Global Industrial Drones Market By Offering (Hardware, Software, Services), By Drone Type (Single-Rotor Drones, Multi-Rotor Drones, Fixed-Wing Drones, Hybrid VTOL Drones), By Mode of Operation (Remotely Piloted Drones, Fully Autonomous Drones, Semi-Autonomous Drones), By End-Use Industry (Infrastructure, Agriculture, Media and Entertainment, Mining & Metals, Telecommunication, Logistics, Utilities, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171134

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

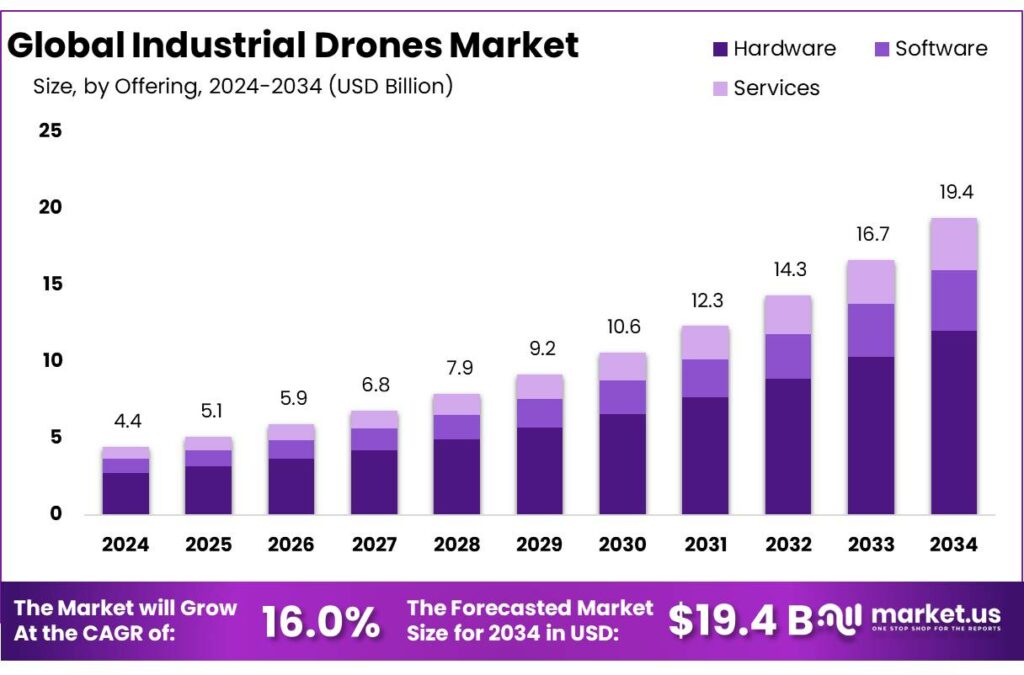

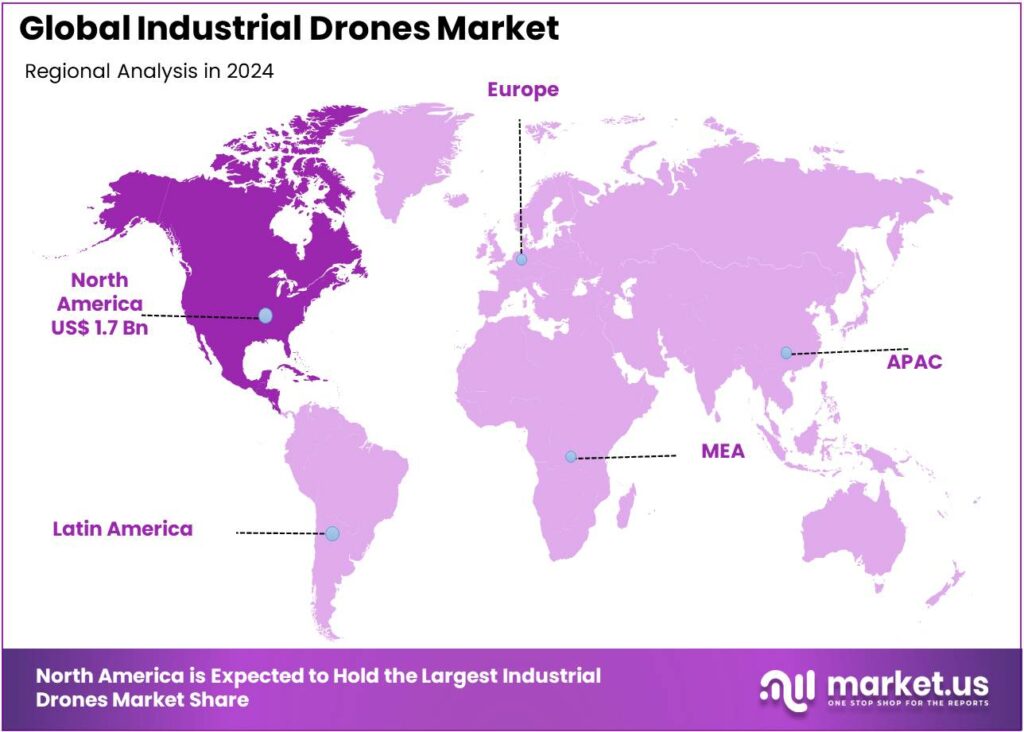

The global industrial drones market size is expected to be worth around USD 19.4 Billion by 2034, from USD 4.4 Billion in 2024, growing at a CAGR of 16.0% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 48.30% share, holding USD 8.8 Billion revenue.

The global industrial drones market is experiencing rapid expansion as organizations increasingly adopt unmanned aerial vehicles (UAVs) to address operational inefficiencies, overcome data collection limitations, and meet rising productivity benchmarks. Although widespread commercial deployment is still developing, early adopters are already achieving 13–14% cost reductions across inspection, monitoring, and logistics operations. This momentum is further strengthened by accelerated digital transformation initiatives driven by AI, machine learning, IoT, 5G connectivity, and cloud analytics.

