Global Immunoassay Market Analysis By Product Type (Reagents & Kits (Rapid Test Reagents & Kits, ELISPOT Reagents & Kits, Western Blot Reagents & Kits, ELISA Reagents & Kits, Multiplex Assay Kits, Others), Analyzers/Instruments (Open Ended Systems, Closed Ended Systems), Software & Services), By Technology (Radioimmunoassay (RIA), Enzyme Immunoassays (EIA) (Chemiluminescence Immunoassays (CLIA), Fluorescence Immunoassays (FIA)), Rapid Test, Others), By Application (Oncology, Cardiology, Endocrinology, Therapeutic Drug Monitoring, Infectious Disease Testing, Autoimmune Diseases, Allergy Diagnostics, Toxicology, Newborn Screening, Others), By Specimen (Blood, Saliva, Urine, Others), By End-User (Hospitals, Pharmaceutical and Biotech Companies, Research & Academic Centers, Clinical Laboratories, Blood Banks, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 66677

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

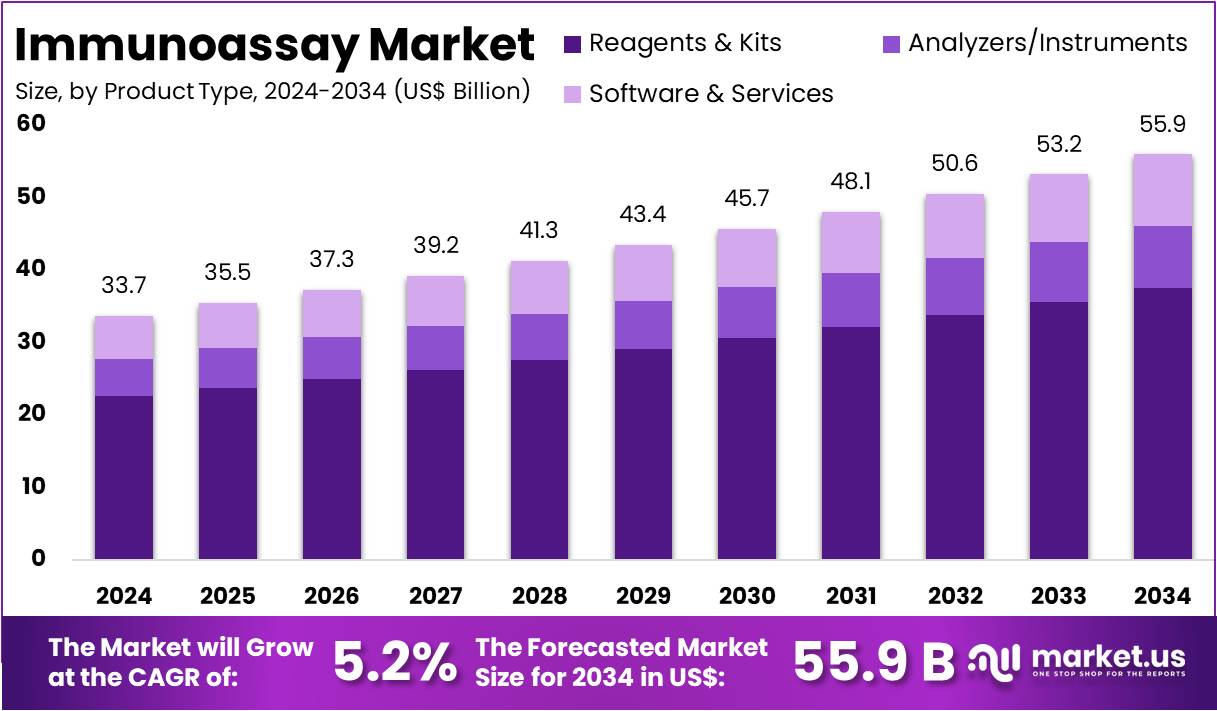

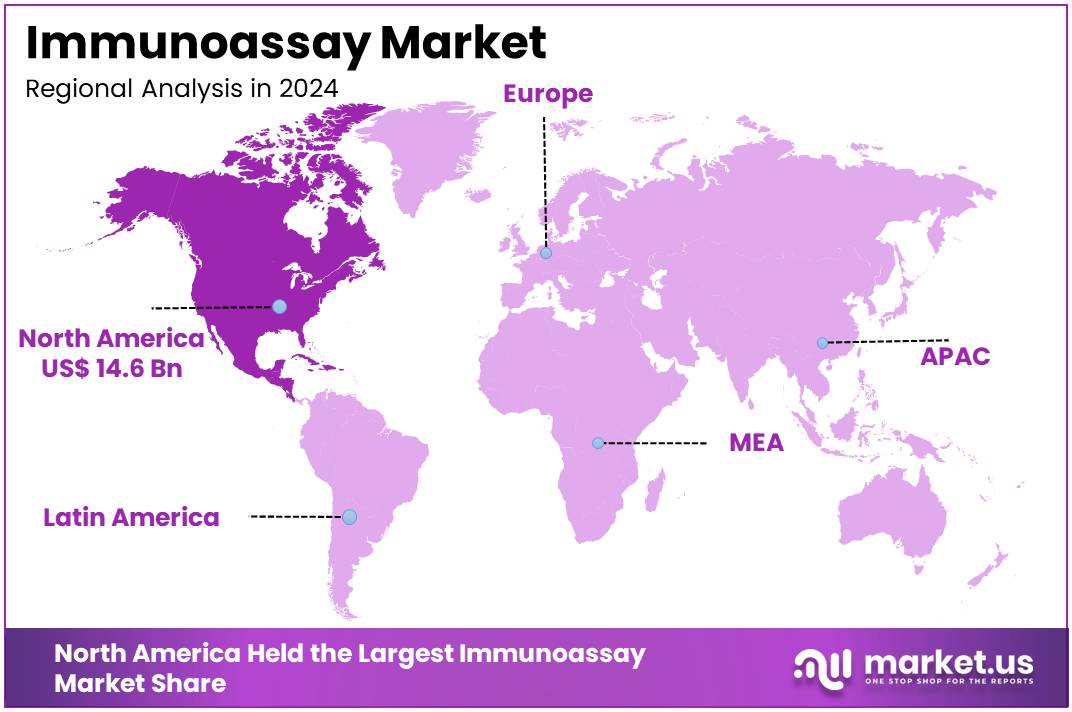

The Global Immunoassay Market size is expected to be worth around US$ 55.9 Billion by 2034, from US$ 37.7 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.4% share and holds US$ 14.6 Billion market value for the year.

Immunoassays are biochemical tests that rely on antigen–antibody binding for accurate detection of substances such as hormones, proteins, and infectious agents. According to scientific studies, the technique’s high specificity makes it effective even at very low concentrations. Formats such as ELISA, chemiluminescent immunoassays, and radioimmunoassays dominate clinical and research settings. These technologies are widely applied across diagnostics, pharmaceutical development, food safety, and environmental testing, enabling consistent and scalable monitoring of key biomarkers for both public and private health systems.

