Global Soy Protein Concentrate Market Size, Share, And Business Benefits By Form (Dry, Liquid), By Nature (Organic, Conventional), By Function (Emulsification, Solubility, Water Binding, Foaming, Thickening Agent, Others), By Application (Food and Beverages, Dietary Supplements, Nutraceuticals, Animal Feed, Cosmetics and Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148309

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

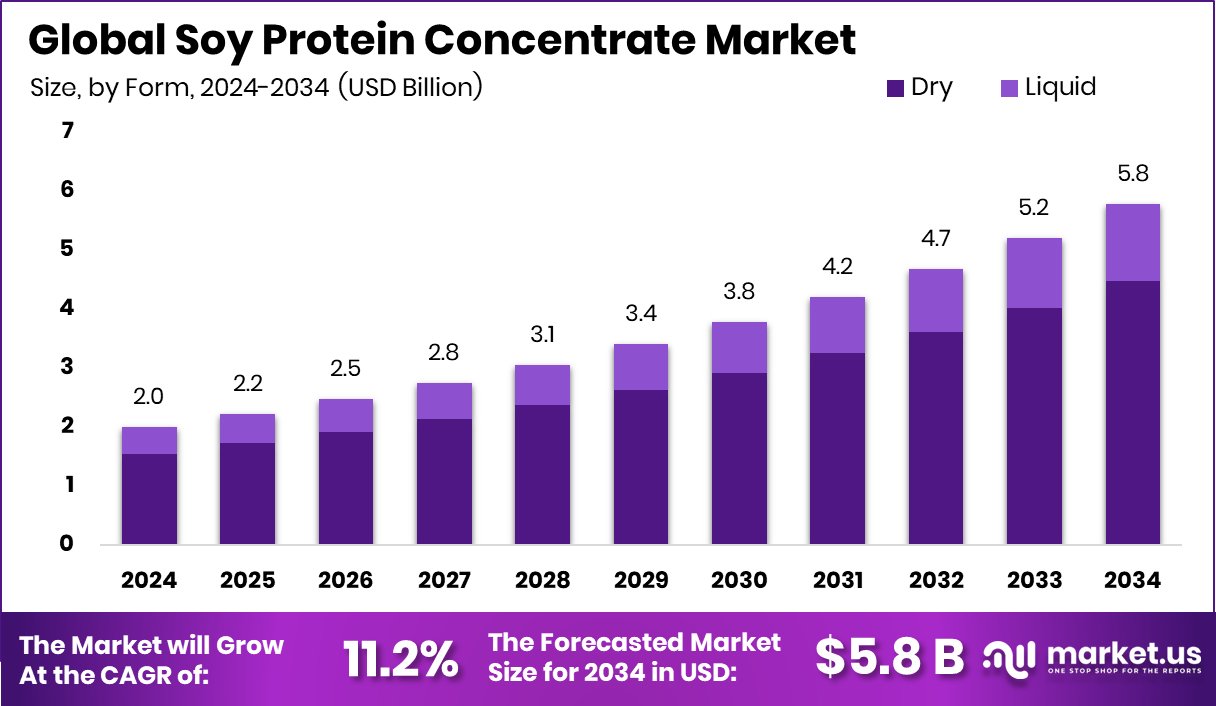

Global Soy Protein Concentrate Market is expected to be worth around USD billion by 2034, up from USD 2.0 billion in 2024, and grow at a CAGR of 11.2% from 2025 to 2034. With USD 0.7 Bn revenue, North America’s soy protein concentrate market flourishes.

Soy Protein Concentrate is a product derived from defatted soybeans by removing soluble carbohydrates, retaining most of the protein content. It is typically composed of around 70% soy protein and is widely used in food applications to enhance nutritional content and functional properties. The product is commonly utilized in meat processing, bakery products, and dairy alternatives due to its excellent emulsifying, water-binding, and texturizing capabilities.

The Soy Protein Concentrate Market focuses on the production, distribution, and consumption of soy protein concentrate across various sectors such as food and beverages, animal feed, and pharmaceuticals. Increasing consumer demand for plant-based protein sources, coupled with the rising awareness of health benefits associated with soy proteins, is propelling market growth. A Dutch firm focused on extracting protein from grass has secured €3.6 million to advance its technology.

The growth of the soy protein concentrate market is primarily fueled by the escalating demand for plant-based protein products as consumers shift towards healthier and sustainable dietary options. Furthermore, advancements in food processing technologies are enabling manufacturers to produce high-quality soy protein concentrates with enhanced functional properties, boosting their utilization across various food applications. Brevel, a climate-focused food tech company, successfully raised an additional $5 million, increasing its total investment round to $25 million.

