Global Thyroid Function Test Market By Test Type (TSH Test, T3 Test, T4 Test, and Others), By End-user (Hospitals, Clinics, Diagnostic Laboratories, and Research Laboratories & Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170226

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

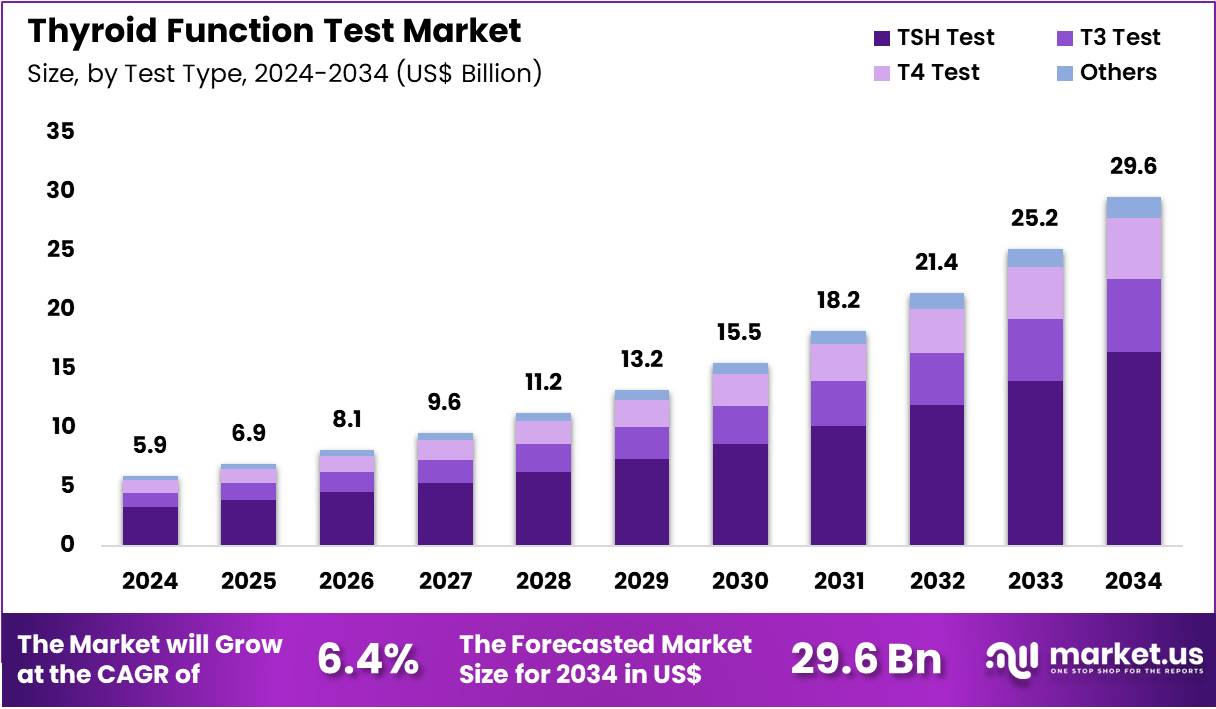

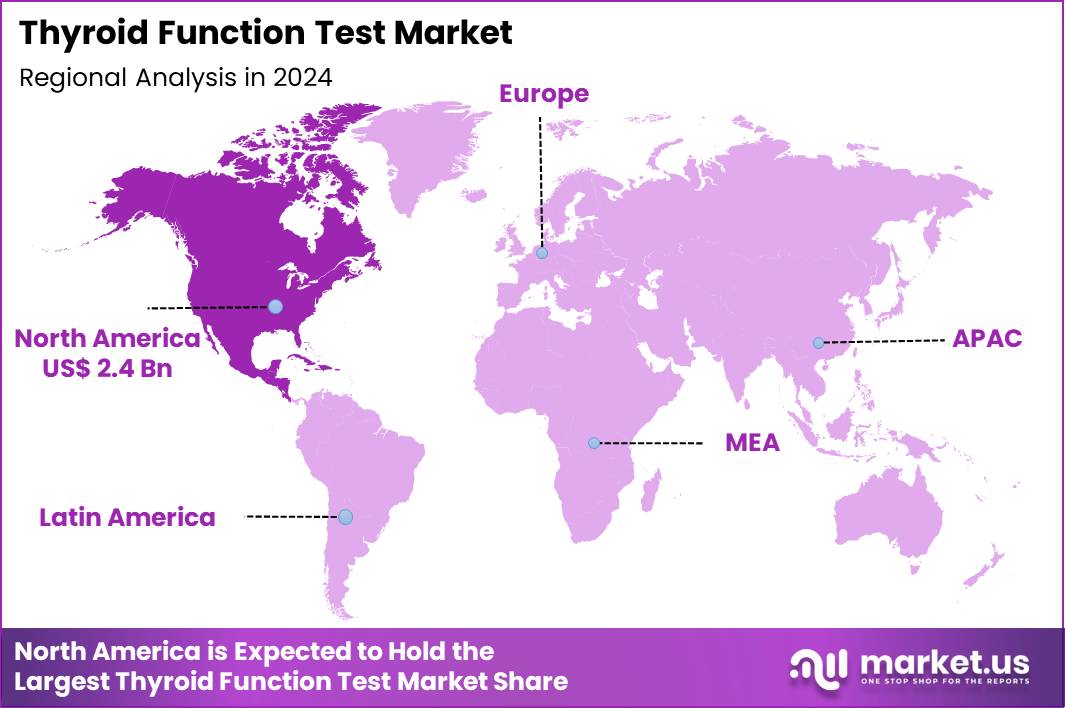

The Global Thyroid Function Test Market size is expected to be worth around US$ 29.6 Billion by 2034 from US$ 5.1 Billion in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 2.4 Billion.

Increasing prevalence of autoimmune thyroid disorders drives the Thyroid Function Test market, as endocrinologists require precise antibody profiling to differentiate Hashimoto’s thyroiditis from other causes of hypothyroidism. Diagnostic manufacturers advance chemiluminescent immunoassays that quantify thyroglobulin antibodies alongside anti-thyroid peroxidase levels with minimal interference.

These tests enable early detection of autoimmune aggression in subclinical hypothyroidism, monitoring of disease activity during pregnancy to predict postpartum thyroiditis, differentiation of Graves’ disease from toxic nodular goiter, and therapeutic response assessment in patients on immunomodulatory treatments. Regulatory clearances expand clinical confidence in specialized assays, creating opportunities for comprehensive autoimmune panels.

