Global Raffinate Market Size, Share, And Business Benefit By Type (Raffinate I, Raffinate II, Raffinate III), By Application (Solvent Extraction, Lubricant Production, Fuel Additives, Chemical Intermediates, Others), By End-Use Industry (Automotive, Chemical, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166807

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

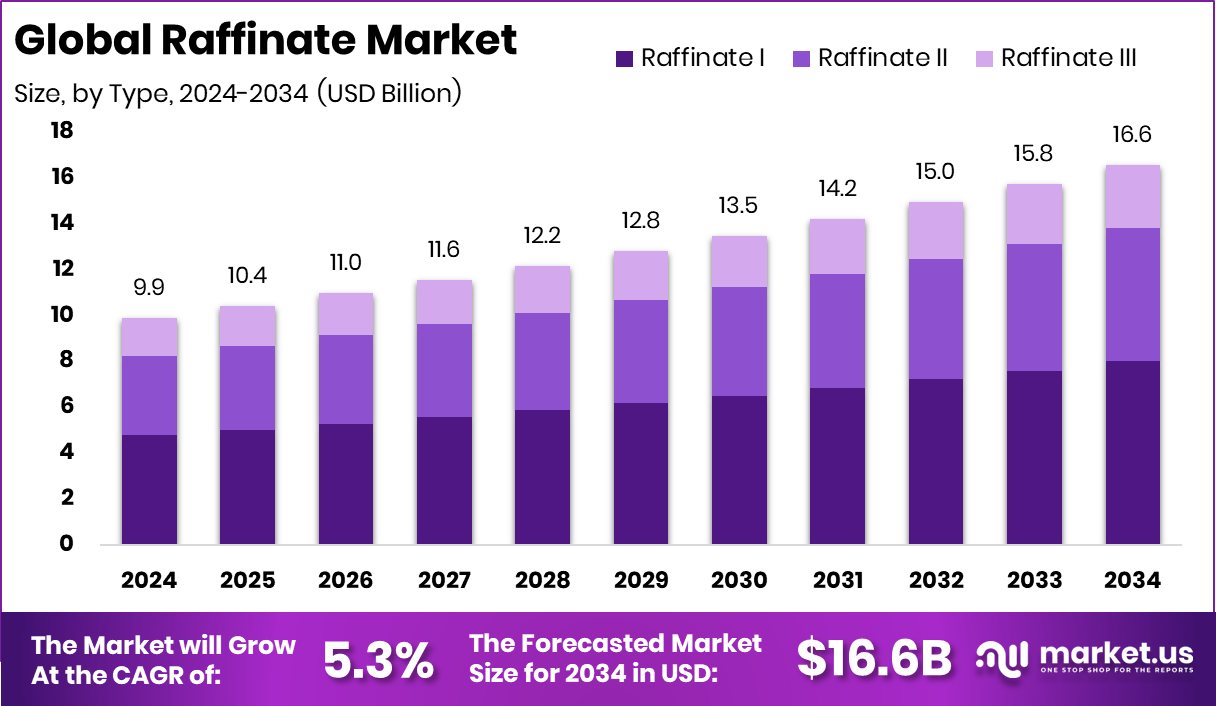

The Global Raffinate Market is expected to be worth around USD 16.6 billion by 2034, up from USD 9.9 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Asia Pacific maintained demand growth due to industrial expansion, supporting the 46.20% share.

Raffinate is the hydrocarbon stream left behind after selective extraction removes aromatics or other target compounds from feedstocks such as naphtha, kerosene, or LPG. It is typically rich in paraffins and olefins, making it useful in lubricant blending, fuel components, and petrochemical intermediates. The Raffinate Market refers to the global demand for these purified streams, driven by their role in producing cleaner-burning fuels, high-stability lubricants, and performance chemicals used across automotive, industrial, and energy sectors.

Growth in the raffinate market is supported by rising consumption of high-quality lubricants and cleaner petrochemical feedstocks. The industry is also witnessing stronger investment momentum, reflected in moves like Klüber Lubrication committing Rs 142 crore to expand capacity in India. Such investments create more demand for refined raffinate streams that enhance lubricant performance.

