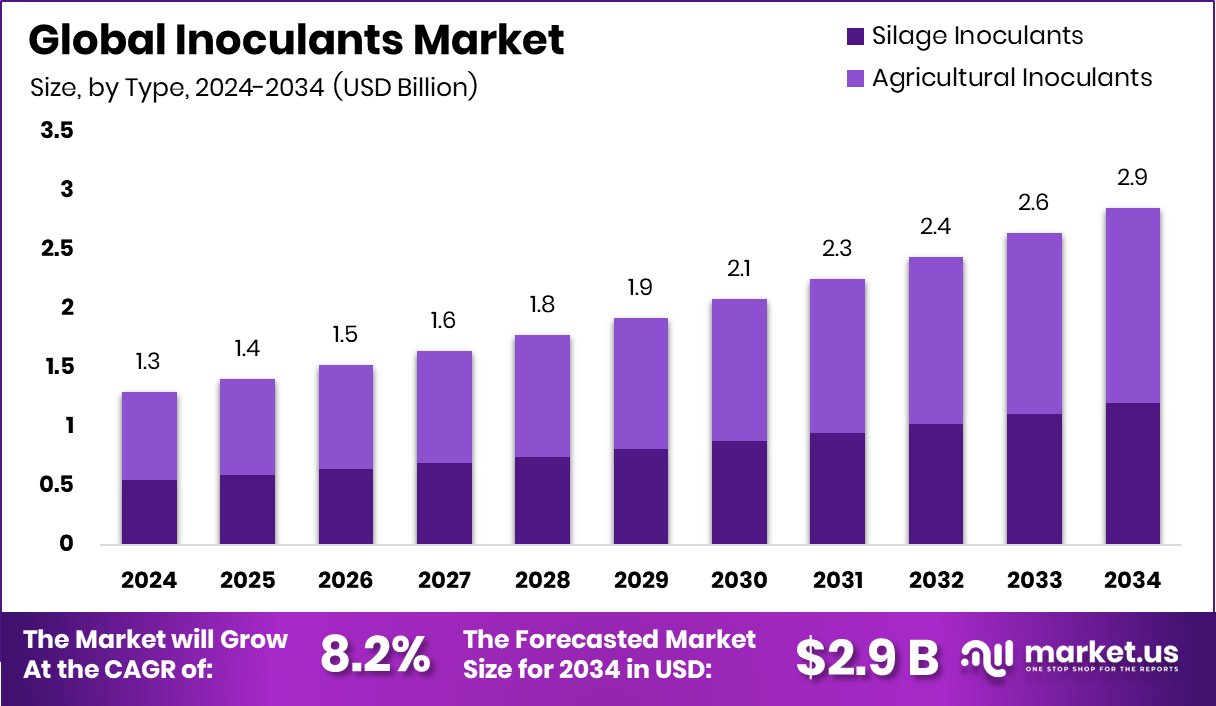

The Global Inoculants Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034. With sustainable farming trends, North America’s inoculants market reaches 47.90%, totaling USD 0.6 Bn.

Inoculants are biological formulations containing beneficial microorganisms such as bacteria, fungi, or yeasts that are applied to seeds, soil, or plants to promote healthy growth. These microbes enhance nutrient availability, improve soil fertility, and support stronger root development. They are widely used in agriculture to boost productivity sustainably, reducing dependency on chemical fertilizers.

The inoculants market refers to the global trade and use of these microbial solutions in farming and livestock sectors. The market is gaining attention as farmers adopt eco-friendly practices and governments encourage sustainable agriculture. It covers various applications, including crop protection, yield improvement, and livestock feed enhancement, contributing to long-term agricultural efficiency. According to an industry report, NewLeaf Symbiotics raised $45 million to accelerate the use of its novel microbial amendments across more row crops.

One of the major growth factors is the rising awareness of sustainable farming practices. With chemical input costs rising and environmental concerns increasing, inoculants provide an affordable and natural alternative, driving their adoption across developed and developing regions. According to an industry report, Groundwork BioAg secured $11 million in funding to scale up its mycorrhizal-based agricultural inputs business.

Demand is also being fueled by the rising global population and the need to ensure food security. Farmers are under pressure to increase yields without degrading soil health, and inoculants offer a solution by improving nutrient uptake and crop resilience under stress conditions. According to an industry report, Biobest, a crop biologicals specialist, announced plans to expand in South America through a $570 million acquisition of Brazil’s Biotrop.

