Global Solar Home Lightings Market Size, Share, Growth Analysis By Product (Grid-Tied Solar Home Lighting, Off-Grid Solar Home Lighting), By Product Type (Solar Lanterns, Solar Bulbs, Solar Tube Lights, Street Lights, Solar Floodlights), By Components (Solar Panels, LED Lamps, External Charger or the Grid, Control Unit, Others), By Application (City, Countryside) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168157

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

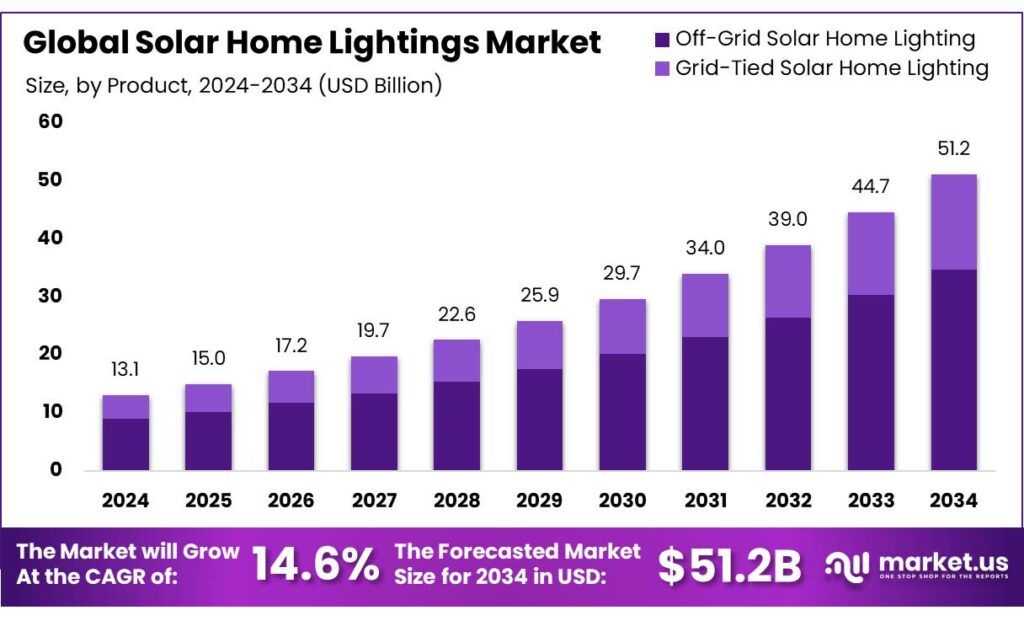

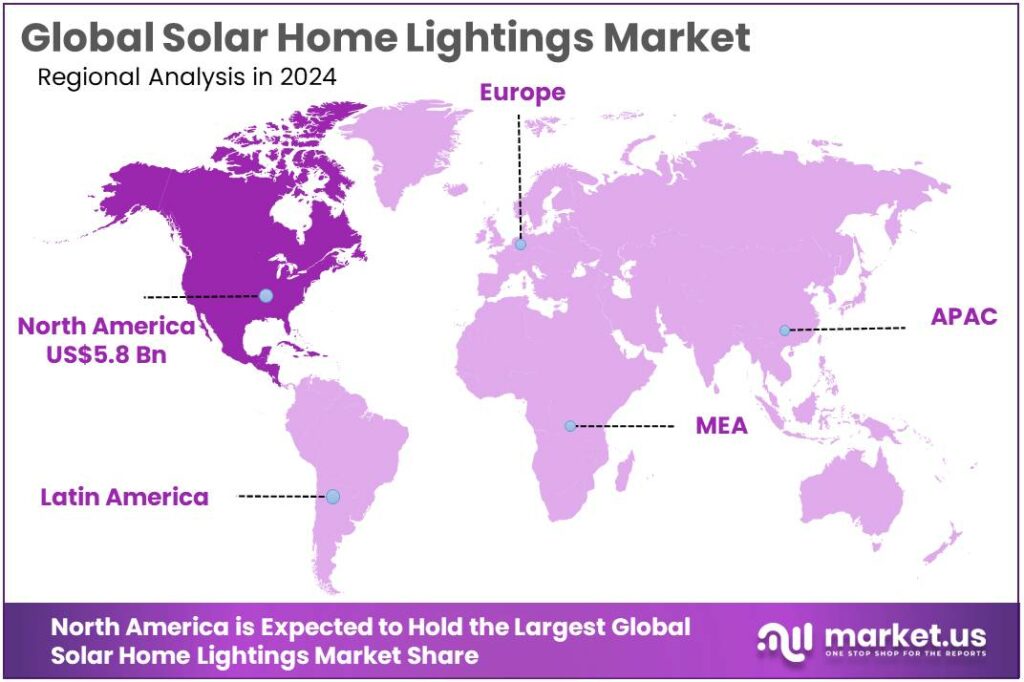

The Global Solar Home Lightings Market size is expected to be worth around USD 51.2 Billion by 2034, from USD 13.1 Billion in 2024, growing at a CAGR of 14.6% during the forecast period from 2025 to 2034. In 2024, Europe held a dominan market position, capturing more than a 44.90% share, holding USD 5.8 Billion revenue.

Solar home lighting refers to small-scale photovoltaic (PV) systems that power LED lamps, phone charging and basic appliances for households, typically in off-grid or weak-grid areas. The market has grown alongside the broader solar boom: global installed solar PV capacity reached about 1,865 GW by the end of 2024, up from 710 GW in 2020, reflecting rapid cost declines and technology diffusion.

The industrial landscape is shaped by falling hardware costs and improving unit economics. According to IRENA, global solar PV module prices have dropped by roughly 90% since around 2010, and the global weighted-average levelised cost of electricity from utility-scale solar PV fell from about USD 0.417/kWh in 2010 to roughly USD 0.043–0.049/kWh by 2022–2024.

