Global High Volume Dispensing Systems Market Size, Share, Growth Analysis By Product Type (Systems and Cabinets, Software), By Dispensing Mode (Manual Dispensing, Automatic Dispensing), By Dispensing Type (Valve Dispensing, Jet Dispensing), By Dispensing Material (Adhesives, Sealants, Lubricants, Epoxies, Greases), By End User (Automotive, Electronics, Medical, Packaging, Aerospace, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 48795

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

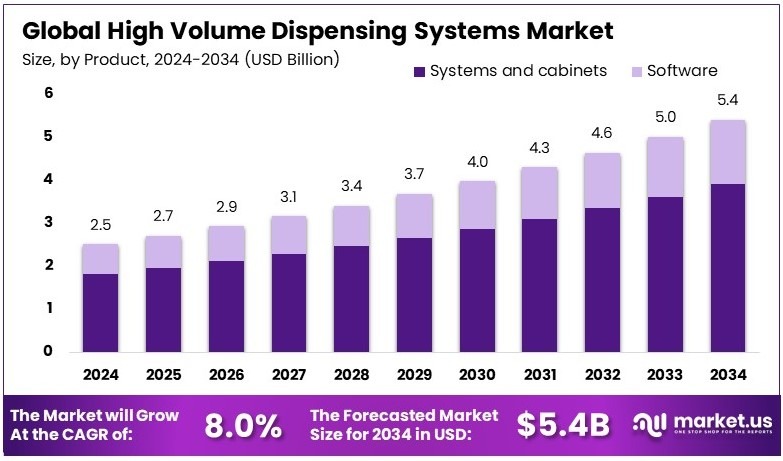

The Global High Volume Dispensing Systems Market size is expected to be worth around USD 5.4 Billion by 2034, from USD 2.5 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

High Volume Dispensing Systems are automated equipment that accurately delivers large quantities of liquids or materials. They are engineered for commercial, industrial, and healthcare applications. These systems ensure precise dosing and efficient operation. They are designed to minimize waste and improve consistency in processes requiring substantial, rapid material distribution effectively.

The High Volume Dispensing Systems Market comprises the commercial trade and distribution network for automated dispensing equipment. It includes manufacturers, distributors, and retailers that supply these systems across various industries. The market operates under established regulatory standards and trade practices, ensuring reliable product quality and consistent availability through supply channels.

High volume dispensing systems are becoming indispensable in managing the increasing healthcare demands across Europe. In 2022, healthcare spending in the EU reached a staggering €1,648 billion, which is equivalent to 10.4% of the region’s GDP. Countries like Germany, France, and Italy are at the forefront, with healthcare expenditures of €489 billion, €314 billion, and €176 billion respectively.

This substantial investment underscores the critical need for efficient healthcare solutions, particularly in the area of medication management. High volume dispensing systems are pivotal in this context, as they streamline the dispensing process, reduce errors, and enhance the overall efficiency of healthcare services.

The market for these systems is characterized by robust demand driven by the need to improve service delivery and patient care in pharmacies and hospitals. These systems are designed to handle large volumes of prescriptions with precision and speed, which is crucial in environments where timeliness and accuracy are paramount. The adoption of such technologies is further encouraged by their potential to significantly reduce wait times and improve patient satisfaction.

However, the market is approaching saturation, with many providers vying for market share through technological advancements and competitive pricing strategies. This intense competition necessitates ongoing innovation and differentiation, with companies focusing on adding features like data analytics and integration with health records to add value beyond mere dispensing.

Key Takeaways

- The High Volume Dispensing Systems Market was valued at USD 2.5 billion in 2024 and is expected to reach USD 5.4 billion by 2034, with a CAGR of 8.0%.

- In 2024, Systems and Cabinets dominated the product type segment with 72.1%, owing to widespread use in healthcare and automation.

- In 2024, Automatic Dispensing led the dispensing mode segment with 64.5%, enhancing efficiency and reducing errors.

- In 2024, Valve Dispensing dominated the dispensing type segment with 58.5%, ensuring precision in material application.

- In 2024, Adhesives led the dispensing material segment with 37.5%, widely used in industrial and medical applications.

