Global Iced Tea Market Size, Share, And Business Benefits By Product Type (Black Iced Tea, Green Iced Tea, Herbal Iced Tea, Others), By Form (Powder/Premix, Liquid/Ready-to-drink), By Nature (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146111

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

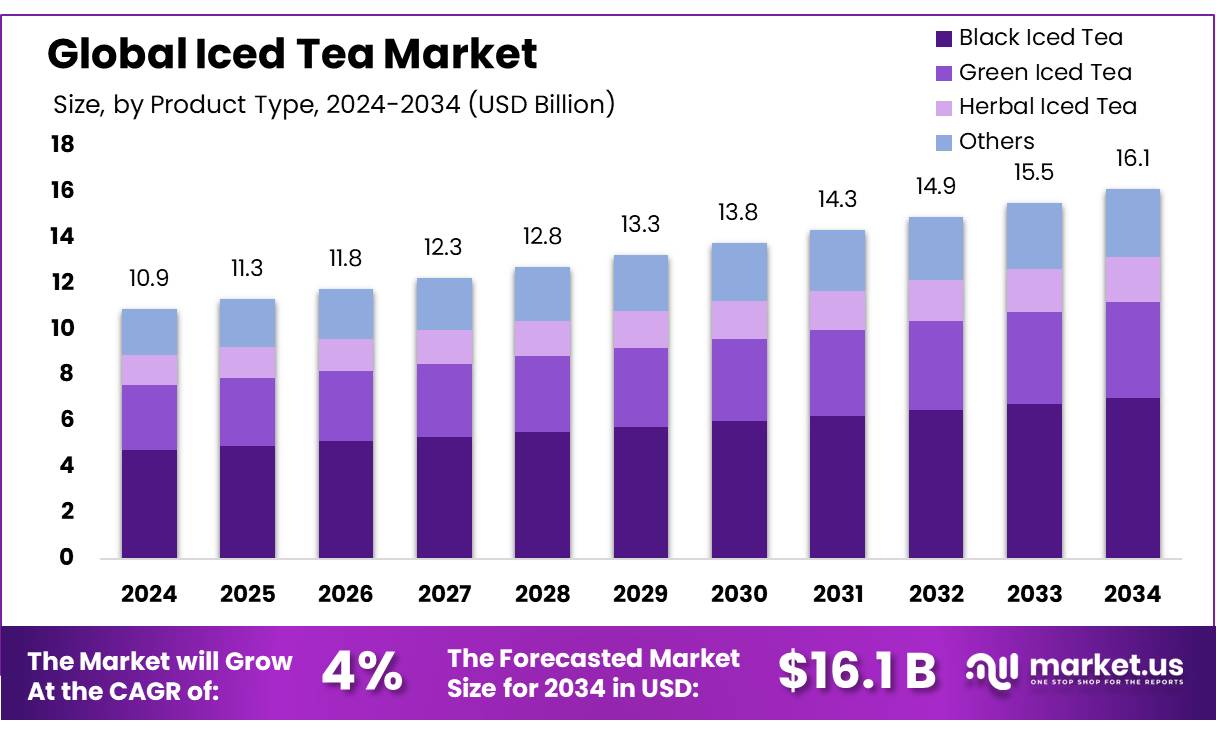

The Global Iced Tea Market size is expected to be worth around USD 16.1 Bn by 2034, from USD 10.9 Bn in 2024, growing at a CAGR of 4.0% during the forecast period from 2025 to 2034.

The Iced Tea market represents a dynamic segment within the global beverage industry, characterized by its wide consumer base and varied product offerings. Originating from both cultural traditions and modern innovations, iced tea has become a popular choice for refreshment across all ages, thanks to its versatility and health benefits. As of 2024, the global iced tea market is estimated to have reached a value of approximately USD 20 billion, driven by a growing consumer preference for healthier alternatives to sugary soft drinks.

In terms of market dynamics, the shift towards organic and natural ingredients has played a pivotal role in shaping the industry. Consumers are increasingly opting for iced teas that offer wellness benefits, such as herbal varieties that include ingredients like ginger, ginseng, and hibiscus. These preferences are steering product development and marketing strategies of major beverage companies.

Furthermore, the rise in disposable incomes globally has enabled more consumers to choose premium iced tea beverages, which are perceived as healthier. According to the U.S. Department of Agriculture, the consumption of tea, especially iced tea, has risen by 5% annually, highlighting a steady demand in a health-conscious market.

