Global HR Outsourcing Market Size, Share Analysis Report By Type (Business Process HR Outsourcing, Shared Services HR Outsourcing, Single Source HR Outsourcing, Software-as-a-Service HR Outsourcing), By Services (Hiring & Recruitment, Labor Laws & Legal Compliance, Payroll & Compensation Management, Safety & Health, Training & Development), By Organization Size (Large Enterprise, Small & Medium Enterprise), By Industry Vertical (IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Healthcare, Manufacturing, Retail & E-commerce, Government & Public Sector, Others (Education, Hospitality, etc.), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150567

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

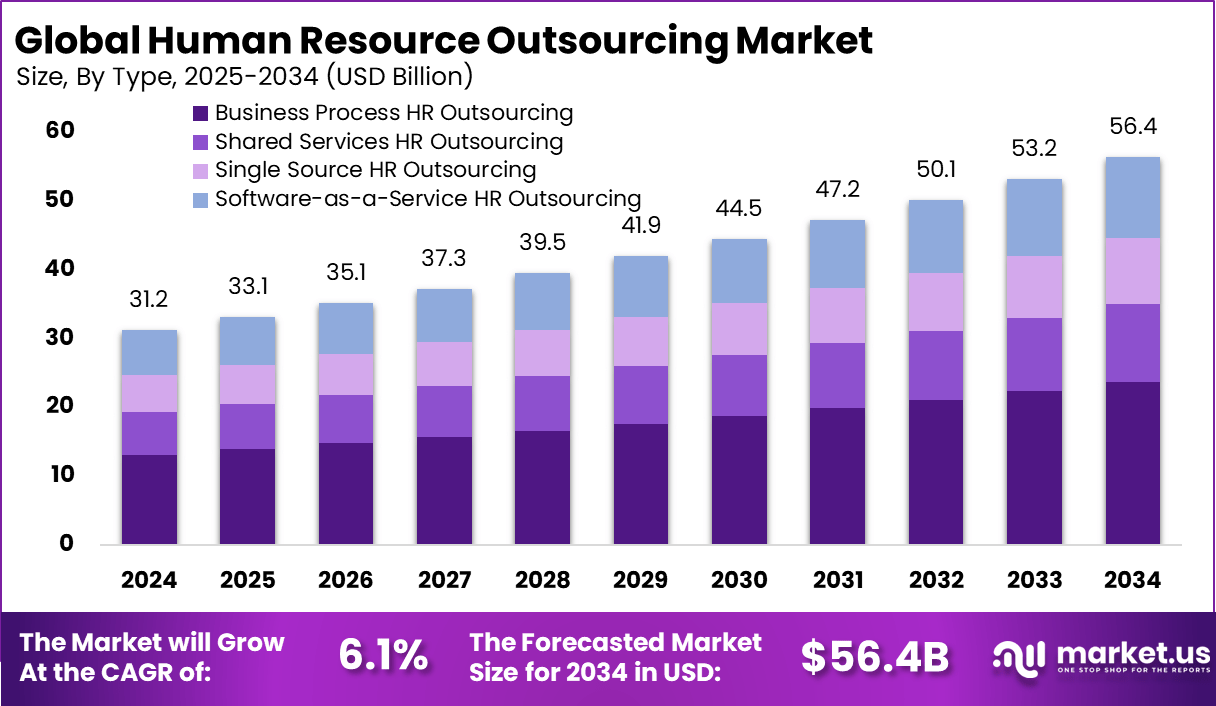

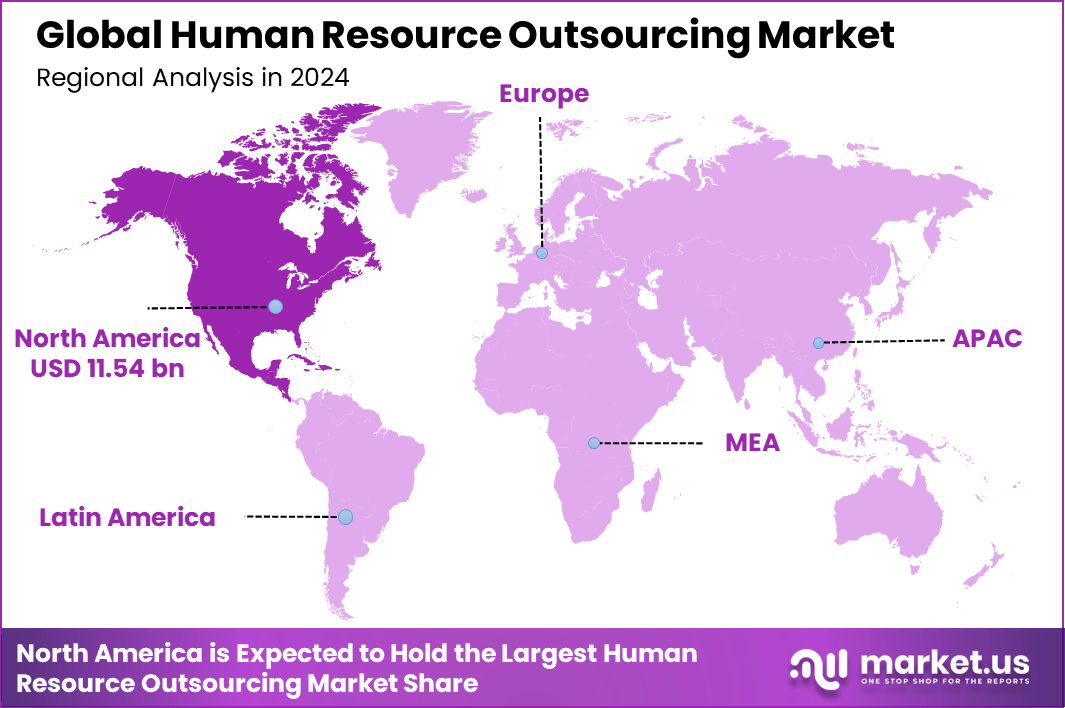

The Global HR Outsourcing Market size is expected to be worth around USD 56.4 Billion By 2034, from USD 31.2 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37% share, holding USD 11.54 Billion revenue.

The HR Outsourcing Market is undergoing a strategic transformation as organizations seek to optimize cost, compliance, and talent acquisition. Services such as payroll, recruitment, benefits administration, and workforce analytics are increasingly being delegated to specialized providers, enabling businesses to concentrate on core functions and strategic growth.

Modern cloud platforms and AI integration have refined these offerings, transitioning HRO from transactional support to strategic partnership models that drive operational complexities away from internal HR. Top Driving Factor stems from the persistent need for cost efficiency and streamlined operations. Organizations face mounting personnel expenses, compliance demands, and administrative burdens.

