Global Industrial Waste Management Market By Waste Type(Construction and Demolition Waste, Manufacturing Waste, Chemical Waste, Mining Waste, Oil and Gas Waste, Agriculture Waste, Nuclear Waste, Others), By Type(Hazardous, Non-hazardous), By Service(Landfill, Recycling, Incineration, Others) , By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Oct 2024

- Report ID: 130024

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

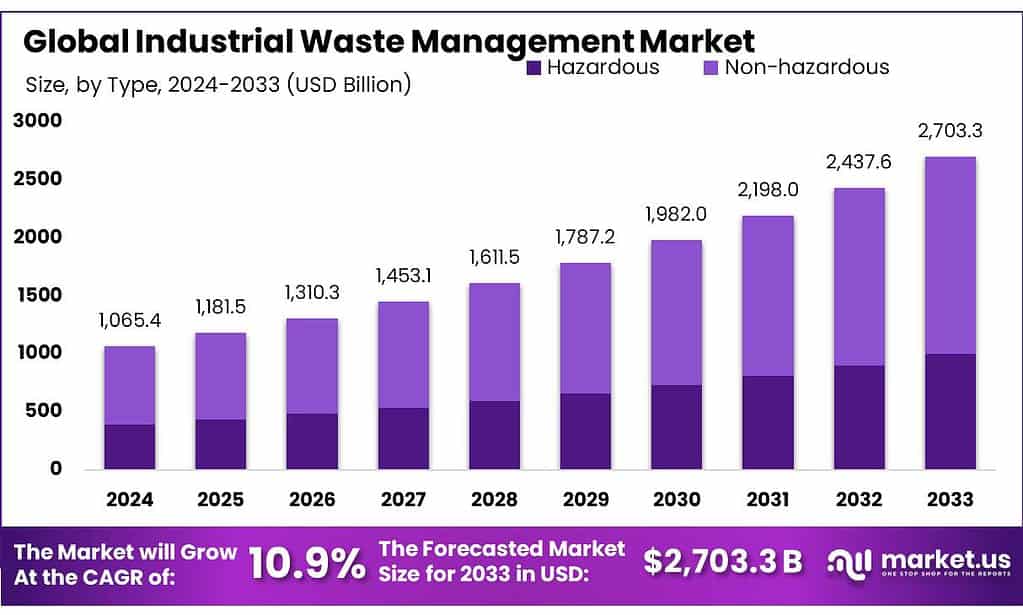

The global Industrial Waste Management Market size is expected to be worth around USD 2703.3 billion by 2033, from USD 1065.4 billion in 2023, growing at a CAGR of 10.9% during the forecast period from 2023 to 2033.

Industrial waste management is an essential practice involving the collection, treatment, and disposal of waste produced by various industrial activities, including factories and manufacturing plants. This process is crucial for preventing environmental pollution, conserving resources, and ensuring public health and safety.

Waste from industries such as chemical, metal, and plastic production requires careful handling. The management process often begins with segregating waste at its source, followed by safe collection methods. The waste is then treated to remove or neutralize harmful components, such as through chemical or thermal processes, and ultimately, it is securely disposed of or recycled into new products.

The demand for effective industrial waste management is growing, driven by the increasing volume of waste generated globally as industrial activities expand. This growth necessitates robust waste management solutions to mitigate environmental impacts and comply with stringent global regulations.

Governments worldwide are enforcing laws that mandate proper waste disposal and encourage recycling and waste reduction, further fueling the need for comprehensive waste management services.

The industrial waste management market is experiencing significant growth, spurred by heightened global awareness of environmental issues and stricter regulations on waste disposal and recycling. Industries such as manufacturing, chemicals, and healthcare are increasingly adopting sustainable waste management practices to reduce environmental risks and align with corporate social responsibility objectives.

These practices not only help manage waste effectively but also contribute to the conservation of resources by recycling and reusing materials wherever possible.

