Global Trisodium Phosphate Market Size, Share, And Business Benefits By Grade (Industrial Grade, Chemical Grade, Others), By End-Use (Chemical and Beverage, Chemical, Textile, Water Treatment, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161664

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

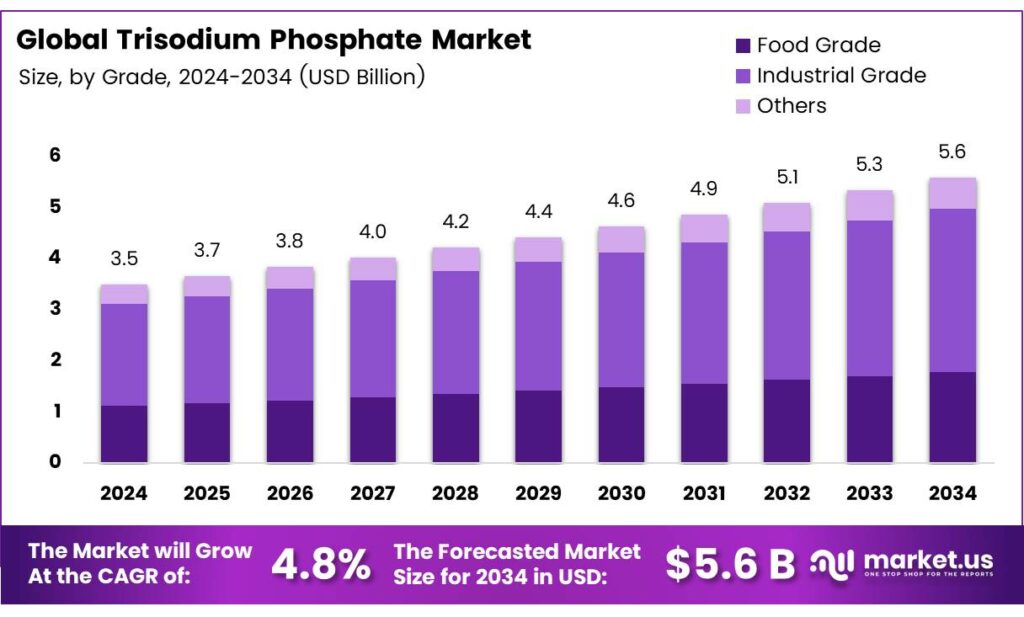

The Global Trisodium Phosphate Market size is expected to be worth around USD 5.6 billion by 2034, from USD 3.5 billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Trisodium phosphate (TSP) is an inorganic compound characterized by its white, granular, or crystalline solid form. It is highly soluble in water, producing an alkaline solution. TSP is synthesized through the neutralization of phosphoric acid using sodium hydroxide and sodium carbonate. Available in both anhydrous and crystalline forms, TSP is manufactured in industrial and pure grades to meet various application needs. Its versatility makes it a valuable compound in multiple industries.

The anhydrous form of trisodium phosphate has the molecular formula Na₃PO₄ and a molecular weight of 164. It appears as a white fine powder with a minimum purity of 98%, a pH range of at least 11.5 (1% w/v solution), a minimum P₂O₅ content of 41%, and a minimum sodium content of 41%. Impurities are minimal, with iron (Fe) content at 0.02%, chloride (Cl) content at 0.2%, and sulfate (SO₄) content at 0.03%.

The crystalline form, with the molecular formula Na₃PO₄·12H₂O and a molecular weight of 380, appears as white crystals. It shares similar specifications, including a minimum purity of 98%, a pH range of at least 11.5, but has a lower P₂O₅ content of 18% and sodium content of 17%, with the same impurity levels as the anhydrous form. Additional specifications for the crystalline form include a P₂O₅ content range of 18.5–22.0%, loss on drying less than 58%, and insoluble matter at 0.025%.

Trisodium phosphate is widely used across various applications, with its primary role being in cleaning agents due to its alkaline properties. It is also employed in photographic developers, sugar clarification, and the removal of boiler scale. Additionally, TSP finds use in paper manufacturing, water softening, and leather tanning. Its effectiveness in these applications stems from its ability to act as a strong base and its solubility in water.

