Global Valve Regulated Lead Acid Batteries Market Size, Share, And Industry Analysis Report By Technology (AGM, Gel, Calcium, Others), By Capacity (Less than 50 Ah, 50 to 200 Ah, More than 200 Ah, Others), By Application (Stationary, Motive, SLI, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 168165

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

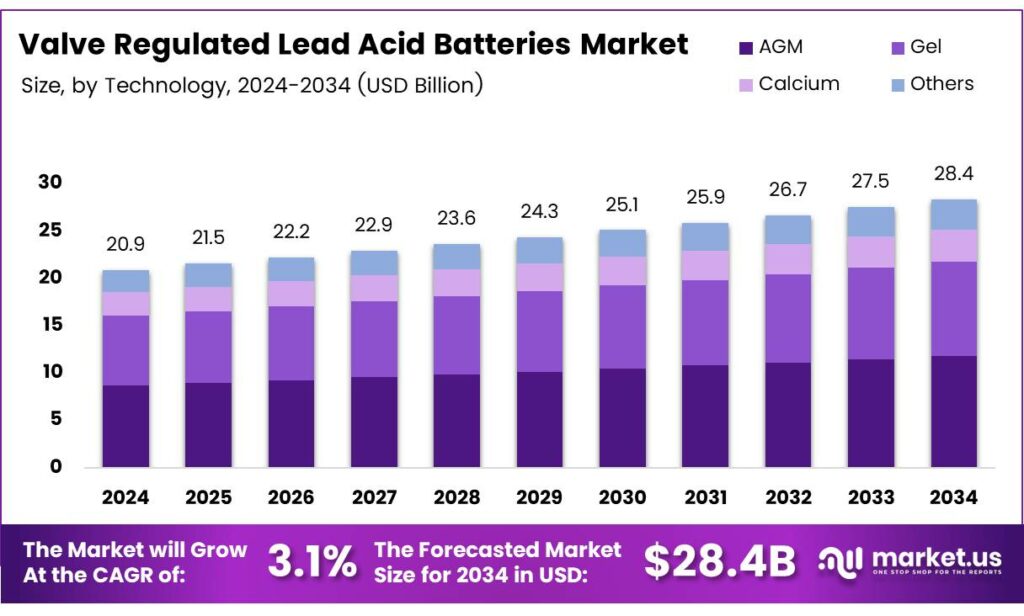

The Global Valve Regulated Lead Acid Batteries Market size is expected to be worth around USD 28.4 billion by 2034, from USD 20.9 billion in 2024, growing at a CAGR of 3.1% during the forecast period from 2025 to 2034.

The Valve Regulated Lead Acid Batteries concept refers to a sealed lead–acid technology designed for safety, reliability, and maintenance-free operation. These batteries regulate internal pressure through valves, preventing gas buildup. As a result, they are widely used in UPS systems, telecom backup, industrial power storage, and emergency power applications.

The Valve Regulated Lead Acid Batteries Market represents the commercial ecosystem around production, deployment, and lifecycle management of VRLA batteries. Demand is driven by power continuity needs, grid stability, and infrastructure digitalisation. Moreover, their predictable performance and recyclability strengthen transactional adoption across regulated industrial environments.

- Early VRLA batteries immobilised sulphuric acid electrolytes using 5–8% fumed silica, creating gel-type batteries. This design eliminated electrolyte stratification and spillage. In electric vehicle-related stationary applications, modern lead–acid systems operate under controlled temperatures and integrated battery management. The International Electrotechnical Commission, these batteries achieve 500–1500 duty cycles. Energy density remains limited to around 30 W-h/kg, often dropping below 25 W-h/kg at high discharge rates.

Despite energy density constraints, gel-based VRLA batteries enable total maintenance-free operation and long service life. Transitioning toward smart grids, governments continue funding resilient storage technologies under safety-first regulations. This alignment keeps VRLA batteries commercially relevant in telecom, utilities, industrial storage, and emergency infrastructure markets.

