Global Hand Sanitizers Market By Product (Gel, Foam, Liquid, and Others), By Composition Type (Alcohol-Based and Alcohol-Free), By End User (Schools, Restaurants, Hospitals, and Others (Shopping Plaza, Military, Corporate Sectors, Hostels), By Distribution Channel (Hypermarket and Supermarket, Drugstore, Online, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov 2023

- Report ID: 43162

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

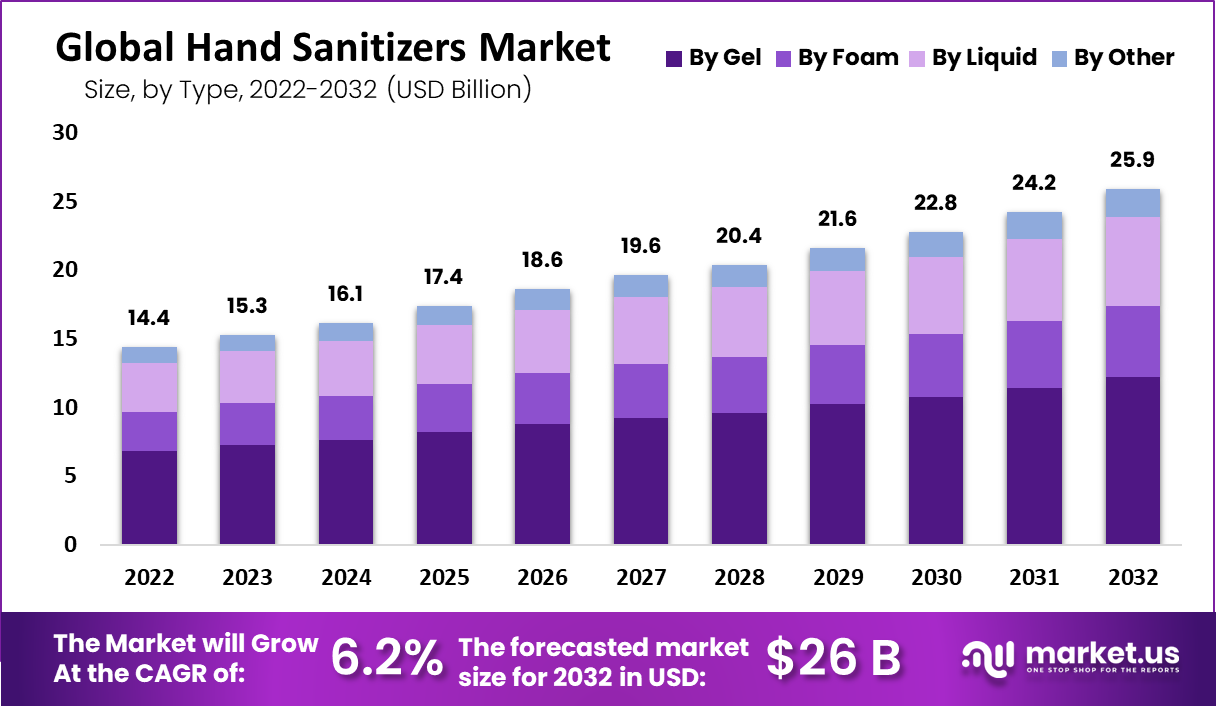

The Global Hand Sanitizers Market size is expected to be worth around USD 25.5 Billion by 2032 from USD 14.2 Billion in 2022, growing at a CAGR of 6.2% during the forecast period from 2022 to 2032.

Because of its antiseptic properties, hand sanitizer will be highly in demand. It can also be used in place of soap and water, which helps in preventing some of the most infectious diseases, including norovirus, COVID-19, influenza, hand, foot, and mouth disease, meningitis, Methicillin-Resistant Staphylococcus Aureus (MRSA) and pertussis (whooping cough). Market revenue growth is expected to be driven by increased awareness of personal hygiene and sanitation following the COVID-19 pandemic.

Coronavirus can spread from one person to another through direct contact with infected individuals or indirect contact with contaminated surfaces. Good hygiene and cleaning practices can prevent the spread of Coronavirus. To reduce the chance of contamination by microorganisms, customers were encouraged to improve their hygiene. Hand sanitizers are germ-killing. Hand sanitizers are used in more places than just homes, such as hospitals, clinics, hotels, and restaurants. Hand sanitizers can be used at any time due to their accessibility and ease of use.

