Global Rowing Machines Market By Type (Hydraulic, Magnetic, Air, Water), By Body Type (Solid Wood, Metal), By Weight Capacity (100 to 199 Pounds, 200 to 249 Pounds, 300 to 499 Pounds), By Distribution Channel (Offline, Online), By Resistant Level (Less Than 24, More Than 24), By Color (Black, Light Grey, Others), By End-User (Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135693

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

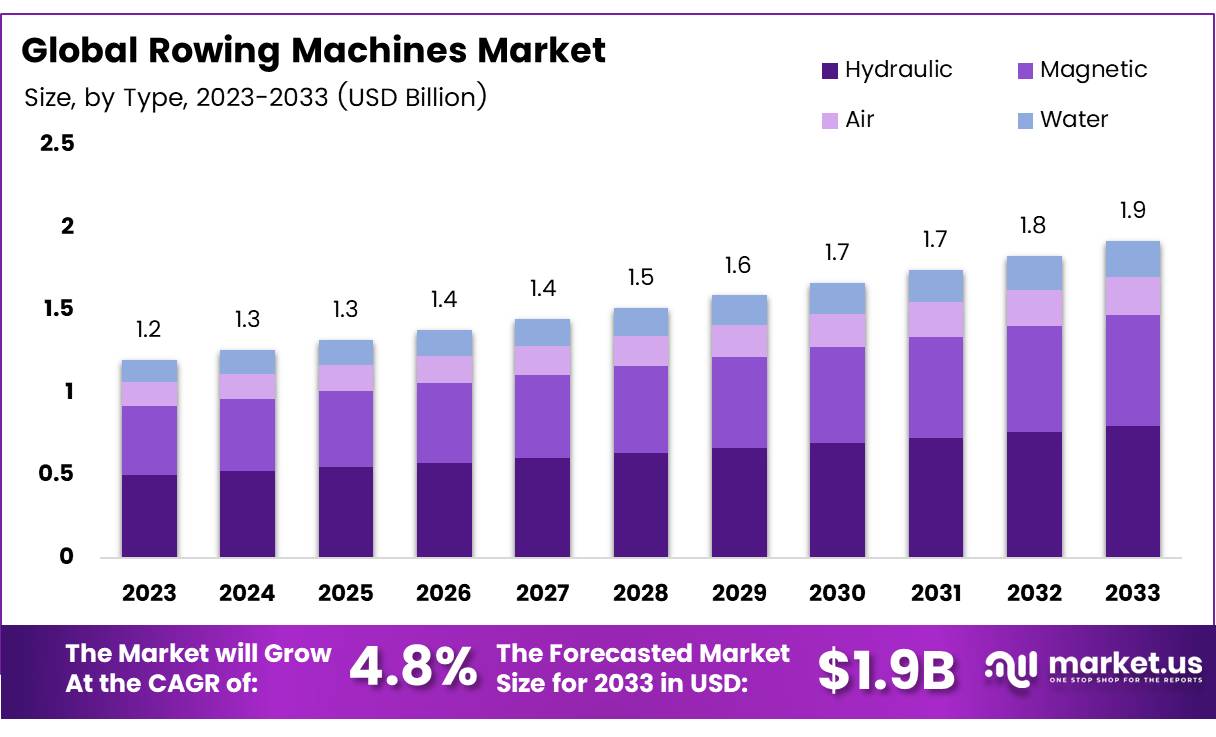

The Global Rowing Machines Market size is expected to be worth around USD 1.9 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Rowing machines are fitness equipment designed to simulate the rowing motion of rowing a boat. They offer a full-body workout, engaging multiple muscle groups, including the legs, core, back, and arms. Rowing machines typically operate using either air resistance, water resistance, or magnetic resistance, providing users with customizable levels of intensity and training variability.

They are commonly used in both home gyms and commercial fitness centers due to their efficiency in improving cardiovascular fitness, endurance, and muscle strength. Additionally, the low-impact nature of rowing makes it an appealing option for individuals seeking a joint-friendly workout.

The rowing machine market refers to the global industry encompassing the design, manufacturing, distribution, and sales of rowing machines for both commercial and personal use. This market has witnessed significant growth, driven by an increasing focus on fitness, wellness, and home workout solutions.

As more consumers seek versatile and effective workout equipment for at-home use, rowing machines have gained popularity due to their ability to target multiple fitness goals in a single machine.

