Global Wound Debridement Products Market By Product Type (Hydrosurgical Debridement Devices, Traditional Wound Debridement Devices, Surgical Wound Debridement Devices, Mechanical Debridement Pads, Low Frequency Ultrasound Devices and Larval Therapy), By Application (Chronic Ulcers, Traumatic Wounds, Surgical Wounds and Burn Cases), By End User (Hospitals, Specialized Clinics, Ambulatory Surgical Centers and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 177821

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

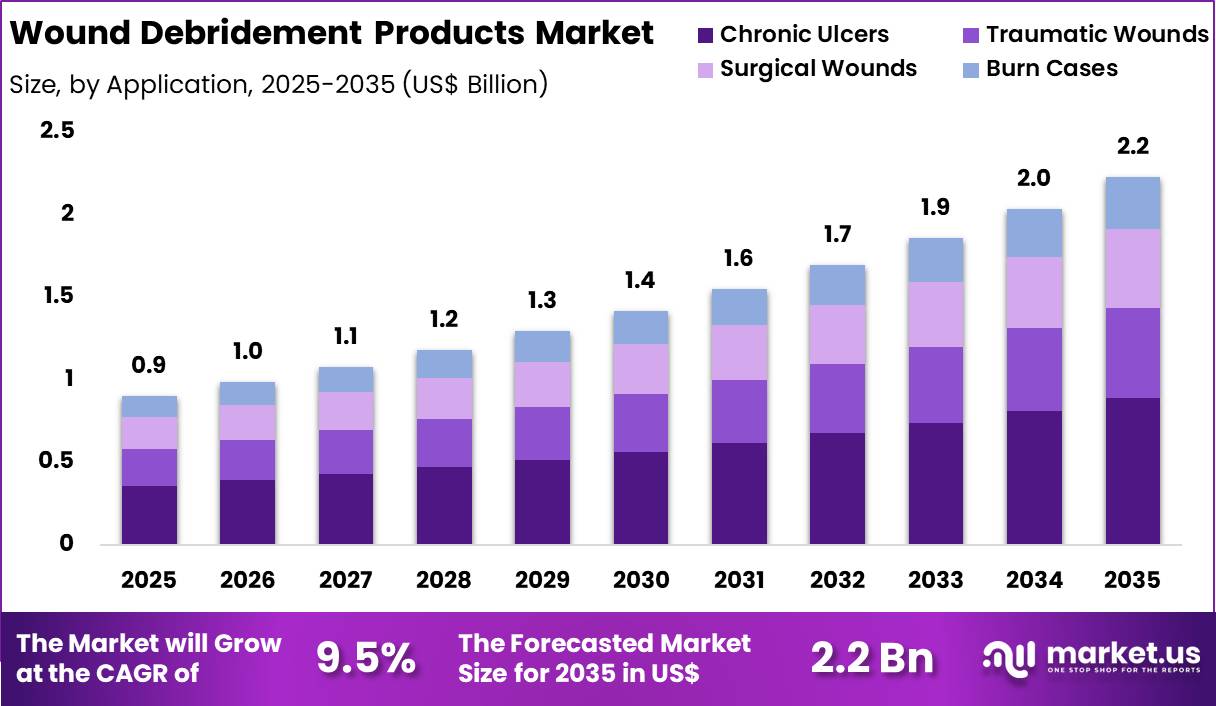

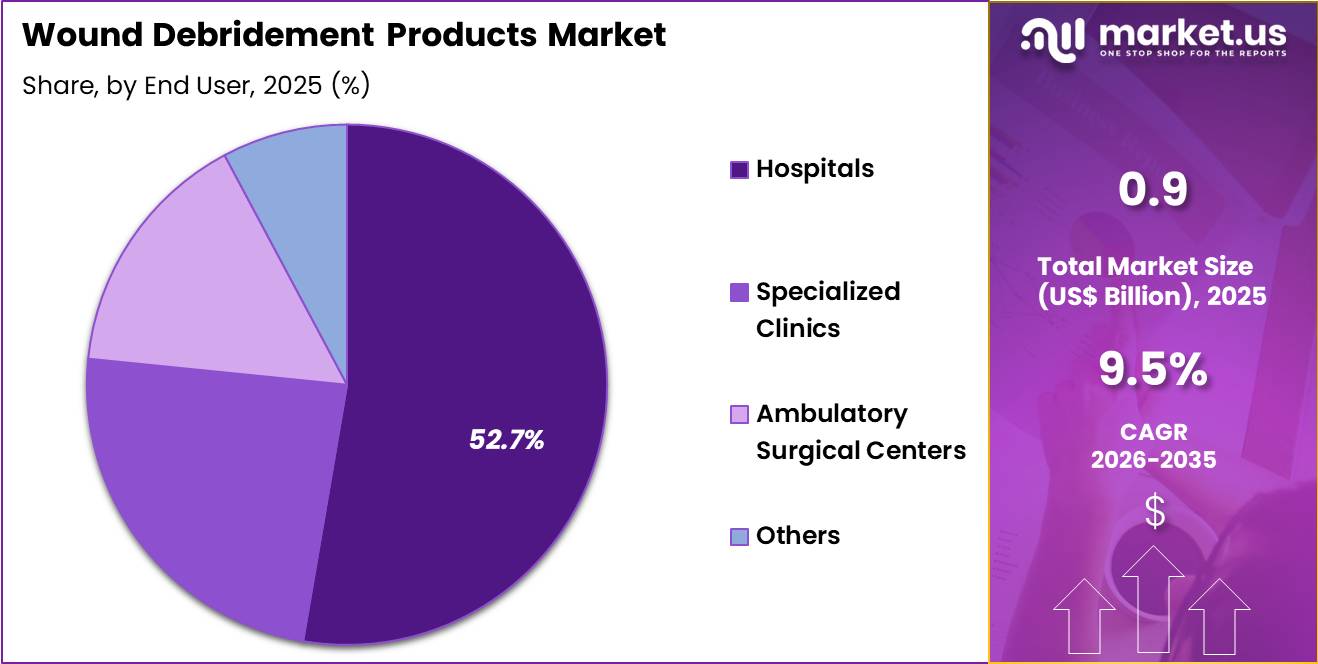

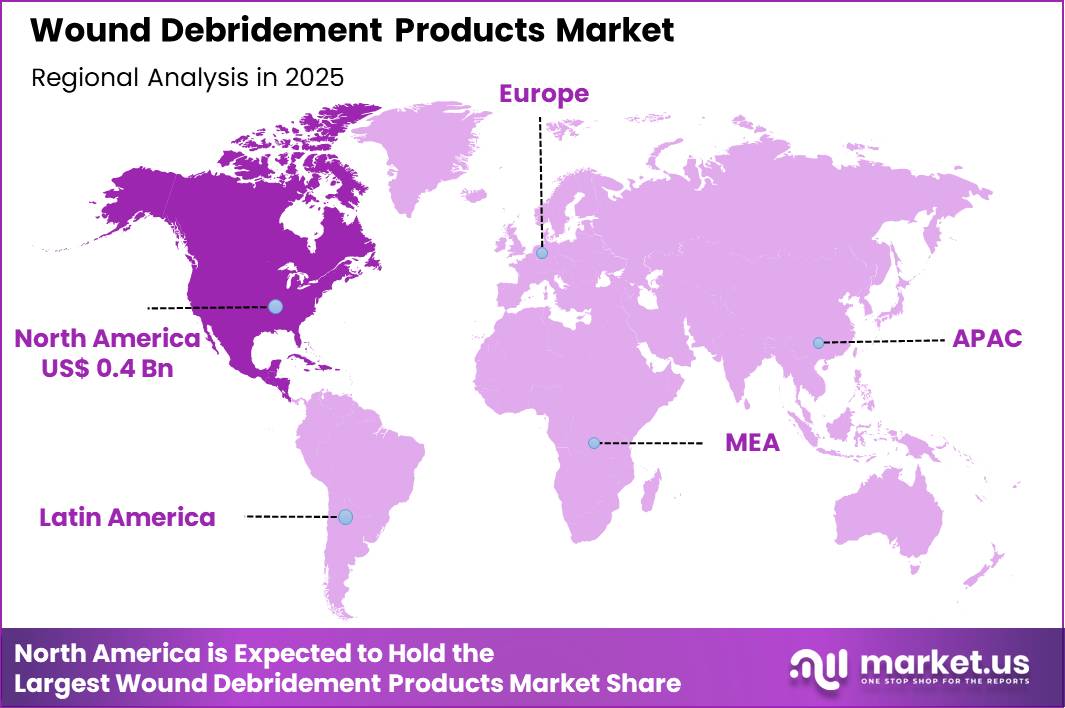

Global Wound Debridement Products Market size is expected to be worth around US$ 2.2 Billion by 2035 from US$ 0.9 Billion in 2025, growing at a CAGR of 9.5% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 39.7% share with a revenue of US$ 0.4 Billion.

Increasing prevalence of chronic wounds, driven by diabetes, obesity, and aging populations, accelerates demand for wound debridement products that effectively remove necrotic tissue and promote healing. Clinicians increasingly apply enzymatic debriding agents like collagenase to diabetic foot ulcers, dissolving eschar and slough without damaging viable tissue during outpatient visits.