The immunoassay market is experiencing consistent growth, largely supported by the rising global disease burden. For instance, the World Health Organization (WHO) reported that in 2022, there were around 20 million new cancer cases worldwide, alongside 9.7 million deaths. These figures highlight sustained demand for tumor marker and companion diagnostic assays. According to the International Agency for Research on Cancer (IARC), lung cancer alone accounted for about 12.4% of all new cases and 18.7% of cancer-related mortality in the same year.

Noncommunicable diseases (NCDs) also fuel demand. WHO data show that NCDs were responsible for 43 million deaths in 2021, representing 75% of all non-pandemic global deaths. Within this group, cardiovascular diseases alone caused approximately 19 million deaths, while cancers contributed nearly 10 million. In the United States, the Centers for Disease Control and Prevention (CDC) reported 38.4 million people with diabetes. Such high prevalence underscores the growing requirement for regular HbA1c and microalbumin testing, where immunoassays play a central role in diagnosis and long-term disease monitoring.

Public Health Policies and Strategic Impact

Demographic shifts add further momentum. World Bank data confirm that the global population aged 65 years and above is steadily increasing. For example, testing intensity among older adults is significantly higher due to oncology, cardiology, endocrinology, and infectious disease monitoring. This demographic trend is expected to reinforce baseline volumes of immunoassay testing in hospitals and laboratories. Projections also suggest a major cancer burden increase, with new cancer cases potentially reaching 35 million by 2050, a 77% rise compared to 2022 levels.