In September 2023, Beckman Coulter received FDA 510(k) clearance for its Access Thyroglobulin Antibody II assay, providing reliable measurement in serum and plasma to support accurate Hashimoto’s diagnosis and management. This approval strengthens diagnostic precision and accelerates adoption in routine thyroid evaluation protocols.

Growing demand for neonatal screening programs accelerates the Thyroid Function Test market, as public health authorities mandate universal TSH testing to prevent intellectual disability from congenital hypothyroidism. Laboratories deploy high-throughput automated platforms that process dried blood spot samples with exceptional sensitivity for elevated TSH and low T4 values.

Applications encompass mandatory newborn screening within 48 hours of birth, follow-up confirmatory testing for borderline results, congenital hypothyroidism subtype classification through TBG measurement, and central hypothyroidism identification via TRH stimulation challenges. Enhanced screening coverage opens avenues for genetic counseling in familial cases and long-term developmental tracking. Pediatric endocrinologists increasingly integrate these tests with growth monitoring to optimize levothyroxine dosing from infancy.

Rising adoption of free hormone measurements invigorates the Thyroid Function Test market, as clinicians favor direct quantification of unbound T3 and T4 to overcome limitations of total hormone assays in altered binding protein states. Technology providers launch equilibrium dialysis methods and analog immunoassays calibrated against gold-standard techniques.

