Global Shale Gas Market Size, Share, And Business Benefits By Technology (Horizontal Fracking, Vertical Fracking, Rotary Fracking), By End-user (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150116

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

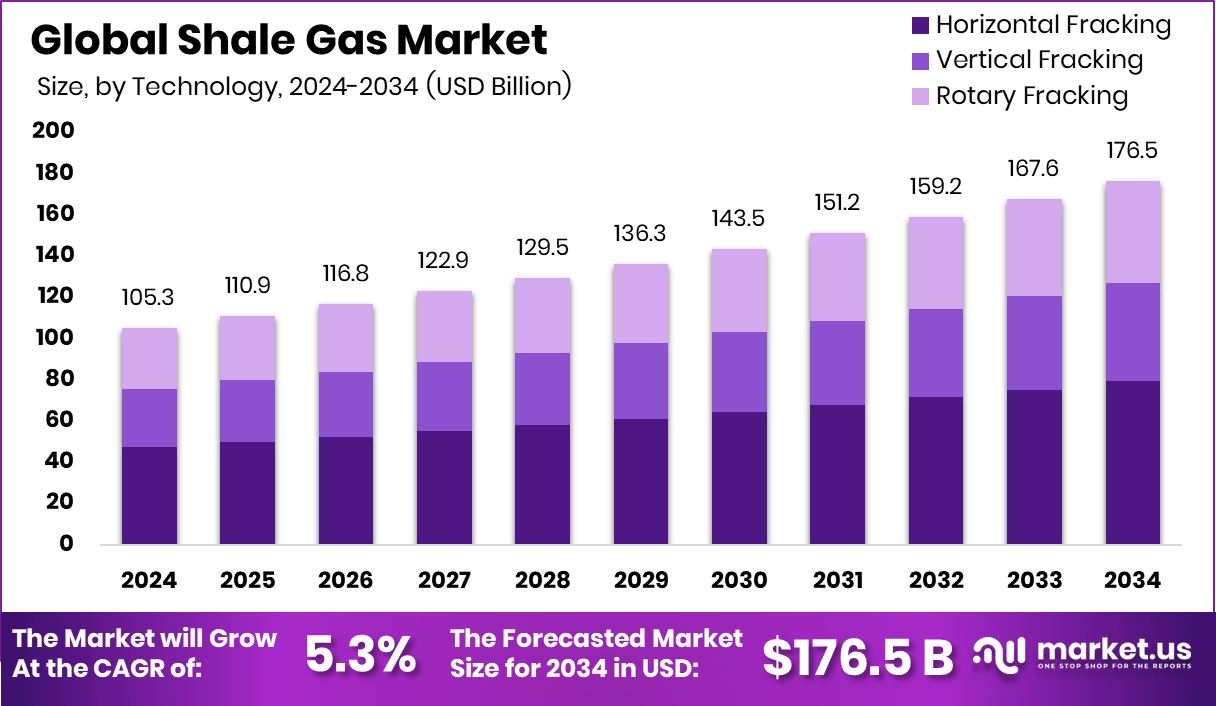

Global Shale Gas Market is expected to be worth around USD 176.5 billion by 2034, up from USD 105.3 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034. North America, 48.3%, leads shale gas production due to abundant reserves and advanced extraction technologies.

Shale gas is a type of natural gas that is found trapped within shale rock formations deep underground. Unlike conventional natural gas, it requires advanced techniques such as horizontal drilling and hydraulic fracturing (fracking) to be extracted. These technologies help release the gas from the tight rock layers, making it a significant resource in energy production.

The shale gas market refers to the global economic activities related to the exploration, extraction, processing, and distribution of shale gas. It includes upstream activities like drilling and fracking, as well as midstream and downstream operations such as transportation and usage in power plants or industries. The market has gained traction due to its role in reducing energy import dependence, enhancing energy security, and offering a cleaner-burning alternative to coal.

Technological advancements in hydraulic fracturing and horizontal drilling have significantly lowered production costs, making shale gas economically viable. Government policies in favor of domestic energy production and reduced carbon emissions have further fueled investments in shale development. These factors collectively support steady market expansion.

Demand for shale gas is rising, particularly from the power generation and industrial sectors. Many countries are shifting from coal to cleaner fuels, boosting the need for natural gas. Its affordability and stable supply also make it a reliable option for large-scale applications.

Key Takeaways

- Global Shale Gas Market is expected to be worth around USD 176.5 billion by 2034, up from USD 105.3 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- In the Shale Gas Market, horizontal fracking dominated with a 44.9% share in extraction techniques.

