Global Injectable Drug Delivery Market Analysis By Type (Injectable Drug Delivery Devices, Injectable Drug Delivery Formulation), By Formulation Packaging (Ampoules, Vials, Cartridges, Bottles), By Therapeutic Application (Autoimmune Diseases, Hormonal Disorders, Orphan Diseases, Cancer, Others), By Usage Pattern (Curative Care, Immunization, Others), By Site of Administration (Skin, Circulatory/Musculoskeletal System, Organs, Central Nervous System), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy Online Stores), By End User (Hospitals and Clinics, Home Care Settings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 16898

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Formulation Packaging Analysis

- Therapeutic Application Analysis

- Usage Pattern Analysis

- Site of Administration Analysis

- Distribution Channel Analysis

- End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

The Global Injectable Drug Delivery Market size is expected to be worth around USD 110.4 Billion by 2033, from USD 45.8 Billion in 2023, growing at a CAGR of 9.2% during the forecast period from 2024 to 2033.

Injectable drug delivery involves administering medications directly into the body using a needle and syringe, often into the bloodstream, muscles, or skin. This method ensures rapid drug absorption, precise dosage control, and excellent bioavailability, essential for treatments requiring immediate effect, like vaccines and biologics. Popular systems include conventional syringes, autoinjectors for self-administration, pre-filled syringes for ease and accuracy, and implantable devices for sustained release. This delivery technique is crucial for targeting specific body sites and managing chronic conditions efficiently.

The injectable drug delivery systems market is experiencing substantial growth, driven by the increased prevalence of chronic diseases and advancements in drug administration technology. These systems are extensively utilized in various healthcare settings, including hospitals, clinics, home care, and ambulatory surgical centers, with hospitals and clinics being the primary consumers. The demand for these systems is fueled by the need for effective medication management and patient compliance, particularly in managing conditions like diabetes and cardiovascular diseases.

In 2023, the United States confirmed its position as a leading exporter of injectable drug delivery systems, with exports exceeding $2.3 billion. This surge in exports is primarily directed towards European and Asian markets, indicating a robust global demand for advanced drug delivery solutions. The efficiency and technological innovations within this sector are key factors driving this international reliance.

On the investment front, significant financial commitments have been observed. The U.S. government allocated $1.2 billion for health-related research and development to foster innovation in healthcare technologies, including injectable drug delivery. Simultaneously, pharmaceutical giants like Pfizer are boosting their R&D expenditures, with investments projected between $12.4 billion and $13.4 billion for the year, aimed at developing new medical treatments and enhancing existing drug delivery systems.

2023 also witnessed pivotal developments within the industry. Becton, Dickinson and Company (BD) launched a new pre-filled syringe technology in January, enhancing drug stability and patient safety. Pfizer acquired Arena Pharmaceuticals for $6.7 billion in March, strengthening its portfolio in this market segment.

Moreover, partnerships and expansions have been prevalent, with Merck & Co. partnering with Moderna to develop mRNA-based injectable therapeutics and Sanofi expanding its production capabilities with a $700 million investment in France. Additionally, a significant merger took place in August between GlaxoSmithKline (GSK) and Novartis’ injectable vaccine divisions, aimed at consolidating their operations and broadening market reach.

These strategic movements underscore the dynamic nature of the injectable drug delivery market and its crucial role in the evolving landscape of global healthcare, highlighting ongoing technological advancements and a firm commitment to enhancing patient care through innovative drug delivery solutions.

Key Takeaways

- The market is expected to grow from USD 45.8 billion in 2023 to USD 110.4 billion by 2033, with a 9.2% CAGR.

- Injectable drug delivery devices held a 64.3% market share in 2023, driven by widespread use for vaccines, insulin, and biologics.