Public health initiatives further strengthen adoption. The WHO Essential Diagnostics List highlights immunoassay-based tests for infectious diseases and glucose monitoring as critical tools. According to WHO, nearly 1.8 million avoidable NCD deaths occur annually in Europe, emphasizing the importance of preventive diagnostics. Similarly, WHO’s Global Antimicrobial Resistance Surveillance System (GLASS) promotes routine diagnostics, creating demand for validated serological and antigen assays. These programs support national procurement and ensure wider access, particularly in low- and middle-income countries where nearly 73% of NCD deaths are recorded.

Policy and funding structures also shape growth. The European Union’s In Vitro Diagnostic Regulation (IVDR) raises performance and clinical evidence requirements, while the U.S. FDA continues to approve innovative devices. WHO’s Prequalification program for in vitro diagnostics simplifies procurement pathways for priority diseases such as HIV, hepatitis, and malaria. In parallel, OECD data indicate that health expenditure for NCDs averaged USD 207 million per 100,000 population. With rising health budgets and post-pandemic laboratory investments, both centralized and point-of-care immunoassay platforms are positioned for sustained expansion in the coming decades.

Key Takeaways

- The global immunoassay market is projected to grow from US$ 37.7 Billion in 2024 to approximately US$ 55.9 Billion by 2034.

- The market expansion is expected at a compound annual growth rate (CAGR) of 5.2% during the forecast period from 2025 to 2034.

- In 2024, reagents and kits dominated the product type segment, securing over 67.0% share due to high usage across diagnostic and research applications.

- Enzyme immunoassays (EIA) led the technology segment in 2024, accounting for more than 60.5% share, driven by their efficiency and widespread adoption.

- Infectious disease testing emerged as the leading application segment in 2024, capturing more than 36.3% share, supported by global focus on disease diagnostics.

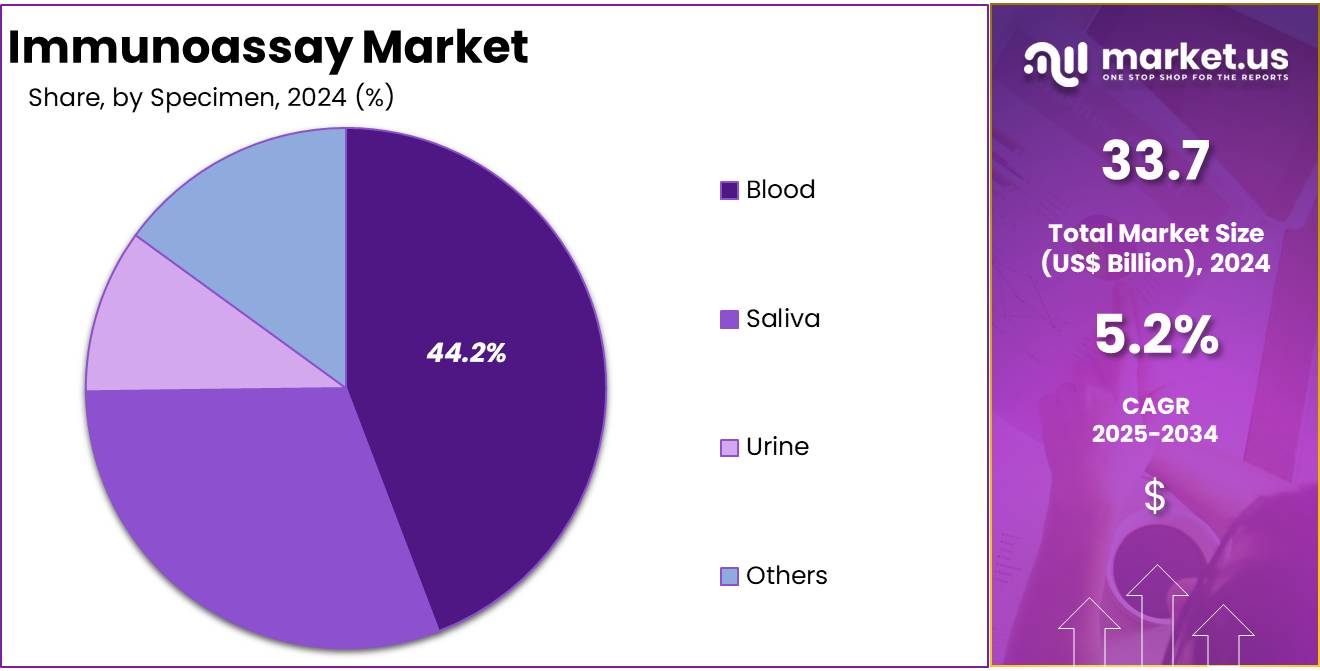

- Blood specimens dominated the specimen segment in 2024, holding over 44.2% share, reflecting their standard role in immunoassay-based diagnostic testing.

