Global Industrial Safety Gloves Market Size, Share, Growth Analysis By Product Type (Disposable Gloves, Reusable Gloves), By Material Type (Nitrile, Latex, Neoprene, Leather, Polyethylene, Others), By End-Use Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135109

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Environment Analysis

- Adjacent Markets Analysis

- Product Type Analysis

- Material Type Analysis

- End-Use Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

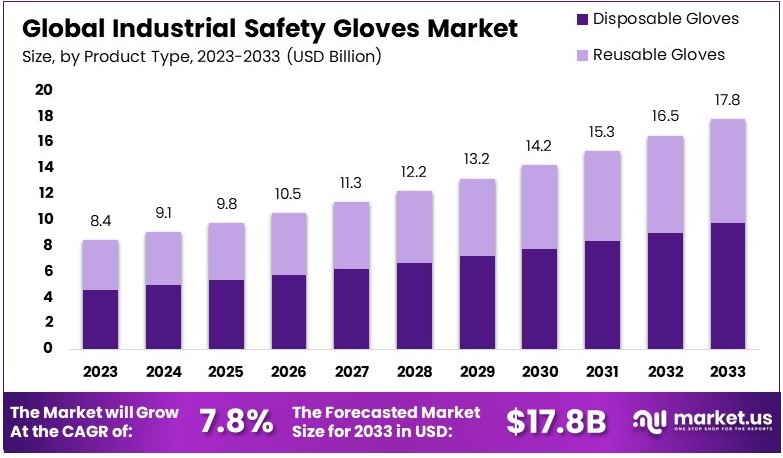

The Global Industrial Safety Gloves Market size is expected to be worth around USD 17.8 Billion by 2033, from USD 8.4 Billion in 2023, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

Industrial safety gloves are protective handwear designed to shield workers from hazards in various industries. They are made from materials like rubber, latex, leather, or synthetic fibers to provide protection against chemicals, abrasions, cuts, and extreme temperatures. These gloves ensure worker safety and compliance with safety regulations.

The industrial safety gloves market encompasses the production and distribution of protective gloves for various industries. It includes different types of gloves tailored to specific safety needs, such as chemical-resistant or cut-resistant gloves.

The Industrial Safety Gloves Market is expanding steadily, driven by rising awareness of workplace hazards and demand for personal personal protective equipment. According to the Bureau of Labor Statistics, 5,486 fatal work injuries occurred in 2022, a 5.7% increase from 2021. Consequently, there is growing demand for high-performance gloves, particularly those with advanced cut resistance rated from A1 to A9 under ANSI/ISEA standards.

Moreover, government regulations enhance market dynamics. In April 2024, OSHA released injury and illness data from over 375,000 establishments to improve transparency. As a result, employers are increasingly investing in premium gloves to meet compliance standards, fostering higher safety levels and boosting market growth.

The competitive landscape is evolving as innovation fosters differentiation. Features like slip resistance and ergonomic designs are becoming standard. Additionally, partnerships, such as BrightView’s collaboration with Red Wing Shoes to equip 18,000 employees, highlight how strategic alliances improve market presence and safety outcomes.

On a larger scale, the growing construction sector fuels demand for industrial gloves. The U.S. Census Bureau reported that construction spending in November 2023 was 0.4% higher than in October 2023. Thus, the rise in construction activity underscores the critical need for reliable gloves to ensure worker safety.

Key Takeaways

- The Industrial Safety Gloves Market was valued at USD 8.4 Billion in 2023 and is expected to reach USD 17.8 Billion by 2033, with a CAGR of 7.8%.

- In 2023, Disposable Gloves dominate the product type segment with 54.3% due to their widespread use and hygiene benefits.

- In 2023, Nitrile leads the material type segment due to its superior resistance to chemicals and punctures.

