Vitamin B6 Market By Product Type (Tablets, Capsules, and Others), By Application (Anaemia, Fatigue, Insomnia, Muscle Cramps, Premenstrual Syndrome, and Others), By Distribution Channels (Pharmacies & Drug Stores, Supermarkets, and Online Channels), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132869

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

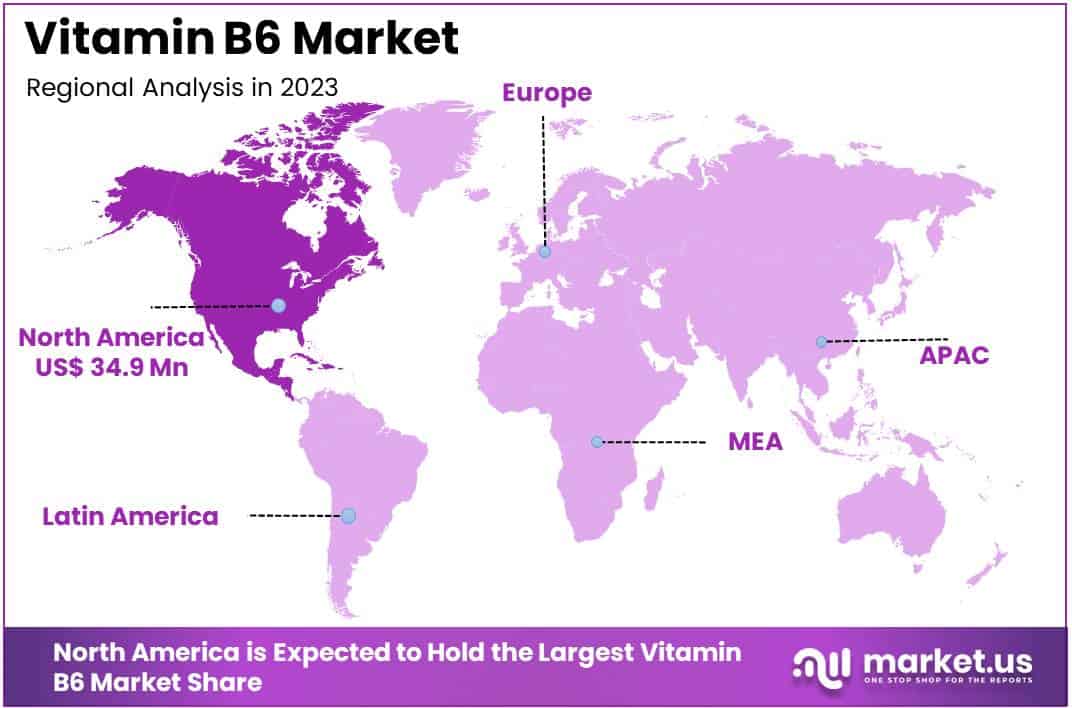

The Global Vitamin B6 Market size is expected to be worth around US$ 210.4 Million by 2033, from US$ 92.2 Million in 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033. North America held a dominant market position, capturing more than a 37.8% share and holds USD 34.9 Billion market value for the year.

Growing awareness of the importance of essential nutrients drives the vitamin B6 market, as consumers increasingly incorporate supplements to support overall health and well-being. Vitamin B6, or pyridoxine, plays a crucial role in various physiological functions, including amino acid metabolism, neurotransmitter synthesis, and immune system support.

According to the U.S. Food and Drug Administration, 28-36% of the general population regularly consumes food supplements containing vitamin B6, reflecting the rising demand for fortified products. The market benefits from its applications in addressing conditions such as anemia, depression, and cognitive decline, where vitamin B6 helps improve symptoms by supporting brain and red blood cell function.

Organizations such as the WHO and FAO have prioritized strategies like food fortification, micronutrient supplementation, and nutrition education to combat deficiencies, creating further opportunities for growth. Recent trends highlight an increased focus on natural and plant-based sources of vitamin B6 in dietary supplements and functional foods, aligning with consumer preferences for clean-label products.

The growing use of vitamin B6 in personalized nutrition and wellness programs also offers significant market potential.

Key Takeaways

- In 2023, the market for vitamin B6 generated a revenue of US$ 92.2 million, with a CAGR of 8.6%, and is expected to reach US$ 210.4 million by the year 2033.