In terms of regional market dynamics, North America is at the forefront of adopting advanced waste management solutions, driven by rigorous regulatory standards and a well-established industrial infrastructure. Europe also shows strong market performance, with a focus on recycling and renewable energy integration, supported by EU directives aimed at minimizing landfill use.

Meanwhile, the Asia-Pacific region is rapidly catching up, with its market expansion fueled by industrial growth and evolving regulatory policies towards waste management. This global shift towards more rigorous waste management practices reflects a broader commitment to environmental sustainability and public health protection.

Key Takeaways

- Industrial Waste Management Market size is expected to be worth around USD 2703.3 billion by 2033, from USD 1065.4 billion in 2023, growing at a CAGR of 10.9%.

- Construction & Demolition Waste held a dominant market position in the industrial waste management sector, capturing more than a 35.6% share.

- Non-hazardous waste held a dominant market position in the industrial waste management sector, capturing more than a 63.5% share.

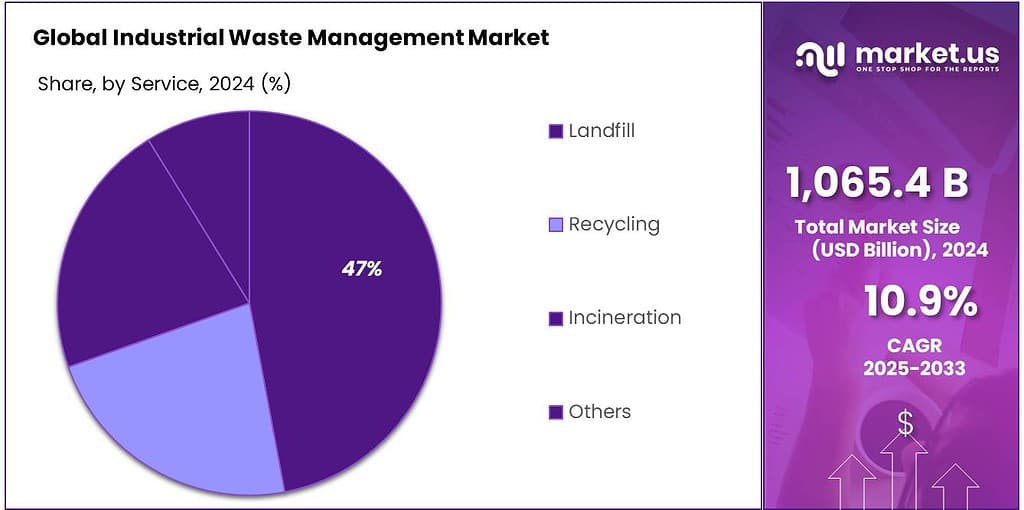

- Landfill held a dominant market position in the industrial waste management sector, capturing more than a 47.4% share.

- Asia-Pacific (APAC) region dominates the market, accounting for approximately 49.4% with a valuation of USD 523.1 billion.

By Waste Type

In 2023, Construction & Demolition Waste held a dominant market position in the industrial waste management sector, capturing more than a 35.6% share. This significant portion is largely due to the vast amounts of material generated from building activities and infrastructure overhauls, which often consist of concrete, wood, asphalt, and metals—all requiring specialized management strategies to recycle or safely dispose of these materials.

Following closely, Manufacturing Waste also constitutes a large segment of the market. This includes waste from the production of goods like electronics, clothing, and automobiles. Manufacturing processes generate various types of waste materials that need to be treated or recycled to prevent environmental contamination and recover valuable resources.

Chemical Waste represents another critical segment, involving hazardous wastes from chemical production processes that must be managed with stringent safety protocols to mitigate risks to the environment and human health. This type of waste requires specialized handling, treatment, and disposal techniques to neutralize its hazardous effects.

Mining Waste includes the debris and other byproducts of extracting minerals and other geological materials from the earth. This type of waste often contains heavy metals and other contaminants that can pose serious environmental hazards if not properly managed.

Oil & Gas Waste encompasses the byproducts of extracting and processing oil and gas resources, which include drilling muds, cuttings, produced water, and other materials that require careful handling to prevent pollution.