- Pharmaceutical and biotechnology companies represented the leading end-user category in 2024, holding more than 31.7% share, fueled by ongoing research and drug development.

- North America retained the largest regional share in 2024, accounting for more than 43.4% and valuing the market at US$ 14.6 Billion.

Product Type Analysis

In 2024, the Reagents & Kits section held a dominant market position in the Product Type Segment of the Immunoassay Market, and captured more than a 67.0% share. This section is supported by consistent use across diagnostic and research settings. Rapid test kits are widely adopted for quick results. ELISA kits continue to play a central role in disease detection. Multiplex kits are increasingly used for efficiency, while ELISPOT and Western Blot kits strengthen their presence in specialized testing.

Analyzers and instruments represent another key product category. Open Ended Systems are chosen in larger laboratories for their flexibility and ability to process higher volumes. Closed Ended Systems are commonly used in smaller settings due to simplicity and automation features. Growing reliance on automated platforms is observed, as they offer faster and more accurate outcomes. The rising demand for high-throughput testing further supports the expansion of analyzers in clinical diagnostics and healthcare services.

Software and services form the third segment within this market. Software platforms assist laboratories with data integration, assay management, and automated reporting. Cloud-based tools enable remote access, which supports efficient decision-making. Service offerings such as training, maintenance, and calibration provide steady revenue to manufacturers. These services also ensure accuracy and compliance with quality standards. The adoption of digital solutions is steadily increasing, indicating a shift toward advanced workflow automation and improved operational efficiency in immunoassay practices.

Technology Analysis

In 2024, the Enzyme Immunoassays (EIA) section held a dominant market position in the technology segment of the immunoassay market, and captured more than a 60.5% share. This leadership was linked to high sensitivity and broad diagnostic applications. Sub-segments such as Chemiluminescence Immunoassays (CLIA) and Fluorescence Immunoassays (FIA) also supported the expansion. CLIA gained demand through automation in laboratories. FIA found acceptance in point-of-care settings. Reliability and versatility continued to drive the adoption of enzyme immunoassays worldwide.

The Radioimmunoassay (RIA) section represented a smaller portion of the market. Its limited share was attributed to safety risks tied to radioactive materials. Many end-users preferred modern alternatives due to efficiency and reduced hazards. Nonetheless, RIA retained importance in specific uses. Endocrinology and hormone studies were two main areas where the method stayed relevant. Despite declining adoption, the segment maintained its clinical significance. This allowed it to preserve value in niche diagnostic practices.

The Rapid Test section recorded steady progress in the market. Growth was primarily encouraged by rising demand for quick diagnostic solutions. Infectious disease testing and home-based screening supported wider adoption. These tests offered convenience, minimal equipment needs, and cost-effectiveness. The “Others” category, including multiplex immunoassays and hybrid formats, also showed potential. Such methods enabled simultaneous analysis of multiple analytes. This was especially useful in research and clinical laboratories. The combination of innovation and practical utility supported their adoption.

Application Analysis

In 2024, the Infectious Disease Testing section held a dominant market position in the Application Segment of the Immunoassay Market, and captured more than a 36.3% share. This leadership was driven by the rising burden of diseases such as HIV, hepatitis, and tuberculosis. Demand for quick and reliable testing methods was also rising. New pathogen outbreaks created an urgent need for accurate diagnostic tools. These factors strongly reinforced the uptake of immunoassay-based solutions across hospitals, laboratories, and point-of-care settings.

Oncology was recognized as another significant application area. The growing incidence of cancer increased the use of immunoassays for early detection and treatment monitoring. Biomarker-based testing gained momentum and supported the segment. Cardiology also showed notable demand due to the prevalence of heart-related disorders. Immunoassays assisted in troponin testing and disease risk evaluation. Endocrinology applications expanded steadily, with diabetes and thyroid conditions requiring accurate hormone measurement. These factors collectively strengthened the role of immunoassays in clinical diagnosis.