Key Takeaways

- The Global Valve Regulated Lead Acid Batteries Market is projected to reach USD 28.4 billion by 2034, up from USD 20.9 billion in 2024, growing at a 3.1% CAGR.

- AGM batteries dominate the market with a 56.9% share due to sealed design and fast recharge capability.

- The 50 to 200 Ah segment leads with a 49.7% market share, driven by telecom and UPS applications.

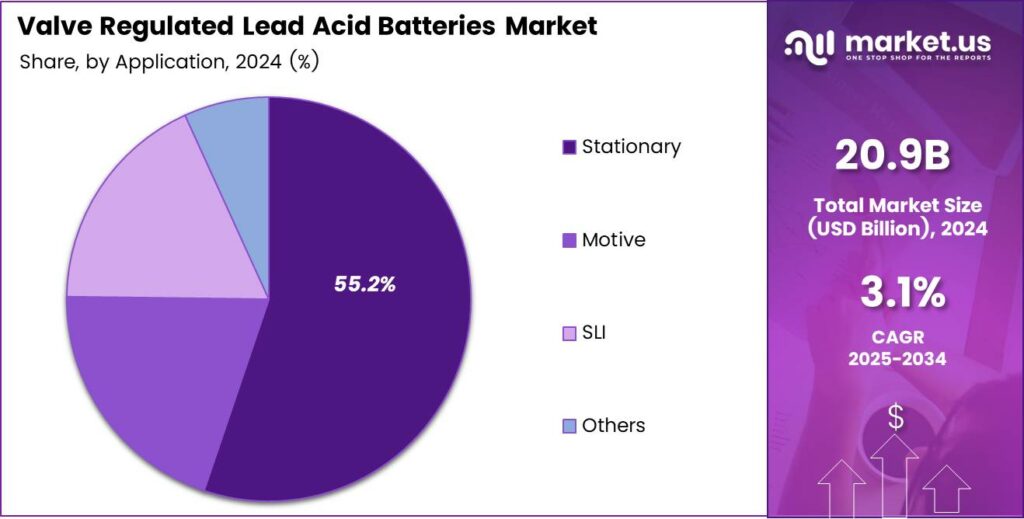

- Stationary systems account for the largest share at 55.2%, supported by data centers and utility backup demand.

