Global Zirconium Silicate Market Size, Share Analysis Report By Type (Zirconium Silicate Powder, Zirconium Silicate Beads), By Application (Ceramic Industry, Refractories, Glass Industry, Foundries, Others), By End-User (Industrial, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162985

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

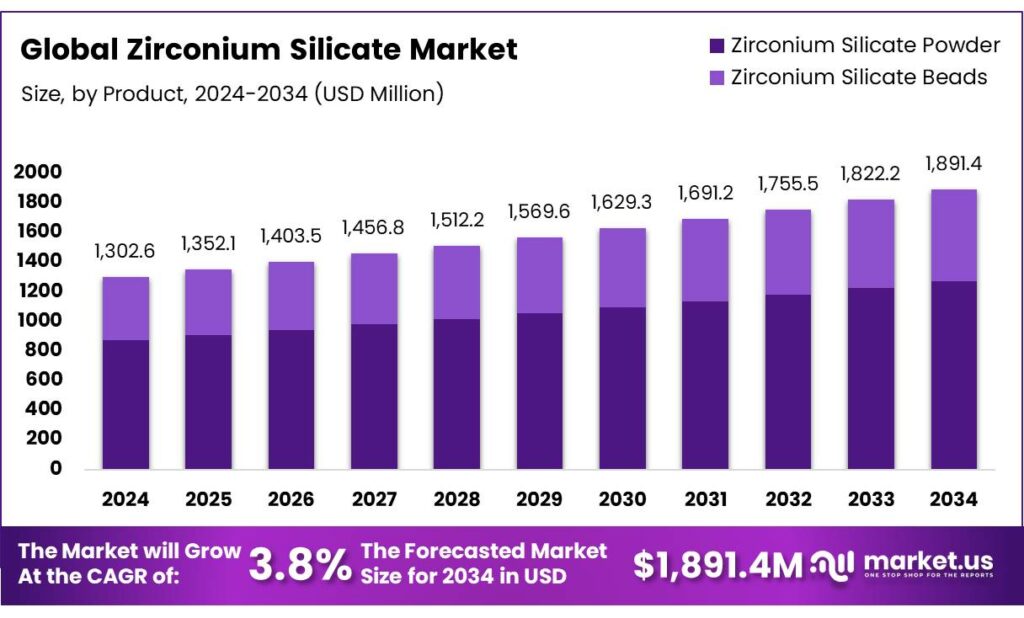

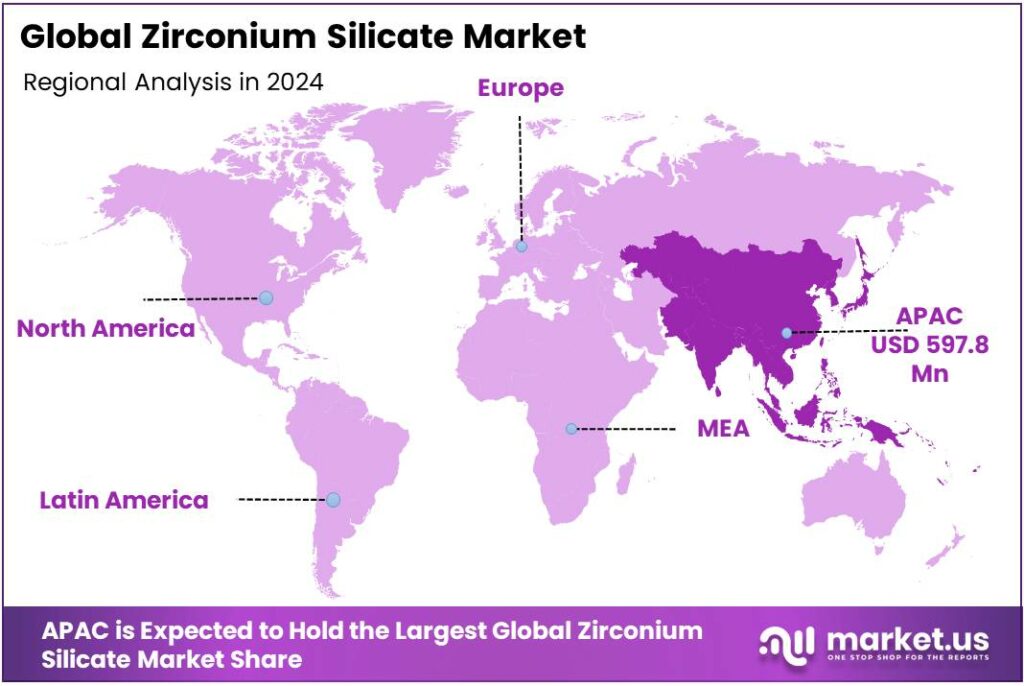

The Global Zirconium Silicate Market size is expected to be worth around USD 1891.4 Million by 2034, from USD 1302.6 Million in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 45.9% share, holding USD 597.8 Million in revenue.

Zirconium silicate—commercially known as zircon—is a hard, chemically inert mineral sourced mainly from heavy-mineral sand deposits. It is indispensable to ceramics, refractories, and foundry applications and also serves as the starting point for zirconium chemicals and zirconia (ZrO₂).

- According to the U.S. Geological Survey (USGS), global mine production of zirconium mineral concentrates rose 4% in 2024 to an estimated 1.5 million tonnes, underscoring steady industrial demand through construction, tiles, sanitaryware and engineered ceramics.

End-use is concentrated and well-defined. The Zircon Industry Association (ZIA) indicates the ceramics sector accounts for ~54% of zircon consumption, with foundries ~14% and refractories ~11–14%; the balance flows into zirconium chemicals and advanced applications. These shares are material for supply planning because ceramics cycles closely track housing, infrastructure, and renovation demand across Asia and Europe.

On the supply side, Australia dominates resources and plays a pivotal role in trade. Geoscience Australia reports the country holds ~35% of the world’s zircon resources, reflecting the scale and quality of its mineral sands endowment.

