Global Residential Solar Energy Storage Market Size, Share Analysis Report By Power Rating (3 to 6 KW, 7 to 10 KW, 10 to 20 KW), By Technology (Lead-acid, Lithium-ion), By Ownership (Customer-owned, Utility-owned, Third-party-owned), By Connectivity Type (On-grid, Off-grid), By System Type (Grid-Connected Solar Energy Systems, Stand-Alone Solar Energy Systems, Hybrid Solar Energy Systems) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160144

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

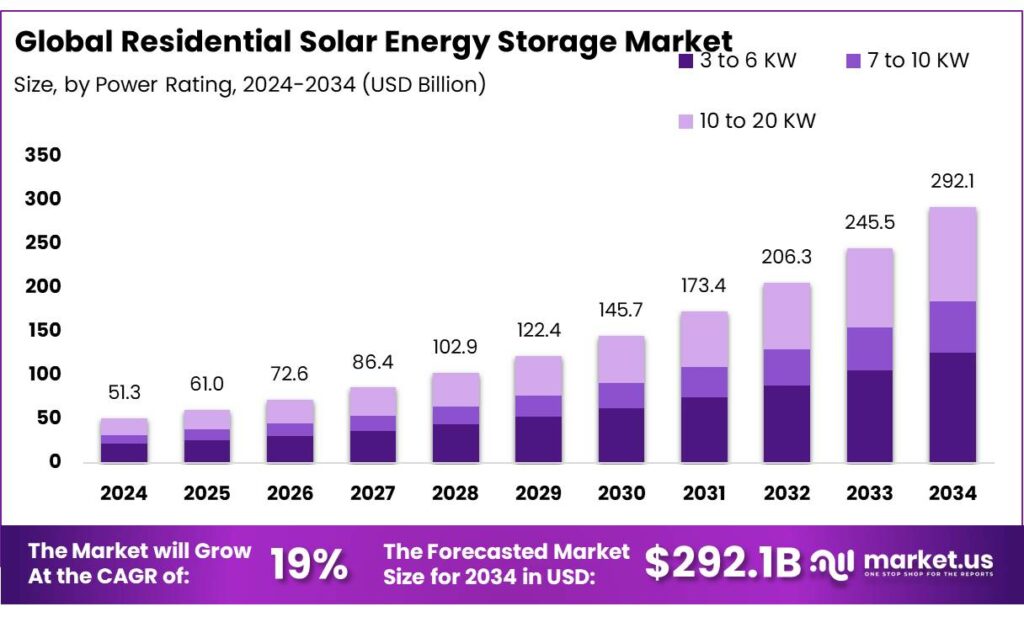

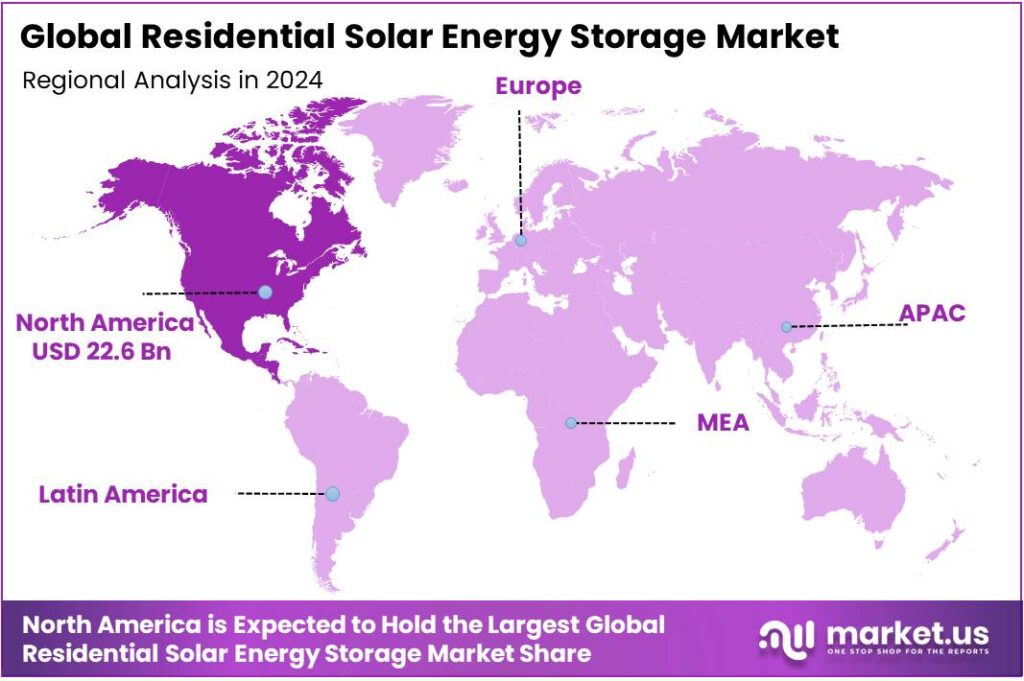

The Global Residential Solar Energy Storage Market size is expected to be worth around USD 292.1 Billion by 2034, from USD 51.3 Billion in 2024, growing at a CAGR of 19.0% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.2% share, holding USD 22.6 Billion in revenue.

The residential solar energy storage segment refers to battery systems co-located at homes with rooftop PV to shift, store, or firm up solar power for consumption later. As solar additions accelerate globally, pairing storage at the household level is increasingly viewed as essential for enabling self-consumption, resilience, and grid flexibility. In the U.S., for example, more than 28% of all new residential solar capacity in 2024 was paired with storage, up from under 12% in 2023.

The industrial scenario is characterized by rapid scaling of both utility and distributed storage, with policy and fiscal incentives playing a determinative role. Behind-the-meter residential batteries are expanding as part of broader battery deployment growth highlighted by international agencies; utility-scale battery capacity in the United States, for example, exceeded 26 GW in 2024 after a 10.4 GW increase during the year, illustrating the acceleration of battery deployment across segments and the technology spill-over that benefits residential adopters.

Key driving factors include cost reductions in battery cells and system integration, policy incentives, grid reliability concerns, and consumer demand for energy resilience. Fiscal support has materially affected uptake: the United States Residential Clean Energy Credit provides a 30% tax credit for qualifying home clean energy property through 2032, which has directly improved the economic case for pairing rooftop PV with home batteries. Such incentives have been complemented by declining levelised costs for solar and storage technologies, enabling shorter payback horizons for many owner-occupied properties.