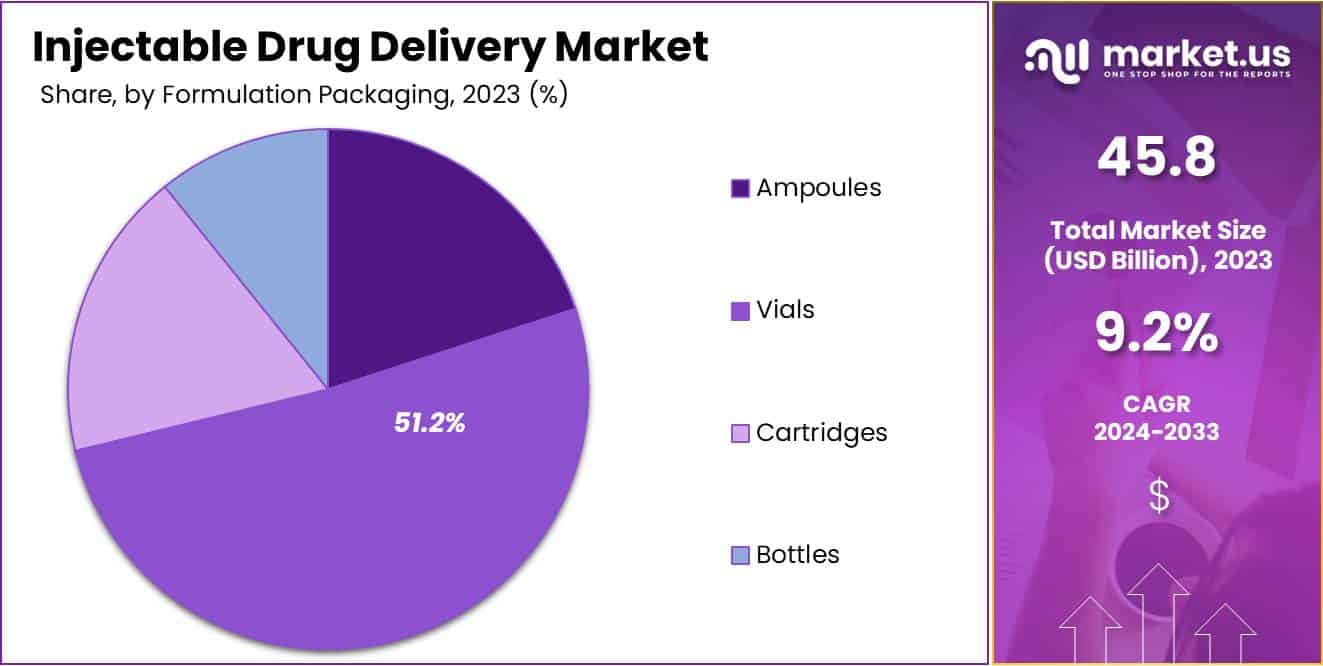

- Vials dominated the formulation packaging segment with a 51.2% share in 2023, owing to sterility and stability advantages.

- The cancer segment captured 36.2% of the therapeutic application market in 2023, driven by the need for targeted therapies.

- Curative care held a 70% market share in 2023, driven by the prevalence of chronic diseases requiring ongoing injectable treatments.

- Circulatory/musculoskeletal system treatments accounted for 49% of the site of administration segment in 2023.

Type Analysis

In 2023, the Injectable Drug Delivery Devices segment held a dominant market position in the Type Segment of the Injectable Drug Delivery Market, capturing more than a 64.3% share. This significant market share can be attributed to the widespread adoption of these devices across various therapeutic applications, including the administration of vaccines, insulin, and biologics. The rise in chronic diseases such as diabetes and cancer has spurred the demand for efficient and precise drug delivery systems, thus propelling the growth of this segment.

Additionally, advancements in technology, such as the development of auto-injectors and pen injectors, have enhanced the convenience and efficacy of drug administration, further driving market expansion. The segment’s dominance is also supported by a robust pipeline of injectable formulations, which promises sustained growth through the forecast period.

In contrast, the Injectable Drug Delivery Formulation segment also showed significant activity, underlined by innovation in particulate systems like nanoparticles and microspheres. However, its growth, while substantial, did not surpass that of the devices segment. Companies within this sector are focusing on developing formulations that can deliver drugs more effectively and reduce the frequency of administration, enhancing patient compliance and outcomes.

Formulation Packaging Analysis

In 2023, the Vials segment held a dominant market position in the Formulation Packaging Segment of the Injectable Drug Delivery Market, capturing more than a 51.2% share. This substantial market share can be attributed to the robust demand for biologics and the surge in biopharmaceutical research, where vials remain preferred due to their sterility, stability, and reliability in storing potent solutions.

Vials are extensively utilized in both clinical settings and commercial drug delivery, owing to their efficiency in maintaining the integrity of injectable formulations. The segment’s growth is further bolstered by technological advancements in vial production, such as the development of break-resistant glass and improved sealing techniques, which enhance the safety and usability of vials in drug delivery systems. This segment is projected to continue its growth trajectory, fueled by ongoing innovations and the increasing prevalence of chronic diseases necessitating precision dosing, which vials facilitate effectively.

Therapeutic Application Analysis

In 2023, the Cancer segment held a dominant market position in the Therapeutic Application Segment of the Injectable Drug Delivery Market, capturing more than a 36.2% share. This substantial market share can be attributed to the escalating incidence of cancer globally and the critical need for targeted therapy modalities. Injectable drug delivery systems are increasingly favored in oncology due to their ability to deliver drugs directly into the bloodstream, thus enhancing the therapeutic efficacy and minimizing side effects. The development of novel biologics and the expansion of biosimilars are further propelling the growth of this segment.

