Global 3D Medical Implants Market By Material-(Metals, Ceramics, Polymers, Composites) By Application-(Hearing Aids, Dentistry, Orthopedic, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 30098

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

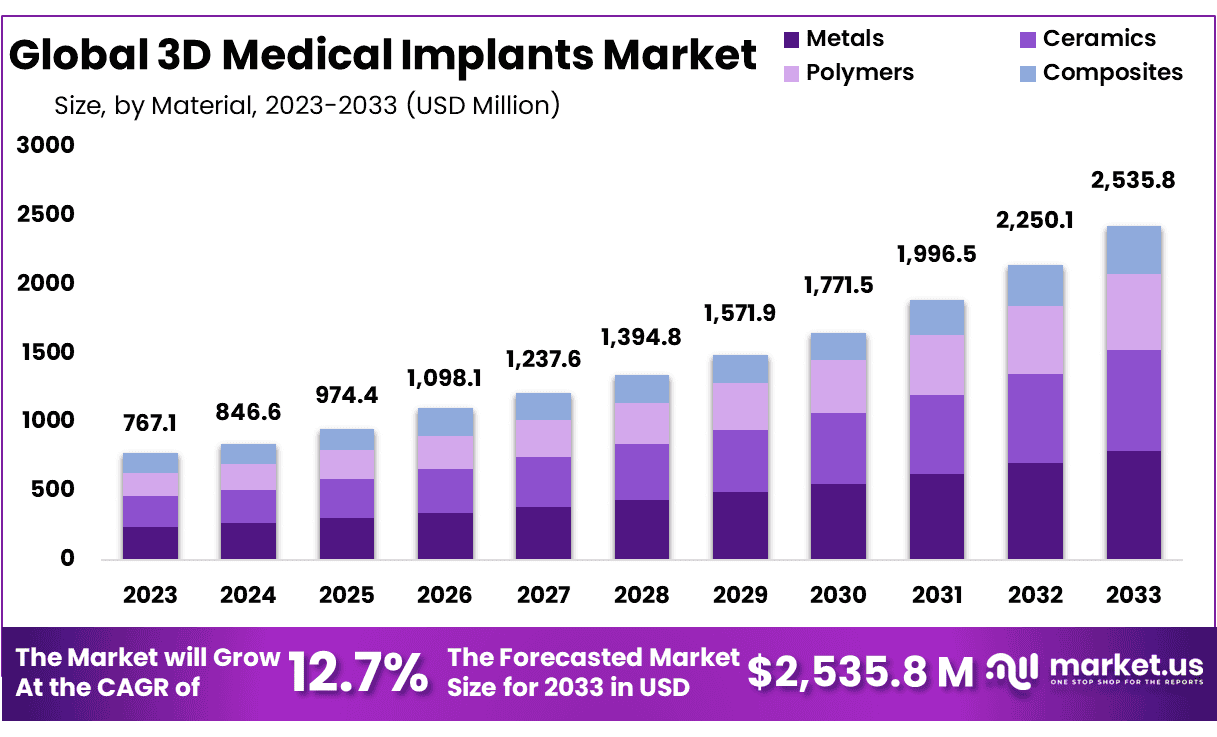

The Global 3D Medical Implants Market size is expected to be worth around USD 2535.8 Million by 2033 from USD 767.1 Million in 2023, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

3D printing is the process of creating a three-dimensional object by building successive layers of raw material. Each layer is attached to the previous one until the object is complete. Objects are produced from a digital 3D file, such as a computer-aided design (CAD) drawing or a Magnetic Resonance Image (MRI). models for faster diagnosis of diseases. 3D printing has medical applications in – Medical devices regulated by FDA’s Center for Devices and Radiological Health (CDRH), Biologics regulated by FDA’s Center for Biologics Evaluation and Research, and Drugs regulated by FDA’s Center for Drug Evaluation and Research.