The market includes various types of rowing machines, such as hydraulic, air, and water rowers, catering to different preferences and price points. Consumer demand is further bolstered by trends in health-consciousness and advancements in fitness technology, such as integrated performance tracking and virtual workout platforms.

The rowing machine market is currently experiencing robust growth, with rising consumer demand for effective and efficient fitness solutions. Additionally, the growing preference among gym-goers for high-intensity and cardio workouts is contributing to the rowing machine’s appeal. Approximately 41% of gym-goers select cardio workouts to improve endurance and fitness (Media), positioning rowing machines as an ideal choice to meet these preferences.

Opportunities within the market are further amplified by health and fitness trends, particularly the rise of low-impact exercises. Rowing machines offer an effective full-body workout that can significantly improve muscle strength and cardiovascular health. For example, a 2023 study by RunRepeat found that just six weeks of rowing increased back muscle strength by 33.9%.

Government investment in health and wellness initiatives, coupled with rising awareness about the importance of physical fitness, has further fueled market growth. Many governments worldwide are increasingly promoting fitness programs and subsidizing fitness equipment for home use, thereby providing a positive regulatory environment for the market.

However, manufacturers must navigate regulatory compliance, especially concerning safety standards, product quality, and environmental sustainability. Ensuring adherence to these regulations will be essential as the market continues to evolve.

As reported by recent statistics, wholesale sales of home-use rowing machines in the United States reached approximately 149 million U.S. dollars in 2023, reflecting a notable increase of 62.2% from 2019. This growth underscores the expanding demand for rowing machines as part of the broader fitness market.

Furthermore, studies highlight the effectiveness of rowing machines in improving physical health, with a 2023 study indicating a 33.9% increase in back muscle strength after just six weeks of use as per RunRepeat.

Key Takeaways

- Global Rowing Machines Market projected to grow from USD 1.2 billion in 2023 to USD 1.9 billion by 2033, with a CAGR of 4.8%.

- Hydraulic rowing machines led the market in 2023 due to their affordability and suitability for small spaces.

- Solid wood rowing machines dominated by offering durability and aesthetic appeal.

- Offline sales channels prevailed in 2023, favored for allowing physical product inspection and immediate purchase.

