Global Wind Turbine Rotor Blade Market Size, Share, And Business Benefits By Blade Length (Below 50 Meters, 50- 80 Meters, Above 80 Meters), By Capacity (Upto 5 MW, 5 – 8 MW, Above 8 MW), By Material (Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Natural Fiber Reinforced Polymer (NFRP), Others), By Design (Fixed-speed Fixed-pitch, Fixed-speed Variable-pitch, Variable-speed Fixed-pitch, Variable-speed Variable-pitch), By Location (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143634

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

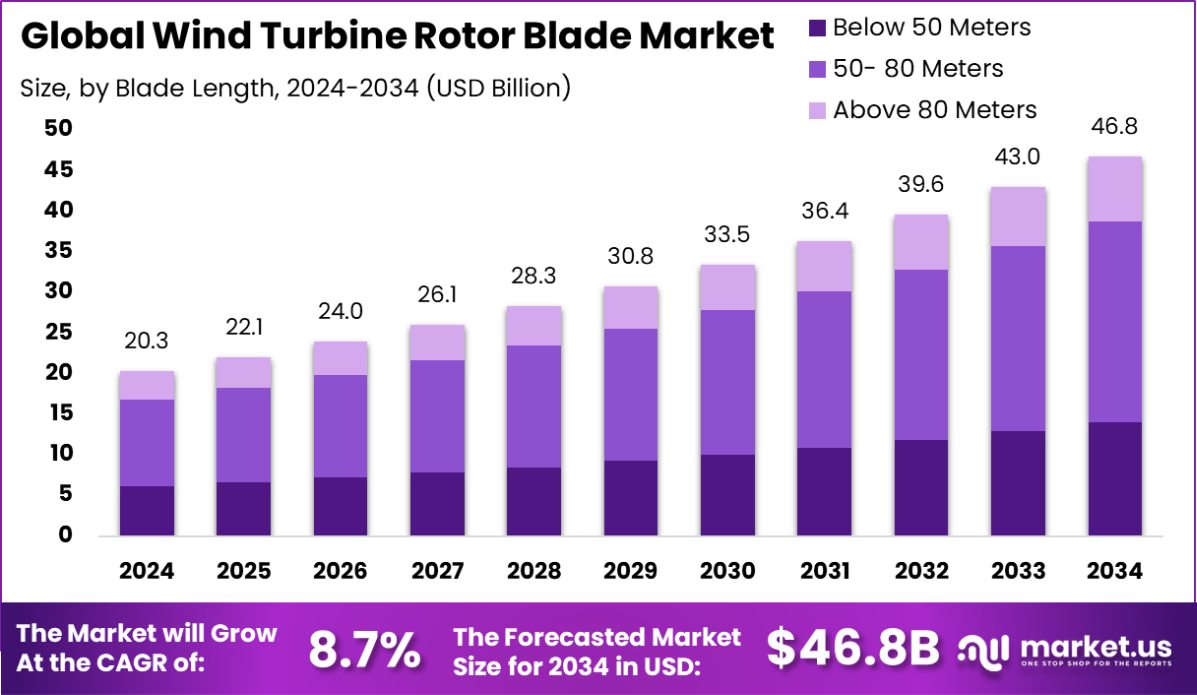

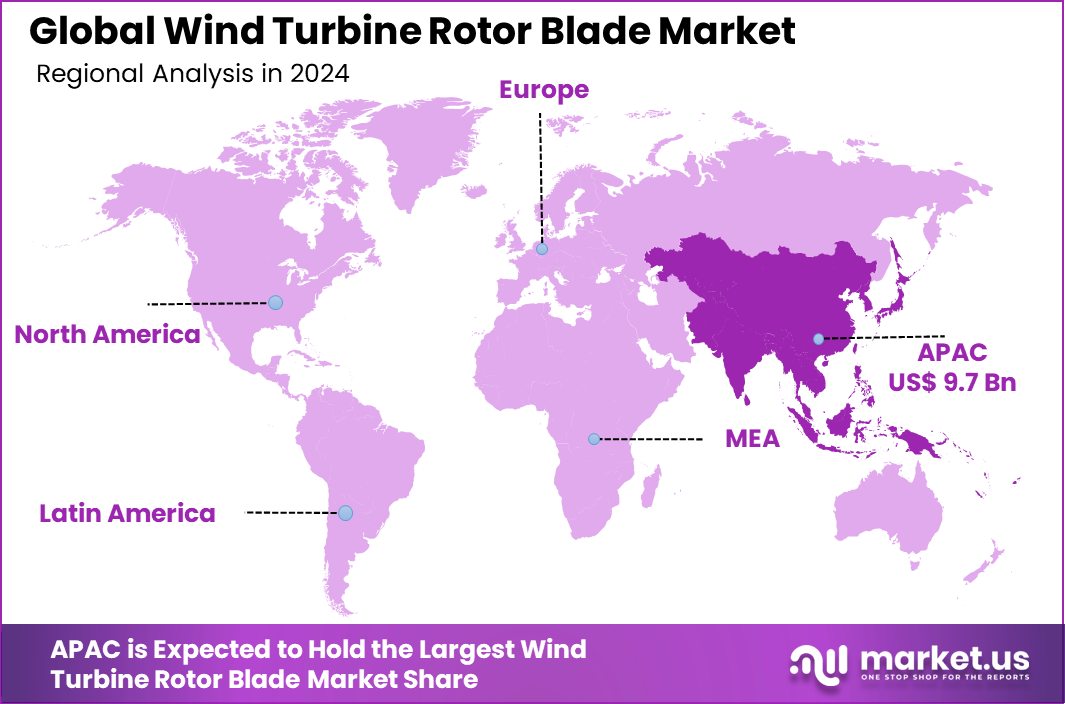

Global Wind Turbine Rotor Blade Market is expected to be worth around USD 46.8 billion by 2034, up from USD 20.3 billion in 2024, and grow at a CAGR of 8.7% from 2025 to 2034. Rapid wind farm installations in Asia-Pacific contributed to the 48.30% market share, supporting sustainable energy transition.

A wind turbine rotor blade is a crucial component of a wind turbine, responsible for converting wind energy into mechanical power. These blades are aerodynamically designed to harness the kinetic energy of wind and transfer it to the turbine’s rotor, generating electricity through a connected generator. Typically made from composite materials such as fiberglass and carbon fiber, rotor blades are engineered for durability, efficiency, and resistance to environmental stressors like strong winds, UV radiation, and moisture.

The wind turbine rotor blade market is driven by the growing adoption of renewable energy and government policies promoting wind power projects. As the world shifts towards cleaner energy sources, wind energy capacity installations are rising globally, fueling demand for advanced rotor blade technologies. The push for higher efficiency and longer blades to capture more wind energy per rotation is further shaping the market, leading to innovations in lightweight and high-strength materials.

