Global Wire And Cable Materials Market Size, Share, And Business Benefits By Material (Insulation Material (Polyvinyl Chloride (PVC), Cross Linked Polyethylene (XLPE), Thermoplastic Polyurethane (TPU) , Polyphenylene Ether (PPE), Polypropylene (PP), Polyethylene (PE), Others), Conductor Material(Copper, Aluminum, Others)), By Application (Power Cable, Coaxial Cable/Electronic Wire, Fiber Optic Cable, Low Voltage Energy, Signal and Control Cable, Telecom and Data Cable), By End-User (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149545

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

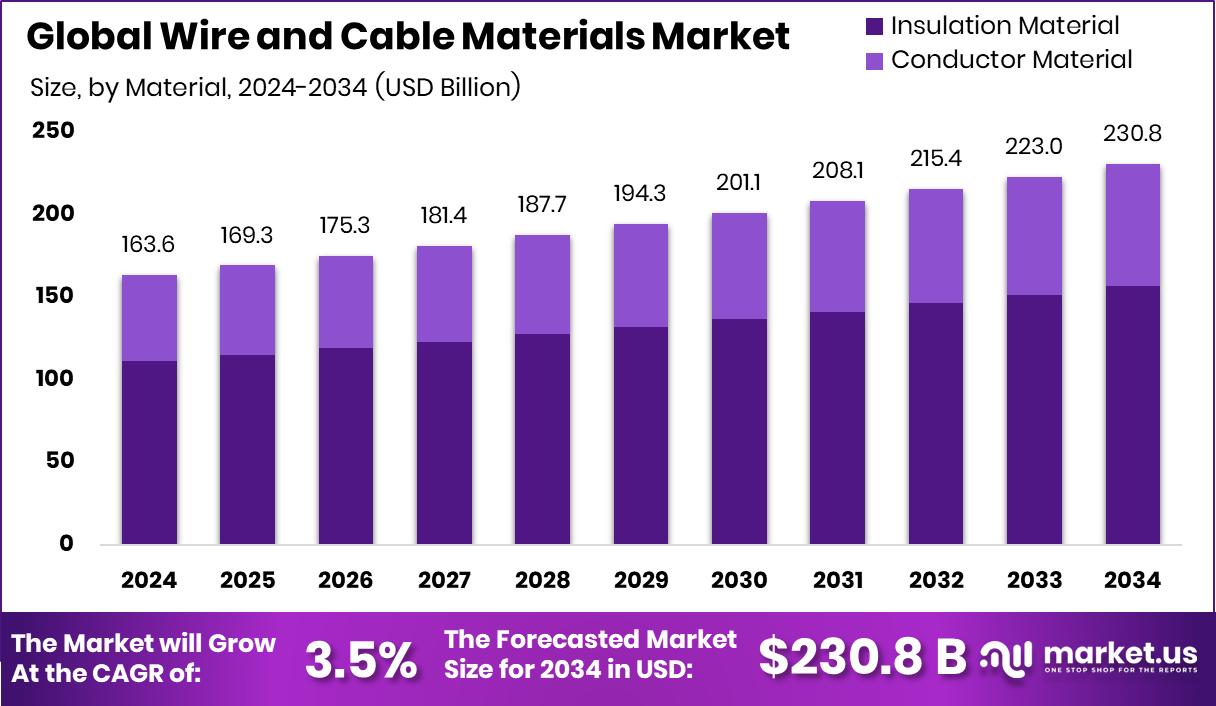

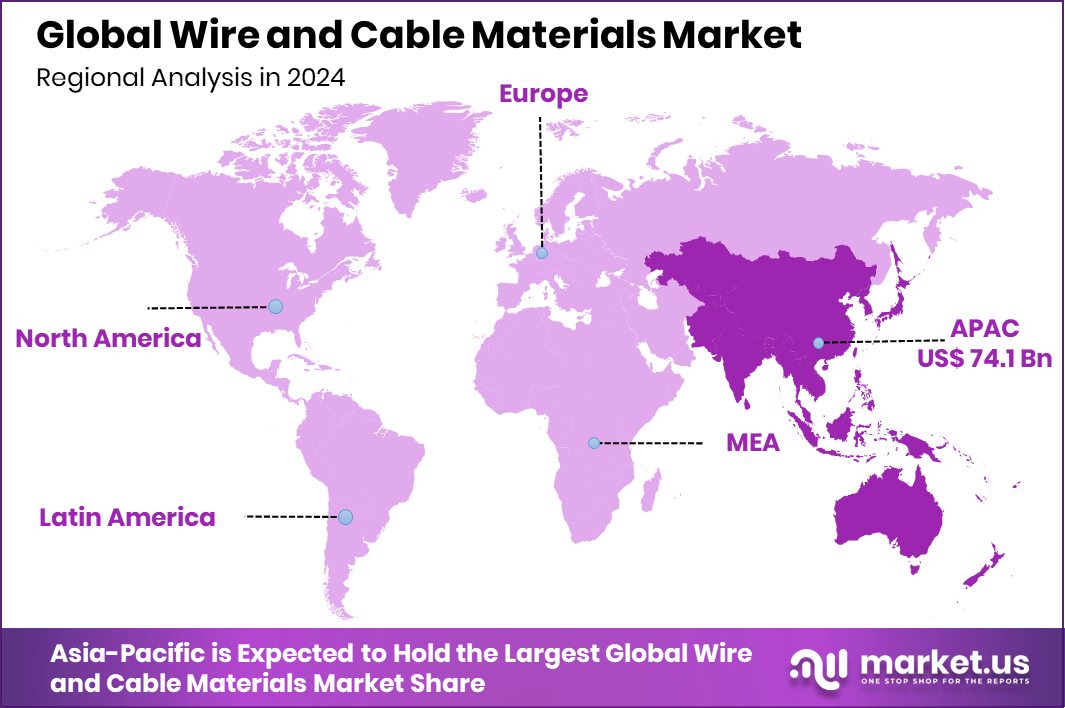

Global Wire and Cable Materials Market is expected to be worth around USD 230.8 billion by 2034, up from USD 163.6 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034. With 45.3% market share, Asia-Pacific dominates the wire and cable materials market.

Wire and Cable Materials refer to the essential raw components used to manufacture electrical wires and cables. These materials include conductors such as copper and aluminum, insulators like PVC, XLPE, and rubber, along with protective sheaths, jacketing compounds, and shielding materials. Their role is to ensure efficient conductivity, insulation, and mechanical protection for use in a wide range of applications like power transmission, communication systems, automotive wiring, and industrial setups.

