Global Gym Apparel Market By Product Type (Top Wear, Bottom Wear, Others), By Distribution Channel (Offline, Online), By End-user (Men, Women, Children), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135353

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

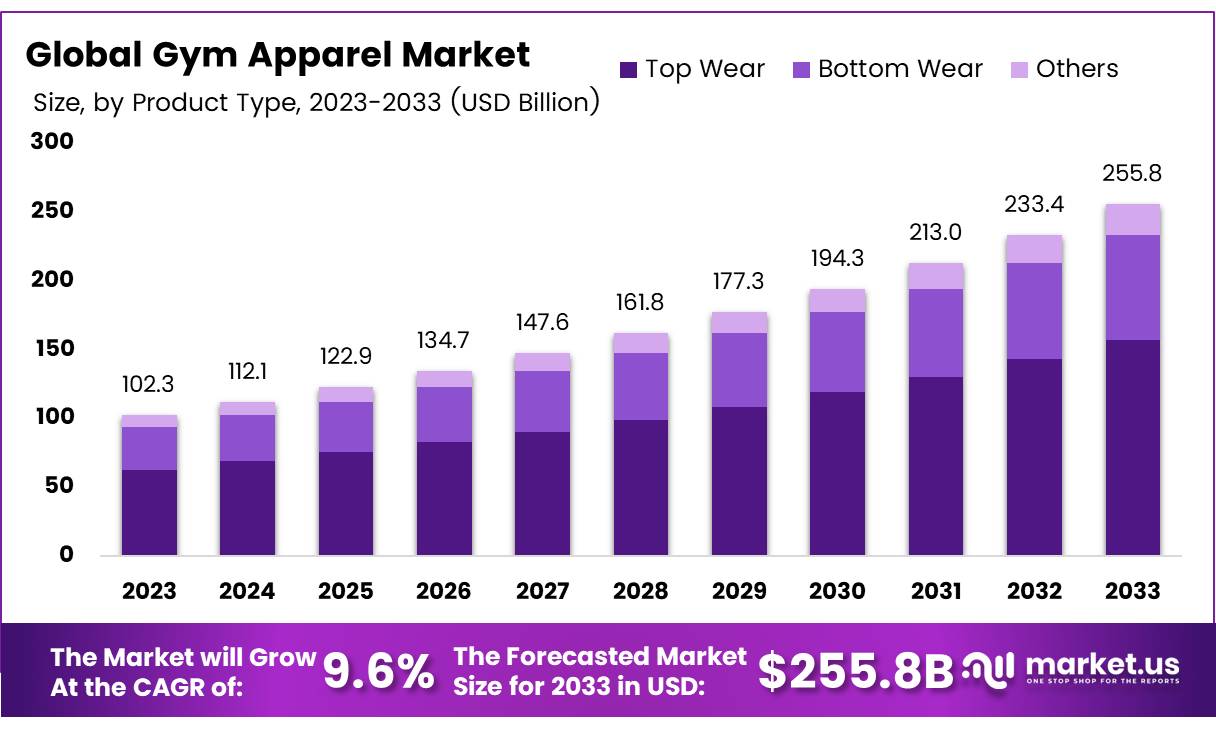

The Global Gym Apparel Market size is expected to be worth around USD 255.8 Billion by 2033, from USD 102.3 Billion in 2023, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

Gym apparel refers to clothing specifically designed for physical exercise, such as gym workouts, running, yoga, and other fitness-related activities. This category includes a wide range of products such as leggings, sports bras, tank tops, gym shorts, sweatpants, and performance-enhancing fabrics.

The key features of gym apparel are comfort, flexibility, breathability, moisture-wicking, and durability, all of which contribute to enhancing performance during workouts.

In recent years, gym apparel has evolved from basic functional clothing to a fashionable and versatile segment that can be worn both in and outside of fitness settings. Brands are now incorporating cutting-edge technologies like antimicrobial fabrics, body-sculpting fits, and sustainable materials to meet the growing demand for functional and eco-friendly workout wear.

The gym apparel market encompasses the manufacturing, distribution, and retail of sportswear designed for exercise and physical activity. This market is driven by a combination of factors including the growing participation in fitness activities, increased health consciousness, and the blending of fashion with functionality in activewear.

