Global Vacuum Contactor Market Size, Share, And Business Benefits By Voltage (1-3.6 KV, 3.7-7.2 KV, 7.3-15 KV, Above 15 KV), By End Use (Utilities Sector, Industrial Sector, Commercial Sector, Mining Sector, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 160470

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Vacuum Contactor Market is expected to be worth around USD 8.1 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034. Rapid urbanization and energy infrastructure upgrades drive Asia Pacific’s 43.80% continued market expansion.

A vacuum contactor is an electrical switching device where the contacts make and break circuits inside a sealed vacuum chamber. Because the contacts are in a vacuum, arcs formed during switching are rapidly extinguished without external ionization, so wear and oxidation are greatly reduced. The device typically consists of an electromagnetic coil, armature, contact system, vacuum interrupter, and supporting housing.

The vacuum contactor market refers to the global demand, supply, technological development, and commercialization of these devices across various sectors—industrial, utilities, power distribution, motor control, renewable energy, infrastructure, and automation. It encompasses manufacturers, component suppliers, end users, and supporting services (design, maintenance). The market is influenced by trends in electrification, automation, infrastructure upgrades, and energy efficiency goals.

The vacuum contactor market benefits from rising electrification and automation in industries such as manufacturing, mining, water treatment, and transportation. As more systems adopt motor control, variable speed drives, and power factor correction, the need for reliable, fast, and low-maintenance switching devices grows. Also, stricter regulations on energy efficiency push toward devices that minimize losses and downtime.

Demand is fueled by infrastructure modernization and expansion, especially in emerging economies seeking stable and efficient power grids. The push for renewable energy integration (solar farms, wind farms) also drives demand because switching inverters, capacitors, and distribution lines requires high-quality contactors. In urbanization and smart grid projects, reliable switching is essential.

Opportunities lie in product innovation, digitalization (e.g,. smart contractors with monitoring), and emerging applications in energy storage, electric vehicle charging infrastructure, and microgrids. For instance, new funding rounds and investments may accelerate adoption—Economy Process Solutions raises $12 Mn in Series A, which could feed into advanced power systems; Vancouver city council approves an extra $22.5 M for a 25-meter pool, reflecting growing municipal infrastructure spending; and E-Vac’s South Carolina rare earth magnet factory is to get an $112 Mn IRA-funded tax credit, showing how supportive policies can stimulate related sectors.

Key Takeaways

- The Global Vacuum Contactor Market is expected to be worth around USD 8.1 billion by 2034, up from USD 4.5 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- In 2024, the 3.7–7.2 KV range dominated the Vacuum Contactor Market with 37.4%.