The compound is packaged in HDPE bags with LDPE liners, available in sizes of 20 kg, 25 kg, 40 kg, and 50 kg, or customized to meet customer requirements. As a prominent manufacturer, distributor, wholesaler, trader, and supplier, we ensure that our trisodium phosphate crystals are processed with high-quality chemical compounds under strict quality control. The offered crystals are appreciated for their premium quality and are available in various grades and packaging options to meet diverse customer needs.

Key Takeaways

- The Global Trisodium Phosphate Market is expected to reach USD 5.6 billion by 2034 from USD 3.5 billion in 2024, with a CAGR of 4.8%.

- Industrial Grade dominated in 2024, holding a 57.3% market share, used in water treatment, detergents, and metal cleaning.

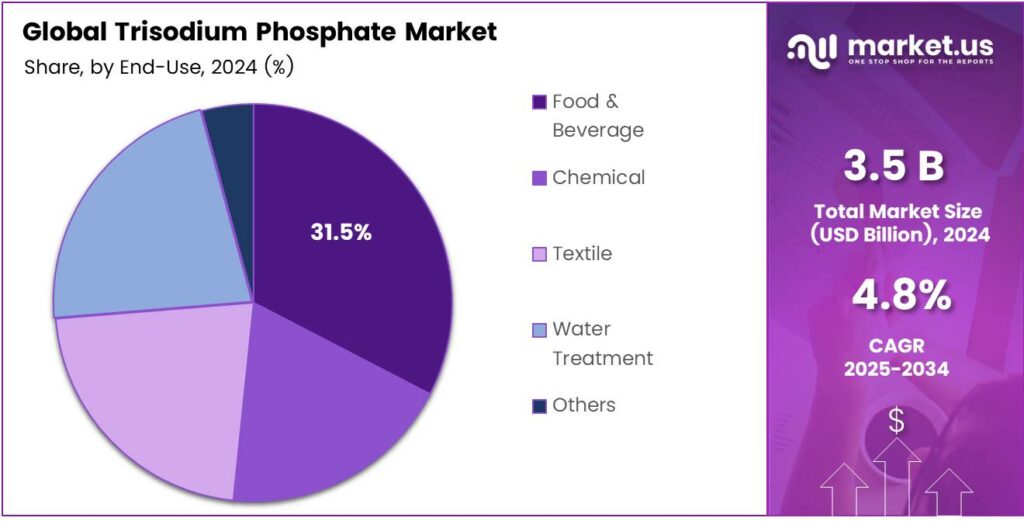

- The Food and Beverage segment led in 2024 with a 31.5% share, vital for acidity regulation and texture stabilization.