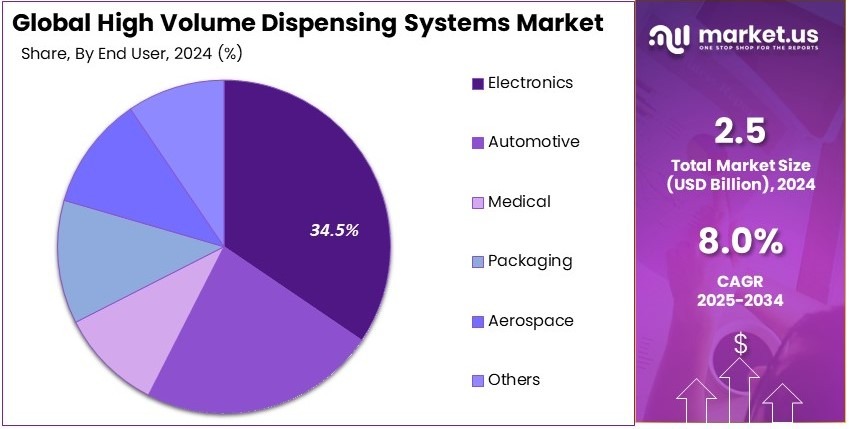

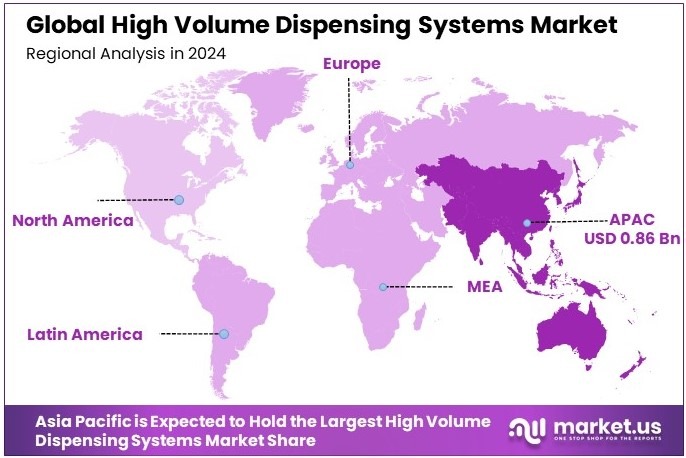

- In 2024, APAC led the regional market with 34.5%, valued at USD 0.86 billion, driven by increased automation adoption.

Product Type Analysis

Systems and Cabinets dominate with 72.1% due to their efficiency in handling bulk dispensing operations in industrial settings.

The high-volume dispensing systems market is segmented into systems and cabinets and software. Systems and cabinets hold the dominant market share at 72.1%. This is because they provide an all-in-one solution for dispensing materials in large volumes, making them essential in industries such as electronics, automotive, and packaging. These systems ensure precision, reduce waste, and improve production speed.

Many industries prefer them because they integrate seamlessly into automated assembly lines, enhancing efficiency and accuracy. The increasing demand for high-speed production, especially in the electronics sector, is driving the growth of this segment.

Additionally, systems and cabinets require less human intervention, reducing labor costs and improving workplace safety. Companies also invest in these systems due to their long-term cost savings, making them a preferred choice for large-scale manufacturing.

Software, while a smaller segment, plays a critical role in optimizing dispensing operations. It is used for monitoring, controlling, and automating dispensing processes, improving efficiency. As industries shift towards digitalization, software adoption is expected to rise, complementing the growth of physical dispensing systems.

Dispensing Mode Analysis

Automatic Dispensing dominates with 64.5% due to its ability to increase efficiency and reduce errors in high-speed production lines.

The dispensing mode segment is divided into manual and automatic dispensing. Automatic dispensing leads with a 64.5% market share. This is because it eliminates human error and ensures consistent material application in large-scale manufacturing. Industries such as electronics and medical devices rely on automatic dispensers for precise applications, such as adhesive bonding and coating. These systems operate with minimal supervision, allowing manufacturers to achieve higher productivity with reduced labor costs. Additionally, automatic dispensing systems are compatible with modern robotic assembly lines, making them an essential part of Industry 4.0 advancements. The growing focus on automation across industries is further driving demand for these systems.

Manual dispensing remains relevant in applications requiring human control, such as specialized repairs and low-volume production. However, its market share is declining due to the increasing adoption of automation.