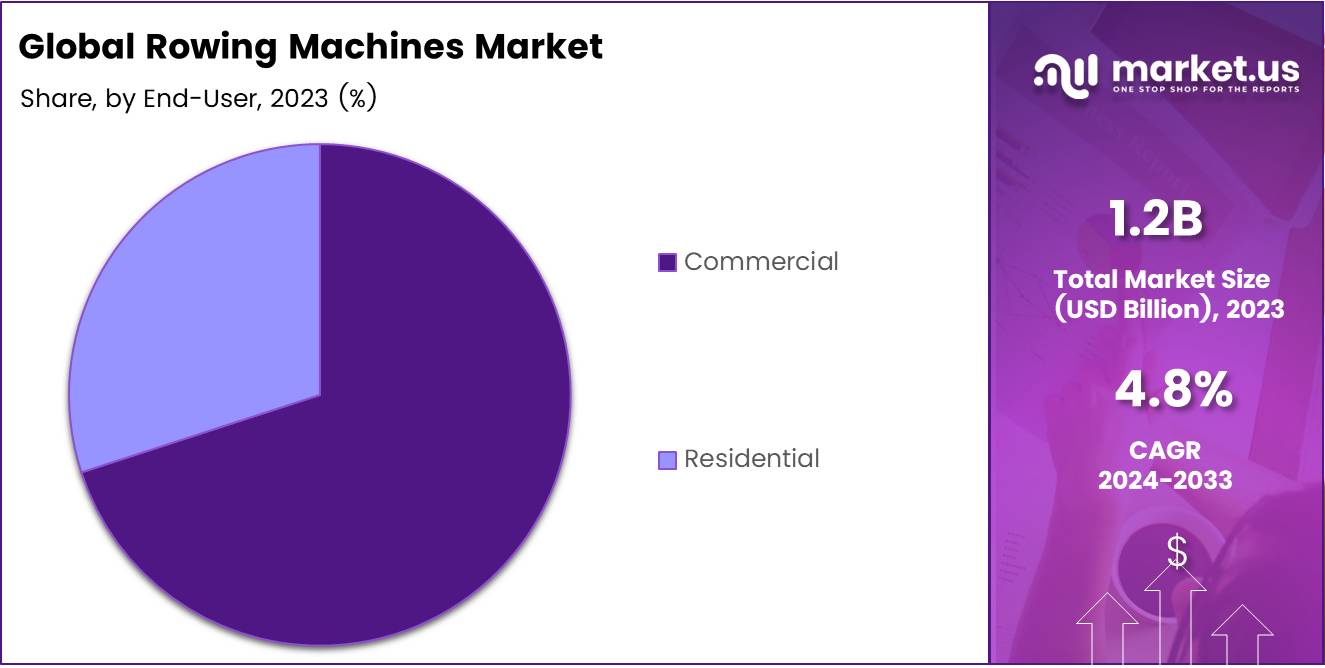

- Commercial use of rowing machines, particularly in gyms and fitness centers, was the largest end-user segment in 2023.

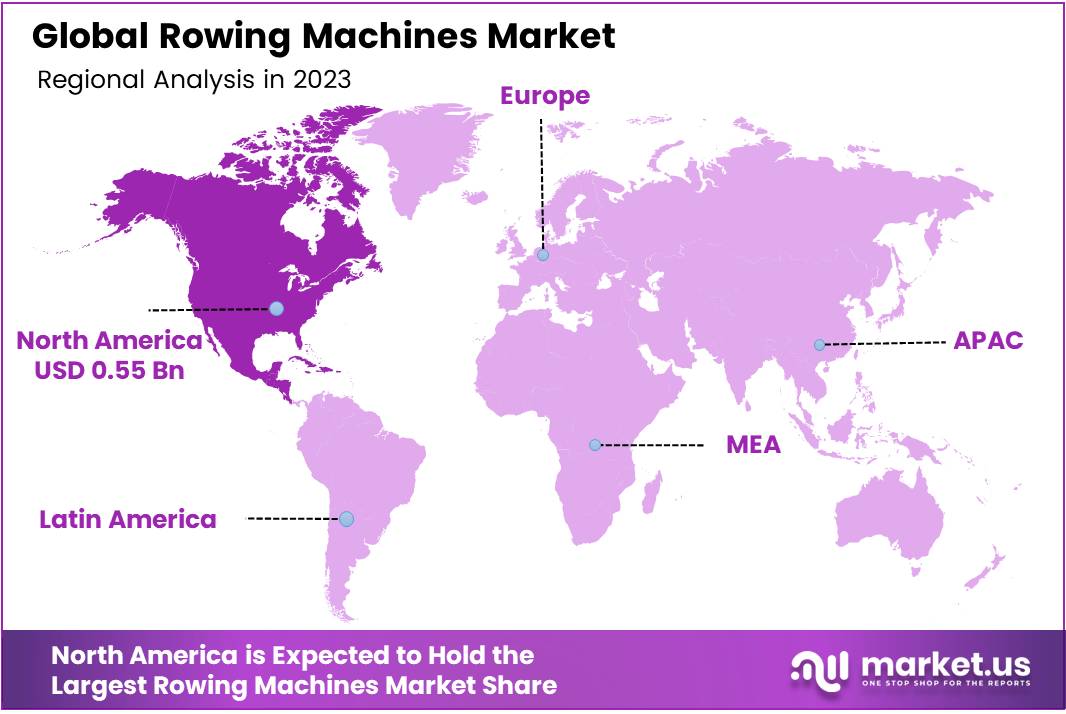

- North America is a major market, holding a 46.2% share in 2023, driven by a strong fitness culture and high health and wellness spending.

Type Analysis

Hydraulic Rowing Machines Lead the Market with Robust Demand

In 2023, Hydraulic held a dominant market position in the By Type Analysis segment of the Rowing Machines Market. The preference for hydraulic rowing machines can be attributed to their affordability and compact design, which make them ideal for home gyms and small fitness facilities.

Hydraulic rowing machines operate using cylinders filled with oil, which create resistance. This mechanism is not only cost-effective but also allows for adjustable resistance levels, enhancing their appeal among users with varying fitness levels.

The market presence of Magnetic, Air, and Water rowing machines also continues to be significant. Magnetic rowing machines, known for their smooth and quiet operation, are preferred in settings where noise reduction is crucial.

Air rowing machines offer a dynamic resistance system that mimics the natural rowing feel on water, making them popular in professional training facilities. Meanwhile, water rowing machines, which use water-filled flywheels to simulate real rowing resistance, are favored for their realistic rowing experience and aesthetic appeal.