Therapeutic Drug Monitoring was highlighted as a consistent contributor. It was driven by the need for safe dosage control and patient compliance. Autoimmune disease diagnostics advanced as cases of rheumatoid arthritis and lupus increased. Allergy diagnostics also grew, supported by rising sensitivities to food and environmental allergens. Toxicology recorded strong usage in both clinical and forensic testing. Newborn screening emerged as vital for detecting congenital disorders. Other areas, including fertility and veterinary testing, provided additional market opportunities for immunoassay applications.

Specimen Analysis

In 2024, the Blood Section held a dominant market position in the Specimen Segment of the Immunoassay Market, and captured more than a 44.2% share. Blood-based testing was observed as the most widely accepted method. This is because of its high accuracy and consistent reliability in diagnostics. The preference for blood immunoassays was supported by their extensive clinical use. Strong reliance on blood testing in detecting infectious diseases, cancers, and chronic conditions contributed to its market leadership.

The Urine Section was identified as another significant contributor. This growth was supported by its simple and non-invasive collection process. Urine immunoassays found rising applications in drug abuse screening and pregnancy testing. Their acceptance in point-of-care testing facilities also strengthened segment performance. The convenience of rapid detection and lower infrastructure requirements made urine-based testing an appealing choice. These factors ensured that the urine segment continued to secure a consistent position in the overall market.

The Saliva Section emerged as a rapidly advancing segment. This progress was supported by the growing interest in non-invasive diagnostic options. Saliva immunoassays demonstrated potential in detecting infectious diseases, hormonal changes, and even cancer-related markers. Technological advances also improved their efficiency and reliability. Alongside this, the Others Section, which includes samples such as stool, cerebrospinal fluid, and tissues, retained a niche role. These specimens were applied in advanced diagnostic research, particularly in neurological and oncology fields, ensuring steady demand growth.

End-User Analysis

In 2024, the Pharmaceutical and Biotech Companies Section held a dominant market position in the End-User Segment of the Immunoassay Market, and captured more than a 31.7% share. This leadership is explained by rising investments in drug discovery and the development of biologics and biosimilars. Large-scale research programs and growing demand for advanced therapeutic solutions have supported this dominance. Strong emphasis on accuracy and innovation in immunoassay technologies has reinforced the importance of this segment within the global market.

Hospitals were also identified as a major user group of immunoassay solutions. The growth in this segment is connected to the rising prevalence of chronic and infectious diseases. Increasing reliance on immunoassays for therapeutic monitoring and routine diagnostics has strengthened adoption in hospital settings. Clinical Laboratories followed closely, supported by their ability to conduct high-volume testing. Automation and reliability of laboratory-based immunoassay platforms have ensured their sustained presence in the broader diagnostic landscape.

Research and Academic Centers emerged as an essential part of the end-user base. Their demand is associated with ongoing studies in immunology, molecular biology, and biomarker research. Growing collaborations with pharmaceutical industries and increasing funding for academic projects have accelerated the use of immunoassays. Blood Banks also played a significant role by focusing on transfusion safety and compliance with regulatory standards. The “Others” category, which includes diagnostic centers and specialty clinics, has gained traction through rising adoption of decentralized and point-of-care immunoassay solutions.

Key Market Segments

By Product Type

- Reagents & Kits

- Rapid Test Reagents & Kits

- ELISPOT Reagents & Kits

- Western Blot Reagents & Kits

- ELISA Reagents & Kits

- Multiplex Assay Kits

- Others

- Analyzers/Instruments

- Open Ended Systems

- Closed Ended Systems

- Software & Services

By Technology

- Radioimmunoassay (RIA)

- Enzyme Immunoassays (EIA)

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

- Rapid Test

- Others

By Application

- Oncology

- Cardiology

- Endocrinology

- Therapeutic Drug Monitoring

- Infectious Disease Testing

- Autoimmune Diseases

- Allergy Diagnostics

- Toxicology

- Newborn Screening

- Others

By Specimen

- Blood

- Saliva

- Urine

- Others

By End-User

- Hospitals

- Pharmaceutical and Biotech Companies

- Research & Academic Centers

- Clinical Laboratories

- Blood Banks

- Others

Drivers

Rising Prevalence of Chronic and Infectious Diseases

The global rise in chronic and infectious diseases has emerged as a major factor fueling the demand for immunoassay-based diagnostics. Conditions such as cancer, cardiovascular disorders, and autoimmune diseases are increasing significantly across populations. Infectious diseases, including HIV and hepatitis, remain persistent public health challenges. These trends have resulted in a greater need for accurate, early-stage diagnostic solutions. Immunoassays, known for their sensitivity and specificity, are positioned as critical tools in disease detection and monitoring.