Agriculture Waste covers non-food byproducts from agriculture, such as manure, harvest waste, and pesticide residues, which need effective management to utilize as organic fertilizers or convert into energy through bio-digestion processes.

Nuclear Waste, though less voluminous compared to other types, is extremely hazardous and requires long-term strategies for isolation and containment to protect living beings and the environment from radiation.

By Type

In 2023, Non-hazardous waste held a dominant market position in the industrial waste management sector, capturing more than a 63.5% share. This type of waste includes materials that do not pose a direct threat to human health or the environment, such as paper, wood, and certain metals and plastics that are largely generated from industrial manufacturing processes.

The management of non-hazardous waste primarily involves recycling and repurposing materials to reduce the consumption of raw resources and minimize landfill usage, aligning with sustainable waste management practices.

Hazardous waste, which includes materials that can be dangerous to human health or the environment, accounts for a smaller portion of the industrial waste management market. This category includes waste like chemicals, toxic metals, and certain electronic components that require specialized handling, treatment, and disposal methods to ensure they do not contaminate air, water, or soil.

Managing hazardous waste often involves complex and strict regulatory compliance to prevent environmental contamination and protect public health, emphasizing the critical need for effective hazardous waste management solutions in industries.

By Service

In 2023, Landfill held a dominant market position in the industrial waste management sector, capturing more than a 47.4% share. This traditional method involves burying waste in designated areas and is commonly used for disposing of both hazardous and non-hazardous wastes that cannot be recycled or incinerated. Despite its prevalence, the focus is on improving landfill operations to minimize environmental impact through advanced lining technologies and methane capture systems.

Following closely is Recycling, a key service in industrial waste management that focuses on converting waste materials into new products to prevent waste of potentially useful materials. This service reduces the consumption of fresh raw materials, lowers energy usage, and decreases air and water pollution compared to conventional waste disposal methods.

Incineration is another significant service, involving the combustion of organic substances contained in waste materials. This method reduces the mass of waste, although it requires careful control to avoid emitting hazardous pollutants. Incineration can also recover energy from waste, which can be used to generate electricity or heat, thereby adding value to the waste disposal process.

Key Market Segments

By Waste Type

- Construction & Demolition Waste

- Manufacturing Waste

- Chemical Waste

- Mining Waste

- Oil & Gas Waste

- Agriculture Waste

- Nuclear Waste

- Others

By Type

- Hazardous

- Non-hazardous

By Service

- Landfill

- Recycling

- Incineration

- Others

Driving Factors

Emphasis on Sustainable and Environmentally Friendly Waste Management

One major driving factor for the Industrial Waste Management market is the growing emphasis on sustainable and environmentally friendly waste management procedures. This shift is largely driven by increasing environmental regulations globally, which mandate more stringent waste handling and disposal methods to minimize pollution and promote recycling and recovery.

Industries are now more focused on adopting waste management practices that not only comply with regulations but also contribute to sustainability goals, leading to significant market growth.

This growth reflects an increasing need for robust waste management solutions across various industries to handle the rising volumes of waste generated by expanding industrial activities. The Asia-Pacific region, in particular, is expected to experience the fastest growth due to rapid industrialization and urbanization, which amplify waste production and the demand for effective management services.

Moreover, the market is influenced by the advancement of technologies and innovations in waste management services, which improve efficiency and effectiveness in treating and recycling industrial waste. This includes the integration of digital technologies, which enhances the monitoring and optimization of waste management processes.

Restraining Factors

High Investment in Technological Advancements

One major restraining factor in the industrial waste management market is the high operational and transportation costs associated with waste management services. Managing waste is labor-intensive and requires significant financial resources, especially in terms of collecting and transporting waste to recycling facilities or landfills.

These challenges are exacerbated in developing regions where infrastructure may be inadequate and funding for advanced waste management systems is limited. Additionally, the complexity of handling hazardous materials poses unique challenges, further straining the resources of waste management services.