Market demand is further shaped by portfolio restructuring in the global lubricants ecosystem. BP’s plan to divest its Castrol unit as part of a $20 billion asset-sale goal and interest from major buyers, including Reliance and Aramco, in a potential $10 billion deal, signals a shift toward cleaner and more efficient base inputs like raffinate.

Opportunity also expands as financial movement enters the lubricant supply chain. Gulf Oil Lubricants India’s promoter offloading a 4% stake worth Rs 263 crore and Golden Gate Capital completing a $479 million sale of lubricant distributor PetroChoice indicate growing capital circulation, which indirectly boosts demand for high-purity raffinate used in performance-grade formulations.

Key Takeaways

- The Global Raffinate Market is expected to be worth around USD 16.6 billion by 2034, up from USD 9.9 billion in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- Raffinate I held a 48.2% share and dominated the Raffinate Market due to wide industrial usage.

- Solvent Extraction dominated the raffinate market with a 34.1% share, driven by cleaner processing demand.

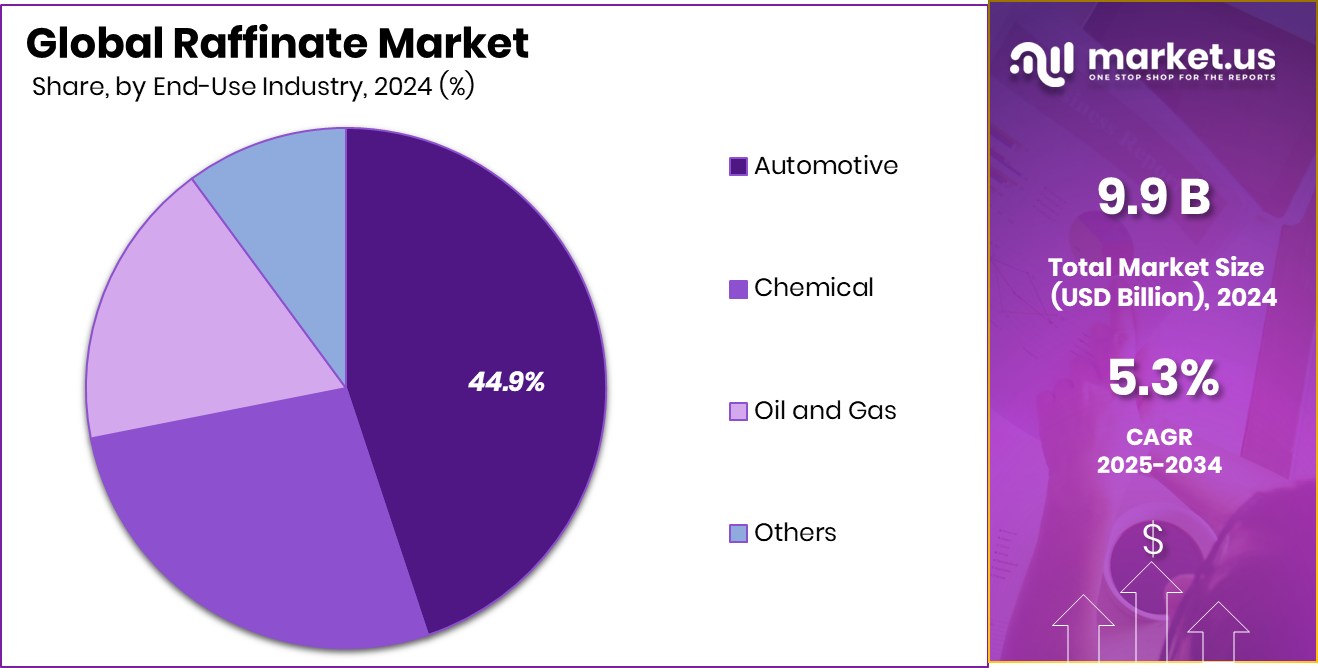

- Automotive applications dominated the raffinate market with a 44.9% share, supported by rising lubricant needs.