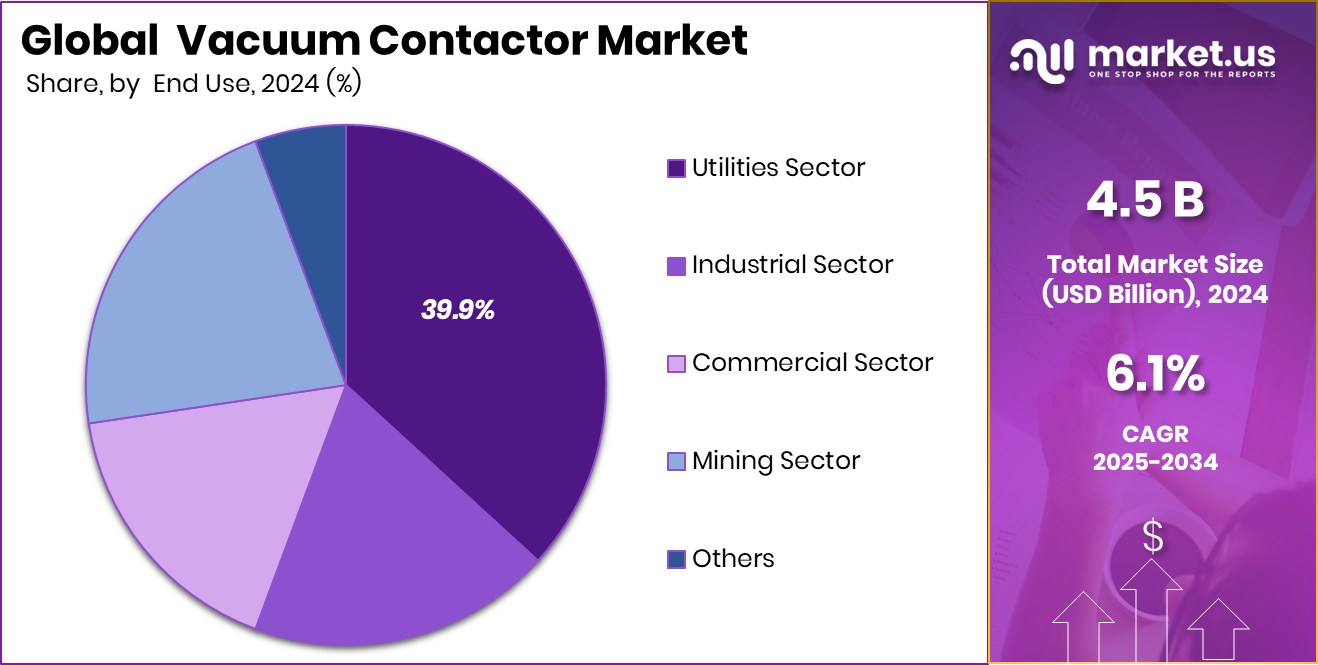

- The utilities sector held a 39.9% share in the global Vacuum Contactor Market in 2024.

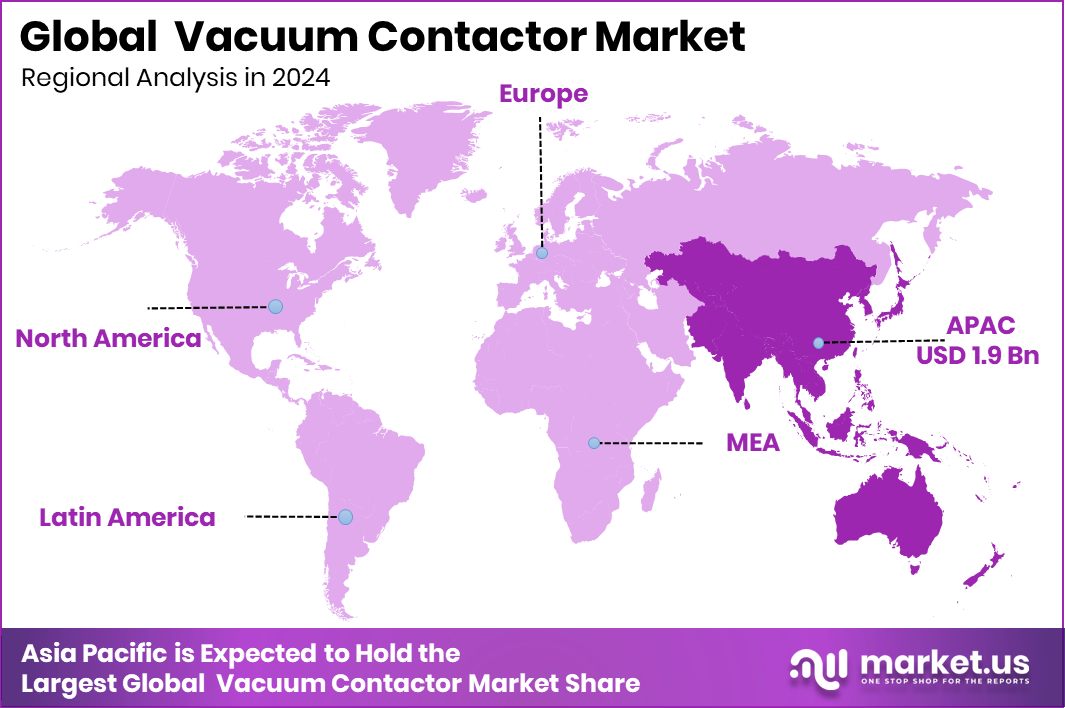

- The Asia Pacific market value reached USD 1.9 billion, showing strong industrial adoption.