The government programs and manufacturing scale are shaping residential storage prospects. India reported notable rooftop solar expansion—with rooftop capacity reaching approximately 17.02 GW within a total solar capacity of roughly 105.65 GW—supported by national schemes and enhanced module manufacturing; this expansion creates a substantive addressable market for residential storage solutions as residential and small commercial consumers seek to maximize on-site utilization.

- Government and regulatory initiatives play a pivotal role in shaping uptake. In India, the government has introduced a viability gap funding (VGF) scheme worth ₹ 91 billion (US $1.09 billion) to support 43.2 GWh of battery energy storage system (BESS) capacity, and a Production-Linked Incentive (PLI) program to support manufacturing of 50 GWh of advanced chemistry cell (ACC) batteries with a budgetary outlay of ₹181 billion.

- Further, India has proposed to escalate its VGF target to 13.2 GWh for subsidized battery capacity by June 2027. The government also mandates a rising “energy storage obligation” for entities like distribution utilities, growing from 1% in FY 2023–24 to 4% by FY 2029–30.

- Additionally, under India’s 2024 budget, the Pradhan Mantri Surya Ghar Muft Bijli Yojana with an investment of ₹ 75,021 crore targets to deploy rooftop solar systems for about 1 crore households along with 300 free units of electricity per month—a move that may indirectly stimulate rooftop-plus-storage adoption.

Key Takeaways

- Residential Solar Energy Storage Market size is expected to be worth around USD 292.1 Billion by 2034, from USD 51.3 Billion in 2024, growing at a CAGR of 19.0%.

- 3 to 6 KW held a dominant market position, capturing more than a 43.2% share.

- Lithium-ion held a dominant market position, capturing more than a 72.3% share.

- Residential customer-owned systems held a dominant market position, capturing more than a 56.1% share.

- On-grid systems held a dominant market position, capturing more than a 67.7% share.

