Global Hospice Market Analysis By Services (Nursing Services, Medical Supply Services, Counseling Services, Short Term Inpatient Services, Physician Services, Others), By Care Type (Acute Care, Respite Care), By Application (Home Settings, Hospitals, Specialty Nursing Homes, Hospice Care Centres), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 83527

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

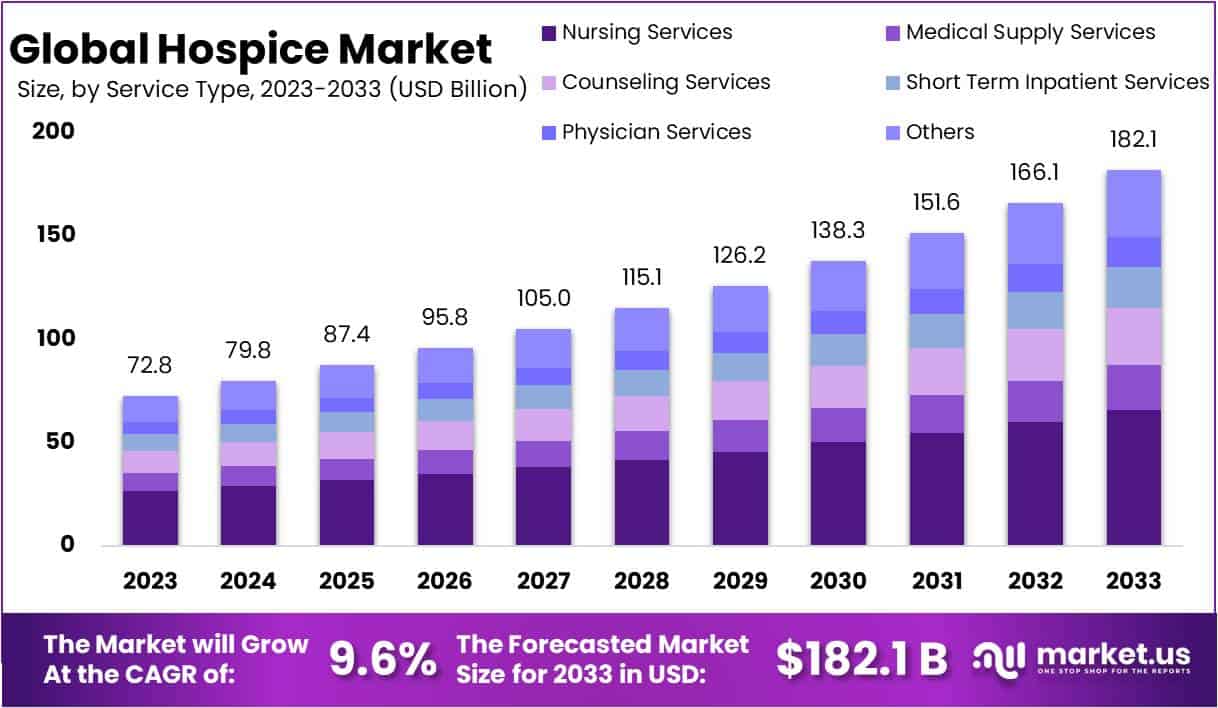

The Global Hospice Market size is expected to be worth around USD 182.1 Billion by 2033, from USD 72.8 Billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

Hospice care is a specialized form of care aimed at providing comfort, dignity, and pain relief to patients with life-limiting illnesses. This compassionate approach focuses on enhancing the quality of life for patients and offering support to their families through comprehensive physical, psychological, and spiritual care services. The hospice market refers to the industry that provides these critical end-of-life services, encompassing a range of providers, services, and care models tailored to meet the complex needs of terminally ill patients.

The hospice industry is experiencing notable growth, driven by demographic shifts and evolving healthcare needs. Approximately 50% of hospice patients are 84 years or older, highlighting the sector’s pivotal role in supporting an aging population. Primary conditions leading to hospice admission include cancer, heart disease, and dementia, which collectively account for a significant proportion of hospice care cases. This trend underscores the essential nature of hospice services in addressing the predominant health challenges faced by the elderly.

