Global Wine Market By Type (Still, Sparkling), By Color (White, Red, Rose Wine), By Grape Variety (Cabernet Sauvignon, Merlot, Airen, Tempranillo, Chardonnay, Syrah, Grenache, Sauvignon Blanc, Trebbiano Toscana, Others), By Distribution Channel (On-trade, Off -trade), By Packaging Type (Bottles, Cans), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By End-User (Male, Female), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145409

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

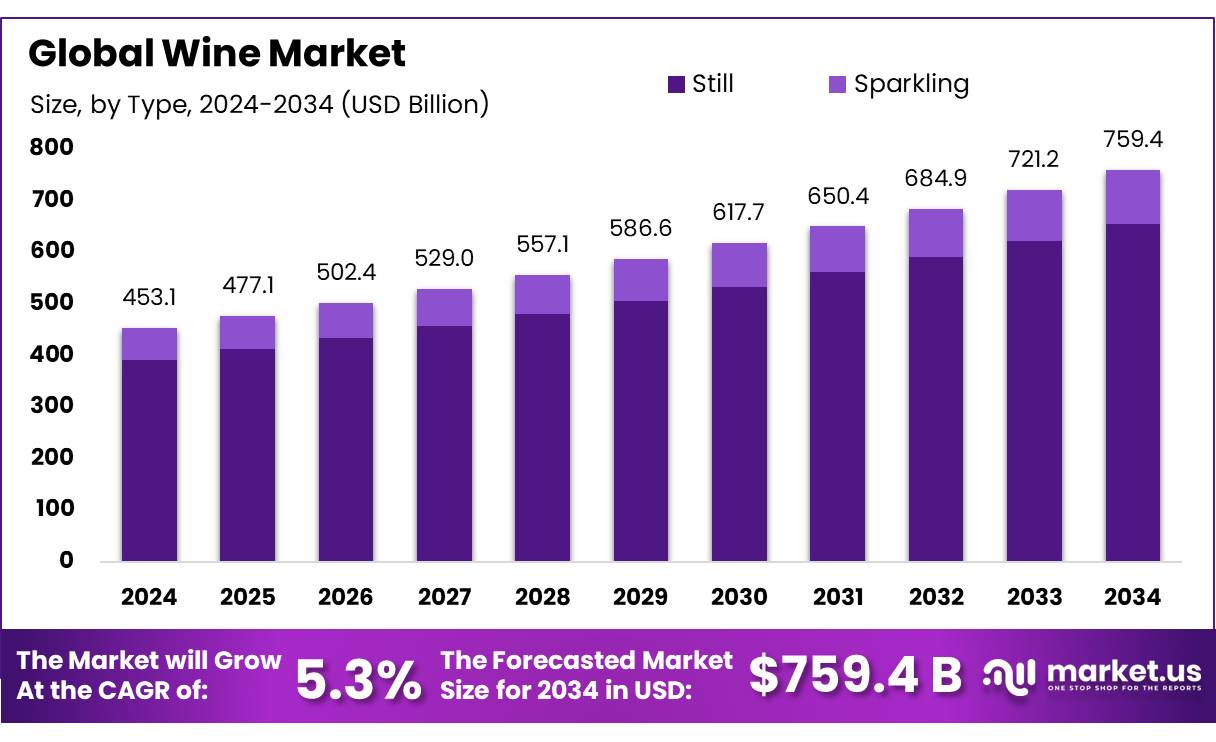

The Global Wine Market size is expected to be worth around USD 759.4 Bn by 2034, from USD 453.1 Bn in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The wine industry, a significant segment of the global beverage market, has seen continuous growth and transformation. This industry comprises various stakeholders, including vineyard operators, winemakers, distributors, and retailers, all contributing to the lifecycle of wine production and sales. The industry’s expansive range spans from small-scale boutique wineries to large multinational corporations that manage extensive vineyard estates and sophisticated production facilities.

According to the International Organisation of Vine and Wine (OIV), global wine production reached approximately 260 million hectoliters in 2023. This indicates a resilient industry despite challenges such as climate change and economic fluctuations. Furthermore, the United States and China are rapidly growing markets, with the U.S. consuming around 33 million hectoliters and China’s market expected to expand by 7% in consumption over the next five years.

Sustainability Initiatives with increasing awareness of environmental impacts, both producers and consumers are shifting towards sustainable and organic wine production. Government incentives, such as grants and tax benefits for sustainable practices, support this shift. For example, the European Union has allocated €100 million in 2024 to promote environmentally sustainable practices in viticulture across its member states.