- North America held a dominant position in the global residential solar energy storage market, capturing more than a 44.2% share, equating to approximately USD 22.6 billion.

By Power Rating Analysis

3 to 6 KW Residential Solar Storage dominates with 43.2% share in 2024

In 2024, 3 to 6 KW held a dominant market position, capturing more than a 43.2% share in the residential solar energy storage segment. This power range has been widely adopted due to its suitability for average household energy needs, efficiently balancing solar generation with daily consumption. Households with moderate electricity usage, typically ranging from 3,500 to 6,500 kWh annually, find this capacity optimal for managing peak demand, storing excess solar energy, and reducing reliance on the grid.

The popularity of 3 to 6 KW systems has been reinforced by falling battery costs and government incentives, such as tax credits for solar-plus-storage installations, which make the systems more affordable for residential users. In addition, this segment benefits from standardized installation practices and compatibility with common rooftop PV setups, making it the preferred choice for new adopters entering the solar storage market in 2024. This trend is expected to continue into 2025 as homeowners increasingly seek energy independence and resilience, further consolidating the 3 to 6 KW segment’s market dominance.

By Technology Analysis

Lithium-ion technology leads with 72.3% share in 2024 due to high efficiency and long lifespan

In 2024, Lithium-ion held a dominant market position, capturing more than a 72.3% share in the residential solar energy storage market. This technology has become the preferred choice for households due to its high energy density, long cycle life, and efficient performance in storing solar energy. Lithium-ion batteries allow homeowners to maximize self-consumption of solar power, reduce electricity bills, and maintain reliable backup during outages. The widespread adoption of Lithium-ion systems has also been supported by decreasing costs, which have made installation more accessible for residential users.

Additionally, government incentives for solar-plus-storage systems further strengthened its appeal, encouraging more households to invest in Lithium-ion technology. By 2025, demand for Lithium-ion residential storage is expected to continue growing as homeowners prioritize energy independence, sustainability, and integration with smart home energy management systems, reinforcing its market dominance in the sector.

By Ownership Analysis

Customer-owned residential solar storage leads with 56.1% share in 2024 due to greater control and savings

In 2024, residential customer-owned systems held a dominant market position, capturing more than a 56.1% share in the solar energy storage segment. Homeowners increasingly prefer owning their solar storage systems because it offers full control over energy usage, maximizes savings on electricity bills, and provides reliable backup during outages. Customer ownership also allows households to directly benefit from government incentives and tax credits for solar-plus-storage installations, reducing the overall cost of adoption.

The flexibility to pair storage with existing or new rooftop solar panels has further strengthened the appeal of customer-owned systems. Looking into 2025, this ownership model is expected to remain the leading choice, as more homeowners seek energy independence, long-term cost savings, and the ability to integrate storage with smart home energy management solutions.

By Connectivity Type Analysis

On-grid residential solar storage leads with 67.7% share in 2024 due to grid support and cost benefits

In 2024, on-grid systems held a dominant market position, capturing more than a 67.7% share in the residential solar energy storage market. These systems are highly preferred by homeowners because they allow excess solar energy to be fed back into the grid, providing additional savings through net metering and reducing dependency on self-consumption alone. On-grid connectivity also ensures uninterrupted power supply while maintaining cost efficiency, as households can draw electricity from the grid when solar generation is low.

The combination of energy security, economic benefits, and compatibility with existing utility infrastructure has driven the widespread adoption of on-grid residential storage. By 2025, demand for on-grid systems is expected to grow further, supported by expanding rooftop solar installations and continued government policies encouraging renewable energy integration with the main electricity network.