The role of immunoassays has become indispensable in clinical diagnostics due to their ability to detect disease biomarkers at very early stages. Early diagnosis is vital for initiating effective treatment strategies and improving patient outcomes. In cases such as cancer and cardiovascular disorders, timely identification of biomarkers can significantly reduce mortality. As healthcare systems prioritize precision diagnostics, immunoassays are increasingly adopted as reliable and cost-effective solutions. This is driving their usage across hospitals, laboratories, and research institutions worldwide.

Furthermore, the global disease burden has placed immense pressure on healthcare providers to implement advanced diagnostic systems. Immunoassays enable effective disease management by providing rapid and accurate results. They support both disease prevention and long-term monitoring, which are crucial in chronic conditions and infectious outbreaks. The increasing patient pool, combined with the urgent need for efficient diagnostic approaches, is expanding the market for immunoassays. This growing reliance underscores their role as a vital component of modern healthcare diagnostics.

Restraints

High Cost of Advanced Immunoassay Instruments and Kits

The adoption of sophisticated immunoassay platforms is restrained by their high setup and operational expenses. Advanced systems such as chemiluminescence and multiplex assays require significant capital investment. These instruments often demand specialized installation, calibration, and ongoing technical support. Such costs create a considerable financial burden for diagnostic laboratories and healthcare facilities, particularly in resource-constrained regions. The need for dedicated infrastructure and skilled operators further elevates expenditure, limiting accessibility in low- and middle-income countries where healthcare budgets are already strained.

In addition to initial investment, the continuous expenses associated with reagents and consumables represent another financial challenge. Immunoassays rely on high-quality kits, antibodies, and substrates that must be regularly procured. These recurring costs are unavoidable and directly impact laboratories’ operating budgets. Since the cost per test remains higher compared to conventional diagnostic techniques, the return on investment is often delayed. This financial barrier discourages smaller laboratories and clinics from integrating advanced immunoassay technologies into their diagnostic offerings.

The high financial requirement consequently restricts the widespread adoption of immunoassay technologies in developing regions. Healthcare providers in such markets are often forced to rely on traditional or less sophisticated diagnostic methods. This limits access to accurate and rapid testing, reducing early detection capabilities for several critical diseases. As a result, the market penetration of advanced immunoassay platforms remains largely confined to developed economies. This cost-related challenge is expected to continue as a key restraint in the overall growth trajectory of the global immunoassay market.

Opportunities

Expansion of point-of-care testing (POCT) applications

The expansion of point-of-care testing (POCT) applications represents a major growth opportunity for immunoassays. The rising demand for portable and rapid diagnostic solutions in decentralized healthcare settings such as clinics, physician offices, and home care is reshaping the diagnostics market. Immunoassays, when integrated into POCT devices, offer the ability to deliver accurate results at the patient’s location. This accessibility helps in addressing diagnostic gaps in remote areas and supports improved patient engagement by reducing dependency on central laboratories.

The integration of immunoassays into POCT devices provides significant benefits in reducing turnaround times. Faster results enable healthcare professionals to make timely clinical decisions, which is especially critical in managing acute conditions and infectious diseases. The adoption of POCT immunoassay devices is also supported by rising demand for early disease detection and preventive care. This creates opportunities for manufacturers to develop innovative solutions that meet the growing need for rapid, reliable, and easy-to-use diagnostic tools across multiple therapeutic areas.

Furthermore, the expansion of POCT applications aligns with broader healthcare trends, including digital health and home-based care. Immunoassays embedded in portable POCT platforms are expected to gain higher adoption as patients and providers prioritize convenience and efficiency. Market growth will also be supported by advancements in device miniaturization and connectivity features, enabling integration with electronic health records and telemedicine platforms. These advancements position immunoassay-based POCT solutions as key drivers of accessible, cost-effective, and patient-centered healthcare delivery.