By outsourcing critical HR functions, firms achieve predictable spend, access to economies of scale, and reduction of in-house process inefficiencies. This shift is supported by economic pressures like inflation and a competitive labor market, which make scalable solutions increasingly attractive. The growing use of AI, automation, and cloud platforms is driving efficiency and innovation across HR outsourcing services.

For instance, In July 2023, Gushwork, an AI-driven platform, received funding from Lightspeed to advance its automation and business process optimization tools. By using generative AI, the platform simplifies tasks like data handling, communication, and workflow automation. This move reflects the growing trend of AI adoption in outsourcing services, particularly in areas such as Human Resource Outsourcing (HRO).

According to Kaapro’s recent insights, organizations can cut HR-related operational costs by up to 40% when outsourcing core functions such as payroll management, benefits administration, and talent acquisition. This level of cost efficiency has positioned outsourcing not merely as a tactical option but as a fundamental business decision in today’s competitive environment.

According to Tawzef, 80% of businesses now use HR outsourcing to gain access to expert services and streamline costs, while 58% specifically cite cost reduction as a primary driver. Deloitte’s research further shows that 78% of companies were satisfied with their outsourcing outcomes, noting that providers either met or exceeded cost-related goals. Key functions such as recruitment (54%) and payroll (37%) remain the most commonly outsourced, while employee training is also gaining traction.

Key Takeaways

- The Global HR Outsourcing Market was valued at USD 31.2 Billion in 2024 and is projected to reach USD 56.4 Billion by 2034, growing at a steady CAGR of 6.1% during the forecast period.

- North America led the market with a dominant 37% share, contributing USD 11.54 Billion in revenue, reflecting high outsourcing penetration across enterprise operations.

