Global Hospital Gowns Market By Product Type (Non-Surgical Gowns, Surgical Gowns, and Patient Gowns), By Usability (Reusable and Disposable), By End-user (Hospitals, Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2025

- Report ID: 140160

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

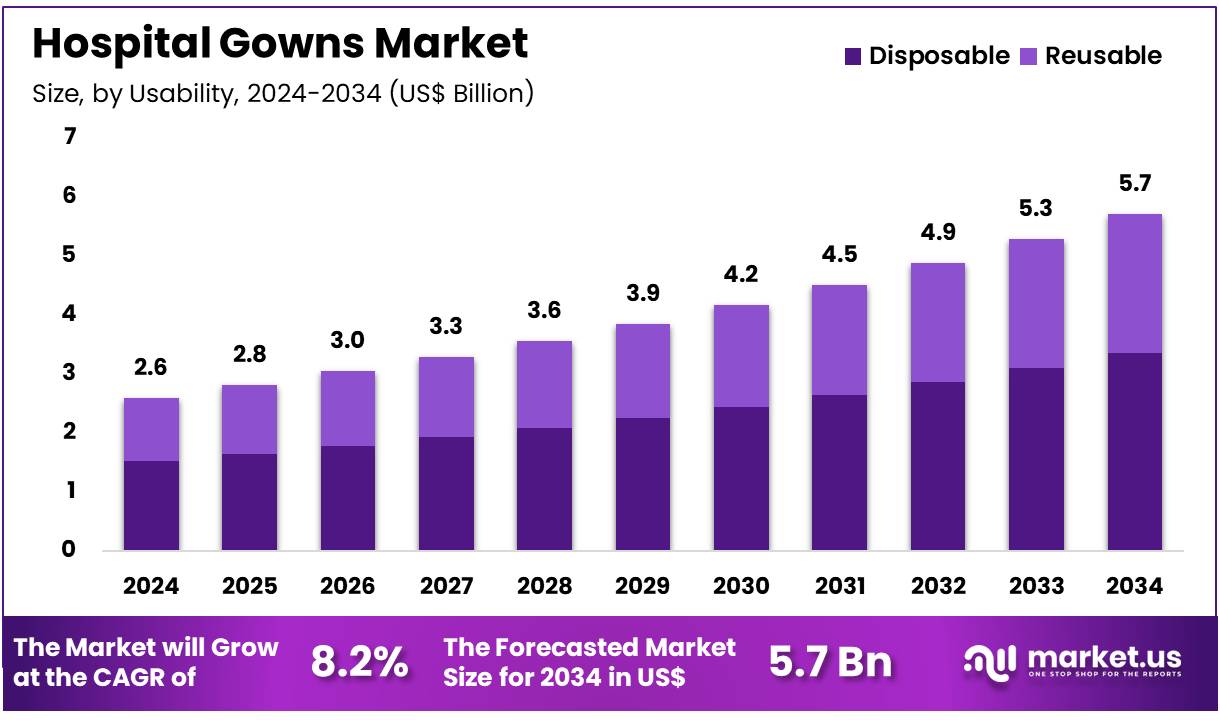

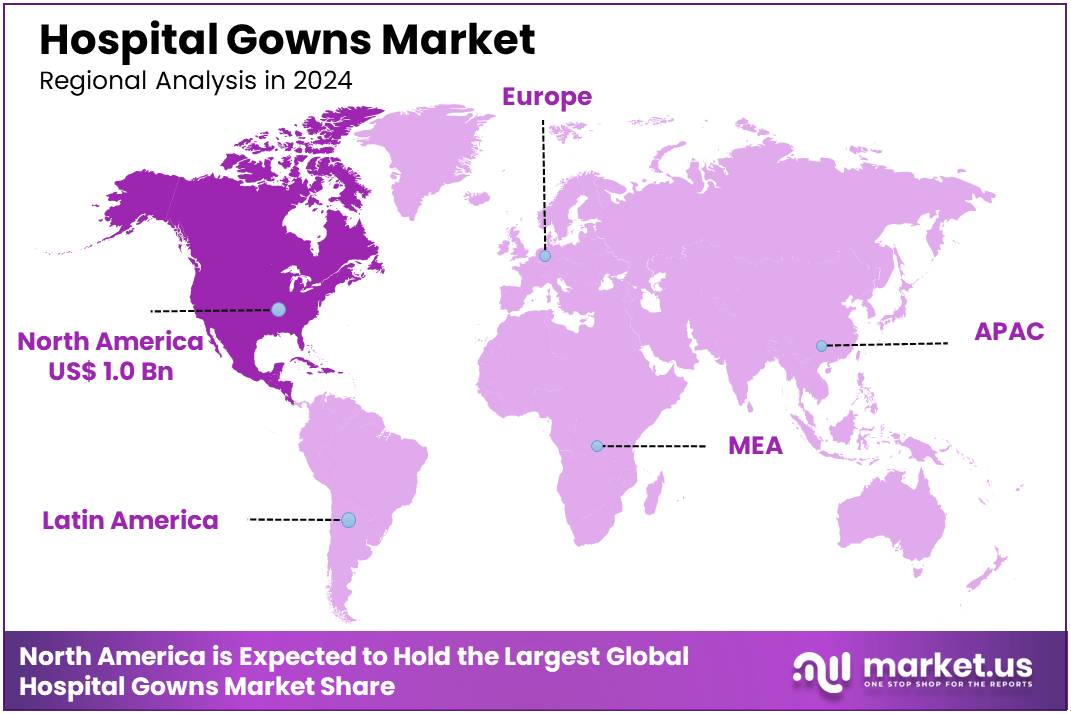

The Global Hospital Gowns Market size is expected to be worth around US$ 5.7 billion by 2034 from US$ 2.6 billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 39.5% share with a revenue of US$ 1.0 Billion.

Increasing awareness of infection control and patient safety is driving the growth of the hospital gowns market. Hospital gowns are essential in healthcare settings, providing comfort, hygiene, and protection for both patients and healthcare workers during medical procedures, surgeries, and daily hospital care. The growing demand for disposable and reusable gowns, particularly in sterile environments such as operating rooms and intensive care units, is a key factor contributing to market expansion.

Rising concerns over hospital-acquired infections (HAIs) and the need for high-quality, protective clothing have further boosted the demand for innovative materials and designs. In January 2022, LASAK s.r.o. received certification for its Europa surgical and protective gown under the UNE EN 13795 standard. This gown, designed for use in sterile environments, is crafted from textured polyester microfibers and offers water resistance, as well as permanent antistatic qualities, providing both comfort and protection for healthcare professionals.

Recent trends highlight a growing preference for gowns that integrate antimicrobial properties and advanced materials to enhance infection prevention and patient care. Additionally, the shift towards sustainable and eco-friendly materials in the manufacturing of reusable gowns offers new opportunities for the market. As healthcare facilities continue to prioritize safety and comfort, the hospital gowns market is set for continued growth driven by technological advancements, regulatory requirements, and evolving healthcare needs.

Key Takeaways

- In 2023, the market for Hospital Gowns generated a revenue of US$ 6 billion, with a CAGR of 8.2%, and is expected to reach US$ 5.7 billion by the year 2033.

- The product type segment is divided into non-surgical gowns, surgical gowns, and patient gowns, with surgical gowns taking the lead in 2023 with a market share of 42.7%.

- Considering usability, the market is divided into reusable and disposable. Among these, disposable held a significant share of 58.6%.

