Global Helichrysum Essential Oil Market Size, Share and Report Analysis By Product Type (Helichrysum Italicum, Helichrysum Angustifolium, Helichrysum Gymnocephalum), By Application (Aromatherapy, Cosmetics And Personal Care, Pharmaceuticals, Food And Beverages, Others), By Distribution Channel (Direct, Retail, Online) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176476

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

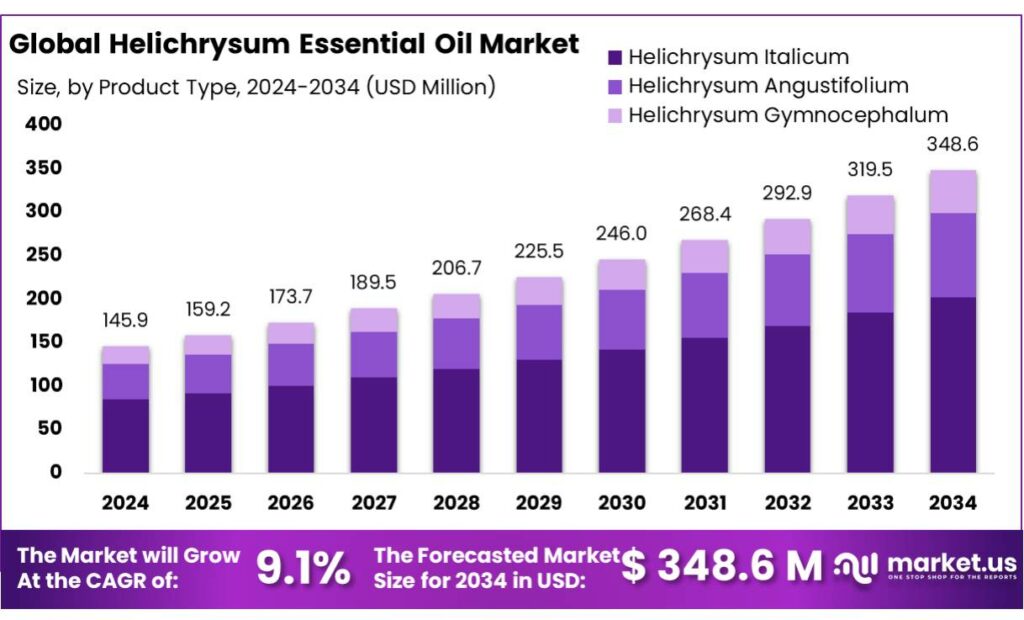

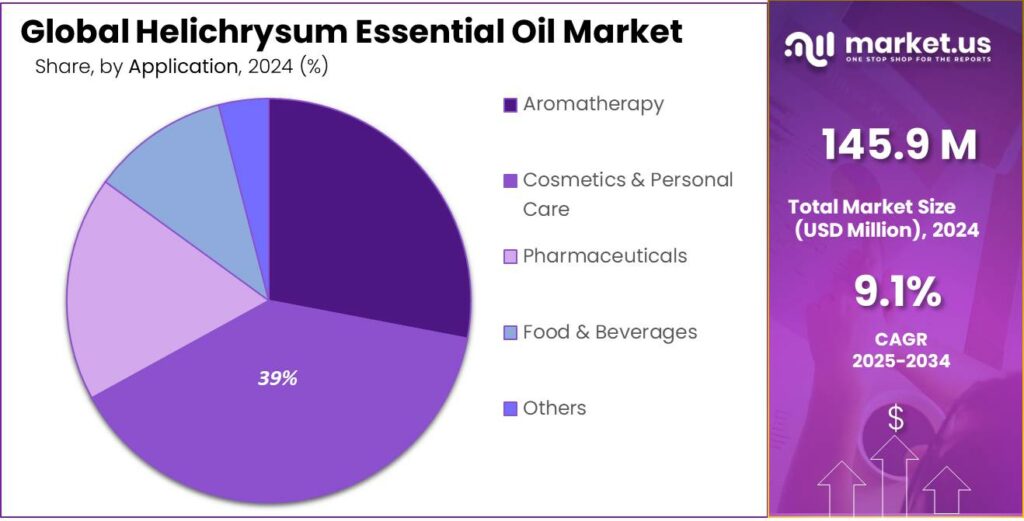

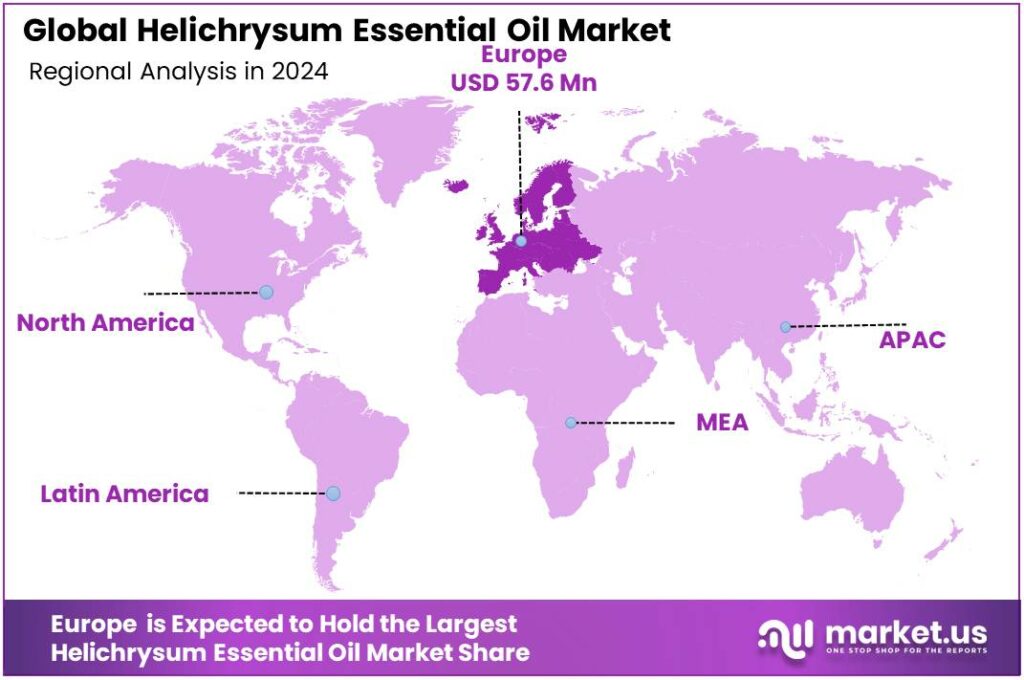

Global Helichrysum Essential Oil Market size is expected to be worth around USD 348.6 Million by 2034, from USD 145.9 Million in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 39.5% share, holding USD 57.6 Million in revenue.

Helichrysum essential oil sits in a premium corner of the natural-ingredients economy because it is produced in small batches, needs consistent agronomy, and is purchased mainly for high-value applications rather than bulk volume. Demand is also supported by the broader essential oils trade: global exports of “essential oils; resinoids; extracted oleoresins” were reported at USD 5,574.19 million in 2023, illustrating a large and active international supply chain that specialty oils like Helichrysum can plug into through distributors and blenders.

The broader industrial scenario around helichrysum is shaped by the fast-growing global essential-oils trade infrastructure. In 2024, global trade in “essential oils” was about USD 6.42 billion, underscoring how integrated sourcing, processing, and cross-border distribution have become for natural aromatic ingredients. Within that system, “other essential oils” remains