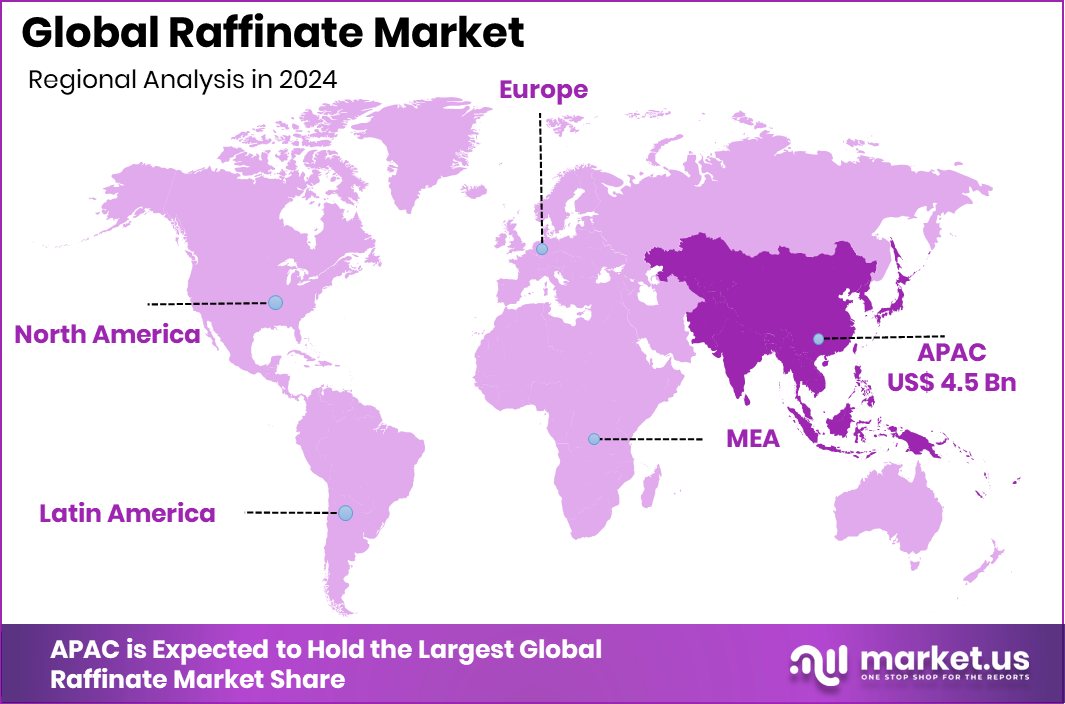

- The Asia Pacific recorded a strong market valuation of USD 4.5 billion overall.

By Type Analysis

Raffinate I dominated the Raffinate Market with 48.2%, driven by broad industrial use.

In 2024, Raffinate held a dominant market position in the By Type segment of the Raffinate Market, securing a 48.2% share. This leadership reflects its strong suitability for applications that require cleaner, more stable hydrocarbon streams with low aromatic content.

Raffinate’s composition—mainly paraffinic and olefinic molecules—supports consistent performance in lubricant blending, fuel additives, and downstream petrochemical processing. Industries prefer this segment because it delivers better oxidation stability and thermal behavior, which helps manufacturers meet tightening efficiency and emission standards.

The 48.2% share also indicates that demand is steadily shifting toward refined feedstocks that improve product quality while reducing processing complexity, allowing Raffinate to maintain a clear edge within the overall type-based classification of the market.

By Application Analysis

Solvent Extraction dominated the Raffinate Market with 34.1%, supported by rising purification needs.

In 2024, Solvent Extraction held a dominant market position in the By Application segment of the Raffinate Market, capturing a 34.1% share. This leading role comes from its importance in removing aromatics and impurities from various feedstocks, allowing refiners to obtain cleaner paraffinic streams used in fuels, lubricants, and petrochemical intermediates.