Demand for soy protein concentrate is driven by the growing awareness of protein-rich diets, particularly among health-conscious consumers and fitness enthusiasts. The product’s versatile nature allows it to be incorporated into diverse food products, ranging from meat substitutes to nutritional supplements, further augmenting its demand.

The rising prevalence of lactose intolerance and the subsequent preference for plant-based dairy alternatives are expected to sustain robust demand for soy protein concentrates. Big Mountain Foods has received $1.4 million in funding from the Canadian government to expand operations and introduce a new chickpea-based tofu product.

Key Takeaways

- Global Soy Protein Concentrate Market is expected to be worth around USD billion by 2034, up from USD 2.0 billion in 2024, and grow at a CAGR of 11.2% from 2025 to 2034.

- In the Soy Protein Concentrate Market, dry form dominates with a substantial 77.3% market share.

- Conventional soy protein concentrate leads the market, accounting for a commanding 82.9% share.

- Emulsification function captures a notable 38.6% share, highlighting its extensive application across industries.

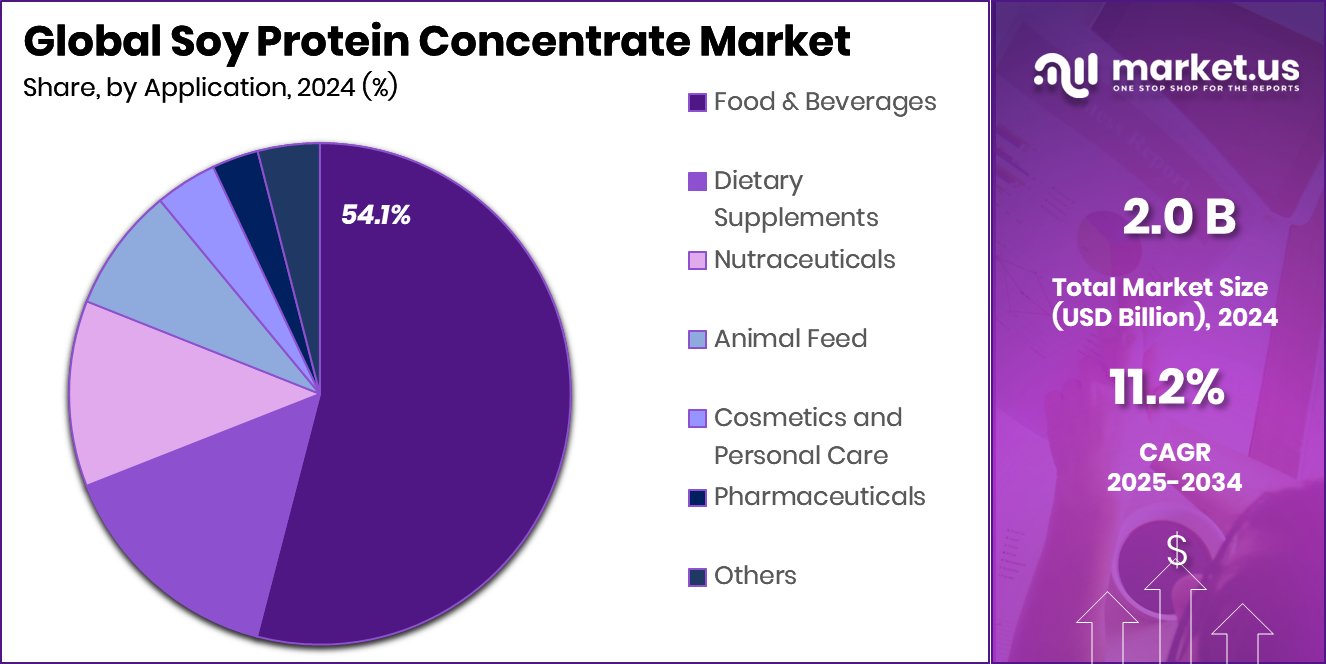

- Food and beverages sector remains the largest application, holding a significant 54.1% market share.

- The North American soy protein concentrate market holds a dominant 36.4% share.

By Form Analysis

In the Soy Protein Concentrate Market, the dry form holds a dominant 77.3% share globally.

In 2024, Dry held a dominant market position in the By Form segment of the Soy Protein Concentrate Market, capturing a substantial 77.3% share. This segment’s leading position can be attributed to its extensive use in various food and beverage applications, driven by its high protein content and functional properties. Dry soy protein concentrate offers superior stability, longer shelf life, and easy incorporation into processed food products, contributing to its widespread adoption.