Key Takeaways

- The Global Inoculants Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 8.2% from 2025 to 2034.

- Agricultural inoculants lead the inoculants market with 58.4%, reflecting strong adoption in modern farming practices.

- Bacterial segment dominates the inoculants market at 79.2%, showcasing microbes’ efficiency in boosting crop productivity.

- Dry form holds 53.6% share in the inoculants market, driven by easier handling and storage.

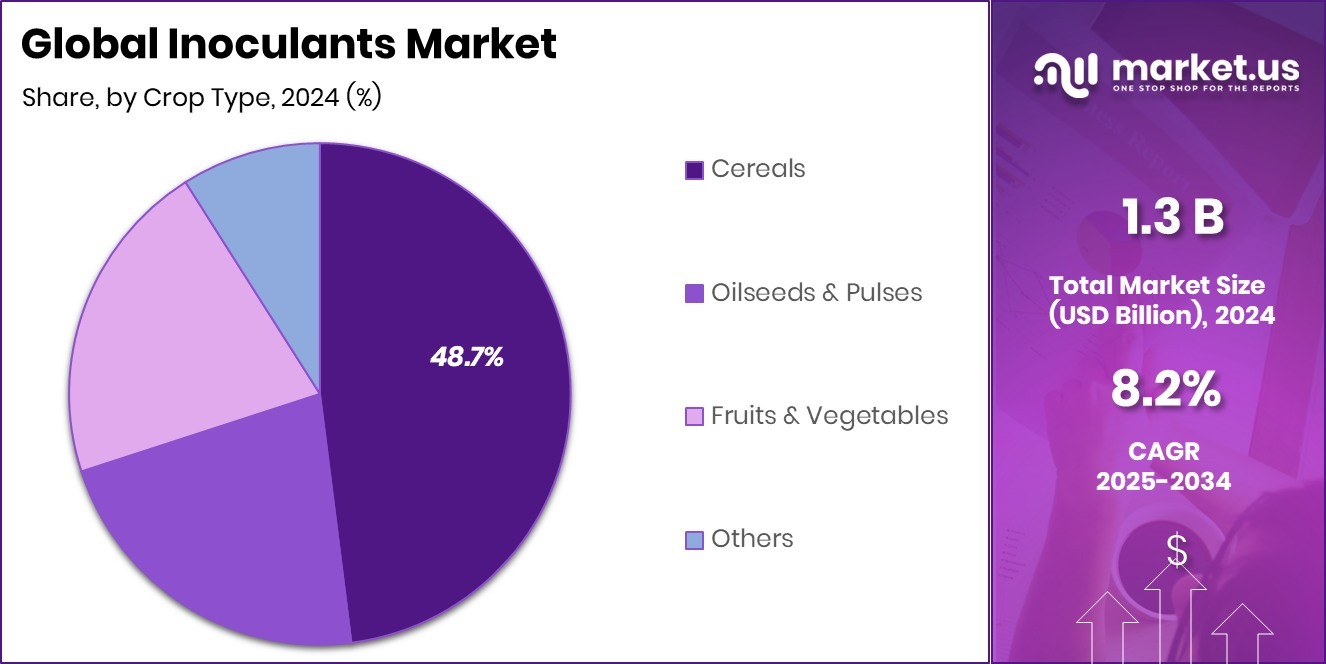

- Cereals account for 48.7% of the inoculants market, highlighting their critical role in global agriculture.

- Farmers in North America increasingly adopt inoculants, driving 47.90% regional growth worth USD 0.6 Bn.

By Type Analysis

Agricultural inoculants dominate the Inoculants Market with a 58.4% share.

In 2024, Agricultural Inoculants held a dominant market position in the By Type segment of the Inoculants Market, with a 58.4% share. This strong performance highlights the growing reliance of global farming communities on microbial-based solutions that enhance soil fertility, crop productivity, and nutrient uptake.

Agricultural inoculants, primarily used in crops like cereals, legumes, and forage, are increasingly adopted as farmers seek to reduce dependence on chemical fertilizers while maintaining high yields.

The rising awareness of sustainable farming practices has been a key factor driving this adoption, as inoculants provide an environmentally friendly alternative that restores soil health and promotes long-term productivity.

The segment’s strength is also supported by the increasing global demand for food, driven by population growth and the need for resilient farming systems under changing climatic conditions.