Moreover, advancements in drug delivery technologies, such as the development of long-acting injectables and biodegradable polymers, are expected to support the sustained growth of this market segment. Government initiatives and funding in cancer research continue to drive the adoption of innovative treatment methodologies, underpinning the robust position of the cancer segment in the injectable drug delivery market.

Usage Pattern Analysis

In 2023, the Curative Care segment held a dominant market position in the Usage Pattern Segment of the Injectable Drug Delivery Market, capturing more than a 70% share. This significant market share can be attributed to the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, which require ongoing management with injectable medications. The increasing adoption of biologics and the development of advanced, patient-friendly injectable formulations have further bolstered the dominance of this segment.

The immunization segment also showed notable growth, driven by global health initiatives to increase vaccination coverage. Other usage patterns, including therapeutic drug delivery and auto-immune treatments, continue to evolve with technological advancements, offering potential growth opportunities in the coming years. These trends underscore the expanding scope and sophistication of injectable drug delivery systems in addressing a broad spectrum of medical needs.

Site of Administration Analysis

In 2023, the Circulatory/Musculoskeletal System segment held a dominant market position in the Site of Administration segment of the Injectable Drug Delivery Market, capturing more than a 49% share. This prominence is largely attributed to the widespread use of injectable delivery systems for vaccines, biologics, and drugs that target systemic conditions and musculoskeletal disorders.

The high penetration rate of these treatments in chronic disease management, such as diabetes and rheumatoid arthritis, significantly contributes to the segment’s growth. Advances in biotechnology and the increasing adoption of monoclonal antibodies and biosimilars that necessitate systemic administration further bolster this segment’s expansion. Market forecasts suggest continued growth, driven by innovations in drug formulations and delivery technologies, enhancing both the efficacy and safety of injectable therapeutics targeting the circulatory and musculoskeletal systems.

Distribution Channel Analysis

Hospital pharmacies are pivotal in the injectable drug delivery market, primarily due to their immediate proximity to patient care areas. This distribution channel is essential for emergency responses, surgeries, and the management of chronic diseases, where timely medication delivery is critical. The segment’s expansion is supported by an increase in chronic disease incidences and the continuous growth of healthcare facilities globally. Moreover, hospital pharmacies ensure a robust supply chain, critical for the seamless delivery of injectable drugs.

In contrast, retail pharmacies and online stores are increasingly significant in the injectable drug delivery market. Retail pharmacies offer patients easy access to injectable medications, with the added benefit of providing necessary administration guidance. Their role is expanding due to a rise in retail outlets and improved medication storage facilities. Similarly, online stores are experiencing growth, driven by advancements in e-commerce and logistics, offering a convenient and often more affordable option for obtaining injectable medications. These platforms are becoming more trusted, thanks to enhancements in online prescription services and health consultations.

End User Analysis

The injectable drug delivery market is predominantly driven by its extensive application in hospitals and clinics, which constitute the largest segment. This predominance is attributed to the necessity for rapid medication administration in treatments and acute care. Enhanced hospital infrastructure further supports efficient injectable use. Concurrently, the escalating prevalence of chronic illnesses necessitates continuous injectable therapies, reinforcing this segment’s growth.

Conversely, the adoption of injectable drug delivery in home care settings is accelerating, influenced by the increasing preference for home-based healthcare and self-medication ease. Innovations in user-friendly injectable devices, such as auto-injectors, support this trend by enabling patients to self-administer medication effectively. This shift not only promises significant cost reductions but also improves patient comfort, particularly for those undergoing long-term treatments like diabetes management.

Key Market Segments

Type

- Injectable Drug Delivery Devices

- Injectable Drug Delivery Formulation

Formulation Packaging

- Ampoules

- Vials

- Cartridges

- Bottles

Therapeutic Application

- Autoimmune Diseases

- Hormonal Disorders

- Orphan Diseases

- Cancer

- Others

Usage Pattern

- Curative Care

- Immunization

- Others

Site of Administration

- Skin

- Circulatory/Musculoskeletal System

- Organs

- Central Nervous System

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy Online Stores

End User

- Hospitals and Clinics

- Home Care Settings

- Others

Drivers

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases such as diabetes, cancer, and autoimmune disorders is a significant driver for the injectable drug delivery market. These conditions often require long-term, effective management through medications, many of which are most efficacious when delivered via injection. This need supports the growth of advanced injectable drug delivery systems to improve therapeutic outcomes and patient compliance.