According to the Centers for Disease Control and Prevention, 47.8% of Medicare decedents received hospice care in 2020, indicating the sector’s integral role in the healthcare system. The industry has seen a substantial increase in Medicare-certified providers, growing by 18% since 2014, suggesting a responsive expansion to meet rising demand. Furthermore, the predominance of for-profit organizations, which constitute 70.4% of the market, reflects a significant trend in the industry’s operational landscape.

In the hospice sector, innovation and strategic growth are crucial, with providers increasingly incorporating pediatric care and concierge services to meet diverse patient needs. This expansion is vital for accommodating the growing spectrum of patient preferences and complex medical requirements. The sector demonstrates a strong commitment to quality, highlighted by initiatives from organizations like the National Hospice and Palliative Care Organization, which champions excellence in care standards.

However, the industry is grappling with significant staffing challenges. Recent reports indicate that over 80% of hospice providers nationwide are experiencing staffing shortages, a factor that is pivotal in sustaining high-quality care and operational efficiency (Healthcare Workforce Solutions, 2023). Despite these hurdles, the hospice market remains a critical element of the healthcare system, emphasizing compassionate care, adapting to demographic shifts, and prioritizing quality and innovation in service delivery. With the aging population projected to double by 2050, the demand for hospice services is expected to escalate, underscoring the need for ongoing adaptation and enhancement of care standards (U.S. Census Bureau, 2023).

Key Takeaways

- Projected growth: Global Hospice Market expected to expand from USD 72.8 Billion in 2023 to USD 182.1 Billion by 2033, at a 9.6% CAGR.

- Demographic influence: 50% of hospice patients are over 84, indicating significant demand for Hospice care in the aging population.

- Leading segment: Nursing Services dominate, holding a 36.2% share, driven by increased demand for personalized, quality Hospice care.