Trends

Adoption of Automated and Multiplex Immunoassay Platforms

The adoption of automated and multiplex immunoassay platforms is emerging as a significant trend in clinical diagnostics and research laboratories. Automation reduces human error, enhances reproducibility, and improves workflow efficiency. Multiplexing allows the detection of multiple analytes in a single assay, reducing time and cost. Together, these features align with the growing demand for rapid and reliable results. Laboratories are increasingly investing in such systems to address rising sample volumes and the need for standardized testing procedures.

The trend is further supported by the growing focus on personalized medicine. Multiplex immunoassays allow simultaneous measurement of biomarkers, enabling tailored treatment decisions for individual patients. Automation supports consistent outcomes across large-scale testing, which is crucial for clinical decision-making. Pharmaceutical companies and research institutions are adopting these platforms to accelerate drug discovery and development. This integration supports the advancement of precision medicine, which continues to gain traction as healthcare shifts toward patient-specific solutions.

The rise of automated and multiplex immunoassay platforms is also driven by the demand for high-throughput testing. Healthcare providers face increasing pressure to deliver faster results while maintaining accuracy. Automation reduces manual labor requirements and enables laboratories to process large numbers of samples efficiently. Multiplexing ensures comprehensive analysis without additional resources. This dual benefit enhances operational capacity, reduces turnaround times, and supports cost efficiency, making it an essential investment for modern laboratories aiming to remain competitive in the diagnostic space.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 43.4% share and holds US$ 14.6 Billion market value for the year. The region’s strong healthcare infrastructure and quick adoption of advanced diagnostic tools supported its leadership. A rising burden of chronic and infectious diseases has created consistent demand for immunoassay testing. The region’s advantage was also shaped by the presence of large patient populations requiring timely and regular diagnostic assessments.

The leading position of North America is also linked to the increasing prevalence of cancer, diabetes, and cardiovascular disorders. These conditions require ongoing diagnostic evaluations, which sustain market demand for immunoassay technologies. Moreover, frequent outbreaks of infectious diseases, including influenza and novel viral threats, boosted the role of immunoassay-based detection. As a result, demand for testing remained stable and widespread, further strengthening North America’s market share in the global landscape.

Technological advancements also played a major role in the region’s growth. Automated and high-throughput platforms improved diagnostic efficiency across hospitals, clinics, and laboratories. The integration of digital diagnostic tools and point-of-care testing further enhanced adoption levels. In the United States, significant R&D investments and strong biotechnology funding encouraged innovation. These initiatives supported rapid product development and market expansion, making the region a hub for next-generation immunoassay technologies.

Government support reinforced this growth momentum. Policies in the U.S. and Canada provided reimbursement benefits that reduced patient costs. These frameworks also encouraged healthcare providers to adopt advanced assays. Alongside this, major diagnostic players and academic institutions in the region fostered continuous product innovation. Regular approvals of new analyzers and immunoassay kits added to competitiveness, securing North America’s leadership within the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The immunoassay competitive landscape remains mature and highly concentrated at the top, with established players benefiting from large installed bases, broad menus, and automation ecosystems that create sustained entry barriers. Growth in mid-tier and decentralized platforms is being supported by hospital network consolidation, emergency department throughput needs, and cost pressures in emerging markets. In the near term, differentiation is expected to stem from menu innovation, automation connectivity, and service models that guarantee system uptime and rapid turnaround times, strengthening customer retention and reagent pull-through.

Abbott maintains a strong leadership position with its Alinity immunochemistry systems, particularly Alinity i and integrated Alinity ci platforms. These systems cover a wide range of assays, including cardiac, infectious disease, fertility, tumor markers, and thyroid testing. A consistent design across the Alinity family enables workflow simplification, standardization, and reduced ownership costs for multi-site hospital networks. Growth will be driven by menu expansion and high-throughput lab placements, securing recurring reagent revenues and further leveraging its installed base in integrated delivery networks.