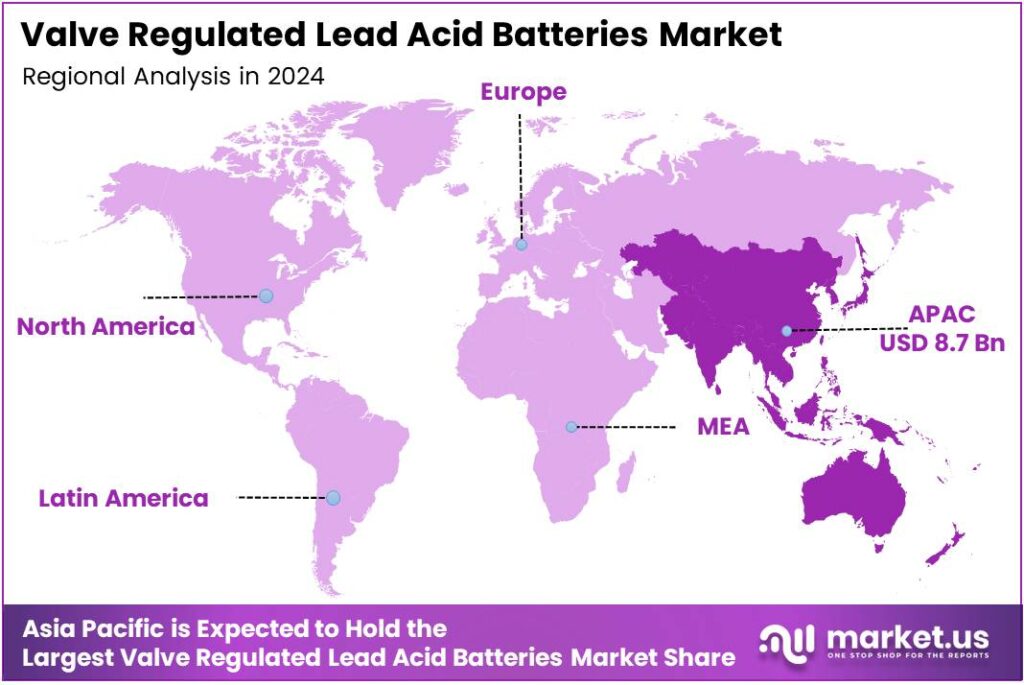

- Asia Pacific is the dominant region, holding 41.8% of the global market and valued at USD 8.7 billion.

By Technology Analysis

AGM dominates with 56.9% due to its sealed design, fast recharge ability, and stable performance.

In 2024, AGM held a dominant market position in the By Technology Analysis segment of the Valve Regulated Lead Acid Batteries Market, with a 56.9% share. Moreover, AGM technology benefits from low internal resistance, making it suitable for UPS, telecom, and data centers requiring high reliability.

Gel technology follows steadily, as it uses silica-based electrolytes to reduce leakage risks. Additionally, it performs well in deep-cycle applications and harsh environments. However, slower charging limits adoption compared to AGM, especially where rapid power recovery is essential.

Calcium-based VRLA batteries gain attention due to reduced water loss and longer shelf life. Furthermore, these batteries lower maintenance needs and improve grid stability. Still, adoption remains selective because cost and performance benefits vary by operating conditions.

By Capacity Analysis

50 to 200 Ah dominates with 49.7% as it balances backup duration and compact system integration.

In 2024, 50 to 200 Ah held a dominant market position in the By Capacity Analysis segment of the Valve Regulated Lead Acid Batteries Market, with a 49.7% share. This range fits telecom towers, UPS units, and emergency systems requiring dependable medium-duration backup.

Less than 50 Ah batteries remain essential for compact electronics and small-scale backup use. Additionally, they support alarm systems and portable power needs. However, limited runtime restricts usage in infrastructure-heavy and continuous-load applications.

More than 200 Ah batteries are widely adopted in large data centers and grid-support installations. Furthermore, they deliver extended backup duration during outages. Despite higher capacity, space requirements, and installation complexity, it influences selective deployment.

By Application Analysis

Stationary dominates with 55.2% driven by rising demand from telecom, data centers, and utility backup systems.

In 2024, Stationary held a dominant market position in the By Application Analysis segment of the Valve Regulated Lead Acid Batteries Market, with a 55.2% share. Growth is supported by telecom network expansion and increasing reliance on uninterrupted power systems.

Motive applications maintain consistent demand in material handling and industrial mobility. Additionally, VRLA batteries offer durability and controlled discharge. However, competition from advanced chemistries slightly limits expansion in high-cycling mobile equipment.

SLI applications continue serving automotive starting, lighting, and ignition needs. Moreover, VRLA batteries provide sealed safety advantages in modern vehicles. Still, evolving vehicle electrification trends moderate long-term dependence on this segment.

Key Market Segments

By Technology

- AGM

- Gel

- Calcium

- Others

By Capacity

- Less than 50 Ah

- 50 to 200 Ah

- More than 200 Ah

- Others

By Application

- Stationary

- Motive

- SLI

- Others

Emerging Trends

Shift Toward Maintenance-Free and Safer Battery Solutions Shapes Market Trends

One key trend in the Valve Regulated Lead Acid Batteries market is the growing demand for maintenance-free energy storage. Users prefer solutions that reduce inspection, topping up, and monitoring efforts. VRLA batteries meet this need through sealed construction and low servicing requirements.