Each type of rowing machine supports different user preferences and fitness goals, influencing their market penetration and growth dynamics within the fitness equipment industry.

Body Type Analysis

Solid Wood Leads with Enhanced Aesthetics and Durability in Rowing Machines

In 2023, Solid Wood held a dominant market position in the By Body Type Analysis segment of the Rowing Machines Market. Solid wood rowing machines are highly valued for their durability and aesthetic appeal, which contribute to a more substantial user experience.

These machines are preferred in both residential and commercial settings, driving their demand across diverse market segments. The appeal of solid wood machines can be attributed to their robust construction and the natural feel they provide during use, which is a significant factor in user satisfaction and product longevity.

On the other hand, metal rowing machines also capture a significant share of the market. Known for their strength and adjustable design, metal rowers cater to a broad audience, ranging from amateur fitness enthusiasts to professional athletes.

The adaptability and lower maintenance of metal rowers make them a preferred choice for gyms and fitness centers, which require equipment that can withstand heavy usage. The growth in the metal segment is supported by continuous innovations in design and functionality, enhancing the overall user experience and expanding market reach.

Distribution Channel Analysis

Offline Channels Dominate Rowing Machine Sales

In 2023, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Rowing Machines Market. This channel’s strong performance can be attributed to consumer preferences for physical verification of product quality and immediate availability, which are crucial factors in the purchasing decisions of fitness equipment.

Traditional retail stores and specialty sports outlets, which allow customers to interact with products firsthand and gain expert advice, continue to drive the majority of sales.

On the other hand, the Online distribution channel is growing steadily, driven by the convenience of home shopping and the increasing penetration of e-commerce platforms. Consumers are gradually shifting towards online purchases, influenced by comprehensive customer reviews, competitive pricing, and the ease of product comparisons. Although the online segment’s growth is notable, it has not yet surpassed the offline segment’s extensive reach and consumer trust.

The dynamics between these distribution channels highlight the importance of a balanced omnichannel strategy that leverages both offline and online strengths. By integrating these channels, companies can enhance customer engagement and expand their market reach, adapting to evolving consumer behaviors and preferences.

End-User Analysis

Commercial and Residential Segments Dominate the Rowing Machines Market in 2023

In 2023, Commercial held a dominant market position in the By End-User Analysis segment of the Rowing Machines Market. This segment’s leadership can largely be attributed to the increasing incorporation of rowing machines in gyms and fitness centers, where their versatility and effectiveness in providing full-body workouts have been highly valued.

The rising trend towards group fitness classes and HIIT (High-Intensity Interval Training) sessions, which often incorporate rowing machines for cardio and strength components, further bolstered commercial demand.

Meanwhile, the Residential segment also saw significant growth, driven by the heightened awareness of health and fitness resulting from the global pandemic. As consumers sought safe and convenient workout options, the demand for home fitness equipment surged.

The versatility and compact design of rowing machines made them a favored choice among home users. This segment’s expansion is supported by the increasing availability of connected rowing machines that offer virtual classes and performance tracking, appealing to tech-savvy consumers aiming to achieve fitness goals from the comfort of their homes.

Both segments are expected to maintain their growth trajectory as awareness of health benefits and the accessibility of fitness solutions continue to rise globally.

Key Market Segments

By Type

- Hydraulic

- Magnetic

- Air

- Water

By Body Type

- Solid Wood

- Metal

By Weight Capacity

- 100 to 199 Pounds

- 200 to 249 Pounds

- 300 to 499 Pounds

By Distribution Channel

- Offline

- Online

By Resistant Level

- Less Than 24

- More Than 24

By Color

- Black

- Light Grey

- Others

By End-User

- Commercial

- Residential

Drivers

Expanding Awareness of Physical Activity Benefits Drives Rowing Machines Market Growth

The rowing machines market is experiencing significant growth, primarily driven by the increasing recognition of the advantages associated with maintaining an active lifestyle. As people become more aware of the health benefits, such as improved cardiovascular health and enhanced overall fitness, there is a growing demand for effective, full-body workout solutions.

Rowing machines meet this need perfectly, offering a low-impact exercise that reduces the risk of injury while engaging multiple muscle groups simultaneously. This suitability for diverse fitness levels and the ability to deliver comprehensive workouts is significantly propelling the market forward.

Additionally, the rise in online shopping has made it easier for consumers to purchase rowing machines, further boosting market expansion. The market is also influenced by a surge in health consciousness, with consumers increasingly prioritizing wellness and physical fitness.