*Actual Numbers Might Vary In The Final Report

Key Takeaways

- The hand sanitizer market is expected to reach USD 25.5 billion globally by 2032.

- It’s projected to grow at a rate (CAGR) of 6.2% from 2023 to 2032.

- Hand sanitizer is in demand because people want to stay clean and safe, especially after COVID-19.

- In 2022, the market was worth USD 14.2 billion.

- Gel-based hand sanitizers had the biggest market share in 2022, at 47.2%.

- Alcohol-based sanitizers are expected to remain popular.

- Supermarkets & hypermarkets sold the most hand sanitizers in 2022, with a 37.2% market share.

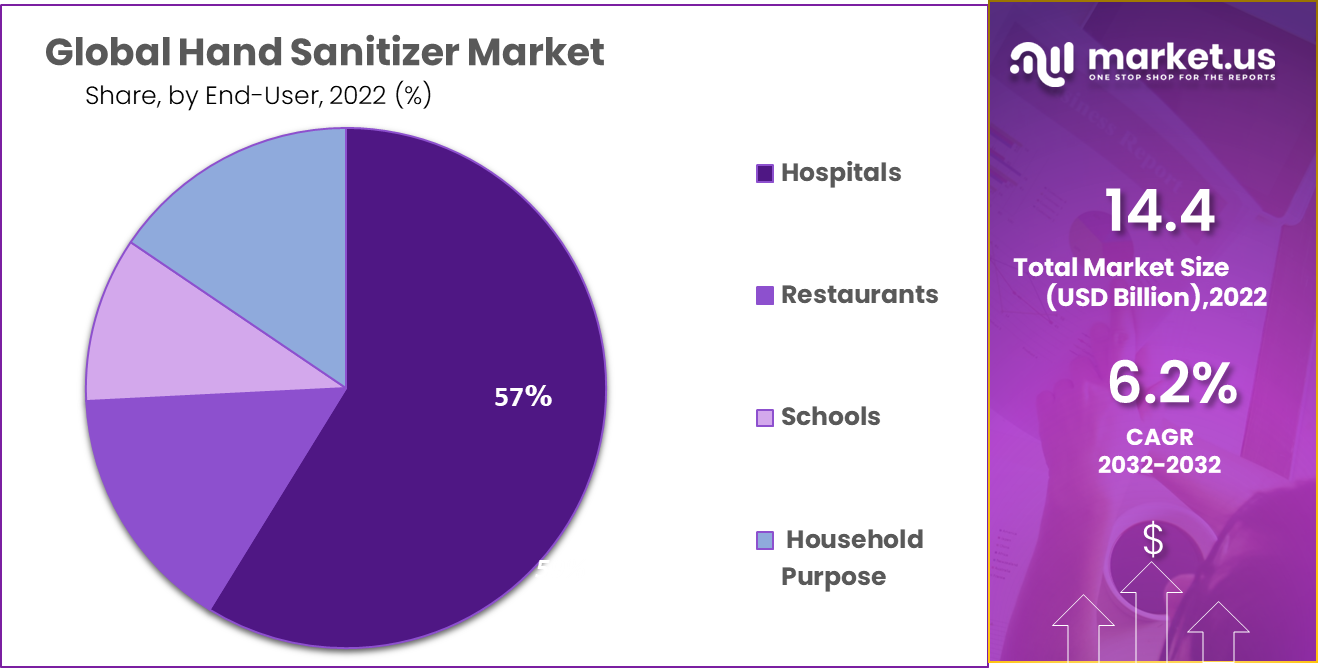

- Hospitals & clinics used hand sanitizers the most in 2022.

- North America led the market in 2022, with 43% of the revenue.

- The pandemic increased awareness of hygiene and boosted the market.

- Governments are spending more on health and safety, helping the market.

- Alcohol-based sanitizers are preferred by doctors.

- Online sales of hand sanitizers have grown.

- Hotels and restaurants are using more hand sanitizers.

- Hand sanitizers are becoming common in households.

Product Type Analysis

Gel-based hand sanitizers are expected to remain dominant during the forecast period

Antiseptics that are used to clean hands are known as hand sanitizers. You can find it in liquid, gel, and foam-based formats. It also contains alcohol, water, and emollients, as well as polyacrylates, artificial colors, and polyacrylates. According to type, the market share of gel-based hand sanitizers in 2022 is 47.2%. The market share for gel-based hand sanitizers is expected to remain dominant during the forecast period. Gel sanitizers are light in their formulations and easy to spread. They can penetrate the skin and kill most bacteria.