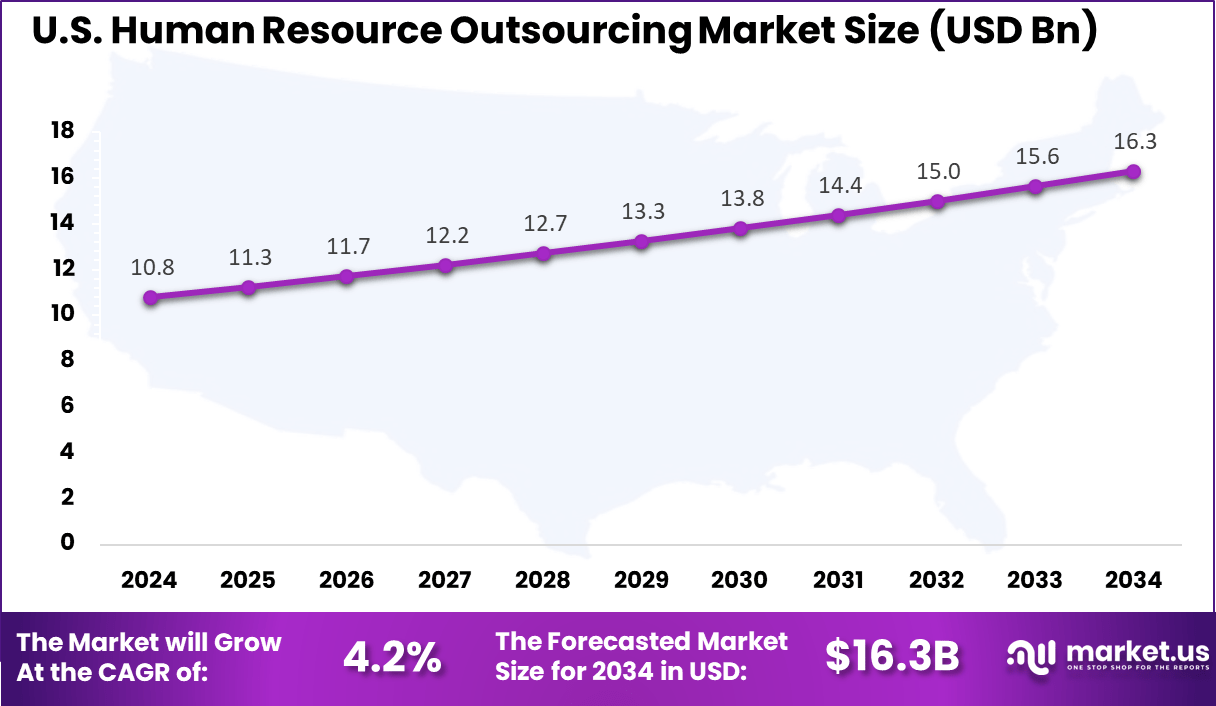

- The U.S. market alone generated USD 10.8 Billion in 2024 and is forecasted to expand at a CAGR of 4.2%, supported by rising demand for scalable workforce solutions.

- Business Process HR Outsourcing held the largest share by type at 42%, driven by increasing adoption of end-to-end HR service models across large corporations.

- The Payroll & Compensation Management segment accounted for 34% of the market by services, reflecting consistent demand for automated salary processing and compliance solutions.

- Large Enterprises dominated the market by organization size, capturing 62% share, owing to their ability to outsource complex HR functions for cost efficiency and scalability.

- The IT & Telecom sector emerged as the leading industry vertical with 21% market share, due to its dynamic workforce structure and high focus on core operational efficiency.

Impact of AI

The integration of artificial intelligence into HR outsourcing has introduced substantial changes, reshaping both process efficiency and workforce strategy. AI-driven automation has allowed routine tasks – such as résumé screening, interview scheduling, payroll, and compliance monitoring – to be transferred to intelligent systems, freeing human resources teams to focus on strategic, creative work.

This shift has been observed globally: Indian recruiters, for instance, now allocate up to 70% of hiring budgets to AI tools to enhance quality and precision, signaling the depth of this transformation. One of the most transformative effects of AI in HR outsourcing is the significant reduction in headcount for repetitive roles. Major firms, including IBM, have replaced hundreds of HR positions with AI agents, reducing HR costs by roughly 40%.

While this move addresses productivity and budget pressures, it also necessitates a proactive response to mitigate workforce displacement. Organizations are thus investing in reskilling initiatives – often aiming for 60% upskilling and 40% strategic hiring of new talent – to prepare HR professionals for roles focused on AI oversight, analytics, and ethical governance.

