Global Wet Pet Food Market Size, Share and Future Trends Analysis Report By Pet (Dogs, Cats), By Source (Animal-based, Plant Derivatives, Synthetic), By Distribution Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148771

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

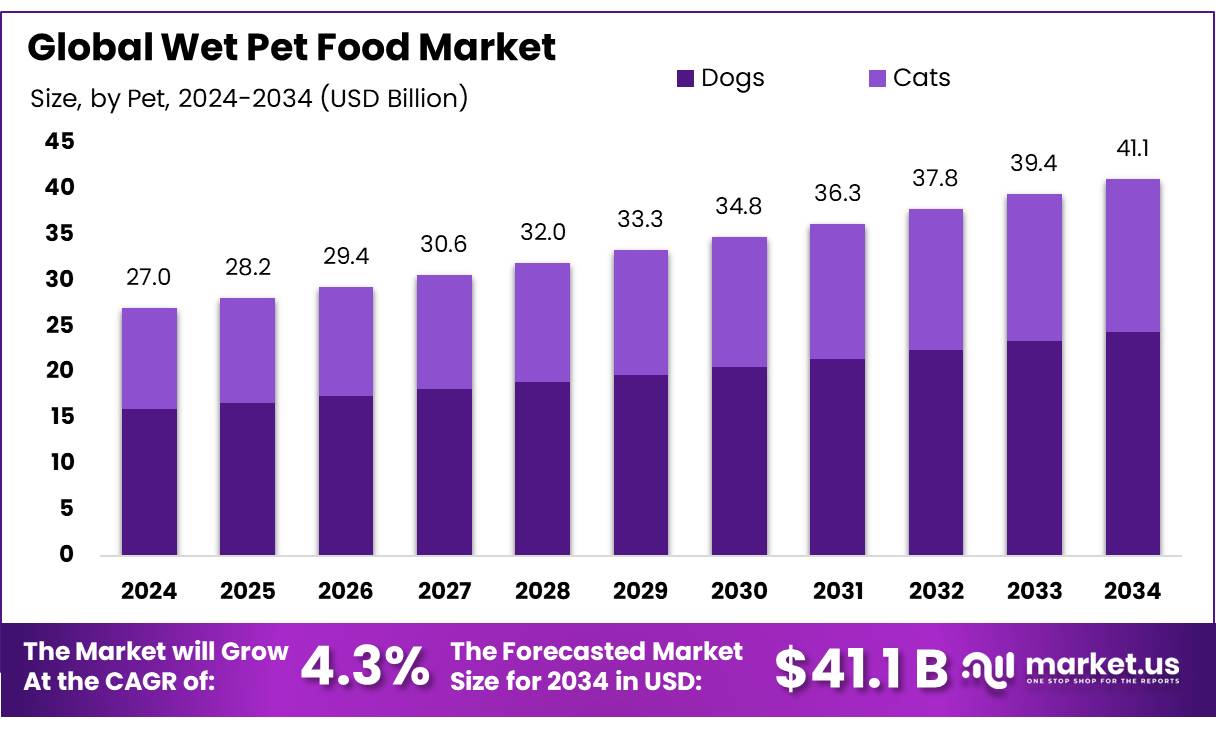

The Global Wet Pet Food Market size is expected to be worth around USD 41.1 Billion by 2034, from USD 27.0 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The wet pet food concentrates industry in India is experiencing significant growth, driven by evolving consumer preferences, increased pet ownership, and a shift towards premium and specialized pet nutrition. Wet pet food concentrates, characterized by their high moisture content and nutrient density, offer convenience and palatability, making them a preferred choice among pet owners. These products are particularly beneficial for pets requiring specific dietary needs, such as those with health conditions or aging pets.

A significant factor propelling this growth is the rising trend of pet humanization, where pets are increasingly considered integral family members. This shift has led to greater demand for premium pet food products that mirror human food trends, including organic, grain-free, and high-protein options. For instance, the U.S. pet food market, which includes wet pet food, was estimated at USD 54 billion in 2024, with projections indicating continued growth.

Government initiatives and regulatory frameworks are also influencing the industry. In China, for instance, the pet consumer market reached $41.9 billion in 2024, with pet food accounting for 52.8% of all pet-related consumption. The United States remained the top pet food supplier to China, accounting for over 69% of the market share in the first 10 months of 2024 . Such data underscores the global interconnectedness of the pet food supply chain and the importance of international trade policies.