Government health campaigns and regulatory bodies are also influencing market growth by promoting healthier beverage choices. For example, the European Food Safety Authority has been actively regulating beverage ingredients, pushing manufacturers to reduce sugar levels and eliminate artificial additives in their iced tea products. These regulatory frameworks help reassure consumers about the quality and safety of the iced tea they consume, potentially driving market growth.

Key Takeaways

- Iced Tea Market size is expected to be worth around USD 16.1 Bn by 2034, from USD 10.9 Bn in 2024, growing at a CAGR of 4.0%.

- Black Iced Tea held a dominant market position, capturing more than a 43.5% share of the global iced tea market.

- Powder/Premix Iced Tea held a dominant market position, capturing more than a 76.5% share of the global iced tea market.

- Organic Iced Tea held a dominant market position, capturing more than an 85.7% share of the global iced tea market.

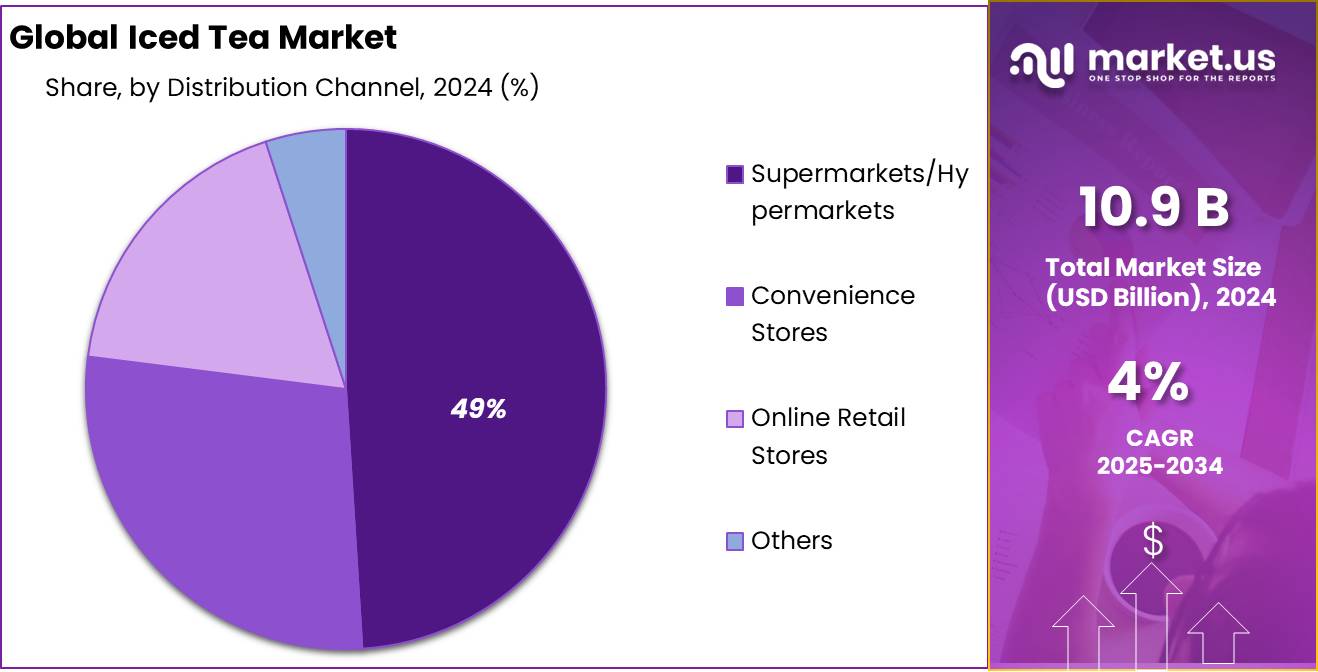

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 49.0% share of the global iced tea market.