Despite this progress, an estimated 685 million people still lacked access to electricity in 2022, with around 570 million of them in Sub-Saharan Africa, underlining the continuing need for decentralised solar lighting solutions. Off-grid solar has emerged as a critical part of the response: as of 2023, off-grid solar products – including solar home lighting systems, multi-light kits and lanterns – were providing energy services to more than 560 million people, with over 50 million products sold across 2022–2023 and annual market turnover of USD 3.9 billion in 2022 and USD 3.8 billion in 2023. GOGLA-affiliated companies alone now serve over 137 million people, showing how commercially driven distribution models have scaled.

Government initiatives are also central to the industry’s growth. In India, the Ministry of New and Renewable Energy links solar home lights to national electrification under the Saubhagya scheme, positioning them as a complement to grid rollout.

The PM-KUSUM programme further targets 34,800 MW of decentralised solar capacity by March 2026, backed by about INR 34,422 crore in central financial support, indirectly strengthening supply chains for off-grid and rural solar products. More recently, the PM-Surya Ghar Muft Bijli Yojana aims to provide rooftop solar systems to 10 million households, offering up to 300 units of free electricity per month, which accelerates awareness and adoption of home solar solutions.

Key Takeaways

- Solar Home Lightings Market size is expected to be worth around USD 51.2 Billion by 2034, from USD 13.1 Billion in 2024, growing at a CAGR of 14.6%.

- Off-Grid Solar Home Lighting held a dominant market position, capturing more than a 67.9% share.

- Solar Lanterns held a dominant market position, capturing more than a 31.4% share.

- Solar Panels held a dominant market position, capturing more than a 36.7% share.