3D printed implants are making the surgical process more efficient, taking less surgical time with faster recovery of patients as compared to traditional implants. Increasing prevalence of medical conditions such as orthopedic, cardiac, dental disease, etc. in which various medical implants are employed via surgical procedures for improving patient quality of life. Many 3D dentures, 3D teeth, 3D aligners, and 3D dental implants popularity are increasing day by day as advancements in the technology continue to expand its use into a wider range of healthcare applications. These are the factors expected to have a positive impact on the overall revenue growth of this industry.

Stringent regulatory guidelines (especially in the US) are a major factor restraining the growth of the 3D medical implant market. Simple 3D-printed devices receive FDA approval, but complex devices that need to comply with a large number of FDA requirements are a hurdle for the availability of 3D-printed products on a large scale. These factors are expected to restrain the growth of the market to a certain extent. Researchers are showing interest in 3D printing technology and adopting new cost-effective technologies.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size: 3D Medical Implants Market size is expected to be worth around USD 2535.8 Million by 2033 from USD 767.1 Million in 2023.

- Market Growth: The market growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

- Material Analysis: Metals continue to lead in the 3D Medical Implants market with 31.2% market share.

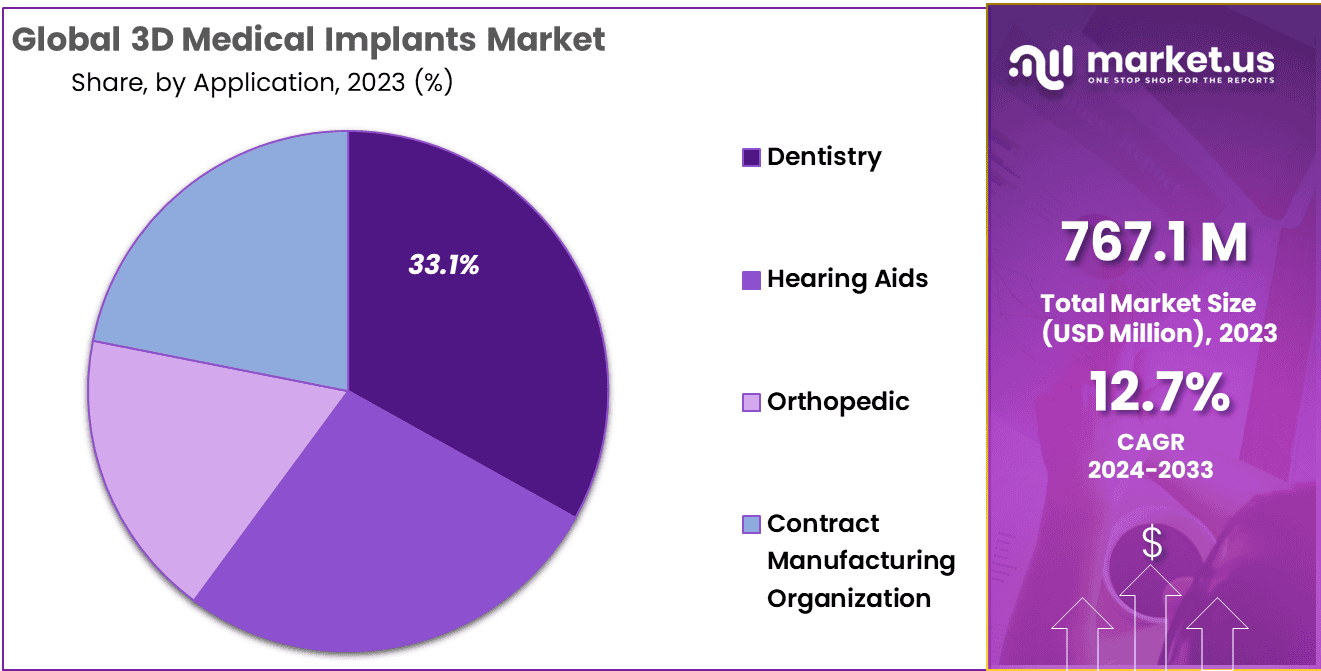

- Application Analysis: Dentistry accounting 33.11% of market share.

