Global Silage Inoculants Market Size, Share, And Business Benefits By Type (Homofermentative Inoculants, Heterofermentative Inoculants, Combination Inoculants), By Formulation (Liquid Inoculants, Dry Inoculants), By Application (Corn Silage, Grass Silage, Legume Silage, Mixed Silage, Others), By End-Use (Dairy Farms, Beef Farms, Commercial Feed Processors), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157096

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

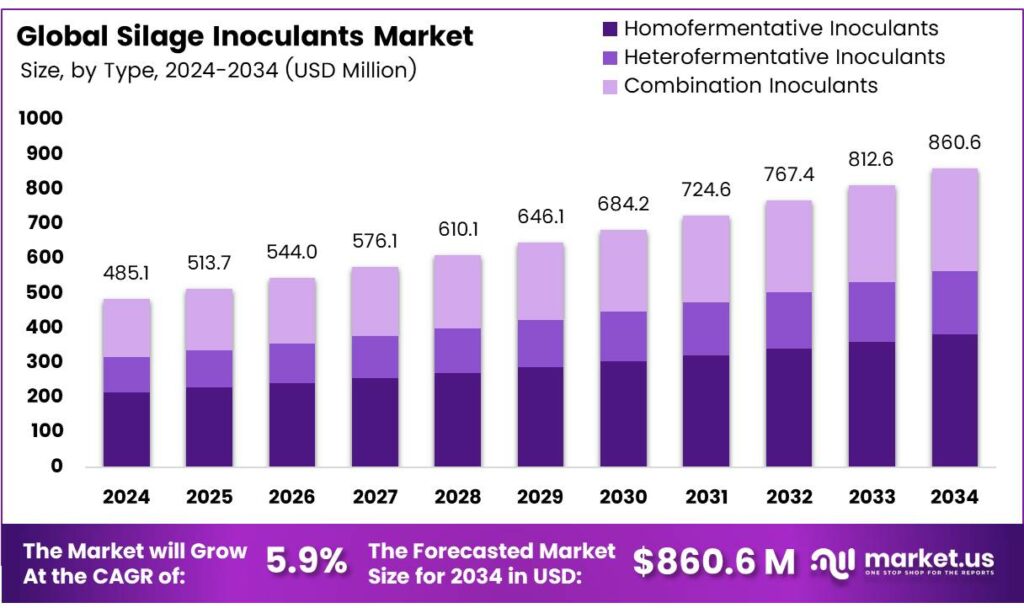

The Global Silage Inoculants Market size is expected to be worth around USD 860.6 Million by 2034, from USD 485.1 Million in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Silage inoculants are forage additives containing lactic acid producing bacteria (LAB) and other anaerobic bacteria such as Lactobacillus buchneri. These inoculants are used to manipulate and enhance fermentation in haylage (alfalfa, grass, cereal), corn silage, and high moisture corn. The goals are faster, more efficient fermentation with reduced fermentation losses, improved forage quality and palatability, longer bunk life, and improvements in animal performance.

Silage inoculants offer significant economic advantages for farmers by reducing dry matter (DM) losses, which directly impacts farm profitability. Without inoculants, DM loss can reach 15%, whereas with inoculants, it drops to 8%. This reduction translates to substantial cost savings, estimated at USD 40 per ton of silage, as farmers can avoid purchasing additional feed to compensate for losses.

Research indicates that each 1% decrease in DM loss can save between USD 15 and USD 50 per ton, providing a clear financial incentive for adopting inoculants. By preserving more silage, farmers can allocate resources more efficiently, enhancing overall agricultural profitability. In addition to lowering feed costs, silage inoculants improve nutrient retention, preserving critical carbohydrates and proteins. Inoculated silage retains up to 10% more nutrients, with crude protein levels increasing from 12% to 14%.

This enhanced nutrient profile boosts cattle performance, as evidenced by dairy producers reporting increased milk yields of up to several liters per cow daily. The improved aerobic stability of inoculated silage, extending from 3 to 7 days, further reduces spoilage rates, minimizing waste and the need for frequent silage replacements. These benefits collectively safeguard farmers’ investments and contribute to a robust return on investment (ROI), with case studies demonstrating an ROI as high as 8-to-1.