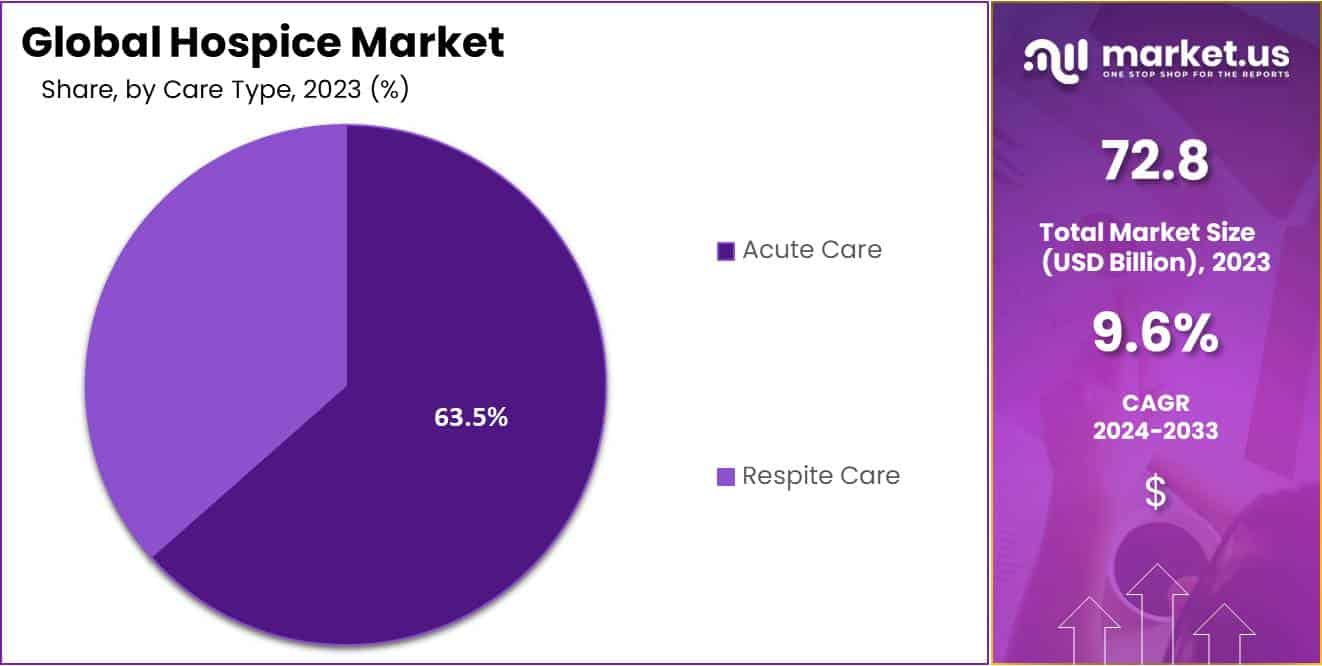

- Care type preference: Acute Care leads the segments with a 63.5% market share, essential for managing severe health conditions in hospice settings.

- Home-based care trend: Over 52% of the market is the Home Settings segment, showing a preference for familiar, comfortable Hospice environments.

- Technological integration: Emerging opportunities as technology, like telehealth, enhances hospice care quality, accessibility, and efficiency.

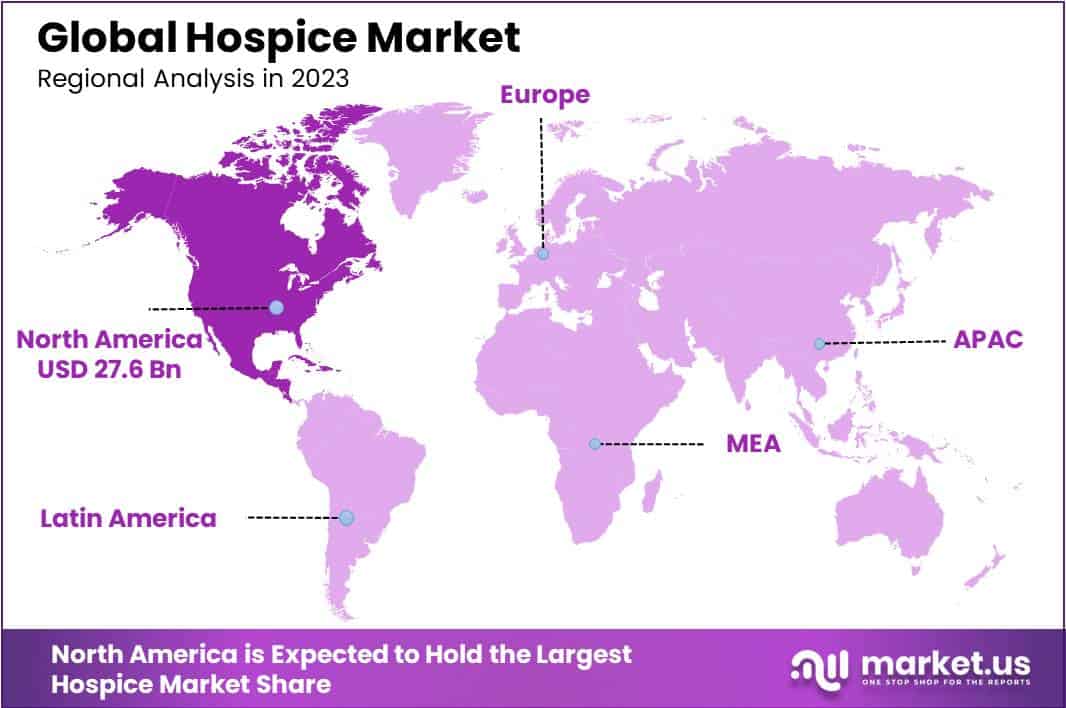

- Market leadership: North America leads the market with a 38% share, supported by advanced healthcare systems and an aging population.

- Asia-Pacific growth: This region is rapidly growing in the hospice market, driven by increasing awareness and healthcare infrastructure enhancements.