a large traded pool that captures many niche oils used by fragrance, personal care, and natural-product manufacturers; for example, 2024 export values show the European Union at roughly USD 439.8 million and France at USD 388.0 million for this HS code.

Key driving factors are tied to clean-label and organic-aligned procurement. Globally, organic agriculture is now practiced in 188 countries, with more than 96 million hectares managed organically by at least 4.5 million farmers, and global sales of organic food and drink reaching almost €135 billion in 2022—a scale that encourages ingredient buyers to keep expanding botanical and certified supply options. In Europe, policy direction reinforces this: the European Environment Agency notes the EU’s target of 25% of agricultural land under organic farming by 2030, while reporting the share increased to 10.8% in 2023.

Third, regulatory clarity supports controlled expansion into food-adjacent uses. In the EU, European Commission rules under Regulation (EC) No 1334/2008 set the framework for flavourings and flavouring ingredients used in foods, with an EU Union list introduced in 2012 and updated over time—an enabling structure for companies that can document composition and safety.

Regulation and safety governance are a second major industrial driver, because essential oils must fit within cosmetics and fragrance compliance frameworks. In the European Union, cosmetics labeling rules treat certain fragrance substances as individually declarable, with 26 fragrance allergens currently subject to specific labeling requirements under the cosmetics regime—an important operational consideration for any formula using complex essential oils.