For example, the World Health Organization reports that noncommunicable diseases (NCDs) such as cardiovascular diseases, cancers, respiratory diseases, and diabetes account for over 70% of global deaths annually. The rising need for effective chronic disease management through medications, many of which require injection, underpins growth in the injectable drug delivery sector.

Restraints

High Cost of Development

A major restraint in the injectable drug delivery market is the high cost associated with developing new and advanced injection technologies. These costs stem from rigorous research and development processes, clinical testing, and regulatory compliance required to bring a safe and effective product to market. These factors can impede the development pace and the availability of innovative injectable solutions.

The cost of developing new drug delivery systems, particularly injectable ones, is substantial. Research suggests that the average cost to bring a new medical device to market can exceed $30 million, depending on the regulatory pathway and complexity of the device. This financial barrier can slow innovation and limit the entry of new players in the market, particularly in areas requiring cutting-edge technologies.

Opportunities

Expansion in Biologic Drug Approvals

The expansion in biologic drug approvals presents a significant opportunity for the injectable drug delivery market. Over the past five years, the FDA has observed a substantial increase in biologic drug approvals, driven by advancements in treating chronic diseases such as cancer and autoimmune disorders.

In 2023 alone, the FDA approved 55 new drugs, including a notable number of biologics. This surge necessitates advanced injectable delivery systems to ensure effective administration and enhance patient compliance This growth is further supported by the increasing prevalence of chronic diseases and the superior efficacy of injectable biologics, underscoring the market’s robust potential for expansion.

Trends

Adoption of Smart Injectors

The adoption of smart injectors is an emerging trend in the injectable drug delivery market, driven by technological advancements and the need for personalized medicine. Smart injectors feature dose tracking, wireless connectivity, and patient monitoring capabilities, which enhance treatment adherence and outcomes.

This growth is fueled by the increasing prevalence of chronic diseases, such as diabetes and cardiovascular conditions, which require precise and efficient drug administration methods. The World Health Organization (WHO) estimates that chronic diseases account for approximately 60% of all deaths globally, underscoring the importance of advanced drug delivery systems. The U.S. Food and Drug Administration (FDA) has also approved several smart injector devices, further validating their efficacy and potential to revolutionize patient care

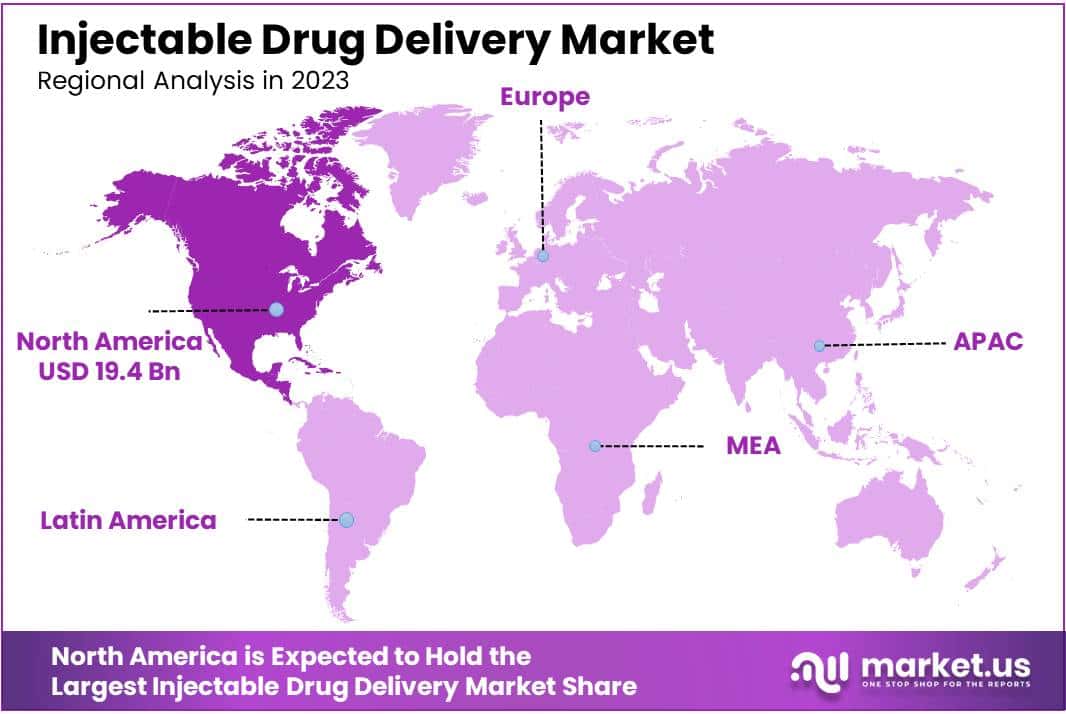

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 42.3% share and holding a market value of USD 19.37 billion. The growth in this region can be attributed to the high prevalence of chronic diseases, advanced healthcare infrastructure, and the presence of key market players. Increasing adoption of advanced injectable devices and favorable reimbursement policies further drive the market.