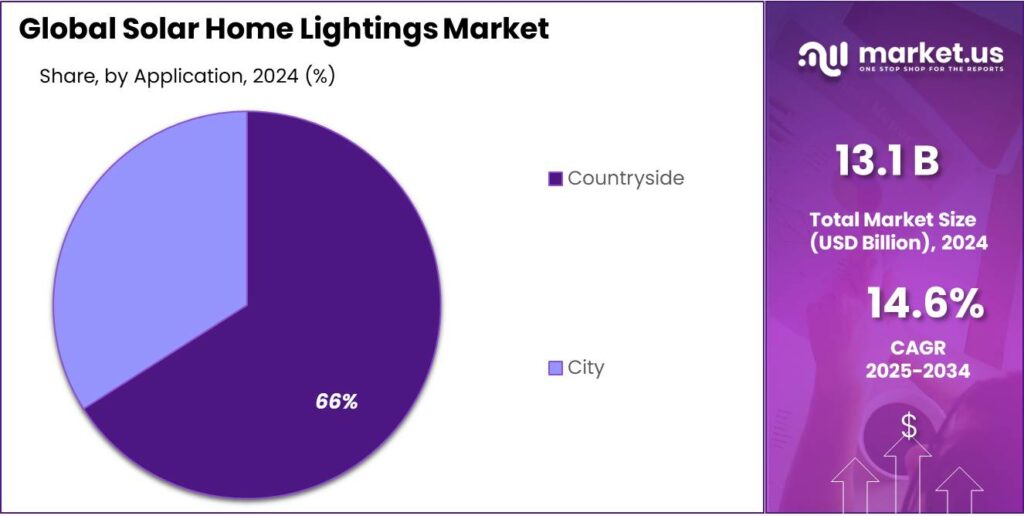

- Countryside held a dominant market position, capturing more than a 66.5% share.

- North America currently stands as the leading regional market for solar home lightings, with 44.90% share and an estimated value of USD 5.8 billion.

By Product Analysis

Off-Grid Solar Home Lighting dominates with 67.9% due to its reliability, easy installation, and suitability for remote households.

In 2024, Off-Grid Solar Home Lighting held a dominant market position, capturing more than a 67.9% share, reflecting its strong acceptance in regions where grid access remains limited or unreliable. This product category plays a critical role in providing basic and essential lighting without dependence on centralized electricity infrastructure. Its dominance is linked to the growing need for affordable and self-sustained energy solutions for households located in rural, peri-urban, and hard-to-reach areas.

By Product Type Analysis

Solar Lanterns dominate with 31.4% due to their portability, affordability, and immediate usability.

In 2024, Solar Lanterns held a dominant market position, capturing more than a 31.4% share, showing their strong role as an entry-level solar lighting solution. These products are widely preferred in households that require basic lighting without installation complexity. Their simple plug-and-play nature supports quick adoption, especially in areas with limited infrastructure and irregular electricity access.

By Components Analysis

Solar Panels dominate with 36.7% due to their essential role as the primary power source in home lighting systems.

In 2024, Solar Panels held a dominant market position, capturing more than a 36.7% share, highlighting their central importance within solar home lighting systems. Every solar lighting setup depends on panels to convert sunlight into usable electricity, making this component non-replaceable. Their dominance reflects consistent demand across both basic and advanced home lighting configurations.

By Application Analysis

Countryside dominates with 66.5% due to higher dependence on alternative lighting and limited grid reach.

In 2024, Countryside held a dominant market position, capturing more than a 66.5% share, clearly reflecting stronger adoption of solar home lighting solutions in rural and semi-rural areas. These regions often face unstable grid supply or complete absence of electricity, making solar lighting a practical and dependable option for daily household needs.

Key Market Segments

By Product

- Grid-Tied Solar Home Lighting

- Off-Grid Solar Home Lighting

By Product Type

- Solar Lanterns

- Solar Bulbs

- Solar Tube Lights

- Street Lights

- Solar Floodlights

By Components

- Solar Panels

- LED Lamps

- External Charger or the Grid

- Control Unit

- Others

By Application

- City

- Countryside

Emerging Trends

Rapid Growth of Off-Grid Solar Lighting Use Across the Globe

One of the most striking recent trends in solar home lighting is the fast expansion of off-grid solar solutions reaching millions — showing that people are increasingly trusting and adopting solar lighting as a reliable alternative to traditional electricity. According to the latest data from International Renewable Energy Agency (IRENA), by the end of 2023, global off-grid renewable power capacity had reached 11.1 GW, of which solar contributed 4.1 GW, marking nearly a five-fold increase since 2014.

In 2023 alone, about 155 million people worldwide were served by off-grid renewable energy technologies — and among them close to 100 million relied on off-grid solar lights for lighting and basic electricity needs. That marks a rapid climb from past years: IRENA notes that use of solar lights globally rose by roughly 56% since 2014. This jump illustrates how solar home lighting is becoming a mainstream solution, especially in regions where grid electricity remains absent, unreliable, or costly.

