Global Healthcare Contract Research Outsourcing Market By Type (Drug Discovery (Target Validation, Lead Optimization, and Lead Identification), Pre-Clinical, and Clinical (Phase I Trial Services, Phase II Trial Services, Phase III Trial Services, and Phase IV Trial Services)), By Service (Clinical Trial Services (Preclinical and Clinical), Regulatory Services, Clinical Data Management & Biometrics (Electronic Patient Recorded Outcomes, Electronic Data Capture, and Others), Medical Writing, Pharmacovigilance, Site Management Protocol, and Others) By Application (Oncology/Hematology, Cardiovascular, Dermatology, Infectious diseases, Autoimmune/Inflammation, Pain, Central nervous system (CNS), Diabetes, and Others), By End-use (Pharmaceutical Companies, Medical Device Companies, Biotechnology Companies, and Academic Institutes & Government Organizations), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 128160

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

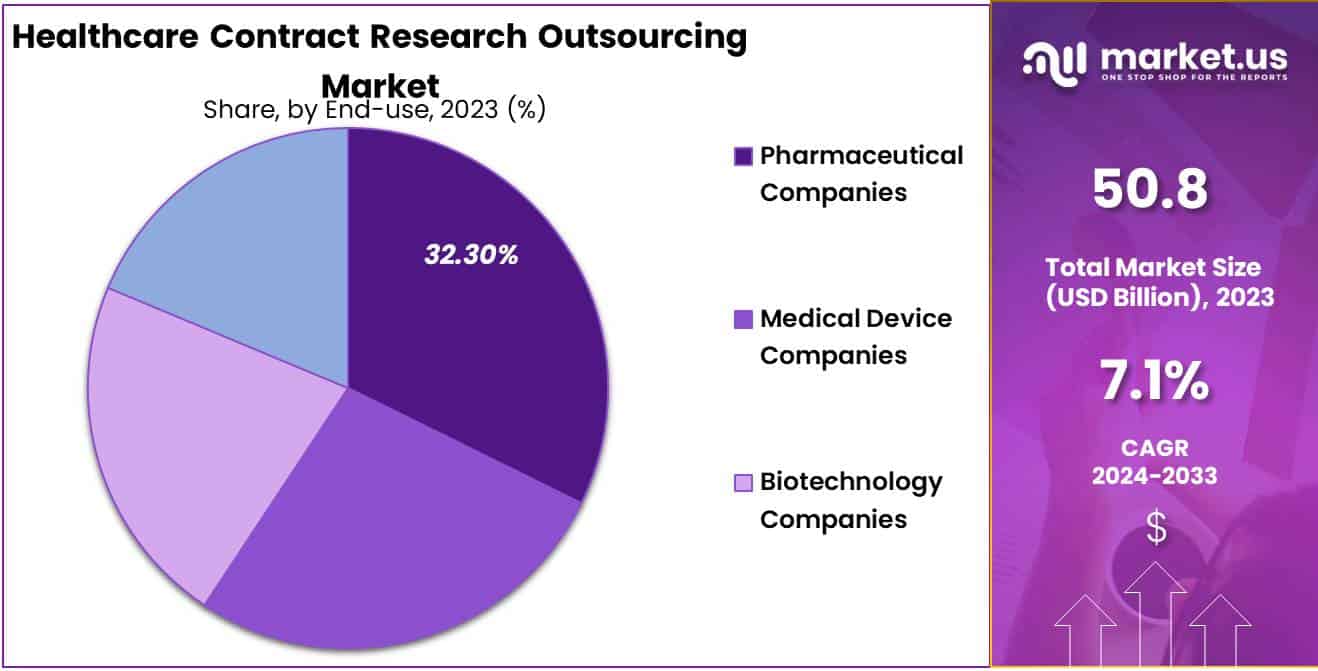

Global Healthcare Contract Research Outsourcing Market size is expected to be worth around US$ 100.9 billion by 2033 from US$ 50.8 billion in 2023, growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

In the coming years, several factors are expected to drive the growth of the contract research organization (CRO) market. These include increased investment in R&D programs, the preference for outsourcing due to time and cost constraints, and the patent expiration of blockbuster drugs.

