Global High Temperature Insulation Market Size, Share, And Industry Analysis Report By Material Type (Ceramic Fibre, Fiberglass, Mineral Wool, Vacuum to Formed Insulating Products, Polyurethane Foam, Polystyrene, Insulating Fire Bricks), By Temperature Range (600°C to 1100°C, 1100°C to 1500°C, 1700°C and Above), By Product Form (Blanket Mat Board, Rigid Modules, Loose Fill, Molded Shapes), By Application (Petrochemicals, Power Generation, Transportation, Electrical and Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174448

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

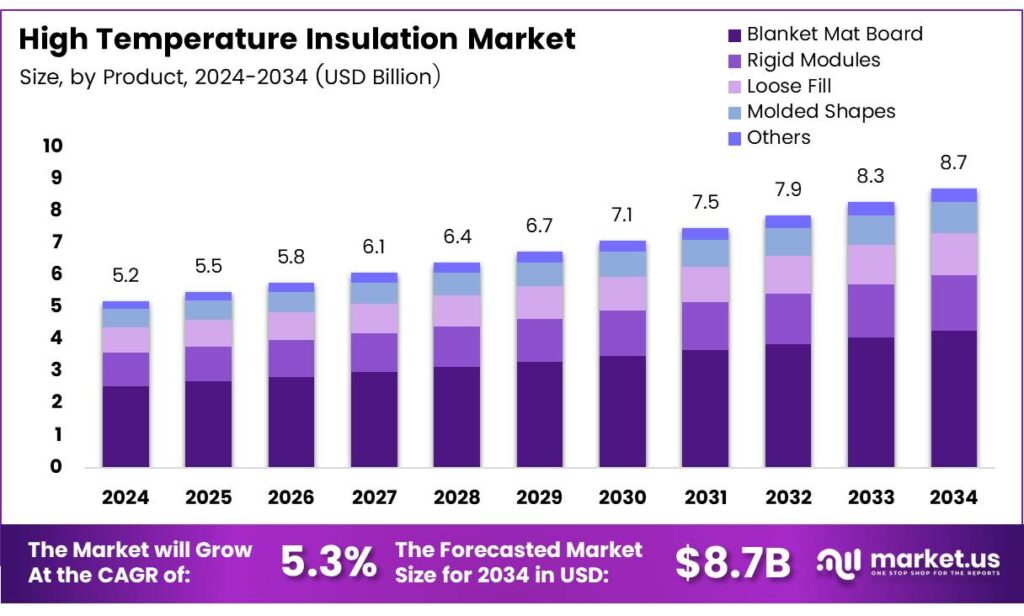

The Global High Temperature Insulation Market size is expected to be worth around USD 8.7 billion by 2034, from USD 5.2 billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The High Temperature Insulation market refers to advanced thermal materials designed to withstand extreme heat while reducing energy loss. These solutions protect equipment, improve process safety, and lower operating costs across furnaces, kilns, reactors, and exhaust systems. Consequently, industries adopt them to enhance efficiency, durability, and regulatory compliance.

High Temperature Insulation plays a strategic role in modern industrial operations. It supports continuous processing at elevated temperatures, improves thermal stability, and minimizes unplanned shutdowns. Moreover, it enables manufacturers to optimize fuel consumption and extend asset life, which directly improves profitability and operational resilience.

- Regulatory pressure further influences buying decisions. Improved insulation in high-heat systems can reduce industrial heat losses by 20–30%, pushing plant operators to include insulation upgrades in routine maintenance and modernization budgets. In Europe, where energy-intensive industries account for nearly 25% of total greenhouse gas emissions, stricter efficiency standards make high-temperature insulation a practical, near-term solution for emissions reduction and cost control.

Public investment continues to strengthen market momentum as 37% of global final energy use comes from industry, making efficiency upgrades a clear policy focus. Governments worldwide promote insulation adoption through energy audits, retrofitting incentives, and low-carbon industrial funding programs. These measures encourage manufacturers to modernize thermal systems and reduce long-term energy costs while improving operational efficiency.

The high-temperature insulation market is driven by growth in steel, cement, glass, petrochemical, and power generation industries, where efficient thermal control is essential. Expanding electric arc furnaces, along with stricter energy-efficiency and decarbonization regulations, are further increasing demand, as insulation helps reduce heat loss, cut emissions, and support sustainable industrial operations.