The growing demand for plant-based protein products in the food industry has further propelled the market for dry soy protein concentrate. Additionally, increasing consumer awareness regarding health benefits and dietary preferences for plant-derived proteins has supported the demand for dry forms, making it a preferred choice among manufacturers.

The segment’s dominance is also bolstered by its cost-effectiveness and versatility in formulation, enabling its integration into diverse food matrices such as baked goods, meat substitutes, and nutritional supplements. As consumer inclination toward plant-based diets continues to rise, the dry segment is expected to maintain its leadership, supported by ongoing innovations in soy protein processing and application development.

By Nature Analysis

Conventional soy protein concentrate captures a significant 82.9% market share, reflecting its widespread use.

In 2024, Conventional held a dominant market position in the By Nature segment of the Soy Protein Concentrate Market, accounting for a significant 82.9% share. The prominence of conventional soy protein concentrate is largely driven by its widespread availability and cost-effectiveness, making it a preferred choice for manufacturers in the food and beverage industry.

This segment’s dominance is also attributed to the established supply chain networks and extensive cultivation of non-organic soybeans, ensuring consistent raw material availability. Conventional soy protein concentrate offers stable quality, making it suitable for a wide range of applications, including processed foods, meat substitutes, and bakery products.

Additionally, the conventional segment benefits from the lower production costs compared to organic alternatives, thereby attracting large-scale food processors seeking to minimize input expenses. The growing demand for affordable plant-based protein ingredients further supports the segment’s leadership, as conventional soy protein concentrate provides a cost-effective solution for formulating protein-enriched foods.

As market demand for high-protein, plant-based products continues to rise, the conventional segment is anticipated to maintain its stronghold, backed by its established market presence and extensive application scope across diverse end-use industries.

By Function Analysis

Emulsification functions dominate the market with a 38.6% share, driving demand in food applications.

In 2024, Emulsification held a dominant market position in the By Function segment of the Soy Protein Concentrate Market, securing a substantial 38.6% share. The leading position of the emulsification function is primarily driven by its vital role in stabilizing food products, particularly in processed foods, meat alternatives, and dairy substitutes.

Soy protein concentrate is widely recognized for its excellent emulsifying properties, enabling it to effectively bind water and fat, thereby enhancing texture and consistency in various formulations. This functional characteristic makes it highly suitable for applications in salad dressings, sauces, and bakery products, where maintaining product stability is crucial.

The segment’s dominance is further supported by the increasing demand for plant-based protein ingredients that deliver multifunctional benefits, such as texture improvement and moisture retention. Additionally, as consumer preferences shift towards healthier, protein-enriched foods, manufacturers are increasingly utilizing soy protein concentrate as a functional ingredient to achieve desirable emulsification outcomes without compromising nutritional value.

By Application Analysis

The food and beverages segment leads the market with a 54.1% share, showcasing strong consumption.

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Soy Protein Concentrate Market, capturing a commanding 54.1% share. This significant share is primarily driven by the extensive utilization of soy protein concentrate in diverse food and beverage formulations, including meat substitutes, baked goods, and nutritional beverages.

The segment’s dominance is underpinned by the rising consumer demand for plant-based protein ingredients that offer functional benefits such as texture enhancement, moisture retention, and protein fortification. Food manufacturers increasingly incorporate soy protein concentrate to meet the growing preference for clean-label, protein-enriched products, particularly in vegan and vegetarian food categories.

Additionally, the cost-effectiveness of soy protein concentrate as a plant-based protein source further amplifies its adoption in processed food applications, where it serves as a reliable ingredient for enhancing nutritional profiles without altering taste.

The expanding trend of health-conscious eating and the surge in demand for high-protein diets further bolsters the market share of the food and beverages segment, positioning it as a key growth driver within the soy protein concentrate market.

Key Market Segments

By Form

- Dry

- Liquid

By Nature

- Organic

- Conventional

By Function

- Emulsification

- Solubility

- Water Binding

- Foaming

- Thickening Agent

- Others

By Application

- Food and Beverages

- Dietary Supplements

- Nutraceuticals

- Animal Feed

- Cosmetics and Personal Care

- Pharmaceuticals

- Others

Driving Factors

Rising Demand for Plant-Based Protein Alternatives Boosts Market

The increasing consumer shift towards plant-based diets is a key driver for the soy protein concentrate market. As more people adopt vegetarian and vegan lifestyles, the demand for protein-rich plant-based ingredients like soy protein concentrate has surged. Additionally, the growing awareness of health benefits associated with plant-based proteins, such as lower cholesterol and improved heart health, further propels market growth.