Solvent extraction remains preferred because it delivers high selectivity, stable yields, and consistent quality, which are essential for industries targeting improved performance and lower emissions.

The 34.1% share reflects the steady reliance on this process to produce raffinate grades that meet modern efficiency requirements. Its strong operational adaptability also supports its continued dominance within application-focused market categories.

By End-Use Industry Analysis

Automotive dominated the Raffinate Market with 44.9%, reflecting strong lubricant-grade raffinate demand.

In 2024, Automotive held a dominant market position in the By End-Use Industry segment of the Raffinate Market, securing a 44.9% share. This strong position reflects the sector’s high consumption of cleaner paraffinic streams required for producing modern lubricants, fuel additives, and performance chemicals.

Automotive manufacturers rely on raffinate to achieve better engine efficiency, reduced deposits, and improved thermal stability across passenger and commercial vehicles. The 44.9% share also highlights the growing need for refined base inputs that support smoother engine operation and help meet tightening emission norms.

With continuous demand for high-quality lubricants and cleaner fuel formulations, the automotive segment naturally maintains its leading role within the industry’s end-use classification.

Key Market Segments

By Type

- Raffinate I

- Raffinate II

- Raffinate III

By Application

- Solvent Extraction

- Lubricant Production

- Fuel Additives

- Chemical Intermediates

- Others

By End-Use Industry

- Automotive

- Chemical

- Oil and Gas

- Others

Driving Factors

Cleaner Hydrocarbon Demand Strengthens Raffinate Growth

A key driving factor for the Raffinate Market is the rising need for cleaner and more stable hydrocarbon streams across fuel and lubricant applications. Industries are moving toward low-aromatic, high-purity materials to improve engine performance, reduce emissions, and meet tightening global standards.

Raffinate fits this shift because its paraffinic and olefinic structure offers better oxidation stability and smoother processing. This demand becomes stronger as refiners and chemical producers expand capacity to supply high-quality feedstocks.

Adding to this momentum, Chinese energy major Sinopec recently launched a $690 million fund aimed at supporting advanced petrochemical and energy-related projects. Such financial commitments encourage technology upgrades, which further increase the use of refined streams like raffinate in modern industrial systems.

Restraining Factors

Limited Feedstock Quality Slows Raffinate Expansion

A major restraining factor for the Raffinate Market is the challenge of inconsistent feedstock quality across refining operations. Since raffinate is produced after removing aromatics or other components through extraction processes, its output strongly depends on the quality and stability of the initial hydrocarbon stream.

When crude oil composition shifts or when refineries operate older extraction units, the final raffinate may show variations in purity, paraffin content, and overall performance. These inconsistencies create problems for industries that need uniform material for lubricant blending, petrochemical production, and fuel additives.

As a result, manufacturers may face higher processing costs or tighter specifications, which slow the wider adoption of raffinate and limit its market growth

Growth Opportunity

Rising Demand for High-Purity Streams Creates Opportunity

A key growth opportunity for the Raffinate Market comes from the increasing need for high-purity hydrocarbon streams in lubricants, fuels, and performance chemicals. As industries shift toward cleaner formulations and tighter emission norms, manufacturers prefer materials with low aromatics and stable paraffinic profiles—qualities that naturally provide. This shift opens doors for refiners to upgrade extraction units and produce more consistent raffinate grades. The momentum strengthens as new capital flows enter the energy and petrochemical space.

Recently, Brazilian oil and gas company Prio launched a $21 million VC fund aimed at supporting innovative technologies and cleaner production pathways. Such financial initiatives encourage advanced processing solutions, creating new opportunities for refining adoption in modern industrial applications.

Latest Trends

Shift Toward Low-Aromatic Feedstocks Shapes Market Trend

One of the latest trends in the Raffinate Market is the growing move toward low-aromatic feedstocks that support cleaner, more efficient downstream products. Industries are increasingly choosing raffinate because its paraffinic and olefinic composition helps improve fuel stability, enhance lubricant performance, and reduce emissions.