- As global spending on digital transformation is projected to reach USD 4 trillion by 2027, many industries continue to face challenges in consolidating data pipelines, managing large data volumes, and extracting actionable insights. UAVs effectively address these gaps by delivering high-resolution visual, thermal, and geospatial intelligence from the outset.

Across supply chains, drones are reshaping operational workflows by enhancing route planning, monitoring congestion, and supporting internal transport movements. With global logistics disruptions costing industries up to USD 1.7 trillion annually, UAV-enabled real-time visibility is becoming increasingly valuable. In inventory management, drones reduce cycle-counting time by 85% and achieve more than 99% accuracy, enabling leaner warehouse operations and alleviating labor-intensive manual processes.

UAVs are also transforming industrial safety and security: approximately 60% of inventory losses are attributed to theft, while workplace safety issues account for 57% of workforce disruption. Drones provide continuous surveillance, hazard detection, and rapid response capabilities, significantly strengthening risk mitigation frameworks.

Key Takeaways

- The global industrial drones market was valued at USD 4.4 billion in 2024.

- In 2024, the hardware segment accounted for the largest share of the market, representing 62.1% of total revenue.

- By drone type, multi-rotor drones held the leading position with a 45.5% market share in 2024.

- Based on mode of operation, remotely piloted drones dominated the market in 2024, capturing 55.8% of total demand.