These precise tools support critical illness evaluation where reverse T3 predominates, pregnancy management requiring trimester-specific free T4 reference ranges, oral contraceptive impact assessment on thyroid binding globulin, and non-thyroidal illness syndrome differentiation from true hypothyroidism. Advanced methodologies create opportunities for personalized dosing algorithms in elderly patients with comorbidities. Collaborative guidelines actively endorse free hormone testing as the preferred approach in complex clinical scenarios. This analytical evolution establishes superior accuracy as the standard in modern thyroid diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.1 Billion, with a CAGR of 6.4%, and is expected to reach US$ 29.6 Billion by the year 2034.

- The test type segment is divided into TSH test, T3 test, T4 test, and others, with TSH test taking the lead in 2024 with a market share of 55.6%.

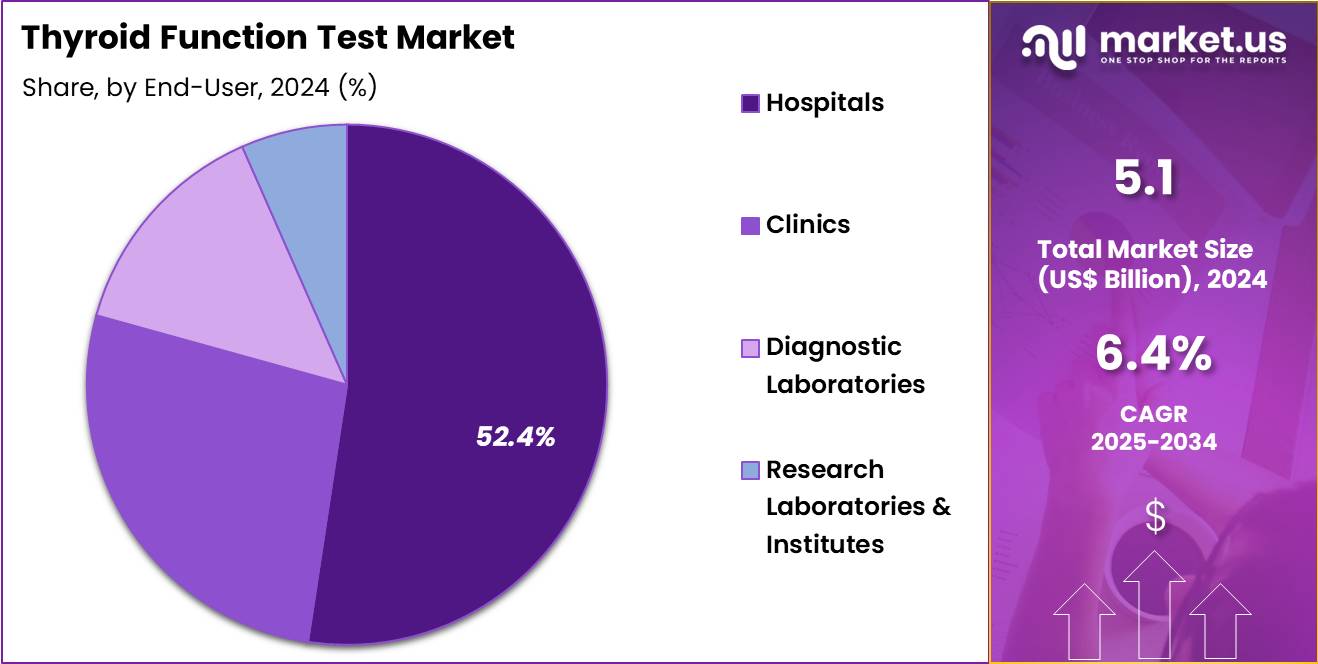

- Considering end-user, the market is divided into hospitals, clinics, diagnostic laboratories, and research laboratories & institutes. Among these, hospitals held a significant share of 52.4%.

- North America led the market by securing a market share of 41.1% in 2024.