- Complementing that, the Australian Government lists zirconium on its Critical Minerals List, and its latest public table records Australia’s production at ~500 kt (2022), world resources ~115,300 kt, and global production ~2,200 kt (2022)—figures that highlight both concentration and the strategic attention governments now place on zircon supply chains.

Energy-system dynamics create an additional structural demand avenue via zircon-derived zirconium metal and alloys for nuclear fuel cladding. The International Energy Agency (IEA) notes nuclear power supplied just over 9–10% of global electricity in 2023, and Asia is set to become the largest installed nuclear region by end-2026, with its share of global nuclear generation reaching ~30% in 2026 under IEA’s outlook. As new reactors connect—particularly in China and India—zirconium alloy requirements for fuel assemblies support upstream demand for zircon and zirconium chemicals, reinforcing the mineral’s strategic profile alongside traditional ceramics use.

Policy support and critical-minerals strategies are catalyzing upstream investment. Australia classifies zircon among its critical minerals and accounted for ~24% of world zircon production in 2023, backed by initiatives such as the Critical Minerals Strategy 2023–2030 and the A$3.4 b “Resourcing Australia’s Prosperity” geoscience program—measures that de-risk exploration and sustain new feed. In parallel, the U.S. has signaled supply-security needs: the FY 2025 stockpile plan included a potential acquisition of 2,300 t of zirconium, while 2024 U.S. trade in zirconium ores showed imports ~19,000 t (ZrO₂) and exports ~16,000 t, indicating active flows to processors.

Key Takeaways

- Zirconium Silicate Market size is expected to be worth around USD 1891.4 Million by 2034, from USD 1302.6 Million in 2024, growing at a CAGR of 3.8%.

- Zirconium Silicate Powder held a dominant market position, capturing more than a 67.2% share of the global zirconium silicate market.