Furthermore, while technological advancements have improved waste management efficiency, they also require significant investment in new equipment and training, which can be a barrier for many companies, particularly smaller ones or those in less developed markets.

The lack of a comprehensive regulatory framework in some regions also contributes to the inefficiency of waste management systems, leading to practices like illegal dumping and inadequate waste processing.

Growth Opportunities

Technological Innovations and Expanding Geographical Markets

One of the primary growth opportunities in the industrial waste management market is the integration of advanced technologies that enhance the efficiency of waste processing and disposal. Innovations such as machine learning for data analysis in waste management operations are increasingly being adopted.

These technologies allow for better sorting, processing, and overall handling of industrial waste, leading to more efficient recycling and reduction processes. Such technological advancements not only improve the capability to manage waste more effectively but also open up opportunities for converting waste into valuable resources or energy .

Another significant opportunity lies in the geographical expansion of waste management services, particularly in rapidly developing regions such as Asia-Pacific. This region is witnessing a surge in industrial activities, which in turn generates substantial amounts of waste.

The increasing urbanization and industrialization in countries like China and India are driving the demand for robust waste management solutions. As these economies continue to grow, the need for effective waste management services is becoming more critical, presenting substantial opportunities for market expansion .

Moreover, there is a growing focus on developing waste-to-energy projects, which further supports market growth. These projects are gaining traction as they not only help in managing waste but also in generating energy, thereby providing a dual benefit.

The shift towards waste-to-energy solutions is being supported by both government initiatives and private investments, indicating a promising area for growth within the industrial waste management sector.

Latest Trends

Adoption of Digital Technologies and Data Analytics

One of the most significant recent trends in the industrial waste management market is the increasing adoption of digital technologies and data analytics. Industrial waste generators are leveraging digital platforms, Internet of Things (IoT) sensors, and advanced analytics to optimize waste management processes. This trend is enhancing the ability to monitor waste generation in real-time, identify opportunities for waste reduction, and significantly improve efficiency in waste handling and recycling .

The market is also seeing a growing shift towards waste-to-energy technologies, which are gaining traction as sustainable solutions for managing industrial waste. These technologies involve converting waste materials into usable forms of energy, such as electricity and heat, thus providing a dual benefit of waste reduction and energy generation. The adoption of such technologies is supported by favorable regulatory policies and growing energy demands from the end-use sectors .

Furthermore, there is an increasing focus on developing a circular economy framework within the industry. This approach emphasizes the maximum recovery and recycling of resources from waste, aiming to keep materials within the economy for as long as possible and minimize environmental impact. The trend towards circular economy practices is driven by both regulatory pressures and the increasing corporate commitment to sustainability goals .

Regional Analysis

The Industrial Waste Management Market exhibits distinct dynamics and growth potential across various regions. The Asia-Pacific (APAC) region dominates the market, accounting for approximately 49.4% with a valuation of USD 523.1 billion.

This significant market share is driven by rapid industrialization in countries like China and India, coupled with increasing regulatory pressures to manage industrial waste sustainably. The region’s focus on enhancing recycling and waste treatment infrastructure to cope with the rising industrial output is a key growth driver.

In North America, the market is propelled by stringent environmental regulations and advanced waste management technologies. The United States and Canada are investing heavily in innovative waste processing and recycling technologies, which support the efficient handling of industrial waste. This region emphasizes sustainable practices and the implementation of circular economy principles to reduce landfill use and increase recycling rates.

Europe follows a rigorous regulatory framework that mandates the reduction, reuse, and recycling of industrial waste. Initiatives such as the European Green Deal aim to transform the EU into a modern, resource-efficient economy, reinforcing the demand for advanced waste management solutions. This commitment to sustainability supports the region’s steady market growth.

The Middle East & Africa (MEA) region shows promising growth, primarily due to infrastructure development projects and increasing industrial activities in the Gulf Cooperation Council (GCC) countries. The adoption of waste-to-energy projects as a strategy to manage industrial waste sustainably is also notable in this region.