These factors, combined with a shift towards fitness trends that emphasize balanced and varied workout regimes, are fostering a robust environment for the growth of the rowing machines market.

Restraints

Price Fluctuations Impacting Rowing Machines

The rowing machines market faces significant challenges, primarily driven by fluctuations in the prices of essential raw materials such as hardened steel, cast iron, and brass.

These materials are fundamental in the manufacturing of rowing machines, contributing directly to their durability and performance. However, their volatile pricing can lead to unpredictable production costs for manufacturers.

As raw material costs increase, manufacturers may be forced to raise the prices of their finished products to maintain profitability. This price increase can deter potential customers, especially those sensitive to price changes, thereby reducing market demand.

Additionally, high production costs not only affect pricing but also influence the strategic decisions of companies regarding product design and feature integration, potentially limiting the availability of innovative or advanced models in the market.

This dynamic poses a substantial restraint on the growth of the rowing machines market, as companies must navigate these financial pressures while trying to meet consumer expectations and maintain competitive pricing.

Growth Factors

Growth Opportunities in the Rowing Machines Market

In the evolving landscape of the fitness industry, rowing machines are gaining prominence due to several dynamic factors. Collaborations with fitness applications present a significant opportunity, enabling users to track their performance and access personalized training programs. This integration not only enhances the user experience but also broadens the market appeal by linking traditional exercise equipment with modern digital fitness trends.

Additionally, the rising awareness of the health risks associated with diabetes and obesity is driving consumer interest towards more effective and engaging workout solutions like rowing machines. These devices offer comprehensive cardiovascular and strength training, appealing to a health-conscious demographic looking to combat these conditions.

Furthermore, manufacturers can capitalize on untapped market segments by introducing rowing machines with specialized features targeted at niche user groups.

These innovations could include ergonomic designs for older adults or enhanced data tracking for competitive athletes, thereby expanding the consumer base and fostering market growth. These strategic directions not only promise to elevate the market’s trajectory but also align with the growing trend towards personalized and health-centric fitness solutions.

Emerging Trends

Integrating Rowing Machines with Fitness Apps

The rowing machines market is experiencing a transformative phase, characterized by several trending factors that are reshaping its dynamics.

A pivotal trend is the integration of rowing machines with fitness apps and digital platforms, which significantly enriches the user experience by offering interactive training options and detailed performance tracking. This digital convergence enables users to engage in more personalized and data-driven workout sessions, enhancing motivation and effectiveness.

Further advancements include enhanced digital displays on rowing machines that provide real-time feedback and access to a variety of interactive training programs. These programs often feature live streaming of workouts and virtual coaching, allowing users to participate in group sessions or receive personalized coaching from the comfort of their homes.

Additionally, there is an increasing focus on ergonomic design, ensuring that rowing machines are more comfortable and accessible to a broader range of users, including those with physical limitations. This emphasis on user comfort and interactive technology is not only making rowing workouts more appealing but also supports sustained use, promoting long-term health benefits and customer retention.

These trends are crucial for driving the adoption of rowing machines in both residential and commercial markets, indicating robust growth potential in the fitness equipment sector.

Regional Analysis

North America Leads Global Rowing Machines Market with 46.2% Share, Generating USD 0.55 Billion in Revenue

The Rowing Machines Market is exhibiting dynamic growth across various regions, reflecting divergent market forces and consumer preferences.

In North America, the market is particularly robust, commanding a dominant 46.2% share with revenues reaching USD 0.55 billion. This region benefits from a well-established fitness culture and higher consumer spending on health and wellness products.

Regional Mentions:

Europe follows closely, driven by increasing health awareness and the presence of numerous fitness enthusiasts. The integration of advanced technology in rowing machines, coupled with a growing number of fitness centers, supports the market expansion in this region.

The Asia Pacific region is witnessing rapid growth due to rising disposable incomes and the expanding middle class. The increasing popularity of home gyms and personal fitness equipment in countries such as China and India is fueling the demand for rowing machines. Additionally, government initiatives promoting health consciousness are further boosting market growth.

The Middle East & Africa, though smaller in market size compared to other regions, is beginning to show potential for significant growth. The increasing urbanization and rising health awareness among the population are key drivers. The availability of luxury fitness facilities in the Gulf Cooperation Council (GCC) countries also supports the demand for high-end rowing machines.