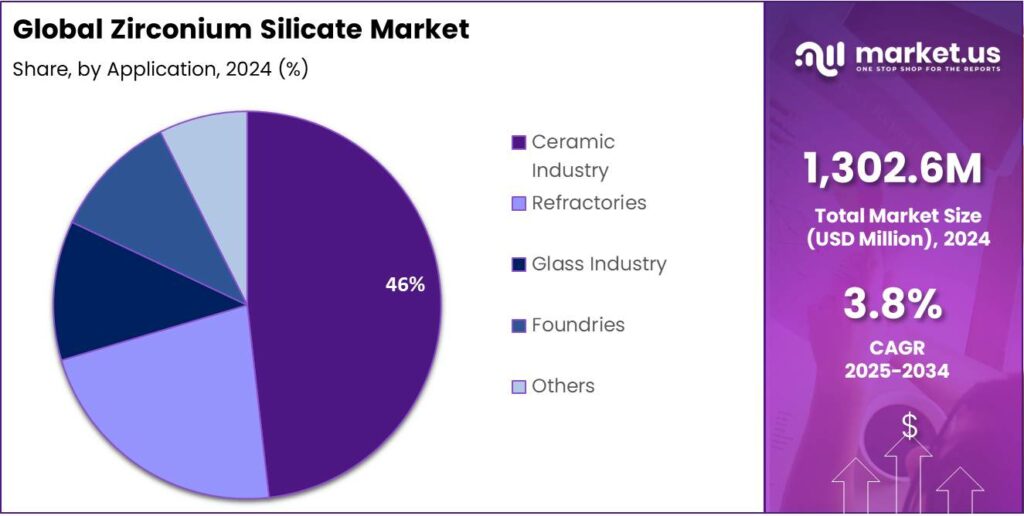

- Ceramic Industry held a dominant market position, capturing more than a 45.6% share of the global zirconium silicate market.

- Industrial segment held a dominant market position, capturing more than a 78.4% share of the global zirconium silicate market.

- Asia-Pacific (APAC) region held a dominant position in the global zirconium silicate market, accounting for 45.9% of the total market share, valued at approximately USD 597.8 million.

By Type Analysis

Zirconium Silicate Powder dominates with 67.2% share due to its extensive use in ceramics and refractories

In 2024, Zirconium Silicate Powder held a dominant market position, capturing more than a 67.2% share of the global zirconium silicate market. The dominance of this segment is primarily attributed to its high purity, fine particle size, and superior thermal stability, which make it a preferred material for ceramic tiles, sanitaryware, and porcelain production. The powder form ensures uniform dispersion in glazes and enhances surface smoothness, contributing to improved finish quality in end-use products. Growing consumption from the building and construction industries, particularly in Asia-Pacific economies such as China and India, further supported this demand surge in 2024.

The segment also benefited from the recovery in industrial production and export of ceramic products during 2024, alongside technological advancements in powder processing that enabled consistent quality control and cost efficiency. The foundry and refractory industries adopted zirconium silicate powder for high-temperature applications, owing to its strong resistance to corrosion and melting, driving steady consumption levels.

By Application Analysis

Ceramic Industry dominates with 45.6% share driven by strong demand from tiles and sanitaryware manufacturing

In 2024, the Ceramic Industry held a dominant market position, capturing more than a 45.6% share of the global zirconium silicate market. The strong presence of this segment is primarily due to the extensive use of zirconium silicate as an opacifier and whitening agent in ceramic tiles, sanitaryware, and porcelain products. Its ability to enhance surface brightness, chemical resistance, and mechanical strength makes it an essential raw material in modern ceramic formulations. The surge in housing projects and infrastructure development across Asia-Pacific and the Middle East significantly contributed to the growth of ceramic production, reinforcing demand for zirconium silicate in 2024.

The sector further benefited from technological upgrades in ceramic glazing and digital printing applications, where zirconium silicate offers consistent opacity and improved gloss. Manufacturers continued to prefer the material for high-end tiles and sanitary fittings because of its thermal stability and wear resistance under high firing temperatures.

By End-User Analysis

Industrial segment dominates with 78.4% share owing to its extensive use across manufacturing and high-temperature applications

In 2024, the Industrial segment held a dominant market position, capturing more than a 78.4% share of the global zirconium silicate market. This strong dominance was driven by its wide-ranging use across ceramics, refractories, foundries, and precision casting industries. Zirconium silicate’s high melting point, thermal stability, and resistance to corrosion make it a preferred material in industrial manufacturing environments where durability and performance are essential. The material’s role in ceramic tiles, sanitaryware, and refractory linings continued to be vital for production efficiency and product longevity, especially in high-temperature processing facilities.