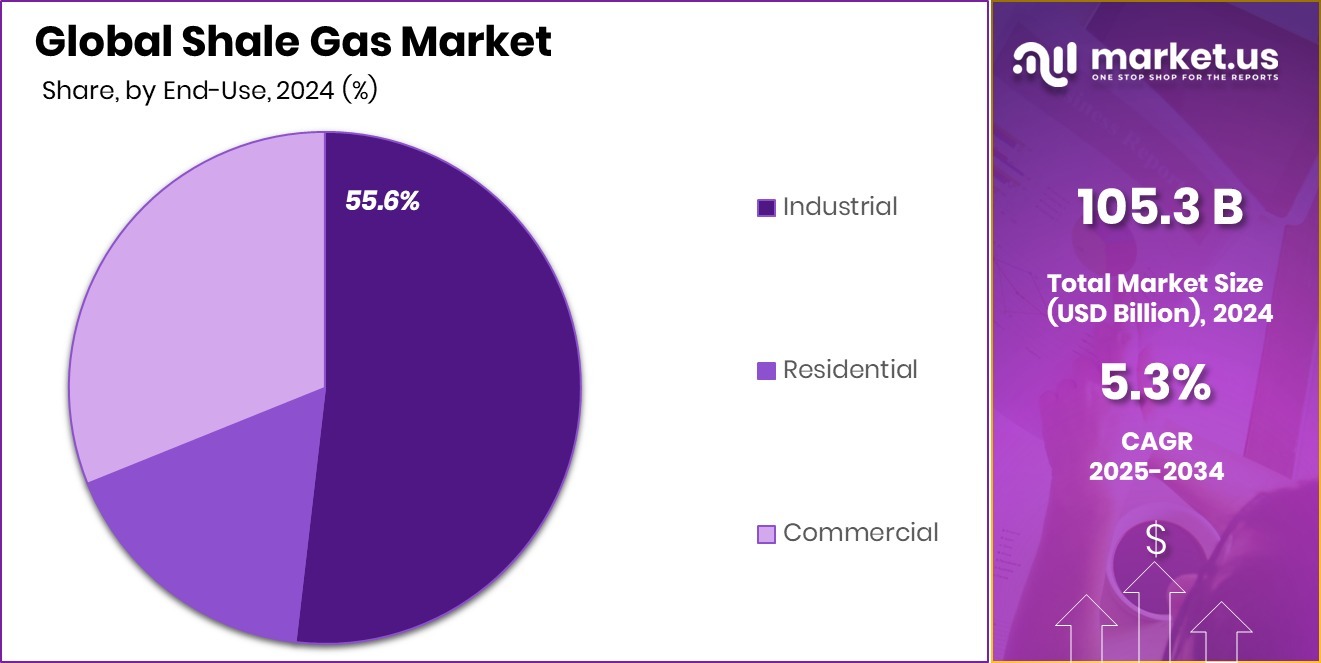

- The industrial sector led the Shale Gas Market in end-user share, accounting for 55.6% in 2024.

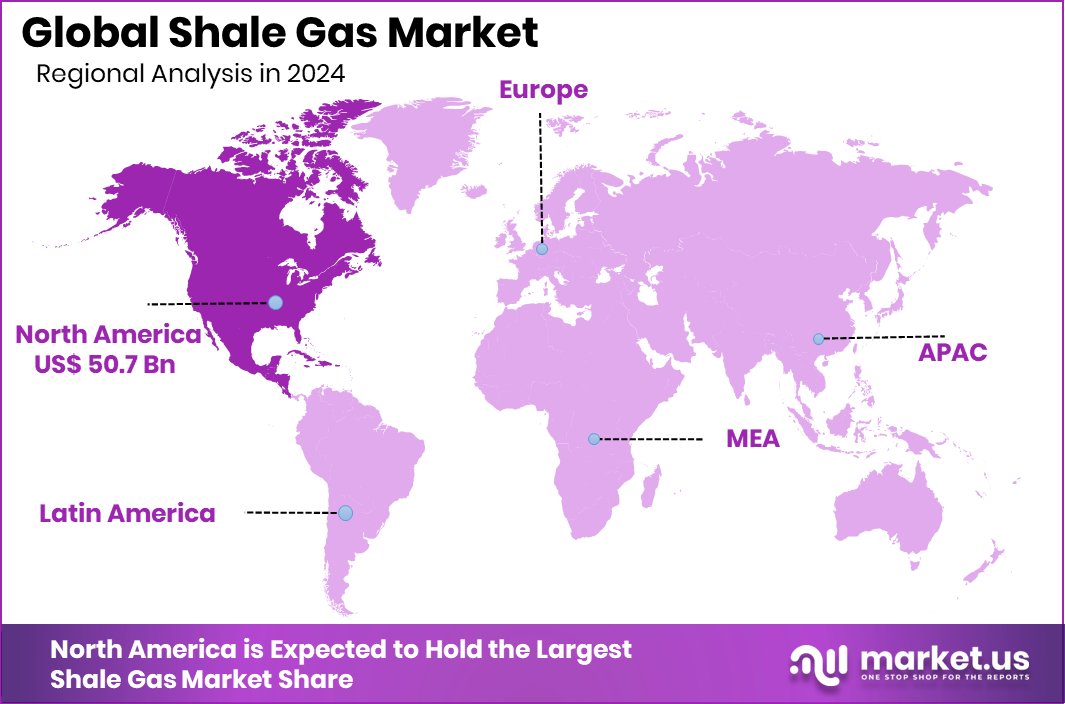

- The shale gas market in North America reached a value of USD 50.7 billion.