According to FitnessOnDemand, in 2022, 68.9 million people were members of fitness facilities, reflecting a 3.7% increase from the previous year. This surge in gym membership and active lifestyle participation directly contributes to the expanding demand for specialized clothing tailored to physical activity.

In addition, the popularity of athleisure—a trend of wearing gym-inspired apparel in non-fitness environments—has further propelled market growth. The global gym apparel market is expected to continue its upward trajectory as more consumers invest in health and wellness products.

The gym apparel market has been experiencing robust growth, driven by an increasing focus on fitness and wellness. According to recent data, more than three in five Americans have prioritized their health and fitness in 2024, marking a 29% increase from the previous year. This growing fitness trend, coupled with the rise in gym memberships, presents significant opportunities for manufacturers and retailers in the gym apparel space.

In the United States alone, over 60 million people are gym members, accounting for around 20% of the population aged six and above. This large, engaged consumer base continues to demand both functional and fashionable gym clothing, contributing to the expansion of the gym apparel market.

In addition to consumer-driven growth, government investment in public health initiatives and fitness programs could further fuel the market. Public and private sector collaborations to promote physical well-being can lead to greater awareness and an increased desire for gym apparel.

Furthermore, evolving regulations, particularly in the areas of environmental sustainability, are pushing apparel manufacturers to innovate with eco-friendly materials, such as recycled polyester or organic cotton. Government incentives supporting sustainable production processes could open up new avenues for growth in the gym apparel segment, especially for brands that prioritize sustainability and ethical practices.

The average consumer spent $111.80 on athletic gear in 2021, including gym apparel, exercise equipment, and game tables, as reported by the Bureau of Labor Statistics (BLS). This highlights the growing willingness of consumers to invest in fitness-related products, signaling strong market potential.

As the gym apparel market expands, brands that combine performance, style, and sustainability will likely capture a larger share of the market, meeting the evolving needs of fitness enthusiasts and fashion-conscious consumers alike.

Key Takeaways

- The global gym apparel market is projected to reach USD 255.8 billion by 2033, growing at a CAGR of 9.6% from 2024 to 2033.

- Top Wear led the product type segment in 2023, capturing 58.2% market share due to rising demand for performance-enhancing activewear.

- Offline distribution channels dominated in 2023, holding 65.8% of the gym apparel market share due to consumer preference for in-store shopping.