AI is enhancing decision-making through predictive and people-analytics tools that identify at-risk employees, forecast skill gaps, and optimize workforce planning. Studies show that nearly 93% of companies employing AI in talent acquisition report strong efficiency gains, with 67% acknowledging cost savings and resource optimization. These systems also help reduce bias: roughly 30% of HR professionals report AI automation has diminished hiring bias by replacing subjective judgment with data-driven criteria.

US Market Expansion

The market for Human Resource Outsourcing (HRO) within the U.S. is growing tremendously and is currently valued at USD 10.8 billion, the market has a projected CAGR of 4.2%. The U.S. market for Human Resource Outsourcing (HRO) is experiencing rapid growth due to the increasing need for cost-effectiveness and operational efficiency.

The emergence of digital HR solutions, including AI, automation, and advanced analytics, has led to an increase in the efficiency (and scalability) of HRO services. Also, the increase in hybrid and remote workplace vocations has increased demand for flexible, information-driven HR products and services, contributing to market expansion.

For instance, In April 2024, GA Partners, a leading HR outsourcing provider, acquired Teamworks Group, a Utah-based professional employer organization (PEO). This strategic move expands GA Partners’ presence in the U.S. market and enhances its ability to deliver comprehensive HR services, including payroll, benefits administration, and compliance support. By integrating Teamworks Group’s capabilities, GA Partners aims to help more businesses improve workforce efficiency and streamline HR operations nationwide.

In 2024, North America held a dominant market position in the Global Human Resource Outsourcing (HRO) Market, capturing more than a 37% share, holding USD 11.54 billion in revenue. North America’s leading position in the Global Human Resource Outsourcing (HRO) Market is due to its advanced technology, demand for efficient HR services, and a large number of large companies.

The expansion of remote work models and hybrid workplace strategies across the United States and Canada has accelerated the demand for flexible and scalable HR outsourcing services. Furthermore, a rise in small and medium-sized enterprises (SMEs) seeking cost-effective HR solutions has contributed significantly to the market’s growth in this region.

For instance, In December 2023, Vensure Employer Solutions acquired Canadian Payroll Services, broadening its presence and expanding its HR services across North America. This acquisition allows Venture to strengthen its position in the U.S. and Canadian markets by offering enhanced payroll and HR solutions to businesses across the region.

Type Analysis

In 2024, Business Process HR Outsourcing (BPO) segment held a dominant market position, capturing more than a 42% share in the Human Resource Outsourcing market. This dominance can be attributed to the rising preference among enterprises to delegate complete HR functions – such as payroll processing, recruitment, training, benefits administration, and compliance management – to external service providers.

By outsourcing end-to-end HR activities, organizations have been able to improve operational efficiency, reduce overhead costs, and ensure better adherence to regulatory frameworks. The shift from transactional to strategic HR management has further strengthened the demand for comprehensive BPO services. The increasing complexity of labor laws, especially across multi-country operations, has encouraged companies to opt for full-spectrum HR outsourcing solutions.

For Instance, in November 2024, Capgemini was recognized by The Hackett Group as a Digital World-Class Provider in its Multi-Process HR Outsourcing Digital World-Class Matrix. This recognition highlights Capgemini’s strong capabilities in delivering digital HR solutions that drive efficiency, innovation, and transformation across the HR function.

Business Process HR Outsourcing provides not only administrative relief but also access to specialized HR technology and domain expertise, which is especially critical for large enterprises operating in diverse geographies. Moreover, the integration of automation tools, analytics, and cloud-based platforms into BPO services has improved decision-making and enhanced workforce engagement.

Services Analysis

In 2024, the Payroll & Compensation Management segment held a dominant market position, capturing more than a 34% share in the Human Resource Outsourcing market. This segment’s leading position is primarily driven by the consistent demand for accuracy, compliance, and timely salary disbursements across all types of businesses.

Managing employee compensation involves navigating complex tax structures, varying wage laws, and multiple payment cycles, which makes it both critical and resource-intensive. As a result, companies are increasingly outsourcing payroll functions to ensure precision, reduce errors, and avoid regulatory penalties.

For instance, In June 2025, IBN Technologies expanded its payroll processing services for businesses in Oregon by offering secure, streamlined solutions. This move aims to enhance payroll efficiency and compliance for local organizations, providing them with advanced, secure solutions that ensure timely and accurate payroll management.