By Technology Analysis

Horizontal fracking dominates the shale gas market with a 44.9% share globally.

In 2024, Horizontal Fracking held a dominant market position in the By Technology segment of the Shale Gas Market, with a 44.9% share. This leading position can be attributed to its ability to access larger volumes of shale gas with fewer drilling sites, significantly improving efficiency and cost-effectiveness.

Horizontal fracking allows for extended wellbores within the shale layer, maximizing contact with gas-rich rock formations and enhancing overall output. The technology has become a preferred choice in major shale reserves due to its capability to reduce the surface footprint while increasing production yields.

Moreover, the growing demand for domestic energy sources and the push toward cleaner alternatives to coal have driven the adoption of horizontal fracking in large-scale operations. Its integration with multi-stage hydraulic fracturing techniques has further improved recovery rates, making it more economically attractive.

Several shale basins are increasingly relying on this method to optimize production and ensure a consistent gas supply for power generation and industrial use. As a result, the 44.9% market share held by Horizontal Fracking underscores its critical role in shaping the technological landscape of shale gas extraction in 2024.

By End-user Analysis

The industrial sector leads shale gas consumption, accounting for 55.6% market share.

In 2024, Industrial held a dominant market position in the end-user segment of the Shale Gas Market, with a 55.6% share. The industrial sector’s reliance on shale gas stems from its consistent energy demand for large-scale operations, including manufacturing, chemical processing, and refining activities.

Shale gas serves as both a fuel and a feedstock, making it an essential input in producing chemicals, fertilizers, plastics, and other industrial materials. Its relatively lower cost and stable supply compared to other fossil fuels have made it a preferred energy source across high-consumption industrial hubs.

This dominance is further reinforced by the industry’s continuous efforts to improve energy efficiency and reduce emissions by shifting away from coal-based inputs. Industrial users have capitalized on the abundance of shale gas to ensure uninterrupted production while complying with stricter emission norms. Additionally, energy-intensive operations such as steel, glass, and cement manufacturing have found shale gas to be a reliable substitute, supporting their sustainability goals.

The 55.6% market share reflects not only the sector’s demand strength but also its strategic alignment with energy security and economic viability. As long-term supply agreements and infrastructure development continue, the industrial segment is expected to retain its lead in shale gas consumption.

Key Market Segments

By Technology

- Horizontal Fracking

- Vertical Fracking

- Rotary Fracking

By End-user

- Industrial

- Residential

- Commercial

Driving Factors

Growing Need for Clean Energy Sources

One of the top driving factors for the shale gas market is the rising demand for cleaner energy alternatives. As countries aim to cut down air pollution and carbon emissions, shale gas becomes an attractive choice. It burns cleaner than coal and oil, making it better for the environment. Many governments are supporting the shift toward natural gas to meet climate goals without hurting economic growth.

Shale gas helps industries and power plants reduce emissions while still getting reliable energy. Because of this, more investment is flowing into shale gas production, especially in regions with large shale reserves. The strong push for cleaner fuels continues to drive steady demand for shale gas worldwide.

Restraining Factors

Environmental Risks from Fracking Technology Use

A major restraining factor in the shale gas market is the environmental concern linked to hydraulic fracturing, or fracking. This process involves injecting water, sand, and chemicals into the ground to release gas, which can lead to groundwater contamination, earthquakes, and air pollution. Local communities and environmental groups have raised strong objections to fracking operations due to their potential long-term harm to ecosystems and public health.

As a result, stricter regulations and opposition movements are slowing down new project approvals in some regions. These environmental risks make it harder for companies to expand shale gas production freely. The ongoing debates around safety and sustainability continue to challenge the growth of the shale gas market.

Growth Opportunity

Untapped Shale Reserves in Emerging Economies

A major growth opportunity for the shale gas market lies in the large untapped reserves found in emerging economies. Countries in Asia, Latin America, and parts of Africa are beginning to explore their shale formations to reduce dependence on imported energy. These regions are now focusing on building infrastructure, updating energy policies, and attracting foreign investment to support shale gas development.