Dispensing Type Analysis

Valve Dispensing dominates with 58.5% due to its ability to handle a wide range of materials with high precision.

The market is segmented into valve dispensing and jet dispensing. Valve dispensing holds a 58.5% market share because it provides better control over material flow, making it ideal for adhesives, sealants, and lubricants. This type of dispensing is widely used in the automotive and electronics industries, where precision and consistency are crucial.

Valve dispensing allows manufacturers to manage viscosity and flow rates, ensuring uniform application. Additionally, it supports different dispensing techniques, such as spraying, bead dispensing, and dot dispensing, making it versatile for multiple industries. Its ability to handle high-viscosity materials also contributes to its dominance in the market.

Jet dispensing is gaining traction due to its speed and ability to apply materials without direct contact. It is particularly useful in high-speed production lines where fast and accurate dispensing is required. However, it is more expensive and requires specialized equipment, limiting its adoption in some industries.

Dispensing Material Analysis

Adhesives dominate with 37.5% due to their widespread use in electronics, automotive, and packaging industries.

The market is segmented by dispensing materials, including adhesives, sealants, lubricants, epoxies, and greases. Adhesives lead with a 37.5% share because they are essential in modern manufacturing. They are used for bonding components in electronic devices, assembling car parts, and sealing packaging. The increasing demand for lightweight and durable products in the automotive and aerospace sectors is driving the adoption of industrial adhesives.

These materials provide strong bonds while reducing the need for mechanical fasteners, improving product design and performance. Additionally, the shift toward eco-friendly adhesives is contributing to market growth, as manufacturers seek alternatives to traditional solvent-based solutions.

Sealants are used for gap-filling and waterproofing applications, particularly in construction and automotive industries. Lubricants play a vital role in reducing friction in machinery, improving efficiency and durability. Epoxies are favored for their high-strength bonding capabilities in industrial applications. Greases are widely used in mechanical systems to enhance performance and longevity.

End-User Analysis

Electronics dominate with 34.5% due to the high demand for precision dispensing in circuit board assembly and component manufacturing.

The market is divided into automotive, electronics, medical, packaging, aerospace, and other industries. Electronics hold the largest share at 34.5% because of the increasing need for accurate and reliable dispensing systems in semiconductor manufacturing and PCB assembly.

Adhesives, sealants, and epoxies are commonly used in electronics production to bond delicate components, insulate circuits, and protect against moisture. The rise in consumer electronics, including smartphones and wearables, is driving the demand for advanced dispensing technologies. Additionally, miniaturization trends in electronics require precise application of materials, which automated dispensing systems can efficiently handle.

The automotive industry uses dispensing systems for bonding, sealing, and lubrication in vehicle assembly. The medical sector relies on precise dispensing for drug delivery systems, diagnostic devices, and surgical tools. The packaging industry benefits from high-speed adhesive application for sealing boxes and cartons. Aerospace manufacturers use dispensing technologies for assembling aircraft components, ensuring strong and lightweight structures.

Key Market Segments

By Product Type

- Systems and Cabinets

- Software

By Dispensing Mode

- Manual Dispensing

- Automatic Dispensing

By Dispensing Type

- Valve Dispensing

- Jet Dispensing

By Dispensing Material

- Adhesives

- Sealants

- Lubricants

- Epoxies

- Greases

By End User

- Automotive

- Electronics

- Medical

- Packaging

- Aerospace

- Others

Driving Factors

Automation and Healthcare Expansion Drive Market Growth

The increasing demand for efficient drug dispensing in pharmacies and hospitals is a key factor driving the growth of high-volume dispensing systems. These systems enhance operational efficiency by reducing manual errors and improving workflow, making them essential for large healthcare facilities handling high prescription volumes.

The pharmaceutical market’s expansion is further fueling adoption. As drug production increases, pharmacies require automated solutions to manage inventory and dispense medications accurately. This demand is particularly strong in hospitals, where quick and precise medication dispensing is crucial for patient care.

Rising healthcare expenditure and improved infrastructure are also contributing to market growth. Governments and private investors are funding hospitals and pharmacies to modernize healthcare services, leading to greater adoption of high-volume dispensing technologies. These investments ensure faster patient service and reduce the workload on healthcare professionals.