- Another trend is increased focus on safety. Industries are choosing batteries that minimize leakage, fumes, and explosion risks. VRLA batteries offer safer indoor operation, making them suitable for offices, hospitals, and telecom shelters. The Central Electricity Authority (CEA), India, will need around 32 GW / 160 GWh of battery storage capacity by 2030 to support its target of 500 GW non-fossil fuel capacity.

Technology optimization is also shaping market trends. Manufacturers are improving internal designs to enhance durability and charging efficiency. These improvements help batteries perform better under variable loads. Recycling and sustainability have become important factors. Well-established lead recycling systems support circular use of materials.

Drivers

Rising Need for Reliable Backup Power Systems Drives Market Growth

The Valve Regulated Lead Acid Batteries market is strongly driven by the growing need for reliable backup power across many sectors. Data centers, telecom towers, hospitals, and commercial buildings depend on uninterrupted power to avoid losses and safety risks. VRLA batteries are widely used because they provide instant power during outages and require less maintenance.

Another key driver is the expansion of telecom and internet infrastructure. With higher mobile usage and network upgrades, operators need dependable energy storage for base stations. VRLA batteries fit well in remote and urban locations due to their sealed design and stable performance.

Industrial growth also supports market demand. Manufacturing plants and process industries use VRLA batteries for control systems, emergency lighting, and automation equipment. Their ability to deliver consistent power makes them suitable for critical operations.

Restraints

Limited Energy Density Compared to Newer Technologies Restrains Market Growth

One major restraint for the Valve Regulated Lead Acid Batteries market is lower energy density compared to lithium-based batteries. VRLA batteries are heavier and occupy more space for the same power output. This limits their use in applications where weight and size matter.

- Shorter cycle life is another challenge. VRLA batteries wear out faster when exposed to deep discharge cycles. This leads to more frequent replacements, increasing long-term operating costs for users. International Energy Agency (IEA), the global volume of batteries used in the energy sector reached more than 2,400 GWh in 2023, roughly four times the level from 2020, driven largely by lithium-ion capacity addition.

Environmental regulations on lead usage further restrain market growth. Lead handling and disposal require strict compliance, which increases manufacturing and recycling costs. Some buyers prefer alternative chemistries to avoid regulatory complexity.

Growth Factors

Expanding Data Centers and Power Infrastructure Creates New Growth Opportunities

The growing number of data centers worldwide presents strong opportunities for the Valve Regulated Lead Acid Batteries market. Data centers require dependable backup systems to protect servers and sensitive equipment. VRLA batteries remain a trusted solution due to predictable performance and proven safety records.

- Power grid modernization also opens up new applications. Utilities use VRLA batteries in substations for control systems and emergency power. India’s energy planners estimate a requirement of 32 GW / 160 GWh battery storage by 2030 to support 500 GW of non-fossil capacity. Developing regions are investing in telecom networks, hospitals, and commercial buildings. VRLA batteries are often preferred due to lower upfront cost and ease of installation.

Hybrid energy systems create another opportunity. In renewable setups, VRLA batteries are used alongside solar or wind systems for short-term backup. Their stable behavior supports grid balance and power continuity. Advancements in battery design, such as improved plates and better separators, are increasing performance and lifespan.

Regional Analysis

Asia Pacific Dominates the Valve Regulated Lead Acid Batteries Market with a Market Share of 41.8%, Valued at USD 8.7 Billion

Asia Pacific leads the Valve Regulated Lead Acid Batteries Market, holding a dominant share of 41.8% and reaching a value of USD 8.7 billion. This leadership is driven by rapid urbanization, expanding telecom networks, and rising demand for reliable backup power across data centers, railways, and industrial facilities. Strong manufacturing ecosystems and cost-efficient production further support large-scale adoption.