The growth of the wire and cable materials market is strongly tied to rising infrastructure projects across the globe. Urbanization and electrification in emerging economies are generating high demand for efficient electrical distribution systems, which directly propels the need for durable and heat-resistant materials. Additionally, the transition to renewable energy grids and smart infrastructure systems is prompting upgrades in cable technologies, further stimulating growth in this material segment.

Demand is being driven by ongoing modernization in industrial and commercial buildings, which require advanced wiring systems that meet updated safety and energy efficiency standards. With rapid digital transformation, data centers and telecommunication networks are expanding, increasing the need for specialized cable materials with high bandwidth and shielding properties.

One major opportunity lies in the shift towards environmentally friendly and recyclable wire and cable materials. Governments are introducing regulations to phase out hazardous compounds, creating a push for green alternatives in insulation and sheathing. This change is opening new product development avenues for material producers aligned with sustainability goals and future-ready infrastructure planning.

Key Takeaways

- Global Wire and Cable Materials Market is expected to be worth around USD 230.8 billion by 2034, up from USD 163.6 billion in 2024, and grow at a CAGR of 3.5% from 2025 to 2034.

- Insulation material held a 67.9% share, showing dominance in wire and cable materials usage.

- Power cable applications accounted for 33.8%, reflecting rising demand in energy distribution systems globally.

