Global Textured Vegetable Protein Market Size, Share, And Business Benefits By Product Type (Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Faba Bean Protein, Lentil Protein, Flax Protein, Chia Protein), By Nature (Conventional, Organic), By Form (Granules, Flakes, Chunks, Others), By End User (Business to Business, Business to Consumer), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 165054

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

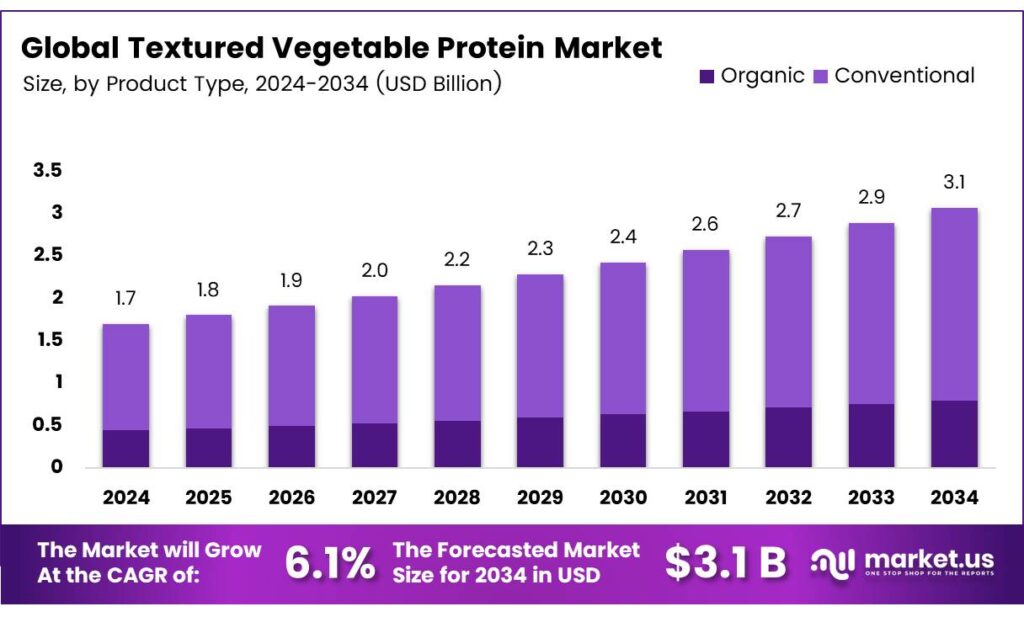

The Global Textured Vegetable Protein Market size is expected to be worth around USD 3.1 billion by 2034, from USD 1.7 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

Textured vegetable protein (TVP) is a dehydrated product crafted from blends of vegetable proteins, such as coconut protein and mung bean flour. It boasts excellent rehydration properties and a porous structure, with a protein content of around 49%. TVP transforms flour-like materials into meat-like textures, delivering chewiness and a fibrous character. These food products, made from edible protein sources, maintain structural integrity and identifiable texture, even after hydration in cooking or other preparation methods.

TVPs have become highly trendy, thanks to their fibrous structure. They serve as authentic, healthy substitutes for fish and meat, especially in vegetarian and vegan dishes. Partnering with experts enables the development and production of sustainable meat alternatives in CO2-neutral facilities powered by 100% green electricity. Soy and pea proteins are classified as flours, concentrates, and isolates based on dry-weight protein content 50%, 70%, and 90%, respectively, along with textured forms.

- The functionality of soy protein stems from protein-water interactions, including wettability, solubility, and swelling. These processes increase viscosity and form a gel matrix during heating. Soy proteins can bind 30–50 g of water per 100 g of protein under centrifugation. While soy proteins dominate as base materials for TVP, other sources like cottonseed, corn, wheat, and peanut proteins can also be texturized.

Spun soy protein involves solubilizing isolated soy protein in an alkaline medium. The solution passes through a spinneret to form fibers, coagulated in an acidic bath. Fibers stretch via rolls at increasing speeds. Binders like egg albumin bundle fibers together. Colors, flavors, and ingredients enhance the product. Spun fiber products cost more due to expensive processes and materials, targeting specialized markets as full meat analogues.