- The product type segment is divided into tablets, capsules, and others, with capsules taking the lead in 2023 with a market share of 45.7%.

- Considering application, the market is divided into anaemia, fatigue, insomnia, muscle cramps, premenstrual syndrome, and others. Among these, premenstrual syndrome held a significant share of 34.8%.

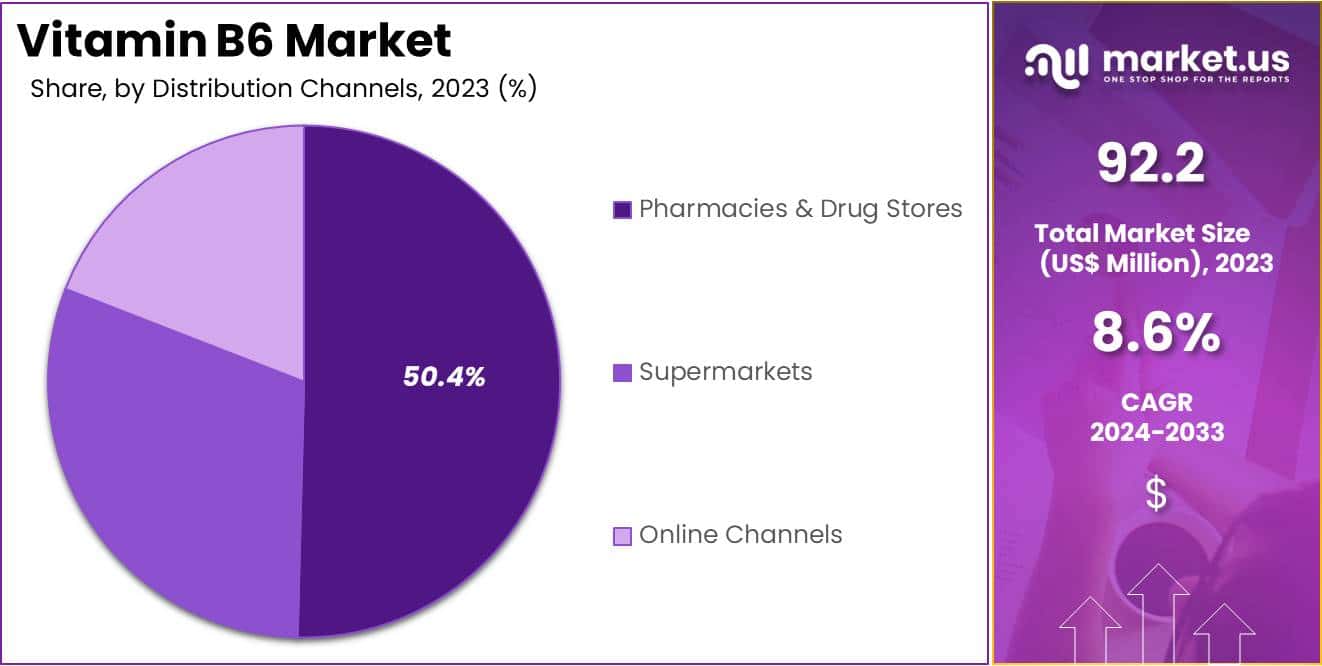

- Furthermore, concerning the distribution channels segment, the pharmacies & drug stores sector stands out as the dominant player, holding the largest revenue share of 50.4% in the vitamin B6 market.

- North America led the market by securing a market share of 37.8% in 2023.

Product Type Analysis

The capsules segment led in 2023, claiming a market share of 45.7% owing to the increasing consumer preference for capsules due to their ease of swallowing, quicker dissolution rates, and better bioavailability.

Capsules also allow for the incorporation of both powdered and liquid forms of vitamin B6, offering greater flexibility in formulations. The rising demand for dietary supplements, particularly among health-conscious consumers, further supports the adoption of capsules.

Additionally, advancements in capsule manufacturing, including the use of plant-based and gelatin-free options, attract a broader customer base, including vegetarians and those with dietary restrictions. As awareness about the benefits of vitamin B6 supplementation grows, the capsules segment is projected to expand significantly.

Application Analysis

The premenstrual syndrome held a significant share of 34.8% due to the increasing recognition of vitamin B6’s role in alleviating PMS symptoms, such as mood swings, irritability, and bloating. Healthcare providers frequently recommend vitamin B6 as a safe and effective solution for managing hormonal fluctuations associated with PMS.