Food manufacturers are increasingly incorporating soy protein concentrate in a variety of products, including meat substitutes, beverages, and functional foods. Furthermore, the affordability and high protein content of soy protein concentrate make it a preferred choice for manufacturers aiming to enhance product formulations while catering to health-conscious consumers.

Restraining Factors

Allergen Concerns Limit Soy Protein Market Growth

Despite its nutritional benefits, soy protein concentrate faces challenges due to allergen concerns. Soy is one of the top allergens globally, leading to restrictions in product formulations and limited consumer acceptance. Food manufacturers must label soy-based products clearly, impacting their appeal to broader consumer segments.

Additionally, the rise in soy allergies has prompted some consumers to seek alternative plant-based proteins like pea or almond protein. This shift in preference reduces the potential market share for soy protein concentrate.

Moreover, regulatory requirements for allergen labeling and the need for stringent quality control further increase production costs, potentially affecting profitability for manufacturers relying on soy as a primary ingredient.

Growth Opportunity

Expanding Use in Animal Feed Industry Drives Growth

The global soy protein concentrate market is experiencing significant growth, largely driven by its expanding application in the animal feed industry. Soy protein concentrate is valued for its high protein content and digestibility, making it an ideal ingredient in livestock and aquaculture feeds. Its inclusion in animal diets supports optimal growth and health, enhancing feed efficiency and overall productivity.

As the demand for high-quality animal protein increases globally, the need for nutritious and cost-effective feed solutions becomes paramount. Soy protein concentrate meets these requirements, leading to its increased adoption in the feed sector. This trend is expected to continue, providing a substantial growth opportunity for the soy protein concentrate market in the coming years.

Latest Trends

Innovative Product Development Enhances Market Appeal

In 2024, the soy protein concentrate market is witnessing a significant trend towards innovative product development. Manufacturers are investing in research and development to create soy protein concentrates with improved taste, texture, and nutritional profiles. These advancements aim to meet the evolving consumer preferences for plant-based protein products that closely mimic the sensory attributes of animal-based proteins.

The development of soy protein concentrates with enhanced functional properties allows for their incorporation into a wider range of food applications, including meat analogs, dairy alternatives, and functional beverages.

Additionally, the focus on clean-label and non-GMO formulations is gaining traction, aligning with the growing consumer demand for transparent and health-conscious food options. This trend of product innovation not only broadens the application scope of soy protein concentrates but also strengthens their position in the competitive plant-based protein market.

Regional Analysis

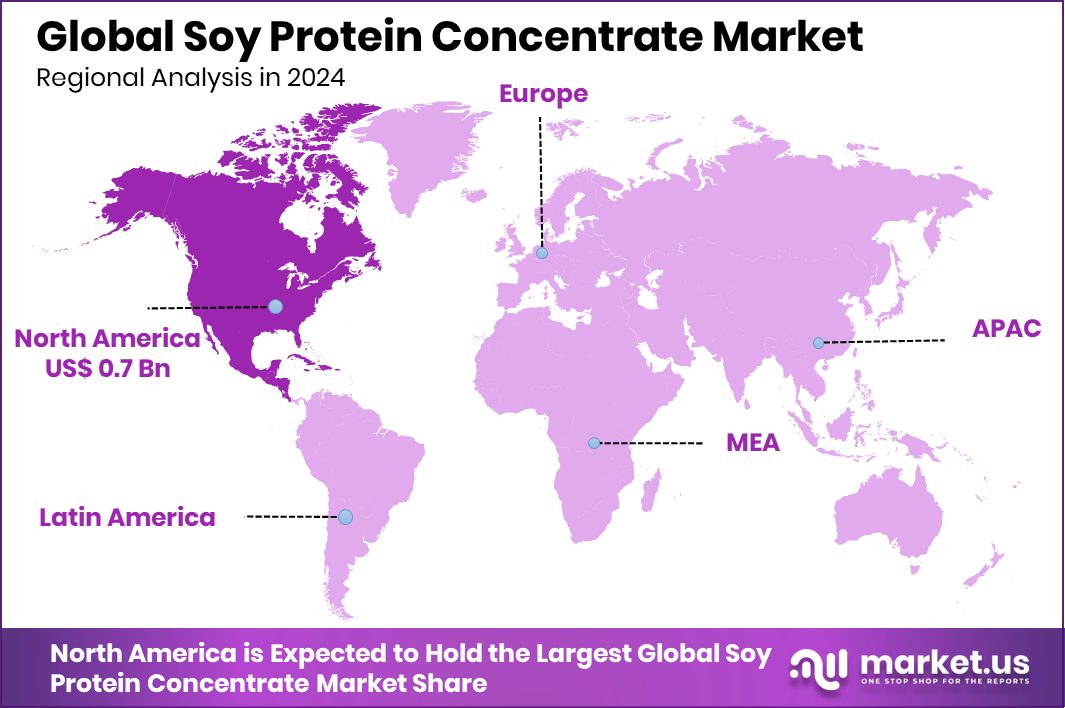

In North America, the Soy Protein Concentrate Market captured 36.4%, generating USD 0.7 Bn.