One of the key growth factors is the increasing focus on decarbonization and energy security. Countries are investing in wind farms to reduce dependence on fossil fuels, accelerating demand for robust and high-performance rotor blades. Technological advancements, including digital monitoring and predictive maintenance, are also boosting efficiency and lifespan, supporting market expansion.

Demand for wind turbine rotor blades is surging due to rising electricity consumption and the cost competitiveness of wind energy. Offshore wind projects are gaining traction, requiring larger and more durable blades to withstand harsh marine conditions. Moreover, advancements in blade manufacturing techniques, such as automated production and modular blade designs, are making wind energy more affordable and scalable.

Key Takeaways

- Global Wind Turbine Rotor Blade Market is expected to be worth around USD 46.8 billion by 2034, up from USD 20.3 billion in 2024, and grow at a CAGR of 8.7% from 2025 to 2034.

- The wind turbine rotor blade market sees 52.30% adoption for 50-80 meter blades, optimizing wind capture efficiency globally.

- Blades supporting 5–8 MW turbines hold a 37.90% share, driven by rising demand for high-capacity wind projects.

- Carbon Fiber Reinforced Polymer (CFRP) dominates with 48.30% market share, enhancing durability, strength, and aerodynamic performance.

- Variable-speed variable-pitch blade designs account for 42.20% share, improving wind adaptability and maximizing power generation efficiency.