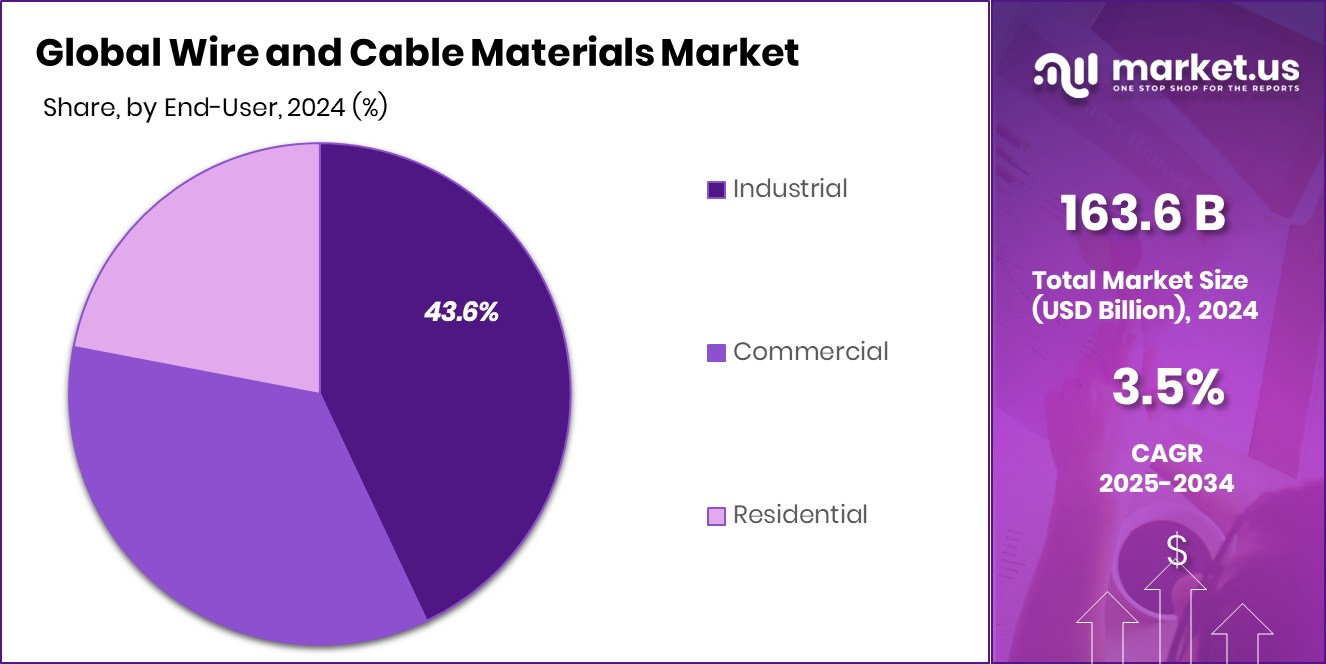

- Industrial end-users led with 43.6%, driven by automation and heavy machinery installations across sectors.

- Asia-Pacific’s expanding infrastructure boosted demand, totaling USD 74.1 billion in value.

By Material Analysis

Insulation material dominates the Wire and Cable Materials Market with a 67.9% share.

In 2024, Insulation Material held a dominant market position in the By Material segment of the Wire and Cable Materials Market, with a 67.9% share. This leadership can be attributed to its critical role in enhancing electrical safety, preventing energy loss, and ensuring thermal stability across a wide range of applications. The widespread adoption of insulation materials such as PVC, XLPE, and thermoplastic elastomers in power transmission, telecommunications, and residential wiring has significantly contributed to their strong market presence.

As infrastructure development intensifies across urban and semi-urban regions, the need for reliable and durable insulation has grown considerably. Moreover, regulatory emphasis on fire-resistant and environmentally compliant materials has further pushed the demand for advanced insulation compounds. Industries are prioritizing quality insulation to ensure compliance with safety standards and to support high-voltage operations without interference.

The 67.9% market share underlines how insulation materials have become indispensable in modern wire and cable production, especially as electrification projects and renewable energy deployments expand globally. With consistent investments in building energy-efficient and safer power systems, insulation materials are expected to maintain their pivotal role in the wire and cable manufacturing value chain.

By Application Analysis

Power cable applications hold a 33.8% share in this materials market.

In 2024, Power Cable held a dominant market position in the By Application segment of the Wire and Cable Materials Market, with a 33.8% share. This dominance reflects the extensive use of power cables in transmission and distribution networks across residential, commercial, and industrial infrastructures. The rise in global electrification efforts, grid modernization projects, and integration of renewable energy sources has significantly driven the demand for robust and efficient power cable systems.

These cables require high-performance materials to ensure thermal resistance, mechanical strength, and long-term operational reliability under varying environmental conditions. The growing deployment of underground and submarine power cables in both urban and offshore applications has also contributed to the material demand in this segment. Additionally, energy efficiency regulations and the push for sustainable energy infrastructure have placed greater emphasis on material quality and durability.

With a 33.8% market share, the Power Cable application segment continues to lead due to its essential function in supporting core energy infrastructure. The steady growth in utility-scale energy projects and smart grid expansions is expected to reinforce the material requirements specific to power cables, positioning this application area as a key driver of material innovation and volume consumption in the wire and cable sector.

By End-User Analysis

Industrial end-users lead demand with a 43.6% share in this growing market.