E-commerce Boom in online sales channels have witnessed a surge, particularly fueled by the pandemic-induced shifts in consumer shopping behaviors. In 2023, online wine sales accounted for approximately 12% of total wine sales globally, a figure expected to grow as digital platforms become more integrated with traditional retail.

The trend towards low-alcohol and alcohol-free wines is gaining traction, especially among health-conscious consumers. This segment has seen a 15% growth in demand year-over-year, reflecting a shift in consumer preferences towards healthier lifestyle choices.

Key Takeaways

- Wine Market size is expected to be worth around USD 759.4 Bn by 2034, from USD 453.1 Bn in 2024, growing at a CAGR of 5.3%.

- Still wine held a dominant market position, capturing more than an 86.30% share.

- White wine maintained its strong market presence, capturing more than a 52.20% share.

- Cabernet Sauvignon held a dominant market position, capturing more than an 18.40% share.

- Off-trade distribution channels firmly held the reins of the wine market, accounting for more than 68.5% of the total market share.

- Bottles continued to be the preferred packaging type in the wine market, securing a dominant 93.70% share.

- 36-45 years age group held a dominant position in the wine market, capturing more than a 34.50% share.

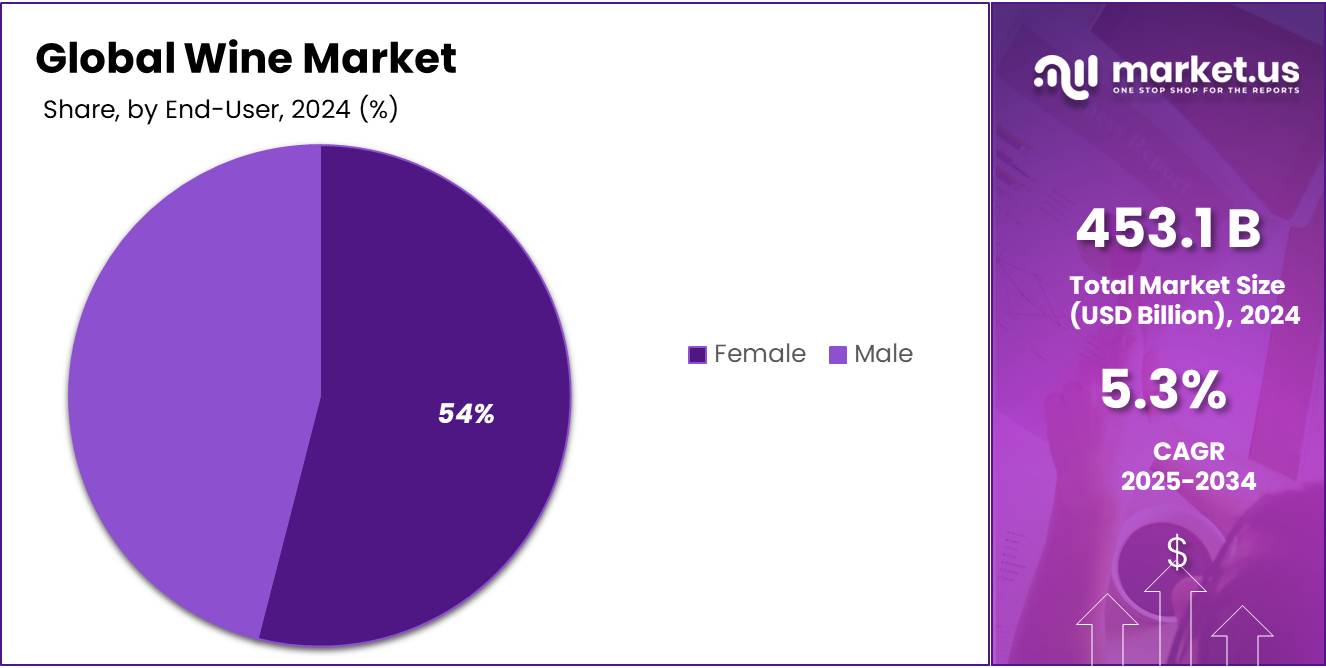

- Female end-users held a dominant market position in the wine industry, capturing more than a 54.30% share.