The segment further benefitted from rising industrialization and growth in infrastructure projects across emerging economies in 2024, which led to a surge in demand for advanced ceramics, glass, and foundry materials. Manufacturing plants increasingly adopted zirconium silicate due to its ability to improve energy efficiency and reduce material wear in industrial equipment.

Key Market Segments

By Type

- Zirconium Silicate Powder

- Zirconium Silicate Beads

By Application

- Ceramic Industry

- Refractories

- Glass Industry

- Foundries

- Others

By End-User

- Industrial

- Commercial

Emerging Trends

Hygiene-by-design upgrades in food facilities are standardizing bright

Across food and beverage (F&B) plants, commissary kitchens, dairies, and cold warehouses, a clear trend is taking hold: projects are being specified “hygiene-by-design,” prioritizing smooth, non-porous, audit-visible surfaces that tolerate frequent, caustic wash-downs. This is lifting demand for high-opacity white ceramic glazes, where zirconium silicate is the workhorse opacifier.

- The World Health Organization estimates 600 million people fall ill from unsafe food each year and 420,000 die, imposing US$110 billion in productivity and medical costs in low- and middle-income countries—numbers that sustain corporate and regulatory focus on surfaces that show soil and clean easily.

Standards are codifying this preference. The Codex General Principles of Food Hygiene (CXC 1-1969) require premises to be designed and maintained to enable effective cleaning and to prevent contamination—language that favors impervious, crack-resistant finishes for walls and floors in high-risk zones. In the European Union, Regulation (EC) No 852/2004 goes further at plant level, requiring processing-area finishes that are “impervious, non-absorbent, washable and non-toxic,” reinforcing the choice of glazed ceramics for durability, chemical resistance, and cleanability—use cases where zircon-opacified glazes are well proven.

Government programs are reinforcing the build-out. In the United States, the USDA announced over US$325 million invested across 74 independent meat and poultry processing projects, catalyzing plant expansions and refurbishments that typically include hygienic wall and floor packages. Parallel local grants under USDA’s Local Meat Capacity program awarded 97 projects totaling US$55.8 million, further multiplying specification opportunities for impervious ceramic systems in small and mid-sized facilities.

FAO indicates agrifood systems engage ~1.3 billion workers, or ~39.2% of the global workforce, so even incremental hygiene retrofits translate into large material flows for compliant finishes.At the same time, FAO estimates ~14% of food is lost post-harvest before retail—losses that cold-chain and processing upgrades help curb, further motivating investment in durable, cleanable surfaces.

Drivers

Food-grade hygiene pushes ceramic upgrades in F&B sites

A powerful demand engine for zirconium silicate is the global push for cleaner, safer food environments. Food and beverage (F&B) factories, commercial kitchens, dairies, and cold-chain hubs are tightening hygiene controls, and that translates into more spending on non-porous, easy-to-sanitize ceramic surfaces—floors, walls, and sanitaryware—where zirconium silicate is the go-to opacifier for bright, uniform, chemically resistant glazes. The public-health stakes are stark: the World Health Organization estimates 600 million people fall ill from unsafe food each year and 420,000 die, imposing 33 million lost healthy life years. Those preventable burdens keep regulators and companies focused on hygienic design and surface cleanability across food facilities worldwide.

Policy frameworks make this hygiene push concrete. The Codex General Principles of Food Hygiene (CXC 1-1969)—developed by FAO and WHO—require food premises to be designed and maintained to allow effective cleaning and prevent contamination, which steers operators toward smooth, impervious, crack-resistant materials that withstand repeated wash-downs and caustic sanitation.

In large regulated markets, legal obligations compound the effect. The European Union’s Regulation (EC) No 852/2004 on the hygiene of foodstuffs requires that floors and walls in processing areas be made of materials that are “impervious, non-absorbent, washable and non-toxic” and that premises be kept in good repair and condition, prompting continuous refurbishment cycles in meat, bakery, dairy, beverage, and ready-meal plants.

