Global Industrial Tourism Market Size, Share, Growth Analysis By Type of Tourism (Factory Tours, Plant Visits, Corporate Museum Visits, Technology and Innovation Centers, Agro-Industrial Tourism), By Industry Sector, By Mode of Booking, By Tourist Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136162

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Findings

- Business Environment Analysis

- Type of Tourism Analysis

- Industry Sector Analysis

- Mode of Booking Analysis

- Tourist Type Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Latest Developments

- Report Scope

Report Overview

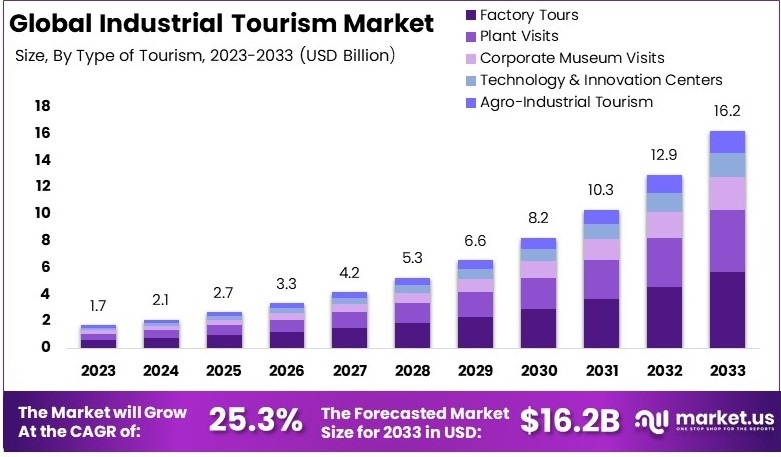

The Global Industrial Tourism Market size is expected to be worth around USD 16.2 Billion by 2033, from USD 1.7 Billion in 2023, growing at a CAGR of 25.3% during the forecast period from 2024 to 2033.

Industrial tourism involves visiting industrial facilities, such as factories, plants, and manufacturing sites, to observe production processes and gain insights into how products are made. It combines education and leisure, allowing tourists to engage with industries firsthand and understand the complexities of modern manufacturing.

The Industrial Tourism Market encompasses all activities and services related to organizing and facilitating visits to industrial sites. This includes guided tours, educational programs, and interactive experiences provided by companies and tourism operators. The market aims to attract visitors interested in the behind-the-scenes operations of various industries.

Industrial tourism is a growing niche, blending educational tourism with leisure as tourists explore manufacturing sites and historical industrial landmarks. Annually, Jack Daniel’s Distillery in the USA welcomes over 250,000 visitors, and Volkswagen’s Autostadt in Germany draws approximately 2 million visitors.

In terms of market dynamics, the industrial tourism sector is marked by significant growth factors and opportunities. For instance, Ironbridge Gorge in the UK attracts around 545,000 visitors yearly, underscoring the appeal of historical industrial sites.

Similarly, the Kalundborg Eco-Industrial Park in Denmark exemplifies the environmental sustainability aspect, reducing CO2 emissions by 275,000 tons annually. These examples highlight the sector’s capacity to combine cultural education with environmental consciousness, presenting a compelling value proposition to tourists.

Furthermore, the broader impact of industrial tourism is substantial, with governments recognizing its potential economic benefits. The U.S. Department of Commerce, for example, has implemented the National Travel and Tourism Strategy, aiming to attract 90 million international visitors by 2027.

This strategy projects an annual spending of $279 billion, emphasizing industrial tourism as a key component. Consequently, this focus is likely to spur further development in local economies, driving both employment and infrastructural enhancements.

Key Findings

- The Industrial Tourism Market was valued at USD 1.7 Billion in 2023, and is expected to reach USD 16.2 Billion by 2033, with a CAGR of 25.3%.

- In 2023, Factory Tours dominate the Type of Tourism segment with 35.5% due to their appeal in showcasing manufacturing processes.

- In 2023, the Automotive sector leads the Industry Sector with 30.2%, highlighting the industry’s strong presence in industrial tourism.

- In 2023, Online Booking is the preferred Mode of Booking with 65.7%, reflecting the shift towards digital reservation systems.