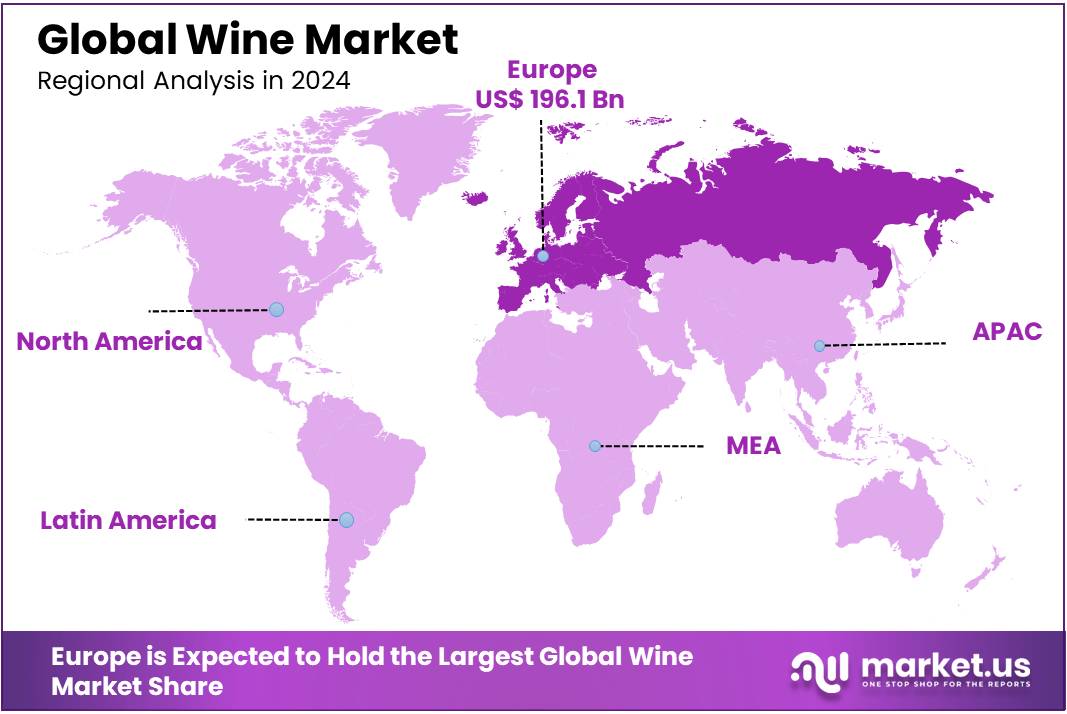

- European wine market continued to assert its dominance, capturing a substantial 43.30% of the global market share, valued at approximately $196.1 billion.

By Type

Still Wine Continues to Lead with an 86.3% Market Share, Emphasizing Its Enduring Popularity

In 2024, Still wine held a dominant market position, capturing more than an 86.30% share. This significant portion of the market reflects its long-standing popularity among consumers who appreciate the traditional wine-making process and the variety of flavors offered by still wines. Predominantly consumed in both casual and formal settings, still wine’s versatility and wide acceptance have helped maintain its leadership status in the wine market, underscoring its appeal across diverse demographics and culinary preferences.

By Color

White Wine Commands Over Half the Market with a 52.2% Share, Showcasing Broad Consumer Preference

In 2024, White wine maintained its strong market presence, capturing more than a 52.20% share. This dominance is largely due to its broad appeal among wine drinkers who favor its light, refreshing qualities and versatility in pairing with a wide range of dishes. White wine’s ability to complement seafood, poultry, and various appetizers has made it a preferred choice in many dining contexts, further securing its majority stake in the market. The preference for white wine underscores its status as a staple in social gatherings and quiet evenings alike.

By Grape Variety

Cabernet Sauvignon Secures a Robust 18.4% Market Share, Highlighting Its Esteemed Reputation

In 2024, Cabernet Sauvignon held a dominant market position, capturing more than an 18.40% share. This grape variety’s prominence is a testament to its robust character and the deep, rich flavors it brings to wines. Known for its adaptability to various climates and soil types, Cabernet Sauvignon continues to be a favorite among wine enthusiasts who cherish its complex profile and aging potential. Its substantial share reflects its status as a cornerstone in the wine industry, often chosen for both special occasions and regular enjoyment.

By Distribution Channel

Off-Trade Channels Lead with Over 68.5% Share in the Wine Market

In 2024, off-trade distribution channels firmly held the reins of the wine market, accounting for more than 68.5% of the total market share. This segment’s dominance can be attributed to the substantial consumer preference for purchasing wine from supermarkets, hypermarkets, and specialty stores, where they enjoy a wide selection of wines at various price points.