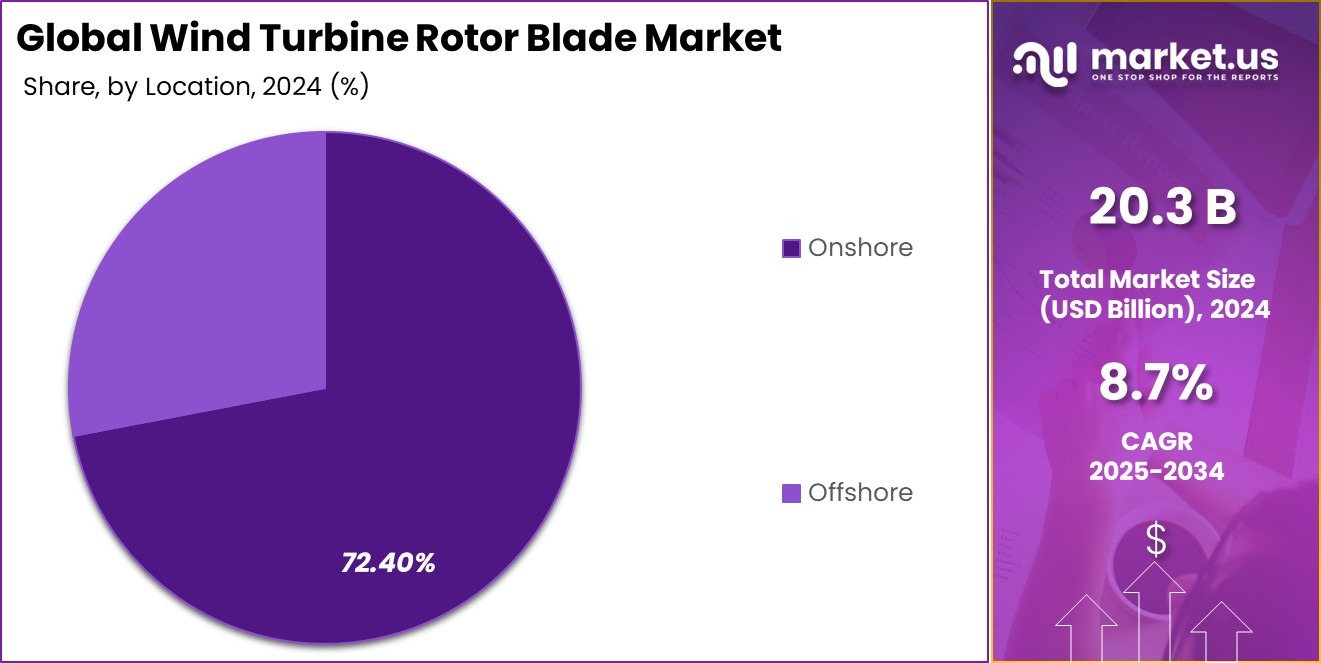

- Onshore wind installations lead with 72.40% market share, benefiting from lower costs, simpler logistics, and infrastructure readiness.

- The Asia-Pacific wind turbine rotor blade market reached USD 9.7 billion, driven by increasing renewable energy investments.

By Blade Length Analysis

Wind turbine rotor blade market sees a 52.30% share for the 50-80 meters blade length category.

In 2024, 50-80 Meters held a dominant market position in the By Blade Length segment of the Wind Turbine Rotor Blade Market, with a 52.30% share. This category remains the preferred choice for onshore wind projects, balancing efficiency, structural integrity, and cost-effectiveness. The demand for mid-range blade lengths is driven by the rapid deployment of onshore wind farms, particularly in regions with moderate wind conditions, where larger blades may not be feasible due to logistical constraints.

The growth of 50-80 meter blades is also attributed to advancements in aerodynamic design and composite materials, improving power output and durability. Manufacturers are increasingly optimizing blade geometry to enhance energy capture while reducing weight and maintenance costs. Additionally, government incentives and grid integration strategies support the adoption of these blades in large-scale wind energy projects, further strengthening their market position.

Meanwhile, longer blades exceeding 80 meters are gaining traction, particularly in offshore applications where larger turbines maximize energy generation. However, their adoption remains limited by transportation and manufacturing complexities. On the other hand, blades under 50 meters are primarily used in small-scale wind farms but represent a niche market with slower growth. The 50-80 meter segment is expected to maintain dominance, supported by favorable economics and ongoing technological advancements.

By Capacity Analysis

5-8 MW capacity turbines dominate 37.90% of the market share, driving demand for advanced blades.

