Global Healthcare Asset Management Solutions Market Analysis By Product (Radiofrequency Identification Devices (RFID), Real Time Location Systems (RTLS)), By Application (Hospital Asset Management, Pharmaceutical Asset Management), By End Use (Hospitals, Laboratories, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152223

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

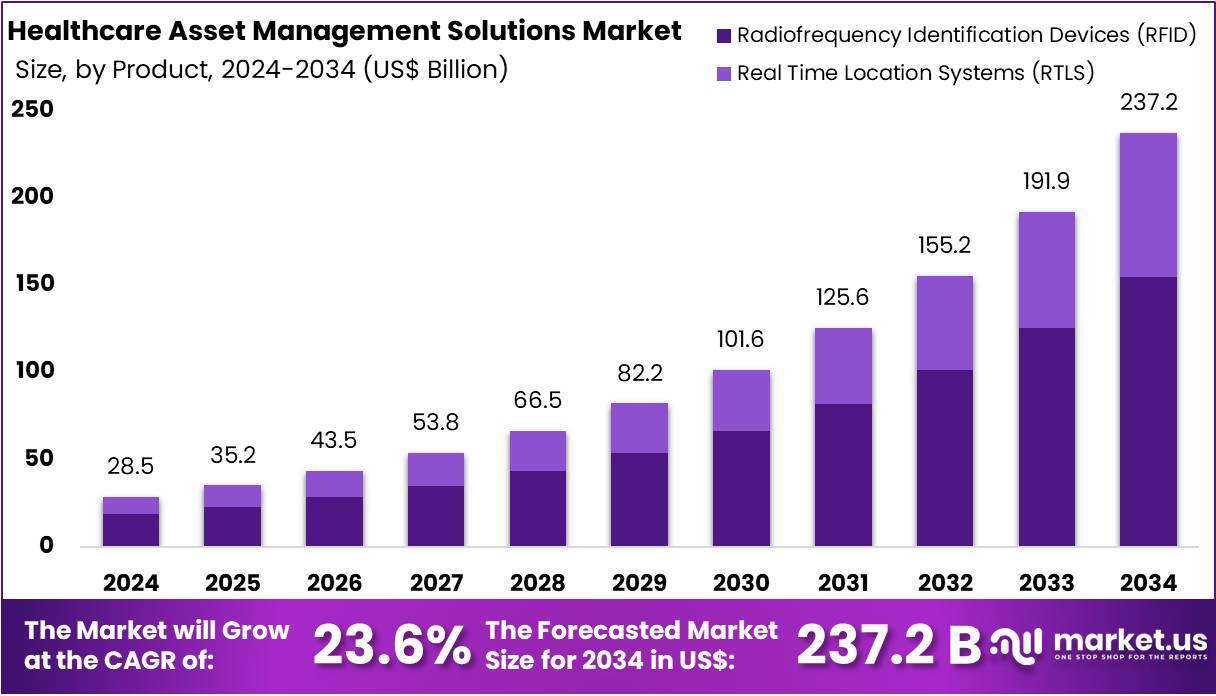

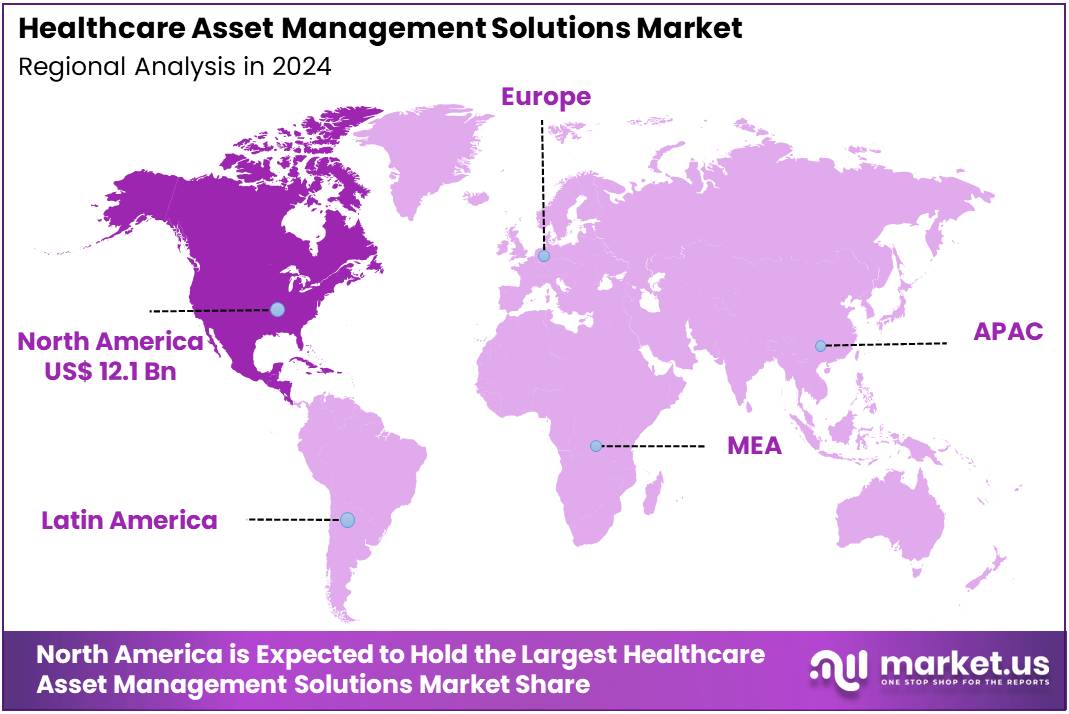

The Global Healthcare Asset Management Solutions Market size is expected to be worth around US$ 237.2 Billion by 2034, from US$ 28.5 Billion in 2024, growing at a CAGR of 23.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.6% share and holds US$ 12.1 Billion market value for the year.

Healthcare Asset Management Solutions refer to systems and technologies that help hospitals and clinics track, manage, and optimize the use of medical equipment and devices. These systems commonly use Radio Frequency Identification (RFID), Real-Time Location Systems (RTLS), barcoding, and IoT integration. They support efficient asset utilization, inventory control, maintenance scheduling, and regulatory compliance. According to the World Health Organization (WHO), healthcare facilities manage more than 2 million medical device types, categorized into over 7,000 generic groups—making effective asset tracking vital for operations.