Test Type Analysis

TSH Test, holding 55.6%, is expected to dominate due to its critical role in diagnosing thyroid dysfunction, particularly in conditions like hypothyroidism and hyperthyroidism. TSH is the most commonly used biomarker to assess thyroid function because it provides a direct indication of thyroid-stimulating hormone levels in the blood, offering a reliable diagnostic tool for endocrinologists. The rising prevalence of thyroid disorders, especially in women and the elderly, strengthens the demand for TSH testing.

Advances in test sensitivity and automation further support its adoption across clinical and laboratory settings. Healthcare providers often use TSH testing as part of routine health check-ups, leading to its frequent use. As awareness of thyroid health continues to grow, both in preventive care and disease management, the demand for TSH tests is projected to increase. These factors keep the TSH test anticipated to remain the most influential test type in the thyroid function test market.

End-User Analysis

Hospitals, holding 52.4%, are expected to remain the dominant end-user segment due to their central role in managing and diagnosing thyroid disorders. Hospitals perform a high volume of thyroid function tests, including TSH, T3, and T4 assays, as part of routine diagnostic and health check-up programs. The increasing incidence of thyroid diseases in the general population, especially autoimmune thyroid disorders, leads to more hospital-based testing.

Hospitals also play a critical role in the early detection of thyroid dysfunctions, which require ongoing monitoring. The adoption of automated diagnostic platforms in hospitals improves the efficiency and accuracy of thyroid testing, further increasing demand. Collaboration between hospital endocrinologists and laboratory departments ensures consistent testing for thyroid function across patient care.

Growing healthcare infrastructure in developing regions strengthens the hospital-based diagnostic testing market. These drivers ensure hospitals remain the leading end-user segment in the thyroid function test market.

Key Market Segments

By Test Type

- TSH Test

- T3 Test

- T4 Test

- Others

By End‑user

- Hospitals

- Clinics

- Diagnostic Laboratories

- Research Laboratories & Institutes

Drivers

The Rising Prevalence of Thyroid Disorders Among Adults Is Driving the Market

The rising prevalence of thyroid disorders among adults has established itself as a principal driver for the thyroid function test market, as it escalates the imperative for regular screening and monitoring to mitigate associated health risks. Thyroid dysfunction, encompassing hypothyroidism and hyperthyroidism, manifests through symptoms such as fatigue and weight fluctuations, necessitating biochemical confirmation via TSH and free T4 assays. This upward trajectory correlates with demographic shifts, including an expanding geriatric cohort susceptible to autoimmune etiologies.

In the United States, an estimated 11.6 million adults were diagnosed with autoimmune thyroid disease based on data from the 2007-2012 National Health and Nutrition Examination Survey, with projections indicating sustained stability into recent years. Such figures compel healthcare systems to integrate thyroid panels into preventive protocols, amplifying test volumes in outpatient settings. Key diagnostic firms are enhancing assay throughput to accommodate heightened demand, ensuring scalability across laboratories.

Public health endorsements further propel utilization, as early detection averts complications like cardiovascular sequelae. The economic rationale supports this momentum, with untreated disorders incurring substantial long-term expenditures on secondary care. As awareness permeates primary care, the market experiences fortified growth through standardized testing cascades. This driver ultimately cements thyroid function tests as integral to endocrine health management.

Restraints

Stringent Reimbursement Criteria for Routine Screening Are Restraining the Market

Stringent reimbursement criteria for routine thyroid function screening persist as a notable restraint on the thyroid function test market, curtailing expansion in asymptomatic populations despite clinical advocacy. Payers, including Medicare, confine coverage to instances of documented symptoms or risk factors, eschewing broad prophylactic applications. This limitation fosters underutilization in wellness programs, where cost-benefit analyses often deem population-level testing uneconomical.

The U.S. Preventive Services Task Force’s 2015 recommendation, reaffirmed through 2024 without alteration, deems evidence insufficient for routine screening in nonpregnant adults, influencing policy adherence. Consequently, providers encounter denials for TSH-only requests absent compelling indications, impeding preventive diagnostics. Resource allocation skews toward acute evaluations, sidelining innovative formats like point-of-care devices in non-reimbursed contexts.