In 2024, 5 – 8 MW held a dominant market position in the By Capacity segment of the Wind Turbine Rotor Blade Market, with a 37.90% share. This capacity range has become the industry standard for both onshore and offshore wind installations, offering an optimal balance between energy generation, efficiency, and cost-effectiveness. As governments and energy developers prioritize larger turbines for increased power output, demand for rotor blades designed for this capacity range continues to rise.

The 5 – 8 MW segment benefits from ongoing advancements in blade technology, including improved aerodynamics and the use of lightweight, high-strength composite materials. These improvements enable turbines to capture more wind energy, boosting overall efficiency and reducing maintenance costs. Additionally, the expansion of offshore wind projects has contributed to the dominance of this segment, as mid-range turbines are widely used in shallow-water deployments.

While turbines below 5 MW remain relevant for smaller wind farms and distributed energy projects, their market share is gradually shrinking due to lower efficiency. Meanwhile, turbines exceeding 8 MW are gaining attention for offshore applications, but their adoption is still limited by higher manufacturing costs and logistical challenges. The 5 – 8 MW category is expected to sustain its market leadership, driven by favorable economics and increased global wind energy investments.

By Material Analysis

Carbon fiber reinforced polymer (CFRP) holds a 48.30% market share, ensuring lightweight and durable blades.

In 2024, Carbon Fiber Reinforced Polymer (CFRP) held a dominant market position in the by-material segment of the Wind Turbine Rotor Blade Market, with a 48.30% share. The growing preference for CFRP is driven by its superior strength-to-weight ratio, enabling the production of longer and more durable rotor blades without compromising structural integrity. As wind turbines increase in size to maximize energy output, CFRP has become the material of choice due to its high stiffness and resistance to fatigue, ensuring extended operational life.

The adoption of CFRP is particularly prominent in offshore wind projects, where rotor blades are exposed to extreme environmental conditions such as strong winds, saltwater corrosion, and humidity. The material’s lightweight nature also enhances energy efficiency by reducing the load on turbine components, ultimately lowering maintenance and operational costs.

While Glass Fiber Reinforced Polymer (GFRP) remains a widely used material due to its cost advantages, its market share is gradually declining as industry players shift towards high-performance materials. The CFRP segment is expected to maintain its dominance, supported by continuous innovations in composite technology, increasing investments in offshore wind energy, and the need for enhanced turbine efficiency in large-scale wind farm installations.

By Design Analysis

Variable-speed variable-pitch design accounts for 42.20% share, optimizing energy capture efficiency.

In 2024, Variable-speed Variable-pitch held a dominant market position in the By Design segment of the Wind Turbine Rotor Blade Market, with a 42.20% share. This design has become the preferred choice due to its ability to optimize power generation under varying wind conditions. By adjusting both the rotor speed and blade pitch, these turbines maximize energy capture while reducing mechanical stress, enhancing operational efficiency, and extending blade lifespan.

The increasing adoption of variable-speed variable-pitch blades is driven by their capability to improve capacity utilization and grid stability. This design minimizes aerodynamic drag and optimizes turbine performance, especially in offshore wind farms, where wind conditions fluctuate more significantly. Additionally, advancements in digital monitoring and predictive maintenance technologies have further strengthened the reliability and efficiency of these rotor blades.

While fixed-pitch blades remain relevant in smaller and low-cost wind projects, their market share continues to decline due to lower energy conversion efficiency. Similarly, variable-pitch fixed-speed turbines are still in use but are gradually being replaced by more adaptable systems.

The variable-speed variable-pitch segment is expected to retain its leadership position, supported by increasing demand for high-performance turbines and the growing expansion of offshore and large-scale wind energy projects.

By Location Analysis

Onshore wind turbines lead with 72.40% market share, emphasizing land-based wind energy expansion.

In 2024, Onshore held a dominant market position in the By Location segment of the Wind Turbine Rotor Blade Market, with a 72.40% share. The strong preference for onshore wind projects is driven by lower installation and maintenance costs, well-established infrastructure, and faster deployment timelines compared to offshore installations.

Onshore wind farms benefit from easier accessibility for repairs, grid connectivity, and lower capital investment, making them a cost-effective solution for renewable energy expansion.

The growth of onshore wind energy is supported by government policies, incentives, and favorable land availability in key wind-rich regions. Additionally, technological advancements in rotor blade design, including lightweight materials and improved aerodynamics, have enhanced energy generation efficiency, further strengthening the segment’s dominance. The increasing global demand for clean energy, coupled with rising electricity consumption, continues to drive investment in onshore wind farms.