The global demand for asset management solutions is being driven by rising patient volumes, increasing digital transformation in healthcare, and a strong focus on patient safety. For instance, the WHO’s Global Strategy on Digital Health 2020–2025 promotes integrated digital systems such as logistics and inventory management platforms. SMART Guidelines by WHO also call for machine-readable protocols to ensure interoperability. These initiatives are enabling hospitals to modernize infrastructure using AI-based tracking, real-time dashboards, and predictive maintenance tools.

Government-led programs have further encouraged digital transformation. For example, India’s Ministry of Health requires digital tagging and maintenance mapping of public-sector medical devices. Under the Biomedical Equipment Management & Maintenance Program (BMMP), over 756,750 devices have been inventoried across 29,115 public health facilities, with a total asset value of ₹4,564 crore (~USD 550 million). Functional uptime targets include 95% for district hospitals, 90% for community health centres, and 80% for primary health centres. BMMP was implemented in 2015 and expanded to 30 states/UTs by 2018.

Global regulatory policies are also playing a major role. The U.S. FDA’s Center for Devices and Radiological Health (CDRH) supports AI-enabled digital lifecycle management. New legislation like the Health Tech Investment Act (2025) will further support reimbursement for such tools. Additionally, ITU-T H.810 guidelines—developed with WHO—focus on global interoperability standards for connected health devices. These frameworks are pushing hospitals to adopt digital asset platforms capable of ensuring safety, compliance, and real-time integration with health systems.