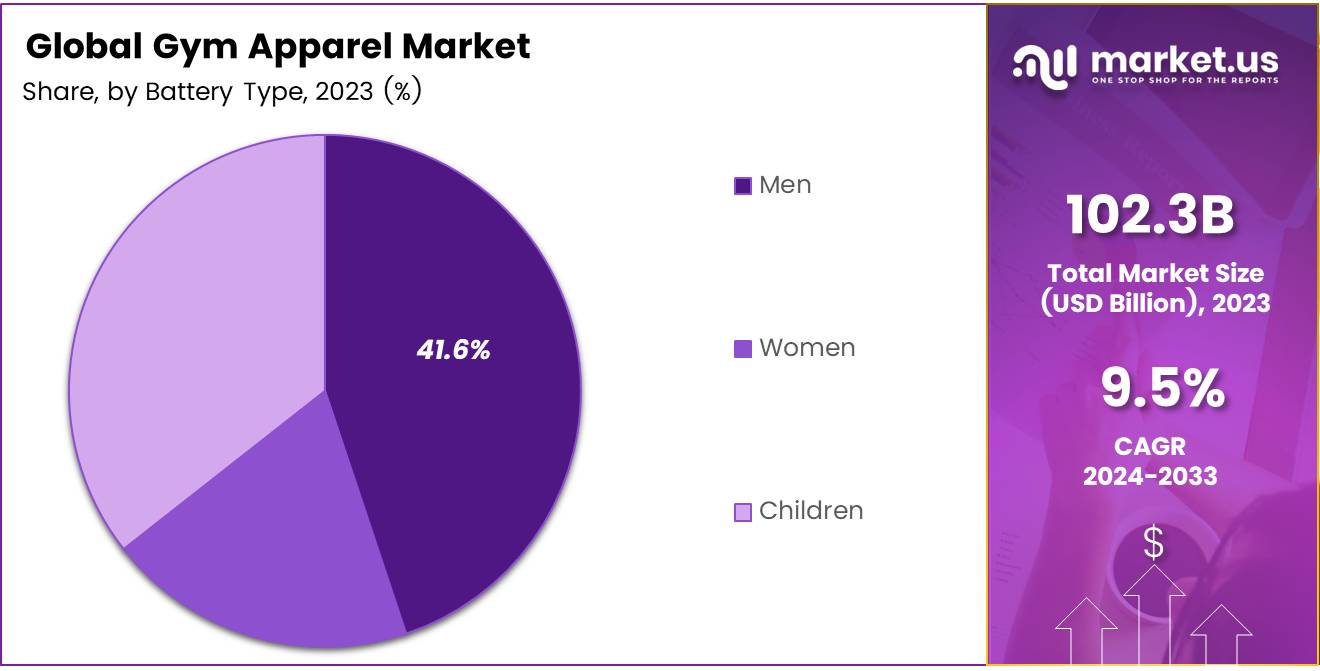

- Men’s gym apparel held 41.6% of the market share in 2023, driven by fitness trends and advanced product features like moisture-wicking fabrics.

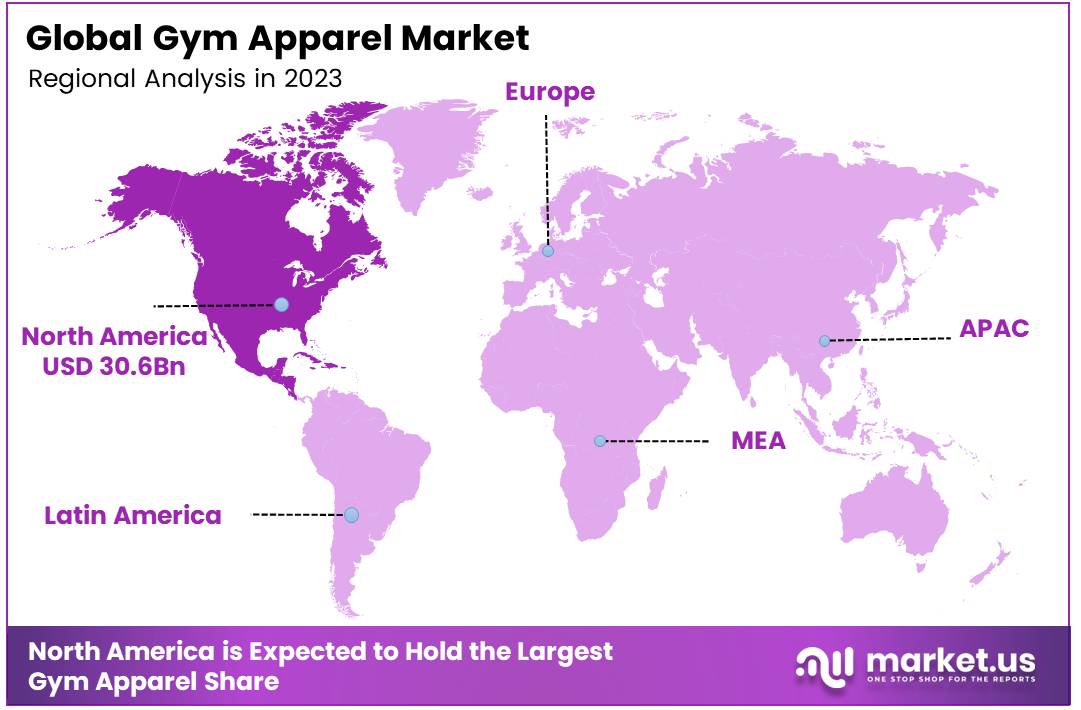

- North America accounted for 30.2% of the gym apparel market in 2023, valued at USD 30.6 billion, supported by a strong fitness culture and high disposable income.

Product Type Analysis

In 2023, Top Wear Dominated the Gym Apparel Market with a 58.2% Share in Product Type Segment

In 2023, Top Wear held a dominant market position in the By Product Type Analysis segment of the Gym Apparel Market, capturing a substantial 58.2% market share. This segment’s growth can be attributed to the increasing consumer demand for performance-enhancing activewear, which includes items such as gym t-shirts, tank tops, sports bras, and hoodies. The emphasis on comfort, moisture-wicking fabrics, and versatile designs has driven the popularity of top wear, positioning it as the leading category in gym apparel.