The segment has also gained momentum due to advancements in automation, cloud-based payroll systems, and data integration tools, which enable real-time visibility and centralized management. In addition, rising global employment, including remote and cross-border teams, has increased the complexity of payroll operations, pushing organizations to depend on outsourcing partners with multi-country capabilities.

Organization Size Analysis

In 2024, the Large Enterprise segment held a dominant market position, capturing more than a 62% share in the Human Resource Outsourcing market. This dominance is primarily due to the scale and complexity of HR operations within large organizations, which often span across multiple regions and legal jurisdictions.

With a broad workforce to manage, these enterprises rely heavily on outsourcing partners to streamline critical HR functions such as payroll processing, benefits administration, recruitment, and compliance management. Outsourcing enables them to reduce internal administrative burdens, control operational costs, and maintain consistent HR standards across global locations.

Moreover, large enterprises typically have the financial capacity to invest in full-spectrum HRO services that are integrated with advanced technologies like AI-based talent analytics and cloud-based HR platforms. These solutions allow for improved workforce planning, better employee engagement, and timely compliance with evolving labor regulations.

For Instance, in May 2025, the U.S. Office of Personnel Management (OPM) awarded a significant HR management contract to Workday, a leading provider of cloud-based HR solutions. This large enterprise contract highlights the increasing trend of government agencies turning to advanced Human Resource Outsourcing (HRO) solutions to streamline operations and improve workforce management.

Industry Vertical Analysis

In 2024, the IT & Telecom segment held a dominant market position, capturing more than a 21% share in the Human Resource Outsourcing market. The segment’s leadership is largely driven by the dynamic and fast-paced nature of the IT and telecom industries, which demand continuous workforce scaling, global talent acquisition, and strict compliance with local and international labor laws.

Companies in this vertical often operate across multiple geographies and face high employee turnover, making it essential to have efficient and responsive HR systems. Outsourcing HR services allows these firms to manage complex employee structures while ensuring cost efficiency and regulatory adherence.

The growing reliance on contract workers, remote teams, and project-based employment models in the tech sector has also fueled the need for flexible HR outsourcing solutions. Service providers offer end-to-end support for recruitment, payroll, performance management, and training, allowing IT and telecom companies to focus on core technological innovation and service delivery.

For Instance, in February 2025, Saudi Telecom Company (STC), a leading IT and telecom provider, launched a new Business Process Outsourcing (BPO) subsidiary to enhance its service offerings, including human resource outsourcing (HRO). This strategic move aims to provide clients in the telecom and IT sectors with integrated HR solutions, such as payroll management, recruitment, and compliance services.

Key Market Segments

By Type

- Business Process HR Outsourcing

- Shared Services HR Outsourcing

- Single Source HR Outsourcing

- Software-as-a-Service HR Outsourcing

By Services

- Hiring & Recruitment

- Labor Laws & Legal Compliance

- Payroll & Compensation Management

- Safety & Health

- Training & Development

By Organization Size

- Large Enterprise

- Small & Medium Enterprise

By Industry Vertical

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Retail & E-commerce

- Government & Public Sector

- Others (Education, Hospitality, etc.)

Market Dynamics

Category Description Emerging Trend - A surge in AI-driven talent analytics and platform automation is reshaping HR outsourcing. Providers are adopting machine learning for recruitment screening, predictive attrition analytics, and AI chatbots that enhance candidate matching and employee engagement.

- The movement toward global capability centers (GCCs) underscore the shift from cost-based to innovation-led HR service hubs – especially in India – where GCCs are managing strategic HR functions and global workforce planning.

Key Driver - The primary driver is cost optimization and focus on core business. Organizations are outsourcing HR functions – such as payroll, benefits, and recruitment – to reduce internal workload and reallocate resources to strategic priorities.

- Additionally, digital transformation and automation in HR is acting as a key catalyst. Investments in cloud platforms and AI tools are making outsourced HR more efficient, scalable, and responsive.

Market Restraint - A major restraint is data security and privacy concerns. Sensitive employee information managed by third-party vendors increases exposure to breaches and complex compliance requirements under GDPR, CCPA, and similar regulations.

- Further, talent retention and workforce dependency on outsourcing providers pose risks. Overreliance may degrade internal HR capabilities and reduce organizational control.

Market Opportunity - The expansion of SME and startup adoption of AI-powered HR platforms offers a strong growth vector. Tools enabling predictive hiring and benchmarking—previously accessible only to large organizations—are now available for smaller players.