These products support mechanical debridement tools such as curettes and scalpels in pressure injury management, enabling precise excision of non-viable layers in hospital settings to prevent infection progression. Surgeons utilize hydrosurgical systems for traumatic wounds, delivering high-pressure saline jets that selectively remove contaminated debris while preserving healthy granulation in emergency care.

Autolytic debridement gels facilitate moisture balance in venous leg ulcers, encouraging natural enzymatic breakdown for home-based therapy. Biological agents incorporating maggot therapy target infected burns, consuming dead tissue and secreting antimicrobial compounds to accelerate recovery in specialized wound centers.

Manufacturers pursue opportunities to formulate hybrid debridement products that combine enzymatic and mechanical actions, expanding applications in complex surgical wounds where rapid clearance enhances graft adherence. Developers advance smart dressings with embedded sensors that monitor debridement progress, broadening utility in telemedicine for remote chronic wound oversight.

These innovations facilitate personalized formulations tailored to wound type and stage, optimizing outcomes in palliative care for non-healing lesions. Opportunities emerge in sustainable, plant-derived enzymatic alternatives that reduce allergen risks, appealing to eco-conscious providers.

Companies invest in portable hydrosurgical devices for field use in trauma response. Recent trends emphasize AI-guided debridement protocols and biodegradable agents, positioning the market for growth in value-based wound care focused on efficacy and patient-centered innovation.

Key Takeaways

- In 2025, the market generated a revenue of US$ 9 Billion, with a CAGR of 9.5%, and is expected to reach US$ 2.2 Billion by the year 2035.

- The product type segment is divided into hydrosurgical debridement devices, traditional wound debridement devices, surgical wound debridement devices, mechanical debridement pads, low frequency ultrasound devices and larval therapy, with hydrosurgical debridement devices taking the lead with a market share of 28.6%.

- Considering application, the market is divided into chronic ulcers, traumatic wounds, surgical wounds and burn cases. Among these, chronic ulcers held a significant share of 39.8%.

- Furthermore, concerning the end user segment, the market is segregated into hospitals, specialized clinics, ambulatory surgical centers and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.7% in the market.

- North America led the market by securing a market share of 39.7%.

Product Type Analysis

Hydrosurgical debridement devices contributed 28.6% of growth within product type and led the wound debridement products market due to their precision, speed, and ability to preserve healthy tissue. Surgeons and wound care specialists prefer hydrosurgical systems because they remove necrotic tissue efficiently while minimizing damage to viable structures.