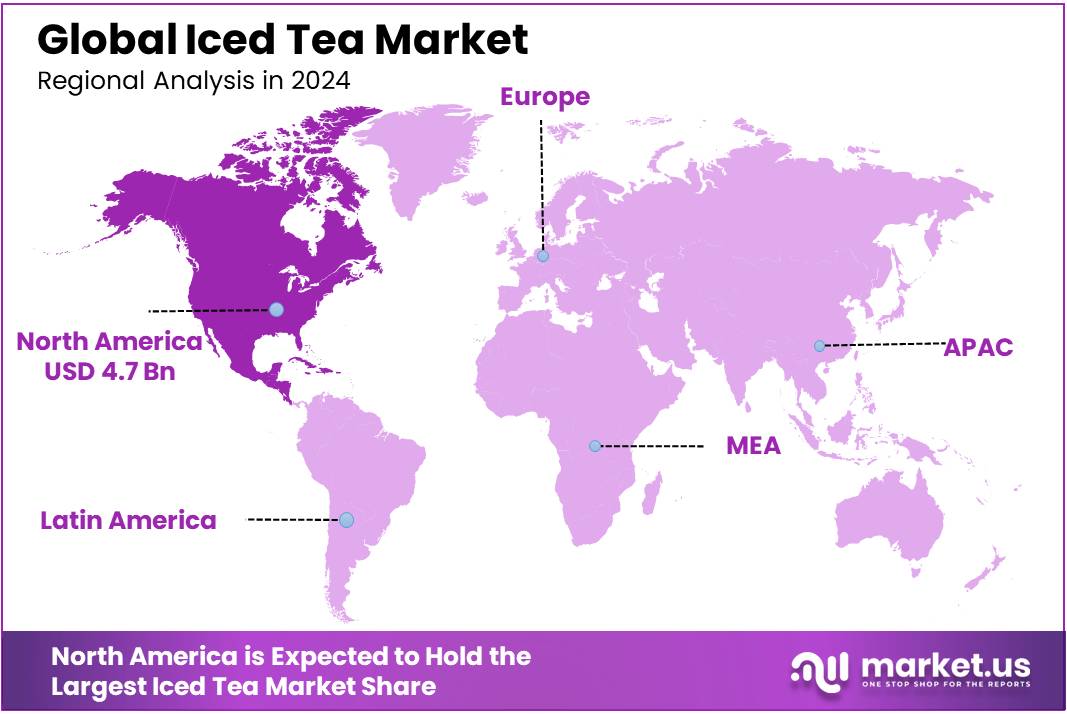

- North America stands out as a dominant force, capturing an impressive 43.6% market share, which translates to approximately USD 4.7 billion.

By Product Type

Black Iced Tea Continues to Lead with 43.5% Market Share Due to Traditional Preferences

In 2024, Black Iced Tea held a dominant market position, capturing more than a 43.5% share of the global iced tea market. This segment’s prominence is largely attributed to its longstanding presence in the beverage industry and its widespread acceptance among tea drinkers. Black iced tea is cherished for its robust flavor and versatility, appealing to both traditional tea consumers and new customers looking for a refreshing, low-calorie alternative to sugary drinks.

The enduring popularity of black iced tea can be credited to its adaptability with various flavors and infusions. From classic lemon and peach to more innovative combinations like blackberry and lavender, black iced tea offers a broad spectrum of options catering to evolving consumer tastes. Moreover, the health benefits associated with black tea, such as its high antioxidant content and potential to improve cardiovascular health, continue to attract health-conscious consumers.

By Form

Powder/Premix Iced Tea Dominates with 76.5% Share Due to Convenience and Variety

In 2024, Powder/Premix Iced Tea held a dominant market position, capturing more than a 76.5% share of the global iced tea market. This substantial market share is primarily due to the convenience and variety offered by the powder/premix form, which caters to the fast-paced lifestyle of modern consumers. These products allow for quick preparation without compromising on taste and quality, making them a popular choice among those looking for a quick, refreshing beverage.

The popularity of powder/premix iced tea is further bolstered by its long shelf life and ease of storage, which appeals to both individual consumers and commercial establishments such as cafes and restaurants. Additionally, manufacturers have successfully expanded the range of available flavors in this segment, from traditional favorites like lemon and peach to exotic and gourmet options, increasing its appeal across a diverse consumer base.

By Nature

Organic Iced Tea Leads Market with 85.7% Share Due to Growing Health Consciousness

In 2024, Organic Iced Tea held a dominant market position, capturing more than an 85.7% share of the global iced tea market. This impressive dominance underscores the increasing consumer preference for healthier and environmentally friendly products. Organic iced tea is made from ingredients that are grown without synthetic pesticides or fertilizers, aligning with the growing consumer trend towards organic and natural food products, which is largely driven by concerns about health risks associated with chemicals and a growing awareness of environmental issues.