Disparities emerge in underserved demographics, where financial barriers exacerbate delayed interventions. Educational initiatives to refine ordering practices clash with fiscal conservatism, prolonging this constraint. Market participants grapple with fluctuating volumes, as seasonal or episodic demands eclipse steady screening flows. Mitigating this restraint hinges on evolving evidence to sway reimbursement paradigms toward inclusive coverage.

Opportunities

Innovations in High-Sensitivity TSH Assays Are Creating Growth Opportunities

Innovations in high-sensitivity TSH assays are forging considerable growth opportunities within the thyroid function test market by elevating diagnostic precision and facilitating nuanced subclinical detection. These advancements refine reference intervals, distinguishing mild perturbations from overt pathology with enhanced analytical specificity. Integration of chemiluminescent platforms enables quantification across broader dynamic ranges, ideal for longitudinal monitoring in at-risk cohorts. Such refinements align with precision medicine tenets, permitting tailored interventions that optimize therapeutic adherence.

Opportunities manifest in ambulatory settings, where compact analyzers expedite results, streamlining workflows amid rising caseloads. Collaborations with regulatory bodies expedite validations, ensuring interoperability with electronic health records for seamless data exchange. Emerging economies stand to gain from cost-optimized variants, bridging infrastructural divides in endocrine care.

Validation cohorts demonstrate correlation coefficients surpassing 0.98 against predicate methods, instilling clinician confidence. As multiplex configurations evolve, concurrent assessment of autoantibodies expands utility, capturing autoimmune precursors. These innovations collectively herald a paradigm of proactive, equitable thyroid surveillance.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors propel the Thyroid Function Test market forward through surging healthcare expenditures and an expanding geriatric population, which heighten demand for routine screenings amid rising thyroid disorder prevalence. Companies in this sector actively capitalize on these trends by investing in automated lab technologies that enhance test accuracy and efficiency. However, economic downturns and inflation squeeze budgets, forcing providers to cut back on non-essential diagnostics and delaying equipment upgrades.

Geopolitical tensions, including ongoing conflicts and trade restrictions, disrupt global supply chains for reagents and instruments, leading manufacturers to face delays and higher procurement costs. Current US tariffs on imported diagnostic reagents, implemented in 2025, exacerbate these challenges by inflating operational expenses for labs reliant on foreign components, potentially sparking shortages and reduced market accessibility.

These tariffs also prompt some suppliers to pass costs to end-users, straining affordability in price-sensitive regions. On the positive side, such pressures accelerate innovation as firms develop domestic alternatives and AI-driven platforms that lower long-term costs.

Latest Trends

The FDA Clearance of Roche’s Elecsys TSH Assay in 2022 Is a Recent Trend

The FDA clearance of Roche Diagnostics’ Elecsys TSH immunoassay in June 2022 delineates a salient recent trend toward ultrasensitive, automated thyroid function evaluation. This assay, integrated into the cobas e immunoassay family, delivers results within 18 minutes, bolstering efficiency in high-throughput laboratories. Its measuring range spans 0.005 to 100 mIU/L, accommodating diverse clinical scenarios from subclinical states to therapeutic oversight.

The clearance affirms substantial equivalence to established benchmarks, with intra-assay precision below 3% across concentrations. This development underscores a pivot to modular systems that consolidate workflows, mitigating operator variability. Early adoptions in U.S. facilities report amplified panel completions, aligning with surging diagnostic mandates.

The trend dovetails with broader immunoassay evolutions, incorporating anti-interference enhancements for reliable outcomes in complex matrices. Roche’s strategic rollout extends to integrated healthcare networks, fostering adoption in integrated delivery systems. Post-clearance analyses validate its role in refining subclinical hypothyroidism thresholds, informing guideline updates. Collectively, this 2022 milestone accentuates the trajectory toward streamlined, insightful thyroid diagnostics.