By System Type Analysis

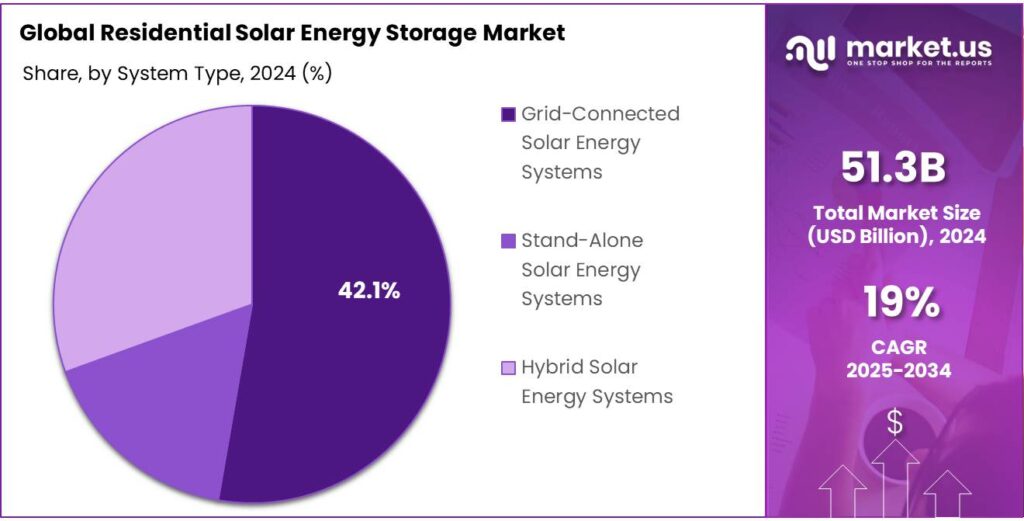

Grid-connected solar energy systems lead with 57.9% share in 2024 due to seamless energy integration

In 2024, Grid-Connected Solar Energy Systems held a dominant market position, capturing more than a 57.9% share in the residential solar energy storage market. These systems are preferred by homeowners because they allow smooth integration with the utility grid, enabling the export of excess solar energy and optimizing electricity cost savings through net metering. Grid-connected systems provide reliable energy supply, reducing the need for large standalone battery capacities while ensuring households can draw power when solar generation is insufficient.

Their popularity is also supported by government incentives and policies that encourage renewable energy adoption, making installations more affordable. Moving into 2025, Grid-Connected Solar Energy Systems are expected to continue dominating the market as more households adopt solar-plus-storage solutions to enhance energy efficiency, lower bills, and contribute to sustainable energy use.

Key Market Segments

By Power Rating

- 3 to 6 KW

- 7 to 10 KW

- 10 to 20 KW

By Technology

- Lead-acid

- Lithium-ion

By Ownership

- Customer-owned

- Utility-owned

- Third-party-owned

By Connectivity Type

- On-grid

- Off-grid

By System Type

- Grid-Connected Solar Energy Systems

- Stand-Alone Solar Energy Systems

- Hybrid Solar Energy Systems

Emerging Trends

Rising Pairing of Solar with Storage

One of the clearest and most powerful trends playing out right now in residential solar energy storage is how often new home solar systems are now being installed together with battery storage—rather than solar standing alone. Homeowners are increasingly seeing that adding a battery makes their rooftop solar more valuable, by shifting usage from daytime to evening, backing up during outages, and giving flexibility to manage energy costs.

In the U.S., for example, more than 28% of all new residential solar capacity installed in 2024 was paired with storage. That is a big jump from under 12% in 2023. This sharp rise shows that households are buying the idea of coupling storage with PV—not just as an add-on, but as part of the core system. It’s an important signal: solar is no longer just about capturing sunlight, but also about using it when you need it.

Behind that trend are a few intersecting forces. First, battery costs continue to drop. According to the National Renewable Energy Laboratory (NREL), for a typical 5 kW / 12.5 kWh residential battery system, capital expenditure (CAPEX) is projected to fall by 17 % to 52 % between 2022 and 2035 under various innovation scenarios. As storage becomes cheaper, the incremental cost of putting one together with solar shrinks, making the pairing more attractive.

Second, changes in tariff structures, net-metering rules, and self-consumption incentives are pushing homeowners to maximize their own use of solar power rather than sending it to the grid. More utilities and regulators are imposing time-of-use rates, demand charges, or stricter export limits. These shifts make it more economical to store the excess solar rather than export it at low rates.

Thirdly, the trend is reinforced by government incentives and subsidy programs that encourage storage adoption. While I found detailed residential-storage incentives most clearly in regions like Germany and Australia (e.g. in Germany home battery sales are expected to grow 26% in 2024, pushing battery ownership from 1.2 million to possibly 2.0 million homes) , such programs validate for consumers that storage is a serious and supported technology.