Reduced procedure time improves operating room throughput and enhances patient comfort. Increasing focus on advanced wound management supports adoption in both acute and chronic care settings.

Growth strengthens as healthcare providers aim to lower infection risk and accelerate healing outcomes. Hydrosurgical techniques improve wound bed preparation, which supports grafting and advanced dressing application.

Training familiarity and positive clinical outcomes reinforce utilization. Hospitals invest in these systems to manage complex wounds effectively. The segment is expected to remain dominant as clinicians prioritize efficient and tissue-sparing debridement solutions.

Application Analysis

Chronic ulcers generated 39.8% of growth within application and emerged as the leading segment due to rising prevalence of diabetes, vascular disorders, and pressure injuries. Chronic wounds require repeated debridement sessions to promote granulation and prevent infection.

Healthcare systems allocate significant resources to manage long-duration ulcers, which increases product utilization. Aging populations further elevate incidence of non-healing wounds that demand continuous care.

Growth accelerates as multidisciplinary wound care programs expand across hospitals and specialized clinics. Early intervention strategies emphasize effective debridement to reduce complication rates. Advanced wound assessment protocols increase procedure frequency.

Reimbursement frameworks often support chronic ulcer treatment, which sustains demand. The segment is anticipated to maintain leadership as chronic wound management remains a persistent clinical challenge.

End-User Analysis

Hospitals accounted for 52.7% of growth within end user and dominated the wound debridement products market due to their ability to manage severe and complex wound cases. Emergency departments and surgical units treat traumatic and postoperative wounds that require immediate debridement. Centralized wound care teams increase product utilization across departments. Hospitals also handle high-risk patients with comorbidities, which raises procedural demand.

Growth continues as hospital-based wound clinics expand service capacity. Infection control initiatives reinforce structured debridement protocols. Teaching hospitals further drive usage through clinical research and training. Referral networks concentrate advanced wound cases within hospital settings. The segment is projected to remain the primary growth driver as hospitals continue to anchor comprehensive wound care management.

Key Market Segments

By Product Type

- Hydrosurgical Debridement Devices

- Traditional Wound Debridement Devices

- Surgical Wound Debridement Devices

- Mechanical Debridement Pads

- Low Frequency Ultrasound Devices

- Larval Therapy

By Application

- Chronic Ulcers

- Traumatic Wounds

- Surgical Wounds

- Burn Cases

By End User

- Hospitals

- Specialized Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Increasing prevalence of diabetes is driving the market.

The rising number of diabetes cases worldwide has led to a higher incidence of chronic wounds, such as diabetic foot ulcers, necessitating effective debridement products for proper wound management. Greater awareness and improved diagnostic tools have contributed to the identification of more patients requiring specialized care to prevent complications like infections and amputations.

Healthcare providers are increasingly utilizing debridement products to remove necrotic tissue and promote healing in diabetic wounds. The correlation between diabetes and impaired wound healing underscores the market’s expansion for enzymatic and mechanical debridement options. Government health organizations report escalating diabetes burdens, prompting investments in wound care solutions.

The association between hyperglycemia and delayed healing further amplifies the need for reliable debridement technologies. National diabetes programs emphasize foot care to reduce hospitalization rates among affected individuals.

Key manufacturers are developing products tailored to this growing demographic of diabetic patients. According to the World Health Organization, 830 million people were living with diabetes in 2022. This driver sustains demand for advanced debridement methods in clinical and home settings.

Restraints

High cost of advanced debridement products is restraining the market.

The elevated pricing of sophisticated debridement systems, such as ultrasound-assisted devices, limits their accessibility in cost-sensitive healthcare facilities. Manufacturing requirements for sterile, high-precision tools contribute to substantial expenses passed on to consumers.

Smaller hospitals often prioritize basic supplies over premium debridement options due to budget constraints. Regulatory demands for efficacy validation add to the financial burden on suppliers. In public health systems, allocations favor economical treatments, delaying adoption of innovative products.