In 2024, Industrial held a dominant market position in the By End-User segment of the Wire and Cable Materials Market, with a 43.6% share. This leadership is closely linked to the continuous expansion of manufacturing facilities, heavy machinery operations, and automation systems that rely heavily on durable and high-performance wiring infrastructure. Industrial applications demand materials that can withstand extreme temperatures, chemical exposure, mechanical stress, and electrical fluctuations, driving consistent usage of advanced wire and cable materials.

The integration of robotics, automated assembly lines, and smart factory systems has further elevated the need for materials that offer superior insulation, conductivity, and resistance to environmental stressors. Power supply continuity, safety assurance, and operational efficiency remain top priorities in industrial zones, making the selection of reliable cable materials essential.

The 43.6% share held by this segment indicates how integral high-quality wiring materials have become to industrial productivity and safety compliance. Furthermore, increasing investments in energy-intensive industries such as oil & gas, chemicals, and mining have sustained demand levels for industrial-grade cable materials.

Key Market Segments

By Material

- Insulation Material

- Polyvinyl Chloride (PVC)

- Cross Linked Polyethylene (XLPE)

- Thermoplastic Polyurethane (TPU)

- Polyphenylene Ether (PPE)

- Polypropylene (PP)

- Polyethylene (PE)

- Others

- Conductor Material

- Copper

- Aluminum

- Others

By Application

- Power Cable

- Coaxial Cable/Electronic Wire

- Fiber Optic Cable

- Low-Voltage Energy

- Signal and Control Cable

- Telecom and Data Cable

By End-User

- Industrial

- Commercial

- Residential

Driving Factors

Infrastructure Growth Boosts Material Demand Worldwide

One of the biggest reasons behind the growth of the wire and cable materials market is the rapid expansion of global infrastructure. Countries are building new roads, buildings, power plants, and smart cities that need a lot of electrical wiring. This growing demand for electricity leads to a higher need for wires and cables—and, in turn, the materials used to make them.

Projects related to urban development, railways, airports, renewable energy plants, and industrial parks all rely on high-quality cable systems. As these projects continue, the demand for reliable insulation, sheathing, and conductive materials also increases. This infrastructure boom, especially in Asia and Africa, is expected to keep driving the market in the coming years.

Restraining Factors

Price Fluctuations in Raw Materials Limit Growth

One major factor slowing down the wire and cable materials market is the changing prices of raw materials. Key materials like copper, aluminum, PVC, and rubber often face sudden price hikes due to supply issues, mining problems, or global trade disruptions. These unstable prices make it hard for manufacturers to plan budgets and maintain steady production costs.

When prices go too high, some companies delay or reduce their production, which affects the overall market. Small and mid-sized producers are hit the hardest, as they cannot easily absorb these cost changes. As long as raw material costs remain unpredictable, this will continue to be a big challenge for companies making wire and cable materials.

Growth Opportunity

Eco-Friendly Materials Open New Market Doors

A major growth opportunity in the wire and cable materials market is the shift toward eco-friendly and recyclable materials. As governments create stricter environmental rules and customers become more aware of sustainability, the demand for greener materials is rising. Companies are now exploring bio-based insulation, halogen-free compounds, and recyclable jackets to reduce pollution and meet safety standards.

This change is not just about following rules—it also helps brands build a cleaner image and attract eco-conscious buyers. Developing countries are also showing interest in using safer, more sustainable materials for power and communication lines.

Latest Trends

Smart Technologies Drive Material Innovation Forward

A key trend shaping the wire and cable materials market is the growing adoption of smart technologies. As industries and households increasingly integrate smart devices, the demand for advanced wiring solutions has surged. These smart systems require cables that can handle higher data speeds, offer better insulation, and ensure safety. Materials like cross-linked polyethylene (XLPE) and halogen-free compounds are gaining popularity due to their durability and environmental benefits.

Additionally, the rise of electric vehicles and renewable energy sources has led to the development of specialized cables that can withstand higher voltages and temperatures. This shift towards smarter, more efficient technologies is pushing manufacturers to innovate and produce materials that meet these evolving requirements.

Regional Analysis

In 2024, Asia-Pacific led with a 45.3% share, worth USD 74.1 billion.

In 2024, Asia-Pacific emerged as the dominant region in the Wire and Cable Materials Market, accounting for 45.3% of the global share with a market value of USD 74.1 billion. This leadership is driven by rapid urbanization, large-scale infrastructure development, and expanding power and telecom sectors across countries like China, India, and Southeast Asian nations.