Drivers

Cost Decline and Improved Affordability

One of the biggest and most human-relatable driving factors in the residential solar energy storage sector is the steep decline in battery costs, which makes these systems more affordable for regular households. Over the past decade, the price per kilowatt-hour (kWh) for lithium-ion battery systems has dropped dramatically. Around 2010, these batteries cost about US $1,100 per kWh; by 2020, that had fallen to around US $137 per kWh. This kind of sharp descent in cost makes it much less of a stretch for a typical household to consider installing a storage system alongside rooftop solar panels.

In India’s context, the government has recognized this driver and is actively fostering it. The Government of India has committed ₹91 billion (~US $1.09 billion) as viability gap funding (VGF) to support 43.2 GWh of battery energy storage deployment. Additionally, a Production-Linked Incentive (PLI) scheme with outlay of ₹181 billion (~US $2,181 million) aims to support manufacturing of 50 GWh of advanced chemistry cell (ACC) batteries. These policies help reduce the cost burden at the production or installation side, and pass a portion of that benefit to end users.

Also, the government is removing some extra cost barriers. For example, India has extended the waiver on inter-state transmission system (ISTS) charges for battery storage projects until June 2028, especially for battery systems co-located with renewable plants. That kind of waiver trims another “hidden tax” on stored or transported energy, making battery systems relatively cheaper.

Restraints

High Upfront Cost and Financing Barriers

One major restraining factor that often stands in the way of widespread adoption of residential solar energy storage is the high initial capital cost and weak financing options. Even though battery and inverter prices have declined over the years, the total cost to set up a reliable storage system still remains substantial — enough that many households hesitate to invest in it.

In India for example, a standalone battery storage system is estimated to cost about US $203 per kWh in 2020, and is projected to fall to US $134 per kWh by 2025, and further to US $103 per kWh by 2030 (in 2018 real dollars) per a bottom-up study. These figures are for utility-scale systems, which already benefit from economies of scale; for small residential systems, the per-kWh cost tends to be significantly higher, because fixed costs (installation, permitting, balance of system) are spread over smaller capacity.

Consumers often confront a long payback period. If electricity savings or avoided grid charges don’t cover the capital cost within, say, 7–12 years (or sometimes more depending on tariffs and usage), people may simply decide it’s not worth the risk. The fear of getting locked into an expensive system, or being stuck with deteriorating battery life before full return, is real and quite human.

This upfront burden is further magnified by import dependency and duty structures. In India, a large share of lithium-ion cells and related components are imported, exposing costs to foreign exchange fluctuations, customs duty or import tariffs, and supply chain risks. In contexts where import duties, GST, or tariff adders are high, these markups inflate the consumer’s cost significantly. Some reports note that battery systems being imported can face custom duty of 20-25 %, on top of the module and component costs.

Opportunity

Participation in Aggregated Virtual Power Plants (VPPs) by Home Batteries

One of the most promising growth opportunities in residential solar energy storage lies in aggregating home battery systems into Virtual Power Plants (VPPs). In simple terms, VPPs let many households pool their storage capacity and operate that pooled resource to provide grid services like demand response, frequency regulation, or peak shaving. That way, homeowners are not just saving on their own bills — they can actually earn extra revenue, while the grid becomes more resilient.

Imagine a thousand homes, each with a 10 kWh battery. Together, they act like a small power plant of 10 MWh. Utilities or grid operators could call on that resource when they need extra energy or to balance sudden fluctuations. For the homeowner, this means monetizing otherwise idle stored energy.

This opportunity is already visible in larger markets. In the U.S., residential storage had a banner year in 2024: more than 1,250 MW of battery capacity was added in the residential segment — a 57% increase over 2023. Out of that, in Q4 alone, 380 MW was installed. That explosive growth hints at how many homes could eventually feed into VPPs. When these homeowners band together, the collective capacity becomes meaningful to utilities.