Key Takeaways

- The Global Textured Vegetable Protein Market is expected to grow from USD 1.7 billion in 2024 to USD 3.1 billion by 2034 at a CAGR of 6.1%.

- Soy Protein dominated the by-product type segment in 2024 with 48.3% market share due to high protein content, affordability, and meat-like texture.

- Conventional TVP led the By Nature segment in 2024 with 74.2% share, driven by reliable production, cost savings, and scalability.

- Granules held the largest share in the By Form segment in 2024 at 39.4%, favored for quick rehydration and versatility in soups and ready meals.

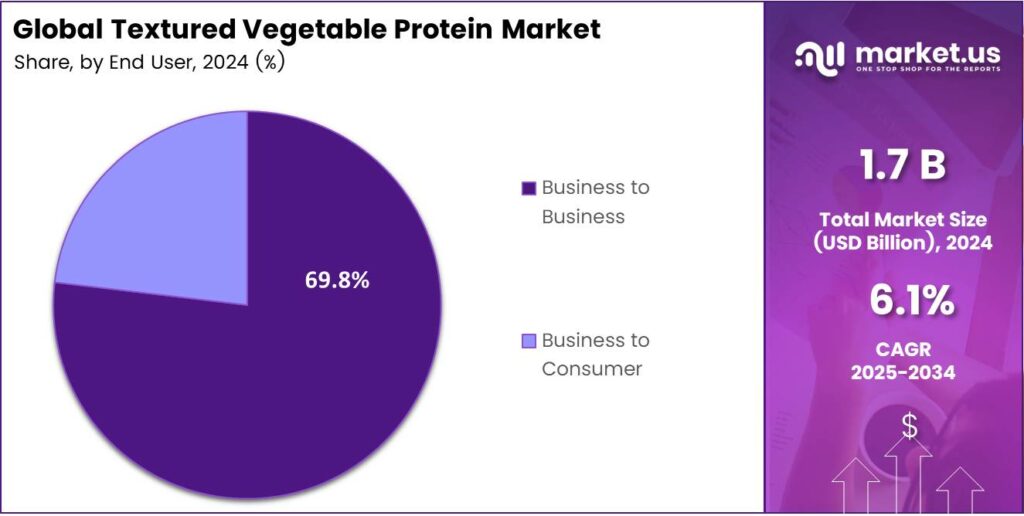

- Business-to-Business dominated the By End User segment in 2024 with 69.8% share, enabling bulk production and innovation through food industry partnerships.