- Cost challenges: The high costs of hospice care are significant barriers, especially for those without adequate insurance or in low-income regions.

- Preference shift: The increasing inclination towards personalized, home-based hospice care reflects changing patient and family expectations and needs.

Services Analysis

In 2023, the Nursing Services segment held a dominant market position in the Services Segment of the Hospice Market, capturing more than a 36.2% share. This substantial share can be attributed to the escalating demand for personalized patient care and the rising prevalence of chronic conditions necessitating prolonged nursing support. The segment’s growth is further bolstered by the increasing recognition of the importance of quality end-of-life care, which emphasizes comfort, respect, and dignity, aligning closely with the core values of hospice philosophy.

The integration of advanced nursing practices in hospice care, focusing on pain management, symptom control, and psychological support, has been pivotal in enhancing the quality of life for terminally ill patients. These services are instrumental in addressing the complex health needs of patients while also providing essential support to families and caregivers, thereby reinforcing the segment’s expansion.

Moreover, the evolving healthcare policies favoring home-based palliative care and the growing inclination towards personalized medical attention have significantly contributed to the segment’s prominence. Financial incentives and supportive legislation have also played a crucial role in encouraging the adoption of nursing services in hospices, thereby driving the segment’s growth.

The competitive landscape of the Nursing Services segment in the Hospice Market is characterized by the presence of key players who are focusing on expanding their service offerings, enhancing their geographic reach, and improving the quality of care. Strategic collaborations, along with technological advancements in healthcare, are anticipated to further propel the market’s growth, ensuring that high-quality, compassionate care is accessible to a larger population.

Care Type Analysis

In 2023, the Acute Care segment secured a leading position in the Hospice Market’s Care Type Segment, boasting over 63.5% of the market share. This dominance is largely due to the increasing prevalence of chronic illnesses, the rise in the elderly population, and greater recognition of early palliative care’s benefits for patients with life-limiting illnesses.

Acute Care in hospice focuses on providing immediate, intensive care to patients facing severe health challenges. It’s pivotal in managing serious symptoms, offering pain relief, and extending emotional support to patients and their families. The segment’s growth is propelled by enhanced healthcare frameworks, integration of palliative services into mainstream medical care, and rising expenditures on hospice services.

Key trends influencing this segment include the shift towards home-based hospice care, the adoption of interdisciplinary care teams, and a preference for individualized care plans. These trends reflect a broader movement towards holistic, patient-centric end-of-life care, underscoring acute care’s essential role in improving patient outcomes.

The segment’s market strength is indicative of the essential nature of acute hospice care in providing comfort and dignity to patients at life’s end. As the sector evolves, it’s expected that future investments will focus on innovating care delivery, bolstering palliative care education, and broadening hospice services to meet increasing demands efficiently.

Application Analysis

In 2023, the Home Settings segment held a dominant market position in the Application Segment of the Hospice Market, capturing more than a 52% share. This significant market share can be attributed to several pivotal factors that underscore the growing preference for home-based hospice care.

Firstly, the shift towards home settings in hospice care is largely driven by the increasing demand for patient-centered care that allows individuals to spend their final days in the comfort and familiarity of their own homes. This trend is supported by the growing emphasis on enhancing the quality of life for terminally ill patients, coupled with the desire of families to be closely involved in the care of their loved ones.

Secondly, advancements in home healthcare technologies, including telehealth and remote patient monitoring systems, have significantly bolstered the feasibility and effectiveness of home-based hospice care. These technological enhancements not only ensure continuous, real-time monitoring of patients but also facilitate timely interventions, thereby ensuring comprehensive care delivery that rivals in-patient hospice services.

Furthermore, the cost-effectiveness of home-based care compared to hospital or inpatient facility care has been a critical factor in its increased adoption. Reduced healthcare expenditure, coupled with the availability of government and private insurance reimbursements for home hospice services, has made it an economically viable option for a majority of patients and their families.

Key Market Segments

Services

- Nursing Services

- Medical Supply Services

- Counseling Services

- Short Term Inpatient Services

- Physician Services

- Others

Care Type

- Acute Care

- Respite Care

Application

- Home Settings

- Hospitals

- Specialty Nursing Homes

- Hospice Care Centers

Drivers

Aging Population

The primary driver for the Global Hospice Market is the increasing aging population worldwide. Reports from the World Health Organization (WHO) indicate that the global population aged 60 years and older is expected to reach 2 billion by 2050, up from 900 million in 2015. This significant rise in the elderly population correlates with an increased prevalence of chronic illnesses and terminal diseases, necessitating the demand for hospice care. The aging demographic typically requires more healthcare services, particularly those that cater to end-of-life needs, thereby fueling the expansion of hospice services globally.

Restraints

High Costs of Hospice Care

One significant restraint facing the Global Hospice Market is the high cost associated with providing hospice care. According to a study published in the Journal of Palliative Medicine, the average cost of hospice care per patient varies significantly but can exceed $10,000 in the last month of life. These expenses can be a barrier for patients and families, especially in regions without adequate insurance coverage or governmental support. The high costs can limit the accessibility of hospice services, particularly for low to middle-income families, thus restraining the market’s growth.

Opportunities

Integration of Technology in Palliative Care

A considerable opportunity within the Global Hospice Market is the integration of technology in palliative care. Innovations such as telehealth, digital symptom management tools, and electronic health records are gaining traction. A report by Health Affairs highlighted that telehealth adoption in palliative care could reduce hospital readmission rates by up to 15%, offering new avenues for delivering hospice care more effectively and efficiently. These technological advancements can enhance patient comfort, improve the quality of care, and allow providers to reach a broader patient base, especially in underserved or remote areas.

Trends

Shift Towards Home-based Hospice Care

A notable trend in the Global Hospice Market is the increasing preference for home-based hospice care. Market analysis from healthcare industry experts suggests that the home-based care segment is projected to grow at a compound annual growth rate (CAGR) of 7% over the next decade. Many patients and families are opting for hospice services at home rather than in hospital settings, seeking a more personal and comfortable environment. This shift is driven by the desire for a dignified end-of-life experience in a familiar setting, which has led to a growing demand for home-based care options and is influencing the market’s strategic direction.

Regional Analysis

In 2023, the hospice market was led by North America, holding over 38% of the market share, with a valuation of USD 27.7 billion. This significant share is largely due to the region’s advanced healthcare infrastructure, the high incidence of chronic diseases, and an increasing elderly population requiring end-of-life care. These factors collectively bolster the demand for hospice services.

Europe stands as the market’s second-largest contributor, driven by an aging populace and sophisticated healthcare frameworks. The region’s market dynamics are also shaped by diverse healthcare policies and a heightened emphasis on palliative care across various countries.

The Asia-Pacific market is witnessing swift growth, fueled by rising hospice service awareness, healthcare infrastructural enhancements, and shifting cultural perceptions towards end-of-life care. Economic powerhouses like China and India are pivotal to this growth, thanks to their healthcare investments.

On the other hand, Latin America and the Middle East & Africa, although smaller in market share, are poised for growth. Improvements in healthcare services, an increasing number of individuals with life-limiting illnesses, and the slow adoption of hospice care contribute to this trend. Nonetheless, growth in these regions may be hindered by limited hospice care awareness and cultural obstacles.

Overall, the hospice market is evolving, influenced by demographic changes, healthcare advancements, and changing attitudes towards palliative care. The sector is likely to see heightened competition, regulatory developments, and opportunities for innovation, particularly in regions where such services are underdeveloped.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the hospice market, notable entities like Covenant Care, National Association for Home Care & Hospice, Kindred Healthcare LLC, and PruittHealth, along with other key players, significantly shape the sector’s landscape. Covenant Care shines with its patient-centered services, emphasizing compassionate care. The National Association for Home Care & Hospice plays a pivotal role, advocating for industry standards and enhancing care quality through its influential presence.

Kindred Healthcare stands out for its comprehensive care model, integrating hospice services within a broad healthcare framework, thus ensuring continuity of care. PruittHealth is recognized for its dedicated approach to supporting the elderly and chronically ill, offering tailored hospice solutions. Collectively, these organizations, along with other key participants, drive innovation, uphold quality standards, and improve patient outcomes, collectively steering the industry’s growth and setting benchmarks for exceptional hospice care.

Market Key Players

- Covenant Care.

- National Association for Home Care & Hospice.

- Kindred Healthcare LLC

- PruittHealth

- National Hospice and Palliative Care Organization

- Oklahoma Palliative & Hospice Care.

- Alzheimer’s Association

- VITAS Healthcare

- LHC Group Inc.

- Dierksen Hospice

- Samaritan Health Services.

- Other Key Players

Recent Developments

- In August 2023, Kindred Healthcare unveiled a strategic alliance with Palliative CareNet, adopting their innovative cloud-based platform to improve communication and streamline care coordination for individuals receiving hospice services. This collaboration signifies a significant step towards integrating advanced technology in palliative care, aiming to enhance the overall patient experience.

- In April 2023, VITAS Healthcare introducing the “Compassionate Conversations” program, designed to shed light on hospice care while promoting transparent dialogue among patients, their families, and healthcare professionals. The initiative seeks to educate the community on end-of-life care options, emphasizing the importance of informed decision-making and support.

- In October 2023, Partnership with the Center to Advance Palliative Care (CAPC), the National Hospice and Palliative Care Organization (NHPCO) launched a new initiative. This venture focuses on enhancing the accessibility and quality of palliative care services in rural areas, addressing the unique challenges faced by these communities and striving for equity in healthcare provision.

Report Scope

Report Features Description Market Value (2023) USD 72.8 Bn Forecast Revenue (2033) USD 182.1 Bn CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Services (Nursing Services, Medical Supply Services, Counseling Services, Short Term Inpatient Services, Physician Services, Others), By Care Type (Acute Care, Respite Care), By Application (Home Settings, Hospitals, Specialty Nursing Homes, Hospice Care Centres) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Covenant Care, National Association for Home Care & Hospice, Kindred Healthcare LLC, PruittHealth, National Hospice and Palliative Care Organization, Oklahoma Palliative & Hospice Care, Alzheimer’s Association, VITAS Healthcare , LHC Group Inc, Dierksen Hospice, Samaritan Health Services, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Hospice market in 2023?The Hospice market size is USD 72.8 billion in 2023.

What is the projected CAGR at which the Hospice market is expected to grow at?The Hospice market is expected to grow at a CAGR of 9.6% (2024-2033).

List the segments encompassed in this report on the Hospice market?Market.US has segmented the Hospice market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Services the market has been segmented into Nursing Services, Medical Supply Services, Counseling Services, Short Term Inpatient Services, Physician Services, Others. By Care Type the market has been segmented into Acute Care, Respite Care. By Application the market has been segmented into Home Settings, Hospitals, Specialty Nursing Homes, Hospice Care Centres.

List the key industry players of the Hospice market?Covenant Care, National Association for Home Care & Hospice, Kindred Healthcare LLC, PruittHealth, National Hospice and Palliative Care Organization, Oklahoma Palliative & Hospice Care, Alzheimer's Association, VITAS Healthcare , LHC Group Inc, Dierksen Hospice, Samaritan Health Services, Other Key Players

Which region is more appealing for vendors employed in the Hospice market?North America is expected to account for the highest revenue share of 38% and boasting an impressive market value of USD 27.6 billion. Therefore, the Hospice industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Hospice?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Hospice Market.

-

-

- Covenant Care.

- National Association for Home Care & Hospice.

- Kindred Healthcare LLC

- PruittHealth

- National Hospice and Palliative Care Organization

- Oklahoma Palliative & Hospice Care.

- Alzheimer's Association

- VITAS Healthcare

- LHC Group Inc.

- Dierksen Hospice

- Samaritan Health Services.

- Other Key Players