In 2024, North America emerged as the dominant region in the Soy Protein Concentrate Market, accounting for a significant 36.4% share and generating USD 0.7 billion in revenue. The region’s leadership is primarily driven by the rising demand for plant-based protein products in the food and beverage sector, supported by growing consumer awareness regarding health and nutrition.

Europe follows closely, leveraging its well-established plant-based food industry, while Asia Pacific witnesses increasing adoption of soy protein concentrate in functional foods and dietary supplements. Meanwhile, Latin America and the Middle East & Africa are gradually expanding their market presence, driven by rising investments in food processing and plant-based protein manufacturing.

As global consumer preferences shift towards protein-rich diets, North America is expected to maintain its market dominance, fueled by robust demand for soy-based protein ingredients in processed foods and beverages.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, ADM, Cargill Inc., and Kerry Group stood out as pivotal players in the global soy protein concentrate market, each leveraging distinct strategies to solidify their market positions.

ADM capitalized on its extensive soy protein portfolio, emphasizing products that enhance meat and poultry offerings by improving water retention, texture, and emulsification. Their textured soy proteins, known for versatility and cost-effectiveness, cater to a broad spectrum of applications, reinforcing ADM’s commitment to delivering high-quality plant-based protein solutions.

Cargill Inc. focused on sustainability and innovation, notably through its partnership with Houdek to scale up ME-PRO®, a soy protein concentrate distinguished by its higher protein content and reduced environmental impact. This ProTerra-certified, non-GMO product aligns with the growing demand for sustainable feed ingredients, particularly in aquaculture, showcasing Cargill’s dedication to environmentally responsible practices

Kerry Group emphasized sustainable nutrition by offering solutions that enhance nutritional profiles and taste while minimizing environmental impact. With a robust R&D team and a global footprint, Kerry Group addressed complex customer challenges, reinforcing its position as a leader in providing innovative, sustainable soy protein concentrate solutions.

Top Key Players in the Market

- ADM

- Cargill Inc.

- Kerry Group

- CHS Inc.

- Bunge Limited

- Wilmar International

- Farbest Brands

- The Scoular Company

- Sotexpro

- Burcon NutraScience Corporation

- Now Foods

- Glanbia Nutritionals

- Prinova Group LLC

- Sonic Biochem

- Medix Laboratories

Recent Developments

- In November 2024, Kerry Group announced the divestment of its dairy business, Kerry Dairy Ireland, to Kerry Co-Operative Creameries Limited for approximately €500 million. This move was aimed at transforming Kerry into a pure-play taste and nutrition company, allowing it to concentrate on its core competencies, including plant-based proteins like soy protein concentrate.

- In November 2021, ADM completed the acquisition of Sojaprotein, a European company specializing in non-GMO soy ingredients. Sojaprotein, based in Serbia, exports to over 65 countries and offers a range of non-GMO vegetable protein ingredients for various sectors, including meat alternatives, confectionery, and animal feed.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 5.8 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Dry, Liquid), By Nature (Organic, Conventional), By Function (Emulsification, Solubility, Water Binding, Foaming, Thickening Agent, Others), By Application (Food and Beverages, Dietary Supplements, Nutraceuticals, Animal Feed, Cosmetics and Personal Care, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Cargill Inc., Kerry Group, CHS Inc., Bunge Limited, Wilmar International, Farbest Brands, The Scoular Company, Sotexpro, Burcon NutraScience Corporation, Now Foods, Glanbia Nutritionals, Prinova Group LLC, Sonic Biochem, Medix Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Soy Protein Concentrate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Soy Protein Concentrate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Cargill Inc.

- Kerry Group

- CHS Inc.

- Bunge Limited

- Wilmar International

- Farbest Brands

- The Scoular Company

- Sotexpro

- Burcon NutraScience Corporation

- Now Foods

- Glanbia Nutritionals

- Prinova Group LLC

- Sonic Biochem

- Medix Laboratories