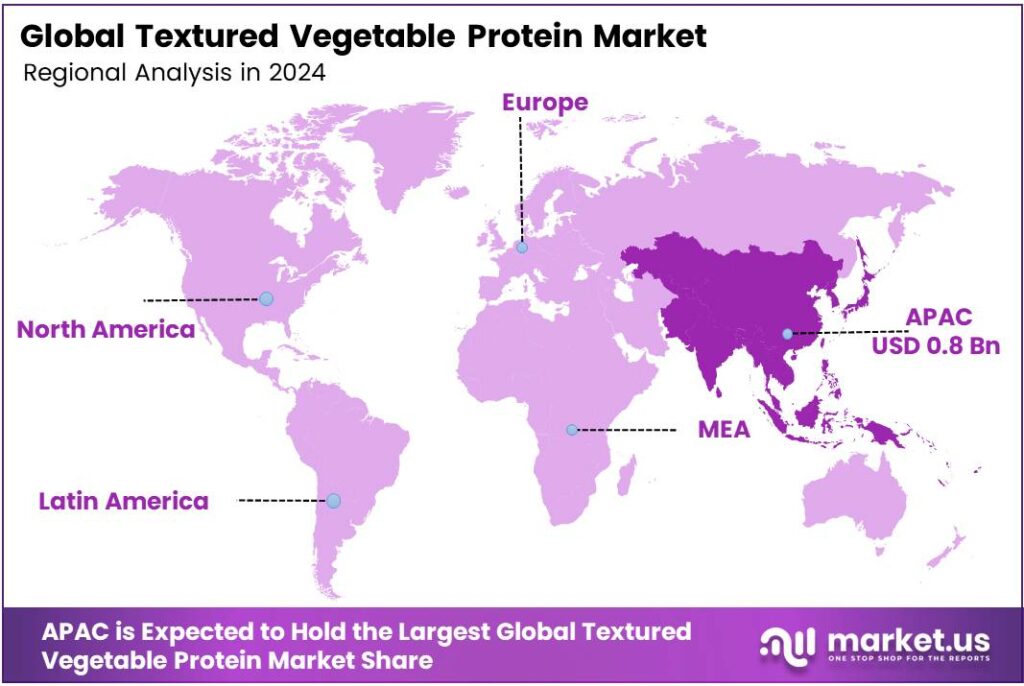

- Asia-Pacific commanded 47.9% of the global TVP market in 2024, valued at USD 0.8 billion, fueled by population growth and rising demand for plant-based proteins.

By Product Type

Soy Protein dominates with 48.3% due to its versatile applications and nutritional profile.

In 2024, Soy Protein held a dominant market position in the By Product Type Analysis segment of the Textured Vegetable Protein Market, with a 48.3% share. It excels in meat analogs, offering high protein content and affordability. Manufacturers favor it for scalability, while consumers appreciate its texture mimicking meat.

Wheat Protein emerges as a key player, providing gluten-based textures ideal for bakery and pasta alternatives. It supports allergen-free options, appealing to diverse diets. Producers leverage its binding properties, enhancing product stability. As sustainability rises, wheat sources gain traction, fostering market expansion through eco-friendly farming.

Pea Protein gains momentum with its hypoallergenic nature and complete amino acid profile. It suits vegan snacks and beverages, offering clean labeling. Innovations in extrusion improve its mouthfeel, attracting health-conscious buyers. This segment thrives on non-GMO trends, boosting adoption in functional foods worldwide.

By Nature Analysis

Conventional leads with 74.2% owing to its established supply chains and lower costs.

In 2024, Conventional held a dominant market position in the By Nature Analysis segment of the Textured Vegetable Protein Market, with a 74.2% share. It dominates through reliable production and wide availability, suiting mass-market products. Cost savings enable competitive pricing, fueling volume sales. Transitioning to this form eases scalability for processors.

Organic rises steadily, driven by consumer demand for chemical-free options. It commands premium pricing in health stores, emphasizing traceability. Certifications boost trust, encouraging brand loyalty. This segment expands via eco-labels, aligning with global wellness movements and sustainable sourcing.

By Form Analysis

Granules command 39.4% with their ease of use in versatile recipes.

In 2024, Granules held a dominant market position in the By Form Analysis segment of the Textured Vegetable Protein Market, with a 39.4% share. They integrate seamlessly into soups and seasonings, offering quick rehydration. Versatility propels their use in ready meals, enhancing convenience for busy households.

Flakes provide a flaky texture, perfect for simulating bacon or fish. They absorb flavors well, aiding recipe creativity. This form appeals to home cooks, expanding through culinary trends and easy storage solutions. Chunks mimic meat pieces effectively, ideal for stews and stir-fries. Their robust structure retains integrity during cooking, satisfying protein seekers. Innovations in sizing broaden applications, supporting growth in ethnic cuisines.

By End User

Business-to-Business secures 69.8% through large-scale integrations in food processing.

In 2024, Business to Business held a dominant market position in the By End User Analysis segment of the Textured Vegetable Protein Market, with a 69.8% share. It powers industrial formulations, enabling efficient bulk production. Partnerships with food giants streamline supply, driving economies of scale and innovation.

Business to Consumer grows via retail channels, offering direct access to plant-based innovations. E-commerce amplifies reach, empowering informed choices. This segment fosters trends like DIY kits, enhancing engagement and loyalty among end-users.

Key Market Segments

By Product Type

- Soy Protein

- Wheat Protein

- Pea Protein

- Rice Protein

- Faba Bean Protein

- Lentil Protein

- Flax Protein

- Chia Protein

By Nature

- Conventional

- Organic

By Form

- Granules

- Flakes

- Chunks

- Others

By End User

- Business to Business

- Business to Consumer

Emerging Trends

Diversification to Pulses & Regional Plant Proteins in TVP Production

A major emerging trend in textured-vegetable-protein (TVP) products is the shift away from relying solely on soy towards pulses and locally grown plant-proteins, as companies and governments respond to sustainability, self-sufficiency, and cost pressures. In the European Commission’s analysis of the EU cropping sector.