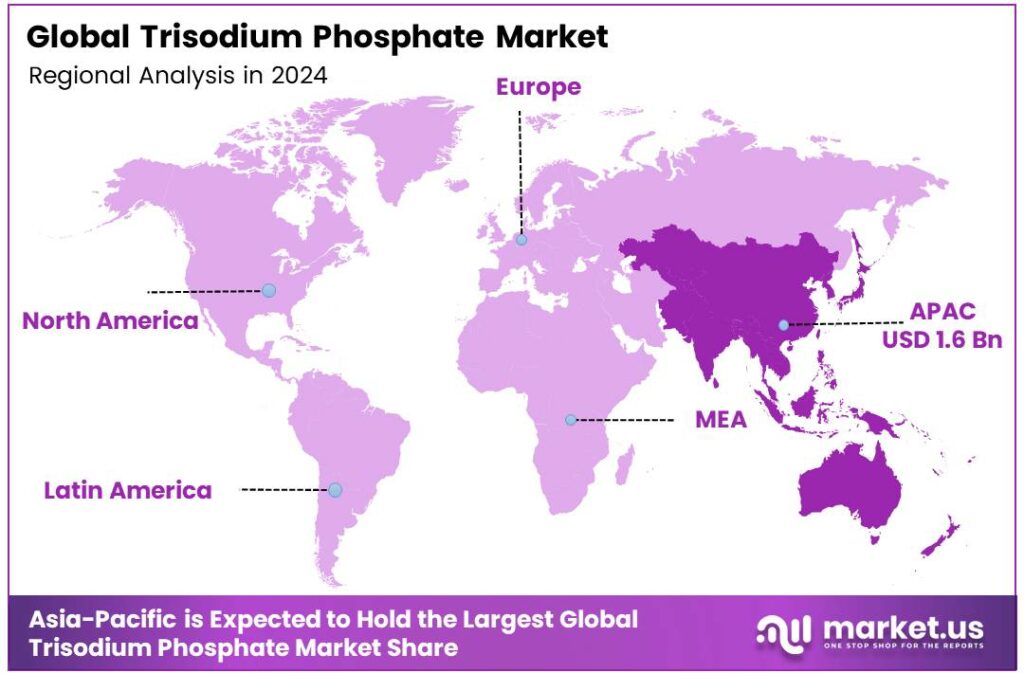

- The Asia-Pacific region held a 46.9% market share in 2024, valued at USD 1.6 billion, driven by strong industrial and food processing sectors.

By Grade

Industrial Grade Leads Trisodium Phosphate Market with 57.3% Share in 2024

In 2024, Industrial Grade held a dominant market position, capturing more than a 57.3% share in the global trisodium phosphate market. This grade was widely used across water treatment plants, detergents, metal cleaning, and surface preparation industries. Its ability to act as an effective degreaser and emulsifier made it the preferred choice among industrial users.

The year also saw increased demand from construction chemicals and textile processing, especially in emerging Asian economies, where manufacturing output expanded strongly. Industrial-grade trisodium phosphate continued to play a vital role in improving production efficiency and maintaining product quality across multiple industrial processes.

Growth is particularly visible in wastewater treatment and surface cleaning sectors, driven by stricter hygiene and environmental compliance standards. The compound’s cost-effectiveness compared to alternatives supports its steady usage in detergent formulations and industrial cleaners. Several small and medium-scale manufacturers in China, India, and Southeast Asia have been expanding their production capacity to meet growing domestic and export demand.

By End-Use

Food & Beverage Segment Captures 31.5% Share in 2024

In 2024, the Food and Beverage segment held a dominant market position, capturing more than a 31.5% share of the global trisodium phosphate market. The compound was widely used as a food additive for regulating acidity, stabilizing texture, and improving moisture retention in processed meat, bakery, and dairy products. Its strong buffering and emulsifying properties made it essential in large-scale food manufacturing, particularly for maintaining quality during storage and transportation.

The growing trend toward packaged and ready-to-eat foods in North America, Europe, and Asia further strengthened its demand throughout 2024. The Food and Beverage end-use segment is expected to sustain steady growth, supported by the rising global consumption of processed foods and beverages. Manufacturers are increasingly using trisodium phosphate to ensure product consistency and safety across extended supply chains.

Food regulatory agencies have been emphasizing controlled usage levels, prompting producers to adopt cleaner formulations while retaining the compound’s performance benefits. The steady rise in commercial food processing and frozen meal production, particularly in developing markets like India, Indonesia, and Brazil, continues to drive the segment forward.

Key Market Segments

By Grade

- Industrial Grade

- Food Grade

- Others

By End-Use

- Food and Beverage

- Chemical

- Textile

- Water Treatment

- Others

Drivers

Surge in Water & Wastewater Treatment Applications

One of the major driving factors for the growth of trisodium phosphate is its increasing use in water and wastewater treatment. In many industries and municipalities, there is growing pressure to meet stricter regulatory limits on phosphorus, heavy metals, and organic contaminants in effluents. Trisodium phosphate (TSP) acts as a pH buffer, a chelating agent, and a precipitation aide, making it effective in adjusting water chemistry and helping remove impurities.

In recent years, many governments and environmental agencies have strengthened their rules around nutrient pollution. For instance, the U.S. Environmental Protection Agency (EPA) continues its efforts to reduce nitrogen and phosphorus pollution in water bodies, pushing utilities to upgrade treatment processes. With such policies in place, municipal wastewater plants and industrial effluent systems are increasingly adopting chemical treatment agents, including phosphate-based ones.