In emerging markets like China, the pet food industry is witnessing rapid expansion. In 2023, China’s cat and dog pet food consumer market sizes were USD 9.8 billion and USD 10.3 billion, respectively, with year-on-year growth rates of 7.6% and 3.9%. This growth is attributed to increasing urbanization, higher disposable incomes, and a growing awareness of pet health and nutrition.

Key Takeaways

- Wet Pet Food Market size is expected to be worth around USD 41.1 Billion by 2034, from USD 27.0 Billion in 2024, growing at a CAGR of 4.3%.

- Dogs held a dominant market position in the wet pet food category, accounting for more than a 59.3% share.

- Animal-based products dominated the wet pet food market, holding more than a 65.7% share.

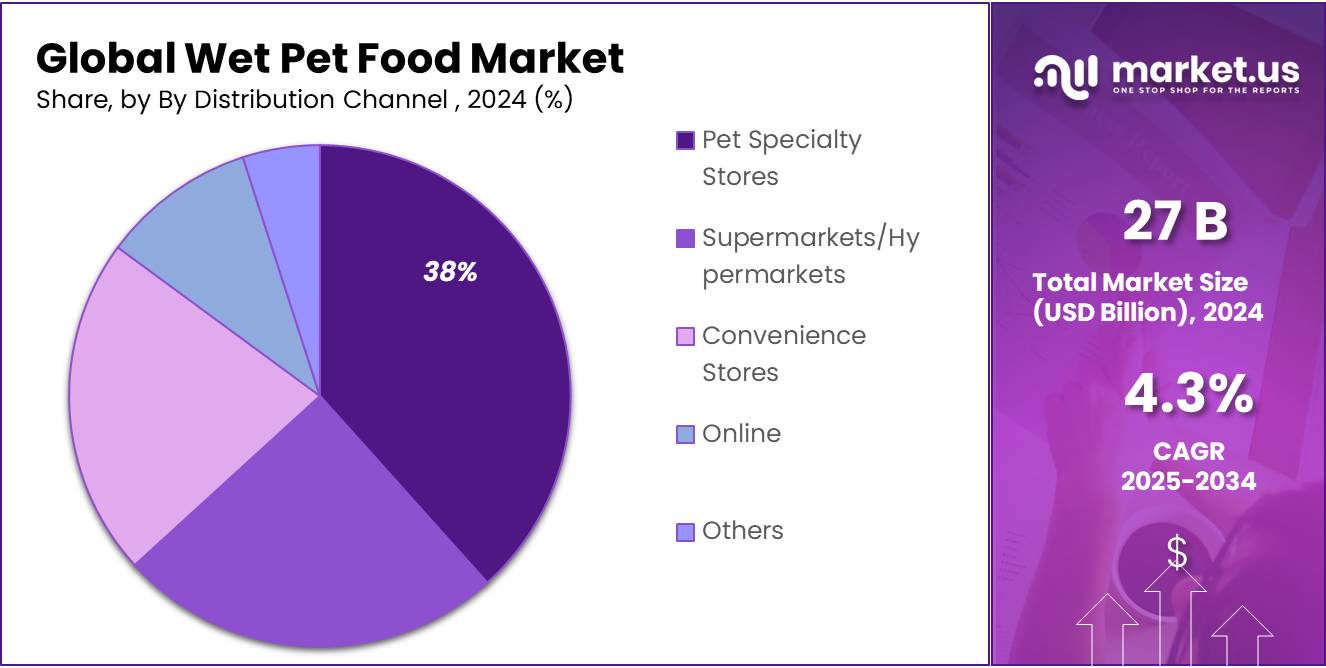

- Pet Specialty Stores held a dominant market position, capturing more than a 38.6% share in wet pet food sales.