Latin America, with its growing focus on health and fitness, particularly in countries like Brazil and Argentina, is also seeing an uptick in the adoption of fitness equipment, including rowing machines. The market in this region benefits from improving economic conditions and a young population keen on fitness and sports.

Overall, while North America remains the dominating region in the rowing machines market, Asia Pacific and Europe are rapidly catching up, contributing significantly to the global market growth through technological advancements and increasing health consciousness among the population.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global rowing machines market in 2023 is characterized by the presence of several key players, each contributing to the competitive dynamics of the industry. Among these, Concept2 Inc., Peloton Interactive Inc., and TECHNOGYM S.p.A are notable for their significant impact on market trends and consumer preferences.

Concept2 Inc. has established itself as a leader in the rowing machine segment, known for its durable and high-performance equipment. The company’s products are favored by both professional athletes and fitness enthusiasts, which has bolstered its market share. Concept2’s commitment to quality and innovation in ergometer technology remains a pivotal factor in its sustained market presence.

Peloton Interactive Inc., traditionally known for its interactive fitness products, has expanded its portfolio to include rowing machines, capitalizing on its robust digital platform to offer immersive workout experiences. This strategic move is anticipated to enhance Peloton’s market reach and appeal to a tech-savvy consumer base seeking connected fitness solutions.

TECHNOGYM S.p.A, a global giant in the fitness equipment industry, continues to drive market growth through its state-of-the-art rowing machines that integrate seamlessly with its wellness ecosystem. TECHNOGYM’s focus on design and technology integration appeals to high-end gyms and health clubs, further cementing its position in the market.

These companies leverage technological advancements and strategic marketing to cater to evolving consumer demands and preferences, thereby shaping the competitive landscape of the global rowing machines market. Their efforts are likely to continue influencing market dynamics, with a focus on innovation and customer engagement driving their growth trajectories in the forthcoming years.

Top Key Players in the Market

- BODYCRAFT

- Johnson Health Tech

- Nautilus Inc.

- Tunturi New Fitness

- Pure Design Fitness

- Concept2 inc.

- WaterRower

- RP3 Rowing

- Mr Captain Brand

- Stamina Products Inc.

- Sunny Health and Fitness

- iFIT Inc.

- York Fitness UK

- Infiniti

- Peloton Interactive Inc.

- ERGATTA

- AVIRON INTERACTIVE INC.

- TECHNOGYM S.p.A

- Hydrow

- Oartec

- adidas AG.

Recent Developments

- In 2023, Ergatta introduced the Ergatta Lite, a connected rowing machine featuring a digital screen, interactive content, and a water-based flywheel, enhancing their portfolio of innovative fitness equipment.

- In 2023, Peloton expanded its market presence in Canada by launching Peloton Row, adding a rowing machine to their product range which already includes Bike, Bike+, Guide, and Tread.

- In 2024, WaterRower, known for its manufacturing capabilities, acquired CityRow, a connected fitness company. This acquisition included at-home rowing machines, digital content, and physical studios, marking a significant expansion of WaterRower’s business operations.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 1.9 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hydraulic, Magnetic, Air, Water), By Body Type (Solid Wood, Metal), By Weight Capacity (100 to 199 Pounds, 200 to 249 Pounds, 300 to 499 Pounds), By Distribution Channel (Offline, Online), By Resistant Level (Less Than 24, More Than 24), By Color (Black, Light Grey, Others), By End-User (Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BODYCRAFT, Johnson Health Tech, Nautilus Inc., Tunturi New Fitness, Pure Design Fitness, Concept2 inc., WaterRower, RP3 Rowing, Mr Captain Brand, Stamina Products Inc., Sunny Health and Fitness, iFIT Inc., York Fitness UK, Infiniti, Peloton Interactive Inc., ERGATTA, AVIRON INTERACTIVE INC., TECHNOGYM S.p.A, Hydrow, Oartec, adidas AG., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BODYCRAFT

- Johnson Health Tech

- Nautilus Inc.

- Tunturi New Fitness

- Pure Design Fitness

- Concept2 inc.

- WaterRower

- RP3 Rowing

- Mr Captain Brand

- Stamina Products Inc.

- Sunny Health and Fitness

- iFIT Inc.

- York Fitness UK

- Infiniti

- Peloton Interactive Inc.

- ERGATTA

- AVIRON INTERACTIVE INC.

- TECHNOGYM S.p.A

- Hydrow

- Oartec

- adidas AG.