Additionally, patient safety and medication accuracy remain top priorities. Automated dispensing reduces human errors, ensuring the right drug and dosage are provided. This is especially important in critical care settings where medication mistakes can have serious consequences.

Restraining Factors

High Costs and System Challenges Restrain Market Growth

The high initial cost of high-volume dispensing systems is a major barrier to market expansion. These machines require significant investment, making them less accessible for small pharmacies and clinics with limited budgets.

Integration challenges also pose a concern. Many healthcare facilities use different pharmacy management systems, and incorporating new dispensing technology can be complex and time-consuming. Compatibility issues can lead to delays in adoption, requiring additional IT support and customization.

Training and maintenance requirements further hinder market growth. Staff must undergo extensive training to operate and manage these systems efficiently. Regular maintenance is also necessary to ensure smooth operation, adding to long-term costs.

Concerns about system errors affect adoption as well. While automation reduces human mistakes, technical glitches or software failures can lead to dispensing errors. In a healthcare setting, these errors can have serious consequences for patient health, leading to hesitation among providers.

Growth Opportunities

AI Integration and Retail Expansion Provide Opportunities

Artificial intelligence is transforming the dispensing market. AI-driven predictive analytics help pharmacies manage inventory efficiently, reducing waste and ensuring timely restocking. By analyzing prescription patterns, these systems improve accuracy and enhance operational efficiency.

Retail pharmacies present another major opportunity. As more consumers seek convenient access to medications, chain pharmacies are investing in high-volume dispensing to meet growing demand. Automating prescription fulfillment speeds up service and improves patient satisfaction.

Compact and user-friendly models are also creating new possibilities. Smaller clinics and specialty pharmacies, which previously could not afford large dispensing systems, can now benefit from scaled-down versions tailored to their needs. These models allow even smaller healthcare providers to improve efficiency and accuracy.

Partnerships with healthcare providers are accelerating market expansion. By working closely with hospitals and pharmacy chains, manufacturers can customize dispensing systems to meet specific requirements, ensuring better adoption and seamless integration.

Emerging Trends

Cloud Integration and Remote Services Are Latest Trending Factors

Cloud-based solutions are revolutionizing real-time inventory management. Pharmacies can now track medication levels, expiration dates, and prescription fulfillment remotely, reducing errors and improving efficiency. This shift is particularly beneficial for large hospital networks managing multiple locations.

Mobile dispensing systems are also gaining traction. These systems allow medications to be dispensed directly at the point of care, reducing wait times and improving patient convenience. This trend is driving demand for portable and flexible dispensing solutions.

RFID technology is enhancing drug tracking capabilities. By using radio-frequency identification, pharmacies can monitor medication movement, prevent theft, and ensure accurate dispensing. This improves security and helps healthcare providers comply with regulatory standards.

Telepharmacy and remote dispensing services are expanding access to medications. As virtual healthcare grows, patients in remote areas can receive prescriptions through automated systems without visiting a physical pharmacy. This innovation is making healthcare more accessible and convenient.

Regional Analysis

APAC Dominates with 34.5% Market Share in High Volume Dispensing Systems Market

Asia Pacific leads the high volume dispensing systems market with a 34.5% share, translating to USD 0.86 billion. This robust market position is underscored by rapid advancements in healthcare infrastructure and growing healthcare expenditures in the region.

Key factors driving this dominance include increasing automation in pharmacies and hospitals to improve efficiency and accuracy in medication dispensing. Moreover, the rising aging population and expanding pharmaceutical sector in countries like China, Japan, and India fuel the demand for these systems.

The future impact of APAC on the high volume dispensing systems market appears highly positive. Continued investments in healthcare technology and the growing adoption of digital health solutions are likely to boost the region’s market share further.

Regional Mentions:

- North America: North America is a key player in the high volume dispensing systems market, driven by advanced healthcare infrastructure and stringent regulatory standards. The region’s focus on reducing medication errors and improving patient safety supports its strong market presence.

- Europe: Europe’s market is bolstered by increasing healthcare spending and the adoption of e-prescriptions, which enhance the efficiency of high volume dispensing systems. The region’s emphasis on healthcare quality and safety standards sustains its market growth.

- Middle East & Africa: The Middle East and Africa are seeing gradual growth in the high volume dispensing systems market, aided by governmental initiatives to modernize healthcare infrastructure and improve pharmacy services across the region.