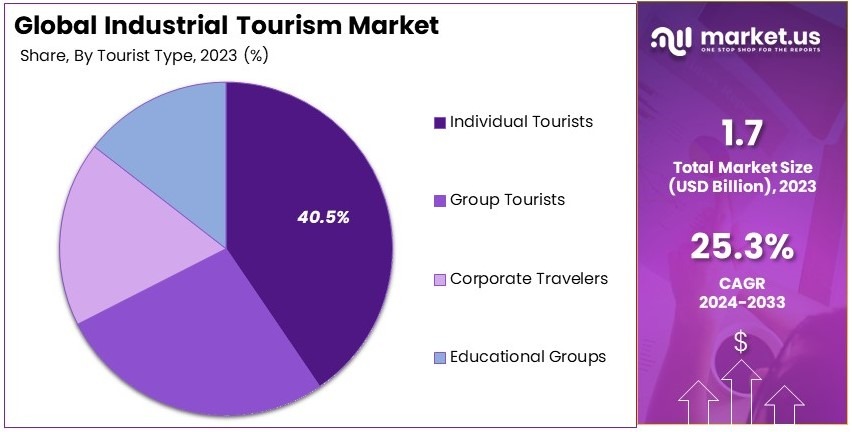

- In 2023, Individual Tourists represent the largest Tourist Type with 40.5%, indicating the market’s focus on personal travel experiences.

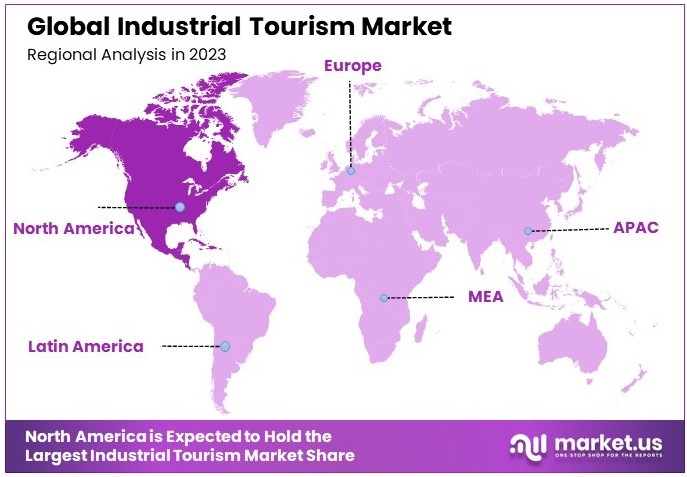

- In 2023, North America holds the dominant regional share, driving the market growth with its advanced industrial infrastructure.

Business Environment Analysis

The industrial tourism market is experiencing a shift due to varying saturation levels, as seen in Ulsan, South Korea. Despite drawing over 17 million visitors in 2013 with a steady 6% growth rate annually, the challenge lies in continually innovating attractions to maintain interest amidst growing competition, as noted in February 2014.

Target demographics for industrial tourism are broadening. Initiatives like FORREC’s design projects in April 2023, which repurpose industrial sites into tourist attractions, cater to both history enthusiasts and tech-savvy visitors. This diversification helps meet the educational and recreational needs of a varied audience.

Product differentiation in industrial tourism is crucial for standing out. SIBUR’s opening of its Polief plant to public tours in July 2024 showcases a unique blend of industrial activity with a focus on sustainability, highlighting solar power and recycling. This approach not only educates but also enhances visitor engagement by emphasizing green practices.

Value chain analysis within industrial tourism reveals significant investment in enhancing visitor experiences. For example, Ulsan’s implementation of the Yeongnam Alps Master Plan and development of new trails, reported in February 2014, aims to create a comprehensive offering that spans multiple aspects of tourism, from eco to industrial.

Adjacent markets, such as ecotourism and educational travel, are increasingly intertwined with industrial tourism. Ulsan’s strategy integrates coastal and eco-tours with industrial visits, creating a multifaceted tourism experience that appeals to a wider market.

Type of Tourism Analysis

Factory tours dominate with 35.5% due to robust industrial curiosity and educational value.