Key Takeaways

- Helichrysum Essential Oil Market size is expected to be worth around USD 348.6 Million by 2034, from USD 145.9 Million in 2024, growing at a CAGR of 9.1%.

- Helichrysum Italicum held a dominant market position, capturing more than a 58.3% share.

- Cosmetics & Personal Care held a dominant market position, capturing more than a 39.1% share.

- Direct held a dominant market position, capturing more than a 44.7% share.

- Europe held the leading position in the Helichrysum Essential Oil Market, with a market share of 39.5% and a value of 57.6 Mn.

By Product Type Analysis

Helichrysum Italicum leads the category with a strong 58.3% share

In 2024, Helichrysum Italicum held a dominant market position, capturing more than a 58.3% share within the Helichrysum Essential Oil Market by product type. This variety continued to gain preference due to its rich aroma profile, higher therapeutic value, and broad acceptance in premium skincare applications. Brands increasingly highlighted its natural anti-inflammatory and regenerative properties, which helped strengthen its demand throughout the year. The segment also benefited from rising consumer interest in clean and plant-based wellness solutions, pushing manufacturers to enhance sourcing transparency and maintain high oil purity.

By Application Analysis

Cosmetics & Personal Care leads the market with a strong 39.1% share

In 2024, Cosmetics & Personal Care held a dominant market position, capturing more than a 39.1% share within the Helichrysum Essential Oil Market by application. This leadership was driven by the growing use of Helichrysum oil in premium skincare, anti-aging creams, facial serums, and natural beauty formulations. Consumers increasingly preferred botanical ingredients, and brands highlighted the oil’s soothing and skin-repairing qualities to build trust. As clean beauty trends strengthened through 2024, manufacturers focused on gentle, plant-derived actives, allowing this segment to expand steadily across global markets.

By Distribution Channel Analysis

Direct distribution leads the market with a solid 44.7% share

In 2024, Direct held a dominant market position, capturing more than a 44.7% share in the Helichrysum Essential Oil Market by distribution channel. Buyers increasingly preferred direct purchases because they offered better product transparency, assured purity, and easier access to certified or small-batch essential oils. Many consumers trusted direct sales from brands, farm cooperatives, or specialized aromatherapy sellers, especially when looking for authentic Helichrysum oil. This approach also supported closer communication between producers and buyers, which helped strengthen brand loyalty throughout 2024.

Key Market Segments

By Product Type

- Helichrysum Italicum

- Helichrysum Angustifolium

- Helichrysum Gymnocephalum

By Application

- Aromatherapy

- Cosmetics & Personal Care

- Pharmaceuticals

- Food & Beverages

- Others

By Distribution Channel

- Direct

- Retail

- Online

Emerging Trends

Sustainability-led sourcing is the newest trend, supported by 19% global food waste and USD 71.6B organic sales momentum

One major latest trend shaping the Helichrysum essential oil space is the move toward sustainability-led, traceable sourcing—where buyers want proof of origin, cleaner processing, and lower waste across the value chain. Even though Helichrysum oil is best known for cosmetics and aromatherapy, the expectations influencing it are increasingly set by the wider food-and-ingredient world. In 2024, more brands started treating “natural” as not enough on its own. They pushed for clearer farm stories, simpler inputs, and responsible harvesting that can be explained in plain language to shoppers.

A big reason this trend is accelerating is the global push to cut waste. The Food and Agriculture Organization notes that 13.2% of food is lost after harvest and before retail, while United Nations Environment Programme statistics point to 19% more being wasted at retail, food service, and household levels. In the same 2024 reporting, UNEP highlights about 1.05 billion tonnes wasted in 2022.

In 2025, the trend became more practical and more commercial: brands leaned into direct relationships with growers and distillers, and they began prioritizing suppliers who can show consistent batches and reliable stewardship. This also connects to the growing “organic and clean-label mindset” that influences what shoppers view as trustworthy. The Organic Trade Association reported organic product sales reaching $71.6 billion.

Drivers

Clean-label food movement is lifting Helichrysum demand, backed by 44.7% direct buying habits

One major driving factor for Helichrysum essential oil is the wider “clean-label” shift happening in food and everyday wellness. When shoppers start paying closer attention to what is inside their food, they often do the same for what they put on their skin. That single behaviour change helps botanical ingredients, including Helichrysum, move from niche to more regular use. In 2024, this was visible in the way consumers leaned toward products positioned as organic, plant-based, and minimally processed—language that makes natural oils feel like a safer, more “honest” choice.