To give a number from trusted sources: phosphate rock production worldwide rose modestly by 0.6% annually between 2019 and 2024, driven largely by downstream needs such as fertilizer and chemical production, including water-treatment chemicals. Moreover, about 95% of phosphate rock mined in the U.S. is used for fertilizer and related chemical production, leaving a significant but limited fraction for industrial uses like water treatment.

Restraints

Regulatory pressure on phosphates is squeezing Trisodium Phosphate demand

A clear restraint for trisodium phosphate (TSP) is the global push to curb phosphate releases into water. Regulators tightened the rules on phosphorus in detergents, one of TSP’s key downstream uses, because excess nutrients fuel algal blooms and degrade lakes and rivers. In the European Union, lawmakers amended the Detergents Regulation to cap phosphorus in consumer laundry and automatic dishwasher detergents, effectively eliminating traditional phosphate-based formulations from store shelves.

The U.S. EPA cites analyses estimating at least $2.4 billion per year in freshwater damages from nitrogen and phosphorus pollution, strengthening the policy case for continued restrictions and enforcement. These costs show up in lost recreation, property values, and the need for more treatment—an environment where regulators are unlikely to relax phosphate rules that would otherwise support TSP sales.

Internationally, the UN Environment Programme has called for a 50% cut in global phosphorus pollution by 2050, alongside a massive boost in phosphorus recycling. This long-term signal encourages detergent and food processors to design out added phosphorus where possible and invest in alternatives, locking in structural headwinds for TSP across consumer and some industrial channels.

Opportunity

Rising Demand from Cleaning & Detergent Industries

Trisodium phosphate (TSP) demand grows due to its use in industrial cleaners, detergents, and degreasing agents. Despite regulations limiting phosphates in consumer detergents, TSP remains vital in heavy-duty cleaning and industrial processes. Its strong cleaning, buffering, and emulsification properties drive its market. Growth continues as industries rely on TSP’s effectiveness.

Trisodium phosphate (TSP) remains essential in metal processing, pulp and paper, and institutional cleaning due to its effective grease removal, pH control, and soil removal enhancement. Global phosphate chemical production continues at a significant scale, driven by sustained demand across various applications.

Global P₂O₅ consumption for fertilizers grew from 45.8 million to 47.5 million tonnes between 2023 and 2024, per USGS estimates, reflecting a rising trend in the phosphate sector. The International Fertilizer Association reports that industrial uses account for 11 Mt P₂O₅ demand. Increasing phosphate rock production supports both fertilizer and non-fertilizer applications. This growth ensures a stable supply for industrial segments.

Trends

Shift Toward Circular Phosphorus Economy

One promising emerging driver for trisodium phosphate is the global movement toward phosphorus recovery and circular nutrient use. As raw phosphate rock reserves face pressure, researchers and policymakers are pushing technologies that recycle phosphorus from waste streams, sewage sludge, agricultural runoff, or food waste and reincorporate it into chemical and fertilizer supply chains.

From a technical standpoint, studies suggest ambitious recovery targets are feasible: Scientists aim for phosphorus recovery rates between 65% and 85% from sewage sludge by 2030. As recovery scales, more recycled phosphates might enter markets that were traditionally dominated by mineral-derived chemicals. This trend could expand or transform demand for TSP, either by competing with it or complementing it in blended formulations.

Already, a noteworthy statistic underscores the potential: nearly 98% of phosphorus consumed in urban areas ends up in sewage sludge. If recovery infrastructure matures, much of this P could re-enter industrial processes rather than being lost. In France, though 75% of sewage sludge is spread on farmland, only about 50% of excreted phosphorus returns to soils in practice; the rest is lost to waterways or waste.

Regional Analysis

Asia-Pacific leads with a 46.9% share and a USD 1.6 Billion market value.