The arable-crop supply delivered 64 million tonnes of crude protein, but the EU still imports 19 million tonnes of crude plant-protein from abroad to meet feed and food needs. That import gap has spurred national and EU-level initiatives that encourage the cultivation of legume crops (peas, beans, faba) and support protein-crop value chains.

- In the Indian context, the Mission for Aatmanirbharta in Pulses has earmarked ₹11,440 crore to scale domestic pulse cultivation from about 252.38 lakh tonnes in 2024-25 (third advance estimates) and cut reliance on imports by 47.38 lakh tonnes for pulses. This signals that value‐chain actors and ingredient buyers in the TVP space are increasingly looking at locally produced pulses rather than global soy supply chains.

Drivers

Protein Security & Affordability Push Consumers and Policymakers Toward TVP

A powerful driver for textured vegetable protein (TVP) is the global push to make protein affordable and reliable. After food-price shocks, many families still struggle to buy balanced meals. The UN Food and Agriculture Organization reports that 2.826 billion people, 35.4% could not afford a healthy diet, one in three people worldwide.

That affordability gap is steering retailers, public caterers, and brands toward cost-stable plant proteins like TVP for everyday foods, school lunches, ready meals, and quick-service menus. Governments are reinforcing this shift. The USDA updated school-meal standards to give districts more flexibility to serve plant-based entrées as meat alternatives, opening space for TVP crumbles, patties, and sauces in K-12 menus.

- Sustainability further tilts the equation. Livestock supply chains account for about 14.5% of global human-caused greenhouse-gas emissions, according to FAO’s assessment. Pressure, which encourages food makers to diversify with lower-impact proteins, including TVP, offers protein density, price predictability, and broad culinary use.

Restraints

Allergen & Consumer Acceptance Hurdles for TVP

One major challenge for the textured vegetable protein (TVP) segment arises from allergen concerns and consumer acceptance barriers. Even though plant-based proteins are growing in popularity, not all consumers feel comfortable or confident in adopting them fully. For instance, studies show that for alternative proteins (including pulses and soy variants), consumer acceptance is influenced by familiarity, taste, and perceived safety.

- Allergenicity is a tangible concern. The common raw material for many TVP products, soy, is recognised by allergy specialists: Approximately 0.4% of infants in the U.S. have a soy allergy. Meanwhile, a meta-analysis places soy allergy prevalence in the general population at about 0.27% when using oral food challenge data.

While these numbers might appear low compared with other allergens, they still require manufacturers and food service providers to navigate strict labelling and cross-contamination protocols — increasing cost and complexity. Beyond allergic risk, consumer perception plays a major role. Factors such as the novelty of the food, extruded protein chunks, doubts about taste or texture, and scepticism about nutritional value can all slow adoption.

Opportunity

Institutional Meals & Climate Goals Are Opening Big, Stable Demand for TVP

Textured vegetable protein (TVP) is the quiet shift in institutional food—school kitchens, public canteens, and government-backed programs—toward plant-protein options that are cost-steady and climate-smart. The UN World Food Programme reports that 466 million children now receive school meals through government-led programs, up by 80 million.

In the United States, the National School Lunch Program served 4.7 billion lunches. As districts add plant-based entrées that meet protein standards, TVP becomes a practical way to serve familiar dishes—tacos, pasta sauce, sloppy joes—at scale and predictable cost. For suppliers, that means multi-year, high-volume bids rather than sporadic retail wins.

- Governments are also investing upstream to secure local plant-protein supply. Canada renewed funding of up to C$150 million for its Protein Industries Cluster and set a Road to $25 billion vision for plant-based food, feed, and ingredients. This kind of policy, with plus capital support, expands extrusion capacity, improves functionality of pulses/soy isolates, and de-risks TVP sourcing for buyers.

Regional Analysis

Asia-Pacific leads with a 47.9% share and a USD 0.8 Billion market value.