While offshore wind projects are gaining momentum due to higher wind speeds and more consistent energy output, their growth is constrained by high installation costs and complex logistics. However, as offshore wind technology advances and costs decline, its market share is expected to grow gradually.

Key Market Segments

By Blade Length

- Below 50 Meters

- 50- 80 Meters

- Above 80 Meters

By Capacity

- Upto 5 MW

- 5 – 8 MW

- Above 8 MW

By Material

- Glass Fiber Reinforced Polymer (GFRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- Natural Fiber Reinforced Polymer (NFRP)

- Others

By Design

- Fixed-speed Fixed-pitch

- Fixed-speed Variable-pitch

- Variable-speed Fixed-pitch

- Variable-speed Variable-pitch

By Location

- Onshore

- Offshore

Driving Factors

Rising Wind Energy Installations Boost Market Growth

The increasing installation of wind farms worldwide is the primary driver of the wind turbine rotor blade market. Governments and private energy companies are heavily investing in wind power as a cleaner and more sustainable energy source. Onshore wind projects are expanding rapidly due to lower costs, while offshore wind farms are gaining traction because of stronger and more consistent wind speeds.

As countries push for energy security and carbon neutrality, wind energy capacity additions continue to grow, creating high demand for advanced rotor blades. Additionally, improvements in blade design, including larger and more efficient models, help maximize energy output. This rising trend in wind energy deployment directly supports the growth of the wind turbine rotor blade market.

Restraining Factors

High Manufacturing Costs Limit Market Expansion

The wind turbine rotor blade market faces challenges due to the high costs of raw materials and production. Advanced blades are made from composite materials like carbon fiber and fiberglass, which are expensive to manufacture. The longer and stronger the blade, the higher the cost, making large-scale wind projects financially demanding. Additionally, transportation and installation expenses add to the overall investment, particularly for offshore wind farms.

Smaller companies and developing regions struggle to afford these costs, slowing adoption rates. While technological advancements are helping reduce production expenses, cost barriers remain a major restraint. Without further cost reductions and efficient manufacturing techniques, the widespread adoption of next-generation rotor blades may face delays in price-sensitive markets.

Growth Opportunity

Recyclable Blade Materials Open New Market Opportunities

The development of recyclable wind turbine rotor blades presents a major growth opportunity in the market. Traditional rotor blades are made from composite materials that are difficult to recycle, leading to environmental concerns as decommissioned blades pile up in landfills.

However, advancements in bio-based and fully recyclable materials are changing the landscape. Companies are investing in sustainable blade manufacturing to reduce waste and improve circular economy practices. Governments are also encouraging eco-friendly solutions by implementing stricter disposal regulations.

As the wind energy sector expands, the demand for recyclable blades is expected to grow, providing long-term benefits for manufacturers. This shift toward sustainability creates a new market segment with significant potential for innovation and investment.

Latest Trends

Larger Rotor Blades Enhance Wind Energy Efficiency

A key trend in the wind turbine rotor blade market is the shift toward longer and more efficient blades. As wind turbines grow in size, manufacturers are designing blades that exceed 80 meters in length to capture more wind energy per rotation. These larger blades help generate higher power output, making wind energy more cost-effective.

Advanced materials, such as carbon fiber composites, are being used to keep blades lightweight while maintaining strength. This trend is particularly strong in offshore wind projects, where stronger and steadier winds allow for larger turbines. The push for higher energy efficiency and lower electricity costs is driving innovation in blade design, making wind power an increasingly competitive renewable energy source.

Regional Analysis

In 2024, Asia-Pacific dominated the Wind Turbine Rotor Blade Market with a 48.30% share, reflecting strong regional growth.

In 2024, Asia-Pacific led the Wind Turbine Rotor Blade Market, holding a 48.30% share and reaching USD 9.7 billion. The region’s dominance is driven by rapid wind energy expansion in China, India, and Japan, supported by government incentives and large-scale wind farm installations. Favorable policies and increasing investments in offshore wind projects further bolster market growth.

North America follows with substantial investments in wind energy infrastructure, particularly in the United States and Canada. The rising adoption of large-capacity wind turbines and advancements in composite blade materials are key growth factors. Meanwhile, Europe is witnessing strong demand due to ambitious renewable energy targets and significant offshore wind projects in countries like Germany, the UK, and Denmark.