Off-trade channels offer consumers the convenience of exploring different brands and labels at their own pace, which is less likely in on-trade venues like restaurants and bars where choices can be more limited and prices higher. As we look ahead to 2025, this trend is expected to continue, with off-trade channels maintaining their leading position in the market, driven by ongoing consumer demand for a diverse and accessible range of wine products.

By Packaging Type

Bottled Wine Dominates with a 93.7% Share, Reflecting Traditional Preferences

In 2024, Bottles continued to be the preferred packaging type in the wine market, securing a dominant 93.70% share. This overwhelming preference for bottled wine underscores the traditional and enduring appeal of this packaging method. Bottles are not only seen as a symbol of quality and preservation for wine but also play a crucial role in the aging process, which is highly valued by connoisseurs and casual drinkers alike. The significant market share held by bottles highlights their integral role in the presentation and storage of wine, reinforcing their status as the gold standard in wine packaging.

By Age Group

Wine Enthusiasts Aged 36-45 Lead with a 34.5% Market Share, Reflecting a Mature Palate

In 2024, the 36-45 years age group held a dominant position in the wine market, capturing more than a 34.50% share. This demographic’s preference for wine is influenced by a blend of matured taste preferences and a higher discretionary income, allowing them to explore a diverse range of premium wines. The significant market share held by this age group illustrates their important role in driving wine trends and preferences, often opting for wines that offer a complex profile and excellent aging potential. Their choice reflects a deep appreciation of wine as both a beverage and a cultural experience.

By End-User

Female Consumers Hold a Majority with 54.3% of the Wine Market, Highlighting Diverse Preferences

In 2024, female end-users held a dominant market position in the wine industry, capturing more than a 54.30% share. This majority reflects the growing influence and purchasing power of female consumers within the wine market. Their preferences have helped shape wine offerings, with an emphasis on variety, quality, and more tailored marketing approaches that resonate with female buyers. The significant share held by females underscores their critical role in sustaining and expanding the wine market, demonstrating their diverse tastes and increasing engagement with wine as both a lifestyle choice and a culinary complement.

Key Market Segments

By Type

- Still

- Sparkling

By Color

- White

- Red

- Rose Wine

By Grape Variety

- Cabernet Sauvignon

- Merlot

- Airen

- Tempranillo

- Chardonnay

- Syrah

- Grenache

- Sauvignon Blanc

- Trebbiano Toscana

- Others

By Distribution Channel

- On-trade

- Pubs, Bars & Cafe’s

- Hotels & Restaurants

- Others

- Off -trade

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

By Packaging Type

- Bottles

- Cans

By Age Group

- 18-25 Years

- 26-35 Years

- 36-45 Years

- Above 46 Years

By End-User

- Male

- Female

Drivers

Rising Health Awareness Bolsters Wine Consumption

A significant driving factor in the growth of the wine market is the increasing awareness of its health benefits, as supported by numerous studies and health organizations. Notably, moderate wine consumption has been linked to cardiovascular benefits, which is a key message endorsed by health advocates and widely accepted by the public.

Research published by leading health entities, such as the Mayo Clinic, suggests that moderate consumption of red wine is linked to a reduced risk of heart disease in some populations. This relationship is often attributed to antioxidants found in red wine like resveratrol, which can help prevent heart disease by increasing levels of ‘good’ HDL cholesterol and protecting against artery damage.

Governments and health organizations have played a pivotal role in disseminating this information, ensuring that it reaches a wide audience through various public health campaigns. For example, the U.S. Department of Health and Human Services occasionally includes guidelines on alcohol consumption, which moderate wine drinkers often reference as a justification for their consumption habits.

This growing health consciousness is not just a trend limited to specific demographics. According to data from the World Health Organization, there has been a measurable increase in the consumption of wine in regions where public health bodies have actively promoted the potential health benefits of moderate wine consumption. For instance, European countries like France and Italy, known for their wine cultures, have seen a steady increase in wine consumption among adults who are health-conscious and view wine as a beneficial part of a balanced diet.

These shifts in consumer behavior are further supported by initiatives from wine producers to market their products as part of a healthy lifestyle. This includes labeling strategies that highlight the presence of beneficial antioxidants and organic certifications that appeal to health-oriented consumers.

Restraints

Stringent Regulations and Taxes Stifle Wine Market Growth

One of the primary factors hindering the growth of the wine market is the stringent regulatory environment and high taxation on alcoholic beverages. These regulations, which vary significantly from country to country, often impose a heavy financial burden on producers and consumers alike, impacting overall market accessibility and affordability.