In 2024, Asia-Pacific held a commanding position in the global Textured Vegetable Protein (TVP) market, capturing more than 47.9% of the total share, valued at approximately USD 0.8 billion. This dominance is primarily driven by the region’s rapidly expanding population, changing dietary preferences, and the growing shift toward plant-based protein sources.

Countries such as China, India, Japan, and Indonesia are witnessing a sharp rise in vegetarian and flexitarian consumers due to increasing health awareness and concerns over meat sustainability. The Food and Agriculture Organization (FAO), per capita, protein consumption in developing Asian nations is increasing, with plant-based alternatives accounting for a major portion of this increase.

Government initiatives promoting sustainable food systems are further supporting TVP adoption. India’s National Mission on Plant Protein (2024) and China’s Five-Year Plan for Nutrition and Health emphasize protein diversification and food security, encouraging investment in soy and pea protein processing. Local manufacturers are scaling production capacities to meet both domestic and export demand.

Asia-Pacific’s thriving food processing, quick-service restaurant (QSR), and nutraceutical sectors continue to amplify demand for textured vegetable protein as a cost-effective, nutritious, and sustainable meat alternative. With supportive policies, rising consumer awareness, the region is expected to remain the global leader in TVP market growth throughout the coming decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Graina is a significant European player specializing in high-quality, non-GMO textured vegetable proteins. The company has carved a strong niche by focusing on sustainable and clean-label ingredients, catering to the growing consumer demand in the health-conscious and meat-alternative sectors. Its strategic position within Europe allows it to effectively supply both food manufacturers and retailers.

ADM is a dominant force in the TVP market. The company leverages its extensive supply chain, massive production capacity, and strong R&D capabilities to offer a diverse portfolio of plant-based proteins. ADM provides integrated solutions and custom ingredients for major food brands, driving innovation and scale in the textured vegetable protein segment. Its global reach and technical expertise make it an indispensable industry leader.

Cargill is a powerhouse in the global food and agriculture industry, with a substantial stake in the TVP market. The company utilizes its vast network of raw material sourcing and production facilities to ensure a reliable supply of textured vegetable protein. Cargill focuses on creating versatile and functional protein solutions for a wide range of food applications, from meat analogues to bakery products.

Top Key Players in the Market

- Granea sp zoo

- Archer Daniels Midland Company

- Cargill Inc

- Crown Soya Protein Group

- International Flavors & Fragrances Inc

- Fuji Oil Co Ltd

- MGP Ingredients Inc

- Roquette Frères

- Wilmar International Ltd

- A&B Ingredients

Recent Developments

- In 2024, Granea emphasized customizable textured pea proteins, highlighting their role in reducing greenhouse gas emissions, water usage, and deforestation compared to animal proteins. These products are tailored for applications like meatballs and meat substitutes, with a focus on enhanced taste, texture, and nutritional value.

- In 2024, ADM consolidated its U.S. soy protein operations by closing the Bushnell, Illinois, plant and shifting production to the Decatur East facility, aiming to enhance efficiency and competitiveness in specialty TVP ingredients. The full completion is targeted for Q1 2025. The move addresses growing demand for non-GMO soy TVP in meat analogs.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.1 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy Protein, Wheat Protein, Pea Protein, Rice Protein, Faba Bean Protein, Lentil Protein, Flax Protein, Chia Protein), By Nature (Conventional, Organic), By Form (Granules, Flakes, Chunks, Others), By End User (Business to Business, Business to Consumer) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Granea sp zoo, Archer Daniels Midland Company, Cargill Inc, Crown Soya Protein Group, International Flavors & Fragrances Inc, Fuji Oil Co Ltd, MGP Ingredients Inc, Roquette Frères, Wilmar International Ltd, A&B Ingredients Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Textured Vegetable Protein MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Textured Vegetable Protein MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Granea sp zoo

- Archer Daniels Midland Company

- Cargill Inc

- Crown Soya Protein Group

- International Flavors & Fragrances Inc

- Fuji Oil Co Ltd

- MGP Ingredients Inc

- Roquette Frères

- Wilmar International Ltd

- A&B Ingredients