Technological innovation continues to shape this space. Many hospitals are shifting to smart, cloud-based solutions using edge IoT, AI/ML analytics, and EHR integration. According to India’s BMMP data, dysfunctional rates for medical equipment ranged from 13% to 34% across states, which highlights the pressing need for automated tracking and maintenance tools. In high-income countries like the U.S., 2% of single-use devices (SUDs) were reprocessed in 2021, saving $462 million in costs and reducing 20 million pounds of medical waste.

The complexity of managing donated medical devices in low- and middle-income countries further underlines the need for asset management. A WHO study reported that while 95% of medical devices in these countries are imported and 80% are donor-funded, only 10–30% become operational. Moreover, data from the global medical device trade shows that China, India, Japan, and Kazakhstan account for 27% of global imports. India alone imported $33.5 million worth of devices, with East Asia representing 36% of total global imports, indicating the vast scale of assets requiring effective management.

Key Takeaways

- By 2034, the global Healthcare Asset Management Solutions Market is projected to reach US$ 237.2 Billion, growing from US$ 28.5 Billion in 2024.

- The market is expected to expand at a strong CAGR of 23.6% during the forecast period from 2025 to 2034.

- In 2024, Radiofrequency Identification Devices (RFID) led the product segment, accounting for over 65.3% of the total market share.

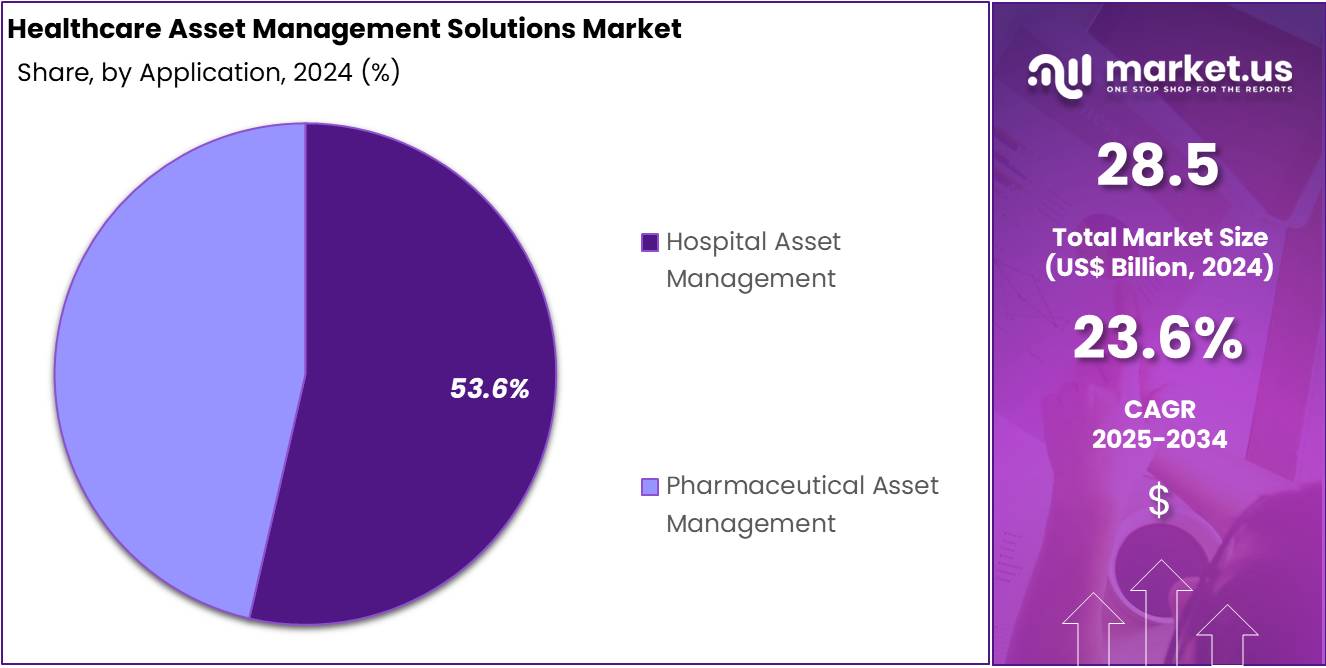

- Hospital Asset Management dominated the application segment in 2024, contributing more than 53.6% to the overall market share.