In many countries, alcohol taxation is used as a tool to discourage excessive drinking and to mitigate the social and health-related costs associated with alcohol abuse. For instance, the World Health Organization (WHO) supports these measures, advocating for high taxes on alcohol as a means of reducing harmful drinking practices. According to the WHO, countries with higher alcohol taxes have generally reported lower rates of alcohol-related health issues, which supports the rationale behind these policies.

Moreover, the regulatory landscape for wine can be particularly complex, involving strict controls over production, labeling, distribution, and advertising. In the European Union, for example, wine production is heavily regulated to protect the integrity and tradition of wines produced in different regions. This includes everything from defining what grape varieties can be used, to how wines are to be labeled and marketed. Such regulations, while preserving quality and heritage, can also limit producers’ ability to innovate and expand their market reach.

Additionally, the import and export of wine are subject to tariffs that can significantly increase the cost for consumers, further restraining market growth. For example, the ongoing trade disputes between major wine-producing and consuming countries have led to increased tariffs on imported wines, making them less competitive in foreign markets.

Opportunity

E-commerce Expansion Offers New Horizons for Wine Sales

The expansion of e-commerce in the wine industry represents a significant growth opportunity, as more consumers turn to online shopping for convenience and variety. The shift towards digital platforms has been accelerated by global events such as the COVID-19 pandemic, which restricted traditional retail and hospitality channels. This trend is not just a temporary shift but part of a broader movement towards online consumer behavior that is expected to persist long term.

According to the Food and Agriculture Organization (FAO), online food and beverage sales have seen exponential growth, and wine is among the categories benefiting the most from this surge. The convenience of having a wide selection of wines delivered directly to one’s door is a compelling proposition for many consumers. Furthermore, online platforms provide an opportunity for smaller wine producers to reach a broader audience beyond their local markets, often bypassed by traditional distribution channels.

Governments and industry bodies have recognized the potential of digital markets and have begun to adapt regulations to better accommodate online wine sales. For instance, in regions like the European Union and the United States, there have been initiatives to streamline licensing processes for online alcohol sales, ensuring compliance while also promoting growth. These efforts help reduce the bureaucratic hurdles that previously made it difficult for wineries to sell their products online.

Moreover, the digital platform allows for innovative marketing strategies such as virtual wine tastings and direct consumer engagement through social media, which can enhance customer relationships and build brand loyalty. These digital strategies are particularly effective in attracting younger demographics, who value the ease and interactive nature of online shopping.

Trends

Sustainability Takes Center Stage in the Wine Industry

A prominent trend in the wine industry is the growing emphasis on sustainability, influencing everything from vineyard practices to packaging. This shift reflects a broader consumer demand for environmental stewardship and transparency in production processes. Increasingly, consumers are making purchasing decisions based on a product’s ecological footprint, leading wine producers to adopt more sustainable practices.

Organizations like the International Organisation of Vine and Wine (OIV) have documented a rise in sustainable viticulture certifications among member countries. These certifications often cover a range of practices, such as reducing chemical use, managing water resources more efficiently, and implementing organic farming techniques. By adopting these methods, wineries not only improve their environmental impact but also often find that these practices enhance the quality of their grapes and, by extension, their wine.

Additionally, the push for sustainability extends to wine packaging. The industry is seeing a move away from traditional glass bottles to more sustainable options like recycled materials or even plant-based plastics. According to data from the United Nations Environment Programme (UNEP), the wine industry’s adoption of lighter or alternative packaging can significantly reduce transportation costs and carbon emissions, making wine production and distribution more sustainable.

Government initiatives have also played a crucial role in this trend. For instance, several European countries have introduced grants and incentives for wineries that convert to organic practices or utilize energy from renewable sources. These governmental supports not only aid in the immediate transition but also signal to consumers and other stakeholders the importance of sustainable practices within the industry.

Regional Analysis

In 2024, the European wine market continued to assert its dominance, capturing a substantial 43.30% of the global market share, valued at approximately USD 196.1 billion. This significant presence is anchored by the region’s deep-rooted wine culture and a strong reputation for producing some of the world’s most renowned wines. Traditional wine-producing countries such as France, Italy, and Spain not only contribute to the majority of Europe’s wine output but are also pivotal in setting global wine trends and standards.