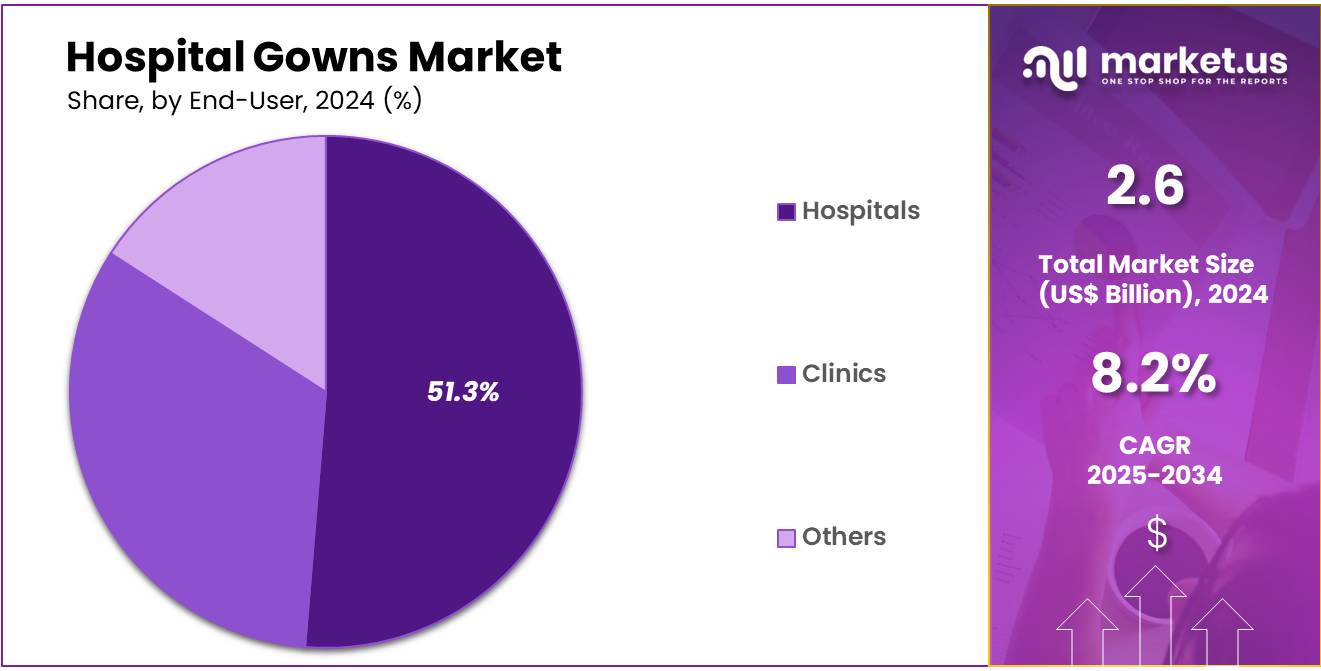

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 51.3% in the Hospital Gowns market.

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

The surgical gowns segment led in 2023, claiming a market share of 42.7% owing to the increasing demand for high-quality, sterile gowns in surgical procedures. Surgical gowns are anticipated to see greater adoption as hospitals and healthcare providers prioritize infection control and patient safety during surgeries. The rising number of surgical procedures globally, especially in developing regions with improving healthcare infrastructure, is likely to fuel the demand for surgical gowns.

Additionally, advancements in gown materials, such as the development of more breathable, durable, and fluid-resistant fabrics, are expected to enhance the functionality of surgical gowns, further driving growth in this segment. As healthcare standards evolve and infection prevention becomes a more pressing concern, the surgical gowns segment is projected to expand significantly.

Usability Analysis

The disposable held a significant share of 58.6% due to the increasing preference for hygienic, single-use gowns in healthcare settings. Disposable hospital gowns provide a significant advantage by reducing the risk of cross-contamination and infections, making them a popular choice in surgical, emergency, and isolation settings. The growing concern over hospital-acquired infections (HAIs) and the rising awareness of hygiene protocols are projected to contribute to the demand for disposable gowns.

Additionally, advancements in disposable gown materials, which offer greater comfort and protection, are likely to attract healthcare providers to this segment. As hospitals and clinics continue to focus on improving patient safety, the disposable segment in the hospital gowns market is expected to see continued growth.

End-User Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 51.3% owing to the increasing number of healthcare facilities and the rising demand for patient care services. Hospitals are likely to remain the primary end-users of hospital gowns as they are essential for maintaining hygiene and protecting both patients and healthcare professionals.

The growing number of hospital admissions, especially with the rise in surgeries, outpatient visits, and emergency cases, is projected to drive the demand for hospital gowns. Furthermore, hospitals’ focus on infection prevention and patient safety, as well as the adoption of disposable and high-quality gowns, will contribute to the growth of this segment. As healthcare systems continue to expand globally, the hospitals segment is likely to maintain a dominant position in the hospital gowns market.