Rising awareness about women’s health and the growing prevalence of PMS among the global female population further boost demand in this segment. Additionally, clinical studies highlighting the efficacy of vitamin B6 in improving symptoms contribute to its adoption. With more women seeking non-prescription remedies for PMS, the premenstrual syndrome segment is likely to drive growth in the vitamin B6 market.

Distribution Channels Analysis

The pharmacies & drug stores segment had a tremendous growth rate, with a revenue share of 50.4% owing to the trusted role pharmacies and drug stores play in providing access to essential vitamins and supplements.

Consumers often rely on these outlets for professional advice from pharmacists, enhancing their confidence in product quality and efficacy. The convenience of purchasing vitamin B6 alongside prescription medications further supports this segment’s growth.

Moreover, the rising prevalence of health-conscious consumers seeking immediate access to supplements contributes to increased foot traffic in these stores. Expanding pharmacy networks, especially in developing regions, and partnerships with healthcare providers are anticipated to boost the segment’s growth in the vitamin B6 market.

Key Market Segments

By Product Type

- Tablets

- Capsules

- Others

By Application

- Anaemia

- Fatigue

- Insomnia

- Muscle Cramps

- Premenstrual Syndrome

- Others

By Distribution Channels

- Pharmacies & Drug Stores

- Supermarkets

- Online Channels

Drivers

Rising Awareness of Vitamin B6 Deficiency

The increasing recognition of widespread vitamin B6 deficiencies has significantly driven the market for this essential nutrient. A study published in August 2024 revealed that over half of the global population consumes inadequate levels of several micronutrients, including vitamin B6.

This deficiency has been linked to various health issues, such as anemia, depression, and weakened immune function. As awareness of these health implications grows, both consumers and healthcare providers are emphasizing the importance of adequate vitamin B6 intake.

This heightened awareness has led to a surge in demand for vitamin B6 supplements and fortified foods, as individuals seek to address potential deficiencies. Consequently, manufacturers are expanding their product lines to include vitamin B6-enriched options, further propelling market growth. The trend underscores a global shift towards proactive health management and nutritional awareness.

Restraints

Potential Health Risks from Excessive Intake

While addressing vitamin B6 deficiencies is crucial, excessive intake poses health risks that restrain market growth. The National Institutes of Health (NIH) warns that high doses of vitamin B6 supplements can lead to neuropathy, characterized by nerve damage causing pain and numbness. Such adverse effects have raised concerns among consumers and healthcare professionals regarding the safe consumption levels of vitamin B6.

These safety concerns have led to stricter regulations and guidelines on supplement dosages, potentially limiting market expansion. Manufacturers must navigate these regulatory landscapes carefully to ensure product safety and maintain consumer trust. Balancing the benefits of adequate vitamin B6 intake with the risks of overconsumption remains a critical challenge for the industry.

Opportunities

Integration into Mental Health Management

Emerging research highlighting vitamin B6’s role in mental health presents a significant opportunity for market expansion. A study from July 2022 indicated that high doses of vitamin B6 supplements could reduce anxiety and depression symptoms.

This finding has opened new avenues for incorporating vitamin B6 into mental health treatment protocols. As mental health issues become more prevalent globally, the demand for supportive nutritional interventions is anticipated to rise. This trend offers manufacturers the chance to develop specialized vitamin B6 products targeting mental well-being, thereby tapping into a growing consumer segment.

Collaborations between nutraceutical companies and mental health professionals could further enhance product credibility and adoption. The integration of vitamin B6 into mental health strategies aligns with a holistic approach to wellness, emphasizing the interplay between nutrition and psychological health.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the dynamics of the vitamin B6 market. Economic growth in developed regions drives demand for dietary supplements and fortified foods, boosting sales of vitamin B6.

Conversely, inflation and economic instability in emerging markets limit consumer spending on non-essential health products, restricting market growth. Geopolitical tensions and trade restrictions disrupt global supply chains, causing fluctuations in raw material availability and increasing production costs.

Additionally, regulatory changes in key markets create challenges for manufacturers, requiring them to adapt to evolving compliance standards. However, rising health awareness and the growing prevalence of lifestyle-related diseases such as diabetes and cardiovascular conditions drive the demand for vitamin B6 as part of preventive healthcare. Expanding healthcare infrastructure and increasing consumer interest in wellness trends present opportunities for sustained growth in this sector.