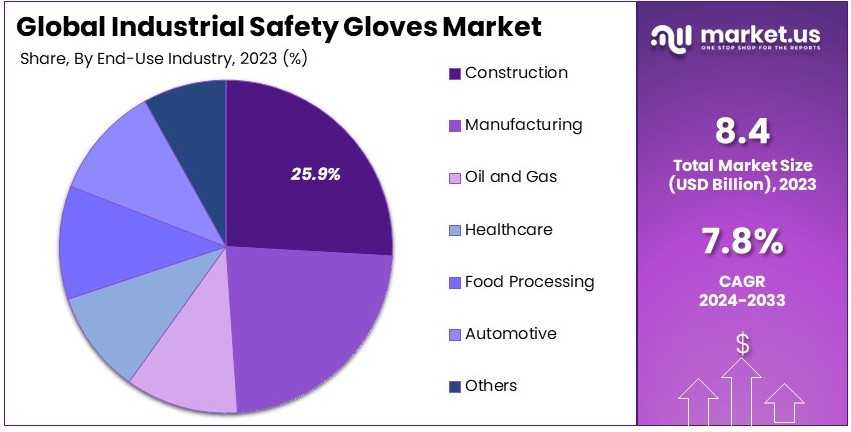

- In 2023, Construction leads the end-use industry segment with 25.9% due to high demand for durable and protective gloves.

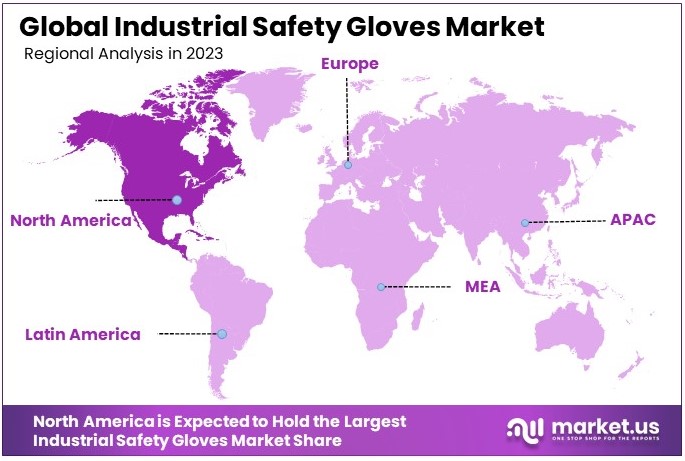

- In 2023, North America dominates the regional segment due to stringent safety regulations and a strong industrial base.

Business Environment Analysis

Market saturation remains moderate as the Industrial Safety Gloves Market expands beyond the post-pandemic surge. US$200 billion in PPE trade in 2022 indicates robust demand. According to the World Trade Organization (WTO) on May 23, 2023, new entrants can find opportunities without overwhelming competition, fostering a balanced marketplace.

The primary users of industrial safety gloves include construction and manufacturing workers. In construction, 6.2% are women and 93.8% are men, with an average age of 38 years. In manufacturing, women account for 30% of the workforce, while 41% are aged 40 and above, highlighting the need for inclusive and comfortable glove designs suitable for diverse user demographics.

Product differentiation is crucial as companies innovate to meet rising demands. For instance, in March 2023, Ansell inaugurated a new plant in India emphasizing high-quality surgical gloves with gamma sterilization. Furthermore, enhanced durability and ergonomic designs can set brands apart in a competitive landscape.

Value chain analysis reveals strategic investments like American Nitrile’s $105 million facility in March 2022 and Ontario’s $165 million project in December 2023. These investments streamline production and distribution, enhancing efficiency. Consequently, a well-integrated value chain supports scalability and responsiveness to market fluctuations.

Investment opportunities are abundant with significant capital inflows. In March 2023, Ansell expanded with a $120 million investment, and Top Glove’s readiness in October 2024 to meet U.S. demand highlights potential for high returns. Moreover, increasing domestic production reduces dependency on imports, appealing to investors seeking stable and growing sectors.

Export-import dynamics are shaped by China’s 17.2% share in global exports as of 2022 and rising U.S. tariffs announced in October 2024. Similarly, Top Glove anticipates a 10 to 20-fold increase in U.S. shipments. Therefore, shifting trade policies and strategic manufacturing locations are pivotal for maintaining competitive advantage.

Adjacent Markets Analysis

Adjacent to the Global Industrial Safety Gloves Market, these related sectors exhibit significant growth driven by increasing workplace safety regulations and rising awareness regarding worker protection. Below is a snapshot of key markets that complement the safety gloves segment, with insights into their market trajectories:

- With a CAGR of 7.0%, the Global Fall Protection Market will expand from USD 3.1 billion in 2023 to USD 6.1 billion by 2033. Increased focus on preventing fall-related injuries is a key growth factor.