Farmers are turning to agricultural inoculants for their proven benefits in nitrogen fixation, phosphate solubilization, and enhanced root development, which directly contribute to improved crop performance. Additionally, the segment is benefiting from ongoing advancements in microbial research, resulting in more tailored and effective solutions suited to diverse agro-climatic zones.

With their wide application range and ability to address pressing agricultural challenges, agricultural inoculants remain the most trusted and widely adopted type, securing their leading market share in 2024.

By Microbe Analysis

Bacterial segment leads the Inoculants Market, holding 79.2% share.

In 2024, Bacterial held a dominant market position in the By Microbe segment of the Inoculants Market, with a 79.2% share. This dominance reflects the extensive use of bacterial inoculants in modern agriculture, particularly for their role in enhancing soil fertility and boosting plant growth.

Bacteria such as rhizobia and other beneficial strains are widely applied to promote nitrogen fixation, improve nutrient uptake, and strengthen root systems, making them a critical component of sustainable crop production.

Their ability to work in symbiosis with plants offers farmers a natural and efficient alternative to synthetic fertilizers, aligning with the global shift toward environmentally friendly farming practices.

The strong presence of bacterial inoculants is further reinforced by their proven effectiveness across a wide variety of crops, including cereals, legumes, and oilseeds.

With agriculture facing challenges from soil degradation and the rising cost of chemical inputs, bacterial solutions are increasingly recognized as reliable tools for ensuring yield stability.

Additionally, advancements in microbial biotechnology are enhancing the precision and performance of bacterial inoculants, creating more adaptable solutions for different soil types and climatic conditions.

Holding a substantial 79.2% share in 2024, bacterial inoculants remain at the forefront of market demand, underscoring their pivotal role in shaping sustainable agricultural practices worldwide.

By Form Analysis

Dry form captures 53.6% share in the Inoculants Market globally.

In 2024, Dry held a dominant market position in the By Crop Type segment of the Inoculants Market, with a 53.6% share. The preference for dry inoculants is primarily driven by their ease of handling, longer shelf life, and cost-effectiveness compared to other forms.

Farmers across diverse agricultural regions favor dry inoculants as they can be conveniently applied to seeds before planting and stored without the need for specialized conditions. This practicality makes them highly accessible to both small and large-scale farming operations, contributing to their widespread adoption.

The strong market share also reflects the efficiency of dry inoculants in delivering beneficial microbes that enhance soil fertility, nitrogen fixation, and root development. Their compatibility with various crop varieties ensures consistent results in boosting productivity while reducing the reliance on chemical fertilizers.

Furthermore, technological improvements in formulation have made dry inoculants more stable and effective under different environmental conditions, which adds to their reliability in modern farming. With farmers increasingly seeking sustainable and cost-efficient inputs, dry inoculants remain the preferred choice, securing their leading position.

By Crop Type Analysis

Cereals account for a 48.7% share in the Inoculants Market.

In 2024, Cereals held a dominant market position in the Product Type segment of the Inoculants Market, with a 48.7% share. This leading position is attributed to the vast global cultivation of cereal crops such as wheat, maize, rice, and barley, which form the staple diet for a significant portion of the world’s population.

The high demand for cereals has pushed farmers to adopt advanced agricultural inputs, with inoculants playing a crucial role in improving yields and maintaining soil fertility. By enhancing nitrogen fixation and nutrient availability, inoculants contribute directly to healthier plant growth and higher productivity in cereal farming.

The 48.7% share also reflects the scale at which cereals are cultivated compared to other crop categories, creating a naturally higher demand for supportive microbial products. Inoculants are particularly valued in cereal farming for their ability to improve root development and resilience against stress factors, ensuring stable production even under challenging environmental conditions.

With the global population continuing to rise, the pressure to produce more cereals sustainably is intensifying, further reinforcing the importance of inoculants in this segment. The dominance of cereals in 2024 demonstrates their central role in both global food security and the inoculants market’s growth trajectory.

Key Market Segments

By Type

- Silage Inoculants

- Agricultural Inoculants

By Microbe

- Fungal

- Bacterial

By Form

- Dry

- Liquid

By Crop Type

- Cereals

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Driving Factors

Rising Need for Sustainable and Eco-Friendly Farming

One of the biggest driving factors for the inoculants market is the growing push toward sustainable and eco-friendly farming methods. Farmers across the world are facing rising costs of chemical fertilizers and pesticides, along with increasing concerns about soil degradation and environmental damage.