- The Hospitals category held a leading position in the end-use segment, capturing over 46.7% share of the market in 2024.

- North America emerged as the dominant region in 2024, securing a 42.6% market share and reaching a value of US$ 12.1 Billion.

Product Analysis

In 2024, the Radiofrequency Identification Devices (RFID) section held a dominant market position in the product segment of the Healthcare Asset Management Solutions Market, and captured more than a 65.3% share. This dominance is linked to the growing use of RFID in tracking patients, staff, and equipment. Experts noted that healthcare facilities are under pressure to improve asset visibility. RFID helps reduce equipment loss and improves daily operations by offering real-time location data. Hospitals are seeing better efficiency using this technology.

Healthcare administrators have increasingly turned to RFID to manage critical medical equipment. The technology helps in quickly locating devices such as infusion pumps and surgical tools. Industry professionals explained that this reduces delays and avoids the cost of buying duplicate equipment. Unlike barcode systems, RFID does not need line-of-sight. It can scan multiple tagged items at once. This automation improves inventory control and supports faster decision-making inside healthcare settings.

Analysts pointed out that the shift toward digital healthcare solutions is supporting RFID adoption. Healthcare systems face rising patient volumes and staff shortages. RFID is helping to ease that pressure. It integrates well with hospital IT infrastructure and is scalable for different sizes of facilities. As more providers move to smart asset tracking, the use of RFID is likely to increase further. This long-term trend supports the ongoing growth of the RFID segment within healthcare asset management solutions.

Application Analysis

In 2024, the Hospital Asset Management section held a dominant market position in the Application segment of the Healthcare Asset Management Solutions Market and captured more than a 53.6% share. This growth was driven by the increasing need to optimize the use of medical equipment and reduce operational costs. Hospitals are adopting advanced asset tracking systems to monitor real-time equipment usage, ensure compliance, and improve patient safety. The demand for efficient resource allocation, especially in large healthcare facilities, has contributed significantly to segment growth.

Pharmaceutical Asset Management is also gaining traction, supported by the growing need for precise inventory control and regulatory compliance. The pharmaceutical sector faces constant challenges in managing temperature-sensitive inventories and reducing product wastage. Asset management tools help track raw materials, monitor storage conditions, and prevent stockouts. As a result, the segment is projected to witness steady growth over the coming years. Increasing digitalization and automation across pharmaceutical operations are expected to further boost adoption.

Other emerging applications include laboratory equipment tracking and mobile asset management across outpatient facilities. These segments, although smaller in size, are expected to grow due to rising focus on operational efficiency. Integration with RFID and IoT technologies is enhancing the reliability and performance of asset management systems. The overall application landscape in healthcare asset management is evolving toward smarter, connected, and more accountable environments. This is likely to reinforce market expansion throughout the forecast period.

End Use Analysis

In 2024, the Hospitals section held a dominant market position in the End Use segment of the Healthcare Asset Management Solutions Market and captured more than a 46.7% share. This was largely due to the rising need for efficient tracking of assets, staff, and patients in hospital settings. Hospitals face increasing operational demands and are adopting asset management tools to reduce costs and downtime. These solutions also help improve patient care by ensuring that critical equipment is available when needed.

Experts observed that hospitals are using technologies like RFID and RTLS to streamline internal workflows. These tools enable real-time visibility of high-value assets. As hospital admissions increase, the demand for better asset control continues to rise. Large hospitals and networks are particularly focused on digital transformation to enhance resource use. This growing reliance on automation and smart tracking is driving continued adoption across developed and developing healthcare systems.