Regional Analysis

North America is leading the Thyroid Function Test Market

North America accounted for 41.1% of the overall market in 2024, and the region saw robust growth as healthcare providers expanded diagnostic testing for thyroid disorders, particularly hypothyroidism and hyperthyroidism, among high-risk populations. Increased awareness about the role of thyroid health in overall well-being led to more frequent screenings, especially in older adults and women, who are more susceptible to thyroid imbalances.

Clinics and laboratories enhanced their use of comprehensive thyroid panels, which include TSH, T3, and T4 tests, to diagnose and monitor thyroid function. The Centers for Disease Control and Prevention (CDC) estimates that 20 million Americans have some form of thyroid disease, with up to 60% unaware of their condition (CDC – “Thyroid Disease 2023”). This large undiagnosed population contributed to the growing demand for thyroid function tests. Additionally, the rise in autoimmune diseases such as Hashimoto’s thyroiditis further increased the need for reliable thyroid diagnostics, supporting market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience steady growth during the forecast period as healthcare systems across the region increase focus on thyroid health, driven by rising awareness of thyroid dysfunction, particularly in countries with large at-risk populations like India and China. Clinical labs and hospitals expand their diagnostic services to detect thyroid disorders early, especially as urbanization and changing lifestyles contribute to increased cases of thyroid disease.

Public-health campaigns in countries like India aim to increase awareness of thyroid diseases and the importance of early testing. The Indian Thyroid Society reported that 42 million people in India suffer from thyroid disorders, with a significant percentage remaining undiagnosed (ITS – “Thyroid Disorders in India 2023”). This substantial burden in a densely populated country is a key driver for increased adoption of thyroid function tests. Improved access to healthcare facilities and diagnostic tools is expected to propel market growth throughout the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading suppliers in the thyroid‑function diagnostics sector pursue growth by expanding hormone assay portfolios to cover TSH, free T4, free T3 and related parameters this approach helps labs and clinics offer comprehensive endocrine screening under one contract. They invest in automated immunoassay platforms and high‑throughput analyser systems that deliver fast turnaround and consistent result quality, enabling clinics and diagnostic chains to scale volume while controlling operational costs.

They increase geographic reach by partnering with local distributors and medical laboratories in emerging markets, tailored to rising prevalence of thyroid disorders and growing awareness of thyroid health. They strengthen their reputation by obtaining regulatory certifications, publishing diagnostic accuracy data, and aligning their offerings with international thyroid‑disorder screening guidelines to build clinician and patient trust.

They integrate diagnostic services with preventive‑health and wellness checks and collaborate with public‑health initiatives to encourage early detection and recurring testing cycles. One leading company, Abbott Laboratories, builds on its global diagnostics footprint, offers a wide portfolio of sensitive hormone assays and leverages automated diagnostics infrastructure and strong lab partnerships to deliver reliable thyroid‑function testing services across diverse healthcare settings worldwide.

Top Key Players

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- In February 2025, the Union Health Ministry in a major Asian country launched an Intensified Special Non-Communicable Disease (NCD) Screening Drive aimed at individuals aged 30 and older. This initiative now includes Thyroid Function Tests (TFTs) to help address the widespread prevalence of NCDs in the region.

- In August 2024, Siemens Healthineers unveiled the Atellica CI Analyzer at a leading diagnostic laboratory in a key emerging market. This advanced system performs a wide range of tests, including TFTs, utilizing microvolume technology to improve diagnostic efficiency and support the growth of high-throughput laboratories.

Report Scope

Report Features Description Market Value (2024) US$ 5.1 Billion Forecast Revenue (2034) US$ 29.6 Billion CAGR (2025-2034) % Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (TSH Test, T3 Test, T4 Test, and Others), By End-user (Hospitals, Clinics, Diagnostic Laboratories, and Research Laboratories & Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, Inc., DiaSorin S.p.A., Danaher Corporation, Bio‑Rad Laboratories, Inc., Ortho Clinical Diagnostics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Thyroid Function Test MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Thyroid Function Test MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Thermo Fisher Scientific, Inc.

- DiaSorin S.p.A.

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics