Global Home Exercise Bike Market By Type (Recumbent Bike, Upright Bike, Dual Action Bike, Interactive Bike), By Sales Channel (Physical Store, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136624

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

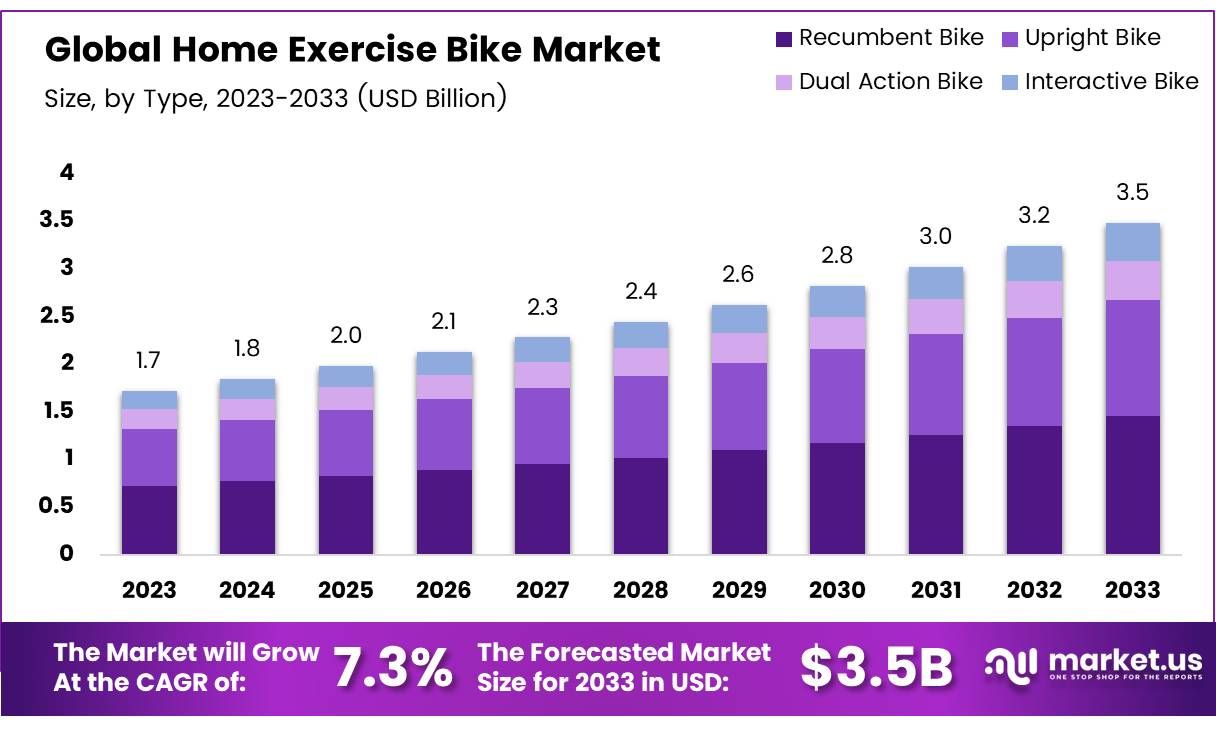

The Global Home Exercise Bike Market size is expected to be worth around USD 3.5 Billion by 2033, from USD 1.72 Billion in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

A home exercise bike is a type of fitness equipment designed for indoor cycling, allowing users to engage in cardio workouts at home. These bikes come in various forms, such as upright bikes that mimic outdoor cycling and recumbent bikes with a more comfortable seated position.

Most home exercise bikes offer adjustable resistance to control workout intensity, and many include digital displays to track performance metrics like time, speed, distance, and calories burned. As fitness trends shift towards convenience and home-based solutions, these bikes have become a popular choice for those looking to improve cardiovascular health, build endurance, and manage weight.

The home exercise bike market includes the manufacturing, distribution, and retail of bikes designed for home use. This market covers a range of products, from traditional stationary bikes to smart bikes integrated with advanced technology. It has grown significantly, driven by a rising demand for home fitness solutions, especially after the COVID-19 pandemic.

As more consumers seek convenient ways to stay fit without the need for gym memberships, the market for home exercise bikes has expanded. In 2023, for example, about 6.23 million people in the U.S. participated in group stationary cycling classes reflecting a growing interest in cycling as a preferred workout.

The home exercise bike market is experiencing strong growth, primarily due to changing consumer behaviors toward fitness at home. According to RunRepeat, 56.1% of people continued to work out at home after the pandemic, with 75% of respondents finding it easier to stay fit at home compared to before (RunRepeat, 2023).

This shift has fueled demand for home fitness products, with many consumers willing to pay extra for premium, sustainable options. In fact, 35% of fitness equipment buyers have paid a 5%-9% premium for eco-friendly products (Coolest Gadgets, 2023).

Government initiatives promoting healthy lifestyles are also benefiting the market. Many governments encourage physical activity through public health campaigns, which could increase investments in home fitness equipment. Regulations around safety and sustainability may drive innovation in the sector, leading to new product features such as smart bikes with integrated online fitness programs.

Additionally, the focus on sustainability presents an opportunity for growth. Consumers are increasingly looking for environmentally friendly products, which is pushing manufacturers to develop eco-conscious exercise bikes. The integration of technology into these bikes, such as real-time performance tracking and virtual workouts, is another area where the market is expanding.

The home exercise bike market benefits from the increasing demand for efficient workout solutions. According to TheManual, exercise bike workouts can burn between 400-600 calories per hour, depending on factors like weight and workout intensity.

Additionally, 72% of U.S. adults reported exercising as much or more through online fitness videos compared to before the pandemic (RunRepeat, 2023). This shows that home-based fitness solutions are not only here to stay but are increasingly popular among consumers.

Key Takeaways

- The global home exercise bike market is projected to reach USD 3.5 billion by 2033, growing at a CAGR of 7.3% from 2024 to 2033.

- Recumbent bikes dominated the home exercise bike market in 2023, driven by the demand for low-impact, comfortable workouts.

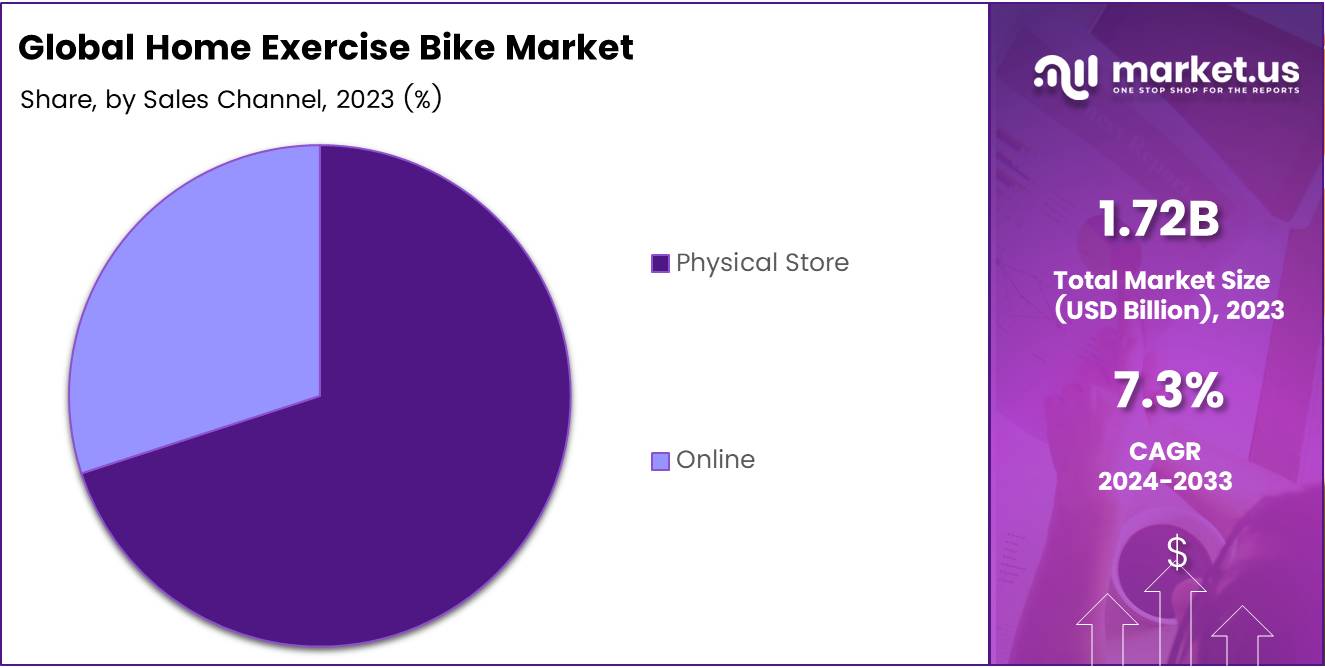

- Physical stores led the home exercise bike market in 2023, with consumers preferring to experience the product firsthand before purchase.

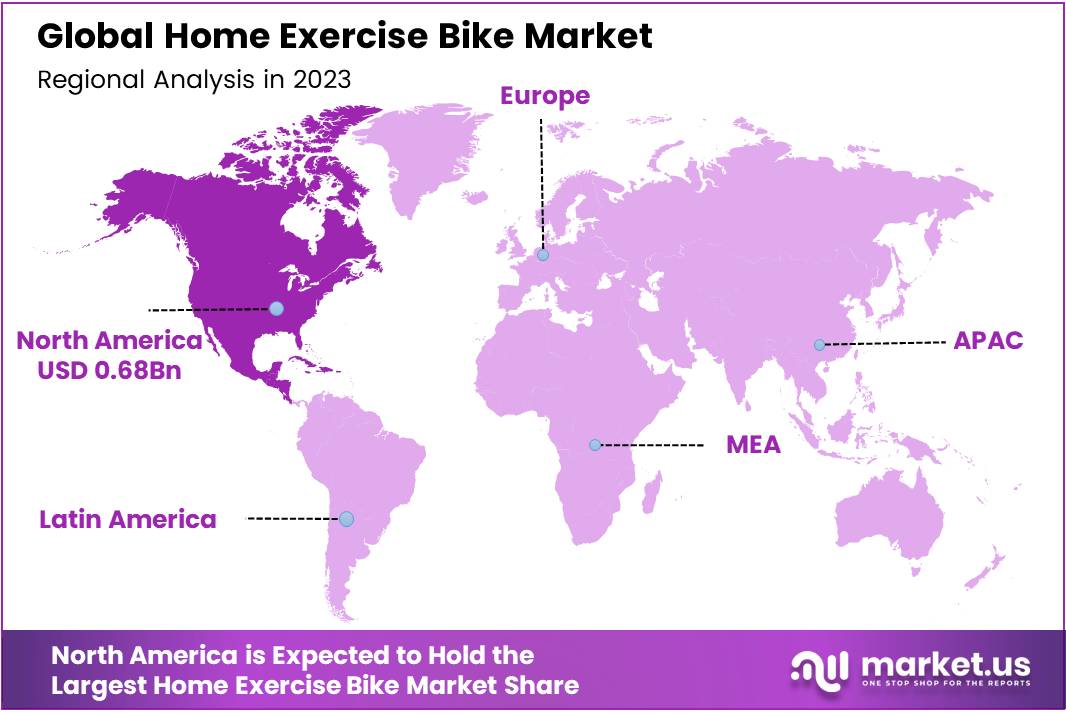

- North America holds the largest market share in the global home exercise bike market, accounting for 40% in 2023, valued at USD 0.68 billion.

Type Analysis

Recumbent Bikes Lead Home Exercise Bike Market in 2023

In 2023, Recumbent Bikes held a dominant market position in the By Type Analysis segment of the Home Exercise Bike Market. This category’s strong performance can be attributed to the growing preference for low-impact, comfortable workout solutions among consumers.

Recumbent bikes are particularly favored by individuals with joint issues, mobility limitations, or those seeking a less intense form of cardiovascular exercise. Their ergonomic design, which allows users to sit in a relaxed position, has contributed significantly to their widespread adoption, especially in the home fitness space.

Upright Bikes, while trailing behind Recumbent Bikes, maintain a significant market presence. They are commonly used for more traditional cycling workouts and are favored by users looking for more intense exercise regimens.

Dual Action Bikes, which combine both upper and lower body workouts, appeal to users seeking full-body engagement and increased calorie burn. Meanwhile, Interactive Bikes, which feature integrated technology for virtual training and connectivity, have seen increasing adoption due to the rise in digital fitness trends.

Sales Channel Analysis

In 2023, Physical Stores Held a Dominant Market Share in the Home Exercise Bike Market by Sales Channel

In 2023, physical stores held a dominant market position in the By Sales Channel segment of the home exercise bike market. The preference for physical retail can be attributed to the ability to experience the product firsthand, where consumers can assess the build, comfort, and functionality of the bikes before making a purchase.

Additionally, physical stores offer immediate availability, enabling consumers to make on-the-spot purchases and avoid potential shipping delays often associated with online orders. Personalized assistance from knowledgeable sales staff also plays a key role in influencing consumer decisions, providing valuable insights and guidance that enhance the shopping experience.

On the other hand, online channels continue to see growth but remained secondary in comparison. While e-commerce offers convenience and a broader selection, the lack of direct product interaction and longer delivery times were perceived as drawbacks by some customers.

Nonetheless, the increasing adoption of digital platforms and the growing trend of home fitness are expected to fuel further expansion of online sales in the near future.

Key Market Segments

By Type

- Recumbent Bike

- Upright Bike

- Dual Action Bike

- Interactive Bike

By Sales Channel

- Physical Store

- Online

Drivers

Growing Demand for Home Exercise Bikes Driven by Health Trends and Convenience

The home exercise bike market is experiencing significant growth due to several key factors. First, there is a growing awareness of the importance of health and fitness, particularly as consumers recognize the benefits of regular physical activity for weight management, cardiovascular health, and overall well-being. This shift is encouraging more people to adopt home-based fitness solutions.

Additionally, the growing trend of remote work, coupled with gym closures during the COVID-19 pandemic, has led many individuals to prioritize at-home workouts for convenience and safety. As a result, more people are investing in home exercise bikes to maintain their fitness routines.

Technological advancements have further fueled market expansion, with modern exercise bikes incorporating features such as virtual workouts, performance tracking systems, and integration with fitness apps. These innovations appeal to tech-savvy consumers seeking an interactive and personalized workout experience.

Furthermore, the convenience and flexibility of home exercise bikes, which allow users to exercise at their own pace and schedule, have made them an attractive alternative to traditional gyms.

The time and money saved by not having to commute or pay for a gym membership contribute to the increasing adoption of these products. Collectively, these drivers are helping to create a robust demand for home exercise bikes, positioning the market for sustained growth in the coming years.

Restraints

Home Exercise Bike Market Faces Challenges in Value and Consumer Appeal Due to Maintenance and Competition

One major challenge facing the home exercise bike market is maintenance and durability concerns. Consumers may be deterred from purchasing these bikes if they perceive high maintenance costs or risk of early breakdowns. Low-quality bikes that require frequent repairs or have a short lifespan could lead to dissatisfaction, ultimately reducing the market’s appeal.

If the bikes are not durable enough or prone to malfunction, this creates a negative perception that can hinder customer retention and overall market growth.

Additionally, the home exercise bike market faces intense competition from alternative fitness solutions. Other types of fitness equipment, such as treadmills, rowing machines, or free weights, provide more diverse workout options that appeal to a broader range of fitness preferences.

These alternatives offer varied exercises, targeting different muscle groups and fitness goals, which may limit the demand for home exercise bikes. For instance, while exercise bikes primarily focus on cardiovascular workouts, alternatives like rowing machines also engage upper body muscles, making them a more versatile option for some consumers.

The increased availability of various home fitness solutions, combined with a growing preference for more all-encompassing workout routines, could restrain the market share of exercise bikes. As a result, businesses operating in this sector must address these issues by improving product quality and diversifying offerings to remain competitive.

Growth Factors

Growth Opportunities in the Home Exercise Bike Market Driven by Consumer Demand and Technological Advancements

The home exercise bike market is witnessing significant growth due to several emerging opportunities. One key trend is the integration with virtual fitness platforms, such as Peloton, Zwift, or Strava. Collaborating with these online fitness services can create new avenues for customer engagement and help manufacturers tap into the growing demand for connected fitness experiences.

Additionally, the rising adoption of smart home devices presents an opportunity for home exercise bike manufacturers to enhance their products with features like voice assistant compatibility, integration with smart TVs, or home automation systems. This integration could improve user experience and make fitness routines more seamless.

Another opportunity lies in customization and personalization. Offering features like adjustable resistance levels, customizable seats, or app-based integration can cater to varying fitness levels and preferences, attracting a broader range of customers.

Lastly, the shift towards subscription-based services is gaining traction in the fitness industry. By offering monthly subscriptions for virtual fitness classes or personalized coaching, bike manufacturers can create a steady revenue stream while increasing the value proposition for consumers.

These opportunities collectively position the home exercise bike market for sustained growth, driven by technological advancements and evolving consumer preferences.

Emerging Trends

Cycling Trends Driving Growth in the Home Exercise Bike Market with Increased Engagement and Convenience

The home exercise bike market is being significantly shaped by several emerging trends. Cycling as a social activity is gaining traction, with virtual cycling communities and online challenges helping to build camaraderie and deepen customer engagement. These platforms allow users to connect, share their progress, and motivate each other, enhancing the overall workout experience.

Additionally, the integration of wearable fitness technology into home exercise bikes has become more common, with devices such as heart rate monitors and smartwatches being compatible with many models. This appeals to tech-savvy consumers who value real-time tracking of their fitness metrics.

The rise of live streaming and interactive classes has also become a key trend, with many home exercise bikes offering access to live, instructor-led classes. This trend, which accelerated during the pandemic, continues to attract users who seek motivation and structure in their home workouts. Moreover, the demand for compact and foldable designs has surged, particularly among city dwellers who face space constraints.

These designs allow users to easily store their equipment when not in use, catering to individuals with limited room. Collectively, these trends indicate a broader shift toward making home cycling workouts more engaging, accessible, and adaptable to modern lifestyles. As these preferences evolve, manufacturers are likely to continue innovating to meet the changing needs of consumers.

Regional Analysis

North America Leads the Home Exercise Bike Market with 40% Share and USD 0.68 Billion Value

The home exercise bike market is experiencing significant growth across various regions, with North America, Europe, and Asia Pacific leading the charge. North America currently dominates the global market, accounting for approximately 40% of the total market share, valued at USD 0.68 billion.

This dominance can be attributed to the region’s high disposable income, increasing health consciousness, and a growing trend toward home-based fitness solutions. The presence of major fitness equipment manufacturers, along with well-established distribution channels, further supports North America’s leadership in the market.

Regional Mentions:

In Europe, the market is expected to exhibit steady growth due to rising awareness of fitness and wellness, coupled with the increasing prevalence of chronic diseases. The region’s market share is also bolstered by the adoption of smart exercise bikes and the rising trend of virtual workouts. With a population increasingly engaged in at-home fitness, the European market is projected to experience sustained growth over the forecast period.

The Asia Pacific region, however, is anticipated to witness the highest growth rate during the forecast period, primarily driven by the increasing urbanization, improving living standards, and growing awareness of fitness. Countries like China and India, with their large populations and rapidly developing middle class, present a significant opportunity for market expansion.

In the Middle East & Africa, market growth is moderate, influenced by the region’s increasing focus on health and wellness. Rising disposable incomes and a growing trend toward fitness are expected to drive demand for home exercise bikes, particularly in affluent countries like the UAE and Saudi Arabia.

Latin America remains a developing market, with gradual growth expected due to increasing urbanization and rising interest in fitness and health. However, regional challenges such as economic instability may slightly hinder market expansion.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Home Exercise Bike Market is characterized by a diverse competitive landscape, with key players encompassing both established fitness equipment giants and niche, innovative brands. In 2023, leading companies such as KPS Capital Partners, Ciclotte, Johnson Health Tech, and Icon Health & Fitness Inc. continue to drive market growth through strategic product innovations, acquisitions, and an increasing focus on digital fitness integration.

KPS Capital Partners plays a pivotal role in fostering growth through investments in prominent fitness brands. The firm’s strategic acquisitions in the fitness industry have helped consolidate its position as a key player, enabling its portfolio companies to expand into emerging markets with new offerings.

Ciclotte, known for its high-end, design-oriented exercise bikes, has carved a niche by targeting premium market segments. Their unique and aesthetically designed bikes, equipped with advanced technology, are gaining traction among consumers seeking both functionality and luxury.

Johnson Health Tech and Icon Health & Fitness Inc. remain dominant players due to their vast distribution networks and extensive product ranges. Both companies emphasize the integration of smart technology and interactive workout features, offering products such as app-connected bikes that cater to the growing demand for virtual fitness solutions.

Sunny Health and Fitness, Body-Solid, and Nautilus offer cost-effective solutions, appealing to a broad consumer base while maintaining strong brand recognition in the budget-friendly segment. Precor and Technogym continue to push the boundaries of performance, catering to both professional and home-use markets with high-quality, commercial-grade bikes.

Overall, the competitive dynamics in 2023 are defined by innovation, with a clear trend towards integrating connected fitness solutions, while companies focus on enhancing user experience through advanced technology and personalization.

Top Key Players in the Market

- KPS Capital Partners

- Ciclotte

- Johnson Health Tech

- Icon Health & Fitness Inc.

- Sunny Health and Fitness

- Body-Solid

- Nautilus

- Precor

- Technogym

- Paradigm Health & Fitness

Recent Developments

- In July 2023, Magic AI secured $2.5 million in funding to revolutionize the home fitness landscape. The investment will be used to enhance its AI-driven fitness platform, which aims to offer personalized workouts and real-time performance tracking.

- In May 2024, Portl raised $3 million in funding to accelerate the development of its AI-powered fitness solutions. The company intends to expand its offerings, integrating advanced AI technologies to deliver more engaging and customized fitness experiences.

- In December 2024, Magic AI successfully secured an additional $5 million in funding to advance its AI-powered mirror technology. The new investment will support the company’s mission to further innovate in-home fitness, delivering a more immersive and adaptive workout experience.

- In February 2023, Quell raised $10 million in a Series A funding round led by Tencent. The funding will help Quell expand its AI-based wearable technology, aimed at enhancing pain management and recovery through personalized, data-driven solutions.

Report Scope

Report Features Description Market Value (2023) USD 1.72 Billion Forecast Revenue (2033) USD 3.5 Billion CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Recumbent Bike, Upright Bike, Dual Action Bike, Interactive Bike), By Sales Channel (Physical Store, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape KPS Capital Partners, Ciclotte, Johnson Health Tech, Icon Health & Fitness Inc., Sunny Health and Fitness, Body-Solid, Nautilus, Precor, Technogym, Paradigm Health & Fitness Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- KPS Capital Partners

- Ciclotte

- Johnson Health Tech

- Icon Health & Fitness Inc.

- Sunny Health and Fitness

- Body-Solid

- Nautilus

- Precor

- Technogym

- Paradigm Health & Fitness