Pharmaceutical companies form another key segment within the market. These firms use asset management solutions to maintain inventory accuracy and regulatory compliance. However, their share is smaller than hospitals. The pharmaceutical sector is expected to adopt more advanced tools as supply chains grow in complexity. Temperature-sensitive drugs and controlled environments further highlight the need for reliable asset tracking. As these challenges grow, asset management systems are becoming critical for ensuring safety and traceability.

Key Market Segments

By Product

- Radiofrequency Identification Devices (RFID)

- Real Time Location Systems (RTLS)

By Application

- Hospital Asset Management

- Pharmaceutical Asset Management

By End Use

- Hospitals

- Laboratories

- Others

Drivers

Cost Optimization and Operational Efficiency Through Smart Asset Technologies

Healthcare systems are increasingly adopting asset management solutions to address mounting cost pressures and workflow inefficiencies. Technologies like RFID, IoT, and cloud-based platforms play a vital role in real-time equipment tracking and predictive maintenance. These tools streamline hospital operations, reduce waste, and enhance patient care delivery. For example, RFID adoption in pharmacies at UF Health Shands and Texas Children’s Hospital eliminated manual processes, reduced labor, and accelerated inventory verification. Similarly, RFID-enabled laboratory tracking cut 26.5 work-hours weekly and eliminated lost samples.

Real-Time Location Systems (RTLS) provide significant improvements in hospital-wide equipment visibility. One multi-facility system tracked over 5,000 assets across three locations and achieved a 30% drop in search time within six months. Additionally, unnecessary equipment purchases declined by 15%, translating into multi-million-dollar cost savings. These systems not only minimize idle inventory but also support better capital expenditure decisions. Efficient asset allocation and faster equipment access ultimately enhance care delivery and improve staff productivity.

Predictive maintenance, powered by IoT and artificial intelligence, further strengthens healthcare asset management. Across industries, unplanned downtime costs can reach up to USD 125,000 per hour. A 2025 study found that IoT and machine learning reduced such downtime by 30–50% and extended equipment life. Healthcare-specific extrapolations show potential benefits for high-value devices like MRI machines and ventilators. Predictive systems can reduce maintenance costs by 30%, cut downtime by 45%, and increase equipment lifespan by 20%, ensuring hospitals operate more efficiently and cost-effectively.

Restraints

Lack of Data Standardization and Integration in Healthcare Asset Management

The lack of data standardization and integration continues to hinder the adoption and efficiency of healthcare asset management solutions. Many healthcare facilities operate with inconsistent data formats and outdated legacy systems. According to a 2022 HIMSS global survey, 73% of provider organizations still relied on legacy information systems. These outdated platforms create obstacles for seamless data exchange and real-time asset tracking. As a result, healthcare providers face operational inefficiencies and delayed decision-making, limiting the full potential of asset management technologies.

In 2024, HIMSS Analytics reported that over 60% of U.S. hospitals were dependent on at least one critical application that lacked modern API capabilities or cloud readiness. This technological lag creates significant interoperability challenges when integrating asset management solutions with electronic health records (EHRs) or computerized maintenance management systems (CMMS). Without integration, data remains siloed, reducing system-wide visibility. This fragmented infrastructure limits the scalability and centralized control necessary for optimized asset utilization and maintenance.

Poor data quality and cybersecurity concerns further compound integration issues. Over 40% of healthcare organizations report that substandard data quality directly impairs clinical and operational decision-making. Meanwhile, data security remains a major concern. In 2023 alone, 725 breaches exposed over 133 million records. In 2024, 720 breaches compromised 276 million records, averaging 758,000 records per day. Such data vulnerabilities discourage broader data sharing and complicate asset management system deployment across multi-facility networks, delaying digital transformation efforts in healthcare.

Opportunities

Integration of IoT and AI to Enhance Healthcare Asset Management Solutions

The healthcare sector is witnessing an accelerated shift toward digital transformation. A key opportunity lies in the growing integration of Internet of Things (IoT) and artificial intelligence (AI)-enabled systems in asset management solutions. Healthcare providers are increasingly deploying IoT sensors across medical devices, infrastructure, and supply chains. These connected devices support real-time asset tracking, streamline workflows, and reduce human error. As a result, hospitals and clinics are improving equipment utilization rates and reducing asset misplacement, driving operational efficiency and cost savings.