- Projected to grow at a robust CAGR of 8.1%, the Global Respiratory Protective Equipment Market will rise from USD 15.4 billion in 2023 to USD 33.6 billion by 2033. Growing concerns about airborne hazards are boosting demand.

- The Global Disposable Protective Clothing Market is forecasted to grow from USD 2.6 billion in 2023 to USD 4.7 billion by 2033, with a CAGR of 6.2%. This growth is fueled by its increasing use in healthcare and hazardous work environments.

- From USD 4.1 billion in 2023, the Global Safety Eyewear Market is expected to reach USD 6.3 billion by 2033, at a CAGR of 4.4%. Rising awareness of eye safety in industrial settings supports market expansion.

- The Global Hearing Protection Devices Market, currently valued at USD 2.2 billion, is set to grow at a remarkable CAGR of 9.8%, reaching USD 5.6 billion by 2033. Noise-reduction technology advancements are fueling this growth.

- Expected to expand at a CAGR of 4.6%, the Global Ground Protection Mats Market will increase from USD 1.4 billion in 2023 to USD 2.2 billion by 2033, driven by rising infrastructure and construction activities.

These markets collectively enhance workplace safety standards and reflect the global commitment to fostering safer work environments.

Product Type Analysis

Disposable Gloves dominate with 54.3% due to their versatility and widespread use across various industries.

Disposable gloves have become essential in many sectors, including healthcare, food processing, and manufacturing. Their single-use nature ensures hygiene and reduces the risk of cross-contamination, making them highly preferred in environments where cleanliness is paramount.

Additionally, advancements in material technology have enhanced their durability and comfort, further increasing their adoption. The affordability and ease of availability also contribute to their dominance in the market.

Reusable gloves, while not as dominant as disposable ones, play a significant role in industries where long-term use is feasible and cost-effective. They offer durability and can be sanitized and reused multiple times, reducing waste and operational costs. This makes them ideal for construction and automotive industries, where workers require gloves that can withstand harsh conditions and repeated use.

The growing emphasis on sustainability is also driving the demand for reusable gloves, as businesses aim to minimize their environmental footprint. Although they hold a smaller market share compared to disposable gloves, their importance is increasing as companies seek more sustainable and cost-efficient safety solutions.

Material Type Analysis

Nitrile gloves lead the market with a substantial share due to their superior resistance to chemicals and punctures.

Nitrile gloves have gained immense popularity, especially in the healthcare and laboratory settings, where protection against biological hazards is critical. Their excellent barrier properties make them ideal for tasks that involve handling hazardous materials, providing users with reliable protection.

Additionally, nitrile gloves are latex-free, reducing the risk of allergic reactions, which broadens their appeal across various user groups. The versatility of nitrile material allows for the production of gloves in different thicknesses and textures, catering to specific industry requirements.

Latex gloves, known for their flexibility and comfort, remain a popular choice in medical and dental practices. They offer excellent tactile sensitivity, making them suitable for tasks that require precision.

Neoprene gloves are favored in industries that require resistance to oils, chemicals, and extreme temperatures. Their robust material properties make them suitable for applications in the oil and gas sector, providing reliable protection against harsh working conditions.

Other materials, such as vinyl and specialized polymers, cater to niche markets and specific industrial needs, contributing to the overall diversity and resilience of the industrial safety gloves market.

End-Use Industry Analysis

Construction industry leads the market with a 25.9% share due to the high demand for durable and protective gloves.

In the construction sector, workers are exposed to various physical hazards, including sharp objects, heavy machinery, and harsh environmental conditions. Protective gloves are essential to ensure safety and enhance productivity by preventing workplace injuries.

The continuous growth in construction activities globally, driven by urbanization and infrastructure development, propels the demand for industrial safety gloves. Manufacturers are focusing on producing gloves that offer maximum protection while maintaining comfort and flexibility, meeting the stringent safety standards required in construction sites.

Manufacturing industries also contribute significantly to the market, where workers handle machinery, chemicals, and perform tasks that require precise hand movements.

Healthcare remains a critical segment, especially highlighted during the COVID-19 pandemic, where the use of disposable gloves surged to prevent the spread of infections. The ongoing focus on hygiene and patient safety continues to sustain the demand for medical-grade gloves in hospitals, clinics, and other healthcare facilities.