The size of the organic marketplace shows why this matters. The Organic Trade Association reported U.S. certified organic product sales of $69.7 billion in 2023, a record level that reflects steady demand for clean-label goods. In 2024, the also-credible USDA Economic Research Service pointed to organic food sales reaching $65.4 billion, showing that organic spending remained substantial even after inflation pressures.

This demand is not only a consumer trend; it is also supported by public policy signals. In Europe, the Farm to Fork direction under the Council of the European Union aims to boost organic production to reach 25% of EU agricultural land under organic farming by 2030. Alongside that, the European Commission has an Organic Action Plan focused on stimulating demand and supporting the organic sector’s growth.

Restraints

Limited raw-material availability is slowing supply growth for Helichrysum oil

A major restraining factor for the Helichrysum essential oil market is the limited availability of raw plant material, especially since Helichrysum italicum grows mainly in specific Mediterranean climates. This narrow geographic concentration makes supply fragile. In 2024, producers struggled with inconsistent yields due to climate pressure, land-use challenges, and the slow maturation cycle of the plant. Unlike common herbs that regenerate quickly, Helichrysum requires careful cultivation and sustainable harvesting, which restricts large-scale expansion.

The strain becomes clearer when looking at broader agricultural trends. According to the Food and Agriculture Organization (FAO), global agricultural land per capita has been steadily declining, falling to 0.19 hectares per person in 2021, compared with 0.24 hectares in 2000, highlighting growing pressure on finite farming areas.

Another challenge is the regulatory scrutiny surrounding botanical ingredients. The World Health Organization (WHO) and Food and Agriculture Organization jointly oversee the Codex Alimentarius guidelines for safe use of natural extracts in food-adjacent applications. These frameworks are essential, but they also require growers and processors to meet rigorous safety and handling expectations. Many small-scale producers lack the resources to comply immediately, which slows down their ability to supply larger brands.

In Europe, stricter sustainability rules under the European Union’s Farm to Fork Strategy require traceability and responsible land use across plant-based supply chains. While supportive from an environmental standpoint, these policies add operational costs for Helichrysum farmers, many of whom operate on tight margins. By 2025, these pressures continued to show. FAO’s climate-agriculture findings note that agricultural productivity growth has dropped by 21% globally since the 1960s due to climate change, which creates long-term uncertainty for delicate crops like Helichrysum.

Opportunity

Food waste pressure is opening a big door for plant-based actives like Helichrysum, as 13.2% of food is lost and 19% is wasted globally

One major growth opportunity for Helichrysum essential oil is the rising push to reduce food loss and food waste, which is making food brands more open to plant-based ingredients that support freshness, stability, and “clean-label” positioning. In real life, many shoppers now expect short ingredient lists and recognisable natural sources. That creates room for botanical oils to move beyond niche wellness and into wider supply chains—especially in areas like natural flavour systems, functional food-adjacent innovation, and preservation-support concepts. The strongest opportunity is not just “selling more oil,” but building Helichrysum into credible, science-led ingredient stories that help brands meet sustainability goals.

The numbers behind this shift are hard to ignore. Food and Agriculture Organization notes that 13.2% of food is lost after harvest and before retail, and United Nations Environment Programme data shows 19% is wasted at the retail, food-service, and household level. These figures matter because they push the food industry to invest in better storage, better processing, and smarter product design. When companies rework products to last longer and travel better, they also rethink the ingredient toolbox—often leaning toward natural options that fit consumer expectations.

In 2024, the opportunity strengthened as climate and sustainability reporting became more mainstream. UNFCCC highlighted that food loss and waste account for 8–10% of annual global greenhouse gas emissions. That kind of statistic changes boardroom priorities: reducing waste becomes a climate action, not only a cost issue. As a result, ingredient buyers increasingly value solutions that align with waste reduction goals. For Helichrysum suppliers, this is a chance to position the oil within high-trust, traceable, quality-driven supply, especially where food companies want ingredients that match their sustainability messaging.