The industrial tourism market is notably segmented by the type of tourism, with factory tours emerging as the dominant sub-segment. Factory tours account for 35.5% of the market’s interest, driven largely by the public’s increasing curiosity about manufacturing processes and the educational opportunities these tours provide. Corporations are leveraging these tours to enhance brand visibility and engage with potential stakeholders.

Plant visits serve as critical educational tools for students and professionals interested in industrial operations, contributing significantly to practical learning experiences.

Corporate museum visits offer insights into the historical evolution of industries and their impact on modern technologies, attracting history enthusiasts and educational institutions.

Technology and Innovation Centers are pivotal in showcasing cutting-edge advancements and fostering innovation, attracting tech enthusiasts and industry professionals.

Agro-Industrial Tourism combines agricultural practices with industrial processes, appealing to tourists interested in sustainable and integrated farming techniques, thus promoting environmental awareness.

Industry Sector Analysis

The automotive sector leads with 30.2% due to advancements in automotive technologies and increased consumer interest in car manufacturing.

In the industry sector, the automotive industry stands out, commanding a 30.2% market share. This prominence is attributed to the significant advancements in automotive technologies and a growing public interest in understanding vehicle manufacturing processes.

The aerospace segment is driven by public fascination with aircraft manufacturing and space exploration, which continues to attract a dedicated audience.

The food and beverage sector appeals broadly due to interest in food processing and safety standards, key concerns for today’s health-conscious consumers.

Manufacturing remains vital as it covers a broad spectrum of industries, from textiles to electronics, illustrating diverse production techniques.

Energy and utilities focus on demonstrating energy production and management techniques, crucial for understanding today’s energy challenges.

Pharmaceuticals or medical tourism and chemicals play a crucial role in highlighting innovations in medicine and industrial chemicals, addressing health and safety standards.

Mode of Booking Analysis

Online booking dominates with 65.7% due to convenience and accessibility.

The mode of booking is crucial in the industrial tourism market, with online booking taking precedence, holding a 65.7% share. This dominance is due to the ease, convenience, and widespread accessibility of online platforms that allow tourists to book tours seamlessly.

Offline booking still plays a significant role, catering to less tech-savvy individuals or where personal interaction is preferred, offering opportunities for immediate assistance and personalized service.

Tourist Type Analysis

Individual tourists lead with 40.5% due to personalized tour preferences and flexibility.

Tourist type is a significant segment in industrial tourism, with individual tourists holding the largest share at 40.5%. This group prefers the flexibility and personalized experience that individual tours offer, allowing them to explore at their own pace and according to their specific interests.

Group tourists are essential for educational tours or organizational visits, benefiting from structured learning and shared experiences.

Corporate travelers utilize tours for business insights and networking, aligning with corporate goals and industry-specific learning.

Educational groups focus on educational outings that provide practical exposure to students in various fields, enhancing theoretical knowledge with real-world applications.

Key Market Segments

By Type of Tourism

- Factory Tours

- Plant Visits

- Corporate Museum Visits

- Technology and Innovation Centers

- Agro-Industrial Tourism

By Industry Sector

- Automotive

- Aerospace

- Food and Beverage

- Manufacturing

- Energy and Utilities

- Pharmaceuticals and Chemicals

By Mode of Booking

- Online Booking

- Offline Booking

By Tourist Type

- Individual Tourists

- Group Tourists

- Corporate Travelers

- Educational Groups

Driving Factors

Technological Advancements Drive Market Growth

Technological advancements are significantly boosting the industrial tourism market. Factories equipped with advanced machinery and innovative systems attract tourists eager to explore modern manufacturing.

For example, Tesla’s Gigafactory in Nevada draws visitors interested in cutting-edge electric vehicle production. These facilities provide unique insights into high-tech processes, making them appealing destinations for those seeking educational experiences.

Experiential travel trends further enhance this growth. Tourists today prefer engaging and interactive visits that immerse them in real-world environments. Industrial sites like Boeing’s factory in Washington offer hands-on experiences, allowing visitors to witness the construction of aircraft. These immersive elements make industrial tourism both enjoyable and educational.

Infrastructure development also plays a critical role. Improved transport networks and visitor facilities increase the accessibility of industrial sites. For instance, the BMW Museum in Munich benefits from seamless transportation links, attracting both domestic and international tourists. Better infrastructure ensures a smoother and more comfortable visitor experience, making industrial tourism sites more appealing.