The widespread popularity of organic iced tea is also supported by the perception that organic products offer superior taste and quality. As consumers become more health-conscious, they are willing to invest in premium products that promise added health benefits, such as higher antioxidant levels and no artificial additives, which are often associated with organic teas.

By Distribution Channel

Supermarkets/Hypermarkets Command a 49% Market Share, Fueled by Broad Accessibility

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 49.0% share of the global iced tea market. This distribution channel’s significant market share is attributed to its extensive reach and the convenience it offers to consumers. Supermarkets and hypermarkets provide a wide array of iced tea brands and varieties under one roof, catering to the diverse preferences of a broad customer base.

The strength of supermarkets/hypermarkets in the iced tea market is bolstered by their strategic locations in urban and suburban areas, making them easily accessible to the majority of consumers. These retail giants also benefit from strong supply chain efficiencies, which ensure a consistent availability of products. Additionally, the ability to offer competitive pricing and frequent promotions plays a critical role in attracting consumers who are looking for value in their purchases.

Key Market Segments

By Product Type

- Black Iced Tea

- Green Iced Tea

- Herbal Iced Tea

- Others

By Form

- Powder/Premix

- Liquid/Ready-to-drink

By Nature

- Organic

- Conventional

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail Stores

- Others

Drivers

Health Awareness and the Shift Towards Natural Beverages Propel Iced Tea Market Growth

One of the primary driving factors for the growth of the iced tea market is the increasing consumer health awareness coupled with a shift towards natural and healthier beverage options. In recent years, there has been a significant rise in consumer preference for beverages that offer health benefits without compromising on taste. This trend is particularly evident in the growing demand for iced teas that are marketed as containing natural ingredients and having lower sugar content.

According to data from the U.S. Department of Agriculture (USDA), there has been a noticeable decline in the consumption of sugary sodas, with a concurrent rise in the consumption of tea among American households. The USDA reports that tea consumption has increased by approximately 10% over the past five years, underlining the shift towards healthier beverage choices.

This trend is further supported by government initiatives aimed at reducing the intake of high-sugar drinks. For instance, several U.S. cities have implemented soda taxes to curb sugar consumption, indirectly benefiting the iced tea market as consumers turn to alternative beverages perceived as healthier. Additionally, the World Health Organization (WHO) has been actively promoting initiatives to reduce sugar intake in diets worldwide, highlighting the potential health risks associated with high sugar consumption, including obesity and diabetes.

The rise in health consciousness and the support from governmental health campaigns create a conducive environment for the growth of the iced tea market. These factors not only encourage consumers to choose healthier beverages but also push manufacturers to innovate and expand their product lines to include healthier options. As such, the iced tea market is expected to continue thriving, driven by both consumer preferences for wellness-promoting products and supportive regulatory frameworks aimed at fostering healthier dietary choices.

Restraints

Competition from Other Beverage Segments Challenges Iced Tea Market Growth

A significant restraining factor for the iced tea market is the intense competition from other beverage segments, particularly the booming ready-to-drink (RTD) coffee and energy drinks sectors. These competitors directly vie for the same consumer base that seeks convenient, refreshing beverages. According to the U.S. Department of Agriculture, while tea consumption has shown moderate growth, the RTD coffee market has witnessed a rapid expansion, with an annual growth rate surpassing 10% over the past several years, underscoring the competitive pressure on the iced tea segment.

This competition is intensified by marketing strategies and product innovations from coffee and energy drink brands, which often boast benefits like increased energy and enhanced mental alertness—appeals that resonate well with the younger demographics. Energy drinks, in particular, have capitalized on aggressive marketing campaigns and endorsements from celebrities and influencers, making them highly visible and attractive to consumers, especially millennials and Gen Z.

Additionally, government regulations on labeling and advertising of beverages can also restrain the growth of the iced tea market. For instance, the Food and Drug Administration (FDA) in the United States mandates clear labeling of caffeine content on packaged beverages. This regulation affects the marketing flexibility of iced teas that contain caffeine, as they must now compete more directly with other caffeinated beverages that might have stronger brand recognition and consumer loyalty in the category of stimulant drinks.

The combination of fierce competition from other beverage types and regulatory constraints not only challenges the market position of iced tea but also forces manufacturers to continually innovate and differentiate their products. To maintain and grow their market share, iced tea brands need to focus on unique selling propositions such as health benefits, organic ingredients, and sustainable sourcing, which can help them stand out in a crowded marketplace.