By Voltage Analysis

In 2024, 3.7–7.2 KV dominated the Vacuum Contactor Market.

In 2024, 3.7–7.2 KV held a dominant market position in the By Voltage segment of the Vacuum Contactor Market, accounting for a 37.4% share. This voltage range is widely adopted in industrial and utility applications for switching and controlling medium-voltage motors, transformers, and capacitor banks. Its reliability and compact design make it suitable for frequent operations in manufacturing plants, power distribution systems, and renewable installations.

Growing investment in automation, infrastructure upgrades, and energy-efficient systems continues to support the demand for contactors within this voltage range. The ability of 3.7–7.2 KV units to provide safe, arc-free switching in compact enclosures further strengthens their preference across industrial and municipal power networks worldwide.

By End Use Analysis

The Utilities sector led the Vacuum Contactor Market with 39.9% share.

In 2024, the Utilities Sector held a dominant market position in the By End Use segment of the Vacuum Contactor Market, capturing a 39.9% share. Utilities rely heavily on vacuum contactors for controlling power distribution, protecting circuits, and ensuring stable grid operations. The growing focus on grid reliability, renewable integration, and modernization of substations has strengthened the adoption of these devices.

Utilities are increasingly replacing conventional air or oil contactors with vacuum-based systems for better efficiency, lower maintenance, and enhanced safety. The ongoing expansion of power infrastructure, combined with investments in smart grids and energy storage systems, continues to drive demand for vacuum contactors across the global utility landscape.

Key Market Segments

By Voltage

- 1-3.6 KV

- 3.7-7.2 KV

- 7.3-15 KV

- Above 15 KV

By End Use

- Utilities Sector

- Industrial Sector

- Commercial Sector

- Mining Sector

- Others

Driving Factors

Rising Electrification and Industrial Automation Boost Growth

One of the key driving factors for the Vacuum Contactor Market is the rapid rise in electrification and industrial automation. As industries modernize their operations, they require reliable and efficient switching devices to control motors, pumps, and power systems. Vacuum contactors provide arc-free, long-lasting performance, making them ideal for heavy-duty industrial applications. The expansion of smart manufacturing and renewable energy facilities is also increasing demand for advanced electrical control systems.

Additionally, government support for clean and efficient industrial technologies is contributing to growth. For instance, Edwards Vacuum landed $18 million in federal funding, which highlights rising investment in advanced vacuum technologies essential for energy-efficient and automated systems across multiple industrial sectors.

Restraining Factors

High Initial Costs and Complex Installation Process

A major restraining factor for the Vacuum Contactor Market is the high initial cost and complex installation process. Vacuum contactors, though efficient and durable, require specialized materials and manufacturing techniques that increase their overall price compared to traditional contactors. For small and medium enterprises or developing regions, this upfront investment can be difficult to justify, especially when budgets are tight.

Moreover, the installation process demands skilled technicians and precise setup to ensure reliable operation, adding further labor and maintenance expenses. These factors can slow adoption rates in cost-sensitive sectors, even when the long-term benefits are clear. The need for technical expertise and high capital outlay continues to limit wider market penetration.

Growth Opportunity

Expanding Renewable Energy and Grid Modernization Projects

A key growth opportunity for the vacuum contactor market lies in the expanding renewable energy and grid modernization projects worldwide. As countries transition toward clean energy, there is a strong push to integrate solar, wind, and energy storage systems into existing power networks. Vacuum contactors play a vital role in ensuring safe and efficient switching within these renewable grids. Their ability to handle frequent operations, reduce maintenance, and prevent arc faults makes them ideal for modern energy infrastructure.

Additionally, increased government and institutional support is accelerating this shift. For example, Senator Schumer helped secure an $18 million Edward Vacuum investment for WNY, highlighting growing regional funding for advanced electrical and vacuum technologies supporting clean energy systems.