Europe’s market strength is further bolstered by its sophisticated wine production techniques, extensive vineyard acreage, and the geographical diversity that allows for a wide variety of wine types and flavors. The region benefits from favorable climate conditions and rich soils, ideal for viticulture, which are instrumental in producing wines that are highly valued on the international stage.

Moreover, the European wine sector is supported by robust regulatory frameworks that safeguard wine quality and authenticity, enhancing consumer confidence in European wines. Initiatives such as the Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI) help maintain high standards and promote the uniqueness of European wines, adding to their global appeal.

Consumer trends within Europe also show a growing preference for premium wines, driven by an increasing interest in wine provenance and sustainability. This trend is supported by rising disposable incomes and a stronger emphasis on quality over quantity. Furthermore, the European market is seeing a surge in organic wine production, responding to consumer demands for more environmentally friendly and sustainably produced wines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

As one of the largest family-owned wineries in the United States, E. & J. Gallo Winery holds a significant presence in the global wine market. Renowned for its innovation and quality, Gallo offers an extensive portfolio of products ranging from table wines to premium vintages. The company’s aggressive marketing strategies and expansive distribution network have solidified its status as a leader in the industry, continually adapting to changing consumer tastes.

Constellation Brands is a major player in the alcoholic beverage industry, with a robust portfolio that includes some of the most popular wine brands globally. Known for its focus on premiumization, the company invests heavily in brand development and marketing to cater to upscale consumers. Its strategic acquisitions have broadened its market reach, making it a key influencer in the wine sector’s dynamics.

The Wine Group LLC stands as one of the world’s largest wine producers by volume. The company is celebrated for its cost-effective production methods and wide range of products that appeal to various consumer segments. With a commitment to sustainability and innovation, The Wine Group continues to expand its market share through consumer-focused branding and widespread retail distribution.

Pernod Ricard is a global beacon in the wine and spirits industry, holding a prestigious portfolio of internationally recognized wine labels. The company’s strategy focuses on premiumization and sustainable growth, leveraging its global distribution channels to enhance accessibility and visibility. Pernod Ricard’s emphasis on craftsmanship and heritage in its wine production helps maintain a high level of consumer loyalty and brand strength.

Top Key Players

- E. & J. Gallo Winery

- Constellation Brands Inc.

- The Wine Group LLC

- Pernod Ricard

- Lagfin SCA

- Treasury Wine Estates Limited

- Bronco Wine Company

- Foley Family Wines

- Bacardi Limited

- Symington Family Estates

- Madeira Wine Company SA

- Bronco Wine Co.

- Casella Family Brand

- Constellation Brands, Inc.

- Henkell Freixenet

Recent Developments

Constellation Brands Inc., a significant force in the U.S. wine market, has recently faced challenges that have prompted a strategic reevaluation of its business focus. As of 2024, the company witnessed a notable 14% decline in wine sales in the three months ending November, with a similar 15% decrease in spirits sales.

In 2024, Pernod Ricard experienced a slight downturn in its wine sector, marking a 1% decline in organic sales, totaling €11,598 million. This modest decrease reflects broader economic and geopolitical uncertainties and a normalization in the spirits market post the exceptional growth seen in the previous years.

Report Scope

Report Features Description Market Value (2024) USD 453.1 Bn Forecast Revenue (2034) USD 759.4 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Still, Sparkling), By Color (White, Red, Rose Wine), By Grape Variety (Cabernet Sauvignon, Merlot, Airen, Tempranillo, Chardonnay, Syrah, Grenache, Sauvignon Blanc, Trebbiano Toscana, Others), By Distribution Channel (On-trade, Off -trade), By Packaging Type (Bottles, Cans), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By End-User (Male, Female) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape E. & J. Gallo Winery, Constellation Brands Inc., The Wine Group LLC, Pernod Ricard, Lagfin SCA, Treasury Wine Estates Limited, Bronco Wine Company, Foley Family Wines, Bacardi Limited, Symington Family Estates, Madeira Wine Company SA, Bronco Wine Co., Casella Family Brand, Constellation Brands, Inc., Henkell Freixenet Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- E. & J. Gallo Winery

- Constellation Brands Inc.

- The Wine Group LLC

- Pernod Ricard

- Lagfin SCA

- Treasury Wine Estates Limited

- Bronco Wine Company

- Foley Family Wines

- Bacardi Limited

- Symington Family Estates

- Madeira Wine Company SA

- Bronco Wine Co.

- Casella Family Brand

- Constellation Brands, Inc.

- Henkell Freixenet