- Latin America: Latin America is making strides in the high volume dispensing systems market with efforts to enhance healthcare services and pharmacy management. The region’s focus on healthcare reforms and technology adoption is setting the stage for future growth.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The high volume dispensing systems market is characterized by the presence of several leading companies that specialize in automated solutions for pharmacies and healthcare facilities. Among them, McKesson Corporation, Omnicell, Inc., ScriptPro LLC, and Swisslog Healthcare are prominent players driving innovation and efficiency in this sector.

McKesson Corporation is a powerhouse in the healthcare industry, offering a wide range of high volume dispensing systems that are renowned for their reliability and efficiency. McKesson’s systems are designed to streamline pharmacy operations, reduce errors, and improve patient safety, making them indispensable in both retail and hospital pharmacies.

Omnicell, Inc. is another key player, known for its advanced automation technologies that optimize medication management and dispensing in healthcare settings. Omnicell’s solutions are integral to enhancing workflow efficiencies and reducing operational costs, thereby supporting better clinical outcomes.

ScriptPro LLC specializes in robotics and software for pharmacies, providing systems that automate the dispensing process and manage inventory with high precision. ScriptPro’s focus on innovation in pharmacy automation technology helps ensure accuracy and security in medication dispensing, which is crucial for patient care.

Swisslog Healthcare excels in integrated automation solutions for medication management. Their systems, which include both robotic and software solutions, are tailored to enhance the efficiency of pharmacy operations while maintaining compliance with healthcare regulations. Swisslog’s commitment to pushing the boundaries of healthcare technology has solidified its role as a leader in the market.

These top companies significantly influence the high volume dispensing systems market through their technological advancements, extensive industry knowledge, and comprehensive service offerings. Their continuous efforts in R&D and customer-focused solutions not only drive their growth but also set industry standards for quality and innovation in healthcare. As the demand for efficient and error-free dispensing solutions grows, these leaders are well-positioned to expand their market presence and impact.

Major Companies in the Market

- Healthmark Group

- Innovation Associates

- McKesson Corporation

- Omnicell, Inc.

- R/X Automation Solutions

- ScriptPro LLC

- TCGRx

- ARXIUM

- Becton, Dickinson and Company

- Healthmark Services

- RxSafe, LLC

- Swisslog Healthcare

- Synapxe Pte Ltd

Recent Developments

- Nordson Electronics Solutions: On August 2024, Nordson Electronics Solutions announced its participation in the SEMICON Taiwan tradeshow, scheduled from September 4–6, 2024, at TaiNEX in Taipei. The company plans to showcase its latest fluid dispensing technologies for advanced semiconductor packaging, including the ASYMTEK Forte® system, designed for high productivity and precision.

- Capsa Healthcare: On August 2024, Capsa Healthcare announced its expansion into retail pharmacy central fill automation, highlighting its advanced central fill and mail-order pharmacy capabilities. These systems are engineered to handle large volumes of prescriptions with precision, enabling pharmacies to process from a few thousand to over 100,000 scripts per shift.

Report Scope

Report Features Description Market Value (2024) USD 2.5 Billion Forecast Revenue (2034) USD 5.4 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Systems and Cabinets, Software), By Dispensing Mode (Manual Dispensing, Automatic Dispensing), By Dispensing Type (Valve Dispensing, Jet Dispensing), By Dispensing Material (Adhesives, Sealants, Lubricants, Epoxies, Greases), By End User (Automotive, Electronics, Medical, Packaging, Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape HEALTHMARK GROUP, Innovation Associates, McKesson Corporation, Omnicell, Inc., R/X Automation Solutions, ScriptPro LLC, TCGRx, ARXIUM, Becton, Dickinson and Company, HEALTHMARK SERVICES, Innovation Associates, McKesson Corporation, Omnicell Inc., RxSafe, LLC, ScriptPro LLC, Swisslog Healthcare, Synapxe Pte Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High Volume Dispensing Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

High Volume Dispensing Systems MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Healthmark Group

- Innovation Associates

- McKesson Corporation

- Omnicell, Inc.

- R/X Automation Solutions

- ScriptPro LLC

- TCGRx

- ARXIUM

- Becton, Dickinson and Company

- Healthmark Services

- RxSafe, LLC

- Swisslog Healthcare

- Synapxe Pte Ltd