Latest Trends

Adoption of Smart and Energy-Efficient Switching Systems

One of the latest trends in the vacuum contactor market is the growing adoption of smart and energy-efficient switching systems. Industries are increasingly integrating digital monitoring and control features into vacuum contactors to improve performance, reliability, and energy management. These intelligent systems help predict failures, optimize maintenance schedules, and ensure safer power distribution in real time.

The trend is also driven by the global move toward sustainable manufacturing and efficient energy use. Additionally, innovation and funding are supporting this shift, such as when a NE Ohio maker of a “wacky hair-drying vacuum” raised $9 million, reflecting how creative and technology-driven solutions in the vacuum space are attracting strong investment to enhance performance and sustainability.

Regional Analysis

In 2024, the Asia Pacific dominated the Vacuum Contactor Market with a 43.80% share.

In 2024, the Asia Pacific dominated the Vacuum Contactor Market, accounting for 43.80% share with a market value of USD 1.9 billion. The region’s leadership stems from rapid industrialization, strong investments in power infrastructure, and expanding renewable energy projects across China, India, Japan, and South Korea. Growing manufacturing activities and the electrification of transportation have further accelerated the adoption of medium-voltage switching systems.

North America follows with steady demand driven by the modernization of power grids, automation in industries, and energy efficiency regulations.

Europe maintains a strong market base supported by industrial retrofitting, smart grid programs, and sustainable energy integration.

Meanwhile, the Middle East & Africa region experiences growing adoption due to infrastructure expansion, oil and gas projects, and rising electricity demand. Latin America shows gradual market growth led by industrial automation and renewable installations in Brazil and Mexico.

Overall, Asia Pacific remains the key growth hub due to large-scale investments in urban infrastructure, renewable energy, and advanced power systems, positioning it as the most influential region shaping the global vacuum contactor market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Siemens leverages its broad electrical engineering portfolio to deliver vacuum contactors that integrate well with its existing switchgear and automation systems. Its strong R&D focus ensures innovations in compactness, energy efficiency, and compatibility with digital control. Siemens also benefits from its deep presence across regions, which helps it tailor products to local grid and industrial standards.

Schneider Electric positions itself around safety, lifecycle support, and system integration. Its vacuum contactor offerings are often bundled with services and protections, appealing to clients seeking low downtime and full-system reliability. Schneider’s strength in energy management enables it to cross-sell contactors alongside other infrastructure solutions, reinforcing long-term customer relationships.

ABB commands respect for its strong legacy in power systems and robust medium-voltage product lines. ABB’s vacuum contactors (such as its V-Contact series) are known for durability, modularity, and ease of retrofit in industrial and utility installations. The company’s focus on digital diagnostics and maintenance support helps it maintain competitiveness in demanding applications.

Top Key Players in the Market

- Siemens

- Schneider Electric

- ABB

- Eaton

- Mitsubishi Electric

- Hyundai Electric

- Toshiba

- Fuji Electric

- Reinhausen

- Yaskawa Electric

Recent Developments

- In August 2024, Schneider Electric launched a new “Easy TeSys” contactor range aimed at motor control applications (2.2 kW to 335 kW). The new range supports both AC and DC applications and includes QR codes for instant access to product documents.

- In June 2024, Siemens’ documentation lists a “vacuum contactor- & fuse-combination” product as part of its medium-voltage portfolio, confirming it continues to develop combined switching technologies.

Report Scope

Report Features Description Market Value (2024) USD 4.5 Billion Forecast Revenue (2034) USD 8.1 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Voltage (1-3.6 KV, 3.7-7.2 KV, 7.3-15 KV, Above 15 KV), By End Use (Utilities Sector, Industrial Sector, Commercial Sector, Mining Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Siemens, Schneider Electric, ABB, Eaton, Mitsubishi Electric, Hyundai Electric, Toshiba, Fuji Electric, Reinhausen, Yaskawa Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vacuum Contactor MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Vacuum Contactor MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens

- Schneider Electric

- ABB

- Eaton

- Mitsubishi Electric

- Hyundai Electric

- Toshiba

- Fuji Electric

- Reinhausen

- Yaskawa Electric