The Asia-Pacific region emerged as the dominant market in the global Trisodium Phosphate (TSP) landscape, accounting for a substantial 46.9% share and a valuation of USD 1.6 billion in 2024. This dominance is primarily attributed to the region’s strong industrial base, extensive use in food processing, detergents, and water treatment sectors, and robust chemical manufacturing capacities across China, India, and Japan.

The growing demand for TSP as a cleaning and degreasing agent in industrial and household applications continues to strengthen regional growth. China holds the largest contribution, driven by high phosphate rock production and government-backed initiatives for sustainable phosphate chemical production under its 14th Five-Year Plan.

India and Southeast Asian nations are rapidly expanding their use of TSP in food preservation and water treatment applications due to rising urbanization and improved sanitation infrastructure. The region’s flourishing construction and metal treatment sectors, supported by increasing infrastructure spending, also enhance the adoption of trisodium phosphate-based cleaning and surface-preparation solutions.

Policy initiatives like India’s National Clean Water Program and China’s Green Manufacturing drive demand for eco-friendly cleaning formulations and wastewater treatment. Expanding food-grade and technical-grade TSP production, affordable raw materials, industrialization, rising detergent exports, and advanced phosphate chemistry R&D solidify Asia-Pacific’s market leadership.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aditya Birla Chemicals leverages extensive manufacturing capabilities and a robust supply chain. Its strength lies in vertical integration and a diverse product portfolio that serves multiple industrial sectors. The company’s significant market share is reinforced by strong brand recognition and a commitment to large-scale, cost-effective production. This allows it to cater to bulk demand consistently, making it a cornerstone supplier in the global trisodium phosphate market and a key competitor for major contracts.

Recochem Corporation is a leading North American supplier known for its extensive distribution network and focus on consumer and industrial chemical solutions. The company excels in branding, packaging, and marketing trisodium phosphate for applications like cleaning agents and automotive products. Its strength is making TSP accessible through retail and wholesale channels, effectively serving both professional and DIY markets.

Chem One Ltd. specializes in high-purity industrial chemicals, including trisodium phosphate. The company’s strategy focuses on quality assurance, reliable sourcing, and serving business-to-business clients in sectors like water treatment and metal finishing. Its role is often that of a strategic partner, providing consistent quality and tailored supply chain solutions. This technical and service-oriented approach secures its position as a trusted intermediary for industrial-grade TSP.

Ixom holds a commanding presence in its regional market for trisodium phosphate. It leverages strong local manufacturing, blending facilities, and a comprehensive distribution infrastructure. Ixom’s expertise lies in providing tailored chemical solutions for water treatment, food processing, and industrial cleaning across Australia and New Zealand. Its deep understanding of regional regulations and customer needs makes it the de facto market leader and a critical supplier within the Australasian region.

Top Key Players in the Market

- Aditya Birla Chemicals

- Recochem Corporation

- Chem One Ltd.

- Ixom

- Chemfax

- Albright and Wilson

- SundiaShifang Juyuan Chemical

- FBC

Recent Developments

- In 2024, Aditya Birla Chemicals, a major player in phosphates, announced a significant expansion in early 2024 to bolster its TSP and related production. The company invested $50 million in a new U.S.-based manufacturing and R&D facility dedicated to phosphates, including TSP variants for food-grade and industrial uses.

- In 2024, Recochem Corporation, known for its multi-grade TSP portfolios in cleaning and industrial applications, has focused on supply chain enhancements in 2024–2025 rather than major TSP-specific expansions. The company strengthened its distribution network for phosphate products, including audit-ready TSP documentation for North American industrial clusters.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Billion Forecast Revenue (2034) USD 5.6 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Industrial Grade, Food Grade, Others), By End-Use (Food and Beverage, Chemical, Textile, Water Treatment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aditya Birla Chemicals, Recochem Corporation, Chem One Ltd., Ixom, Chemfax, Albright and Wilson, SundiaShifang Juyuan Chemical, FBC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Trisodium Phosphate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Trisodium Phosphate MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aditya Birla Chemicals

- Recochem Corporation

- Chem One Ltd.

- Ixom

- Chemfax

- Albright and Wilson

- SundiaShifang Juyuan Chemical

- FBC