Bottom Wear followed as the second-largest segment, contributing to a significant portion of market share. Items like leggings, shorts, and gym trousers have seen growing adoption due to their functionality and comfort, making them essential for workout routines. Despite the lower share compared to top wear, bottom wear continues to benefit from ongoing trends toward athleisure and active lifestyles.

The Others category, which includes accessories like gym socks, headbands, and gloves, holds a smaller market share. However, it is gradually gaining traction as consumers seek comprehensive gym kits for their fitness needs.

Overall, the gym apparel market’s product type segmentation highlights a continued preference for top wear, driven by changing fitness habits and rising demand for stylish, comfortable, and functional workout clothing.

Distribution Channel Analysis

In 2023, Offline Channels Dominated the Gym Apparel Market with a 65.8% Share

In 2023, Offline distribution channels held a dominant market position in the By Distribution Channel segment of the gym apparel market, accounting for 65.8% of the total market share. This significant share reflects the continued consumer preference for in-store shopping, where the ability to physically examine products and try on apparel before purchase remains a crucial factor.

The offline retail environment, including specialty stores, department stores, and fitness equipment retailers, provides consumers with the immediacy of purchase and the opportunity for direct engagement with sales staff, which reinforces consumer loyalty.

Online segment has experienced growth driven by the convenience of shopping from home and the increasing number of fitness-focused e-commerce platforms, it continues to face certain challenges such as sizing concerns, product returns, and the lack of a physical shopping experience. Despite these challenges, the online market is expected to experience steady growth as digital shopping trends continue to gain traction among younger and tech-savvy consumers.

End-user Analysis

In 2023, Men Led the Gym Apparel Market with 41.6% Share in End-User Segment

In 2023, Men held a dominant market position in the By End-user Analysis segment of the gym apparel market, with a 41.6% share. The growing trend of fitness-focused lifestyles, alongside a heightened emphasis on performance-driven gym wear, has contributed to this leading position.

Men’s gym apparel continues to see strong demand due to advancements in product features, such as moisture-wicking fabrics, improved fit, and durability, which cater to active gym-goers and athletes.

Women’s gym apparel has also experienced significant growth, driven by an increasing focus on fitness and wellness. This demographic is increasingly drawn to both functional and fashionable gym clothing, with a rising interest in athleisure styles. As the fitness industry embraces a more inclusive approach, the demand for specialized and high-performance gym wear for women continues to rise.

The children’s segment has witnessed steady growth, with an increasing awareness of the importance of physical activity and fitness from an early age. Apparel for children has evolved to focus on comfort, durability, and flexibility, supporting the active lifestyles of younger consumers.

Each demographic is shaping the future of the gym apparel market through distinct preferences and needs, ensuring continued market diversification.

Key Market Segments

By Product Type

- Top Wear

- Bottom Wear

- Others

By Distribution Channel

- Offline

- Online

By End-user

- Men

- Women

- Children

Drivers

Rising Health Consciousness and the Growing Fitness Industry Driving Gym Apparel Demand

The gym apparel market is experiencing robust growth, driven by several key factors. One of the primary drivers is the rising health consciousness among consumers. As people become more aware of the benefits of maintaining an active lifestyle, the demand for high-quality gym wear has increased.

This shift towards fitness and wellness has led many individuals to invest in specialized clothing designed for comfort and performance. The expanding fitness industry is another critical factor. With a significant rise in the number of gyms, fitness centers, and wellness programs worldwide, there is an increased need for apparel that supports various physical activities.

Additionally, the athleisure trend is contributing to the market’s growth. As gym wear is now widely accepted as casual and everyday attire, many consumers purchase gym apparel for both exercise and social use. This shift in fashion has made athletic wear more mainstream, with consumers seeking products that combine style and functionality.

Furthermore, the rapid growth of e-commerce has played a pivotal role in the market expansion. Online shopping platforms make it easier for consumers to access a wide range of gym apparel brands and styles, offering convenience and variety. Together, these factors are significantly fueling the demand for gym apparel, and the market is expected to continue to expand as these trends evolve.