AI-enabled healthcare asset management solutions are being used to predict maintenance needs, track equipment conditions, and reduce downtime. Machine learning algorithms analyze large volumes of asset data to generate actionable insights. These predictive capabilities help healthcare facilities schedule preventive maintenance, avoid sudden equipment failures, and extend the lifecycle of high-value assets. The growing availability of cloud computing further enhances scalability and facilitates data sharing across departments, making asset operations more efficient and less dependent on manual intervention.

This opportunity is especially significant in emerging markets and pharmaceutical sectors where infrastructure upgrades are underway. The demand for connected and intelligent asset management systems is rising due to the need for transparency, compliance, and efficiency. Advanced analytics tools help in identifying usage trends, optimizing inventory levels, and supporting regulatory documentation. As government and private healthcare providers prioritize digital health strategies, IoT and AI integration in asset management is expected to play a central role in achieving smart, data-driven healthcare ecosystems.

Trends

Integration of Smart, Cloud-Based, and Predictive Technologies in Healthcare Asset Management

The healthcare asset management landscape is witnessing a major shift toward smart and cloud-based technologies. Hospitals are replacing legacy systems with cloud-hosted platforms that ensure real-time access to asset data. These systems offer better flexibility, scalability, and interoperability. They integrate seamlessly with existing healthcare IT infrastructures such as Electronic Health Records (EHR) and Computerized Maintenance Management Systems (CMMS). This trend is accelerating the digital transformation of hospital operations and improving the traceability of critical assets.

AI and machine learning (ML) technologies are playing a central role in this transition. Predictive analytics tools are being deployed to forecast equipment failure, optimize maintenance schedules, and improve operational efficiency. Hospitals are utilizing data-driven insights to reduce equipment downtime and extend asset lifecycles. This proactive approach enables informed decision-making and resource optimization. Such predictive capabilities are particularly vital in high-dependency areas like intensive care units, surgical theaters, and emergency departments.

Moreover, the adoption of edge computing and Internet of Things (IoT) devices further supports this trend. Edge-IoT architecture allows faster data processing close to the source, reducing latency and ensuring timely asset tracking. With these advancements, hospitals are moving toward autonomous asset management ecosystems. These “smart hospitals” operate with greater precision and minimal human intervention. This transition not only enhances patient safety but also contributes to significant cost savings and operational excellence in the healthcare industry.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 42.6% share and holds US$ 12.1 Billion market value for the year. This leadership is supported by the rapid adoption of digital healthcare technologies across the United States and Canada. Hospitals and healthcare systems in the region have shown strong demand for real-time asset tracking tools to enhance operational efficiency and reduce costs. Government initiatives to promote healthcare digitization further support market expansion.

The region benefits from the presence of advanced infrastructure and a high concentration of healthcare facilities. The increasing need for automation in inventory management and patient tracking has driven widespread adoption of RFID, RTLS, and IoT-based asset management solutions. Additionally, stringent regulatory standards related to equipment maintenance and patient safety have encouraged healthcare providers to invest in reliable asset monitoring systems.

Moreover, the rising number of chronic disease cases and hospital admissions has led to greater investments in hospital capacity and operational tools. This has strengthened demand for scalable asset management platforms in both public and private healthcare settings. The growing focus on minimizing medical equipment loss and improving response time in emergency care also contributes to North America’s leading share in the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global healthcare asset management solutions market is driven by several key players focused on innovation, strategic alliances, and regional growth. Companies such as AiRISTA Flow Inc. and CenTrak Inc. lead by offering robust RTLS and RFID-based tracking systems. AiRISTA Flow provides end-to-end solutions with AI integration, enhancing asset tracking and workflow efficiency. CenTrak uses hybrid technologies to support regulatory compliance and high accuracy. Both firms aim to increase hospital efficiency and patient safety through scalable and customizable asset management systems across diverse healthcare settings.