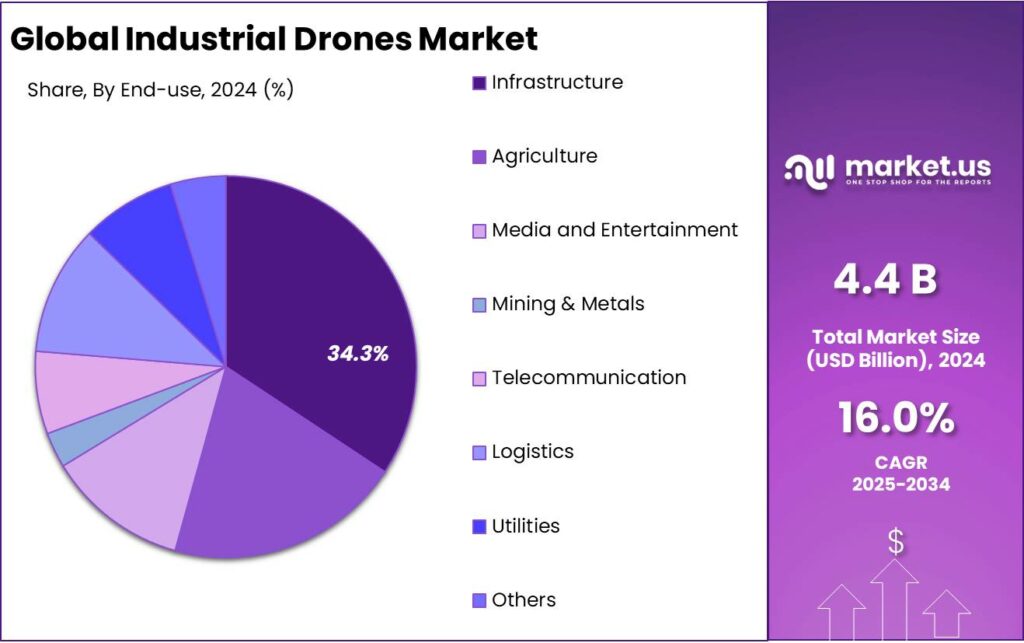

- Among end-use industries, the infrastructure sector was the largest contributor in 2024, accounting for 34.3% of the market share.

- North America led the global industrial drones market in 2024 with a substantial 39.1% share.

Offering Analysis

The hardware segment, which includes airframes, propulsion systems, batteries, sensors, and payload modules, accounted for a dominant 62.1% share of the global industrial drone market in 2024. Strong demand continues as organizations invest in physical UAV platforms to support inspection, surveying, delivery, and monitoring activities across industries such as energy, oil and gas, construction, and infrastructure development.

Hardware adoption is particularly robust in environments with demanding operating conditions, where durable airframes, extended-range power systems, advanced LiDAR or thermal sensors, and heavy-lift configurations are required. Ongoing infrastructure expansion and industrial automation initiatives worldwide continue to sustain high levels of investment in drone hardware.

The software segment, which includes flight control systems, data analytics platforms, cloud-based fleet management tools, and AI-driven inspection and mapping applications, represents the fastest-growing component of the industrial drone market, with an estimated CAGR of approximately 18.6%.

As enterprises generate increasing volumes of drone-derived data, demand for advanced analytical and visualization capabilities continues to rise. Growth is particularly strong in sectors such as utilities, mining, logistics, and agriculture, where actionable insights from aerial data enhance asset management, safety compliance, and operational efficiency.

Drone Type Analysis

Multi-rotor drones accounted for 45.5% of the global industrial drone market in 2024, supported by their versatility, cost-effectiveness, and ease of deployment. These platforms are widely used for inspection, surveillance, mapping, and short-range logistics applications.

Their ability to hover, maneuver precisely, and operate efficiently in confined or complex industrial environments makes them particularly well suited for use across construction, utilities, and oil and gas sectors. Strong adoption is also reflected in regulatory data; U.S. Federal Aviation Administration records indicate more than 855,860 commercial drones registered by 2025, with multi-rotor systems representing the majority.

Hybrid VTOL drones are emerging as the fastest-growing drone type, with an expected CAGR of 20.1% over the forecast period. These platforms combine the vertical takeoff and landing capabilities of multi-rotor drones with the long-range endurance and efficiency of fixed-wing systems, enabling extended missions without the need for runway infrastructure. Adoption is accelerating in industries requiring large-area coverage, including mining, agriculture, and environmental monitoring.

Growth is further supported by increasing approvals for Beyond Visual Line of Sight (BVLOS) operations worldwide; in Europe, BVLOS approvals doubled between 2022 and 2024, facilitating broader deployment of VTOL platforms. As industrial operators place greater emphasis on endurance, accuracy, and operational flexibility, hybrid VTOL drones are becoming a key driver of market expansion.