Latin America, though smaller in market size compared to other regions, is gradually advancing in terms of industrial waste management capabilities. Investments to improve waste treatment facilities and government initiatives to regulate waste management practices are driving growth in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The industrial waste management market is characterized by the presence of several key players that contribute to the sector’s dynamics and competitiveness globally. Among these, Veolia and Waste Management, Inc. stand out as leading firms, both widely recognized for their extensive services ranging from collection and disposal to recycling and recovery of industrial waste.

Veolia, in particular, is known for its innovative solutions in water and waste management that cater to industrial clients across multiple sectors, emphasizing sustainability and efficiency. Waste Management, Inc. also leads with a strong focus on sustainable practices, offering comprehensive waste solutions tailored to the needs of large industrial clients.

Another notable player, CLEAN HARBORS INC., specializes in hazardous waste management and environmental services, providing vital support for industries dealing with complex waste challenges. Their services are crucial in maintaining compliance with stringent environmental regulations and in ensuring safe and responsible waste handling.

Similarly, Suez and Covanta Holding are significant contributors to the market, with Suez excelling in water and waste management solutions across a global network, and Covanta focusing on waste-to-energy solutions that transform industrial waste into renewable energy.

Additionally, companies like Biffa and Republic Services play critical roles in the regional markets, particularly in Europe and North America, respectively. Biffa is renowned for its recycling initiatives and waste management solutions within the UK, while Republic Services is a major player in the U.S. market, offering waste collection, recycling, and disposal services.

These companies, along with others like Stericycle, which specializes in medical and hazardous waste, and new entrants like Valicor, which focuses on environmental services, collectively drive the industrial waste management industry towards greater innovation and sustainability.

Market Key Players

- Biffa

- Biomedical Waste Solutions

- CLEAN HARBORS INC.

- Covanta Holding

- Daiseki Co., Ltd.

- Enviroserv Waste Management (Pty) Ltd.

- Fcc Environment

- Hitachi Zosen

- Reclay Group

- REMONDIS SE & Co. KG

- Republic Services

- SA Waste

- SembCorp

- Sembcorp Industries

- Stericycle

- Stericycle, Inc.

- Suez

- Urbaser

- Valicor

- Veolia

- Waste Connections

- Waste Management, Inc.

Recent Development

March 2023, Biffa reported a substantial revenue increase, showcasing a solid financial performance with statutory revenues rising by 16 percent to £1.68 billion.

BioMedical Waste Solutions is a prominent player in the industrial waste management sector, specifically focusing on medical and biohazardous waste.

Report Scope

Report Features Description Market Value (2023) US$ 1065.4 Bn Forecast Revenue (2033) US$ 2703.3 Bn CAGR (2024-2033) 10.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Waste Type(Construction and Demolition Waste, Manufacturing Waste, Chemical Waste, Mining Waste, Oil and Gas Waste, Agriculture Waste, Nuclear Waste, Others), By Type(Hazardous, Non-hazardous), By Service(Landfill, Recycling, Incineration, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Biffa, Biomedical Waste Solutions, CLEAN HARBORS INC., Covanta Holding, Daiseki Co., Ltd., Enviroserv Waste Management (Pty) Ltd., Fcc Environment, Hitachi Zosen, Reclay Group, REMONDIS SE & Co. KG, Republic Services, SA Waste, SembCorp, Sembcorp Industries, Stericycle, Stericycle, Inc., Suez, Urbaser, Valicor, Veolia, Waste Connections, Waste Management, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Waste Management MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Waste Management MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Biffa

- Biomedical Waste Solutions

- CLEAN HARBORS INC.

- Covanta Holding

- Daiseki Co., Ltd.

- Enviroserv Waste Management (Pty) Ltd.

- Fcc Environment

- Hitachi Zosen

- Reclay Group

- REMONDIS SE & Co. KG

- Republic Services

- SA Waste

- SembCorp

- Sembcorp Industries

- Stericycle

- Stericycle, Inc.

- Suez

- Urbaser

- Valicor

- Veolia

- Waste Connections

- Waste Management, Inc.