Another factor amplifying this trend is global momentum behind renewable energy expansion. The steady increase in off-grid solar capacity coincides with a broader surge in renewables: in 2023, total global additions to renewable power capacity jumped substantially. As solar becomes more affordable and efficient, costs of solar home lighting kits are gradually falling — making them accessible to low- and middle-income households who previously couldn’t justify the expense.

Moreover, off-grid solar lighting is becoming part of national and global strategies for achieving universal energy access. According to a 2024 press release from World Bank and related partners, off-grid solar is identified as the most cost-effective way to provide first-time electricity access to almost 400 million people globally by 2030. That aligns with plans by governments and development agencies to integrate solar home systems into electrification drives — offering hope for areas where grid expansion remains slow or economically unviable.

Drivers

Persistent Electricity Access Gap — a strong demand-pull for solar home lighting

In many parts of the world, a substantial number of households still lack reliable access to electricity, and that shortfall is a major catalyst fueling demand for solar home lighting solutions.

- According to the International Energy Agency (IEA), as of 2024 approximately 730 million people globally remain without access to electricity. This gap is most acute in rural or remote areas where extending grid infrastructure is costly or impractical — creating a natural opening for decentralized, solar-based lighting systems.

The momentum behind this shift is supported by government-led electrification efforts. For example, in India, the flagship scheme Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA) has reportedly electrified approximately 2.86 crore households nationwide through on-grid connections between its launch in 2017 and completion in 2022. However, even as grid expansion proceeds, not all un-electrified or off-grid households are easily connected — either due to remoteness, cost, or logistical barriers — which sustains the relevance and need for off-grid solar home lightings.

In 2024, the inertia in universal electricity access — especially in remote or rural areas — meant that solar home lighting remained the fastest way to bring light into homes without waiting for grid extension. For millions of households around the world, solar home systems provide immediate, reliable, and clean lighting, often replacing kerosene lamps or expensive diesel-based options. This demand-driven push keeps the industry robust, even in the face of broader energy-transition reforms.

Restraints

Weak after-sales, repair and end-of-life systems

The rapid diffusion of solar home lighting has been constrained by weaknesses in after-sales service, repair capacity and end-of-life management, a factor that is both technical and social in character. Across countries where pico-PV and small solar home systems were distributed at scale, a substantial number of units have ceased to function within a few years of purchase; of the 375 million off-grid solar products distributed globally since the early 2000s, ≈75% are estimated to have fallen into disrepair.

Battery failure is the single most frequent technical cause of system obsolescence in the small-system segment, and the lack of accessible spare parts and trained technicians multiplies the problem. Field studies indicate that more than 90% of non-functioning products could be repaired at modest cost in many settings, and around 89% of households retain broken units rather than discard them — behaviour that signals latent demand for repair services but also a market failure in service provision.

The fiscal and regulatory context has a direct bearing on these outcomes. Investment in initial product deployment has often outpaced funding for after-sales networks, warranty administration and circular-economy measures. Global analysis has highlighted a substantial financing gap for off-grid solar more broadly — an estimated additional US$21 billion per year is required to fully unlock the sector’s potential, including funds that could be directed to service and replacement cycles rather than only to initial sales.

Opportunity

Off-Grid Solar’s Reach to the Remaining Energy-Deprived Population

One of the biggest growth opportunities for solar home lighting lies in the fact that a substantial portion of the global population still lacks reliable access to electricity — and solar-powered home lighting offers a practical, scalable route to close that gap. According to the International Energy Agency (IEA), as of 2024 about 730 million people worldwide remained without electricity access. This number underscores a massive addressable market for off-grid solar home-lighting solutions.

Furthermore, the growth trajectory of off-grid solar is already visible. A recent report by the World Bank and its partners suggests that off-grid solar has the potential to bring first-time electricity access to almost 400 million people worldwide by 2030 — largely via solar home systems and lanterns. That projection translates into enormous demand potential over the next few years, especially in regions where conventional electrification lags.

The potential is also magnified by demographic and population trends. As long as tens or hundreds of millions remain without electricity, the tailwinds for solar home lighting remain strong. In addition, even partially electrified areas — where electricity supply may be intermittent or unreliable — represent ripe markets for hybrid solutions using solar light kits as a supplement or backup.