Key Market Segments

Product Type

- Non-Surgical Gowns

- Surgical Gowns

- Patient Gowns

Usability

- Reusable

- Disposable

End-user

- Hospitals

- Clinics

- Others

Drivers

Development of Novel Products Driving the Hospital Gowns Market

The development of novel products is anticipated to drive the hospital gowns market significantly. In September 2023, Medtronic’s CE mark certification for the Simplera Continuous Glucose Monitor highlighted the importance of integrating advanced solutions in healthcare. Similarly, innovative hospital gown designs enhance patient comfort, safety, and usability, catering to evolving healthcare needs.

Manufacturers prioritize materials that offer durability, fluid resistance, and antimicrobial properties to meet stringent infection control standards. Rising demand for disposable gowns amid growing concerns about cross-contamination boosts product development. Healthcare providers increasingly adopt gowns with advanced features such as tear resistance and ergonomic design, improving staff efficiency and patient satisfaction. Collaborations between textile companies and healthcare organizations drive innovation in eco-friendly and biodegradable materials for hospital use.

Technological advancements, including smart textiles, enable the integration of monitoring sensors within gowns for critical care applications. Governments and regulatory bodies emphasize the importance of quality standards, pushing manufacturers to introduce superior products. Expanding investments in healthcare infrastructure and growing surgical procedures further enhance demand for innovative gown solutions. These trends position novel product development as a key driver in transforming the hospital gowns market.

Restraints

High Costs Are Restraining the Hospital Gowns Market

High costs associated with hospital gowns are restraining the market. Advanced gowns with features such as antimicrobial coatings and fluid resistance require expensive materials and manufacturing processes, increasing prices. Healthcare facilities in low-income regions struggle to adopt these premium products due to budget constraints. Disposable gowns, although effective in infection control, add recurring expenses to hospital budgets. The need for large-scale procurement further elevates costs, especially for public hospitals with limited resources.

Inconsistent pricing and supply chain inefficiencies create affordability challenges for smaller clinics. Limited insurance reimbursement for disposable medical supplies discourages widespread adoption of high-quality gowns. Addressing these barriers requires cost-efficient innovations and streamlined manufacturing to ensure broader accessibility of advanced hospital gowns.

Opportunities

Growing Awareness as an Opportunity for the Hospital Gowns Market

Growing awareness about infection control and patient safety is projected to create significant opportunities for the hospital gowns market. A March 2023 study in the Journal of Obstetrics and Gynecology Research emphasized the global concerns regarding health risks from unsafe medical practices. This awareness drives demand for hospital gowns designed to minimize infection transmission and improve hygiene standards.

Hospitals prioritize high-quality gowns to protect patients and staff in critical care and surgical settings. Public health campaigns and initiatives by regulatory bodies highlight the importance of using proper protective gear in medical facilities.

Rising awareness among patients also encourages healthcare providers to adopt gowns that ensure comfort and safety. Manufacturers innovate to meet these demands, introducing gowns with enhanced protective and ergonomic features. Collaboration between hospitals and suppliers ensures the availability of certified products that comply with international safety standards. These trends underscore the role of awareness in driving the adoption of advanced hospital gown solutions globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the hospital gowns market. On the positive side, growing healthcare investments and increasing global demand for healthcare services drive the need for essential hospital supplies, including gowns. The rising focus on hygiene and infection control further boosts the demand for high-quality, disposable gowns.

However, economic downturns can lead to reduced healthcare budgets, limiting the purchase of non-essential or higher-cost items. Geopolitical issues, such as trade restrictions and disruptions in supply chains, can impact the availability and cost of raw materials used in manufacturing hospital gowns.

Moreover, fluctuating tariffs and regulations in different countries may affect international trade, especially for manufacturers who rely on cross-border supply chains. Despite these challenges, ongoing improvements in healthcare infrastructure and growing awareness of infection control practices ensure steady demand for hospital gowns, fostering market growth.

Latest Trends

Surge in Partnerships and Collaborations Driving the Hospital Gowns Market

Rising partnerships and collaborations are driving growth in the hospital gowns market. High levels of cooperation between healthcare institutions, medical suppliers, and manufacturers are expected to enhance the quality, sustainability, and production efficiency of hospital gowns.

These collaborations allow for the integration of innovative materials and technologies, such as antimicrobial fabrics and eco-friendly production methods. In December 2023, Kindeva Drug Delivery and Orbia Fluorinated Solutions (Koura) announced a partnership aimed at transforming the sustainability of pressurized Metered Dose Inhalers (pMDIs).