Siemens Healthineers competes through its Atellica IM analyzers and Atellica Solution platforms, supported by legacy IMMULITE systems. Its Atellica architecture integrates immunoassay and chemistry testing while connecting to automation systems like Aptio, delivering flexibility and efficiency for core labs. Competitive advantages include consolidated footprints and high throughput for central laboratories. Growth is expected to come from migration of users from legacy systems to Atellica platforms, combined with reagent pull-through supported by automation integration in high-volume hospital networks.

bioMérieux, Danaher’s Beckman Coulter, QuidelOrtho, and Roche hold differentiated positions across the immunoassay segment. bioMérieux leverages its VIDAS family for decentralized testing in emergency and specialty care, focusing on infectious disease and acute care biomarkers. Beckman Coulter emphasizes throughput with its DxI series, including the next-generation DxI 9000 for large hospital labs. QuidelOrtho benefits from the 2022 merger, integrating core-lab immunoassay with rapid diagnostics to enhance menu breadth. Roche continues to lead with its cobas e analyzers, supported by deep Elecsys assay menus and strong ECLIA performance driving high reagent utilization.

Market Key Players

- Abbott

- Siemens Healthineers

- bioMérieux SA

- Danaher Corporation (Beckman Coulter)

- Ortho Clinical Diagnostics

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Becton Dickinson and Company

- Quidel Corporation

- Hologic Inc.

- Qiagen N.V.

- Agilent Technologies Inc.

- DiaSorin S.p.A.

- Tosoh Bioscience

- Merck KGaA

- Mindray Medical International

- Meridian Bioscience

- Bio-Techne

Recent Developments

- In October 2024: Abbott introduced the locally manufactured immunoassay module, Alinity i, along with an automated GLP (Good Laboratory Practice) line at its Hangzhou facility in China. This initiative represents one of the earliest local production efforts for imported immunoassay medical devices in the region. The facility is projected to produce approximately 500 million tests annually, serving both domestic and global markets.

- In August 2024: The U.S. FDA granted 510(k) clearance for the VITROS® Syphilis Assay. This clearance allows the test to be used on the VITROS 3600 Immunodiagnostic System as well as the VITROS 5600 and XT 7600 Integrated Systems. The approval expands the company’s immunoassay menu, strengthening its diagnostic portfolio.

- In December 2022: bioMérieux received CE marking for VIDAS® KUBE, the next-generation immunoassay analyzer designed to succeed the MINI VIDAS® and VIDAS® instruments. The commercial launch began in selected countries in early 2023, with global expansion continuing into the second quarter. The VIDAS® KUBE provides improved automation, greater workflow efficiency, and an expanded test menu. It is suitable for both clinical and industrial microbiology applications, remains compatible with existing pathogen test menus, and is validated under ISO 16140-2:2016, AOAC-RI, and AOAC-OMA standards.

Report Scope

Report Features Description Market Value (2024) US$ 33.7 Billion Forecast Revenue (2034) US$ 55.9 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Kits (Rapid Test Reagents & Kits, ELISPOT Reagents & Kits, Western Blot Reagents & Kits, ELISA Reagents & Kits, Multiplex Assay Kits, Others), Analyzers/Instruments (Open Ended Systems, Closed Ended Systems), Software & Services), By Technology (Radioimmunoassay (RIA), Enzyme Immunoassays (EIA) (Chemiluminescence Immunoassays (CLIA), Fluorescence Immunoassays (FIA)), Rapid Test, Others), By Application (Oncology, Cardiology, Endocrinology, Therapeutic Drug Monitoring, Infectious Disease Testing, Autoimmune Diseases, Allergy Diagnostics, Toxicology, Newborn Screening, Others), By Specimen (Blood, Saliva, Urine, Others), By End-User (Hospitals, Pharmaceutical and Biotech Companies, Research & Academic Centers, Clinical Laboratories, Blood Banks, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott, Siemens Healthineers, bioMérieux SA, Danaher Corporation (Beckman Coulter), Ortho Clinical Diagnostics, F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Sysmex Corporation, Becton Dickinson and Company, Quidel Corporation, Hologic Inc., Qiagen N.V., Agilent Technologies Inc., DiaSorin S.p.A., Tosoh Bioscience, Merck KGaA, Mindray Medical International, Meridian Bioscience, Bio-Techne Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abbott

- Siemens Healthineers

- bioMérieux SA

- Danaher Corporation (Beckman Coulter)

- Ortho Clinical Diagnostics

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Becton Dickinson and Company

- Quidel Corporation

- Hologic Inc.

- Qiagen N.V.

- Agilent Technologies Inc.

- DiaSorin S.p.A.

- Tosoh Bioscience

- Merck KGaA

- Mindray Medical International

- Meridian Bioscience

- Bio-Techne