In Europe, the market accounted for a significant share, driven by increasing geriatric population and rising demand for biologics and biosimilars. The region’s market growth is supported by government initiatives promoting the use of innovative drug delivery systems and strong investment in research and development.

The Asia-Pacific region is anticipated to exhibit the highest growth rate during the forecast period. Factors such as rising healthcare expenditure, growing patient awareness, and increasing penetration of global pharmaceutical companies contribute to this growth. Emerging economies like China and India are witnessing rapid adoption of injectable drug delivery systems due to expanding healthcare facilities and growing prevalence of chronic diseases.

Latin America and the Middle East & Africa regions are expected to experience moderate growth. In Latin America, improving healthcare infrastructure and increasing government investments in the healthcare sector are key growth drivers. The Middle East & Africa region benefits from increasing focus on healthcare advancements and rising prevalence of chronic diseases, although market growth is somewhat restrained by economic and political instability in certain areas.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The injectable drug delivery market is significantly influenced by several key players. Amgen Inc. is prominent with its strong portfolio of biologics, including products like Enbrel and Neulasta, enhancing its market presence through advanced delivery systems that improve patient compliance. Antares Pharma Inc. is recognized for its specialty pharmaceutical products, focusing on self-administered injectable devices such as pen injectors and auto-injectors, which cater to the need for convenience and ease of use.

Becton, Dickinson and Company, or BD, leads globally in medical technology with its wide range of syringes, needles, and safety injection devices, continuously innovating in prefillable syringes and autoinjectors. Consort Medical Plc, through its subsidiary Bespak, excels in designing and manufacturing auto-injectors and pen systems, collaborating with pharmaceutical companies to develop bespoke solutions.

Other notable players like Eli Lilly and Company, Pfizer Inc., and Novo Nordisk contribute with extensive product portfolios and innovative technologies, supported by strategic initiatives such as partnerships and acquisitions, thereby strengthening their positions in the market.

Market Key Players

- Amgen Inc.

- Antares Pharma Inc.

- Becton, Dickinson and Company

- Consort Medical Plc (Bespak)

- Crossject

- Medtronic plc

- Mylan N.V.

- SHL Group

- West Pharmaceutical Services Inc.

- Ypsomed AG

Recent Developments

- May 2024: Amgen received FDA approval for IMDELLTRA (tarlatamab-dlle), a novel T-cell engager therapy for treating extensive-stage small cell lung cancer (ES-SCLC). This approval is based on the promising results from the Phase 2 DeLLphi-301 trial, which showed a 40% objective response rate and a median overall survival of 14.3 months.

- In November 2023: At the American Heart Association (AHA) Scientific Sessions, Amgen presented new data on Repatha, demonstrating no cognitive decline associated with very low levels of LDL-C over long-term use. This reinforces the safety and efficacy of Repatha in managing cardiovascular disease risks.

- In June 2023: BD introduced the BD Evolve On-Body Injector, designed for subcutaneous drug delivery. This product launch aims to improve patient compliance and comfort for chronic disease treatments, showcasing BD’s innovation in the drug delivery sector.

- In February 2023: West Pharmaceutical Services announced a significant investment in its manufacturing facility in Waterford, Ireland. The expansion aims to increase production capacity for injectable drug delivery systems, addressing growing market demand and ensuring supply chain resilience.

Report Scope

Report Features Description Market Value (2023) USD 45.8 Bn Forecast Revenue (2033) USD 110.4 Bn CAGR (2024-2033) 9.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device Type (Conventional, Self-injection), By Formulation (Novel drugs delivery, Conventional drug delivery, Other Formulations), By End-User (Home Care, Hospitals, Diagnostic Laboratories, Research Institutes, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Baxter International Inc., Pfizer Inc., Terumo Corporation, Dickinson and Company, Becton, Schott AG, Teva Pharmaceuticals Industries Ltd., Eli Lilly and Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Injectable Drug Delivery MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Injectable Drug Delivery MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amgen Inc.

- Antares Pharma Inc.

- Becton, Dickinson and Company

- Consort Medical Plc (Bespak)

- Crossject

- Medtronic plc

- Mylan N.V.

- SHL Group

- West Pharmaceutical Services Inc.

- Ypsomed AG