Pharmaceutical and biopharmaceutical companies increasingly collaborate with CROs to access advanced services, making CROs the preferred choice for project assignments. The pressure on drug developers related to clinical data management, regulatory compliance, and safety standards further fuels demand for CROs in the healthcare sector.

Outsourcing production and clinical trials of medicines is a common practice among healthcare and pharmaceutical companies. Additionally, as clinical trials become more privatized, there is a surge in outsourcing to developing countries. Many CROs are expanding their global research networks to enhance customer services.

For example, in February 2023, MMS, a data-focused CRO, partnered with the Institute for Advanced Clinical Trials (I-ACT) to accelerate critical therapeutics development, including medications, vaccines, and medical devices specifically designed for pediatric use. As part of this commitment, MMS sponsors I-ACT’s Spin Challenge, a unique initiative to raise funds and accelerate clinical trials focused on children’s healthcare.

Key Takeaways

- Market Size: Healthcare Contract Research Outsourcing Market size is expected to be worth around US$ 100.9 billion by 2033 from US$ 50.8 billion in 2023.

- Market Growth: The market growing at a CAGR of 7.1% during the forecast period 2024 to 2033.

- Type Analysis: The clinical segment led in 2023, claiming a market share of 62.3% owing to several factors.

- Service Analysis: The clinical trial services held a significant share of 22.7% due to several factors

- Application Analysis: The oncology/hematology segment had a tremendous growth rate, with a revenue share of 15.2%

- End-Use Analysis: The pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 32.3%.

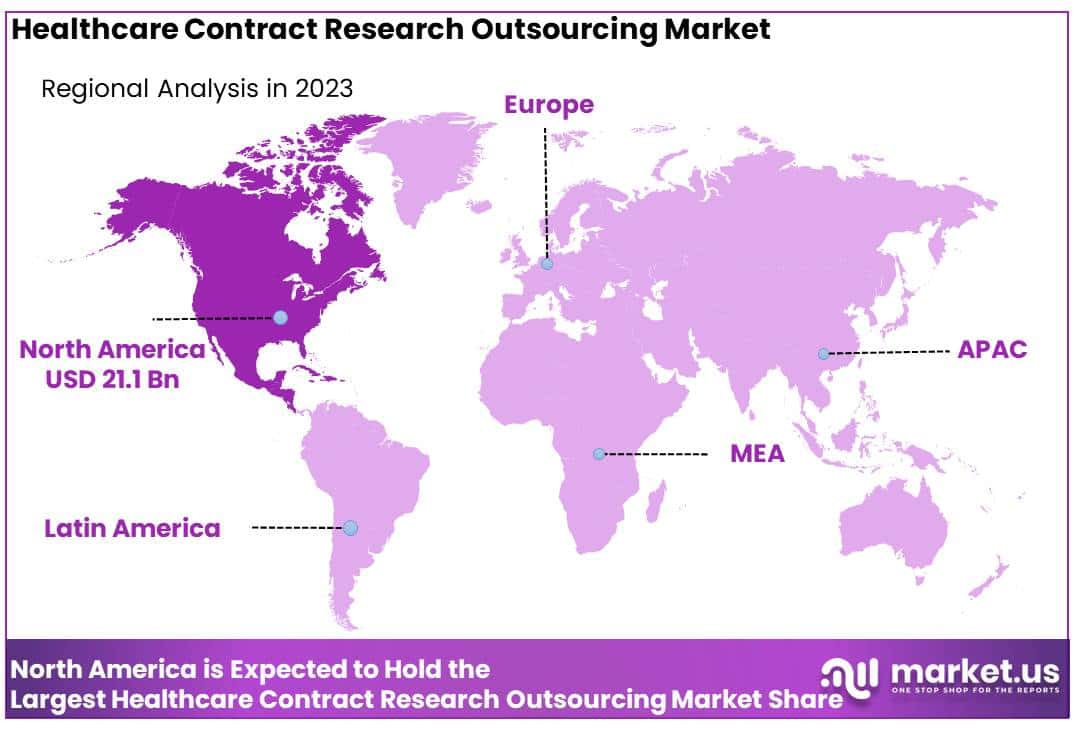

- Regional Analysis: North America dominated the market with the highest revenue share of 41.6%.