Inoculants provide a natural solution by using beneficial microorganisms to boost soil health, improve nutrient absorption, and increase crop productivity without harming the environment. This makes them a cost-effective and safer choice for farmers who want long-term results.

Governments and agricultural bodies are also encouraging the use of bio-based products, which further supports adoption. As awareness spreads, more farmers are shifting toward inoculants, making sustainability a powerful driver of market growth.

Restraining Factors

Limited Farmer Awareness and Knowledge Slows Adoption

A key restraining factor in the inoculants market is the limited awareness and understanding among farmers about how these products work and their long-term benefits. Many farmers, especially in rural or developing regions, still rely heavily on traditional farming practices or chemical inputs because they are more familiar and offer quick, visible results.

Inoculants, being biological solutions, often require proper storage, handling, and correct application to show the best results, which can be a challenge for those with less technical knowledge.

Misuse or poor application can lead to reduced effectiveness, creating doubts among users. Without proper training, guidance, and demonstration of results, farmer hesitation continues to slow down wider adoption of inoculants in agriculture.

Growth Opportunity

Expanding Use in Emerging Agricultural Economies Worldwide

One major growth opportunity for the inoculants market lies in their expanding use across emerging agricultural economies. Countries in Asia, Africa, and Latin America are experiencing rapid population growth and increasing food demand, which pushes farmers to find ways to boost yields without overusing chemical fertilizers.

These regions also have large areas of arable land with untapped potential for modern farming practices. As governments and organizations promote sustainable agriculture, inoculants present a low-cost and effective solution to improve soil fertility and crop resilience.

With rising investment in agricultural infrastructure and better distribution networks, inoculants can reach more farmers in these regions, creating strong opportunities for market expansion and long-term adoption.

Latest Trends

Integration of Inoculants with Precision Farming Practices

A key trend shaping the inoculants market is their integration with modern precision farming techniques. Farmers today are increasingly using digital tools, sensors, and data-driven methods to monitor soil health, crop growth, and nutrient requirements.

In this environment, inoculants are being paired with precision farming to deliver targeted solutions that maximize efficiency. For example, seed coatings and customized microbial blends are designed for specific soil types or climatic conditions, ensuring higher success rates.

This combination not only improves productivity but also reduces wastage of inputs and lowers farming costs. As technology adoption grows worldwide, inoculants are becoming part of a smarter, data-supported farming system, making this integration a strong and emerging market trend.

Regional Analysis

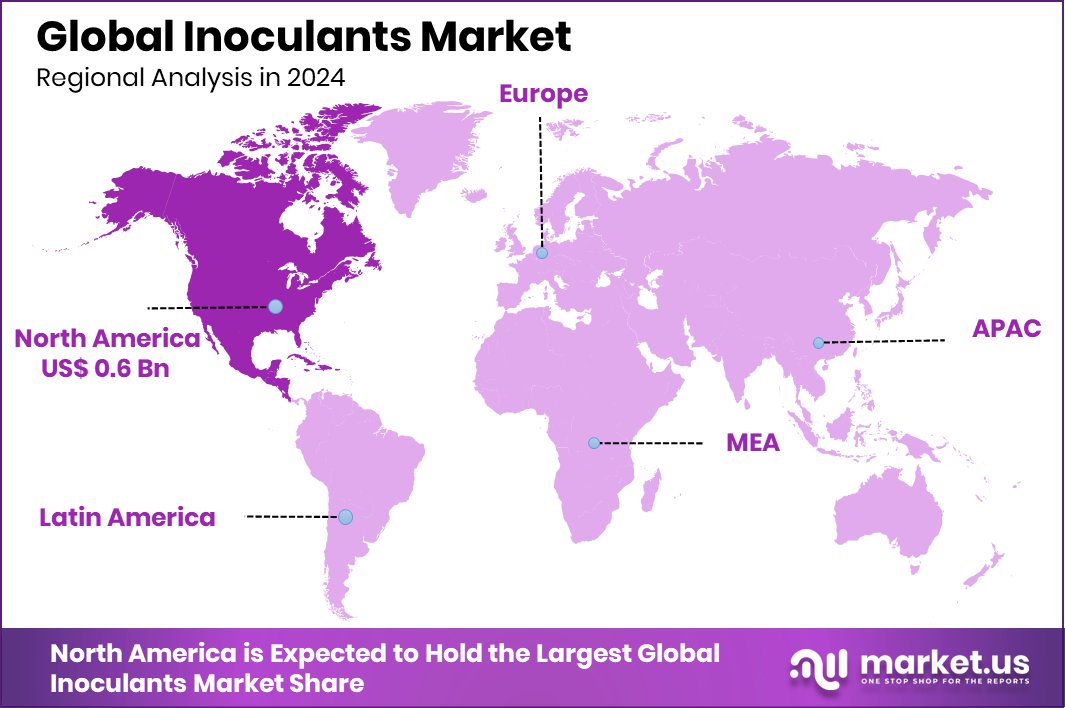

North America holds a 47.90% share of the inoculants market, valued at USD 0.6 Bn.