Other industries, such as electronics and pharmaceuticals, also rely on industrial safety gloves to protect against specific hazards, contributing to the overall growth and diversification of the market.

Key Market Segments

By Product Type

- Disposable Gloves

- Reusable Gloves

By Material Type

- Nitrile

- Latex

- Neoprene

- Leather

- Polyethylene

- Others

By End-Use Industry

- Manufacturing

- Construction

- Oil and Gas

- Healthcare

- Food Processing

- Automotive

- Others

Driving Factors

Increasing Workplace Safety Regulations Drives Market Growth

The Industrial Safety Gloves Market is significantly influenced by the increasing workplace safety regulations. Governments and regulatory bodies worldwide are implementing stricter safety standards to protect workers from occupational hazards.

Consequently, industries are compelled to adopt high-quality safety gloves to comply with these regulations, ensuring worker protection and avoiding legal penalties. Additionally, the rise in workplace accidents has heightened the focus on safety measures, driving demand for advanced protective gloves.

Moreover, growing industrialization in emerging economies contributes to the market growth as new factories and industries adhere to safety regulations from the outset. These factors collectively create a robust demand for industrial safety gloves, fostering market expansion and encouraging manufacturers to innovate and improve their product offerings.

Restraining Factors

High Cost of Advanced Safety Gloves Restraints Market Growth

The Industrial Safety Gloves Market faces significant restraints due to the high cost of advanced safety gloves. Advanced gloves made from high-performance materials, such as Kevlar or nitrile, offer superior protection but come at a premium price.

Additionally, the investment required for high-quality gloves may deter companies from upgrading their existing safety gear, especially in regions with lower economic development. Supply chain disruptions, such as shortages of raw materials or increased transportation costs, further exacerbate the financial burden on manufacturers and consumers.

Moreover, the availability of cheaper substitute products, which may not offer the same level of protection, can lead to lower adoption rates of premium safety gloves. These financial challenges limit the overall market growth by making advanced safety gloves less accessible to a broader range of industries and businesses.

Growth Opportunities

Expansion in Healthcare Sector Provides Opportunities

The Industrial Safety Gloves Market has significant growth opportunities driven by the expansion in the healthcare sector. The ongoing global health challenges, including pandemics and increased healthcare infrastructure, have heightened the demand for disposable and high-protection gloves.

Healthcare workers require reliable and efficient gloves to ensure hygiene and prevent the spread of infections, thereby boosting the market. Additionally, innovations in glove design and functionality, such as enhanced grip and touch sensitivity, cater to the specific needs of medical professionals, further driving demand.

Furthermore, the increasing adoption of smart gloves equipped with sensors and connectivity features opens up new avenues for market expansion, allowing manufacturers to offer advanced protective solutions that meet evolving industry requirements.

Emerging Trends

Sustainable and Eco-friendly Glove Solutions Is the Latest Trending Factor

Sustainability is emerging as a key trending factor in the Industrial Safety Gloves Market, with a growing emphasis on eco-friendly glove solutions. Consumers and businesses are increasingly prioritizing environmental responsibility, driving demand for gloves made from sustainable materials such as biodegradable polymers and recycled fabrics.

Additionally, the integration of IoT in safety gloves is gaining traction, allowing for enhanced functionality and monitoring capabilities, which aligns with the modern industry’s move towards smart and connected solutions. Customization and personalization of gloves are also trending, as companies seek to provide tailored protective gear that meets specific needs and preferences.

Enhanced comfort and ergonomic designs are becoming popular, as workers demand gloves that not only offer protection but also improve usability and reduce fatigue. These trends collectively shape the market, pushing manufacturers to adopt sustainable practices and incorporate advanced technologies to stay competitive and meet the evolving demands of the workforce.

Regional Analysis

North America Dominates with Major Market Share

North America holds the leading position in the Industrial Safety Gloves Market, accounting for significant market share. This dominance is driven by stringent workplace safety regulations, high awareness about worker protection, and extensive industrial activity in sectors such as healthcare, construction, and manufacturing.

The region benefits from advanced technological capabilities that enable the production of high-quality safety gloves tailored to diverse industrial needs. Additionally, North America’s strong emphasis on occupational health and safety fosters widespread adoption of safety gloves in workplaces. The presence of key market players and significant investments in R&D further reinforce the region’s leadership in the market.