Key Takeaways

- The Global High Temperature Insulation Market is projected to grow from USD 5.2 billion in 2024 to USD 8.7 billion by 2034, registering a 5.3% CAGR during 2025–2034.

- Ceramic Fibre leads the market by material type with a dominant share of 54.2%, driven by high thermal resistance and lightweight performance.

- The 600°C to 1100°C temperature range holds the largest share at 44.1%, reflecting its wide use across core industrial processes.

- Blanket/Mat/Board products account for the highest product-form share at 48.9%, supported by flexibility and ease of installation.

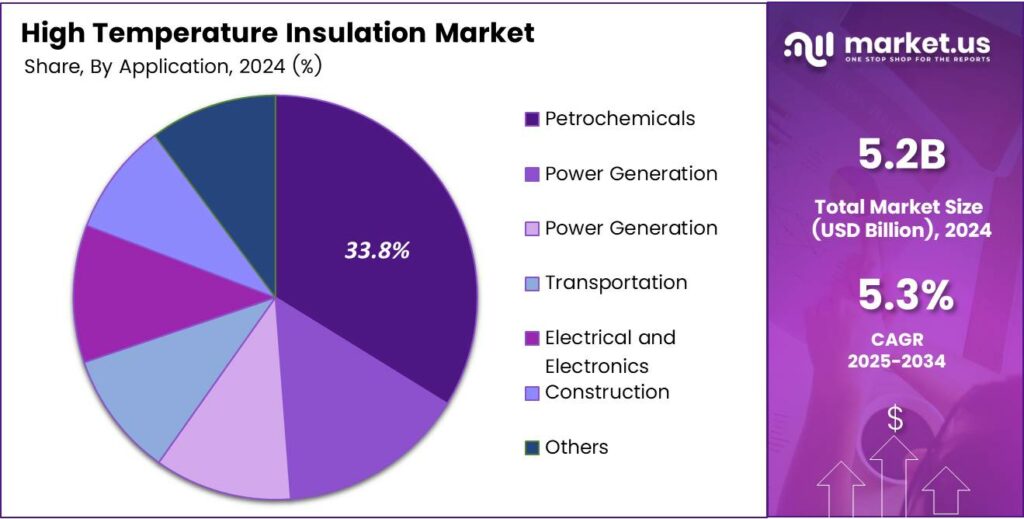

- Petrochemicals represent the leading application segment with a market share of 33.8%, supported by continuous high-temperature operations.

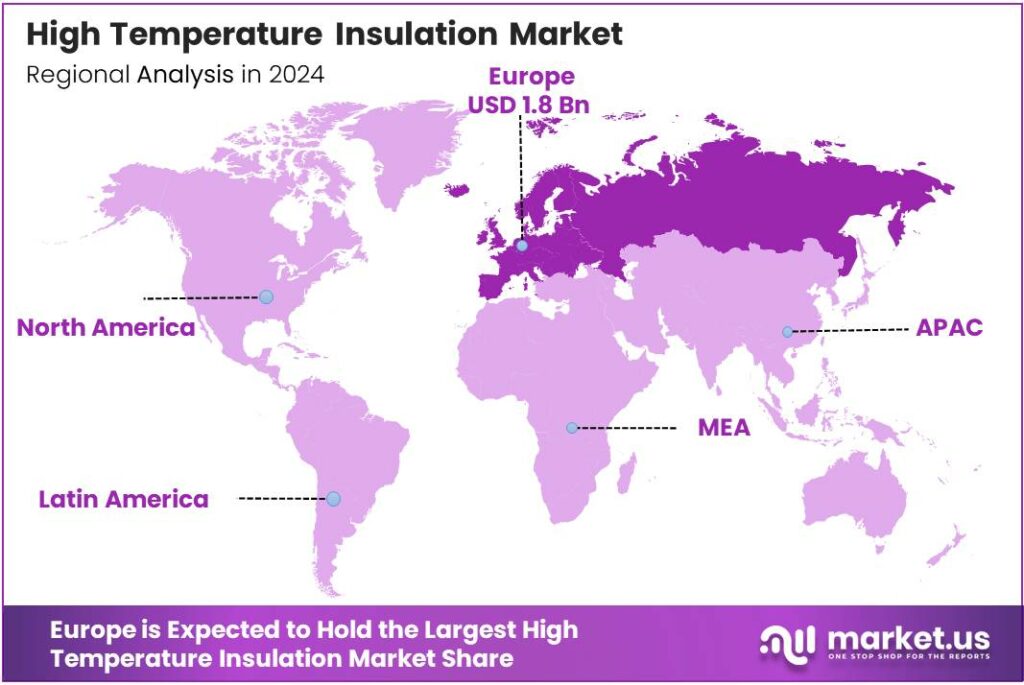

- Europe dominates the global market with a share of 34.9%, valued at USD 1.8 billion, backed by strict energy-efficiency regulations.