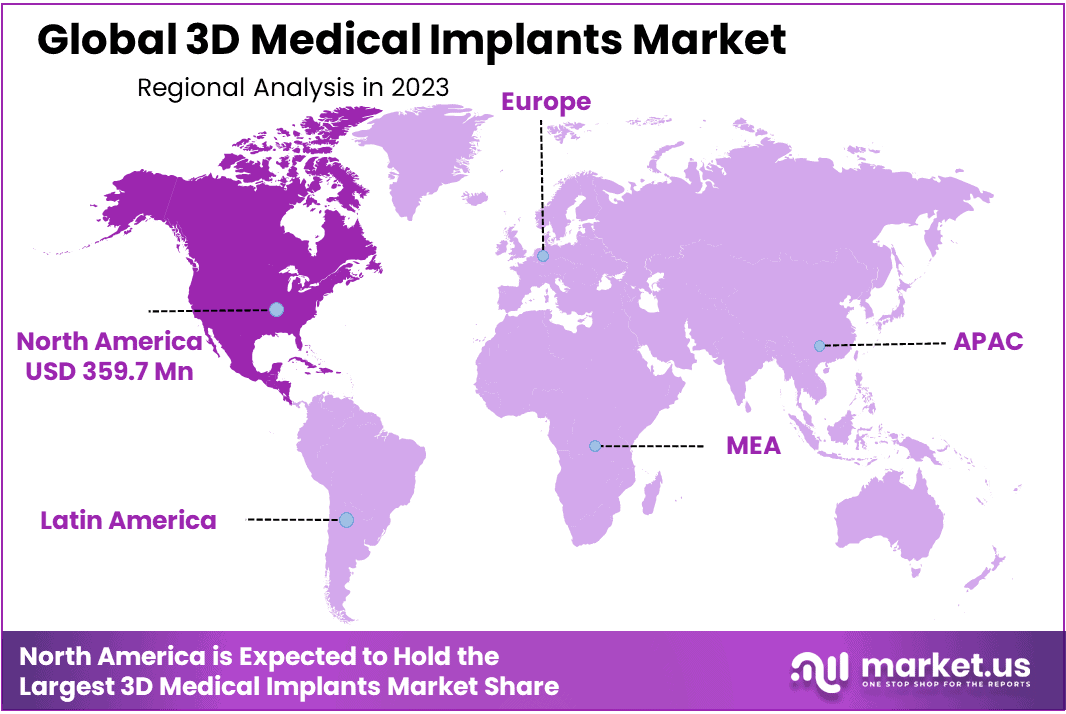

- Regional Analysis: North America holds 46.9% of the 3D Medical Implants Market with revenues reaching USD 359.7 Million.

- Strategic Initiatives: Market dynamics are determined by strategic initiatives like product launches, mergers, acquisitions and collaborations aimed at expanding market presence.

- Affordability Is Key: In an increasingly competitive landscape, the affordability of 3D medical implants plays a pivotal role in shaping market expansion and long-term success.

- Resilience and Adaptability: The 3D Medical Implants market displays resilience and adaptability, positioning itself for long-term growth despite ever-evolving healthcare demands.

Material Analysis

Metals continue to lead in the 3D Medical Implants market with 31.2% market share. Metals, known for their biocompatibility and durability, remain at the heart of healthcare engineering, playing an essential part in making precision medical implants. Beyond metals alone, however, there exists a multitude of materials such as ceramics, polymers and composites on offer in today’s market.

Ceramic implants offer inherent strength and biocompatibility that ensure stability for medical implant applications, while polymers boast their lightweight versatility to make use of in various medical implant scenarios. Composite materials offer the ideal combination of strength and flexibility to advance implant technologies. Metals, ceramics, polymers and composites come together in this market to show its progressive strides with 3D-printed medical implants promising improved patient outcomes and creating transformative future medical interventions.

Application Analysis

By application, Dentistry accounting 33.11% of market share. 3D printing technology has had an enormous impact on dental implant solutions, providing precise and tailored solutions to improve oral healthcare. It has revolutionized how implants are produced. 3D printing technology extends well beyond dental applications to produce implants for hearing aids and orthopedic interventions.