North America shows steady market growth supported by high replacement demand in UPS systems, data centers, and grid backup applications. Mature power infrastructure and strict reliability standards encourage continued usage of VRLA batteries. The region also benefits from rising investments in energy resilience and emergency power systems. Industrial automation and digital infrastructure expansion remain key supporting factors.

Europe’s market growth is supported by strong demand from renewable energy storage, telecom base stations, and rail signaling systems. Regulatory focus on energy efficiency and safe battery management reinforces VRLA adoption. Aging grid infrastructure across several countries continues to drive battery replacement cycles. Sustainability policies also encourage optimized recycling and longer battery lifespans.

The U.S. market is driven by strong demand from data centers, healthcare facilities, and critical infrastructure. Increasing digitalization raises the need for dependable backup power solutions. Replacement of aging battery systems remains a key growth factor. Continued investments in energy security and emergency preparedness further support VRLA battery adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global Valve Regulated Lead Acid (VRLA) Batteries Market, GS Yuasa International is viewed as a benchmark player with a broad portfolio across automotive, industrial, and standby power applications. The company’s focus on product reliability, safety, and incremental performance improvements positions it well in telecom, UPS, and power backup installations.

Leoch International Technology is recognized for its strong presence in industrial and motive power VRLA batteries, particularly in applications like telecom base stations, data centers, and material-handling equipment. The company leverages cost-competitive manufacturing and customized solutions to target emerging markets. Its emphasis on deep-cycle and long-life designs supports demand from e-mobility and renewable energy storage users.

EXIDE INDUSTRIES plays a critical role in VRLA adoption across automotive, inverter, and standby power segments, especially in developing economies. The company benefits from an extensive distribution network and strong OEM relationships, enabling it to capture both replacement and new installation demand. Its gradual shift toward maintenance-free and sealed VRLA technologies aligns with urbanization and rising power quality concerns.

EnerSys is positioned as a technology-driven leader in premium VRLA solutions for mission-critical sectors such as aerospace, defense, telecom, and data centers. The company emphasizes advanced design, high power density, and stringent quality standards, making its batteries suitable for high-reliability environments. Its strategic push into energy storage and smart power systems supports long-term relevance as grids and industries modernize.

Top Key Players in the Market

- GS Yuasa International

- Leoch International Technology

- EXIDE INDUSTRIES

- EnerSys

- MUTLU

- HOPPECKE Battery GmbH

- Shandong Sacred Sun Power Sources

- Clarios

- Okaya Power

- Microtex Energy

Recent Developments

- In 2025, GS Yuasa launched the SWL+ series, a next-generation VRLA battery line optimized for high-rate discharge and standby power in data centers, infrastructure, and manufacturing. This series features enhanced cycle life and efficiency for critical environments.

- In 2024, Leoch introduced a high-temperature VRLA battery line capable of operating up to 65°C, expanding applications in harsh climates like the Middle East and Africa, a 10°C improvement over standard models. Leoch unveiled advancements in deep-cycle VRLA technologies for renewable integration, uninterrupted power, and smart energy management.

Report Scope

Report Features Description Market Value (2024) USD 20.9 billion Forecast Revenue (2034) USD 28.4 billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (AGM, Gel, Calcium, Others), By Capacity (Less than 50 Ah, 50 to 200 Ah, More than 200 Ah, Others), By Application (Stationary, Motive, SLI, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GS Yuasa International, Leoch International Technology, EXIDE INDUSTRIES, EnerSys, MUTLU, HOPPECKE Battery GmbH, Shandong Sacred Sun Power Sources, Clarios, Okaya Power, Microtex Energy Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Valve Regulated Lead Acid Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Valve Regulated Lead Acid Batteries MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GS Yuasa International

- Leoch International Technology

- EXIDE INDUSTRIES

- EnerSys

- MUTLU

- HOPPECKE Battery GmbH

- Shandong Sacred Sun Power Sources

- Clarios

- Okaya Power

- Microtex Energy