Providers may resort to traditional methods like sharp debridement to control costs in routine care. This restraint affects penetration in low-income regions with limited reimbursement. Industry efforts to introduce affordable alternatives aim to address these barriers gradually.

Despite clinical efficacy, economic factors hinder widespread implementation across diverse settings. Consequently, cost management strategies are essential for alleviating this market impediment.

Opportunities

Growth in advanced wound care revenues is creating growth opportunities.

The positive trajectory in sales from advanced wound care segments indicates potential for debridement products to integrate into comprehensive treatment portfolios. Increased investments in wound management support the deployment of debridement tools in expanding clinical applications. Strategic alliances with distributors enable tailored solutions for chronic wound therapies.

The substantial procedural base in developed economies magnifies prospects for product enhancements. Policy advancements in wound reimbursement strengthen infrastructure for debridement adoption. Primary corporations pursue regional expansions to capitalize on economic upturns. This opportunity corresponds with initiatives to elevate standards in outpatient wound care.

Focused developments can generate notable advancements in specialized debridement applications. ConvaTec reported advanced wound care revenues of $742.7 million in 2024, up from $695.3 million in 2023. Smith & Nephew reported advanced wound management revenues of $1,681 million in 2024, up from $1,606 million in 2023.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the wound debridement products market through hospital spending patterns, reimbursement discipline, and procurement strategies across acute and long term care settings. Inflation and higher interest rates increase operating costs for providers, which heightens price sensitivity around advanced debridement devices and single use consumables.

Geopolitical tensions disrupt supplies of medical grade steel, enzymatic agents, dressings, and sterile packaging, creating sourcing uncertainty and longer delivery cycles. Current US tariffs on imported devices and raw materials raise production and distribution costs, which compresses margins and complicates contract negotiations.

These headwinds affect smaller suppliers and slow adoption in budget constrained facilities. On the positive side, trade pressure accelerates domestic manufacturing, diversified sourcing, and stronger supplier partnerships.

Rising prevalence of chronic wounds, diabetic ulcers, and an aging population sustains steady clinical demand. With operational efficiency, product innovation, and resilient supply chains, the market remains positioned for consistent and confident growth.

Latest Trends

Launch of improved hydrogel formulations is a recent trend in the market.

In 2024, the introduction of enhanced hydrogel products has advanced autolytic debridement by providing better moisture balance and pain relief in wound beds. These formulations incorporate active ingredients to facilitate gentle tissue removal without mechanical intervention. Manufacturers have emphasized biocompatibility testing to ensure safety for chronic wound applications.

Clinical feedback drives these innovations to enhance outcomes in pressure ulcers and venous leg ulcers. MPM Medical launched an improved formula of RegeneCare HA hydrogel in 2024, containing procollagen, 2% lidocaine, and hyaluronic acid. This development addresses needs for effective debridement in outpatient settings.

The trend focuses on user-friendly applications for home care scenarios. Regulatory clearances in 2024 for these models have accelerated availability. Industry collaborations refine compositions for extended wear times. These evolutions aim to reduce treatment durations while minimizing patient discomfort.

Regional Analysis

North America is leading the Wound Debridement Products Market

North America accounted for a 39.7% share of the Wound Debridement Products market in 2024, supported by rising incidence of chronic wounds and strong adoption of advanced care protocols. Hospitals and specialized wound centers increased use of enzymatic, mechanical, and surgical debridement tools to accelerate healing and reduce infection risk.

A growing elderly population and higher rates of diabetes continued to expand the pool of patients with pressure ulcers and diabetic foot ulcers. Clinicians emphasized early intervention and multidisciplinary wound management, which increased procedural volumes.

Expansion of outpatient wound clinics and home healthcare services strengthened recurring demand for consumable products. Reimbursement frameworks and clinical guidelines also encouraged evidence based debridement practices.