When applied to hearing aid production, 3D printing allows for custom and comfortable devices that maximize both form and function. Orthopedic technology helps create customized implants, improving patient outcomes in procedures involving joints and skeletal structures. The 3D Medical Implants market’s popularity in Dentistry, Hearing Aids and Orthopedics represent an unparalleled leap forward for healthcare – offering enhanced patient care and precision during medical interventions.

*Actual Numbers Might Vary In The Final Report

Market Segments

Material

- Metals

- Ceramics

- Polymers

- Composites

Application

- Hearing Aids

- Dentistry

- Orthopedic

- Others

Driver

Advancements in 3D Printing Technology

One key driver of 3D Medical Implants market growth is advancements in 3D printing technology. Advancements in additive manufacturing techniques enable production of intricate patient-specific medical implants with unprecedented precision, providing increased customization while also improving biocompatibility and functionality, meeting individual patient needs more effectively.

Rising Demand for Customized Medical Solutions

The growing desire for personalized medical solutions drives the 3D Medical Implants market forward. Patients increasingly demand tailored treatment options that fit perfectly into an individual’s anatomy; with 3D printing enabling this, this move towards personalized healthcare not only improves outcomes but also encourages wider adoption of 3D-printed medical implants across medical specialties.

Trend

Dominance of Dentistry in 3D Medical Implants

One prominent trend in the market is dentistry’s dominance at 33.11%. 3D-printed dental implants demonstrate how this technology provides customized, precise solutions for oral healthcare needs of individual patients, proving its worthiness as dental practitioners increasingly embrace its advantages for crowns, bridges and implants procedures. This trend may continue as dental practitioners take full advantage of 3D printing’s potential as dental practices increasingly embrace 3D printing for procedures like crowns bridges and implants.

Expanding into Hearing Aids and Orthopedics

An emerging trend is the widespread application of 3D printing beyond dentistry into Hearing Aids and Orthopedics. Hearing Aid applications use this technology to produce customized devices, and personalized implants provide improved outcomes in joint surgeries – marking a paradigm shift in hearing healthcare. Furthermore, 3D printing technology’s versatility demonstrates its adaptability in meeting diverse medical needs.

Restraints

Economic Activity and Compliance Issues

One major restraint in the 3D Medical Implants market is regulatory issues and compliance requirements associated with 3D printed medical devices. Strict regulations can impede market entry and commercialization processes quickly; to stay ahead, market players need to remain compliant with relevant standards in order to navigate this obstacle effectively.

Material Limitations and Biocompatibility Concerns

Market challenges related to material restrictions and biocompatibility issues persist in 3D printing medical implants, particularly 3D-printed medical devices. While its versatility offers great potential, meeting stringent biocompatibility standards remains of utmost importance to ensure optimal results from 3D-printed medical implants and avoid adverse reactions or unexpected outcomes in long-term. Addressing such concerns early is key in order to guarantee long-term success and avoid adverse reactions to them.

Opportunity

Expanding Patient-Specific Implant Applications

Opportunity lies within 3D printing’s expanding applications for patient-specific implants. As technology develops, market participants may explore ways to design implants customized specifically to patient needs ranging from cranial implants to organ specific implants – creating opportunities for innovation and market expansion.

Global Adoption and Market Penetration

Global adoption and market penetration present significant opportunities. Market players can explore uncharted regions and healthcare systems, providing 3D-printed medical implants to more people. Collaborations between healthcare providers, educational institutions and regulatory bodies may facilitate 3D printing technology into mainstream medical practices – creating substantial growth potential in terms of market adoption and penetration.

Regional Analysis

North America holds 46.9% of the 3D Medical Implants Market with revenues reaching USD 359.7 Million. This success can be attributed to rising patient interest for high-end dental and orthopedic implants as part of treatment, according to Centers for Disease Control and Prevention data, 51 percent of American people aged 30 or over have dental or orthopedic conditions that require high-end treatment, comprising 64.7 Million residents residing there alone – this demand underlines the necessity of new 3D medical implants throughout North America in order to adapt with changing health care landscape while meeting diverse patient needs with different medical needs.