Opportunity

Expanding Flavors and Customization Offer New Growth Avenues for Iced Tea Market

A significant growth opportunity for the iced tea market lies in the expansion of flavor offerings and customization options. As consumer palates become more adventurous, there is increasing demand for a variety of flavors and tailor-made options in beverages. Iced tea manufacturers who innovate in flavor diversification are likely to capture a larger market share by appealing to a broader consumer base.

Recent trends have shown a marked preference for exotic and gourmet flavors in beverages. For instance, flavors such as pomegranate, blueberry, and jasmine are becoming increasingly popular among consumers seeking unique and refreshing tastes. According to insights from the U.S. Department of Agriculture, there is a noticeable consumer shift towards beverages that offer both health benefits and innovative flavors. This trend presents a lucrative opportunity for the iced tea industry to innovate by incorporating a variety of herbal and fruit infusions that can attract health-conscious consumers looking for flavor without compromising on health.

Moreover, the concept of customization, where consumers can tailor their beverages according to their taste preferences, is gaining traction. This trend is supported by the rise of specialty tea shops and cafes, which offer customized tea blends. These establishments often feature a range of options for sweetness levels, types of tea leaves, and flavor infusions, enabling consumers to have a personalized beverage experience.

Additionally, government initiatives promoting healthier lifestyle choices underscore the potential for growth in the iced tea market. For example, public health campaigns encouraging the reduction of sugary drink consumption can drive consumers towards healthier alternatives like iced tea, especially if these options are diversified in flavor and customizable.

Trends

Sustainability and Eco-Friendly Packaging Drive Innovations in Iced Tea Market

A prominent trend in the iced tea market that’s shaping its future is the increasing emphasis on sustainability, particularly in the realm of eco-friendly packaging. As environmental awareness rises among consumers, there is a growing demand for products that minimize ecological impact, which includes packaging solutions that are recyclable, biodegradable, or made from post-consumer recycled materials.

This trend is not just a niche market phenomenon; major food and beverage organizations, as referenced by the U.S. Environmental Protection Agency (EPA), indicate that sustainable practices can significantly influence consumer purchase decisions. The EPA has supported various initiatives to reduce packaging waste and enhance recycling efforts, which aligns with the consumer shift towards more environmentally responsible purchasing.

Iced tea brands that adopt eco-friendly packaging solutions are not only meeting regulatory standards and environmental guidelines but are also enhancing their brand image and appeal to environmentally conscious consumers. For example, the introduction of plant-based plastics and the use of glass bottles, which are both recyclable and perceived as healthier and safer by consumers, have gained popularity. These materials also help in preserving the taste and quality of iced tea better than some traditional packaging materials.

Moreover, the push towards sustainability is often accompanied by innovations in product formulation. Organic and all-natural ingredients in iced tea cater to the health-conscious consumer while aligning with the green ethos of sustainability. The combination of health benefits and environmental sustainability becomes a compelling selling point that differentiates brands in a competitive market.

Regional Analysis

North America Dominates Iced Tea Market with 43.6% Market Share Valued at $4.7 Billion

In the global landscape of the iced tea market, North America stands out as a dominant force, capturing an impressive 43.6% market share, which translates to approximately USD 4.7 billion. This substantial market presence is underpinned by a robust consumption culture that embraces iced tea as a staple beverage, favored for its refreshing qualities and versatility in flavor.

The North American market’s strength is further supported by well-established distribution channels that range from large supermarket chains to specialty cafes, all of which contribute to the widespread availability and popularity of iced tea. In the United States and Canada, iced tea is commonly consumed both at home and in dining establishments, reflecting its deep-rooted popularity in the region’s beverage habits.

Consumer preferences in North America are characterized by a strong inclination towards healthier beverage options, driving demand for iced teas that are low in sugar, organically produced, or feature natural ingredients and flavorings. This health-centric trend has spurred innovation among iced tea manufacturers, who are increasingly introducing products with added health benefits, such as antioxidants and reduced caffeine content, to cater to the wellness-focused consumer base.