Because of their accessibility and ease of use, these products will be highly sought after. Global Coronavirus has led to a huge demand for gel sanitizers. This is especially in Europe, America, and Asia-Pacific. A television news channel reported that gel hand sanitizers were selling out online at Walgreens and Amazon in March 2020. Foam-based hand sanitizers will grow at a 6.2% CAGR from 2022 to 2032.

The product is becoming more popular because it penetrates quickly into the skin and lasts longer. Foam-based sanitizers don’t require to be scrubbed off and are easy to use on your hands. This makes it easier to apply and saves time. This product is expected to see increased demand due to its superior ability to kill microorganisms. Clean-cut, an environmentally-friendly cleaning brand that uses zero-waste products, introduced a foam-based soap for hand washing in March 2021. It has a scent-free formula. It is FDA-approved and claims to kill 99.9% of germs.

Composition Type Analysis

Alcohol-based sanitizers hold the leading position in the market

The amount of alcohol in the total sanitizer solution is what makes these product types different. The market will be dominated by alcohol-based products as they offer greater germ protection. Alcohol-based sanitizers can be used in hospitals to protect patients and their surroundings. They are less likely to cause infection than other skin-washing products like soaps or oils and do not promote antimicrobial resistance.

Doctors prefer alcohol-based sanitizers because they can prevent human-to-human transmissions of disease-causing viruses like CORONA 229E and NL63. The demand for alcohol-free sanitizers is increasing due to the shift towards organic personal hygiene products.

This type of sanitizer is more natural and avoids skin irritations and itching that can occur in alcohol-based products. These hand sanitizers are made from ethanol and isopropanol. These alcohols immediately denature proteins and cause damage to lipid-based coatings in some bacteria and viruses. Water acts as a carrier and bonds with the hydrogel.

Emollients can be added in small quantities to protect skin from drying due to alcohol and to neutralize the acidic effects of polyacrylate. There are alcohol-free options. These products are made with glycerin, thickening agents, and disinfectants like benzalkonium chloride BAC (or other antimicrobial substances).

Distribution Channel Analysis

The largest distribution channels, such as supermarkets and hypermarkets. They had a market share of approximately 37.7% of global revenue in 2021.

The increase in cleanser sales has been due to an increase in these stores’ presence in different areas. CNBC published a report stating that hand sanitizer sales rose by 30% between March 2019 and March 2020. Hand sanitizers were scarce in Singapore within the first weeks of the outbreak. Other household cleaning products were also out of stock by March 2020. This was due to panic buying and stocking up on soaps. Online distribution channels will grow faster than all others. Over the forecast period, this segment will continue to be a reliable source of revenue.

Due to the growing popularity of e-commerce platforms such as India and China, manufacturers are being forced to adapt their retail strategies to these emerging markets. The coronavirus outbreak has caused consumers to stock up on hand sanitizers in order to protect themselves from the virus.

Between January 2019 and February 2020, the number of online purchases of antibacterial products, including gloves, masks, and sanitizers, increased by 817%. This is a significant increase compared to last year. WHO advised that hand sanitizer gels containing product alcohol be sold on major online platforms such as Amazon, Walmart, Walgreens, and Walgreens within the first few weeks of the outbreak.

End-User Analysis

As more people become aware of the importance of hand hygiene, they will be in high demand.

End-use has categorized it into hospitals and clinics, hotels, restaurants, households, and others. Hospitals and clinics will account for the largest revenue share in 2021. Due to rising rates of infection, bacteria, and infected surfaces in hospitals and clinics, hand sanitizers are expected to be in high demand. Because of the increasing incidence of nosocomial infections in hospitals, hand sanitizers have become more popular.

In the Forecast Period, Hotel and restaurant revenue will continue to grow. To stop the spread of the virus, hand sanitizers and face masks were crucial items for COVID-19. These are the “new norm” in hospitalizations. These are often used in hotels and restaurants to supply hand sanitizers. Diverse companies have reopened restaurants, hotels, and offices.

For the household segment, there will be a modest growth rate in revenue over the forecast period. This segment is experiencing a greater awareness of the importance of keeping their homes clean and tidy. There are many places in a home that can be infected by bacteria and viruses. Contact with objects or everyday activities in the home can cause illness.