By Type Analysis

The clinical segment led in 2023, claiming a market share of 62.3% owing to several factors. Firstly, the increasing prevalence of biologics and recent epidemic events have fueled the demand for novel treatments. Additionally, personalized medicines and orphan drugs have driven the need for specialized research services. Secondly, advancements in technology and the globalization of clinical trials have underscored the importance of CROs.

Organizations seek external expertise to efficiently conduct clinical trials across multiple regions. Lastly, outsourcing Phase III clinical trials to CROs has been particularly lucrative. These trials represent a critical stage in drug development, accounting for approximately 90.0% of expenses during clinical development. Overall, the clinical segment’s prominence reflects the pivotal role CROs play in advancing healthcare research and innovation.

By Service Analysis

The clinical trial services held a significant share of 22.7% due to several factors. Firstly, the increasing number of clinical trials and the need for effective monitoring have created a higher demand for these services. Over the past decade, clinical research has been outsourced to CROs due to cost-effectiveness and specialized technical expertise.

Secondly, the introduction of smart analytics and real-time data acquisition devices is expected to enhance clinical monitoring data in the healthcare sector. Real-time data related to drug safety and toxicity allows early identification of trial errors, enabling timely adjustments such as trial redesign or termination.

Notably, IT services and consulting companies are venturing into clinical research, innovating across clinical monitoring platforms. For instance, in June 2023, ICON plc launched an updated Digital Platform, streamlining the incorporation of site, patient, and sponsor services for standardized data delivery. Overall, the clinical trial services segment plays a pivotal role in advancing healthcare research and ensuring efficient trial management.

By Application Analysis

The oncology/hematology segment had a tremendous growth rate, with a revenue share of 15.2% as the biotechnology and pharmaceutical companies continually invest in developing novel therapies, including targeted drugs, immunotherapies, and personalized medicine. CROs play a crucial role in conducting clinical trials and accelerating drug development.

The competitive landscape in oncology and hematology drives companies to seek external expertise. CROs offer specialized services, such as clinical trial management, data analysis, and regulatory support, allowing companies to focus on innovation while outsourcing operational aspects.

Furthermore, the increasing prevalence of cancer worldwide underscores the importance of oncology research. As more patients require effective treatments, CROs collaborate with sponsors to design and execute clinical trials, ensuring rigorous evaluation of new therapies.

By End-use Analysis

The pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 32.3%. In the pharmaceutical industry, there is a strong focus on developing safer and more effective technologies.

During the projected period, increased spending on research and development (R&D) is expected to bolster revenues for biopharmaceutical companies. To reduce costs associated with internal testing platforms, pharmaceutical firms are rapidly outsourcing their R&D to contract research organizations (CROs).

Additionally, small pharmaceutical enterprises are leveraging CRO technologies to advance product design, driven by the growing demand for innovative designs and the need to address copyright obsolescence. Overall, pharmaceutical companies play a significant role in the global healthcare CRO outsourcing industry, benefiting from shortened drug discovery timelines, cost efficiency, and access to specialized expertise through outsourcing to CROs.

Key Market Segments

By Type

- Drug Discovery

- Target Validation

- Lead Optimization

- Lead Identification

- Pre-Clinical

- Clinical

- Phase I Trial Services

- Phase II Trial Services

- Phase III Trial Services

- Phase IV Trial Services

By Service

- Clinical Trial Services

- Preclinical

- Clinical

- Regulatory Services

- Clinical Data Management & Biometrics

- Electronic Patient Recorded Outcomes

- Electronic Data Capture

- Others

- Medical Writing

- Pharmacovigilance

- Site Management Protocol

- Others

By Application

- Oncology/Hematology

- Cardiovascular

- Dermatology

- Infectious diseases

- Autoimmune/Inflammation

- Pain

- Central nervous system (CNS)

- Diabetes

- Others

By End-use

- Pharmaceutical Companies

- Medical Device Companies

- Biotechnology Companies

- Academic Institutes & Government Organizations

Drivers

High Prevalence of Chronic Diseases

The high prevalence of chronic diseases drives the market by increasing the demand for innovative treatments and therapies. Pharmaceutical companies require specialized expertise and resources to develop effective treatments, leading to a surge in outsourcing of CROs.