Mode of Operation Analysis

Remotely piloted drones accounted for 55.8% of the global industrial drone market in 2024, supported by broad regulatory acceptance and strong operator familiarity. The majority of industrial applications—including facility inspection, security surveillance, and construction monitoring—continue to require human oversight to meet aviation safety and compliance standards.

- Data from the U.S. Federal Aviation Administration indicates that more than 388,838 remote drone pilots were certified by 2024, highlighting the industry’s continued reliance on human-operated systems. Remotely piloted drones offer cost efficiency, rapid deployment, and enhanced operational control, particularly in complex or unpredictable environments. Their widespread adoption across utilities, oil and gas, logistics, and agriculture reinforces remote piloting as the dominant operational mode in industrial drone deployments.

Fully autonomous drones represent the fastest-growing operational segment, with a projected CAGR of 18.1%, driven by advancements in artificial intelligence, computer vision, and sensor fusion technologies. These systems are capable of executing predefined flight paths, performing obstacle avoidance, and collecting data without direct human intervention, enabling continuous monitoring and high-frequency inspections.

Growing regulatory support is accelerating adoption; globally, approvals for Beyond Visual Line of Sight (BVLOS) operations increased by nearly 40% between 2022 and 2024, facilitating broader deployment of autonomous drone fleets. Industries with repetitive and large-scale inspection needs—such as warehousing, mining, and solar energy—are leading the transition toward autonomy to reduce labor costs, improve data accuracy, and advance digital transformation initiatives.

End-use Analysis

In 2024, the infrastructure sector emerged as the largest end-use segment in the global industrial drones market, accounting for approximately 34.3% of total demand. Strong adoption is driven by the increasing use of drones for inspection, monitoring, surveying, and progress tracking across large-scale infrastructure assets, including bridges, roads, rail networks, airports, ports, and urban development projects.

Drones enable rapid data collection, reduce reliance on manual inspections, and significantly lower operational risks and costs associated with working at height or in hazardous environments. Growth in this segment is reinforced by ongoing investments in transportation networks, smart cities, and public infrastructure modernization worldwide. Governments and private developers are integrating drones into construction and maintenance workflows to improve efficiency, safety, and transparency.

The logistics segment represents the fastest-growing application area within the industrial drones market, with an expected CAGR of 19.7% over the forecast period. Growth is being driven by the rapid expansion of e-commerce and mounting pressure on traditional last-mile delivery networks. Global parcel shipments exceeded 161 billion units in 2022, according to Pitney Bowes, and volumes are projected to double by 2030, intensifying demand for faster, more cost-efficient delivery solutions.

Leading companies such as Amazon, UPS, Wing, and Zipline are actively scaling autonomous delivery pilots to address these challenges. Notably, Zipline has completed more than one million commercial medical deliveries, demonstrating the operational viability of drone-based logistics at scale.

Key Market Segments

By Offering

- Hardware

- Airframe

- Motors & Propulsion Systems

- Batteries & Power Systems

- Navigation & Control Systems

- Sensors & Cameras

- Communication Systems

- Others

- Software

- Services

By Drone Type

- Single-Rotor Drones

- Multi-Rotor Drones

- Fixed-Wing Drones

- Hybrid VTOL Drones

By Mode of Operation

- Remotely Piloted Drones

- Fully Autonomous Drones

- Semi-Autonomous Drones

By End-use

- Infrastructure

- Agriculture

- Media and Entertainment

- Mining & Metals

- Telecommunication

- Logistics

- Utilities

- Others

Drivers

Rising Demand for High-Frequency Inspection and Monitoring

The increasing need for high-frequency inspection and monitoring across industrial sectors is a major driver of the industrial drones market. UAVs equipped with high-resolution cameras, LiDAR, and thermal imaging systems offer faster, safer, and more cost-effective alternatives to manual inspections. These drones can efficiently assess large-scale assets such as pipelines, transmission lines, storage tanks, and construction sites, reducing inspection times by up to 60% while providing highly accurate datasets.

Their ability to minimize human exposure to hazardous or inaccessible environments significantly enhances workplace safety. With global infrastructure investments expected to surpass USD 5 trillion annually by 2030, organizations are increasingly turning to automated aerial monitoring to maintain operational continuity, comply with regulatory requirements, and detect faults before they escalate into costly failures.