Key Market Segments

Based on Product

- Gel

- Foam

- Liquid

- Others

Based on Composition Type

- Alcohol-Based

- Alcohol-Free

Based on the Distribution Channel

- Hypermarket and Supermarket

- Drugstore

- Online

- Others

Based on End-User

- Schools

- Restaurants

- Hospitals

- Household Purpose

- Others (Shopping Plaza, Military, Corporate Sectors, Hostels)

Drivers

Increasing COVID-19 Infection Globally

Global healthcare spending is increasing, which will raise awareness among common people about safety in daily life and hygiene. Hygiene can be used to reduce the chance of getting contaminated or infected by microorganisms. Due to increased awareness of hygiene, the market for hand sanitizers is expected to grow. Coronavirus was prevalent during a time when both the mortality rate and cost of treatment were high.

To prevent the spread of the virus, hand sanitizers and wearing masks are essential. It can also be used in clinics and laboratories to disinfect equipment and prevent the spread of bacteria. There are many benefits to hand sanitizers, such as the ability to clean surfaces, disinfect keyboards, remove nail polish, and kill bacteria. This will help drive market growth.

Restraints

Skin irritation by hand sanitizer could limit this market’s growth in revenue.

Skin irritation can be caused by hand sanitizers. It can lead to dry, flaky, cracked, and sensitive skin. This increases the chance of germs spreading. After using different types of hand sanitizers, it can cause red, itchy, and discolored eczema patches. Hand sanitizers that contain triclosan could cause problems such as disruptions in the normal hormonal cycle and impair fertility. Hand sanitizers can also contain phthalates.

Phthalates can mimic hormones and cause problems in the functioning of the endocrine system. They can also affect genital development. Some hand sanitizers contain parabens. These chemicals are not good for the skin. One study showed that children’s immunity could be reduced if they use hand sanitizers too early in their lives. Due to lower levels of COVID-19 contamination, the market for hand sanitizers will slow down.

Opportunity

Rising health awareness among individuals

The growing prevalence of skin, respiratory, and gastrointestinal infections in the population is further fueling the increasing demand for hand soaps. Alcohol-based hand soaps can reduce the spread of viruses and bacteria on the skin. They also help to prevent stomach infections, diarrhea, nausea, vomiting, and other serious illnesses. Hand sanitizers can be more effective than soaps or hand washes. Natural and organic ingredients are being used by product manufacturers to create sanitizers that don’t cause allergic reactions and are safe for the skin.

Trends

Increases amount of innovation and differentiation products

Manufacturers are more inclined to purchase raw materials at lower prices. Raw material procurement is the process of establishing long-term supply agreements with raw material suppliers. Independent manufacturers may hire third-party suppliers in order to sell their products. Manufacturers of hand sanitizers are more focused on product innovation and differentiation. They are moving towards consolidation through mergers and acquisitions, joint ventures, and collaborative partnerships. These trends are boosting the market for these products.

Regional Analysis

Regional analysis shows that North America’s hand soap market was responsible for the highest revenue share in 2021.

Hand sanitizers saw a significant rise in demand from North American countries both during COVID-19 and after COVID-19. For example, the National Research Council of Canada (NRC) announced it had created solutions to address pandemic needs. It can also be used for Canada’s immediate need for sanitizing, which was hindered due to shortages in alcohol and raw material.

The market’s revenue growth will be limited by a slight decline in demand. In Asia Pacific, revenue is expected to grow steadily over the forecast period. The COVID-19 pandemic in the Asia Pacific saw India and China experience a significant rise in hand sanitizer demand.

Hand sanitizers were not available in India, so 50% of Indians couldn’t afford them. Due to a shortage of stock, 26% of the Indian population used sanitizers from unknown brands. Panic buying by individuals caused disruption to the supply of sanitizers. Due to falling sales of hand sanitizer, large companies had to exit this market. Dabur Ltd., an Indian multinational consumer goods company, stated that it would no longer produce sanitizers due to declining demand. Radico Khaitan, a giant liquor company, announced that it would cease producing pure alcohol for sanitizer producers on March 22, 2022.