*Actual Numbers Might Vary In The Final Report

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Player Analysis

Major industry players are devoting significant resources to research and development efforts, with the intent of expanding their product lines and driving the 3D Medical Implants Market forward. New products, significant mergers and acquisitions, contractual agreements and partnerships with other organizations stand out as pivotal market developments that demonstrate active engagement of participants to increase market presence. Furthermore, in an ever-competitive healthcare environment offering cost-effective products is vital for sustained expansion and sustained success for this industry.

Market Key Players

- Cerhum SA

- Oxford Performance Materials Inc.

- Straumann Group, MedShape, Inc.

- Renovis Surgical Technologies, Inc.

- BioArchitects

- 3D Medical Manufacturing, Inc.

- EOS GmbH, Stratasys Ltd.

- Emerging Implant Technologies GmbH

Recent Developments

- Cerhum SA: Developed and launched the innovative KeeSpine TL system, a 3D-printed titanium lumbar interbody fusion implant with improved stability and osseointegration.

- Oxford Performance Materials Inc.: Introduced OsteoFab PEKK, a next-generation biocompatible polymer for 3D printing of spinal implants, offering superior strength and wear resistance.

- Straumann Group: Acquired Medtronic’s dental implant business, strengthening their position as the global leader in the dental implant market.

- MedShape, Inc.: Developed the MedShape Patient Portal, a platform for patients to visualize their personalized implant and participate in the surgical planning process.

- BioArchitects: Pioneered the development of 3D bioprinted tissues and organs for transplantation, with a focus on vascularized bone and cartilage constructs.

Report Scope

Report Features Description Market Value (2023) USD 767.1 Million Forecast Revenue (2033) USD 2535.8 Million CAGR (2024-2033) 12.7 Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material-(Metals, Ceramics, Polymers, Composites);By Application-(Hearing Aids, Dentistry, Orthopedic, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Cerhum SA, Oxford Performance Materials Inc., Straumann Group, MedShape, Inc., Renovis Surgical Technologies, Inc., BioArchitects , 3D Medical Manufacturing, Inc., EOS GmbH, Stratasys Ltd., Emerging Implant Technologies GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the key strategic initiatives shaping the market dynamics?Key strategic initiatives shaping the market dynamics include product launches, mergers, acquisitions, and collaborations, emphasizing the proactive engagement of market participants.

How big is the 3D Medical Implants Market?The global 3D Medical Implants Market size was estimated at USD 767.1 Million in 2023 and is expected to reach USD 2535.8 Million in 2033.

What is the 3D Medical Implants Market growth?The global 3D Medical Implants Market is expected to grow at a compound annual growth rate of 12.7%. From 2024 To 2033

Who are the key companies/players in the 3D Medical Implants Market?Some of the key players in the 3D Medical Implants Markets are Cerhum SA, Oxford Performance Materials Inc., Straumann Group, MedShape, Inc., Renovis Surgical Technologies, Inc., BioArchitects , 3D Medical Manufacturing, Inc., EOS GmbH, Stratasys Ltd., Emerging Implant Technologies GmbH.

Why is affordability considered crucial in the 3D Medical Implants industry?Affordability is crucial in the 3D Medical Implants industry as it influences market expansion and long-term success, especially in a competitive and challenging market environment.

What qualities characterize the 3D Medical Implants market’s resilience and adaptability?The 3D Medical Implants market demonstrates resilience and adaptability through its focus on innovation, strategic initiatives, and the ability to provide cost-effective solutions, positioning itself for sustained growth in the dynamic healthcare landscape.

-

-

- Johnson & Johnson

- ЕОЅ GmbН, Stratasys Ltd

- Materialise, SLM Solutions Group AG

- Medprin Biotech GmbH

- Охfоrd Реrfоrmаnсе Маtеrіаlѕ Іnс

- МеdЅhаре Іnс.

- Kyocera Medical Technologies Inc.

- ВіоАrсhіtесtѕ

- Others.