Expansion of Precision Agriculture and Smart Farming

The rapid growth of precision agriculture is another key driver accelerating the adoption of industrial drones. UAVs enable farmers to monitor crop health, evaluate soil conditions, detect pest infestations, and optimize the application of water, fertilizers, and pesticides. With more than 120,000 agricultural drones deployed in China and global investment in smart farming continuing to expand at double-digit growth rates, drones are reshaping agricultural practices. Equipped with multispectral and thermal sensors, UAVs support data-driven decision-making that increases yields, reduces input costs, and enhances resource efficiency.

- In the United States, the adoption of agricultural drones has accelerated rapidly, with registrations under the Federal Aviation Administration rising from approximately 1,000 in January 2024 to about 5,500 by mid-2025. Strong uptake is also evident in several middle-income countries. In Thailand, for example, drones were deployed across 30% of the nation’s farmland in 2023, a remarkable increase from near-zero usage in 2019, primarily for pesticide application and fertilizer distribution.

Restraints

Regulatory Limitations on BVLOS and Autonomous Operations

One of the most significant restraints on the industrial drones market is the stringent regulatory environment governing Beyond Visual Line of Sight (BVLOS) and autonomous operations. In many regions, regulatory bodies continue to mandate human oversight, manual piloting, or extensive safety documentation before approving autonomous flights. Securing BVLOS waivers is often a lengthy process—requiring detailed risk assessments, operational manuals, and investment in costly detect-and-avoid technologies.

These constraints hinder the deployment of drones for long-range applications such as pipeline inspections, powerline monitoring, and logistics operations, where automation would offer substantial efficiency and cost benefits. Moreover, the slow pace of regulatory evolution and varying regional compliance frameworks create uncertainty for operators, complicating investment decisions, operational planning, and cross-border integration of drone fleets.

High Cost of Advanced Sensors and Enterprise-Grade Platforms

The high cost of advanced drone systems also serves as a major barrier to widespread adoption. Industrial-grade drones equipped with LiDAR scanners, multispectral cameras, thermal sensors, and AI-enabled navigation typically range from USD 20,000 to 50,000 per unit—far exceeding the price of consumer drones.

In addition to hardware, organizations must allocate budget for pilot training, certification, maintenance services, specialized analytic software, and cloud-based data storage, collectively raising the total cost of ownership. These financial demands are particularly challenging for small and medium-sized enterprises with limited capital for automation technologies. In emerging markets, import duties and the lack of local manufacturing further inflate costs, leading many potential users to defer adoption despite clear operational advantages.

Opportunity

Supportive Government Subsidies for Drone Adoption in the Agriculture Sector

Rising government support for agricultural modernization represents a significant opportunity for the industrial drones market. Numerous countries are introducing subsidies, financial incentives, and targeted technology programs to accelerate the integration of drones into farming operations. These initiatives aim to improve agricultural productivity, reduce resource consumption, and promote sustainable practices—areas where drones deliver measurable advantages through precision spraying, crop monitoring, soil analysis, and optimized input management.

In the United States, federal and state programs play an important role in enabling farmers to adopt drone technologies. USDA Rural Development programs, including the Rural Energy for America Program (REAP) and Value-Added Producer Grants (VAPG), offer funding for energy-efficient equipment and support new agricultural products and services.

The Sustainable Agriculture Research and Education (SARE) program provides grants for farmers and ranchers pursuing sustainable solutions, which may include drone-based precision agriculture. Additionally, numerous state-level agricultural departments offer grants aligned with local priorities, further expanding funding opportunities for drone adoption.

Across Europe, supportive frameworks under the Common Agricultural Policy (CAP) and national initiatives reinforce drone integration in farming. CAP instruments—particularly Pillar II rural development programs—provide investment support for modernizing physical assets, including advanced agricultural machinery such as drones.

The European Agricultural Fund for Rural Development (EAFRD) co-finances rural development projects that emphasize modernization, environmental performance, and innovation, creating a favorable environment for drone adoption. Individual EU member states and regions also supplement these programs with their own grants and subsidies to promote digital and sustainable agriculture.