Restraining Factors

High Costs and Accessibility Restrain Market Growth

High costs remain one of the most significant barriers to the growth of the industrial tourism market. Establishing and maintaining tourism-ready industrial sites involves substantial investment. Small-scale manufacturers and companies with limited budgets often struggle to allocate resources for such ventures.

Accessibility is another major challenge. Many industrial sites are located in remote areas or regions with underdeveloped infrastructure. For instance, mining operations in rural areas often lack adequate transportation facilities, making it difficult for tourists to visit.

Environmental regulations also hinder growth. Industries are required to comply with stringent sustainability standards, such as emission controls and waste management policies. For example, steel plants face high costs to meet environmental criteria, further complicating their ability to cater to tourists. Safety concerns add to these restraints.

Industrial sites, particularly chemical factories, must maintain rigorous safety protocols to ensure visitor protection. These measures demand continuous investment and management, which can deter companies from opening their facilities to tourists.

Growth Opportunities

Virtual Integration and Market Expansion Provide Opportunities

The integration of virtual and augmented reality (VR/AR) technologies is opening new growth opportunities for the industrial tourism market. VR and AR allow for highly immersive and interactive tours, enabling tourists to explore facilities remotely or with enhanced on-site experiences. For example, the Ford Rouge Factory’s virtual tours provide an engaging way to understand automobile manufacturing, attracting both tech-savvy and international audiences.

Emerging markets are another area ripe for growth. Countries in Southeast Asia, such as Vietnam and Indonesia, are actively promoting their industrial heritage. These regions, rich in unique manufacturing histories, are investing in industrial tourism to boost their economies and attract global tourists. The combination of cultural and industrial narratives makes these markets highly appealing.

Niche tourism segments also offer lucrative potential. Eco-industrial tourism, such as visits to renewable energy facilities or sustainable factories, appeals to environmentally conscious travelers. For instance, wind turbine plants and solar energy farms are gaining popularity as destinations. These tours highlight sustainable practices and resonate with growing traveler concerns about the environment.

Strategic partnerships further amplify opportunities. Collaborations between tourism boards and local industries help create unique experiences. For example, partnerships between artisanal breweries and local tour operators have led to specialized tours that combine industrial insights with cultural elements.

Emerging Trends

Sustainable Practices and Digital Trends Are Latest Trending Factors

Sustainability is one of the most significant trends influencing the industrial tourism market. Industrial sites increasingly adopt eco-friendly practices to align with growing traveler preferences for responsible tourism. For instance, the Siemens Renewable Energy Plant showcases its green energy solutions while promoting environmental awareness. Such initiatives attract tourists who prioritize sustainability in their travel choices.

Digital marketing has also emerged as a game-changer. Platforms like Instagram and YouTube are powerful tools for showcasing industrial sites. Short videos and visually engaging content highlight the unique features of these sites, reaching a global audience. Social media campaigns effectively boost visibility, making it easier for tourists to discover and engage with industrial tourism options.

Personalized and customized travel experiences are gaining momentum. Tourists now seek tailored visits that reflect their specific interests. For example, customized tours at artisanal manufacturing facilities or niche industrial sites provide deeper and more meaningful experiences. This trend is especially popular among travelers seeking unique and exclusive encounters.

The sharing economy further supports industrial tourism’s growth. Platforms like Airbnb and Uber make it easier for tourists to plan their visits and navigate destinations. These services provide affordable and flexible options, enabling more travelers to explore industrial sites.

Regional Analysis

North America Dominates the Industrial Tourism Market

North America leads the Industrial Tourism Market, primarily due to its extensive industrial base and high visitor engagement with sectors such as automotive, aerospace, and technology. The presence of iconic companies and advanced manufacturing facilities drives substantial interest and traffic to these industrial sites.

The region benefits from a mature tourism infrastructure and a strong culture of business tourism, supplemented by effective marketing strategies that highlight the educational and innovative aspects of industrial visits. Additionally, robust safety standards and well-organized tour operations enhance the overall visitor experience.Looking forward, North America is poised to maintain its influence in the Industrial Tourism Market. Ongoing investments in industrial innovation and public interest in manufacturing processes will likely continue to attract tourists. The trend towards sustainable and educational tourism may also play a role in boosting the region’s market share.