- According to the U.S. Geological Survey, global mine production of zirconium mineral concentrates rose ~4% to ~1.5 million t in 2024, while the U.S. National Defense Stockpile plan listed a potential acquisition of 2,300 t of zirconium for FY 2025—signals that supply security and strategic value are being actively managed. Steady availability of zircon concentrate underpins glaze formulation stability and supports the refurbishment cadence in F&B facilities.

Restraints

Energy-cost shocks and tight F&B margins delay ceramic refurbishments

Zirconium silicate demand leans heavily on ceramic tiles and sanitaryware used in food factories, dairies, and commercial kitchens. A major brake right now is the squeeze from volatile energy costs and tight food-sector margins, which pushes operators to defer capex on ceramic refits—directly throttling zircon opacifier offtake.

- In Europe, industrial natural-gas demand fell ~23% in 2022, the single largest relative drop among sectors as prices spiked—forcing many heat-intensive producers to slow or shut kilns, raise prices, and delay projects down the value chain. That volatility has not fully normalized; in 2024, European gas price volatility was still ~50% above the 2010–2019 average, with Asia LNG volatility ~90% above its prior-decade norm—conditions that keep ceramic budgets cautious and extend maintenance cycles rather than full surface replacements.

Regulatory compliance adds another restraint through testing costs and material scrutiny for food-contact ceramics. The EU’s long-standing framework for ceramic food-contact materials sets migration limits of 1.5–4 mg/L for lead and 0.1–0.3 mg/L for cadmium, prompting regular compliance testing and, in some cases, reformulation and surface-design changes that can favor alternatives with fewer grout lines or different finishes. While zirconium silicate itself is not the restricted metal, the compliance burden and plant downtime to validate glazes can delay ceramic rollouts in food sites, indirectly suppressing zircon demand during audit cycles.

- The WHO estimates unsafe food causes 600 million illnesses and 420,000 deaths annually, imposing USD 110 billion each year in productivity losses and medical costs in low- and middle-income countries. In practice, these realities push many F&B operators to spend first on HACCP programs, testing, and sanitation protocols—vital, but not ceramic-intensive—before approving extensive wall/floor refits that would pull significant zircon volumes.

Opportunity

Food-grade buildouts in cold chain and processing hubs

A major growth opening for zirconium silicate comes from the global buildout of food-safe spaces—cold stores, meat and dairy plants, beverage halls, commissary kitchens, and distribution centers—where operators prefer bright, non-porous, chemical-resistant ceramic finishes. Zirconium silicate is the workhorse opacifier that delivers high whiteness and stain-hiding glazes, helping walls and floors meet cleanability targets under routine wash-downs. The policy and public-health drivers are strong.

The World Health Organization estimates 600 million people fall ill and 420,000 die each year from unsafe food, costing US$110 billion in productivity and medical expenses in low- and middle-income countries. Those losses keep regulators and companies focused on hygienic design and surfaces that do not harbor residues—practices that ultimately lift demand for zircon-opacified ceramic tiles and sanitaryware in food facilities.

Cold-chain expansion is especially important because it multiplies food-contact surfaces per site. The Global Cold Chain Alliance reports the Global Top 25 refrigerated warehouse and logistics firms now operate 7.3 billion ft³ (≈207 million m³) of cold storage capacity, a footprint that grew around 10% in 2025 alone. Every increment of capacity adds corridors, dock areas, processing rooms, and sanitation zones that benefit from durable, low-porosity ceramic finishes—applications where zirconium-silicate-based glazes are standard.

Government programs add momentum by financing more plants and upgrades. In the United States, the USDA recently awarded US$35 million to 15 independent meat processors to expand processing capacity and competition, catalyzing facility investments that include hygienic walls, floors, and sanitaryware. In India, the Ministry of Food Processing Industries reports 1,134 food-processing projects sanctioned under PMKSY to 30 June 2025, including 41 Mega Food Parks and 395 cold-chain projects—each one a candidate for ceramic-lined rooms that can handle thermal shock and repeated wash-downs.