Regional Insights

North America Leads Solar Home Lightings Market with 44.9% Share, Valued at USD 5.8 Billion

North America currently stands as the leading regional market for solar home lightings, with 44.90% share and an estimated value of USD 5.8 billion. This strong position reflects the region’s mature solar ecosystem, high rooftop solar adoption, and growing consumer focus on resilient, backup lighting solutions for homes. Supportive policy frameworks, tax credits, and falling equipment prices have together created a favorable environment for solar-based residential lighting and small home systems.

- The United States in particular anchors this performance. According to the U.S. Energy Information Administration, small-scale (mostly rooftop) solar PV capacity reached about 47,704 MW by the end of 2023, generating around 74 billion kWh of electricity from small-scale PV systems alone.

This broad base of distributed solar creates a natural platform for integrated home-lighting solutions, including solar-powered lighting, garden lights, and hybrid backup systems that keep critical loads running during outages. At the same time, the Solar Energy Industries Association notes that nearly 800,000 U.S. households added solar in 2023, highlighting rapid household-level adoption of solar technologies.

- Policy momentum continues to reinforce this regional dominance. The Inflation Reduction Act has helped push record deployment of solar; in 2024, solar accounted for about 84% of new U.S. power generation capacity, with around 50 GW installed in a single year, the largest annual addition for any energy technology in over two decades.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Tata Power Solar is positioned as a vertically integrated Indian solar player supplying modules, rooftop systems and small off-grid solutions used in household lighting and home-scale systems. It has expanded manufacturing and announced a 10 GW wafers/ingots initiative following existing cell/module capacity growth, which strengthens its ability to supply durable home lighting kits and bundled rooftop-plus-battery offerings to residential customers. The firm’s domestic focus supports government rooftop and rural electrification efforts.

Philips (now operating under Signify for lighting) supplies consumer solar lighting products and professional solar luminaires that are used in home and outdoor lighting applications. The company leverages global LED expertise to deliver easy-install solar lanterns and outdoor solar lights with warranties and channel support, helping to raise product quality expectations in consumer markets. Philips’ branded offerings are often used in retail and institutional procurement where reliability and standards compliance matter.

Ascent Solar develops lightweight, flexible CIGS thin-film modules that are suited to niche, weight-sensitive applications and small off-grid kits. Recent production-scale efficiency gains (reported at ~15.7% production-scale CIGS) and space-sector partnerships have strengthened its technology profile; this positions Ascent to supply specialized flexible modules for portable home lighting kits and integrated solar blankets where conventional rigid panels are unsuitable. The company’s tech focus supports differentiated product offerings for last-mile electrification.

Top Key Players Outlook

- Tata Power Solar Systems

- Shenzhen Yingli New Energy

- Su-Kam

- Phillips

- Ascent Solar

- Sharp

- GE Renewable Energy

- AUO

Recent Industry Developments

In 2025 Ascent Solar Technologies announced a significant technical milestone: a production-scale efficiency of 15.7% for its CIGS modules, a marked improvement over earlier figures — reinforcing its credentials for reliable solar power in compact and flexible form factors.

In its 2024 ESG report, Yingli Solar reported a reduction in unit energy consumption by 3,062 kWh per MW compared to 2023, and its products achieved a 100% qualification rate, reflecting strong quality control standards.

Report Scope

Report Features Description Market Value (2024) USD 13.1 Bn Forecast Revenue (2034) USD 51.2 Bn CAGR (2025-2034) 14.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Grid-Tied Solar Home Lighting, Off-Grid Solar Home Lighting), By Product Type (Solar Lanterns, Solar Bulbs, Solar Tube Lights, Street Lights, Solar Floodlights), By Components (Solar Panels, LED Lamps, External Charger or the Grid, Control Unit, Others), By Application (City, Countryside) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tata Power Solar Systems, Shenzhen Yingli New Energy, Su-Kam, Phillips, Ascent Solar, Sharp, GE Renewable Energy, AUO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solar Home Lightings MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Solar Home Lightings MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tata Power Solar Systems

- Shenzhen Yingli New Energy

- Su-Kam

- Phillips

- Ascent Solar

- Sharp

- GE Renewable Energy

- AUO