In Latin America, countries like Brazil and Mexico are expanding wind capacity, though at a slower pace compared to other regions. Middle East & Africa is emerging with government-led initiatives in Saudi Arabia and South Africa, though development is still in early stages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global wind turbine rotor blade market are focusing on innovation, efficiency, and sustainability to strengthen their market presence. Companies such as Acciona S.A., Aeris Energy, Aerodyne Energies, and CRRC Wind Power are investing in advanced composite materials, extended blade designs, and automation to meet the growing demand for wind energy.

Acciona S.A. continues to leverage its expertise in renewable energy infrastructure, focusing on integrating high-performance rotor blades into its wind farms. The company is actively investing in sustainable blade materials, aiming to reduce environmental impact while enhancing durability. Its strong presence in Europe and Latin America positions it as a key player in the global market.

Aeris Energy, a leading blade manufacturer, is expanding its production capacity to support increasing wind farm installations, particularly in North America and Brazil. With a focus on lightweight and high-strength materials, the company is developing rotor blades designed for larger offshore turbines, improving efficiency and power output.

Aerodyne Energies is driving technological advancements in aerodynamic blade designs, optimizing wind energy capture. The company’s emphasis on predictive maintenance technologies and AI-driven performance monitoring enhances blade lifespan and reduces downtime, making it a strategic player in both onshore and offshore markets.

CRRC Wind Power is capitalizing on China’s expanding wind sector, contributing to Asia-Pacific’s dominant market share. The company’s expertise in large-scale blade production and focus on cost-efficient manufacturing solidify its competitive edge. Its expansion into international markets strengthens its position in the global wind turbine rotor blade industry.

Top Key Players in the Market

- Acciona S.A.

- Aeris Energy

- Aerodyne Energies

- CRRC Wind Power

- EnBW

- Enercon GmbH

- Envision Renewables

- Gamesa Corporation Technology

- General Electric

- Goldwind

- Hitachi Power Solutions

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power

- Nordex SE

- Senvion

- Sinoma Wind Power Blade Co. Ltd

- Suzlon Energy Limited

- TPI Composites Inc.

- Vestas Wind Systems AS

Recent Developments

- In 2024, Aeris Energy extended its Vestas contract until 2028, boosting orders for 8.8 GW capacity, adding R$7.6 billion revenue. This strengthens its role in renewable energy and reinforces its global wind sector position.

- In 2024, CRRC Wind Power reported ¥234.26 billion in revenue, showing 5.08% growth. The company unveiled a powerful 40 kWh offshore wind turbine, with a 260-meter rotor and 320-meter blade tip height, reinforcing its position in global renewable energy.

Report Scope

Report Features Description Market Value (2024) USD 20.3 Billion Forecast Revenue (2034) USD 46.8 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Blade Length (Below 50 Meters, 50- 80 Meters, Above 80 Meters), By Capacity (Upto 5 MW, 5 – 8 MW, Above 8 MW), By Material (Glass Fiber Reinforced Polymer (GFRP), Carbon Fiber Reinforced Polymer (CFRP), Natural Fiber Reinforced Polymer (NFRP), Others), By Design (Fixed-speed Fixed-pitch, Fixed-speed Variable-pitch, Variable-speed Fixed-pitch, Variable-speed Variable-pitch), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Acciona S.A., Aeris Energy, Aerodyne Energies, CRRC Wind Power, EnBW, Enercon GmbH, Envision Renewables, Gamesa Corporation Technology, General Electric, Goldwind, Hitachi Power Solutions, Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd, LM Wind Power, Nordex SE, Senvion, Sinoma wind power blade Co. Ltd, Suzlon Energy Limited, TPI Composites Inc., Vestas Wind Systems AS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Wind Turbine Rotor Blade MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Wind Turbine Rotor Blade MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Acciona S.A.

- Aeris Energy

- Aerodyne Energies

- CRRC Wind Power

- EnBW

- Enercon GmbH

- Envision Renewables

- Gamesa Corporation Technology

- General Electric

- Goldwind

- Hitachi Power Solutions

- Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd

- LM Wind Power

- Nordex SE

- Senvion

- Sinoma Wind Power Blade Co. Ltd

- Suzlon Energy Limited

- TPI Composites Inc.

- Vestas Wind Systems AS