By Material Type Analysis

Ceramic Fibre dominates with 54.2% share due to its high thermal resistance and lightweight nature.

In 2025, Ceramic Fibre held a dominant market position in the By Material Type Analysis segment of the High Temperature Insulation Market, with a 54.2% share. This dominance is driven by its excellent heat resistance, low thermal conductivity, and suitability for furnaces, kilns, and reactors. Moreover, industries prefer ceramic fibre for energy efficiency.

Fiberglass continues to play a supportive role as it offers cost efficiency and moderate temperature resistance. It is commonly used in applications where extreme heat exposure is limited, helping industries balance insulation performance with affordability.

Mineral Wool is widely used in industrial and construction settings due to its fire resistance and sound insulation properties. Although heavier than ceramic fibre, it remains important for boilers and industrial piping systems. Vacuum to Formed Insulating Products are gaining traction for compact systems.

Polyurethane Foam and Polystyrene are applied mainly in lower-temperature industrial zones. Meanwhile, Insulating Fire Bricks (IFB) remain critical for structural furnace linings, while Others include niche materials used for specialized applications.

By Temperature Range Analysis

600°C to 1100°C dominates with 44.1% share due to broad industrial usability.

In 2025, the 600°C to 1100°C held a dominant market position in the By Temperature Range Analysis segment of the High Temperature Insulation Market, with a 44.1% share. This range supports steel, cement, and petrochemical operations where consistent thermal control is essential.

The 1100°C to 1500°C range serves high-intensity furnaces and reactors. These systems require advanced insulation to manage thermal shock and energy losses effectively. Another 1100°C to 1500°C category addresses specialized processing units.

These applications emphasize material stability and long service life under continuous heat exposure. 1700°C and above is a niche but critical segment. It supports extreme environments such as advanced ceramics, aerospace testing, and specialty metallurgical processes.

By Product Form Analysis

Blanket Mat Board leads with 48.9% share due to flexibility and ease of installation.

In 2025, Blanket Mat Board held a dominant market position in the By Product Form Analysis segment of the High Temperature Insulation Market, with a 48.9% share. Its flexibility allows easy installation around complex equipment, improving operational efficiency.

Rigid Modules are preferred in high-vibration and high-temperature zones. They provide structural stability and consistent insulation performance in furnaces and kilns. Loose-fill insulation supports irregular spaces and retrofit projects. It allows operators to insulate difficult geometries without extensive redesign.

Molded Shapes are engineered for precision applications. These products ensure uniform insulation in burners, ducts, and specialty industrial equipment. Others include customized insulation forms developed for unique industrial requirements, supporting niche operational needs.

By Application Analysis

Petrochemicals dominate with 33.8% share due to continuous high-temperature operations.

In 2025, Petrochemicals held a dominant market position in the By Application Analysis segment of the High Temperature Insulation Market, with a 33.8% share. Refineries rely on insulation to reduce heat loss and improve process safety.

Power Generation applications depend on insulation for boilers, turbines, and exhaust systems. Effective insulation improves efficiency and reduces maintenance costs. Another Power Generation segment focuses on emerging thermal power upgrades. These systems emphasize energy conservation and emission reduction.

Transportation applications include insulation for rail, marine, and aerospace systems. Heat-resistant materials protect components and enhance safety. Electrical and Electronics use insulation to protect sensitive components, while Construction applies it for fire protection and energy efficiency. Others include niche industrial uses.