Chronic diseases, such as cancer, diabetes, and cardiovascular diseases, require extensive research, testing, and regulatory compliance, making CROs an attractive option. CROs provide cost-effective, efficient, and high quality services, enabling pharmaceutical companies to focus on core activities.

The World Health Organization (WHO) recent report states that noncommunicable diseases (NCDs) are responsible for approximately 41 million deaths annually, representing 71% of total global deaths. Among NCDs, cardiovascular diseases are the leading cause, resulting in 17.9 million deaths each year. Cancer follows with 9.3 million deaths, respiratory ailments with 4.1 million deaths, and diabetes with 1.5 million deaths.

Restraints

Regulatory Guidelines Variations & Lack of Skilled Individuals

The medical CRO industry faces challenges due to gaps in knowledge and variations in federal regulations and licensing procedures across different countries. A shortage of skilled workers also hinders the implementation of advanced technology. While exporting research may save costs, it’s essential to ensure that the outcomes maintain appropriate quality.

Syndicated research involves outsourced clinical studies, medical writing, medical affairs, and government relations. Despite some skepticism, certain industry sectors continue to manage contracted research activities to the necessary standards.

Opportunities

Advancements in Personalized Drugs

Given the shift in modern medical focus from reactive to preventive care, personalized medicine has emerged as a relatively new concept in healthcare. With the high costs associated with traditional treatments, personalized medicine plays a crucial role in therapeutic strategies. Contract Research Organizations (CROs) are increasingly emphasizing personalized medicine to reduce the time and costs related to failed drug development. Throughout each stage, CROs offer support and guidance for personalized medicine trials.

Smaller companies, facing the expense of constructing extensive facilities, often outsource their research and development (R&D) to preclinical CROs. This outsourcing helps reduce overall costs and saves resources and time required for the entire process, from drug discovery to FDA marketing authorization.

Notably, in 2023, more than one-third of new U.S. FDA drug approvals were for personalized medicines, continuing a trend observed over four consecutive years. This trend is particularly pronounced in the rare disease domain, where the number of new treatment approvals more than doubled.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the healthcare contract research outsourcing market, shaping its growth trajectory and dynamics. Macroeconomic factors like high healthcare spending, economic growth, and investment in research & development drive growth in the market.

Geopolitical factors such as trade agreements and partnerships facilitate collaboration and access to new markets. However, economic downturns, trade tensions, and regulatory changes can create uncertainty and challenges. On the positive side, government initiatives and investments in healthcare infrastructure support the growth of the market.

Latest Trends

Growing Use of CROs in the Drug Development Process

CROs streamline the drug development process by dedicating resources and optimizing operations, resulting in reduced time-to-market for novel therapies. However, drug development carries inherent risks, including clinical trial failures and regulatory challenges.

To mitigate these risks, CROs offer comprehensive risk assessments, quality assurance, and regulatory compliance services. With a global presence, many CROs conduct trials and research across multiple regions, allowing pharmaceutical companies to tap into diverse patient populations and regulatory contexts, ultimately enhancing the generalizability of trial results.

Regional Analysis

North America is leading the Healthcare Contract Research Outsourcing Market

North America dominated the market with the highest revenue share of 41.6%. The North American market benefits from increased government support for research and development (R&D) activities through subsidies and funding to research organizations and businesses. Notably, during the COVID-19 pandemic, the Pharmaceutical Technological Development and Research Organization played a crucial role in vaccine creation.