North America followed closely, supported by investments in grid modernization, data centers, and the continued adoption of electric vehicles. Europe witnessed stable growth due to strong demand in smart buildings and renewable energy projects, particularly in Western European countries.

The Middle East & Africa region showed a steady rise, backed by energy diversification and construction projects across the Gulf Cooperation Council (GCC) countries. Latin America’s performance was moderate, influenced by electrical upgrades in industrial zones and increasing urban demand.

However, the region’s growth remained constrained compared to other parts of the world. Among all, Asia-Pacific maintained its leading position, both in percentage and market value, highlighting its pivotal role in global demand for wire and cable materials. With ongoing electrification and manufacturing activity, Asia-Pacific is expected to retain its dominance in the foreseeable future.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Alphagary maintained its strategic foothold in the global wire and cable materials market by focusing on advanced compound formulations tailored for energy, telecom, and industrial applications. The company emphasized material innovation, particularly in flexible PVC and halogen-free compounds, to meet evolving regulatory and safety standards. Its commitment to sustainable and high-performance solutions helped strengthen its role as a reliable supplier to cable manufacturers operating in both mature and emerging markets.

BASF SE leveraged its broad chemical portfolio and R&D capabilities to supply critical insulation and sheathing materials, particularly thermoplastic polyurethanes (TPUs) and engineering plastics. In 2024, BASF continued supporting cable producers with materials offering superior thermal stability, chemical resistance, and mechanical strength. The company’s integration of environmental compliance across its wire and cable solutions aligned with the increasing demand for eco-friendly and recyclable products, especially in Europe and Asia.

Celanese Corporation showcased steady growth through its high-performance polymers, including compounds used in insulation and jacketing for power and communication cables. Its focus in 2024 was on enhancing durability and processing efficiency, offering materials that support miniaturization, high-voltage applications, and harsh-environment performance.

Top Key Players in the Market

- Alphagary Ltd.

- BASF SE

- Celanese Corporation

- Dow

- Dr. Dietrich Müller GmbH

- DuPont de Nemours, Inc.

- Elantas GmbH

- Exxon Mobil Corporation

- Finolex Industries Limited

- Henan Jinhe Industry Co., Ltd

- ITW Formex

- Nikkan Industries Co., Ltd

- Nitto Denko Corporation

- The 3M Company

Recent Developments

- In April 2025, Alphagary’s parent company, Orbia, reported its first-quarter financial results, noting a decrease in net revenues to $1,811 million, primarily driven by lower revenues in Polymer Solutions and Building & Infrastructure. Despite this, the company highlighted growth in Fluor & Energy Materials and Precision Agriculture, indicating a diversified portfolio and resilience in other sectors.

- In January 2024, BASF inaugurated its largest Thermoplastic Polyurethane (TPU) production line at the Zhanjiang Verbund site in China. The plant incorporates advanced automation technologies, enhancing efficiency and product quality.

Report Scope

Report Features Description Market Value (2024) USD 163.6 Billion Forecast Revenue (2034) USD 230.8 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Insulation Material (Polyvinyl Chloride (PVC), Cross Linked Polyethylene (XLPE), Thermoplastic Polyurethane (TPU) , Polyphenylene Ether (PPE), Polypropylene (PP), Polyethylene (PE), Others), Conductor Material(Copper, Aluminum, Others)), By Application (Power Cable, Coaxial Cable/Electronic Wire, Fiber Optic Cable, Low Voltage Energy, Signal and Control Cable, Telecom and Data Cable), By End-User (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alphagary Ltd., BASF SE, Celanese Corporation, Dow, Dr. Dietrich Müller GmbH, DuPont de Nemours, Inc., Elantas GmbH, Exxon Mobil Corporation, Finolex Industries Limited, Henan Jinhe Industry Co., Ltd, ITW Formex, Nikkan Industries Co., Ltd, Nitto Denko Corporation, The 3M Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  wire and cable materials marketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

wire and cable materials marketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alphagary Ltd.

- BASF SE

- Celanese Corporation

- Dow

- Dr. Dietrich Müller GmbH

- DuPont de Nemours, Inc.

- Elantas GmbH

- Exxon Mobil Corporation

- Finolex Industries Limited

- Henan Jinhe Industry Co., Ltd

- ITW Formex

- Nikkan Industries Co., Ltd

- Nitto Denko Corporation

- The 3M Company