Growing Adoption of Drones in Media and Entertainment

The increasing use of drones in the media and entertainment industry presents a significant opportunity for the industrial drones market. Drones have rapidly evolved from aerial filming tools into integral components of large-scale visual productions, enabling dynamic, immersive, and technologically advanced experiences that were previously unattainable.

One of the most notable developments is the rise of drone-based light shows, where hundreds or even thousands of synchronized UAVs equipped with LED lights create elaborate aerial choreographies. These displays not only replace traditional fireworks but also surpass them in precision, creativity, and environmental sustainability. A recent example is the Middle East’s largest drone show, featuring 9,000 drones operated by Dubai-based Lumasky to celebrate the announcement of Disney’s first regional theme park.

Drones are also transforming live performances and major entertainment events. Prominent artists such as Drake and Metallica have integrated drones into their concerts to deliver interactive visual effects that enhance audience engagement. At global festivals like Coachella, drone choreographies synchronized with music have become signature elements, elevating the emotional and visual impact of performances.

High-profile international events further demonstrate the expanding potential of drone entertainment—most notably the Tokyo 2020 Olympic Games, where over 1,800 drones formed a striking floating globe in the sky. Similar drone displays have been featured at the Super Bowl and other major cultural events, highlighting growing demand for drone-based visual storytelling.

Trends

Emergence of B2C Goods Deliveries via Drones

The rapid expansion of drone-based business-to-consumer (B2C) deliveries is reshaping the future of last-mile logistics. In 2024, approximately 14,000 daily deliveries are expected to contribute to a total of 5 million B2C drone deliveries worldwide, with this volume projected to surge to 808 million within the next decade.

This dramatic growth is supported by improving unit economics, as the average cost per delivery—currently estimated between $6 and $25—is anticipated to decline by more than 70% over the same period. Such cost reductions are expected to bring drone delivery prices in line with, and eventually below, traditional last-mile delivery models, marking a pivotal shift in logistics strategy and adoption.

Rising Use of Cargo Drones in Offshore Wind Operations

The deployment of heavy-lift cargo drones in offshore wind operations is rapidly advancing as energy companies seek safer and more efficient methods for transporting essential equipment. Ørsted, in partnership with UK-based operator Skylift, has begun using FlyingBasket cargo drones to deliver critical safety evacuation boxes weighing up to 70 kg—equivalent to the weight of a household washing machine.

These drones transport equipment from vessels directly to the nacelles atop wind turbines, positioned more than 100 meters above sea level, approximately the height of a 25-storey building. This initiative represents a major technological progression for the offshore wind sector. With over 550 flights completed and deliveries made to more than 400 turbines, it stands as the largest drone delivery program ever undertaken in offshore wind environments. It also marks the first instance of drone-based delivery being executed at such long distances from shore, reaching turbines located up to 75 miles offshore.

Geopolitical Impact Analysis

Escalating geopolitical tensions and tariff measures are exerting significant pressure on the industrial drones market, particularly in the United States. Tariffs imposed on drones and related accessories imported from China—where market leader DJI dominates global supply—are sharply increasing procurement costs.

Drone distributors and resellers dependent on Chinese-manufactured systems are seeing price hikes exceeding 100%, undermining their business models and reducing competitiveness. This cost inflation ultimately affects end users, as retail prices reflect the replacement cost of future inventory rather than the original unit cost.

The impact extends beyond finished drones to critical components. Many U.S. drone manufacturers rely heavily on Chinese-made motors, sensors, electronic components, and rare earth materials. China’s reciprocal tariffs and export controls on these key inputs are creating delays, increasing production costs, and disrupting supply chain continuity. These constraints are prompting manufacturers to reassess sourcing strategies and explore alternative production hubs—such as Vietnam and Mexico—to mitigate exposure to elevated tariffs and reduce reliance on China.

Regional Analysis

North America accounted for 39.1% of the global industrial drones market in 2024, supported by strong technology adoption, a mature regulatory environment, and substantial investment across key sectors such as energy, construction, agriculture, and logistics. The United States represents the majority of regional drone expenditure, benefiting from advanced Federal Aviation Administration (FAA) frameworks, the rapid expansion of drone-as-a-service business models, and increasing deployment for infrastructure inspection, surveillance, and public safety applications.