With rising energy demand and the need for affordable, cleaner fuel, shale gas is becoming an attractive option. If these countries successfully adopt modern drilling technologies and overcome regulatory barriers, they could become significant contributors to the global shale gas supply. This opens up new markets and long-term opportunities for industry players and investors alike.

Latest Trends

Rising Demand from AI-Powered Data Centers

A notable trend in the shale gas market is the increasing demand from data centers, especially those supporting artificial intelligence (AI) and high-performance computing. These facilities require substantial electricity, and natural gas-fired power plants are a reliable source to meet this need. As AI applications expand, the energy consumption of data centers grows, leading to higher natural gas usage.

This surge in demand has positively impacted shale gas producers, enhancing their market valuations and encouraging further investment in shale gas extraction and infrastructure. The intersection of technological advancement and energy needs underscores the evolving dynamics of the shale gas market, positioning it as a key player in supporting the digital economy’s growth.

Regional Analysis

In 2024, North America held a 48.3% share of the shale gas market.

In 2024, North America dominated the global shale gas market, holding a substantial 48.3% share, valued at USD 50.7 billion. This dominance is primarily driven by the United States, where advanced drilling technologies and abundant shale reserves continue to fuel large-scale production. The region has witnessed significant investment in shale exploration and infrastructure, supporting a consistent supply chain from extraction to end-use.

In Europe, the shale gas market remains limited due to regulatory restrictions and environmental concerns, with exploration activities progressing cautiously. The Asia Pacific region is emerging as a key area of interest, especially with countries like China showing potential due to large untapped reserves, although full-scale commercial production is still developing. The Middle East & Africa region, despite its strong presence in conventional hydrocarbons, has minimal involvement in shale gas due to geological and economic constraints.

Latin America is exploring opportunities, particularly in Argentina’s Vaca Muerta formation, but overall production and market penetration remain in early stages. Among all, North America clearly leads the global shale gas landscape, with its 48.3% market share reflecting both technological maturity and strong domestic demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Royal Dutch Shell PLC maintained a prominent presence in the global shale gas market by focusing on operational efficiency and sustained production output across key shale regions. The company continued leveraging its expertise in horizontal drilling and hydraulic fracturing, particularly in North American basins, to enhance recovery rates while minimizing environmental impact. Shell’s integrated value chain—from upstream shale extraction to downstream gas marketing—allowed it to respond flexibly to market demand and price fluctuations.

ConocoPhillips also played a major role in shaping the global shale gas landscape in 2024. The company remained highly active in the Permian Basin and Eagle Ford, where it capitalized on its low-cost production model. With a clear emphasis on capital discipline and returns-focused investments, ConocoPhillips strengthened its shale gas portfolio by optimizing existing assets and maintaining a balanced approach to exploration and development. Its strategic focus on shareholder value creation through steady output and cost control positioned it as a resilient player in a volatile market.

PetroChina Company Limited, on the other hand, demonstrated a continued commitment to developing domestic shale resources, particularly in the Sichuan Basin. The company made consistent efforts in adopting advanced extraction technologies and improving project economics, which are critical in China’s complex geological landscape. In 2024, PetroChina’s activities aligned with national energy security objectives, contributing to reduced reliance on gas imports and supporting China’s cleaner fuel transition.

Top Key Players in the Market

- Royal Dutch Shell PLC

- ConocoPhillips

- PetroChina Company Limited

- Exxon Mobil Corporation

- Chevron Corporation

- BHP Billiton Limited

- Antero Resources

- Cabot Oil & Gas

- Devon Energy

- Baker Hughes Incorporated

Recent Developments

- In May 2025, Shell reportedly considered acquiring BP to form a $300 billion energy giant. The merger aims to boost efficiency and diversify assets but may face regulatory hurdles due to its scale and potential impact on market competition.

- In April 2025, ConocoPhillips furthered this strategy by initiating the sale of oil and gas assets in Oklahoma’s Anadarko Basin, inherited from the Marathon deal. These assets span approximately 300,000 net acres and produce around 39,000 barrels of oil equivalent per day, with about half being natural gas.

Report Scope

Report Features Description Market Value (2024) USD 105.3 Billion Forecast Revenue (2034) USD 176.5 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Horizontal Fracking, Vertical Fracking, Rotary Fracking), By End-user (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Royal Dutch Shell PLC, ConocoPhillips, PetroChina Company Limited, Exxon Mobil Corporation, Chevron Corporation, BHP Billiton Limited, Antero Resources, Cabot Oil & Gas, Devon Energy, Baker Hughes Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Royal Dutch Shell PLC

- ConocoPhillips

- PetroChina Company Limited

- Exxon Mobil Corporation

- Chevron Corporation

- BHP Billiton Limited

- Antero Resources

- Cabot Oil & Gas

- Devon Energy

- Baker Hughes Incorporated