Key Market Segments

By Material Type

- Ceramic Fibre

- Fiberglass

- Mineral Wool

- Alkaline Earth Silicate (AES)

- Aluminum Silicate Wool (ASW)

- Polycrystalline Wool or Fibre (PCW)

- Long Fibre

- Vacuum to Formed Insulating Products

- Polyurethane Foam

- Polystyrene

- Insulating Fire Bricks (IFB)

- Others

By Temperature Range

- 600°C to 1100°C (1112°F to 2012°F)

- 1100°C to 1500°C (2012°F to 2732°F)

- 1700°C and Above (3092°F)

By Product Form

- Blanket / Mat / Board

- Rigid Modules

- Loose Fill

- Molded Shapes

- Others

By Application

- Petrochemicals

- Power Generation

- Transportation

- Electrical and Electronics

- Construction

- Others

Emerging Trends

Shift Toward Advanced and Safer Insulation Solutions Gains Momentum

One key trend is the move toward advanced insulation materials with higher performance and lower thickness. Industries prefer solutions that save space while delivering strong thermal resistance. This trend supports adoption in compact equipment and retrofitting projects.

- Industrial suppliers show aerogel insulation can be up to 75% thinner than traditional materials while maintaining similar thermal resistance, which directly helps reduce surface heat loss in pipes and furnaces. Safety-focused materials are also gaining attention.

Digital monitoring is another emerging trend. Insulation systems are increasingly combined with temperature sensors and predictive maintenance tools. This allows operators to detect heat losses early and plan maintenance more efficiently, improving plant reliability.

Drivers

Rising Industrial Energy Efficiency Needs Drive Market Growth

High temperature insulation demand is strongly driven by energy-intensive industries such as steel, cement, glass, petrochemicals, and power generation. These sectors operate furnaces, kilns, boilers, and reactors at extreme temperatures, making insulation essential to reduce heat loss. By improving thermal efficiency, companies lower fuel consumption and operating costs, which directly supports profitability.

- The U.S. Department of Energy highlights that improving industrial insulation is one of the quickest ways to cut wasted heat, especially in systems operating above 400°C, where losses rise sharply. High temperature insulation helps meet these rules by stabilizing process temperatures and protecting workers from heat exposure. This regulatory pressure encourages the steady replacement and upgrade of insulation systems.

Industrial modernization also supports market growth. Many plants are upgrading to electric arc furnaces, advanced manufacturing lines, and continuous processing systems. These systems require reliable insulation to maintain stable temperatures and avoid unplanned downtime. As a result, insulation becomes a critical component of operational reliability.

Restraints

High Material Costs and Installation Complexity Limit Adoption

One major restraint in the high-temperature insulation market is the high cost of advanced materials. Products such as ceramic fibers, microporous insulation, and specialized refractory systems are more expensive than conventional insulation. For small and medium industries, this upfront cost can delay adoption despite long-term savings.

- High-temperature insulation often requires skilled labor and precise fitting to perform effectively. Improper installation can reduce thermal efficiency and create safety risks. In the United States, the Department of Energy’s Industrial Heat Shot aims to cut greenhouse-gas emissions from industrial heating by 85% by 2035, highlighting insulation as a key supporting technology.

Health and handling concerns add further restraint. Some insulation materials generate dust or fibers during installation and removal, raising worker safety concerns. Industries must invest in protective equipment and compliance measures, which increases project costs and complexity.

Growth Factors

Industrial Decarbonization Creates Strong Future Opportunities

A major growth opportunity comes from global decarbonization efforts. Industries are under pressure to reduce fuel consumption and emissions. High temperature insulation directly supports these goals by cutting heat losses and improving energy efficiency, making it a practical solution for sustainability targets.

Expansion of renewable and alternative energy systems also opens new opportunities. Biomass plants, waste-to-energy facilities, hydrogen production units, and thermal energy storage systems all operate at high temperatures. These applications require specialized insulation, creating demand beyond traditional industries.

Emerging markets offer strong growth potential. Rapid industrialization in Asia, the Middle East, and parts of Africa is increasing investments in steel, cement, and power infrastructure. New plants are more likely to adopt modern insulation standards from the start, supporting long-term market expansion.

Regional Analysis

Europe Dominates the High Temperature Insulation Market with a Market Share of 34.9%, Valued at USD 1.8 Billion

Europe leads the High Temperature Insulation Market, holding a dominant share of 34.9% and reaching a market value of USD 1.8 billion. This leadership is supported by strong industrial activity across steel, glass, cement, and petrochemicals, along with strict energy-efficiency and emission regulations. Continuous upgrades of aging industrial infrastructure further increase the need for advanced insulation solutions.