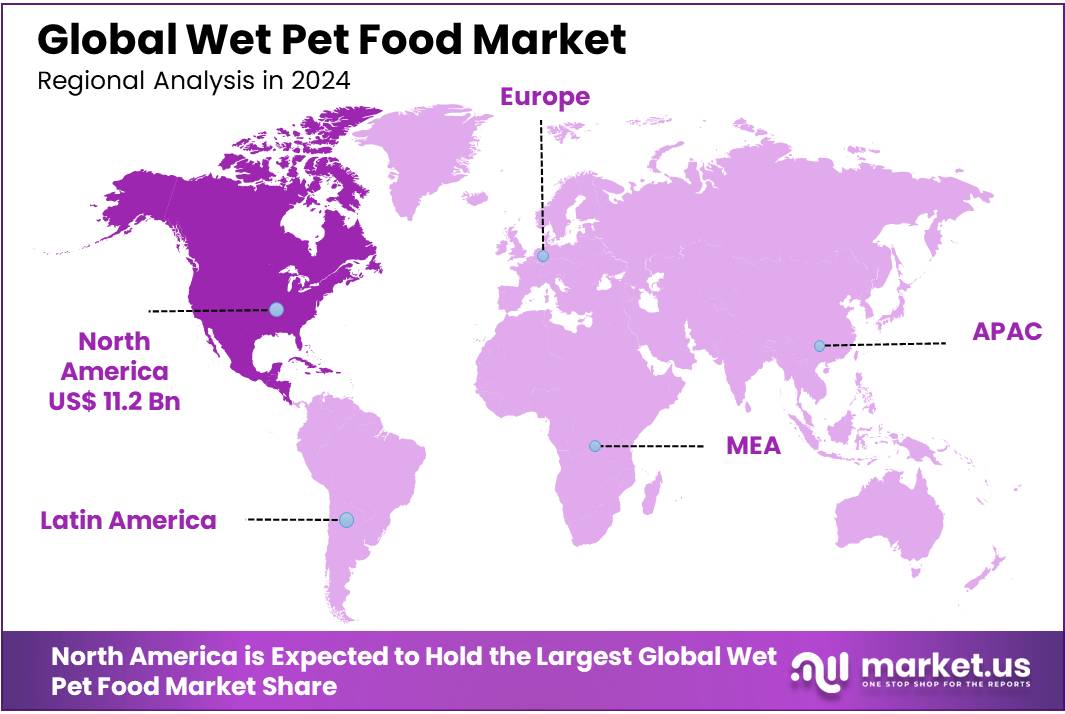

- North America held a dominant position in the global wet pet food market, capturing a substantial 42.9% share, with sales reaching approximately USD 11.2 Billion.

By Pet

Dogs dominate the Wet Pet Food Market with a 59.3% share, driven by growing pet ownership and preference for nutritious diets.

In 2024, dogs held a dominant market position in the wet pet food category, accounting for more than a 59.3% share. This strong position was primarily driven by increased dog ownership across urban households and a rising awareness among pet owners about nutritional diets for dogs. Many dog owners now prefer wet pet food due to its perceived nutritional advantages, including better hydration and digestibility. Additionally, premium wet dog foods have gained popularity, driven by consumer willingness to spend more on pet health and wellness. The trend of treating pets as family members has also significantly boosted demand, ensuring dogs maintain a leading position in this market segment.

By Source

Animal-based wet pet food leads with 65.7%, boosted by high pet owner trust and nutritional benefits.

In 2024, Animal-based products dominated the wet pet food market, holding more than a 65.7% share. The key reason behind this leading position is the trust pet owners place in animal-derived foods, believing them to offer better nutritional quality and digestibility for pets. Animal-based wet pet foods, such as those made from chicken, beef, and fish, are widely preferred because they closely match pets’ natural dietary needs. Many pet owners feel these foods support better overall health, coat quality, and energy levels in their pets. Moreover, continued growth in the pet humanization trend has strengthened the demand, further securing animal-based wet pet food’s strong market position in 2024.

By Distribution Channel

Pet Specialty Stores lead with 38.6%, driven by trusted service and wide product variety.

In 2024, Pet Specialty Stores held a dominant market position, capturing more than a 38.6% share in wet pet food sales. The popularity of these stores comes from their extensive product choices and knowledgeable staff, making them a preferred shopping destination for pet owners. Customers trust specialty stores because they offer personalized service, expert advice on pet nutrition, and premium brands that are often unavailable elsewhere. Many pet owners appreciate the direct, face-to-face interaction, allowing them to choose suitable wet pet food based on their pet’s specific needs. This strong customer loyalty, along with increased spending on pet care, helped Pet Specialty Stores maintain their leading position in the market during 2024.