As environmental standards become stricter, refiners are adjusting their extraction processes to deliver purer streams that fit modern efficiency requirements. This trend is also driven by the rising need for consistent quality in petrochemical intermediates used for plastics, additives, and specialty chemicals.

With companies prioritizing cleaner inputs across manufacturing lines, the preference for high-purity raffinate continues to build, shaping both product development and long-term market direction.

Regional Analysis

Asia Pacific led the Raffinate Market with a 46.20% share in 2024.

Asia Pacific dominated the Raffinate Market with a 46.20% share valued at USD 4.5 billion, supported by strong petrochemical activity, rising lubricant consumption, and continuous processing upgrades across major refining hubs. This leadership reflects the region’s fast-growing manufacturing and automotive sectors, which create steady demand for high-purity paraffinic streams used in fuels and performance lubricants.

North America shows stable growth driven by advanced refining technologies and a well-established industrial base that requires cleaner feedstocks for lubricant blending and chemical production. Europe maintains consistent demand as regulations encourage the use of low-aromatic materials, supporting refiners that focus on high-quality extraction outputs.

The Middle East & Africa benefit from expanding refining capacity and increasing downstream diversification efforts, which gradually boost the use of raffinate in local industries. Latin America demonstrates moderate uptake supported by evolving fuel standards and rising interest in improved lubrication performance across transportation and industrial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ExxonMobil plays a significant role in shaping the global Raffinate Market by leveraging its large refining network and strong technical capabilities. The company’s focus on producing cleaner, high-purity hydrocarbon streams supports industries that require consistent raffinate quality for lubricants, fuels, and petrochemicals. Its long-term emphasis on efficiency and process optimization allows it to supply stable raffinate grades that align with evolving performance and emission requirements across global markets.

Shell Plc contributes to the market through its integrated downstream operations and continued improvements in extraction technologies. The company’s experience in producing low-aromatic streams strengthens the availability of raffinate used in advanced lubricant formulations and cleaner fuel components. Shell’s strategy of upgrading refinery units and supporting high-quality feedstock production positions it as an important player responding to efficiency-driven industrial needs.

Chevron Corporation adds further stability to the Raffinate Market with its strong presence in fuels, lubricants, and petrochemical feedstocks. The company’s approach centers on delivering refined streams that enhance product performance and reliability for industrial and transportation uses. Chevron’s consistent production capabilities help address demand for paraffinic-rich raffinate, especially as manufacturers aim for improved oxidation stability and cleaner-burning formulations.

Top Key Players in the Market

- ExxonMobil

- Shell Plc

- Chevron Corporation

- TotalEnergies SE

- Sinopec Limited

- BASF SE

- LyondellBasell Industries

- INEOS Group

- SABIC

- Reliance Industries Limited

Recent Developments

- In December 2024, ExxonMobil announced plans to invest up to US$30 billion in low-emission opportunities from 2025–2030. While not explicitly labelled as a raffinate project, this large investment signals the company’s shift toward cleaner feedstocks and higher-value streams, which directly impacts markets for materials like raffinate.

- In January 2024, Shell announced that at its Germany Rheinland energy & chemicals park, it will convert the hydrocracker at the Wesseling site into a Group III base oil plant with ~300,000 t /yr capacity. This moves the site away from crude-oil processing and toward higher-value paraffinic feedstocks — a change that ties into raffinate-type streams.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 16.6 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Raffinate I, Raffinate II, Raffinate III), By Application (Solvent Extraction, Lubricant Production, Fuel Additives, Chemical Intermediates, Others), By End-Use Industry (Automotive, Chemical, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil, Shell Plc, Chevron Corporation, TotalEnergies SE, Sinopec Limited, BASF SE, LyondellBasell Industries, INEOS Group, SABIC, Reliance Industries Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ExxonMobil

- Shell Plc

- Chevron Corporation

- TotalEnergies SE

- Sinopec Limited

- BASF SE

- LyondellBasell Industries

- INEOS Group

- SABIC

- Reliance Industries Limited