A relevant indicator comes from the Centers for Disease Control and Prevention, which reported in 2023 that 38.4 million Americans live with diabetes, a major risk factor for chronic non healing wounds that sustains product utilization.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Wound Debridement Products market in Asia Pacific is expected to grow steadily during the forecast period as healthcare systems respond to rising chronic disease burdens and trauma cases. Governments invest in hospital upgrades and specialized wound care units to reduce complications and amputation rates.

Increasing prevalence of diabetes and vascular disorders expands the patient base requiring routine wound management. Surgeons and clinicians adopt modern enzymatic and hydrosurgical methods to improve healing outcomes and shorten recovery time. Medical tourism and expansion of private hospitals further contribute to procedural growth.

Training initiatives improve awareness of structured wound care pathways among healthcare professionals. A verifiable signal of demand appears in 2023 data from the International Diabetes Federation, which estimated that 206 million adults in the South East Asia and Western Pacific regions live with diabetes, underscoring the substantial clinical need that supports continued expansion across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the wound debridement products market grow by strengthening portfolios with advanced enzymatic, autolytic, and mechanical solutions that improve healing outcomes while reducing clinician time and patient discomfort. They also deepen customer engagement through training programs, clinical evidence generation, and comprehensive support that help wound care teams adopt best practices and optimize treatment pathways.

Firms expand their reach by aligning distribution with large healthcare systems, specialty clinics, and home care providers that drive both acute and chronic wound management demand. Strategic geographic expansion into Europe, North America, and high-growth Asia Pacific captures rising investments in wound care infrastructure and aging populations with higher incidence of diabetes and vascular conditions.

Smith & Nephew plc exemplifies a global medical technology company with a broad suite of advanced wound care solutions, strong commercial operations, and coordinated market development initiatives that align product innovation with practitioner needs.

The company advances its growth agenda through disciplined R&D funding, targeted acquisitions that fill complementary gaps, and a customer-centric commercialization strategy that translates clinical insight into durable market performance.

Top Key Players

- Smith & Nephew

- Mölnlycke Health Care

- 3M

- ConvaTec

- Coloplast

- Medline Industries

- Integra LifeSciences

- B. Braun

- Cardinal Health

- Derma Sciences

Recent Developments

- In February 2025, MediWound began enrollment in a global Phase III, randomized, double-blind clinical trial evaluating EscharEx for the treatment of venous leg ulcers. The study spans 40 clinical sites across the US and Europe, with an interim data review anticipated in mid-2026.

- In May 2025, a peer-reviewed post-hoc study published in Wounds reported that EscharEx demonstrated faster debridement and improved formation of healthy tissue compared with collagenase (SANTYL®), reinforcing its therapeutic differentiation in chronic wound care.

- In April 2025, MediWound presented updated clinical and preclinical data at two leading wound-care congresses. The findings emphasized EscharEx’s selective enzymatic action, strong support for granulation tissue development, and effectiveness in both diabetic foot ulcer and venous leg ulcer models.

Report Scope

Report Features Description Market Value (2025) US$ 0.9 Billion Forecast Revenue (2035) US$ 2.2 Billion CAGR (2026-2035) 9.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hydrosurgical Debridement Devices, Traditional Wound Debridement Devices, Surgical Wound Debridement Devices, Mechanical Debridement Pads, Low Frequency Ultrasound Devices and Larval Therapy), By Application (Chronic Ulcers, Traumatic Wounds, Surgical Wounds and Burn Cases), By End User (Hospitals, Specialized Clinics, Ambulatory Surgical Centers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smith & Nephew, Mölnlycke Health Care, 3M, ConvaTec, Coloplast, Medline Industries, Integra LifeSciences, B. Braun, Cardinal Health, Derma Sciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wound Debridement Products MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Wound Debridement Products MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew

- Mölnlycke Health Care

- 3M

- ConvaTec

- Coloplast

- Medline Industries

- Integra LifeSciences

- B. Braun

- Cardinal Health

- Derma Sciences