Regional Mentions:

- Europe: Europe maintains a robust presence in the Industrial Safety Gloves Market, driven by strict regulatory frameworks and a focus on sustainable practices. The demand for protective gloves in automotive and chemical industries supports steady growth.

- Asia Pacific: Asia Pacific is rapidly emerging as a key market player, fueled by industrial expansion and growing awareness about workplace safety. Countries like China and India are investing in large-scale manufacturing and construction projects.

- Middle East & Africa: The Middle East and Africa exhibit moderate growth in the market, primarily driven by construction and oil and gas industries. Investments in infrastructure development further propel the demand for safety gloves.

- Latin America: Latin America’s growth in the Industrial Safety Gloves Market is driven by the region’s expanding manufacturing and agriculture sectors. Efforts toward improving workplace safety standards are gradually boosting adoption rates.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Industrial Safety Gloves Market is dominated by key players like Ansell Limited, Honeywell International Inc., 3M Company, and MCR Safety, which lead through innovation, global reach, and diversified product portfolios.

Ansell Limited holds a significant position with its advanced glove technologies and strong presence across healthcare and industrial sectors. The company focuses on delivering high-performance gloves, ensuring both safety and comfort for workers. Its commitment to innovation and sustainability enhances its market standing.

Honeywell International Inc. is a major player offering a broad range of industrial safety gloves. Leveraging its expertise in advanced materials, Honeywell provides solutions that cater to diverse industries such as construction, oil and gas, and manufacturing. The company’s global footprint strengthens its competitive edge.

3M Company capitalizes on its innovation-driven approach, offering technologically advanced gloves tailored for high-risk industries. With strong R&D capabilities, 3M consistently delivers products that meet stringent safety standards while addressing user comfort and durability.

These companies collectively shape the competitive landscape, driving market growth through their focus on innovation, customer satisfaction, and compliance with global safety standards.

Major Companies in the Market

- Ansell Limited

- Honeywell International Inc.

- 3M Company

- MCR Safety

- Kimberly-Clark Corporation

- Superior Glove Works Ltd.

- Showa Glove Co.

- Lakeland Industries, Inc.

- Towa Corporation

- Globus (Shetland) Ltd.

- Radians, Inc.

- HexArmor

- Semperit AG Holding

- Dipped Products PLC

- Magid Glove & Safety Manufacturing Company LLC

Recent Developments

- Indian Rubber Gloves Manufacturers Association (IRGMA): In July 2024, the Indian Rubber Gloves Manufacturers Association (IRGMA) urged the Ministry of Environment, Forests, and Climate Change to ban the importation of chlorinated gloves. This move seeks to mitigate health risks for healthcare professionals and patients. IRGMA also advised government hospitals to procure Bureau of Indian Standards (BIS)-approved gloves through the Government e-Marketplace to ensure safety compliance.

- Innodisk: In October 2024, Innodisk launched the InnoPPE recognition solution, an AI-powered system for real-time detection of personal protective equipment, such as helmets and gloves, in industrial environments. This solution integrates with existing surveillance systems, aiming to enhance safety and compliance without operational disruption.

Report Scope

Report Features Description Market Value (2023) USD 8.4 Billion Forecast Revenue (2033) USD 17.8 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable Gloves, Reusable Gloves), By Material Type (Nitrile, Latex, Neoprene, Leather, Polyethylene, Others), By End-Use Industry (Manufacturing, Construction, Oil and Gas, Healthcare, Food Processing, Automotive, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ansell Limited, Honeywell International Inc., 3M Company, MCR Safety, Kimberly-Clark Corporation, Superior Glove Works Ltd., Showa Glove Co., Lakeland Industries, Inc., Towa Corporation, Globus (Shetland) Ltd., Radians, Inc., HexArmor, Semperit AG Holding, Dipped Products PLC, Magid Glove & Safety Manufacturing Company LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Safety Gloves MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Industrial Safety Gloves MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansell Limited

- Honeywell International Inc.

- 3M Company

- MCR Safety

- Kimberly-Clark Corporation

- Superior Glove Works Ltd.

- Showa Glove Co.

- Lakeland Industries, Inc.

- Towa Corporation

- Globus (Shetland) Ltd.

- Radians, Inc.

- HexArmor

- Semperit AG Holding

- Dipped Products PLC

- Magid Glove & Safety Manufacturing Company LLC