Regional Mentions:

- Europe: Europe holds a significant position, backed by its rich industrial heritage and strong emphasis on sustainable practices. The region attracts tourists interested in automotive and fashion industry tours.

- Asia Pacific: Asia Pacific is witnessing growth due to the rise in manufacturing hubs and technology parks in countries like China, Japan, and South Korea, which attract professionals and technology enthusiasts.

- Middle East & Africa: This region is gradually adopting industrial tourism, focusing on oil, gas, and renewable energy sectors, attracting visitors interested in energy and resource management.

- Latin America: Latin America is developing its market presence, particularly in the mining and agricultural sectors, appealing to those interested in the extraction processes and agro-industrial tours.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Industrial Tourism Market, leading entities such as Boeing, Toyota Motor Corporation, Heineken N.V., and Guinness Storehouse (Diageo) significantly contribute to attracting and educating visitors. Boeing, with its advanced aerospace manufacturing facilities, draws aviation enthusiasts and professionals alike, offering them a glimpse into the complexities of aircraft production and technological innovations.

Toyota Motor Corporation capitalizes on its global presence in the automotive industry by opening up its factories to public tours, demonstrating efficient production techniques and pioneering environmental sustainability practices.

Heineken N.V. enhances the visitor experience by merging education with entertainment, showcasing its brewing process while emphasizing its rich heritage and commitment to quality. Similarly, Guinness Storehouse (Diageo) effectively uses its iconic status in the beverage industry to offer immersive experiences that include brewery tours, tastings, and insights into the historical brewing processes that have made Guinness a global brand.

These companies excel in the industrial tourism sector by not only opening their doors to the public but also by creating engaging educational experiences that highlight their brand histories, manufacturing prowess, and technological advancements. Through these tours, they not only boost brand loyalty but also foster a deeper connection with their consumers by offering transparency and a firsthand look at their operational excellence.

Major Companies in the Market

- Boeing

- Toyota Motor Corporation

- Heineken N.V.

- Guinness Storehouse (Diageo)

- Volkswagen Group

- Nissan Motor Co., Ltd.

- Ford Motor Company

- BMW Group

- Airbus

- General Motors Company

- Tesla, Inc.

- Harley-Davidson, Inc.

- Coca-Cola Company

Latest Developments

- Heineken Experience and Heineken: The Heineken Experience in Amsterdam, Netherlands, offers visitors an immersive tour of the historic brewery. As one of the city’s most popular attractions, it draws hundreds of thousands of visitors each year, contributing to Heineken’s brand visibility and consumer engagement.

- BMW Welt and Museum and BMW: BMW’s Welt and Museum in Munich, Germany, serve as significant industrial tourism sites, offering insights into the company’s history and technological advancements. These venues attract over a million visitors annually, reinforcing BMW’s commitment to transparency and public engagement.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 16.2 Billion CAGR (2024-2033) 25.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Tourism (Factory Tours, Plant Visits, Corporate Museum Visits, Technology and Innovation Centers, Agro-Industrial Tourism), By Industry Sector (Automotive, Aerospace, Food and Beverage, Manufacturing, Energy and Utilities, Pharmaceuticals and Chemicals), By Mode of Booking (Online Booking, Offline Booking), By Tourist Type (Individual Tourists, Group Tourists, Corporate Travelers, Educational Groups) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Boeing, Toyota Motor Corporation, Heineken N.V., Guinness Storehouse (Diageo), Volkswagen Group, Nissan Motor Co., Ltd., Ford Motor Company, BMW Group, Airbus, General Motors Company, Tesla, Inc., Harley-Davidson, Inc., Coca-Cola Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Boeing

- Toyota Motor Corporation

- Heineken N.V.

- Guinness Storehouse (Diageo)

- Volkswagen Group

- Nissan Motor Co., Ltd.

- Ford Motor Company

- BMW Group

- Airbus

- General Motors Company

- Tesla, Inc.

- Harley-Davidson, Inc.

- Coca-Cola Company