Restraints

High Cost of Premium Products and Competition from Fast Fashion Limiting Growth

Despite the growth of the gym apparel market, several challenges are restricting its potential. One of the primary restraints is the high cost of premium products. High-quality gym wear, made from specialized fabrics and designed for optimal performance, often comes with a significant price tag. This pricing can limit access for budget-conscious consumers, who may opt for lower-cost alternatives.

While many consumers are willing to invest in gym apparel that offers superior comfort and durability, the overall cost can be a barrier for a large portion of the market. Additionally, the rise of fast fashion is another factor impacting market dynamics.

Fast fashion retailers, known for offering inexpensive, trendy clothing, have expanded into the gym apparel sector, providing affordable alternatives to consumers. These brands often prioritize style over performance, attracting a price-sensitive customer base.

As a result, established gym apparel brands face intense competition, as consumers may choose to purchase cheaper, fashionable options from fast fashion retailers rather than invest in specialized workout gear.

This trend poses a significant challenge for traditional gym apparel companies that rely on premium pricing to position their products as high-end options. Together, these factors are creating a competitive environment that could hinder growth and profitability for established gym apparel brands in the long term.

Growth Factors

Emerging Growth Opportunities in the Gym Apparel Market

The gym apparel market presents several promising growth opportunities driven by evolving consumer preferences and technological advancements. One key opportunity is the integration of smart wearables into gym apparel.

By incorporating fitness trackers and sensors into clothing, brands can offer consumers real-time data on their workouts, such as heart rate, calories burned, and muscle activity. This fusion of technology and apparel enhances the fitness experience and meets the growing demand for data-driven fitness solutions.

Additionally, the increasing focus on women’s fitness presents an opportunity for brands to develop gym wear tailored to female consumers. As women-centric fitness communities grow in popularity, there is a rising demand for stylish, functional, and comfortable apparel designed specifically for women’s unique needs.

Another significant growth opportunity lies in the rising consumer interest in sustainability. Eco-friendly and recyclable gym apparel is becoming increasingly popular among environmentally conscious buyers, providing brands the chance to cater to this demand by adopting sustainable materials and production practices.

Furthermore, the shift towards home fitness, accelerated by recent global events, opens up new avenues for gym apparel designed for home workouts. Comfortable, versatile, and affordable gym wear that suits at-home fitness routines can attract a broad consumer base. By capitalizing on these trends—smart technology integration, women’s apparel, sustainability, and home fitness—brands can tap into emerging segments of the market and drive sustained growth.

Emerging Trends

Social Media and Technological Innovations Shaping Gym Apparel Trends

The gym apparel market is experiencing several key trends that are influencing consumer behavior and product development. One of the most significant factors is the influence of social media. Platforms like Instagram, TikTok, and YouTube have become powerful drivers of gym apparel trends, with fitness influencers and athletes showcasing the latest styles and encouraging followers to adopt similar trends. This has accelerated demand for fashionable, performance-oriented workout clothing that aligns with the influencers’ styles.

Another growing trend is gender-neutral apparel. As society becomes more inclusive, there is a rising demand for gym wear that is not specifically designed for one gender, appealing to a broader consumer base. This trend is gaining traction as consumers look for versatility and representation in their clothing choices.

Hybrid clothing, which blends the functionality of gym wear with casual style, is also on the rise. This type of apparel allows consumers to transition easily from a workout session to everyday activities, offering greater convenience and style versatility.

Additionally, technological advancements in fabrics are shaping the future of gym apparel. Consumers are increasingly seeking materials that enhance their performance and comfort, such as moisture-wicking fabrics that keep the body dry, anti-odor technology that prevents unpleasant smells, and UV-protective materials for outdoor workouts. These innovations are making gym apparel more functional and appealing to a wider range of fitness enthusiasts, driving the growth of the market.

Regional Analysis

North America dominates the gym apparel market, with 30.2% market share, valued USD 30.6 billion

The global gym apparel market is characterized by varied growth across different regions, driven by factors such as increasing health consciousness, the popularity of fitness trends, and a growing inclination toward athleisure wear.

North America holds the largest share of the gym apparel market, accounting for 30.2%, with a market value of USD 30.6 billion. This dominance is driven by a robust fitness culture, high disposable income, and the growing adoption of athleisure apparel.

The United States plays a pivotal role in this growth, where a significant portion of the population actively participates in fitness activities, creating strong demand for both functional and fashionable gym wear.