North America shows steady growth driven by the modernization of power generation facilities, refineries, and advanced manufacturing plants. Rising investments in energy efficiency and heat-loss reduction across industrial operations support insulation demand. The region also benefits from ongoing upgrades in electric arc furnaces and industrial boilers. Compliance with safety and thermal performance standards continues to shape material adoption.

Asia Pacific remains a fast-expanding region due to rapid industrialization and capacity additions in steel, cement, and chemicals. Growing power generation projects and the expansion of manufacturing hubs increase the need for reliable high-temperature insulation. Governments across the region emphasize energy conservation in industrial operations. This drives the adoption of cost-effective and durable insulation materials.

The Middle East and Africa market is supported by large-scale oil & gas, petrochemical, and power generation projects. High operating temperatures in refineries and processing units create consistent demand for thermal insulation. Industrial diversification initiatives also encourage investment in new manufacturing facilities. These factors collectively strengthen regional market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, 3M Company is viewed as a steady benchmark player because it blends material science depth with a broad industrial reach. Its strength is translating demanding thermal needs into scalable product families for process industries, maintenance teams, and OEMs. The main watchpoint is balancing performance upgrades with cost pressure and tougher EHS expectations in high-heat applications.

ADL Insulflex Inc. is typically assessed as a focused, application-driven supplier that competes through responsiveness and engineered fit rather than sheer scale. Its value is strongest where customers need quick-turn solutions, customization, and dependable supply for industrial insulation jobs. The risk factor is exposure to cyclical project demand, where lead times and raw-material availability can quickly influence margins and delivery commitments.

Zircar Zirconia, Inc. is often positioned as a specialist for extreme-temperature environments where zirconia-based and advanced ceramic solutions matter most. In analyst terms, it benefits from niche credibility in high-performance insulation and refractory-adjacent applications that prioritize stability over price. Growth upside is tied to advanced manufacturing and high-temperature processing, while constraints can come from longer qualification cycles and limited addressable volumes.

Unifrax LLC is viewed as a scale player with a strong portfolio across high-temperature fibers and related insulation systems, supporting large industrial customers with repeatable specifications. Its advantage is breadth—serving diverse end uses while pushing product evolution around efficiency and compliance needs. It manages product transitions, regulatory scrutiny, and customer demand for lower-emission, safer insulation choices without compromising thermal performance.

Top Key Players in the Market

- 3M Company

- ADL Insulflex Inc.

- Zircar Zirconia, Inc.

- Unifrax LLC

- Morgan Advanced Materials

- Almatis GmbH

- Rath Group

- Aspen Aerogels, Inc.

- Hi-Temp Insulation, Inc.

- Insulcon Group

Recent Developments

- In 2024, 3M will include a double-digit increase in new product launches and capital expenditures for environmental projects. These include investments in pollution control equipment like thermal oxidizers and solvent recovery units, which relate to high-temperature operations and compliance with environmental regulations.

- In 2025, ADL Insulflex Inc. is a high-temperature insulation. The company continues to position itself as a leader in high-temperature protection products, such as Pyrojacket firesleeve and custom insulation solutions. These may cover product applications or distributor updates, aligning with the ongoing focus on high-temperature materials for industrial use.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Ceramic Fibre, Fiberglass, Mineral Wool, Alkaline Earth Silicate (AES), Aluminum Silicate Wool (ASW), Polycrystalline Wool or Fibre (PCW), Long Fibre, Vacuum to Formed Insulating Products, Polyurethane Foam, Polystyrene, Insulating Fire Bricks (IFB), Others), By Temperature Range (600°C to 1100°C, 1100°C to 1500°C, 1700°C and Above), By Product Form (Blanket/Mat/Board, Rigid Modules, Loose Fill, Molded Shapes, Others), By Application (Petrochemicals, Power Generation, Transportation, Electrical and Electronics, Construction, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M Company, ADL Insulflex Inc., Zircar Zirconia, Inc., Unifrax LLC, Morgan Advanced Materials, Almatis GmbH, Rath Group, Aspen Aerogels, Inc., Hi-Temp Insulation, Inc., Insulcon Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  High Temperature Insulation MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

High Temperature Insulation MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- ADL Insulflex Inc.

- Zircar Zirconia, Inc.

- Unifrax LLC

- Morgan Advanced Materials

- Almatis GmbH

- Rath Group

- Aspen Aerogels, Inc.

- Hi-Temp Insulation, Inc.

- Insulcon Group