For European countries, the forecast period will see a slight increase in revenue. Many European countries, including Italy, were affected by the large covid-19 outbreak. This caused a great demand for hand soaps. Existing companies found it difficult to produce enough hand sanitizers to meet the global demand. Unilever plans to restart its U.K. deodorant production line on April 24, 2020, and use that resource to make hand sanitizers. Global efforts, combined with the expertise of experts, enabled us to fight Coronavirus and address global needs.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

There is a fragmented market for hand sanitizers. Both at the global and regional levels, there are many major players. Key players participate in product development and strategic alliances to expand their product portfolios and strengthen their position in the global market. Reckitt Benckiser Group PLC, Unilever, Procter & Gamble, GOJO Industries Inc., S.C. Johnson & Son Inc., CVS Health, Paul Hartmann AG, Best Sanitizers Inc., Vi-Jon, and Himalaya Wellness Company are just a few of the key players in this market.

Turner Venture Group, Inc. announced that on May 11, 2022, it would partner with Herban Healing LLC, its portfolio business, to distribute hand sanitizers made from Bloomi Labs CBD in Greater Houston, Texas, via Herban’s retail outlets. Herban placed an order for BloomiClean. The product will be distributed through flagship retail outlets. Global demand for hand sanitizers will be met by the expansion of the retail network.

Market Key Players

With the presence of many local and regional players, the market for hand sanitizer is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

The following are some of the major players in the global hand sanitizer industry

- Reckitt Benckiser Group plc

- Procter and Gamble

- The Himalaya Drug Company

- GOJO Industries Inc.

- Henkel AG and Company

- Unilever

- Vi-Jon

- Chattem, Inc.

- Best Sanitizers Inc.

- Kuto

- 3M Company

- Other Key Players.

Recent Development

- In April 2020 Honeywell announced that it would expand its manufacturing operations at two chemical plants as a response to the COVID-19 pandemic. The plant will manufacture and supply hand soaps to government agencies. These products are manufactured by Honeywell at its facilities in Muskegon (Michigan), Zelze, and Germany.

SC Johnson, a global manufacturer and distributor of disinfecting and cleaning products for businesses and homes, updated its product testing line in April 2020 to better serve healthcare workers, first responders, and its own workers. - On March 2022 Indian multinational consumer goods company Dabur Ltd. declared that it would cease producing sanitizers because of reduced demand. Radico Khaitan, a major spirits company, has also cut back its production of pure alcohol in order to supply sanitizer businesses.

- On May 31, 2022, Technical Help in Engineering and Marketing Amazon Basic Care announced their collaboration in the development of a capsule hand sanitizer. The packaging uses 60% less material than similar-sized sachets. It has an environmental advantage, as it can withstand temperatures of up to 40degC/104degF over 252 consecutive days. Because of the affordability of packaging, hand sanitizers are expected to increase in demand.

Report Scope

Report Features Description Market Value (2022) USD 14.2 Billion Forecast Revenue (2032) USD 25.5 Billion CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product- Gel, Foam, Liquid, and Others; By Composition Type- Alcohol-Based and Alcohol-Free; By End User- Schools, Restaurants, Hospitals, Household Purpose, and Others (Shopping Plaza, Military, Corporate Sectors, Hostels); By Distribution Channel- Hypermarket and Supermarket, Drugstore, Online, and Others. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Reckitt Benckiser Group plc, Procter and Gamble, The Himalaya Drug Company, GOJO Industries Inc., Henkel AG and Company, Unilever, Vi-Jon, Chattem Inc., Best Sanitizers Inc., Kuto, 3M Company, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the hand sanitizers market growth?The global hand sanitizers market is expected to grow at a compound annual growth rate of 6.2% from 2022 to 2032 to reach USD 25.5 Bn by 2032.

How big is the hand sanitizers market?The global hand sanitizers market size was estimated at USD 13.3 billion in 2021 and is expected to reach USD 14.2 billion in 2022.

Which key players operating in the hand sanitizers market?Some of the prominent players operating in this market place are Reckitt Benckiser Group plc, Procter and Gamble, The Himalaya, Drug Company, GOJO Industries Inc., Henkel AG and Company, Unilever, Vi-Jon, Chattem, Inc., Best Sanitizers Inc., Kuto, 3M Company, Other Key Players.

-

-

- Reckitt Benckiser Group plc

- Procter and Gamble

- The Himalaya Drug Company

- GOJO Industries Inc.

- Henkel AG and Company

- Unilever

- Vi-Jon

- Chattem, Inc.

- Best Sanitizers Inc.

- Kuto

- 3M Company

- Other Key Players.