The inoculants market shows varied growth across global regions, with North America emerging as the dominant contributor. Holding a 47.90% market share valued at USD 0.6 billion, North America leads due to advanced farming practices, high adoption of sustainable solutions, and strong government support for eco-friendly agriculture.

Farmers in the U.S. and Canada are increasingly shifting from chemical inputs to biological alternatives, which strengthens the use of inoculants in both row crops and forage production. Europe follows closely, driven by strict environmental regulations and policies that encourage bio-based agricultural inputs, while the Asia Pacific is witnessing strong growth momentum supported by population expansion and rising food security concerns.

The Middle East & Africa region reflects growing potential, with farmers exploring bio-based products to tackle soil fertility challenges, while Latin America continues to build demand through expanding commercial farming operations. Collectively, these regions highlight diverse opportunities and adoption trends, yet North America maintains its position as the market leader.

Its dominance reflects a balance of innovation, awareness, and infrastructure, setting the benchmark for other regions aiming to adopt sustainable farming practices. This strong regional footprint underlines the role of inoculants in shaping modern agricultural practices worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Corteva Agriscience continues to strengthen its position through advancements in seed-applied technologies and microbial-based products. The company focuses on delivering value to farmers by improving yield, soil health, and nutrient efficiency, aligning with the growing need for eco-friendly practices.

BASF SE has a strong footprint in crop solutions, and its research in biological inoculants underlines its commitment to long-term agricultural sustainability. With increasing emphasis on reducing synthetic inputs, BASF leverages innovation and partnerships to expand microbial solutions that fit diverse crops and climates.

Bayer AG, a global leader in agricultural sciences, integrates inoculants into its broader crop science segment. The company emphasizes innovation pipelines that combine biotechnology, crop protection, and microbial solutions, helping farmers achieve higher productivity while meeting environmental standards.

Novozymes A/S stands out as a pioneer in enzyme and microbial solutions, using its expertise in biotechnology to advance inoculants. The company plays a vital role in providing bio-based solutions that enhance nutrient availability and reduce reliance on chemicals.

Top Key Players in the Market

- Corteva Agriscience

- BASF SE

- Bayer AG

- Novozymes A/S

- Cargill, Incorporated

- Archer Daniels Midland Company

- Lallemand Inc.

- Kemin Industries, Inc

- Verdesian Life Sciences

- BIO-CAT

Recent Developments

- In February 2025, BASF pre-launched Votivo Prime, a bio-based contact nematicide containing Bacillus firmus strain I-1582, during Argentina’s EnBio event. It’s meant to protect crops—like wheat, barley, and soybeans—from harmful nematodes. The company expects a full market launch by mid-2026.

- In February 2024, Corteva celebrated the first anniversary of its acquisitions of Symborg and Stoller and used the milestone to introduce a unified brand—Corteva Biologicals. This move marked their enhanced range of microbial-based products designed to help farmers improve nutrient use, plant health, and overall yield. The solutions in this line—such as Utrisha™ N (a nitrogen-fixing bacterium) and X-Cyte™ (a product promoting stress resilience)—can be used alongside traditional inputs or independently in organic farming.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Silage Inoculants, Agricultural Inoculants), By Microbe (Fungal, Bacterial), By Form (Dry, Liquid), By Crop Type (Cereals, Oilseeds and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Corteva Agriscience, BASF SE, Bayer AG, Novozymes A/S, Cargill, Incorporated, Archer Daniels Midland Company, Lallemand Inc., Kemin Industries, Inc, Verdesian Life Sciences, BIO-CAT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Corteva Agriscience

- BASF SE

- Bayer AG

- Novozymes A/S

- Cargill, Incorporated

- Archer Daniels Midland Company

- Lallemand Inc.

- Kemin Industries, Inc

- Verdesian Life Sciences

- BIO-CAT