Moreover, the region has seen a rise in the demand for premium iced tea products. Consumers are showing a willingness to pay a premium for gourmet and artisanal iced tea offerings, which often feature exotic flavors or organic ingredients. This shift towards high-quality, premium products is reshaping the market dynamics and encouraging brands to differentiate their offerings to capture the evolving consumer interest.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

4C Foods Corp. is renowned for its diverse array of beverage products, including a popular line of iced tea mixes. Known for quality and tradition, 4C offers flavors that cater to all palates, emphasizing convenience with their easy-to-prepare solutions. Their market presence is bolstered by a strong distribution network, ensuring wide availability across North America.

Arizona Beverage Company stands out with its iconic big can and wide variety of iced tea flavors. As one of the market leaders in ready-to-drink iced teas, Arizona is celebrated for its no-frills, affordable pricing and distinctive packaging. Their commitment to real tea without artificial flavors has helped them maintain a loyal consumer base.

Harney & Sons elevates the iced tea experience with their premium loose teas and iced tea blends. Known for their high-quality ingredients and expert blending, they cater to gourmet tea enthusiasts. Their commitment to providing a luxurious tea experience has earned them a respected place in high-end restaurants and cafes.

Snapple Beverage Corp. is a staple in the iced tea market, famous for its ‘Made from the Best Stuff on Earth’ slogan. Their wide array of flavors and the distinctive pop of their glass bottle caps resonate with a broad audience. Snapple has continually innovated its product line to include diet and naturally sweetened options, staying relevant in a health-conscious market.

Top Key Players in the Market

- 4C Foods Corp.

- Arizona Beverage Company

- BOS Brands

- Harney & Sons Fine Teas Snapple Beverage Corp.

- Harris Freeman & Co

- Keurig Dr Pepper Inc.

- Lipton (Unilever)

- Luzianne (Reily Foods Company)

- Nestle SA

- PepsiCo Inc.

- Sweet Leaf Tea Company

- Tata Consumers Products Limited

- Tejava

- The Coca-Cola Company

- The Hain Celestial Group, Inc.

- The Republic of Tea

- Turkey Hill Dairy

Recent Developments

In 2024, 4C Foods Corp. continued to solidify its position in the iced tea market with its wide range of flavored tea mixes, appealing to a diverse consumer base looking for both convenience and taste. As a family-owned business with a rich heritage, 4C Foods Corp. prides itself on offering high-quality, easy-to-prepare iced tea options.

In 2024, Arizona Beverage Company continued to excel in the iced tea market, known for its iconic large cans and wide variety of flavors that cater to an expansive customer base. Famous for its slogan, “America’s No. 1 Selling Iced Tea Brand,” Arizona has managed to uphold its reputation through consistent quality and innovative flavor profiles such as Green Tea with Honey and Arnold Palmer Half and Half.

In 2024, BOS Brands maintained its unique position in the iced tea market with its distinctive line of organic rooibos iced teas sourced from South Africa. Known for their vibrant and colorful packaging, BOS Brands appeals to health-conscious consumers with their all-natural, caffeine-free offerings that are rich in antioxidants and have no artificial colors or flavors.

Report Scope

Report Features Description Market Value (2024) USD 10.9 Bn Forecast Revenue (2034) USD 16.1 Bn CAGR (2025-2034) 4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Black Iced Tea, Green Iced Tea, Herbal Iced Tea, Others), By Form (Powder/Premix, Liquid/Ready-to-drink), By Nature (Organic, Conventional), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 4C Foods Corp., Arizona Beverage Company, BOS Brands, Harney & Sons Fine Teas Snapple Beverage Corp., Harris Freeman & Co, Keurig Dr Pepper Inc., Lipton (Unilever), Luzianne (Reily Foods Company), Nestle SA, PepsiCo Inc., Sweet Leaf Tea Company, Tata Consumers Products Limited, Tejava, The Coca-Cola Company, The Hain Celestial Group, Inc., The Republic of Tea, Turkey Hill Dairy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 4C Foods Corp.

- Arizona Beverage Company

- BOS Brands

- Harney & Sons Fine Teas Snapple Beverage Corp.

- Harris Freeman & Co

- Keurig Dr Pepper Inc.

- Lipton (Unilever)

- Luzianne (Reily Foods Company)

- Nestle SA

- PepsiCo Inc.

- Sweet Leaf Tea Company

- Tata Consumers Products Limited

- Tejava

- The Coca-Cola Company

- The Hain Celestial Group, Inc.

- The Republic of Tea

- Turkey Hill Dairy