From the policy side, governments are increasingly creating programs that nudge VPP models forward. In the U.S., the Energy Storage Grand Challenge by DOE fosters research and commercialization of storage technologies, which includes frameworks for aggregation and grid integration. From the policy side, governments are increasingly creating programs that nudge VPP models forward. In the U.S., the Energy Storage Grand Challenge by DOE fosters research and commercialization of storage technologies, which includes frameworks for aggregation and grid integration.

In India, the stand-alone storage market is seeing strong momentum. In just the first quarter of 2025, tenders totaling 6.1 GW of energy storage were issued, making up 64% of all utility-scale storage tenders nationwide. While those are utility tenders, many of the policies and cost reductions that support large-scale storage also benefit behind-the-meter systems.

Regional Insights

North America leads with 44.2% share and USD 22.6 billion in 2024 for residential solar energy storage

In 2024, North America held a dominant position in the global residential solar energy storage market, capturing more than a 44.2% share, equating to approximately USD 22.6 billion in value. This leadership is primarily attributed to the United States, which accounted for the majority of the regional market share. The U.S. solar industry installed nearly 50 GW of capacity in 2024, marking a 21% increase from the previous year. This substantial growth reflects the escalating demand for residential solar energy storage solutions.

Several factors have contributed to North America’s market dominance. The implementation of the Inflation Reduction Act in 2022 introduced significant tax credits, including a 30% federal investment tax credit for solar-plus-storage systems, thereby reducing the upfront costs for homeowners. Additionally, states like California and Texas have been at the forefront of adopting residential energy storage, driven by strong incentives and policies promoting renewable energy integration.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Panasonic’s EverVolt home battery integrates lithium iron phosphate cells with hybrid inverters, enabling AC/DC coupling and modular expansion. Its next-generation EverVolt 2.0 supports continuous output up to 7.6 kW off-grid, or 9.6 kW with grid support, and offers usable capacity options of 17.1 kWh / 25.65 kWh. However, in April 2025, Panasonic announced it would exit its solar and battery storage business while honoring existing warranties.

VARTA, a longstanding German battery maker, operates a storage subsidiary that focuses on residential and small industrial markets. In 2022, VARTA produced around 3 billion battery cells across facilities in Germany, Romania and Indonesia. Its efforts in storage are positioned through Varta Storage GmbH, and it pursues innovation via silicon-dominant anodes to increase energy density.

Tesla’s home battery offering, the Powerwall, lets homeowners store solar power, support load shifting, and ride through outages. Tesla Energy deployed 31.4 GWh of battery storage systems in 2024. With strong brand recognition and vertical integration across EVs, solar and storage, Tesla leverages scale, software, and customer ecosystem to remain a market leader.

Top Key Players Outlook

- Tesla

- Panasonic Holdings Corporation

- BYD Company Ltd

- Enphase Energy

- Sonnen GmbH

- VARTA AG

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Eaton

- SMA Solar Technology AG

Recent Industry Developments

In 2024, Tesla deployed 31.4 GWh of energy storage (across both utility and behind-the-meter systems), doubling its 2023 deployment and marking 113 % growth year on year.

In 2024, VARTA’s total revenue was EUR 793.2 million, while adjusted EBITDA reached EUR 30.6 million.

Report Scope

Report Features Description Market Value (2024) USD 51.3 Bn Forecast Revenue (2034) USD 292.1 Bn CAGR (2025-2034) 19.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Rating (3 to 6 KW, 7 to 10 KW, 10 to 20 KW), By Technology (Lead-acid, Lithium-ion), By Ownership (Customer-owned, Utility-owned, Third-party-owned), By Connectivity Type (On-grid, Off-grid), By System Type (Grid-Connected Solar Energy Systems, Stand-Alone Solar Energy Systems, Hybrid Solar Energy Systems) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Tesla, Panasonic Holdings Corporation, BYD Company Ltd, Enphase Energy, Sonnen GmbH, VARTA AG, Delta Electronics, Inc., Huawei Technologies Co., Ltd., Eaton, SMA Solar Technology AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Residential Solar Energy Storage MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Residential Solar Energy Storage MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla

- Panasonic Holdings Corporation

- BYD Company Ltd

- Enphase Energy

- Sonnen GmbH

- VARTA AG

- Delta Electronics, Inc.

- Huawei Technologies Co., Ltd.

- Eaton

- SMA Solar Technology AG