Key Market Segments

By Pet

- Dogs

- Cats

By Source

- Animal-based

- Plant Derivatives

- Synthetic

By Distribution Channel

- Pet Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Drivers

Rising Pet Humanization Driving Demand for Wet Pet Food

In recent years, the trend of pet humanization has significantly boosted the demand for wet pet food. More pet owners now view their pets as family members, leading to increased spending on premium and nutritious pet food options. According to the American Pet Products Association (APPA), in 2023, U.S. pet owners spent over US$51 billion on pet food and treats, marking a steady rise from previous years. This reflects the growing willingness of consumers to invest in high-quality food products that ensure their pets’ health and happiness.

Wet pet food is particularly favored because it offers higher moisture content, better palatability, and improved nutrient retention compared to dry food. This aligns with pet owners’ desires to provide a balanced and enjoyable diet, especially for pets with specific dietary needs or older pets requiring softer textures. The National Animal Supplement Council (NASC) reported in 2024 that over 65% of dog and cat owners are willing to pay a premium for foods that promote wellness and prevent illness, which strongly favors wet pet food products.

Government initiatives supporting pet health awareness also contribute to this market growth. The U.S. Food and Drug Administration (FDA) has launched educational campaigns about proper pet nutrition and safety, helping consumers make informed choices. Additionally, various state governments support regulations that encourage transparency and safety in pet food manufacturing, boosting consumer confidence.

Restraints

High Cost and Storage Challenges Limit Wet Pet Food Adoption

One significant factor holding back the growth of the wet pet food market is its relatively high cost compared to dry pet food. Wet pet food typically requires more expensive packaging and preservation methods, which raises the retail price. According to the U.S. Department of Agriculture (USDA), wet pet food can cost up to 30-40% more per serving than dry food, making it less accessible for budget-conscious pet owners. This price difference becomes a barrier, especially for households with multiple pets or limited disposable income.

In addition to cost, wet pet food poses storage and convenience challenges. Because of its higher moisture content, it needs to be refrigerated after opening and has a shorter shelf life than dry food. This can be inconvenient for busy pet owners or those without adequate refrigeration space. The National Institute of Food and Agriculture (NIFA) highlights that around 35% of pet owners prefer dry food primarily for its ease of storage and longer shelf life, which contributes to wet food’s slower market penetration.

Another restraint is the environmental impact related to wet pet food packaging. Wet foods usually come in cans or pouches, which have a higher carbon footprint than the bags used for dry food. Increasing consumer awareness about sustainability is leading some pet owners to reconsider their choices. In response, some government bodies are encouraging pet food manufacturers to adopt more eco-friendly packaging solutions through grants and environmental programs, such as the EPA’s Sustainable Materials Management initiatives.

Opportunity

Expansion into Emerging Markets and Export Growth

The wet pet food market is experiencing significant growth opportunities, particularly through expansion into emerging markets and increased export activities. Government initiatives and industry efforts are playing a crucial role in this expansion.

For instance, the U.S. Department of Agriculture (USDA) has awarded $1.65 million to the Pet Food Institute under its Regional Agricultural Promotion Program. This funding aims to boost U.S. pet food exports and expand market access in emerging global markets, including a focus on South Africa .

Similarly, in Taiwan, the USDA’s Foreign Agricultural Service highlights significant activity in the pet food market, with total imports reaching a record high of $276.8 million in 2024. The United States is a key supplier of premium dry pet food to Taiwan, indicating strong export potential .

These efforts are complemented by the increasing adoption of pets in regions like Saudi Arabia, where the pet market has been growing at an average annual rate of 30% since 2019, reaching $275 million in 2024 .

Such initiatives and market dynamics present substantial growth opportunities for the wet pet food industry, emphasizing the importance of strategic expansion and export efforts in tapping into emerging markets.

Trends

Surge in Premium Wet Pet Food Demand

This growth is largely attributed to pet owners’ increasing willingness to invest in high-quality, nutritious food for their pets. Wet pet food, known for its higher moisture content and palatability, is particularly favored for its appeal to older pets and those with specific dietary needs. The trend towards premium products is evident, with a notable rise in demand for grain-free, organic, and veterinarian-formulated options .

Government initiatives and industry standards play a crucial role in shaping this market. Regulatory bodies ensure that pet food products meet safety and nutritional standards, fostering consumer trust. For instance, in the United States, the Food and Drug Administration (FDA) oversees pet food labeling and safety, ensuring that products are free from harmful additives and accurately labeled .