The inoculant also supports oxygen scavenging and enhances lactic and acetic acid production, improving aerobic stability and starch digestibility, particularly in corn and sorghum grains. Available in 1 lb. (453.6 g) and 2.5 lb. (1,134 g) foil pouches, Nutretain can treat 200 tons, 500 tons, or 1,000 tons of fresh forage, depending on the packaging, making it a practical solution for large-scale silage production.

Key Takeaways

- The Global Silage Inoculants Market is expected to reach USD 860.6 Million by 2034 from USD 485.1 Million in 2024, with a 5.9% CAGR.

- Homofermentative Inoculants led in 2024, holding 44.5% market share due to effective lactic acid production.

- Liquid Inoculants dominated in 2024 with a 58.3% share, favored for ease of application and fast activation.

- Corn Silage captured 39.1% market share in 2024, driven by high starch content and consistent yields.

- Dairy Farms held 57.9% market share in 2024, fueled by demand for nutrient-rich silage for milk production.

- North America led with 38.6% of global demand in 2024, valued at USD 187.2 million, due to strong dairy and beef sectors.

Analyst Viewpoint

The silage inoculants market is gaining traction as global livestock production ramps up to meet food security demands. These microbial additives, which improve silage fermentation and nutrient retention, are critical for cost-effective feed preservation. The increasing adoption of precision farming and eco-friendly practices is driving demand, particularly in North America and the Asia-Pacific region, where livestock industries are expanding.

Farmers, especially in large-scale dairy and beef operations, are increasingly valuing silage inoculants for their ability to reduce feed spoilage and improve animal performance. Consumers’ growing demand for high-quality, sustainably produced meat and dairy is pushing farmers to adopt these additives. However, in less developed markets, lack of awareness and upfront costs can hinder adoption, highlighting the need for education and cost-effective solutions.

The regulatory landscape, particularly in North America and the EU, is stringent, with strict safety and efficacy standards for microbial additives. Compliance with these regulations can be costly but ensures product reliability, boosting farmer confidence. Emerging markets in the Asia-Pacific face fewer regulatory hurdles, offering growth opportunities, though harmonizing standards globally remains a challenge for scaling operations.

By Type

Homofermentative Inoculants lead with 44.5% share in 2024

In 2024, Homofermentative Inoculants held a dominant market position, capturing more than a 44.5% share of the global silage inoculants market. This strong position highlights their effectiveness in rapidly producing lactic acid, which ensures faster pH reduction and better preservation of forage.

Farmers have increasingly relied on these inoculants because they enhance silage stability, minimize spoilage losses, and improve feed quality for livestock. The year 2024 witnessed consistent adoption, particularly in dairy and beef farming, where maintaining nutrient-rich silage is crucial for productivity.

The demand for Homofermentative Inoculants is expected to grow further as livestock producers prioritize high-yield, nutrient-dense silage. The segment’s efficiency in reducing dry matter loss and extending storage life positions it as a preferred choice over alternative inoculants. With ongoing advancements in microbial formulations, these inoculants are likely to sustain their market strength, ensuring continued dominance in the silage management sector.

By Formulation

Liquid Inoculants dominate with a 58.3% market share in 2024

In 2024, Liquid Inoculants held a dominant market position, capturing more than a 58.3% share of the global silage inoculants market. Their dominance is driven by ease of application, uniform distribution, and faster microbial activation compared to dry formulations.

Liquid Inoculants are expected to maintain their leadership as demand for high-quality silage continues to rise. With livestock farming expanding and efficiency becoming a central focus, these inoculants provide a practical solution that saves time and ensures better returns. Their compatibility with modern mechanized farming practices and enhanced shelf-life formulations will further reinforce their strong presence in the market, keeping them ahead of other forms.

By Application

Corn Silage leads with a 39.1% market share in 2024

In 2024, Corn Silage held a dominant market position, capturing more than a 39.1% share of the global silage inoculants market. Corn remains the most widely used forage crop due to its high starch content, energy density, and ability to deliver consistent yields for dairy and beef cattle.

The adoption of inoculants in corn silage has been particularly strong as farmers seek to enhance fermentation quality, reduce spoilage, and maximize feed efficiency. This dominance reflects corn’s central role in meeting the nutritional needs of livestock across both developed and emerging markets.

The segment is expected to sustain its leading position, supported by rising livestock production and the continued preference for corn-based feed rations. The increasing focus on optimizing animal health and productivity is driving the demand for inoculants that improve nutrient retention in corn silage. With steady advancements in microbial blends tailored for corn fermentation.