In 2023, the U.S. market held a significant share due to rising R&D efforts, extensive drug development, and the thriving biosimilars and biologics industry. The U.S. stands as a pharmaceutical powerhouse, with research companies allocating nearly one-fifth of their revenues to R&D.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific dominated the healthcare contract research organization (CRO) market in 2023, holding the largest revenue share. The region is poised for rapid growth due to several factors. Firstly, there is a high prevalence of chronic conditions, creating a substantial demand for clinical research services. Secondly, the availability of diverse populations facilitates patient recruitment and retention.

Additionally, regulatory standards have been established to ensure quality. Public initiatives aimed at expediting drug approvals also contribute to market growth. For instance, in October 2021, India’s Department of Pharmaceuticals drafted rules to reduce approval time for innovative products by at least 50% within the next two years, fostering R&D activities in the country. These initiatives are expected to drive further regional expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the healthcare contract research outsourcing market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives such as mergers and acquisitions aimed at enhancing their competitive positioning. In February 2021, Icon plc acquired PRA Biomedical Sciences, a global contract research company.

Icon plc provides outsourced drug and device development services to various industry sectors, including biotechnology and pharmaceuticals. This acquisition highlights the role of CROs like PRA Biomedical Sciences in supporting drug development and clinical trials, which aligns with healthcare contract research outsourcing.

Top Key Players

- Jubilant Biosys Ltd.

- IQVIA HOLDINGS INC.

- ICON Plc

- GVK Biosciences Private Limited

- CTI Clinical Trial & Consulting

- Covance Clinical Biotech

- Clintec

- Clinipace

- Charles River Laboratories International, Inc.

- Bruker Corporation

- Albany Molecular Research, Inc.

- Advanced Clinical

Recent Developments

- In May 2023, Charles River Laboratories and Wheeler Bio partnered to introduce RightSourceSM, a biologics testing laboratory. RightSource is overseen by Charles River and aims to provide quality control services to a broader range of companies. This collaboration exemplifies the trend of outsourcing biologics testing and quality control services to specialized contract research organizations (CROs) like RightSource.

- In January 2023, Bruker Corporation and Biognosys AG formed a strategic partnership for biologics-based clinical research. Biognosys AG planned to open its first laboratory for advanced proteomics outsourcing services in the US. This partnership reflects the growing reliance on CROs for specialized research services, including proteomics, within the healthcare sector.

Report Scope

Report Features Description Market Value (2023) US$ 50.8 billion Forecast Revenue (2033) US$ 100.9 billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Drug Discovery (Target Validation, Lead Optimization, and Lead Identification), Pre-Clinical, and Clinical (Phase I Trial Services, Phase II Trial Services, Phase III Trial Services, and Phase IV Trial Services)), By Service (Clinical Trial Services (Preclinical and Clinical), Regulatory Services, Clinical Data Management & Biometrics (Electronic Patient Recorded Outcomes, Electronic Data Capture, and Others), Medical Writing, Pharmacovigilance, Site Management Protocol, and Others) By Application (Oncology/Hematology, Cardiovascular, Dermatology, Infectious diseases, Autoimmune/Inflammation, Pain, Central nervous system (CNS), Diabetes, and Others), By End-use (Pharmaceutical Companies, Medical Device Companies, Biotechnology Companies, and Academic Institutes & Government Organizations) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Jubilant Biosys Ltd., IQVIA HOLDINGS INC., ICON Plc, GVK Biosciences Private Limited, CTI Clinical Trial & Consulting, Covance Clinical Biotech, Clintec, Clinipace, Charles River Laboratories International, Inc., Bruker Corporation, Albany Molecular Research, Inc., and Advanced Clinical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Contract Research Outsourcing MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare Contract Research Outsourcing MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Jubilant Biosys Ltd.

- IQVIA HOLDINGS INC.

- ICON Plc

- GVK Biosciences Private Limited

- CTI Clinical Trial & Consulting

- Covance Clinical Biotech

- Clintec

- Clinipace

- Charles River Laboratories International, Inc.

- Bruker Corporation

- Albany Molecular Research, Inc.

- Advanced Clinical