- According to the FAA, the U.S. commercial drone fleet is projected to reach 955,000 units, while the recreational fleet is expected to total approximately 1.82 million units by 2027. To accommodate this growth, the FAA continues to refine policies that enable safe integration of drones into national airspace.

The Asia Pacific region is emerging as the fastest-growing market, projected to expand at a CAGR of 20.2%, driven by widespread adoption across agriculture, smart cities, manufacturing, and e-commerce. China dominates regional drone production, manufacturing more than 70% of the world’s commercial UAVs, while Japan and South Korea are advancing drone-based automation to address workforce shortages associated with aging populations.

India is also gaining momentum, supported by rapid digitalization and government initiatives such as BVLOS trials, agricultural drone subsidy programs, and increased defense procurement. With accelerating urbanization, expanding industrial activity, and rising logistics demand, Asia Pacific is positioned to become a major hub for high-frequency drone operations, autonomous systems, and drone-in-a-box deployments over the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global industrial drones market is characterized by a broad and competitive landscape comprising companies that specialize in advanced UAV hardware, autonomous navigation technologies, data analytics, and industry-specific drone solutions. DJI continues to hold a dominant position, supported by its Mavic 3 Enterprise and Matrice series, which offer high-resolution imaging, RTK-enabled precision, and versatility across multiple industrial applications.

Skydio has strengthened its presence through AI-driven autonomous navigation capabilities, expanding adoption in infrastructure inspection and defense-related use cases with obstacle-aware drone platforms. Parrot focuses on secure, military-grade UAV solutions, with its ANAFI product line gaining traction among government agencies and industrial operators requiring high data security standards.

The following are some of the major players in the industry

- DJI

- Skydio, Inc.

- Parrot Drones SAS

- EHang

- Insitu (Boeing)

- Flyability

- 3D Robotics, Inc.

- Yuneec International Co. Ltd.

- AeroVironment, Inc.

- FLIR Systems, Inc.

- Microdrones GmbH

- Delair

- AgEagle Aerial Systems Inc

- Terra Drone Corporation

- Percepto

- Other Key Players

Recent Development

- In July 2025, DJI introduced a new generation of agricultural drones with the launch of the Agras T100, T70P, and T25P, featuring substantial improvements in payload capacity, operational efficiency, and automation capabilities. The updated models incorporate advanced safety technologies, including LiDAR, millimeter-wave radar, and Penta-Vision sensing systems, enhancing obstacle detection and flight reliability in complex farming environments.

Report Scope

Report Features Description Market Value (2024) USD 4.4 Bn Forecast Revenue (2034) USD 19.4 Bn CAGR (2025-2034) 16.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software, Services), By Drone Type (Single-Rotor Drones, Multi-Rotor Drones, Fixed-Wing Drones, Hybrid VTOL Drones), By Mode of Operation (Remotely Piloted Drones, Fully Autonomous Drones, Semi-Autonomous Drones), By End-Use Industry (Infrastructure, Agriculture, Media and Entertainment, Mining & Metals, Telecommunication, Logistics, Utilities, Others), Global Industrial Drones Market, Logistics & E-Commerce, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape DJI, Skydio, Inc., Parrot Drones SAS, EHang, Insitu (Boeing), Flyability, 3D Robotics, Inc., Yuneec International Co. Ltd., AeroVironment, Inc., FLIR Systems, Inc., Microdrones GmbH, Delair, AgEagle Aerial Systems Inc, Terra Drone Corporation, Percepto, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- DJI

- Skydio, Inc.

- Parrot Drones SAS

- EHang

- Insitu (Boeing)

- Flyability

- 3D Robotics, Inc.

- Yuneec International Co. Ltd.

- AeroVironment, Inc.

- FLIR Systems, Inc.

- Microdrones GmbH

- Delair

- AgEagle Aerial Systems Inc

- Terra Drone Corporation

- Percepto

- Other Key Players