- Moreover, the rise of cloud-based continuous learning and remote workforce support within outsourced HR services enables providers to offer engaging, compliant, and flexible systems in a hybrid work environment.

Market Challenge - Ensuring transparency and trust in AI-based HR decisions is a critical challenge. Without transparent models and human oversight, AI-driven screening and attrition prediction may generate bias and legal scrutiny.

- Additionally, integration complexity with existing HRMS/SIEM systems demands sophisticated API and IT infrastructure; many organizations struggle to synchronize legacy systems with advanced outsourced solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Accenture continued to expand its global HRO capabilities through a strategic acquisition in 2025 of a specialist HR technology provider, enhancing its cloud-based employee services. This move has allowed the firm to better serve multinational clients by integrating payroll, learning, and compliance into one digital framework, reinforcing its role in end-to-end workforce transformation.

Adecco strengthened its position in sector-specific HR services by acquiring a healthcare-focused outsourcing company in mid-2024. By 2025, this acquisition has helped the company deliver tailored staffing and compliance solutions to hospitals and medical institutions, addressing rising labor shortages and regulatory demands in the healthcare field.

Infosys BPM expanded its talent outsourcing and payroll capabilities through targeted acquisitions across Asia in 2024. In 2025, these have been fully integrated into its digital HRO suite, providing clients with smarter, automated HR operations across markets like India, Singapore, and the Middle East.

Top Key Players Covered

- Accenture PLC

- Adecco Group AG

- Aon plc

- Automatic Data Processing Inc.

- Capgemini Services SAS

- Capita Plc

- Ceridian HCM Holding Inc.

- CGI Inc.

- FMR LLC

- Genpact Ltd.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Hexaware Technologies Ltd.

- Infosys BPM Ltd.

- International Business Machines Corp.

- ManpowerGroup Inc.

- MHR International UK Ltd.

- Randstad NV

- UKG Inc.

- Wipro Ltd.

- Other Key Players

Recent Developments

- In May 2025, Accenture and SAP joined forces to help companies enable connected intelligence across their enterprises, driving speed and agility in the AI era. This collaboration aims to empower organizations to integrate advanced technologies and data insights into their HR operations, enhancing the efficiency of human resource management through AI-driven solutions.

- In October 2024, Automatic Data Processing (ADP) raised its annual revenue growth forecast following its acquisition of Workforce Software, a move that strengthened its position in the Human Resource Outsourcing (HRO) market. This acquisition enhances ADP’s capabilities in HR management, particularly in workforce management and compliance, further expanding its portfolio of HR solutions.

Report Scope

Report Features Description Market Value (2024) USD 31.2 Bn Forecast Revenue (2034) USD 56.4 Bn CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Business Process HR Outsourcing, Shared Services HR Outsourcing, Single Source HR Outsourcing, Software-as-a-Service HR Outsourcing), By Services (Hiring & Recruitment, Labor Laws & Legal Compliance, Payroll & Compensation Management, Safety & Health, Training & Development), By Organization Size (Large Enterprise, Small & Medium Enterprise), By Industry Vertical (IT & Telecom, BFSI (Banking, Financial Services, and Insurance), Healthcare, Manufacturing, Retail & E-commerce, Government & Public Sector, Others (Education, Hospitality, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Accenture PLC, Adecco Group AG, Aon plc, Automatic Data Processing Inc., Capgemini Services SAS, Capita Plc, Ceridian HCM Holding Inc., CGI Inc., FMR LLC, Genpact Ltd., HCL Technologies Ltd., Hewlett Packard Enterprise Co., Hexaware Technologies Ltd., Infosys BPM Ltd., International Business Machines Corp., ManpowerGroup Inc., MHR International UK Ltd., Randstad NV, UKG Inc., Wipro Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Accenture PLC

- Adecco Group AG

- Aon plc

- Automatic Data Processing Inc.

- Capgemini Services SAS

- Capita Plc

- Ceridian HCM Holding Inc.

- CGI Inc.

- FMR LLC

- Genpact Ltd.

- HCL Technologies Ltd.

- Hewlett Packard Enterprise Co.

- Hexaware Technologies Ltd.

- Infosys BPM Ltd.

- International Business Machines Corp.

- ManpowerGroup Inc.

- MHR International UK Ltd.

- Randstad NV

- UKG Inc.

- Wipro Ltd.

- Other Key Players