The increasing focus on pet health and nutrition is also influencing purchasing decisions. Pet owners are more informed and selective, often opting for products that align with their pets’ health requirements. This shift is prompting manufacturers to innovate and offer products that cater to specific health concerns, such as digestive sensitivities and weight management.

Regional Analysis

In 2024, North America held a dominant position in the global wet pet food market, capturing a substantial 42.9% share, with sales reaching approximately USD 11.2 Billion. This leadership is primarily driven by the United States, where pet ownership is deeply ingrained in the culture. According to the American Pet Products Association (APPA), 66% of U.S. households, equating to about 86.9 million homes, owned a pet in 2023. This widespread pet ownership has led to increased demand for pet food products, including wet pet food, which is often preferred for its palatability and nutritional benefits.

The dominance of North America in the wet pet food market is further supported by the presence of major industry players and continuous product innovations. Companies are focusing on developing wet pet food products that cater to specific dietary needs, such as grain-free, organic, and protein-rich formulas, to meet the evolving demands of pet owners. Additionally, the rise of e-commerce has made it easier for consumers to access a wide range of pet food products, contributing to the market’s growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Better Choice Company is a U.S.-based pet health and wellness firm specializing in premium pet nutrition. Their flagship brand, Halo Holistic®, offers wet and dry foods formulated with natural ingredients. In Q3 2024, the company reported a 33% sequential revenue growth, with Halo Holistic® accounting for approximately 75% of sales. Better Choice emphasizes direct-to-consumer channels and international markets, reflecting its commitment to providing high-quality, science-backed pet nutrition.

Established in 1892, Bob Martin & Co. is a UK-based company offering a range of pet care products, including wet and dry pet foods. The brand is known for its affordable and accessible products, catering to a broad customer base. Bob Martin’s integration into Pets Choice Ltd. has expanded its reach, enhancing its presence in the premium nutrition sector of the UK pet food market.

CATMOR is a South African brand under RCL FOODS, providing a variety of cat food products. The brand focuses on delivering complete nutrition for cats, with offerings in both wet and dry food categories. CATMOR’s products are formulated to meet the dietary needs of cats, emphasizing taste and nutritional value to ensure feline health and satisfaction.

Top Key Players in the Market

- Better Choice Company

- Bob Martin $ Co.

- CATMOR

- Charoen Pokphand Foods PCL

- Farmina Pet Foods

- Freshpet

- Furchild Pet Nutrition

- General Mills Inc.

- Hill’s Pet Nutrition

- Inaba-Petfood Co., Ltd.

- i-Tail Corporation

- Jeil Feed

- Juava Pet Food

- Mars Petcare Inc.

- MONGE SPA P.IVA

Recent Developments

In 2024, Charoen Pokphand Foods PCL (CPF) achieved significant growth in its food business segment, reporting revenues of THB 129,143 million, which accounted for 22% of the company’s total sales revenue.

In 2024, Freshpet made significant strides in the wet pet food market, reporting a 27.2% increase in net sales to $975.2 million, up from $766.9 million in 2023.

Report Scope

Report Features Description Market Value (2024) USD 27.0 Bn Forecast Revenue (2034) USD 41.1 Bn CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pet (Dogs, Cats), By Source (Animal-based, Plant Derivatives, Synthetic), By Distribution Channel (Pet Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Better Choice Company, Bob Martin $ Co., CATMOR, Charoen Pokphand Foods PCL, Farmina Pet Foods, Freshpet, Furchild Pet Nutrition, General Mills Inc., Hill’s Pet Nutrition, Inaba-Petfood Co., Ltd., i-Tail Corporation, Jeil Feed, Juava Pet Food, Mars Petcare Inc., MONGE SPA P.IVA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Better Choice Company

- Bob Martin $ Co.

- CATMOR

- Charoen Pokphand Foods PCL

- Farmina Pet Foods

- Freshpet

- Furchild Pet Nutrition

- General Mills Inc.

- Hill's Pet Nutrition

- Inaba-Petfood Co., Ltd.

- i-Tail Corporation

- Jeil Feed

- Juava Pet Food

- Mars Petcare Inc.

- MONGE SPA P.IVA