By End-Use

Dairy Farms dominate with a 57.9% market share in 2024

In 2024, Dairy Farms held a dominant market position, capturing more than a 57.9% share of the global silage inoculants market. The strong demand from dairy producers is linked to the need for high-quality, nutrient-rich silage that directly supports milk yield and animal health.

Dairy operations often require consistent and large volumes of silage throughout the year, making the use of inoculants crucial for maintaining feed stability, reducing spoilage, and improving digestibility. This reliance on inoculants reflects the sector’s focus on efficiency and profitability in an increasingly competitive dairy industry.

Dairy Farms are expected to continue driving the market, as global milk consumption trends upward and producers aim to meet higher quality standards. Growing herd sizes and the push for sustainable feeding practices further emphasize the role of silage inoculants in dairy nutrition.

Key Market Segments

By Type

- Homofermentative Inoculants

- Heterofermentative Inoculants

- Combination Inoculants

By Formulation

- Liquid Inoculants

- Dry Inoculants

By Application

- Corn Silage

- Grass Silage

- Legume Silage

- Mixed Silage

- Others

By End-Use

- Dairy Farms

- Beef Farms

- Commercial Feed Processors

Drivers

Cheaper Feed and Better Animal Productivity

Farmers often feel the pinch when feed prices go up or grazing land gets hard to find. Inoculants make silage ferment better, helping preserve more good stuff in the forage and reducing wasted dry matter (DM). Think of it as a smart helper in the barn, keeping what matters, so animals get the nutrition they need without extra cost. Research from the U.S. Dairy Forage Research Center shows that using silage inoculants can cut dry matter losses by around 2–3% age points.

That’s like saving 2 to 3 kg out of every 100 kg of feed, real savings, not just numbers on paper. On top of that, for dairy and beef farmers, better silage means better animal performance. The Food and Agriculture Organization (FAO) reported an increase of 60 grams of milk per kilogram of dry matter fed when using forage inoculants. Silage inoculants are a reasonably priced solution with a proven benefit. They often lead to 3–5% better animal performance and even deliver up to an 8‑to‑1 return on investment (ROI), five rupees back for every rupee spent.

Restraints

Handling & know-how barriers in hot, real-world conditions

A quiet but very real brake on silage inoculant use is the practical side of making and keeping good silage when the weather is hot and the farm team is stretched. On many small and mid-size dairies, the knowledge and time needed to hit the right chop length, packing density, and moisture are uneven.

Heat and storage are another snag. Many inoculants are living cultures; they don’t like warm trucks or rooms. A controlled study showed some products lost 0.5–1.0 log CFU/mL simply by being exposed to 35 °C, with even larger losses at higher temperatures, meaning fewer viable bacteria get to the forage.

Manufacturers themselves caution about cold-chain: for example, one widely used product lists a shelf life of 24 months at −18 °C, 12 months at +4 °C, but only 3 months at room temperature (<20 °C). In many dairy regions, ambient temperatures are well above that for much of the year, so keeping stocks potent is a real cost and logistics challenge.

Opportunity

Reducing Dry-Matter Losses to Save Feed

Silage inoculants shine as a major growth driver because they help farmers save more of their precious feed. Without good management, silage can lose up to 10–20 % of its dry matter during storage, which means a lot more feed has to be grown or bought just to feed the same number of animals. The inoculants typically reduce dry‑matter losses by about 2–3% age points, for example, lowering a loss from 20% down to 17–18 % of the feed that otherwise.

That small improvement goes a long way. Imagine a farmer with a thousand tonnes of silage losing 20% means 200 tonnes wasted. Cutting that by just 2–3 points saves 20–30 tonnes of good feed, enough to support a significant number of animals without extra input costs. It also means less pressure to grow additional fodder, which saves water, land, and time, not to mention money.

In India, the National Livestock Mission under the Department of Animal Husbandry and Dairying encourages local silage units by offering subsidies of 50% of the capital cost, up to ₹50 lakh, for feed and fodder infrastructure like silage‑making units . That support helps farmers set up the systems they need to take advantage of silage inoculants and get those 2–3% improvements on real silos.

Trends

Climate Resilience and Policy Push Boost Silage Inoculant Use

Farmers today face more unpredictable weather, heat, erratic rain, and quick forage spoilage. That makes stable silage more essential than ever. Silage inoculants, especially those that improve aerobic stability, are gaining ground as a simple, effective way to keep silage edible and nutritious longer. As pressure grows to maintain feed quality under a changing climate, more farmers are turning to inoculants.