Their collaboration focuses on replacing conventional propellants with a more environmentally friendly alternative, advancing the development of greener medical solutions. Similarly, as sustainability becomes a key consideration in hospital gown production, the increasing trend of partnerships is likely to drive further innovation in the market.

Regional Analysis

North America is leading the Hospital Gowns Market

North America dominated the market with the highest revenue share of 39.5% owing to increasing healthcare infrastructure, rising patient volumes, and heightened focus on patient comfort and safety. As the healthcare sector continues to expand, hospitals have been prioritizing the development and supply of high-quality hospital gowns to improve the patient experience and ensure safety in various medical settings.

In October 2023, Starlight Children’s Foundation, in partnership with the MoneyGram Haas F1 Team, launched a limited-edition hospital gown at St. David’s Children’s Hospital in Austin, Texas. This special gown, featuring the VF-23 design, was introduced during the 2023 U.S. Grand Prix to provide young patients with a unique and exciting experience.

Such initiatives have highlighted the growing emphasis on making hospital stays more pleasant and personal for patients, particularly in pediatrics. Additionally, the ongoing demand for high-performance, durable, and comfortable medical gowns has further driven market growth, as hospitals increasingly invest in quality healthcare textiles to ensure better hygiene, comfort, and functionality for patients.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding healthcare facilities, increasing patient numbers, and greater awareness of the importance of comfort and hygiene in medical apparel. Countries like China, India, and Japan are anticipated to see a rise in hospital admissions due to aging populations and the growing incidence of chronic diseases, which will fuel the demand for hospital gowns. Additionally, the increasing focus on healthcare quality and patient-centered care across the region is likely to further support market growth.

As hospitals seek to provide better patient experiences, the demand for gowns that offer comfort, durability, and infection control will increase. Innovations in gown materials, such as breathable, eco-friendly, and antimicrobial fabrics, are also expected to drive growth.

Government initiatives to improve healthcare infrastructure and the rise of private healthcare facilities in emerging economies will contribute to the expansion of the hospital gowns market in Asia Pacific. As the region’s healthcare needs evolve, the market for hospital gowns is projected to see significant growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the hospital gowns market focus on developing innovative, protective, and comfortable designs that meet the safety needs of healthcare professionals and patients. Companies invest in R&D to create gowns using advanced fabrics, such as antimicrobial and fluid-repellent materials, enhancing infection control.

Collaborations with hospitals and healthcare facilities help drive product adoption and customization based on specific requirements. Geographic expansion into regions with rising healthcare infrastructure and demand for improved medical apparel supports growth. Many players also prioritize regulatory compliance and affordability to ensure widespread adoption.

Cardinal Health is a leading company in this market, offering a comprehensive range of high-quality surgical and isolation gowns. The company focuses on innovation, utilizing advanced materials to enhance protection and comfort. Cardinal Health’s global distribution network and commitment to healthcare excellence solidify its leadership in the medical apparel industry.

Top Key Players

- Standard Textile Co., Inc

- Medline Industries, Inc

- Cardinal Health

- Angelica Corporation

- AmeriPride Services Inc

- 3M

Recent Developments

- In November 2023, Cardinal Health introduced the SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This cutting-edge gown is designed to provide surgical teams with enhanced access to essential instruments, promoting greater efficiency and safety in the operating room.

- In January 2023, the Association for the Advancement of Medical Instrumentation (AAMI) released an updated American National Standard offering essential guidelines for both manufacturers and users of personal protective equipment (PPE) within the healthcare industry.

Report Scope

Report Features Description Market Value (2024) US$ 2.6 billion Forecast Revenue (2034) US$ 5.7 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Surgical Gowns, Surgical Gowns, and Patient Gowns), By Usability (Reusable and Disposable), By End-user (Hospitals, Clinics, and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Standard Textile Co., Inc, Medline Industries, Inc, Cardinal Health, Angelica Corporation, AmeriPride Services Inc, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Standard Textile Co., Inc

- Medline Industries, Inc

- Cardinal Health

- Angelica Corporation

- AmeriPride Services Inc

- 3M