In 2025, government and multilateral signals continued to support plant-based growth pathways. Across Europe, policy direction remains focused on strengthening organic and sustainable farming systems, which indirectly supports the broader botanical ingredients ecosystem. For example, EU-level planning continues to promote organic development and investment, anchored to the long-term 25% organic farming target by 2030 (policy goal referenced in EU institutions’ work on organic action planning and the broader strategy direction).

Regional Insights

Europe dominates Helichrysum essential oil demand with 39.5%, valued at 57.6 Mn

Europe held the leading position in the Helichrysum Essential Oil Market, with a market share of 39.5% and a value of 57.6 Mn, supported by a strong ecosystem of natural-beauty formulators, aromatherapy users, and Mediterranean sourcing networks. The region benefits from proximity to traditional growing zones and distillation know-how, which helps maintain oil freshness and traceability—two factors European buyers increasingly expect for premium botanicals. Europe’s mature cosmetics manufacturing base also supports repeat ordering, as Helichrysum is typically used in high-value skincare and wellness blends where quality consistency matters more than bulk volume.

A key regional tailwind is policy-backed momentum toward “clean” and traceable agriculture. The Council of the European Union highlights that Farm to Fork aims to reach 25% of EU agricultural land under organic farming by 2030, encouraging member states to build national organic plans that strengthen certified supply chains. In parallel, the European Environment Agency reports the EU share of agricultural land under organic farming rose to 10.8% in 2023, reflecting steady growth in verified, sustainability-led production systems that also support botanical ingredients.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Based in Spijkenisse, the Netherlands, Ultra operates from Malledijk 3H, 3208 LA (Loods 12–15) and supplies essential oils and natural raw materials to flavor, fragrance, and aromatherapy buyers. Its positioning in a major logistics corridor near Rotterdam supports faster EU distribution. For Helichrysum sourcing, buyers typically use Ultra for documented origin lots and repeat-quality supply.

Allin Exporters sells essential oils through a broad online catalogue, with its “Natural Essential Oils” section listing 112 items and aromatherapy oils listing 63 items. It also publishes multiple contact lines for buyers, including +91-9313132789 and +1-949-273-0720, supporting both domestic and overseas orders. This scale helps Helichrysum buyers compare grades, pack sizes, and categories quickly.

Immortelle Therapy positions itself as a producer/manufacturer (not a middleman) and promotes 100% organic & pure essential oils, supported by third-party GC/MS reports and USDA-related certification messaging. Its sales office is in New York City, with a listed phone line +1 (212) 844 9004 for wholesale inquiries. For Helichrysum italicum, it emphasizes farm/distillery-direct supply.

Top Key Players Outlook

- Ultra International B.V.

- Allin Exporters

- Immortelle Therapy

- Norex Flavours Private Limited

- Shiva Exports India

- Aarnav Global Exports

- doTERRA International LLC

- Plant Therapy Essential Oils

- Aromatics International

- Mountain Rose Herbs

Recent Industry Developments

In 2024–2025, Allin Exporters strengthened its presence in the Helichrysum essential oil market by offering 100% pure, natural and undiluted Helichrysum oil products in multiple pack sizes (e.g., 30 ml, 50 ml, 100 ml, and larger bottles) that are retailed both in India and internationally, especially via online platforms like Flipkart and Amazon.

In 2025, Ultra International B.V. remained an active B2B supplier supporting Helichrysum essential oil buyers by offering origin-specific material such as “Helichrysum Oil (France)” and maintaining a clear product catalogue approach that helps perfumery, aromatherapy, and personal-care formulators source consistent inputs.

Report Scope

Report Features Description Market Value (2024) USD 145.9 Mn Forecast Revenue (2034) USD 348.6 Mn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Helichrysum Italicum, Helichrysum Angustifolium, Helichrysum Gymnocephalum), By Application (Aromatherapy, Cosmetics And Personal Care, Pharmaceuticals, Food And Beverages, Others), By Distribution Channel (Direct, Retail, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ultra International B.V., Allin Exporters, Immortelle Therapy, Norex Flavours Private Limited, Shiva Exports India, Aarnav Global Exports, doTERRA International LLC, Plant Therapy Essential Oils, Aromatics International, Mountain Rose Herbs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Helichrysum Essential Oil MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Helichrysum Essential Oil MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ultra International B.V.

- Allin Exporters

- Immortelle Therapy

- Norex Flavours Private Limited

- Shiva Exports India

- Aarnav Global Exports

- doTERRA International LLC

- Plant Therapy Essential Oils

- Aromatics International

- Mountain Rose Herbs