Regional Mentions:

In Europe, the market remains strong, driven by rising health awareness and increasing consumer preference for high-quality gym apparel. The region is particularly influenced by countries such as the UK, Germany, and France, where the fitness culture is well-established. There is also a growing trend towards sustainable and eco-friendly gym wear, which has accelerated market expansion in the region.

The Asia Pacific region is experiencing rapid growth, driven by the increasing urbanization and expanding middle class, particularly in countries like China, Japan, and India. Fitness awareness is steadily rising, along with the growing number of gyms and wellness centers. The demand for gym apparel in this region is expected to continue expanding due to the increasing popularity of fitness activities and athleisure fashion.

Middle East & Africa and Latin America contribute a smaller share to the global gym apparel market but are showing strong growth potential. Increasing health awareness, improved disposable incomes, and the rising popularity of fitness activities are driving demand for gym apparel in these regions. However, these markets are still in the early stages of development, providing substantial growth opportunities in the coming years.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the competitive landscape of the global gym apparel market is characterized by the dominance of several key players, each leveraging their extensive brand recognition, product innovation, and retail presence.

Nike Inc. remains a leading force in the gym apparel segment, with its strong brand appeal, cutting-edge technology, and wide product range tailored to various fitness needs. Nike’s emphasis on performance-enhancing fabrics and sustainability aligns with shifting consumer preferences, enhancing its market position.

Adidas AG also commands a significant share, focusing on high-performance apparel combined with style, appealing to both athletes and fitness enthusiasts. Adidas has increasingly adopted sustainable practices in its product lines, enhancing its appeal to environmentally conscious consumers. The brand’s strategic collaborations and consistent innovation further solidify its standing in the global gym apparel market.

PUMA SE, with its strong focus on fashion and functional fitness wear, continues to make notable strides, offering a unique blend of athletic and lifestyle apparel. The company’s partnerships with high-profile athletes and influencers further boost its market visibility and appeal.

ASICS Corp. targets serious athletes with its specialized performance-focused apparel, leveraging its heritage in running shoes and sportswear to cater to the niche of high-performance athletic apparel.

Hanesbrands Inc. and Gildan Activewear Inc., while primarily recognized for their basics and activewear, have expanded their offerings to include innovative gym apparel lines, catering to budget-conscious consumers seeking quality at competitive prices.

The global gym apparel market continues to evolve as these companies adapt to emerging trends, including the increasing demand for sustainable products and the growing popularity of athleisure. Their ability to innovate while maintaining brand loyalty is expected to drive ongoing growth within this sector.

Top Key Players in the Market

- Adidas AG

- ASICS Corp

- Nike Inc.

- PUMA SE

- Columbia Sportswear

- Dick’s Sporting Goods Inc.

- Hanesbrands Inc.

- G-III Apparel Group Ltd.

- Gildan Activewear Inc.

- VF Corporation

Recent Developments

- In November 2024, Boldfit raised $13 million from Bessemer Venture Partners at a $74 million valuation. This funding will help the fitness and wellness brand expand its product offerings and strengthen its market presence in the competitive fitness apparel industry.

- In January 2023, Oya Femtech Apparel raised $1.3 million in a pre-seed funding round. The funding will fuel the brand’s development of innovative, performance-driven activewear designed specifically for women’s health and well-being.

- In November 2024, athletic apparel maker Vuori reached a $5.5 billion valuation in its latest funding round. With this significant valuation, Vuori aims to scale its operations globally, solidifying its position as a leader in the performance and lifestyle activewear market.

Report Scope

Report Features Description Market Value (2023) USD 102.3 Billion Forecast Revenue (2033) USD 255.8 Billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Top Wear, Bottom Wear, Others), By Distribution Channel (Offline, Online), By End-user (Men, Women, Children) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Adidas AG, ASICS Corp, Nike Inc., PUMA SE, Columbia Sportswear, Dick’s Sporting Goods Inc., Hanesbrands Inc., G-III Apparel Group Ltd., Gildan Activewear Inc., VF Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas AG

- ASICS Corp

- Nike Inc.

- PUMA SE

- Columbia Sportswear

- Dick’s Sporting Goods Inc.

- Hanesbrands Inc.

- G-III Apparel Group Ltd.

- Gildan Activewear Inc.

- VF Corporation