National Livestock Mission (NLM) is stepping in with meaningful help. Under its Sub-Mission on Feed & Fodder Development, it now offers a capital subsidy for silage-making and feed infrastructure projects for farmers and entrepreneurs, paid in two equal tranches. This backing takes a big chunk out of setup costs, making it easier for farm families to start using silage systems backed by inoculants.

Regional Analysis

North America leads with a 38.6% share and a USD 187.2 Million market value.

North America is the dominant regional hub for silage inoculants, accounting for 38.6% of global demand with a market value of USD 187.2 million. The region’s leadership rests on dense dairy and beef production, extensive corn‐silage acreage, and a strong focus on feed efficiency and consistency across large, professionally managed farms.

Adoption is highest in dairy belts and feedlot corridors where producers target faster pH drop, lower dry matter losses, and better aerobic stability during feed out. On-farm results commonly cited by nutritionists, such as 2–4 percentage point reductions in dry matter losses and steadier intakes, reinforce recurring purchase behavior and premium willingness for proven strains.

Distributors and co-ops play a central role, bundling inoculants with forage harvest services and application equipment, which improves correct dosing and reduces wastage at scale. Demand skews toward homofermentative and combination formulations to lock in lactic acid production early while protecting against yeasts and molds during storage and feed out. Liquid and water-soluble formats remain preferred for large chopper fleets, supporting rapid turnaround in short harvest windows.

Policy and stewardship norms around antibiotic reduction, along with the region’s emphasis on methane intensity per unit of milk or beef, also support inoculant use as part of broader forage quality programs. While weather volatility and forage moisture swings can challenge performance consistency, better monitoring (temperature probes, shrink tracking) and nutritionist oversight are helping producers standardize outcomes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Monsanto (now part of Bayer) silage inoculant offerings were integrated into Bayer’s portfolio following its acquisition. Leveraging its vast research and development capabilities in crop science and microbiology, the company focused on developing high-efficacy bacterial strains to enhance fermentation and improve aerobic stability in silage.

Pioneer (Corteva Agriscience) is a globally recognized leader in agricultural inputs. Its strength in the silage inoculants market stems from deep-rooted research in forage genetics and microbial technology. Pioneer offers a diverse portfolio of proven inoculants, such as 11CFT, designed to efficiently drive fermentation, reduce dry matter loss, and enhance the aerobic stability of silage.

Hansen (Chr. Hansen) is a global bioscience company and a pure-play specialist in microbial solutions, making it a dominant innovator in the silage inoculant market. With a history spanning over 145 years, its core expertise lies in developing and producing high-quality, research-backed bacterial strains. Products like Lactobacillus buchneri-based inoculants are industry standards for preventing spoilage and improving aerobic stability.

Top Key Players in the Market

- Monsanto

- Pioneer

- Hansen

- Novozymes

- Lallemand

- Nature’s Way

- Cargill

- Kemin Industries

- DuPont

- BASF

- Bayer

Recent Developments

- In 2024, Bayer continues to leverage Monsanto’s expertise in biotechnology, including microbial solutions for agriculture. While specific silage inoculant products are not highlighted in recent updates, Bayer emphasizes sustainable agricultural practices, including microbial technologies to enhance crop and feed quality.

- In 2024, Corteva Agriscience announced partnerships with local farms to enhance silage strategies, including the use of advanced inoculants to improve fermentation and feed quality. These efforts focus on tailoring solutions to specific farm needs, leveraging Pioneer’s expertise in corn and forage seeds.

Report Scope

Report Features Description Market Value (2024) USD 485.1 Million Forecast Revenue (2034) USD 860.6 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Homofermentative Inoculants, Heterofermentative Inoculants, Combination Inoculants), By Formulation (Liquid Inoculants, Dry Inoculants), By Application (Corn Silage, Grass Silage, Legume Silage, Mixed Silage, Others), By End-Use (Dairy Farms, Beef Farms, Commercial Feed Processors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Monsanto, Pioneer, Hansen, Novozymes, Lallemand, Nature’s Way, Cargill, Kemin Industries, DuPont, BASF, Bayer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Silage Inoculants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Silage Inoculants MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Monsanto

- Pioneer

- Hansen

- Novozymes

- Lallemand

- Nature's Way

- Cargill

- Kemin Industries

- DuPont

- BASF

- Bayer