Regional Insights

Asia-Pacific dominates with 45.9% share valued at USD 597.8 million, driven by strong ceramic and industrial production

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global zirconium silicate market, accounting for 45.9% of the total market share, valued at approximately USD 597.8 million. This dominance is attributed to the rapid growth of the ceramic and construction industries across China, India, and Southeast Asian countries. China remained the leading consumer and producer of zirconium silicate, supported by large-scale tile manufacturing clusters and advanced ceramic production units. The high consumption of zirconium silicate in ceramic glazes, sanitaryware, and refractories has positioned the region as the core hub of global demand.

In 2024, regional demand was further reinforced by robust urbanization trends and infrastructural expansion. China’s ceramic tile exports exceeded 760 million square meters, while India’s production capacity crossed 1.2 billion square meters, reflecting the region’s strong ceramic manufacturing base. Additionally, the presence of established mineral sands suppliers in Australia and Indonesia contributed to stable raw material availability, supporting domestic processing and exports within APAC.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Jingjiehui Group: Based in Fujian Province, this group operates multiple production sites and trading subsidiaries and offers zirconium silicate among its primary products. The company emphasises sustainable supply, and in 2023 it reportedly exported over 74,000 metric tons of zirconium silicate, representing about 18 % of China’s total exports of the material.

Zhangzhou Antai Zirconium Development, Founded in 2002 in Fujian Province, China, Antai focuses on zirconium silicate and zircon sand processing. With capacity expansions over time (historically ~60,000 tpy) and plans to scale further, the firm aims to support tile- and sanitaryware-industry demands for high-purity zirconium silicate.

Chilches Materials: A Spanish manufacturer based in Castellón, Spain, Chilches focuses on premium zircon sand processing and zirconium silicate under brand names like “MICROZIR©”. It supports ceramics, glass and foundry industries, supplying finely-ground opacifiers and high-performance zirconium silicate grades internationally.

Top Key Players Outlook

- JINGJIEHUI GROUP

- Zhangzhou Antai Zirconium Development Co. Ltd.

- Shandong Jinao Technology Advanced Materials Co.,Ltd.

- Yixing Yaoguang Group Co.,LTD

- Chilches Materials

- Imerys

- Industrie Bitossi

- HakusuiTech Co., Ltd.

- Shandong Gold Sun Zirconium

- Tirupati Microtech

- Shandong Chenyuan Power

- T&H GLAZE

- Nitto Granryo Kogyo

Recent Industry Developments

In 2024 Zhangzhou Antai Zirconium Development, has indicated plans to expand further toward a 100,000-tonne capacity, with a technology investment of CNY 30 million to add two new grinding lines producing 30,000 tpy of high-purity, ultrafine zirconium silicate.

Shandong Jinao Technology Advanced Materials Co Ltd, is a key producer in the zirconium silicate sector, located in Binzhou City, Shandong Province, China. Founded in 2005, the company occupies about 200 mu of site area and has a building area over 80,000 m² with more than 100 employees as of 2024.

Report Scope

Report Features Description Market Value (2024) USD 1302.6 Mn Forecast Revenue (2034) USD 1891.4 Mn CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Zirconium Silicate Powder, Zirconium Silicate Beads), By Application (Ceramic Industry, Refractories, Glass Industry, Foundries, Others), By End-User (Industrial, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape JINGJIEHUI GROUP, Zhangzhou Antai Zirconium Development Co. Ltd., Shandong Jinao Technology Advanced Materials Co.,Ltd., Yixing Yaoguang Group Co.,LTD, Chilches Materials, Imerys, Industrie Bitossi, HakusuiTech Co., Ltd., Shandong Gold Sun Zirconium, Tirupati Microtech, Shandong Chenyuan Power, T&H GLAZE, Nitto Granryo Kogyo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- JINGJIEHUI GROUP

- Zhangzhou Antai Zirconium Development Co. Ltd.

- Shandong Jinao Technology Advanced Materials Co.,Ltd.

- Yixing Yaoguang Group Co.,LTD

- Chilches Materials

- Imerys

- Industrie Bitossi

- HakusuiTech Co., Ltd.

- Shandong Gold Sun Zirconium

- Tirupati Microtech

- Shandong Chenyuan Power

- T&H GLAZE

- Nitto Granryo Kogyo