Novanta Inc., through ThingMagic, plays a significant role with RFID technology integrated into medical imaging and diagnostic equipment. This enhances device visibility, uptime, and regulatory support. Sonitor Technologies offers ultrasound-based RTLS platforms with precise room-level accuracy and minimal signal interference. Its Sense™ system is widely adopted in high-acuity care environments. VERSUS TECHNOLOGIES, a Midmark Corporation brand, provides solutions combining RTLS, workflow optimization, and analytics. These tools support patient flow improvement and better capital asset utilization in hospital systems.

Other major contributors such as Zebra Technologies, STANLEY Healthcare, and IBM are expanding their healthcare portfolios through partnerships and acquisitions. Their focus on cloud-based systems, IoT integration, and enhanced cybersecurity is shaping the competitive landscape. These advancements align with the ongoing shift in healthcare delivery models. The market is expected to witness stronger competition, driven by innovation in real-time tracking and growing emphasis on patient-centric care outcomes and operational efficiency across healthcare institutions globally.

Market Key Players

- AiRISTA Flow Inc.

- CenTrak Inc.

- Novanta Inc.

- Sonitor Technologies

- VERSUS TECHNOLOGIES

- STANLEY Healthcare

- Zebra Technologies Corporation

- GE Healthcare

- IBM

- Siemens Healthcare GmbH

- Motorola Solutions Inc.

- Infor Inc.

Recent Developments

- In October 2024: AiRISTA Flow secured a national group purchasing agreement with Premier, Inc.—a healthcare improvement company representing approximately 4,350 U.S. hospitals and 325,000 other providers. This agreement grants Premier members access to AiRISTA’s full suite of RTLS hardware and software at pre-negotiated pricing and terms, enhancing affordability and scalability for asset and personnel tracking solutions in healthcare environments.

- In March 2025: CenTrak introduced a fully integrated, plug‑and‑play Bluetooth Low Energy (BLE) platform. The solution offers healthcare providers a scalable and cost-effective Real‑Time Location System (RTLS), seamlessly transitioning between BLE‑Only, BLE Multi‑Mode, and Clinical‑Grade locating networks. This innovation enables precise asset tracking, staff duress alerts, infant protection, and hand hygiene monitoring—all unified on a single interoperable platform. Additionally, CenTrak announced cloud‑based software deployment plans later in 2025 to reduce IT burden for healthcare clients.

- In March 2024: Sonitor introduced SonitorONE™, a unified RTLS platform unveiled at HIMSS 2024 in Orlando. This innovative solution consolidates six locating technologies into a single infrastructure, reducing installation footprint and offering tag flexibility while delivering high precision and zonal location tracking. Sonitor reports that the platform can require up to 50% fewer devices than competing systems, lowering total cost of ownership and simplifying deployment and maintenance.

Report Scope

Report Features Description Market Value (2024) US$ 28.5 Billion Forecast Revenue (2034) US$ 237.2 Billion CAGR (2025-2034) 23.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Radiofrequency Identification Devices (RFID), Real Time Location Systems (RTLS)), By Application (Hospital Asset Management, Pharmaceutical Asset Management), By End Use (Hospitals, Laboratories, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AiRISTA Flow Inc., CenTrak Inc., Novanta Inc., Sonitor Technologies, VERSUS TECHNOLOGIES, STANLEY Healthcare, Zebra Technologies Corporation, GE Healthcare, IBM, Siemens Healthcare GmbH, Motorola Solutions Inc., Infor Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Asset Management Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Asset Management Solutions MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AiRISTA Flow Inc.

- CenTrak Inc.

- Novanta Inc.

- Sonitor Technologies

- VERSUS TECHNOLOGIES

- STANLEY Healthcare

- Zebra Technologies Corporation

- GE Healthcare

- IBM

- Siemens Healthcare GmbH

- Motorola Solutions Inc.

- Infor Inc.