Trends

Shift Towards Natural and Food-Based Sources

A notable trend in the vitamin B6 market is the consumer shift towards natural and food-based sources over synthetic supplements. Health-conscious individuals are increasingly seeking to meet their nutritional needs through diet, favoring whole foods rich in vitamin B6, such as poultry, fish, potatoes, and bananas.

This preference aligns with a broader movement towards clean eating and natural health solutions. In response, food manufacturers are fortifying products with vitamin B6 and highlighting these additions in their marketing strategies.

This trend reflects a growing consumer desire for transparency and natural ingredients in their dietary choices. The market is adapting by offering a wider range of vitamin B6-enriched natural products, catering to this evolving consumer preference. This shift underscores the importance of aligning product development with consumer values centered on natural health and wellness.

Regional Analysis

North America is leading the Vitamin B6 Market

North America dominated the market with the highest revenue share of 37.8% owing to increasing consumer awareness of health and wellness, particularly concerning immune support and cognitive function.

The rise in dietary supplement consumption, especially among aging populations, has significantly contributed to this trend. According to the Council for Responsible Nutrition’s 2022 survey, 75% of U.S. adults reported taking dietary supplements, with vitamins being the most commonly used.

Additionally, the prevalence of vitamin B6 deficiency-related conditions, such as anemia and certain neurological disorders, has led to a higher demand for supplementation. The food and beverage industry’s incorporation of vitamin B6 into fortified products has further expanded its market presence.

Regulatory support for health claims associated with vitamin B6 has also encouraged manufacturers to develop and market products targeting specific health concerns, thereby boosting consumer confidence and driving sales.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising health consciousness and increasing disposable incomes. Rapid urbanization and changing dietary habits have led to a greater focus on preventive healthcare, with consumers seeking supplements to address nutritional gaps.

The expansion of the middle-class population in countries like China and India has increased the affordability and accessibility of dietary supplements. Government initiatives promoting health and wellness, along with the proliferation of e-commerce platforms, have facilitated the distribution and availability of vitamin B6 products.

The food and beverage industry’s trend toward fortifying products with essential vitamins to cater to health-conscious consumers is likely to further drive market growth. Collaborations between local manufacturers and international brands are expected to introduce a diverse range of vitamin B6 products, meeting the region’s varied consumer preferences and contributing to the market’s expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the vitamin B6 market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the vitamin B6 market focus on diversifying their product offerings to cater to various industries, including pharmaceuticals, dietary supplements, and animal feed.

Many companies invest in research and development to enhance product quality and develop innovative formulations that improve bioavailability. Strategic partnerships with distributors and retailers help expand their market reach and strengthen supply chains.

Businesses also target emerging markets, where increasing health awareness drives demand for nutritional supplements. Marketing campaigns emphasizing health benefits and regulatory compliance further support brand differentiation and customer loyalty.

Top Key Players in the Vitamin B6 Market

- Zhejiang Medicine

- Jiangxi Tianxin Pharmaceutical Co., Ltd.

- HuiSheng Pharma

- Hegno

- DSM

- BASF SE

Recent Developments

-

- In May 2021: DSM introduced a high-purity, heat-stable vitamin B6 product designed for fortification in a broader range of food and beverage applications. This launch supports the growth of the vitamin B6 market by enabling manufacturers to incorporate the nutrient into a variety of products, meeting the rising demand for fortified foods.

- In June 2023: DSM-Firmenich announced the closure of its Xinghuo vitamin B6 plant in China as part of a strategic restructuring to optimize its vitamin production footprint and reduce costs.

Report Scope

Report Features Description Market Value (2023) US$ 92.2 million Forecast Revenue (2033) US$ 210.4 million CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tablets, Capsules, and Others), By Application (Anaemia, Fatigue, Insomnia, Muscle Cramps, Premenstrual Syndrome, and Others), By Distribution Channels (Pharmacies & Drug Stores, Supermarkets, and Online Channels) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zhejiang Medicine, Jiangxi Tianxin Pharmaceutical Co., Ltd., HuiSheng Pharma, Hegno , DSM, and BASF SE. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zhejiang Medicine

- Jiangxi Tianxin Pharmaceutical Co., Ltd.

- HuiSheng Pharma

- Hegno

- DSM

- BASF SE